Business

How the War in Ukraine Could Slow the Sales of Electric Cars

Russia’s invasion of Ukraine has shaken the worldwide marketplace for nickel simply because the metallic beneficial properties significance as an ingredient in electrical automotive batteries, elevating fears that prime costs may sluggish the transition away from fossil fuels.

The worth of nickel doubled in in the future final week, prompting the London Steel Trade to freeze buying and selling and successfully deliver the worldwide nickel market to a standstill. After two years of provide chain chaos brought on by the pandemic, the episode supplied extra proof of how geopolitical tensions are destroying buying and selling relationships that corporations as soon as took without any consideration, forcing them to rethink the place they get the components and metals they use to make vehicles and lots of different merchandise.

Automakers and different corporations that want nickel, in addition to different battery uncooked supplies like lithium or cobalt, have begun in search of methods to protect themselves in opposition to future shocks.

Volkswagen, for instance, has begun to discover shopping for nickel immediately from mining corporations, Markus Duesmann, chief government of the carmaker’s Audi division, mentioned in an interview on Thursday. “Uncooked supplies are going to be a problem for years to come back,” he mentioned.

The prospect of extended geopolitical tensions is prone to speed up makes an attempt by the US and Europe to develop home provides of commodities that always come from Russia. There are nickel deposits, for instance, in Canada, Greenland and even Minnesota.

“Nickel, cobalt, platinum, palladium, even copper — we already realized we’d like these metals for the inexperienced transition, for mitigating local weather change,” mentioned Bo Stensgaard, chief government of Bluejay Mining, which is engaged on extracting nickel from a website in western Greenland in a enterprise with KoBold Metals, whose backers embody Jeff Bezos and Invoice Gates. “If you see the geopolitical developments with Ukraine and Russia, it’s much more apparent that there are provide dangers with these metals.”

However establishing new mining operations is prone to take years, even many years, due to the time wanted to accumulate permits and financing. Within the meantime, corporations utilizing nickel — a gaggle that additionally contains metal makers — might want to take care of greater costs, which is able to ultimately be felt by customers.

A median electric-car battery accommodates about 80 kilos of nickel. The surge in costs in March would greater than double the price of that nickel to $1,750 a automotive, in line with estimates by the buying and selling agency Cantor Fitzgerald.

Russia accounts for a comparatively small proportion of world nickel manufacturing, and most of it’s used to make stainless-steel, not automotive batteries. However Russia performs an outsize function in nickel markets. Norilsk Nickel, often known as Nornickel, is the world’s largest nickel producer, with huge operations in Siberia. Its proprietor, Vladimir Potanin, is one among Russia’s wealthiest folks. Norilsk is amongst a restricted variety of corporations licensed to promote a specialised type of nickel on the London Steel Trade, which handles all nickel buying and selling.

In contrast to different oligarchs, Mr. Potanin has not been a goal of sanctions, and the US and Europe haven’t tried to dam nickel exports, a step that might harm their economies in addition to Russia’s. The prospect that Russian nickel may very well be minimize off from world markets was sufficient to trigger panic.

Analysts count on costs to come back down from their latest peaks however stay a lot greater than they have been a yr in the past. “The pattern could be to come back right down to a stage near the place we final left off,” round $25,000 a metric ton in comparison with the height of $100,000 a ton, mentioned Adrian Gardner, a principal analyst specializing in nickel at Wooden Mackenzie, a analysis agency.

Nickel was on a tear even earlier than the Russian invasion as hedge funds and different traders wager on rising demand for electrical automobiles. The worth topped $20,000 a ton this yr after hovering between $10,000 and $15,000 a ton for a lot of the previous 5 years. On the similar time, much less nickel was being produced due to the pandemic.

After Russia invaded Ukraine in late February, the worth rose above $30,000 in slightly over per week. Then got here March 8. Phrase unfold on the buying and selling desks of brokerage companies and hedge funds in London that an organization, which turned out to be the Tsingshan Holding Group of China, had made an enormous wager that the worth of nickel would drop. When the worth rose, Tsingshan owed billions of {dollars}, a scenario identified on Wall Road as a brief squeeze.

The worth shot as much as slightly over $100,000 a ton, threatening the existence of many different corporations that had wager mistaken and prompting the London Steel Trade to halt buying and selling.

The Russia-Ukraine Warfare and the International Financial system

The trade tried to restart buying and selling in nickel twice this week with new value limits, however sudden drops induced buying and selling to halt as soon as once more. “The market is damaged,” mentioned Keith Wildie, the top of buying and selling on the London-based metals agency Romco.

There isn’t any signal that nickel costs will result in manufacturing facility shutdowns in the way in which that shortages of elements made in Ukraine introduced meeting strains at Volkswagen, BMW and different carmakers to a standstill. It is going to take a couple of weeks for value will increase to ripple by the system.

For now, automakers and different huge nickel patrons like metal makers could possibly discover different suppliers, use extra recycled materials or swap to battery designs that require much less nickel.

“There may be sufficient nickel,” Ola Källenius, chief government of Mercedes-Benz, mentioned in an interview this week. However carmakers might need to pay extra, he mentioned, including, “It’s not unlikely that we’ll have secondary results from this battle.”

The Ukraine battle has underscored the urgency of shifting away from fossil fuels, Mr. Duesmann of Audi mentioned. Russian oil performs a a lot larger function within the international financial system than Russian nickel. “It might be too shortsighted to say, ‘Electromobility doesn’t work,’” he mentioned.

Past the speedy disruption to provides, automakers are involved a couple of retreat from the open markets which were so good for enterprise. Katrin Kamin, a commerce professional on the Kiel Institute for the World Financial system in Germany, famous that international commerce had held up remarkably properly through the pandemic.

“Maybe we must always communicate much less of globalization being in disaster and extra of worldwide relations being at a low level,” Ms. Kamin mentioned in an electronic mail.

However the Ukraine battle, she added, “is a serious blow to commerce.”

Ana Swanson contributed reporting.

Business

Wildfires Will Deepen Housing Shortage in Los Angeles

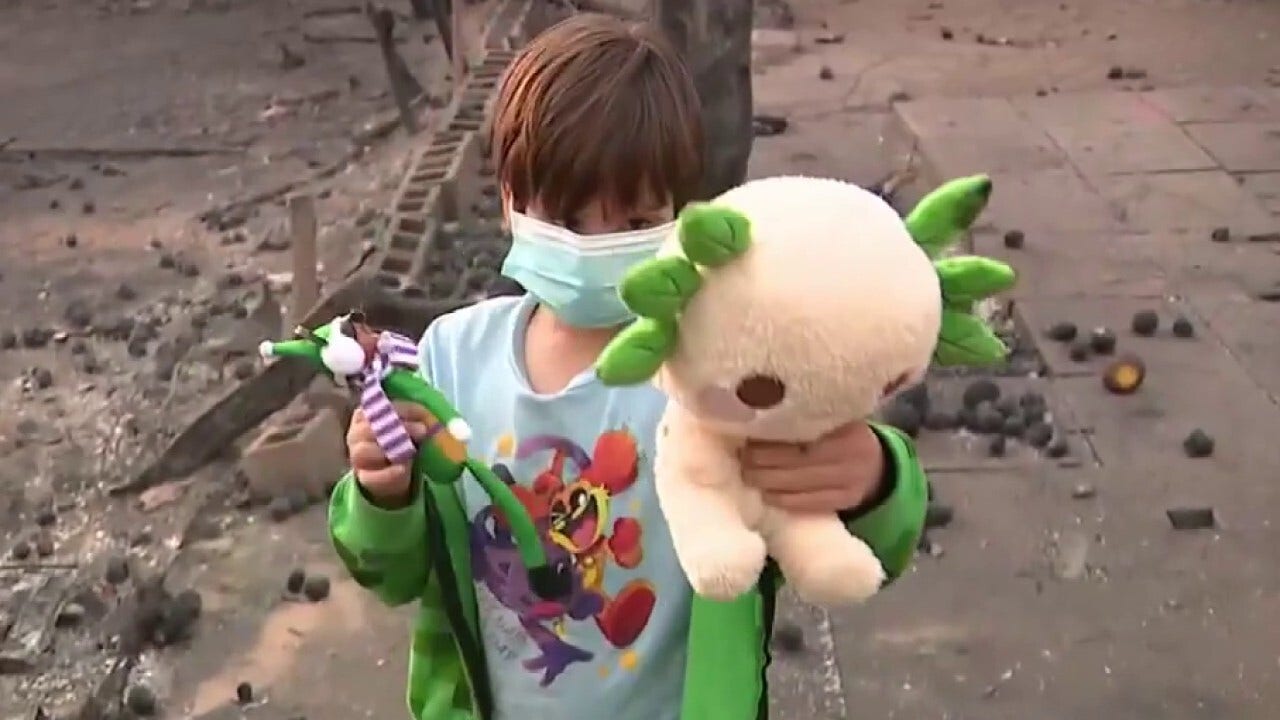

Each of the homes burned in the Los Angeles fires is its own individual calamity.

Collectively, the losses — whether in the hundreds or, as is far more likely, in the thousands — will weigh on the city’s already urgent housing shortage.

Fires are still raging, and with 180,000 people under evacuation orders as of Thursday morning, the degree of displacement in the city and its surrounding areas will take time to assess. For the time being, evacuees are holing up in public shelters in Los Angeles County, with friends or family members or in hotels.

But in the coming weeks and months, people whose homes are gone will have to find more stable accommodations while they rebuild. That will not be easy in a metro area that, as of 2022, already had a shortage of about 337,000 homes, according to data from Zillow. The number of homes on the market in Los Angeles was 26 percent below prepandemic norms as of December, according to Zillow.

“One of the biggest challenges ahead will be getting people who lost their homes into permanent, long-term housing,” Victor M. Gordo, the mayor of Pasadena, said on Wednesday. Pasadena, which is battling the Eaton fire, has already lost hundreds of homes.

The area’s tight rental market is likely to become further strained as many of the thousands of displaced residents turn to rental units, while figuring out their next move. The median rent for a one-bedroom apartment in Los Angeles, as of Jan. 7, was more than $2,000, according to Zillow.

“You’re going to have a positive shock in demand, and a negative shock in supply, so this automatically means prices go up in the rental markets,” said Carles Vergara-Alert, a professor of finance at IESE Business School in Barcelona, who has studied the effects of wildfires on housing markets.

Any uptick in rental costs would affect tenants across the region, beyond those displaced by the fires, Dr. Vergara-Alert said.

Jonathan Zasloff, who lost his home in Pacific Palisades this week, teaches land use and urban policy at the University of California, Los Angeles law school, and is acutely aware of how his search for interim housing could affect the broader market.

Dr. Zasloff is staying with his brother for the time being, while a friend is putting up his wife and daughter. They evacuated their house, which they had lived in for almost 15 years, around noon on Tuesday, before the official evacuation order was issued for the area. That evening, Dr. Zasloff realized the severity of the crisis when he was watching television and saw a reporter standing on his fire-ravaged block.

His insurance agent told him it could take two to three years to rebuild his house. His family might try to find a rental in West Los Angeles near UCLA in the meantime, he said.

There aren’t many rentals in that part of the city, Dr. Zasloff said, so students and other renters could be displaced as he, and people like him who lost their homes, move in.

“It’s very possible that this event is going to cause a big increase in homelessness, even though the people who got pushed out of their homes are people of means,” he said.

California has been in the grip of an affordable housing crisis for a decade. Both state and local lawmakers have passed a raft of new laws that aim to make housing cheaper and more plentiful by making it easier to build. In Los Angeles, for instance, Mayor Karen Bass signed an executive order that streamlines permitting for projects in which 100 percent of the units are affordable. In response to state housing reforms, there has been a boom of backyard homes — called accessory dwelling units, or A.D.U.s — that homeowners often rent out for extra income and that have added to the housing stock.

Still, both the city and state remain well behind their housing production goals, and affordability has only continued to erode. The number of apartment units approved by the city of Los Angeles, for example, dipped to a 10-year low in 2024, according to data from the Los Angeles Department of Building and Safety compiled by Crosstown LA, a news site. That downturn in building permitting has raised concern about roadblocks to new housing unit creation.

“This is a place that had massive affordability challenges last week, and after this week it’s going to be that much more challenging,” said Dave Rand, a land-use lawyer at Rand Paster & Nelson in Los Angeles, who also serves on the board of directors of a statewide affordable housing organization.

After the fires are extinguished and the recovery begins, Mr. Rand said, there is hope that the common cause of rebuilding can be a catalyst for tackling affordability challenges by continuing to make it easier to build housing, particularly affordable rental housing, at a faster pace.

“This is such a devastating event that hopefully it rocks the system to the point where we can get real reform,” he said.

The Los Angeles City Council has aimed to build nearly half a million new units by 2029. But many people trying to rebuild all at once after the fires could lead to higher costs, and slow down the overall production of housing, said Jason Ward, a co-director of the center on housing and homelessness at the RAND Corporation.

A longstanding construction labor shortage in Los Angeles does not help. Andy Howard, a general contractor who has worked across the city for three decades, including in the areas affected by the fires, said many of the subcontractors he work with in the past have left California since the pandemic. And there are not enough young people entering the industry.

The fires are “going to make it worse,” Mr. Howard said. “It’s going to drive the cost up, for sure.”

Business

For Hollywood workers, L.A. fires are the latest setback as productions halt

As the market for documentaries and other content slowed and work dried up in Hollywood, producer Kourtney Gleason was already worried about making the mortgage payments on the home she bought last year with her boyfriend.

Now, as raging fires have halted film and TV production in Southern California and many in the industry have lost homes, she’s terrified that the entertainment business will be set back yet again. Though she’s been in the industry for 12 years, Gleason is now reluctantly looking at restaurant jobs to get by.

“The industry in the town is so fragile that every little thing becomes a bigger bump in the road,” she said. “Another bump that will push things back from getting ramped up.”

The destruction of the fires only compounds the difficult lot for many of Hollywood’s workers. Still reeling from the pandemic, they faced financial hardship during the dual Hollywood labor strikes in 2023, then were hit with a sustained slowdown in film and TV production that has driven many to rethink their careers in the industry.

“A lot of the below-the-line workers were already under an incredible amount of pressure,” said Kevin Klowden, executive director of the Milken finance institute. “For Hollywood workers, it becomes one more blow.”

The sheer scope of the region’s multiple fires means that nearly every echelon of Hollywood has been hard hit.

The Palisades fire, which has burned more than 17,200 acres and destroyed numerous homes, businesses and longtime landmarks in the Pacific Palisades area, is home to many Hollywood stars, studio executives and producers. Actors such as Billy Crystal and Cary Elwes lost homes in the blaze.

Across the region, the Eaton fire has now burned at least 10,600 acres in the Pasadena and Altadena areas and destroyed many structures. The San Gabriel Valley is home to many of the industry’s more modest or middle-class workers, who were already financially harmed by the production slowdown and relocation of shoots to other states or countries.

The fires could rank as one of the costliest natural disasters in U.S. history. A preliminary estimate calculated by AccuWeather, the weather forecasting service, put the damage and total economic loss at $52 billion to $57 billion, which could rise if the fires continue to spread. J.P. Morgan on Thursday raised its expectations of economic losses to close to $50 billion.

Many affected homeowners reported the insurers had dropped their policies, as some of the biggest insurers have stopped writing or renewing policies in high-risk coastal and wildfire areas. The complications with fire insurance, combined with the region’s problems with housing affordability and supply, will only be exacerbated by these fires, Klowden said, leading some to reconsider whether they can stay in California.

“It adds up,” he said. “How many more people decide they can’t afford to stay?”

Hollywood workers had been holding onto hope that 2025 would be a better year for work, perhaps closer to the levels they saw before the pandemic.

But with yet another disaster, “it feels like it’s just another weight that’s been placed,” said Jacques Gravett, a film editor who has primarily worked in television on such shows as “Power Book IV: Force” on Starz and “13 Reasons Why” on Netflix.

Gravett was out of work for 13 months between the pandemic and the strikes, and said he’s concerned about how already struggling workers will be able to absorb the financial blow from the fires.

“At least when you’re working and something happens, you have resources to get you by, and a lot of people don’t have the resources now,” said Gravett, who is co-chair of the Motion Picture Editors Guild’s African-American steering committee. “Now we’re faced with another tragedy for those who’ve been displaced. What do you do?”

The effect of the fires on industry workers could give lawmakers a push to approve Gov. Gavin Newsom’s proposed increase to the state’s film and TV tax credit program, which aims to lure production back to California and increase jobs in the Golden State, Klowden said.

“Right now, the industry desperately is waiting on the incentives to be expanded,” he said.

In the near term, discussions about new projects are already hitting a wall. Gary Lennon, showrunner of various “Power” spinoffs, including “Force,” said an agent told him there will likely be a temporary pause before anyone wants to talk about new ideas.

“Buyers and meetings for pitches being sold will take a hit for a moment,” Lennon said. “People are focused on what is immediately happening in front of them.”

Even before the fires, he said he was already getting two to three calls a week from production designers, editors, costume designers and others looking for work.

But once the industry is ready to ramp back, he said he thinks it will move quickly.

“So much has happened recently, I think production will start right away again because people do need to work,” Lennon said. “And that’s a good thing.”

Business

Paul Oreffice, a Combative Chief of Dow Chemical, Dies at 97

Paul F. Oreffice, who as the pugnacious head of Dow Chemical grew and diversified the company at the same time that he rebuffed Vietnam veterans over Agent Orange, argued that the chemical dioxin was harmless and oversaw the manufacturing of silicone breast implants that were known to leak, died on Dec. 26 at his home in Paradise Valley, Ariz. He was 97.

His family confirmed his death.

Mr. Oreffice (pronounced like orifice) spoke in staccato, fast-paced sentences, and they were often deployed in pushing back against environmentalists, politicians and journalists during an era, the 1970s and ’80s, when the environmental movement was gaining force by focusing on toxic chemicals in the air and water.

Under his 17-year leadership, which included the titles of president, chief executive and chairman, Mr. Oreffice weathered intense controversies.

His public relations instinct was for confrontation, not conciliation. He had an intense dislike for what he perceived as government meddling in business, which he traced to his having grown up in Italy under Mussolini. “I’ve seen what overgoverning can do,” he told The New York Times in 1987. “I was born under a Fascist dictatorship, and my father was jailed by it.”

Mr. Oreffice took the reins of the Dow USA division in 1975, when its public image was tainted from campus protests of the 1960s that had vilified the company as a maker of the incendiary agent napalm, which was widely used in Vietnam.

When Dow pulled out of apartheid South Africa in 1987 under pressure from shareholders, Mr. Oreffice said: “I’m not proud of it. I think we should have stayed and fought.”

In 1977, when Jane Fonda lacerated Dow in a speech at Central Michigan University, not far from Dow headquarters, in Midland, Mich., Mr. Oreffice canceled the company’s donations to the school, writing its president that he could not support Ms. Fonda’s “venom against free enterprise.”

Instead, Mr. Oreffice financed the campaigns of anti-regulation politicians. And he sued the Environmental Protection Agency for surveilling Dow’s sprawling Midland plants from the air when the company refused an on-site inspection.

The case made its way to the United States Supreme Court, which in 1986 ruled against the company, at the time the No. 2 American chemical maker after DuPont. (The companies merged in 2017, then split into three companies.)

In 1983, Rep. James H. Scheuer, Democrat of New York, disclosed that Dow had been allowed to edit an E.P.A. report on the leakage of dioxin, one of the most toxic substances ever manufactured, from the Midland plants into the Tittabawassee and Saginaw Rivers and Saginaw Bay.

E.P.A. regional officials told Congress that their superiors in the Reagan administration ordered the changes to comply with demands made by Dow. Mr. Oreffice, appearing on NBC’s “Today” show, offered a sweeping dismissal.

“There is absolutely no evidence of dioxin doing any damage to humans except for causing something called chloracne,” he said. “It’s a rash.”

His statement brushed aside evidence that dioxin was extremely hazardous to laboratory animals and had been shown in some research to be linked with a rare soft-tissue cancer in humans.

One former Dow president, Herbert Dow Doan, a grandson of the company founder, told a public relations publication, Provoke Media, in 1990 that Mr. Oreffice’s style was not one fine-tuned to mollify critics. “The reason is part ego, part pride,” he said. “Paul is inclined to push his line to the point where some people say he is arrogant.”

There is no question that Mr. Oreffice’s strength of will also uplifted Dow’s businesses, which through the 1970s were overly dependent on basic chemicals like chlorine. When a glut of low-priced petrochemicals flooded the global market in the early 80s, he aggressively reshaped Dow by diversifying into consumer products, such as shampoos and the cleaning fluid Fantastik, and by moving into foreign markets. By 1987, Dow posted a record profit of $1.3 billion (about $3.5 billion in today’s currency).

At the same time, a class-action lawsuit on behalf of 20,000 Vietnam veterans and their families against Dow and other makers of Agent Orange was further tarnishing the company’s image. The suit, filed in 1979, charged that dioxin in Agent Orange led to cancer in combat veterans and genetic defects in their children.

Dow argued that it had made Agent Orange at the request of the government and was not responsible for how it was used. But in 1984, the company and other makers of Agent Orange, without admitting liability, settled the lawsuit for $180 million, with the proceeds going to veterans and their families.

In another controversy, Dow Corning, a joint venture between Dow Chemical and Corning Inc., released documents in February 1992 showing that it had known since 1971 that silicone gel could leak from breast implants it made.

Tens of thousands of women had sued the company, claiming their implants had given them breast cancer and autoimmune diseases. Dow Corning agreed to a $3.2 billion settlement after the company had been driven to file for bankruptcy protection.

In 1999, an independent review by an arm of the National Academy of Sciences concluded that silicone implants do not cause major diseases.

Paul Fausto Orrefice was born Nov. 29, 1927, in Venice. His parents, Max and Elena (Friedenberg) Oreffice, moved the family to Ecuador in 1940 as Mussolini declared war on Britain and France. Paul came to the U.S. in 1945, entering Purdue University with fewer than 50 words of English at his command.

He graduated with a B.S. in chemical engineering in 1949, became a naturalized citizen, and after two years in the Army went to work for Dow in 1953.

“When I walked into Midland, Mich., this was ‘WASP’ country, and I was a ‘W’ but I wasn’t an ‘ASP,’” he told The Washington Post in 1986. “I spoke with an accent and combed my hair straight back, which just wasn’t done.”

Mr. Oreffice represented Dow in Switzerland, Italy, Brazil and Spain before being called back to the Midland headquarters in 1969 and appointed the company’s financial vice president. He became president of Dow Chemical U.S.A. in 1975 and was then promoted to president and chief executive of the parent Dow Chemical Company in 1978. In 1986, he added the title of chairman.

To the astonishment of many observers, Dow poured millions of dollars in the mid-1980s into a public-relations campaign to improve its image, including a new slogan, “Dow let’s you do great things.”

Under company rules, when he reached age 60, Mr. Oreffice stepped down as president and chief executive in 1987. He retired as chairman in 1992.

He is survived by his wife of 29 years, Jo Ann Pepper Oreffice, his children Laura Jennison and Andy Oreffice, six grandchildren and one great-granddaughter.

In retirement, Mr. Oreffice pursued a passion for thoroughbred racehorses, investing in Kentucky Derby starters and spending summers at a home in Saratoga Springs, N.Y. He was a partner in a Preakness Stakes winner, Summer Squall, and a Belmont Stakes winner, Palace Malice.

In 2006, he published a memoir about rising from an immigrant with little English to a corporate titan, titling it “Only in America.”

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics7 days ago

Politics7 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics5 days ago

Politics5 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health4 days ago

Health4 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades