Business

Column: Moderna and Pfizer are jacking up the price of COVID vaccines. The government should stop them

Stéphane Bancel, the chief govt of drug firm Moderna, might barely restrain his delight in issuing his annual letter to shareholders on Jan. 3.

“For the reason that starting, it has been our mission to ship on the promise of mRNA know-how for sufferers,” Bancel wrote, referring to the vaccines within the firm’s product pipeline that use quick items of genetic code to assist cells construct immunity.

“And we delivered at pace with our mRNA vaccine in opposition to COVID-19,” he continued. “As our first permitted product, it has impacted lots of of tens of millions of lives world wide. … We’re harnessing the ability of mRNA to create a brand new class of medicines and an organization that maximizes its impression on human well being.”

Moderna is dedicated to pricing that displays the worth that COVID-19 vaccines deliver to sufferers, healthcare programs, and society.

— Moderna spokesman Christopher Ridley

A few pertinent factors have been lacking from Bancel’s 2,700 phrases of self-congratulation. One was the contribution of the federal authorities to the corporate’s success.

That included a analysis grant of virtually $1 billion from the federal government’s Biomedical Superior Analysis and Improvement Authority, or BARDA, via 2020, plus a $1.5-billion federal buy assure in 2020 for COVID vaccines earlier than testing was even accomplished — a deal that materially lowered Moderna’s monetary dangers in creating the vaccine.

Nor does that depend the tens of millions, probably billions, in federally-funded fundamental analysis at tutorial establishments and authorities laboratories in mRNA know-how— the muse of the product developed by Moderna.

Additionally glossed over was Moderna’s intention to boost the worth of its COVID vaccine from the estimated $20.69 per dose paid by the federal authorities via December 2022 for 1.2 billion doses of COVID vaccines, together with Moderna’s product and an identical mRNA formulation produced by Pfizer, to as a lot as $130 per dose.

Pfizer, which didn’t obtain federal analysis funding however did get hold of a authorities buy assure, has additionally introduced a value improve to as a lot as $130 per dose.

Pfizer’s vaccine additionally derives from fundamental government-funded analysis; certainly, on its web site the corporate acknowledges the foundational work on mRNA know-how by Katalin Karikó and Drew Weissman of the College of Pennsylvania, analysis that was funded partly by the Nationwide Institutes of Well being.

Each firms have justified the deliberate value hikes partly by citing the financial savings in healthcare prices the vaccines have produced.

In an electronic mail, a Pfizer spokesman instructed me that its vaccine and different therapies have “saved lots of of 1000’s of lives [and] tens of billions of {dollars} in well being care prices.” Pfizer “has priced the vaccine to make sure the worth is according to the worth delivered,” the e-mail stated.

Moderna makes an identical level. “Moderna is dedicated to pricing that displays the worth that COVID-19 vaccines deliver to sufferers, healthcare programs, and society,” firm spokesman Christopher Ridley stated by electronic mail.

It’s not possible to overstate the ethical depravity of this argument. The businesses are saying, in essence, that they deserve a reduce of the financial savings in lives and cash attributable to their merchandise, they usually’ll determine the dimensions of that reduce for themselves— unbiased of concerns reminiscent of the price of creating and manufacturing the medication or the impression that larger costs can have on sufferers’ entry.

The COVID vaccines have sharply lowered mortality charges from the pandemic throughout the board.

(U.S. Facilities for Illness Management and Prevention)

No trade aside from prescribed drugs asserts that its costs must be based mostly on the upper prices of options, but it surely’s a well-known consider drug pricing. Gilead Sciences, for example, set the worth of Sovaldi and Harvoni, its hepatitis C remedies, above $80,000 for a 12-week course based mostly on the medication’ “worth premium” — the upper price of different remedies.

After a U.S. Senate committee issued a blistering report about Gilead’s pricing technique, the corporate acknowledged that the medication have been “priced consistent with the earlier requirements of care” and that the costs “are lower than the price of prior regimens, despite the fact that our therapies have considerably larger treatment charges and only a few negative effects.”

The worth will increase of the Pfizer and Moderna vaccines virtually inevitably will translate into decrease vaccination charges, whilst executives at each vaccine firms assert that the worth will increase shall be invisible to most People.

“Anybody with business or authorities insurance coverage who’s eligible to be vaccinated ought to be capable to entry the vaccine with none out-of-pocket funds,” Pfizer govt Angela Lukin instructed Wall Avenue analysts on a convention name Oct. 20, when the corporate introduced its proposed listing value of $110 to $130 per dose.

That’s extremely deceptive, nevertheless. Underinsured or uninsured People might be charged the complete value, which might put the vaccine past their means to pay. To the extent insurers or Medicare and Medicaid would shoulder a lot of the price for his or her enrollees, it might be mirrored in larger premiums.

Pfizer says that some uninsured People shall be eligible for the corporate’s affected person help program, which covers some co-pays for its medication. However that program requires an utility and appreciable paperwork; it’s no substitute for strolling right into a pharmacy and receiving the shot on request, as has been doable via the federal government program.

Make no mistake: It is a public well being situation. The federal government’s COVID vaccination program prevented greater than 18.5 million extra hospitalizations and three.2 million extra deaths, based on analysis by the Commonwealth Fund.

“With out vaccination, there would have been almost 120 million extra COVID-19 infections,” estimated the Commonwealth Fund, which additionally calculated that the vaccination program “saved the U.S. $1.15 trillion … in medical prices that may in any other case have been incurred.

Authorities statistics plainly present that vaccinated people have a sharply lowered COVID-related mortality fee, with the features multiplying for sufferers who’re totally vaccinated and boosted.

Although there’s no query that the vaccines have saved society cash and lives, that leaves the query of how a lot in income the producers should reap from them — in addition to calculate the price of lowered entry to those merchandise attributable to larger costs.

The list-price will increase are solely a part of the story. The opposite aspect of the coin is the revenue margin Moderna and Pfizer anticipate to see from the vaccines. Based on an evaluation by Oxfam, the mRNA vaccines might be produced for as little as $1.18 to $2.85 per dose, that means that even on the authorities value the businesses have been amassing huge income.

There would seem like loads of headroom for Moderna and Pfizer to revenue from the vaccines even at decrease costs. Pfizer has projected annual gross sales of its vaccine at $34 billion and Moderna at $18 billion to $19 billion. These estimates have been based mostly on 2022 gross sales, earlier than value will increase take impact. Authorities authorities have began to speak a few regime of annual COVID vaccine boosters, just like flu vaccines, implying a gentle stream of revenues for the businesses for years to return.

The worth will increase replicate what Moderna and Pfizer each confer with because the transition to business advertising of the vaccines. That’s crucial as a result of the federal authorities has run out of cash to purchase doses and distribute them at no cost. Final 12 months, President Biden requested Congress for $3.9 billion “to assist guarantee prepared entry to vaccinations, testing, remedy and operational help” for People. He didn’t get it.

The impression of federal funding for Moderna has been stupendous — and a big proportion of that acquire has flowed on to shareholders. Based on the corporate’s most up-to-date quarterly report, the corporate spent $2.1 billion on analysis and growth within the first 9 months of 2022. However it spent $2.9 billion in the identical interval on inventory buybacks, which pump up the worth of its inventory.

These repurchases have been a part of $6 billion in inventory buybacks approved final 12 months by the Moderna board, of which greater than $3 billion stays obtainable. Fundamental math tells you that had Moderna not acquired its greater than $1 billion in R&D help from the federal government, it could have had at the very least that a lot much less to upstream to shareholders.

As I’ve written earlier than, it’s the cowardice of political leaders and authorities regulators that enables drug corporations reminiscent of Moderna and Pfizer to dictate larger costs for merchandise developed partly with authorities funding.

The federal government arguably has authority over pricing and distribution of merchandise developed with federal funding, such because the COVID vaccines. The important thing issue is the Bayh-Dole Act of 1980, which allowed non-public firms to commercialize innovations that grew out of federally funded analysis, but it surely reserved sure rights for the federal government to guard taxpayers’ investments.

Chief amongst them are “march-in rights.” These enable the federal government to require {that a} federally funded drug be licensed to different producers, or to supply a license itself to different drugmakers to make sure that the drug is extensively accessible. These rights might be exercised if the federal government concludes {that a} producer hasn’t taken ample steps to make a product publicly obtainable or hasn’t introduced it out on “phrases which might be cheap.”

The federal government has by no means exercised its march-in rights, although it has often threatened to take action to extract concessions from producers. However as drug costs skyrocket, stress on federal authorities to take motion is intensifying.

Prostate most cancers sufferers, for example, have been urgent the Division of Well being and Human Companies to take motion on Xtandi, a surprise drug for the illness that was developed at UCLA with substantial funding from the Pentagon and the Nationwide Institutes of Well being.

The typical wholesale value of Xtandi, for which Pfizer holds a producing license, involves $189,800 a 12 months. (UCLA had collected greater than $520 million in royalties from the drug when it offered the rights in 2016.) Thus far, Well being and Human Companies has failed even to carry a listening to on a year-old petition by prostate most cancers sufferers aimed toward bringing the drug value down by exercising march-in rights.

The COVID vaccines might be one other take a look at case. Few medication available on the market at the moment can match their capability to advance public well being and few could also be as delicate to the extent of value will increase deliberate by Moderna and Pfizer.

It is a topic on which the federal authorities can not and shouldn’t stay silent.

Business

After 57 years of open seating, is Southwest changing its brand?

Jim Kingsley of Orange County, who recently flew Southwest on a two-leg journey from Minneapolis to Los Angeles, likened the budget-friendly airline to In-N-Out Burger.

Both brands are affordable, consistent and more simplistic compared with competitors, Kingsley said.

“They’re not trying to offer all the things everybody else offers,” he said, “but they get the quality right and it’s a good value.”

Change, however, is in the air.

Southwest, which since its founding nearly 60 years ago has positioned itself in the cutthroat airline industry as an easygoing, egalitarian option, upended that guiding ethos this week with word that it would get rid of its famous first-come, first-seated policy in favor of traditional assigned seats and a premium class option. They will also offer overnight, red-eye flights in five markets including Los Angeles.

Experts say the changes, especially the switch to assigned seating, are a smart move and will appeal to many as the company tries to stabilize its precarious finances that included a 46% drop in profits in the second quarter from a year earlier to $367 million. But it remains to be seen whether Southwest will pay an intangible cost in making the moves: Will it be able to hold on to its quirky identity or will it put off loyal customers, and in doing so, become just another airline?

“You’re going to hear nostalgia about this, but I think it’s very logical and probably something the company should have done years ago,” said Duane Pfennigwerth, a global airlines analyst at Evercore.

“In many markets away from core Southwest markets, we think open seating is a boarding process that many people avoid,” he said.

That is all well and good, but “I didn’t ask for these changes,” Kingsley said. “Cost and quality is what I care about.”

Open seating has its pros and cons, Kingsley said, though he’s generally a fan. On his trip to Los Angeles, his group wasn’t able to get seats all together. But he likes that preferred seats are available on a first-come, first-served basis, instead of being offered for a high price.

Eighty percent of Southwest customers and 86% of potential customers prefer an assigned seat, the airline said in a statement.

“By moving to an assigned seating model, Southwest expects to broaden its appeal and attract more flying from its current and future customers,” the airline said.

An even bigger draw of Southwest, according to Kingsley, is its policy of including two free checked bags per ticket. This perk often makes Southwest a better bargain, especially for longer trips or bigger groups, he said.

The free bags are a big deal to customers, experts said, and contribute to the airline’s consumer-friendly brand. The airline hasn’t indicated they plan to change their bag policy.

“Southwest has always had a really good, positive vibe,” said Alan Fyall, chair of Tourism Marketing at the University of Central Florida’s College of Hospitality. “It’s free bags, good prices and point-to-point routes. That’s what they stand for and that’s what people love about them.”

Southwest’s change to assigned seating doesn’t mean they’re no longer a budget-friendly airline, Fyall said, but it does differentiate them from the lowest-cost, lowest-amenity options such as Frontier and Spirit.

The move will also require Southwest to update all or a portion of its fleet to include first-class seats. Currently, all seats on a Southwest flight are identical. Fyall said it’s worth the investment.

It’s an appropriate time for Southwest to make adjustments, said Chris Hydock, an assistant professor at Tulane University’s Freeman School of Business.

“They’ve not been profitable the last couple of quarters and they’ve had some activist investor pressure to increase their revenue,” he said.

Costs such as wages and maintenance have risen across the airline industry even as travel increased after the pandemic. Southwest saw a net loss of $231 million in the first quarter of 2024. Wall Street analysts estimate that assigned, premium seating could boost revenue by $2 billion per year.

“This is one of the options where they could potentially increase their revenue and do something that a lot of consumers have a strong preference for anyway,” Hydock said.

For Southwest’s changes to pay off, it has to stick to its roots when it comes to its culture and brand, experts and travelers agreed.

“I love Southwest being different,” Kingsley said. “If they’re trying to be like the other airlines, I think they’re shooting themselves in the foot.”

Business

Column: 99 years after the Scopes 'monkey trial,' religious fundamentalism still infects our schools

Almost a century has passed since a Tennessee schoolteacher was found guilty of teaching evolution to his students. We’ve come a long way since that happened on July 21, 1925. Haven’t we?

No, not really.

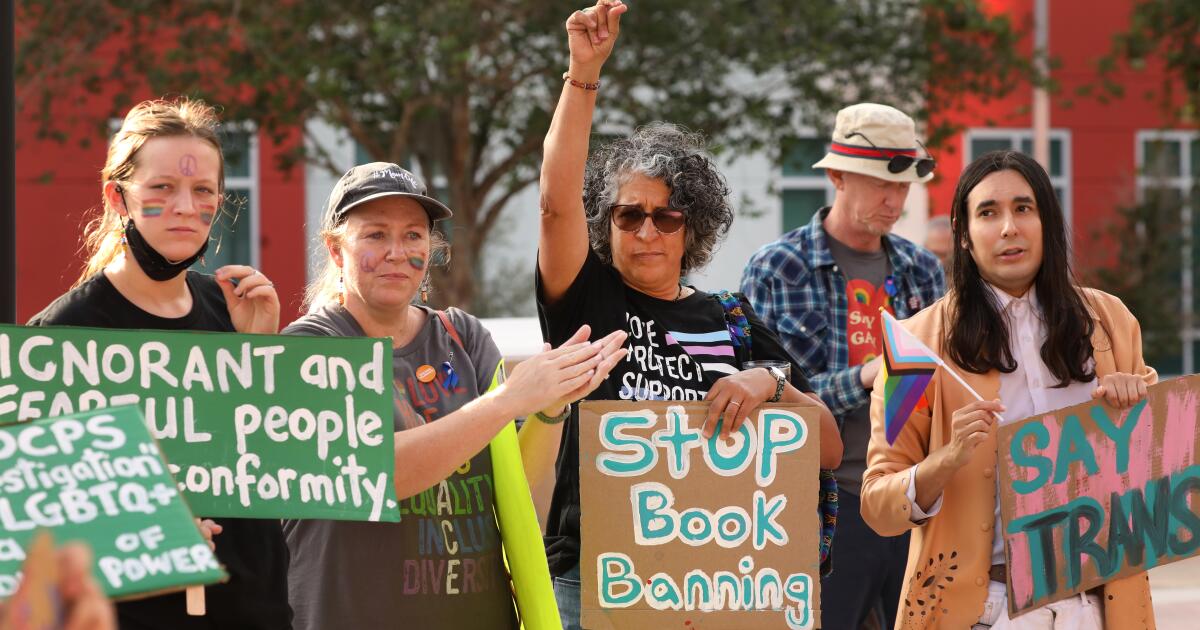

The Christian fundamentalism that begat the state law that John Scopes violated has not gone away. It regularly resurfaces in American politics, including today, when efforts to ban or dilute the teaching of evolution and other scientific concepts are part and parcel of a nationwide book-banning campaign, augmented by an effort to whitewash the teaching of American history.

I knew that education was in danger from the source that has always hampered it—religious fanaticism.

— Clarence Darrow, on why he took on the defense of John Scopes at the ‘monkey trial’

The trial in Dayton, Tenn., that supposedly placed evolution in the dock is seen as a touchstone of the recurrent battle between science and revelation. It is and it isn’t. But the battle is very real.

Let’s take a look.

The Scopes trial was one of the first, if not the very first, to be dubbed “the trial of the century.”

And why not? It pitted the fundamentalist William Jennings Bryan — three-time Democratic presidential candidate, former congressman and secretary of State, once labeled “the great commoner” for his faith in the judgment of ordinary people, but at 65 showing the effects of age — against Clarence Darrow, the most storied defense counsel of his time.

The case has retained its hold on the popular imagination chiefly thanks to “Inherit the Wind,” an inescapably dramatic reconstruction — actually a caricature — of the trial that premiered in 1955, when the play was written as a hooded critique of McCarthyism.

Most people probably know it from the 1960 film version, which starred Frederic March, Spencer Tracy and Gene Kelly as the characters meant to portray Bryan, Darrow and H.L. Mencken, the acerbic Baltimore newspaperman whose coverage of the trial is a genuine landmark of American journalism.

What all this means is that the actual case has become encrusted by myth over the ensuing decades.

One persistent myth is that the anti-evolution law and the trial arose from a focused groundswell of religious fanaticism in Tennessee. In fact, they could be said to have occurred — to repurpose a phrase usually employed to describe how Britain acquired her empire — in “a fit of absence of mind.”

The Legislature passed the measure idly as a meaningless gift to its drafter, John W. Butler, a lay preacher who hadn’t passed any other bill. (The bill “did not amount to a row of pins; let him have it,” a legislator commented, according to Ray Ginger’s definitive 1958 book about the case, “Six Days or Forever?”)

No one bothered to organize an opposition. There was no legislative debate. The lawmakers assumed that Gov. Austin Peay would simply veto the bill. The president of the University of Tennessee disdained it, but kept mum because he didn’t want the issue to complicate a plan for university funding then before the Legislature.

Peay signed the bill, asserting that it was an innocuous law that wouldn’t interfere with anything being taught in the state’s schools. The law “probably … will never be applied,” he said. Bryan, who approved of the law as a symbolic statement of religious principle, had advised legislators to leave out any penalty for violation, lest it be declared unconstitutional.

The lawmakers, however, made it a misdemeanor punishable by a fine for any teacher in the public schools “to teach any theory that denies the story of the Divine Creation of man as taught in the Bible, and to teach instead that man had descended from a lower order of animal.”

Scopes’ arrest and trial proceeded in similarly desultory manner. Scopes, a school football coach and science teacher filling in for an ailing biology teacher, assigned the students to read a textbook that included evolution. He wasn’t a local and didn’t intend to set down roots in Dayton, but his parents were socialists and agnostics, so when a local group sought to bring a test case, he agreed to be the defendant.

The play and movie of “Inherit the Wind” portray the townspeople as religious fanatics, except for a couple of courageous individuals. In fact, they were models of tolerance. Even Mencken, who came to Dayton expecting to find a squalid backwater, instead discovered “a country town full of charm and even beauty.”

Dayton’s civic boosters paid little attention to the profound issues ostensibly at play in the courthouse; they saw the trial as a sort of economic development project, a tool for attracting new residents and businesses to compete with the big city nearby, Chattanooga. They couldn’t have been happier when Bryan signed on as the chief prosecutor and a local group solicited Darrow for the defense.

“I knew that education was in danger from the source that has always hampered it — religious fanaticism,” Darrow wrote in his autobiography. “My only object was to focus the attention of the country on the programme of Mr. Bryan and the other fundamentalists in America.” He wasn’t blind to how the case was being presented in the press: “As a farce instead of a tragedy.” But he judged the press publicity to be priceless.

The press and and the local establishment had diametrically opposed visions of what the trial was about. The former saw it as a fight to protect from rubes the theory of evolution, specifically that humans descended from lower orders of primate, hence the enduring nickname of the “monkey trial.” For the judge and jury, it was about a defendant’s violation of a law written in plain English.

The trial’s elevated position in American culture derives from two sources: Mencken’s coverage for the Baltimore Sun, and “Inherit the Wind.” Notwithstanding his praise for Dayton’s “charm,” Mencken scorned its residents as “yokels,” “morons” and “ignoramuses,” trapped by their “simian imbecility” into swallowing Bryan’s “theologic bilge.”

The play and movie turned a couple of courtroom exchanges into moments of high drama, notably Darrow’s calling Bryan to the witness stand to testify to the truth of the Bible, and Bryan’s humiliation at his hands.

In truth, that exchange was a late-innings sideshow of no significance to the case. Scopes was plainly guilty of violating the law and his conviction preordained. But it was overturned on a technicality (the judge had fined him $100, more than was authorized by state law), leaving nothing for the pro-evolution camp to bring to an appellate court. The whole thing fizzled away.

The idea that despite Scopes’ conviction, the trial was a defeat for fundamentalism, lived on. Scopes was one of its adherents. “I believe that the Dayton trial marked the beginning of the decline of fundamentalism,” he said in a 1965 interview. “I feel that restrictive legislation on academic freedom is forever a thing of the past, … that the Dayton trial had some part in bringing to birth this new era.”

That was untrue then, or now. When the late biologist and science historian Stephen Jay Gould quoted that interview in a 1981 essay, fundamentalist politics were again on the rise. Gould observed that Jerry Falwell had taken up the mountebank’s mission of William Jennings Bryan.

It was harder then to exclude evolution from the class curriculum entirely, Gould wrote, but its enemies had turned to demanding “‘equal time’ for evolution and for old-time religion masquerading under the self-contradictory title of ‘scientific creationism.’”

For the evangelical right, Gould noted, “creationism is a mere stalking horse … in a political program that would ban abortion, erase the political and social gains of women … and reinstitute all the jingoism and distrust of learning that prepares a nation for demagoguery.”

And here we are again. Measures banning the teaching of evolution outright have not lately been passed or introduced at the state level. But those that advocate teaching the “strengths and weaknesses” of scientific hypotheses are common — language that seems innocuous, but that educators know opens the door to undermining pupils’ understanding of science.

In some red states, legislators have tried to bootstrap regulations aimed at narrowing scientific teaching onto laws suppressing discussions of race and gender in the classrooms and stripping books touching those topics from school libraries and public libraries.

The most ringing rejection of creationism as a public school topic was sounded in 2005 by a federal judge in Pennsylvania, who ruled that “intelligent design” — creationism by another name — “cannot uncouple itself from its creationist, and thus religious, antecedents” and therefore is unconstitutional as a topic in public schools. Yet only last year, a bill to allow “intelligent design” to be taught in the state’s public schools was overwhelmingly passed by the state Senate. (It died in a House committee.)

Oklahoma’s reactionary state superintendent of education, Ryan Walters, recently mandated that the Bible should be taught in all K-12 schools, and that a physical copy be present in every classroom, along with the Ten Commandments, the Declaration of Independence and the Constitution. “These documents are mandatory for the holistic education of students in Oklahoma,” he ordered.

It’s clear that these sorts of policies are broadly unpopular across much of the nation: In last year’s state and local elections, ibook-banners and other candidates preaching a distorted vision of “parents’ rights” to undermine educational standards were soundly defeated.

That doesn’t seem to matter to the culture warriors who have expanded their attacks on race and gender teaching to science itself. They’re playing a long game. They conceal their intentions with vague language in laws that force teachers to question whether something they say in class will bring prosecutors to the schoolhouse door.

Gould detected the subtext of these campaigns. So did Mencken, who had Bryan’s number. Crushed by his losses in three presidential campaigns in 1896, 1900 and 1908, Mencken wrote, Bryan had launched a new campaign of cheap religiosity.

“This old buzzard,” Mencken wrote, “having failed to raise the mob against its rulers, now prepares to raise it against its teachers.” Bryan understood instinctively that the way to turn American society from a democracy to a theocracy was to start by destroying its schools. His heirs, right up to the present day, know it too.

Business

NASA identifies Starliner problems but sets no date for astronauts' return to Earth

After weeks of testing, NASA and Boeing officials said Thursday they have identified problems with the Starliner’s propulsion system that have kept two astronauts at the International Space Station for seven weeks — but they didn’t set a date to return them to Earth.

Ground testing conducted on thrusters that maneuver Boeing’s capsule in space found that Teflon used to control the flow of rocket propellant eroded under high heat conditions, while different seals that control helium gas showed bulging, they said.

The testing was conducted after the thrusters malfunctioned when Starliner docked with the space station on June 6 and a helium leak that was detected before launch worsened on the trip to the station. The helium pressurizes the propulsion system.

However, officials said the problems should not prevent astronauts Suni Williams and Butch Wilmore from returning to Earth aboard the Starliner capsule, which lifted off on its maiden human test flight June 5 for what was supposed to be an eight-day mission.

“I am very confident we have a good vehicle to bring the crew back with,” Mark Nappi, program manager of Boeing’s Commercial Crew Program, said at a news conference.

NASA and Boeing officials have said previously that the Starliner could transport the astronauts to Earth if there were an emergency aboard the space station, but they opted to conduct the ground tests to ensure a safe, planned return.

Decisions on whether and when to use Starliner or another vehicle will be made by NASA leaders after they are presented next week with all the information collected from the testing, which will include a “hot fire” test of the engines of the Starliner docked at the space station, Nappi said.

Rigorous ground testing conducted at NASA’s White Sands Test Facility on a thruster identical to the ones on the Starliner found that, despite the issues with Teflon degradation, the thruster was able to perform the maneuvers that would be needed to return Starliner to Earth, said Steve Stich, program manager for NASA’s Commercial Crew Program.

Official also have said that the Starliner still has about 10 times more helium than is needed to bring the capsule back to Earth.

The problems that have cropped up have been an embarrassment for Boeing, which along with SpaceX was given a multibillion-dollar contract in 2014 to service the station with crew and cargo flights after the end of the space shuttle program. Since then, Elon Musk’s Hawthorne-based company has sent more than a half-dozen crews up, while Boeing is still in its testing phase — with the current flight delayed for weeks by the helium leak and other issues that arose even before the thrusters malfunctioned.

Should NASA make a decision not to bring the crew home on the Starliner — which could still return to Earth remotely — the astronauts could be retrieved by SpaceX’s Crew Dragon capsule, though SpaceX’s workhorse Falcon 9 rocket is currently grounded after a failure this month.

The Russian Soyuz spacecraft also services the station and carries American astronauts.

-

World1 week ago

World1 week agoOne dead after car crashes into restaurant in Paris

-

Midwest1 week ago

Midwest1 week agoMichigan rep posts video response to Stephen Colbert's joke about his RNC speech: 'Touché'

-

News1 week ago

News1 week agoVideo: Young Republicans on Why Their Party Isn’t Reaching Gen Z (And What They Can Do About It)

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: A new generation drives into the storm in rousing ‘Twisters’

-

News1 week ago

News1 week agoIn Milwaukee, Black Voters Struggle to Find a Home With Either Party

-

Politics1 week ago

Politics1 week agoFox News Politics: The Call is Coming from Inside the House

-

News1 week ago

News1 week agoVideo: J.D. Vance Accepts Vice-Presidential Nomination

-

World1 week ago

World1 week agoTrump to take RNC stage for first speech since assassination attempt