Business

China mira hacia México para satisfacer al mercado de EE. UU.

Invoice Chan nunca había puesto un pie en México, y mucho menos en la solitaria franja desértica del norte del país donde apruptamente decidió construir una fábrica de 300 millones de dólares. Pero eso le parecía un detalle insignificante, en medio de la presión para adaptarse a una economía world que cambia con rapidez.

Period enero de 2022 y la empresa de Chan, Man Wah Furnishings Manufacturing, enfrentaba grandes dificultades al trasladar los sofás de sus fábricas en China a los clientes en Estados Unidos. Los precios de envío se habían disparado. Washington y Pekín estaban enfrascados en una feroz guerra comercial.

Man Wah, una de las empresas de muebles más grandes de China, estaba ansiosa por fabricar sus productos en el lado norteamericano del Pacífico.

“Nuestro principal mercado es Estados Unidos”, dijo Chan, director ejecutivo de la subsidiaria mexicana de Man Wah. “No queremos perder ese mercado”.

Ese mismo objetivo explica por qué decenas de importantes empresas chinas están invirtiendo agresivamente en México, aprovechando un acuerdo comercial expansivo con América del Norte. Siguiendo un camino forjado por las empresas japonesas y surcoreanas, las firmas chinas están estableciendo fábricas que les permiten etiquetar sus productos como “Hecho en México”, y luego los transportan en camiones libres de impuestos a Estados Unidos.

El interés de los fabricantes chinos en México forma parte de una tendencia más amplia conocida como nearshoring o deslocalización cercana. Las empresas internacionales están acercando la producción a los clientes para limitar su vulnerabilidad a los problemas de transporte y las tensiones geopolíticas.

La participación de las empresas chinas en este cambio muestra la suposición cada vez más profunda de que la brecha que divide a Estados Unidos y China será una característica duradera de la próxima fase de la globalización. Sin embargo, también revela algo elementary: más allá de las tensiones políticas, las fuerzas comerciales que unen a Estados Unidos y China son aún más poderosas.

Las empresas chinas no tienen intención de abandonar la economía estadounidense, que sigue siendo la más grande del mundo. En cambio, están estableciendo operaciones dentro del bloque comercial de América del Norte como una forma de suministrar bienes a los estadounidenses, desde productos electrónicos hasta ropa y muebles.

El estado fronterizo mexicano de Nuevo León se ha posicionado para cosechar las recompensas de esa tendencia. Dirigido por un impetuoso gobernador de 35 años, Samuel García, el estado ha cortejado la inversión extranjera mientras busca mejorar las carreteras para facilitar el paso a los cruces fronterizos.

García asistió recientemente al Foro Económico Mundial en Davos, Suiza, para reclutar más empresas.

“Nuevo León está teniendo un alineamiento planetario geopolítico”, declaró el gobernador durante una entrevista en la capital del estado de Monterrey, dentro del palacio de gobierno, un laberinto de grandes habitaciones con techos altos y balcones que miran hacia los picos irregulares de la Sierra Madre. “Estamos recibiendo muchos asiáticos que quieren venir al mercado estadounidense”.

Desde que García asumió el cargo en octubre de 2021, se han invertido casi 7000 millones de dólares en inversiones extranjeras en Nuevo León, lo que convierte a ese estado en el mayor receptor después de Ciudad de México, según la Secretaría de Economía de México.

En 2021, las empresas chinas fueron responsables del 30 por ciento de la inversión extranjera en Nuevo León, solo superadas por Estados Unidos con el 47 por ciento.

Parte de este dinero está financiando fábricas que harán productos terminados para la venta en Estados Unidos. Pero buena parte de esas operaciones se centran en una remodelación más amplia de la cadena de suministro world.

A medida que la pandemia interrumpió la industria china y colapsó los puertos, las empresas con fábricas en Estados Unidos sufrieron escasez de piezas manufacturadas en Asia. Ahora muchas compañías exigen que sus proveedores establezcan plantas en América del Norte o corren el riesgo de perder su negocio.

Lizhong, un fabricante chino de rines para automóviles, está construyendo la primera fábrica de la compañía fuera de Asia en un parque industrial en Nuevo León. Los principales clientes de Lizhong, incluidos Ford y Common Motors, presionaron a la empresa para que abriera una fábrica en América del Norte, según Wang Bing, su gerente common para México.

Una empresa de Corea del Sur, DY Energy, que fabrica componentes para equipos de construcción, está considerando el norte de México para instalar una fábrica cerca de un importante cliente en Texas.

“Después de pasar por la pandemia y la disaster de la cadena de suministro debido al cierre de China por la covid, a muchos fabricantes norteamericanos les gustaría eliminar el riesgo”, dijo Sean Website positioning, ejecutivo de DY Energy con sede en Seattle.

“La globalización ha terminado”, declaró. “Ahora se habla de local-ización”.

César Santos ha hecho una apuesta sustancial respecto a que esos pronunciamientos resulten ciertos.

Santos, un abogado corporativo de 65 años, dirige una empresa secundaria como desarrollador en Monterrey, una ciudad industrial en auge llena de restaurantes de lujo, centros comerciales resplandecientes y spas.

Hace una década, se le acercó un desarrollador en Los Ángeles que representaba a una empresa electrónica china que estaba contemplando construir una fábrica en México. Santos controlaba un activo de gran interés: una parcela de 849 hectáreas.

Salpicada de cactus, la propiedad se encontraba a menos de 241 kilómetros de la frontera con Texas. Mientras los estados vecinos luchaban con la violencia vinculada al narcotráfico, Nuevo León tenía una reputación de seguridad. El estado contaba con una fuerza laboral altamente calificada, dada la presencia de universidades que producían en masa graduados de ingeniería, entre ellas el Tec de Monterrey, a menudo denominado “el MIT de México”.

La tierra había sido el rancho ganadero de su familia cuando Santos period un niño, el escenario de aventuras a caballo. Ahora ve una oportunidad lucrativa para convertirlo en un parque industrial.

Hizo un viaje a China, en un tren de alta velocidad desde Shanghái hasta la ciudad de Hangzhou, frente a un lago, para reunirse con Holley Group, que había construido un parque industrial para empresas chinas en Tailandia.

“China period un país que había desarrollado todo muy rápido”, dijo Santos. “Estaba realmente asombrado”.

Para 2015, se unió a Holley y otro socio chino para forjar una empresa conjunta, Hofusan Actual Property. Planean una purple de almacenes y fábricas frente a un lodge y apartamentos temporales para gerentes visitantes, además de más de 12.000 hogares para trabajadores.

El Grupo Holley envió a Jiang Xin para supervisar la empresa. Antes había trabajado en el proyecto de esa empresa en Tailandia. Pero México representaba una propuesta diferente.

“Las empresas chinas no tenían thought de México, y las únicas cosas que sabíamos eran cosas malas, cosas peligrosas”, dijo Jiang. “Luego vino Trump”.

Cuando asumió la presidencia en 2017, Donald Trump exigió que las empresas estadounidenses abandonaran China. Para 2018, estaba aplicando fuertes aranceles a cientos de miles de millones de dólares en importaciones chinas.

“Lo de los aranceles nos ayudó”, dijo Jiang. “Las empresas chinas querían más opciones. Y nosotros somos una de sus opciones”.

Cuando Chan comenzó a contemplar la posibilidad de operar en México en el otoño de 2021, otras 27 empresas chinas ya habían asegurado terrenos dentro del parque Hofusan. Solo quedaba un predio grande.

Man Wah ya había respondido a los aranceles construyendo una fábrica en Vietnam y usándola con el fin de manufacturar productos para el mercado estadounidense. Pero el precio altísimo de los envíos empobreció esa estrategia.

Cada mes, Man Wah estaba moviendo 3500 contenedores de 12 metros a través del Pacífico desde Vietnam. De repente, los viajes que costaban 2000 dólares se incrementaron 10 veces más.

Chan usó la plataforma de redes sociales china, WeChat, para conectarse con Jiang. Sus preguntas eran contundentes. ¿Qué tan pronto podría Man Wah comenzar la construcción? (Inmediatamente). ¿Cómo estaban las carreteras? (No eran excelentes, pero estaban mejorando). ¿Había algún restaurante chino auténtico en los alrededores? (No).

En cuestión de semanas, Man Wah se comprometió a comprar el terreno. En enero de 2022, Chan firmó el contrato antes de abordar un vuelo a México, dejando atrás a su esposa y sus dos hijos en la ciudad china de Shenzhen.

Mientras se construye la nueva fábrica, Man Wah ya ha comenzado a producir sofás en una pequeña planta cercana que alquilaron.

Incluso antes de ubicar el sitio temporal, Chan cargó 70 contenedores llenos de maquinaria y materias primas en China y los puso en un barco con destino a México.

“Siempre hacemos las cosas rápido”, dijo. “No te preocupes por nada, solo hazlo”.

Man Wah se preocupa por algunas cosas: contratar suficientes trabajadores y cultivar proveedores locales.

La empresa tiene planes de fabricar cerca de 900.000 piezas de mueblería al año en México. Eso requerirá contratar y retener a 6000 trabajadores.

Man Wah está acostumbrado a operar en China y Vietnam, donde los sindicatos independientes están básicamente prohibidos y la gente de las zonas rurales acude a las zonas industriales en busca de trabajo.

En Nuevo León, la tasa de desempleo es de 3,6 por ciento. El aumento de la inversión ha desencadenado una feroz competencia por los trabajadores.

Las empresas astutas han cortejado a sus empleados con extras como comidas de calidad y transporte al trabajo. Pero Man Wah y otras empresas chinas responden a los jefes en China, que están condicionados hacia el ahorro mientras piensan en los trabajadores como fácilmente remplazables.

Encontrar proveedores locales también es un desafío. Según los términos del acuerdo comercial de América del Norte, los fabricantes deben emplear porcentajes mínimos de piezas y materias primas de la región para calificar para el acceso libre de impuestos a los demás países del bloque.

Hace tres años, Lenovo, el fabricante chino de computadoras, abrió una nueva fábrica en Monterrey dedicada a fabricar servidores, los dispositivos que almacenan datos para la computación en la nube.

Hasta el año pasado, Lenovo traía un componente essential, las llamadas placas base, desde una fábrica en China. Pero a medida que se intensificaron los problemas de transporte internacional, la empresa cambió a un proveedor en la ciudad mexicana de Guadalajara.

Lenovo también dejó de importar materiales de embalaje de China y, en cambio, los compra en México.

Pero continúa importando muchos componentes clave de China, desde dispositivos de memoria hasta cables especializados.

“No existe una cadena de suministro para estas cosas en México”, dijo Leandro Sardela, director de operaciones occidentales de la empresa.

Peter S. Goodman es corresponsal de economía mundial, con sede en Nueva York. Antes fue corresponsal de economía mundial con sede en Londres y corresponsal económico nacional en Nueva York durante la Gran Recesión. También trabajó en The Washington Publish como jefe de la oficina de Shanghái. @petersgoodman

Business

After 57 years of open seating, is Southwest changing its brand?

Jim Kingsley of Orange County, who recently flew Southwest on a two-leg journey from Minneapolis to Los Angeles, likened the budget-friendly airline to In-N-Out Burger.

Both brands are affordable, consistent and more simplistic compared with competitors, Kingsley said.

“They’re not trying to offer all the things everybody else offers,” he said, “but they get the quality right and it’s a good value.”

Change, however, is in the air.

Southwest, which since its founding nearly 60 years ago has positioned itself in the cutthroat airline industry as an easygoing, egalitarian option, upended that guiding ethos this week with word that it would get rid of its famous first-come, first-seated policy in favor of traditional assigned seats and a premium class option. They will also offer overnight, red-eye flights in five markets including Los Angeles.

Experts say the changes, especially the switch to assigned seating, are a smart move and will appeal to many as the company tries to stabilize its precarious finances that included a 46% drop in profits in the second quarter from a year earlier to $367 million. But it remains to be seen whether Southwest will pay an intangible cost in making the moves: Will it be able to hold on to its quirky identity or will it put off loyal customers, and in doing so, become just another airline?

“You’re going to hear nostalgia about this, but I think it’s very logical and probably something the company should have done years ago,” said Duane Pfennigwerth, a global airlines analyst at Evercore.

“In many markets away from core Southwest markets, we think open seating is a boarding process that many people avoid,” he said.

That is all well and good, but “I didn’t ask for these changes,” Kingsley said. “Cost and quality is what I care about.”

Open seating has its pros and cons, Kingsley said, though he’s generally a fan. On his trip to Los Angeles, his group wasn’t able to get seats all together. But he likes that preferred seats are available on a first-come, first-served basis, instead of being offered for a high price.

Eighty percent of Southwest customers and 86% of potential customers prefer an assigned seat, the airline said in a statement.

“By moving to an assigned seating model, Southwest expects to broaden its appeal and attract more flying from its current and future customers,” the airline said.

An even bigger draw of Southwest, according to Kingsley, is its policy of including two free checked bags per ticket. This perk often makes Southwest a better bargain, especially for longer trips or bigger groups, he said.

The free bags are a big deal to customers, experts said, and contribute to the airline’s consumer-friendly brand. The airline hasn’t indicated they plan to change their bag policy.

“Southwest has always had a really good, positive vibe,” said Alan Fyall, chair of Tourism Marketing at the University of Central Florida’s College of Hospitality. “It’s free bags, good prices and point-to-point routes. That’s what they stand for and that’s what people love about them.”

Southwest’s change to assigned seating doesn’t mean they’re no longer a budget-friendly airline, Fyall said, but it does differentiate them from the lowest-cost, lowest-amenity options such as Frontier and Spirit.

The move will also require Southwest to update all or a portion of its fleet to include first-class seats. Currently, all seats on a Southwest flight are identical. Fyall said it’s worth the investment.

It’s an appropriate time for Southwest to make adjustments, said Chris Hydock, an assistant professor at Tulane University’s Freeman School of Business.

“They’ve not been profitable the last couple of quarters and they’ve had some activist investor pressure to increase their revenue,” he said.

Costs such as wages and maintenance have risen across the airline industry even as travel increased after the pandemic. Southwest saw a net loss of $231 million in the first quarter of 2024. Wall Street analysts estimate that assigned, premium seating could boost revenue by $2 billion per year.

“This is one of the options where they could potentially increase their revenue and do something that a lot of consumers have a strong preference for anyway,” Hydock said.

For Southwest’s changes to pay off, it has to stick to its roots when it comes to its culture and brand, experts and travelers agreed.

“I love Southwest being different,” Kingsley said. “If they’re trying to be like the other airlines, I think they’re shooting themselves in the foot.”

Business

Column: 99 years after the Scopes 'monkey trial,' religious fundamentalism still infects our schools

Almost a century has passed since a Tennessee schoolteacher was found guilty of teaching evolution to his students. We’ve come a long way since that happened on July 21, 1925. Haven’t we?

No, not really.

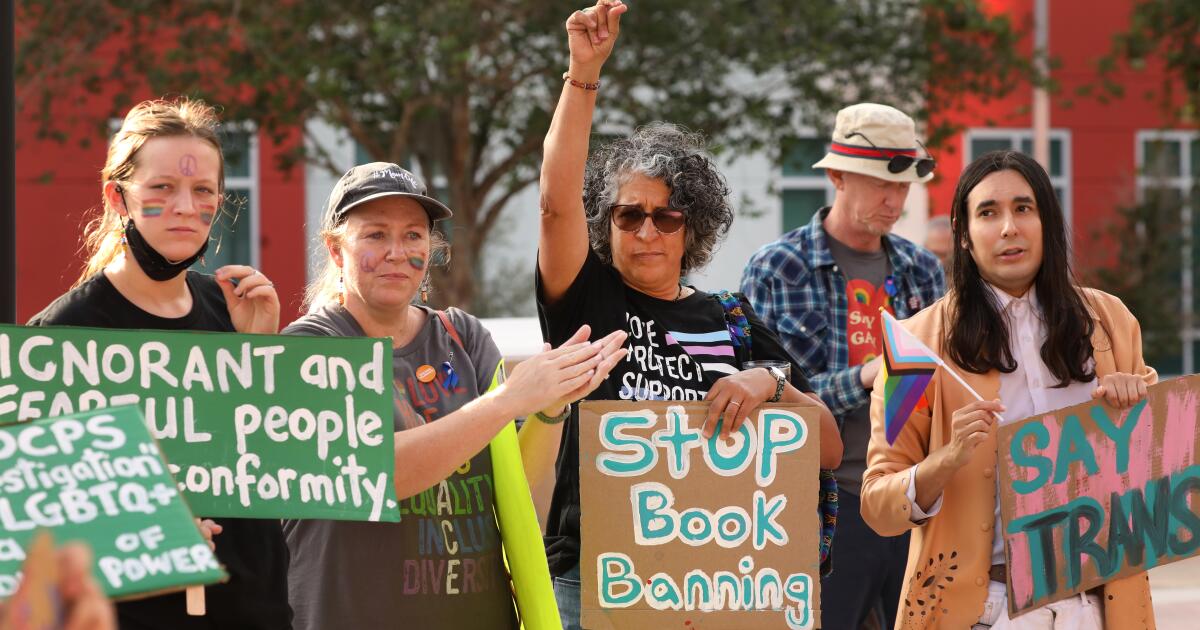

The Christian fundamentalism that begat the state law that John Scopes violated has not gone away. It regularly resurfaces in American politics, including today, when efforts to ban or dilute the teaching of evolution and other scientific concepts are part and parcel of a nationwide book-banning campaign, augmented by an effort to whitewash the teaching of American history.

I knew that education was in danger from the source that has always hampered it—religious fanaticism.

— Clarence Darrow, on why he took on the defense of John Scopes at the ‘monkey trial’

The trial in Dayton, Tenn., that supposedly placed evolution in the dock is seen as a touchstone of the recurrent battle between science and revelation. It is and it isn’t. But the battle is very real.

Let’s take a look.

The Scopes trial was one of the first, if not the very first, to be dubbed “the trial of the century.”

And why not? It pitted the fundamentalist William Jennings Bryan — three-time Democratic presidential candidate, former congressman and secretary of State, once labeled “the great commoner” for his faith in the judgment of ordinary people, but at 65 showing the effects of age — against Clarence Darrow, the most storied defense counsel of his time.

The case has retained its hold on the popular imagination chiefly thanks to “Inherit the Wind,” an inescapably dramatic reconstruction — actually a caricature — of the trial that premiered in 1955, when the play was written as a hooded critique of McCarthyism.

Most people probably know it from the 1960 film version, which starred Frederic March, Spencer Tracy and Gene Kelly as the characters meant to portray Bryan, Darrow and H.L. Mencken, the acerbic Baltimore newspaperman whose coverage of the trial is a genuine landmark of American journalism.

What all this means is that the actual case has become encrusted by myth over the ensuing decades.

One persistent myth is that the anti-evolution law and the trial arose from a focused groundswell of religious fanaticism in Tennessee. In fact, they could be said to have occurred — to repurpose a phrase usually employed to describe how Britain acquired her empire — in “a fit of absence of mind.”

The Legislature passed the measure idly as a meaningless gift to its drafter, John W. Butler, a lay preacher who hadn’t passed any other bill. (The bill “did not amount to a row of pins; let him have it,” a legislator commented, according to Ray Ginger’s definitive 1958 book about the case, “Six Days or Forever?”)

No one bothered to organize an opposition. There was no legislative debate. The lawmakers assumed that Gov. Austin Peay would simply veto the bill. The president of the University of Tennessee disdained it, but kept mum because he didn’t want the issue to complicate a plan for university funding then before the Legislature.

Peay signed the bill, asserting that it was an innocuous law that wouldn’t interfere with anything being taught in the state’s schools. The law “probably … will never be applied,” he said. Bryan, who approved of the law as a symbolic statement of religious principle, had advised legislators to leave out any penalty for violation, lest it be declared unconstitutional.

The lawmakers, however, made it a misdemeanor punishable by a fine for any teacher in the public schools “to teach any theory that denies the story of the Divine Creation of man as taught in the Bible, and to teach instead that man had descended from a lower order of animal.”

Scopes’ arrest and trial proceeded in similarly desultory manner. Scopes, a school football coach and science teacher filling in for an ailing biology teacher, assigned the students to read a textbook that included evolution. He wasn’t a local and didn’t intend to set down roots in Dayton, but his parents were socialists and agnostics, so when a local group sought to bring a test case, he agreed to be the defendant.

The play and movie of “Inherit the Wind” portray the townspeople as religious fanatics, except for a couple of courageous individuals. In fact, they were models of tolerance. Even Mencken, who came to Dayton expecting to find a squalid backwater, instead discovered “a country town full of charm and even beauty.”

Dayton’s civic boosters paid little attention to the profound issues ostensibly at play in the courthouse; they saw the trial as a sort of economic development project, a tool for attracting new residents and businesses to compete with the big city nearby, Chattanooga. They couldn’t have been happier when Bryan signed on as the chief prosecutor and a local group solicited Darrow for the defense.

“I knew that education was in danger from the source that has always hampered it — religious fanaticism,” Darrow wrote in his autobiography. “My only object was to focus the attention of the country on the programme of Mr. Bryan and the other fundamentalists in America.” He wasn’t blind to how the case was being presented in the press: “As a farce instead of a tragedy.” But he judged the press publicity to be priceless.

The press and and the local establishment had diametrically opposed visions of what the trial was about. The former saw it as a fight to protect from rubes the theory of evolution, specifically that humans descended from lower orders of primate, hence the enduring nickname of the “monkey trial.” For the judge and jury, it was about a defendant’s violation of a law written in plain English.

The trial’s elevated position in American culture derives from two sources: Mencken’s coverage for the Baltimore Sun, and “Inherit the Wind.” Notwithstanding his praise for Dayton’s “charm,” Mencken scorned its residents as “yokels,” “morons” and “ignoramuses,” trapped by their “simian imbecility” into swallowing Bryan’s “theologic bilge.”

The play and movie turned a couple of courtroom exchanges into moments of high drama, notably Darrow’s calling Bryan to the witness stand to testify to the truth of the Bible, and Bryan’s humiliation at his hands.

In truth, that exchange was a late-innings sideshow of no significance to the case. Scopes was plainly guilty of violating the law and his conviction preordained. But it was overturned on a technicality (the judge had fined him $100, more than was authorized by state law), leaving nothing for the pro-evolution camp to bring to an appellate court. The whole thing fizzled away.

The idea that despite Scopes’ conviction, the trial was a defeat for fundamentalism, lived on. Scopes was one of its adherents. “I believe that the Dayton trial marked the beginning of the decline of fundamentalism,” he said in a 1965 interview. “I feel that restrictive legislation on academic freedom is forever a thing of the past, … that the Dayton trial had some part in bringing to birth this new era.”

That was untrue then, or now. When the late biologist and science historian Stephen Jay Gould quoted that interview in a 1981 essay, fundamentalist politics were again on the rise. Gould observed that Jerry Falwell had taken up the mountebank’s mission of William Jennings Bryan.

It was harder then to exclude evolution from the class curriculum entirely, Gould wrote, but its enemies had turned to demanding “‘equal time’ for evolution and for old-time religion masquerading under the self-contradictory title of ‘scientific creationism.’”

For the evangelical right, Gould noted, “creationism is a mere stalking horse … in a political program that would ban abortion, erase the political and social gains of women … and reinstitute all the jingoism and distrust of learning that prepares a nation for demagoguery.”

And here we are again. Measures banning the teaching of evolution outright have not lately been passed or introduced at the state level. But those that advocate teaching the “strengths and weaknesses” of scientific hypotheses are common — language that seems innocuous, but that educators know opens the door to undermining pupils’ understanding of science.

In some red states, legislators have tried to bootstrap regulations aimed at narrowing scientific teaching onto laws suppressing discussions of race and gender in the classrooms and stripping books touching those topics from school libraries and public libraries.

The most ringing rejection of creationism as a public school topic was sounded in 2005 by a federal judge in Pennsylvania, who ruled that “intelligent design” — creationism by another name — “cannot uncouple itself from its creationist, and thus religious, antecedents” and therefore is unconstitutional as a topic in public schools. Yet only last year, a bill to allow “intelligent design” to be taught in the state’s public schools was overwhelmingly passed by the state Senate. (It died in a House committee.)

Oklahoma’s reactionary state superintendent of education, Ryan Walters, recently mandated that the Bible should be taught in all K-12 schools, and that a physical copy be present in every classroom, along with the Ten Commandments, the Declaration of Independence and the Constitution. “These documents are mandatory for the holistic education of students in Oklahoma,” he ordered.

It’s clear that these sorts of policies are broadly unpopular across much of the nation: In last year’s state and local elections, ibook-banners and other candidates preaching a distorted vision of “parents’ rights” to undermine educational standards were soundly defeated.

That doesn’t seem to matter to the culture warriors who have expanded their attacks on race and gender teaching to science itself. They’re playing a long game. They conceal their intentions with vague language in laws that force teachers to question whether something they say in class will bring prosecutors to the schoolhouse door.

Gould detected the subtext of these campaigns. So did Mencken, who had Bryan’s number. Crushed by his losses in three presidential campaigns in 1896, 1900 and 1908, Mencken wrote, Bryan had launched a new campaign of cheap religiosity.

“This old buzzard,” Mencken wrote, “having failed to raise the mob against its rulers, now prepares to raise it against its teachers.” Bryan understood instinctively that the way to turn American society from a democracy to a theocracy was to start by destroying its schools. His heirs, right up to the present day, know it too.

Business

NASA identifies Starliner problems but sets no date for astronauts' return to Earth

After weeks of testing, NASA and Boeing officials said Thursday they have identified problems with the Starliner’s propulsion system that have kept two astronauts at the International Space Station for seven weeks — but they didn’t set a date to return them to Earth.

Ground testing conducted on thrusters that maneuver Boeing’s capsule in space found that Teflon used to control the flow of rocket propellant eroded under high heat conditions, while different seals that control helium gas showed bulging, they said.

The testing was conducted after the thrusters malfunctioned when Starliner docked with the space station on June 6 and a helium leak that was detected before launch worsened on the trip to the station. The helium pressurizes the propulsion system.

However, officials said the problems should not prevent astronauts Suni Williams and Butch Wilmore from returning to Earth aboard the Starliner capsule, which lifted off on its maiden human test flight June 5 for what was supposed to be an eight-day mission.

“I am very confident we have a good vehicle to bring the crew back with,” Mark Nappi, program manager of Boeing’s Commercial Crew Program, said at a news conference.

NASA and Boeing officials have said previously that the Starliner could transport the astronauts to Earth if there were an emergency aboard the space station, but they opted to conduct the ground tests to ensure a safe, planned return.

Decisions on whether and when to use Starliner or another vehicle will be made by NASA leaders after they are presented next week with all the information collected from the testing, which will include a “hot fire” test of the engines of the Starliner docked at the space station, Nappi said.

Rigorous ground testing conducted at NASA’s White Sands Test Facility on a thruster identical to the ones on the Starliner found that, despite the issues with Teflon degradation, the thruster was able to perform the maneuvers that would be needed to return Starliner to Earth, said Steve Stich, program manager for NASA’s Commercial Crew Program.

Official also have said that the Starliner still has about 10 times more helium than is needed to bring the capsule back to Earth.

The problems that have cropped up have been an embarrassment for Boeing, which along with SpaceX was given a multibillion-dollar contract in 2014 to service the station with crew and cargo flights after the end of the space shuttle program. Since then, Elon Musk’s Hawthorne-based company has sent more than a half-dozen crews up, while Boeing is still in its testing phase — with the current flight delayed for weeks by the helium leak and other issues that arose even before the thrusters malfunctioned.

Should NASA make a decision not to bring the crew home on the Starliner — which could still return to Earth remotely — the astronauts could be retrieved by SpaceX’s Crew Dragon capsule, though SpaceX’s workhorse Falcon 9 rocket is currently grounded after a failure this month.

The Russian Soyuz spacecraft also services the station and carries American astronauts.

-

World1 week ago

World1 week agoOne dead after car crashes into restaurant in Paris

-

Midwest1 week ago

Midwest1 week agoMichigan rep posts video response to Stephen Colbert's joke about his RNC speech: 'Touché'

-

News1 week ago

News1 week agoVideo: Young Republicans on Why Their Party Isn’t Reaching Gen Z (And What They Can Do About It)

-

Movie Reviews1 week ago

Movie Reviews1 week agoMovie Review: A new generation drives into the storm in rousing ‘Twisters’

-

News1 week ago

News1 week agoIn Milwaukee, Black Voters Struggle to Find a Home With Either Party

-

Politics1 week ago

Politics1 week agoFox News Politics: The Call is Coming from Inside the House

-

News1 week ago

News1 week agoVideo: J.D. Vance Accepts Vice-Presidential Nomination

-

World1 week ago

World1 week agoTrump to take RNC stage for first speech since assassination attempt