Business

As many work from home, office landlords roll out entertainment to entice tenants

As landlords wrestle to get individuals again into workplace buildings that emptied in the course of the pandemic, some are turning to leisure and different enticements similar to yoga lessons to woo cautious employees.

On the Water Backyard workplace complicated in Santa Monica, a dance troupe has taken up residence and places on free performances and lessons for teenagers. Flower arranging lessons are packed and the weekly tenants-only comedy present after work is a sizzling ticket. Musical performances by native artists are a lunchtime draw.

Farmers markets, concert events, artwork reveals and different sights for workplace tenants aren’t utterly new, however they’ve taken on urgency as landlords and executives of corporations occupying their buildings try to get employees enthused about displaying up. Some property house owners are hiring “tenant expertise managers.”

In most industrial buildings, solely about half the employees present up at their places of work on weekdays, key-card swipes reveal. Workplace leasing can also be weak: House leases declined once more final quarter to carry the general whole of unleased area in Los Angeles County to almost 20%, properly above the 12% price earlier than the pandemic.

To get employees within the workplace, “you should discover new methods to interact individuals,” stated Bess Wyrick, head of programming on the Water Backyard for property supervisor CBRE.

Stefany Silva, left, Kimberly Fuentes, Jennifer Sandoval and Nicolette Battad discover ways to make floral preparations on the Water Backyard workplace complicated in Santa Monica on Dec. 8.

(Genaro Molina / Los Angeles Instances)

With every day workplace attendance not necessary at many corporations, “It’s not about attempting to create a work-lifestyle steadiness,” she stated. “It’s about making a hybrid office the place persons are excited to return.”

Hybrid work patterns have unfold broadly for the reason that pandemic shutdown of 2020. As corporations carry employees again collectively, many have lowered the variety of days their staff are required to be within the workplace, creating versatile mixtures of workplace days and distant work days.

Beauty firm L’Oréal Group calls for that staff work within the workplace at the very least 3 times every week, on days of their selecting. L’Oréal sweetens the workplace expertise with such comforts as a health heart, restaurant, juice cafe and a cabana-like bar that serves espresso drinks and, relying on the event, alcohol.

Disney Chief Government Bob Iger not too long ago introduced that staff working from residence should return to the workplace Monday by means of Thursday beginning March 1. Fridays are usually the least populated days for places of work, analysis reveals, and whereas most staff toil at residence that day, a number of corporations are taking them off the enterprise calendar altogether and dealing 32 hours every week.

Man Blanco of Soiled Latte Co. prepares espresso for employees on the Water Backyard complicated in Santa Monica final month.

(Genaro Molina / Los Angeles Instances)

Landlords are additionally eager to make places of work interesting so tenants will preserve renting area of their buildings.

The campus-like Water Backyard was a dreary place after being devoid of occupants in the course of the worst of the pandemic, Wyrick stated. Whereas they have been gone, close by companies and eating places close by failed or left for different causes.

“The realm was a ghost city,” she stated.

Wyrick’s first transfer was to rearrange dwell performances by native musicians and dancers within the courtyard. Among the many complicated’s largest tenants are retailer Amazon and expertise agency Oracle.

One among Wyrick’s objectives was to make the Water Backyard a spot individuals wished to go to, together with neighbors who may stroll over to soak up a mid-day live performance or see items by native artists displayed and on the market within the lobbies of the 4 workplace buildings. Getting a buzz of life into the campus may assist deal with a typical chicken-and-egg grievance about going again to the workplace — individuals don’t need to go there if different individuals aren’t round.

Paying performers to seem, serving free meals to tenants at vacation soirees and different deliberate occasions are a part of a advertising and marketing technique to get the property occupied, she stated.

“We are going to lose cash at first,” she stated, “but it surely drives individuals to place roots within the area.”

The important thing measure of success is leasing, and Water Backyard has added tenants over the previous 12 months. Its 1.4 million sq. toes of rental area is 86% leased, up from 72% leased a yr in the past, Wyrick stated.

Harpist Pheobe Madison Schrafft performs for employees on a lunch break on the Water Backyard workplace complicated in Santa Monica.

(Genaro Molina / Los Angeles Instances)

One among her leaps to enliven the place was to comply with an unusually brief lease with a well known dance firm for an expansive first-floor area final occupied by a furnishings showroom. In trade, Jacob Jonas The Firm agreed to interact with different tenants by means of free lessons, performances and different occasions.

The nonprofit dance firm has carried out at Lincoln Middle, the Kennedy Middle and the Hollywood Bowl, in addition to with such musical artists as Rosalia, Sia, Elton John and Britney Spears.

For years, the corporate was based mostly within the Wallace Annenberg Middle for the Performing Arts in Beverly Hills. The prospect to bounce in a working workplace complicated constructed to the buttoned-down tastes of Nineteen Nineties enterprise executives holds particular enchantment to firm founder Jacob Jonas, a Santa Monica native who obtained his begin as a avenue performer on the Venice boardwalk at age 13.

“Our neighbors are a number of the main companies in our nation. There’s one thing actually validating about that and sharing our work,” he stated. “When you could have individuals working behind a desk from 9 to five after which having the ability to expose them to creativity and expose them to artwork in such a singular setting, that crossover is relatively stunning.”

Staff and guests on the Water Backyard can take workshops in floral design, see weekly comedy reveals and attend film nights.

Garryl Bohanon will get some work performed close to a Hanukkah show within the courtyard of the Water Backyard workplace complicated in Santa Monica on Dec. 8.

(Genaro Molina / Los Angeles Instances)

Almost a fifth of the L.A. County’s workplace area was unleased on the finish of final yr, in line with CBRE, and extra empty area might hit the market quickly as tenants hoping to save cash attempt to sublease undesirable area as a result of considerations of a constricting financial system and potential layoffs. Some are lowering their area as a result of their staff are working remotely.

“The overall consensus amongst most economists is we’re heading right into a recession,” stated Bradford Ortlund, a analysis supervisor at CBRE. Many corporations are declining to increase their places of work or lowering area as they look forward to the financial image to return into focus.

The character of upmarket places of work was already shifting earlier than the pandemic as many landlords toned down the dramatic formality of their entrances initially supposed to confer standing and trustworthiness on the businesses inside. As aloofness fell out of favor, house owners got down to make their lobbies and courtyards locations to linger and revel in relatively than merely go by means of in awe.

Their want to get individuals working remotely again into places of work makes hotel-like hospitality freshly invaluable, stated the house owners of U.S. Financial institution Tower, the tallest workplace constructing in Los Angeles at 72 tales.

It was constructed to be an imposing company cathedral in 1989, however landlord Silverstein Properties is near finishing a $60-million makeover supposed to make it really feel extra like a laid-back resort the place tenants and guests are invited to sit back. The foyer will embrace a cocktail and juice bar, a espresso bar, a grab-and-go market of packaged meals, communal tables, a big lounge with plush seating and cabanas so as to add a resort aptitude.

Workers will concentrate on hospitality, stated tenant expertise supervisor Melanie Navas. Individuals’s names and birthdays are to be remembered. The 54th flooring is a tenants-only lounge with a espresso bar and weekly breakfast spreads to assist encourage a way of neighborhood. There are yoga lessons on the gymnasium on the 57th flooring with views of town.

“The objective is to get individuals to really feel like they need to come again to work and are available again to the constructing,” she and, “and having them depart pleased.”

Artwork is a prime precedence for Brookfield Properties, the most important proprietor of workplace area in downtown Los Angeles, which has a longstanding program of engagement with tenants. Everlasting and rotating artwork shows are nice — and good for occupancy, stated Bert Dezzutti, head of the western area for Brookfield.

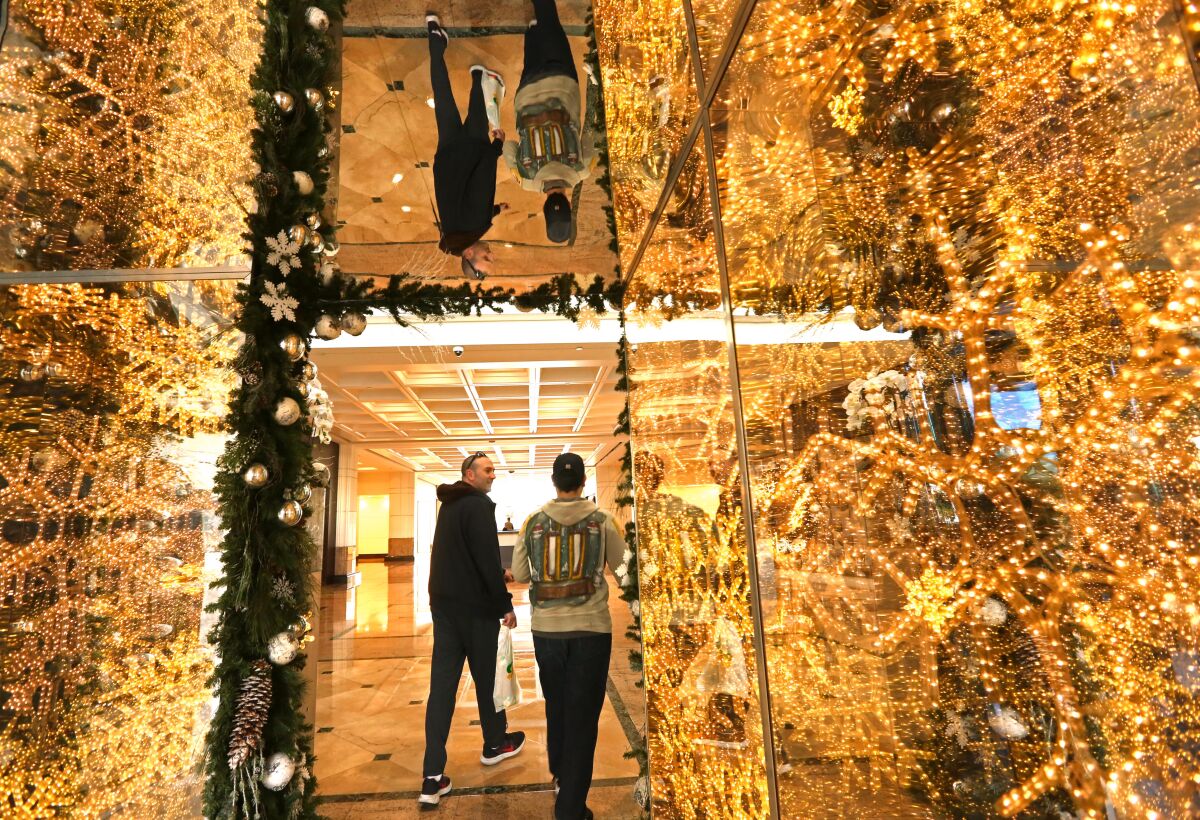

Staff are framed by a vacation foyer show contained in the Water Backyard workplace complicated in Santa Monica.

(Genaro Molina / Los Angeles Instances)

“Youthful employees usually tend to return to the workplace if they’re round artwork,” he stated, citing a survey Brookfield commissioned in the UK final yr that additionally discovered that artwork and cultural actions enhance individuals’s sense of wellbeing and makes them extra productive on the workplace.

“One optimistic that has emerged from the tragedy of the COVID-19 pandemic is a brand new concentrate on what makes a ‘pleased’ office,” the survey report stated. Findings counsel that employees need to work in areas enriched by artwork, tradition and wellness, which they consider promote creativity and contentment.

“The places of work of the long run have to be greater than machines for working in,” the report stated, “they need to cater to the wealthy internal life that all of us possess.”

One youth-friendly program Brookfield places on in L.A. is an annual music pageant that follows the Coachella Valley Music and Arts Pageant. Acts from the favored desert live performance collection seem after work on 4 August nights at a Brookfield workplace and retail complicated close to Crypto.com Area.

Musicians from the Colburn Faculty carry out acoustic units at one other Brookfield property. There are DJ concert events open to all and wellness occasions for tenants that embrace skincare lessons and meditative sound baths.

“We’re creating alternatives for individuals to work together,” Dezzutti stated. “It’s all about engagement.”

Business

Red Lobster offered customers all-you-can-eat shrimp. That was a mistake

Red Lobster promised customers an endless supply of shrimp for $20 — a gamble the struggling restaurant chain hoped would help pull it out of its pandemic doldrums.

But Americans, and their appetites, had other plans.

The beloved yet beleaguered pillar of casual dining abruptly shuttered dozens of locations this week, heightening speculation that the chain is careening toward bankruptcy.

Although its dire financial situation isn’t the result of a single misstep, executives at the company that owns a large stake in the chain, as well as industry experts, said that miscalculations over the popularity of the all-you-can-eat shrimp special accelerated the company’s downward spiral.

The closures, including at least five locations in California, were announced in a LinkedIn post Monday by Neal Sherman, the chief executive of a liquidation firm called TAGeX Brands, which is auctioning off surplus restaurant equipment from the shuttered locations.

Representatives for Red Lobster did not respond to a request for comment about the closures, which were listed on its website as temporary, or whether it planned to file for bankruptcy.

But company executives have been vocal about the misguided gamble with shrimp and how they misjudged just how hungry Americans would be for a deal on the crustaceans.

In an effort to boost foot traffic and ease the sales slump that swept through the restaurant industry during the pandemic, Red Lobster executives last year decided to relaunch a popular marketing ploy from years past to lure customers: For $20 they could eat as much shrimp as they wanted.

Eager for a deal during an era of stubbornly high inflation, many consumers eagerly embraced the offer as a challenge. People took to TikTok to brag about how many of the pink morsels they could put down in a single sitting — one woman boasted she’d consumed 108 shrimp over the course of a 4-hour meal.

“In the current environment, consumers are looking to find value and stretch budgets where they can,” said Jim Salera, a research analyst at Stephens, who tracks the restaurant industry. “At $20, it’s very possible for a consumer to eat well past the very thin profit margin.”

During a presentation about sales from the third quarter of last year, Ludovic Garnier, the chief financial officer of Thai Union Group, a seafood conglomerate that has been Red Lobster’s largest shareholder since 2020, cited the endless shrimp deal as a key reason the chain had an operating loss of about $11 million during that time frame.

“The price point was $20,” Garnier said.

He paused.

“Twenty dollars,” he repeated with a tinge of regret in his voice. “And you can eat as much as you want.”

Although the promotion boosted traffic by a few percentage points, Garnier said, the number of people taking advantage of the all-you-can-eat offer far exceeded the company’s projections. In response, they adjusted the price to $22 and then $25.

All-you-can-eat offers can be effective marketing strategies to get people in the door in the competitive world of casual dining — Applebee’s offers $1 margaritas dubbed the Dollarita, buffet chains such as Golden Corral and Sizzler promise abundance at a flat rate, and Olive Garden, one of Red Lobster’s main competitors, has long lured customers with unlimited salad and bread sticks.

But Red Lobster made a few crucial missteps with the shrimp deal, said Eric Chiang, an economics professor at University of Nevada, Las Vegas, and a self-proclaimed buffet aficionado.

The company not only started with a low price point, but offered a prized and pricey menu item that can serve as an entire meal — not many customers at Olive Garden, he noted, are going to stock up on bread sticks and salad alone.

“Most people will also order the Taste of Italy,” he said, “or something that gives you meat and pasta.”

Chiang said the most effective loss leaders, a term for products that aren’t profitable but bring in enough new customers or lead to the sale of enough other items to make the offer worthwhile, use cheap ingredients. A good example is 7-Eleven’s Free Slurpee Day, he said, as the company gives away about 15 cents of ice and syrup to customers who then pay to fill up their gas tanks.

Consumers are especially drawn to all-you-can-eat deals and buffets during tighter economic times, Chiang said.

“This is a story of inflation,” he said. “All you can eat for $15? That gives customers a sense of control. Like we’re not being gouged, not being nickel and dimed for every dessert.”

Red Lobster, it turns out, has been in trouble for a while.

In 2003, the chain, which at the time was owned by Darden Restaurants, the company that owns Olive Garden, offered a similarly disastrous all-you-eat crab special for around $23.

So many people came back for seconds, thirds and even fourths, executives said at the time, that it cut into profit margins. Before long, the company’s then-president stepped down.

In 2014, after a period of disappointing sales and less foot traffic, Darden sold Red Lobster to San Francisco private equity firm Golden Gate Capital for more than $2 billion, a stake that was eventually taken over by Thai Union.

Despite the turmoil, the company, which until this week touted about 700 locations, remained a brand so beloved that it earned a reference in Beyonce’s song “Formation,” in which she describes post-coital trips to Red Lobster.

After the song’s release, the company said it saw a 33% jump in sales, but that glow was short lived and had faded long before the ill-fated shrimp deal was brought back last year.

“You have to be pretty close to the edge for one promotion to tip you over the edge,” said Sara Senatore, a senior analyst at Bank of America, who follows the restaurant industry.

In January, Thai Union Group — citing a combination of financial struggles it pinned to the pandemic, high labor and material costs and the oft-cited buzzword of industry “headwinds” — announced plans to dump its stake in the company, which was founded in 1968 in Lakeland, Fla. The closures this week hit at least five California locations — Redding, Rohnert Park, Sacramento, San Diego and Torrance — according to the website of the liquidation company, which posted images of available items, including a lobster tank, seating booths, refrigerators and a coffee maker.

During a presentation to investors in February, Thiraphong Chansiri, the chief executive of Thai Union, expressed frustration with the situation surrounding Red Lobster, saying it had left a “big scar” on him.

“Other people stop eating beef,” he said. “I’m going to stop eating lobster.”

Business

Column: Exxon Mobil is suing its shareholders to silence them about global warming

You wouldn’t think that Exxon Mobil has to worry much about being harried by a couple of shareholder groups owning a few thousand dollars worth of shares between them — not with its $529-billion market value and its stature as the world’s biggest oil company.

But then you might not have factored in the company’s stature as the world’s biggest corporate bully.

In February, Exxon Mobil sued the U.S. investment firm Arjuna Capital and Netherlands-based green shareholder firm Follow This to keep a shareholder resolution they sponsored from appearing on the agenda of its May 29 annual meeting. The resolution urged Exxon Mobil to work harder to reduce the greenhouse gas emissions of its products.

Exxon has more resources than just about anybody; ‘overkill’ doesn’t begin to describe the imbalance of power.

— Shareholder advocate Nell Minow

The company’s legal threat worked: Days after the lawsuit was filed, the shareholder groups, weighing their relative strength against an oil behemoth, withdrew the proposal and pledged not to refile it in the future.

Yet even though the proposal no longer exists, the company is still pursuing the lawsuit, running up its own and its adversaries’ legal bills. Its goal isn’t hard to fathom.

“What purpose does this have other than sending a chill down the spines of other investors to keep them from speaking up and filing resolutions?” asks Illinois State Treasurer Michael W. Frerichs, who oversees public investment portfolios, including the state’s retirement and college savings funds, worth more than $35 billion.

In response to the lawsuit, Frerichs has urged Exxon Mobil shareholders to vote against the reelection to the board of Chairman and Chief Executive Darren W. Woods and lead independent director Joseph L. Hooley at the annual meeting.

He’s not alone. The $496-billion California Public Employees’ Retirement System, or CalPERS, the nation’s largest public pension fund, is considering a vote against Woods, according to the fund’s chief operating investment officer, Michael Cohen.

“Exxon has gone well beyond any other company that we’re aware of in terms of suing shareholders for trying to bring forward a proposal,” Cohen told the Financial Times. “There doesn’t seem to be anything other than an agenda of sending a message of shutting down shareholders’ ability to speak their mind.”

California Treasurer Fiona Ma, a CalPERS board member, backs a vote against Woods. “As the largest public pension fund in the country, we have a responsibility to lead on issues that threaten to undermine shareowners,” she says.

The proxy advisory firm Glass Lewis & Co., which helps institutional investors decide how to vote on shareholder proposals and board elections, has counseled a vote against Hooley, citing Exxon Mobil’s “unusual and aggressive tactics” in fighting activist investors.

Exxon Mobil’s action against Arjuna and Follow This opens a new chapter in the long battle between corporate managements and shareholder gadflies.

Fossil fuel companies have been especially touchy about shareholder resolutions calling on them to take firmer action on global warming and to be more transparent about the effects their products have on climate.

In part that may be the result of some significant victories by activist shareholders. In 2021, nearly 61% of Chevron shareholders voted for the company to “substantially” reduce its greenhouse gas emissions — a shockingly large majority for a shareholder vote on any issue. That same year, the activist hedge fund Engine No. 1 led a campaign that unseated three Exxon Mobil board members and replaced them with directors more sensitive to climate risk.

Exxon Mobil also subjected the San Diego County community of Imperial Beach to a campaign of legal harassment over the city’s participation in a lawsuit aimed at forcing the company and others in the oil industry to pay compensation for the cost of global warming, which stems from the burning of the companies’ products.

Even in that context, Exxon Mobil’s campaign against Arjuna and Follow This represents a high-water mark in corporate cynicism.

The lawsuit asserts that the investment funds’ proposed resolution violated standards set forth by the Securities and Exchange Commission governing the propriety of such resolutions — it was related to “the company’s ordinary business operations” and closely resembled resolutions on similar topics that had failed to exceed threshold votes at the company’s 2022 and 2023 annual meetings. Both standards allow a company to block a resolution from the meeting agenda, or proxy.

That may be so, but the conventional practice is for managements to seek approval from the SEC to exclude such resolutions through the issuance of what’s known as an agency “no action” letter.

Exxon Mobil hasn’t taken that step. Instead, it filed its lawsuit in federal court in Forth Worth, where the case was certain to be heard by one of the only two judges in that courthouse, both conservatives appointed by Republican presidents — a crystalline example of partisan “judge shopping.” The case came before Trump appointee Mark T. Pittman, who has allowed it to proceed.

The company hasn’t said why it followed that course. “The U.S. system for shareholder access is the best in the world,” company spokeswoman Elise Otten told me by email. “To make sure it stays that way, the rules must be enforced or the abuse by activists masquerading as shareholders will continue threatening the system.”

In practice, however, the SEC has been quite strict about requiring that shareholder proposals meet its standards. “There can only be one reason” for the lawsuit, says shareholder advocate Nell Minow — “it’s to crush the shareholder. Exxon has more resources than just about anybody; ‘overkill’ doesn’t begin to describe the imbalance of power.”

The company accused Arjuna and Follow This of aiming not “to improve ExxonMobil’s business performance or increase shareholder value,” but of pursuing the goal of “disrupting ExxonMobil’s investments and development of fossil fuel assets and causing ExxonMobil to change its business model, regardless of the benefits, costs, or the world’s needs.”

The company maintained that the shareholder groups aimed to “force ExxonMobil to change the nature of its ordinary business or to go out of business entirely.”

That’s flatly untrue. The resolution observed that the company’s “cost of capital may substantially increase if it fails to control transition risks by significantly reducing absolute emissions.”

That judgment is shared by many institutional investors and government regulators, and points to a path for preserving Exxon Mobil’s business prospects, not destroying them.

In any case, what Exxon Mobil failed to note is that shareholder resolutions are always advisory — they can’t require management to do anything.

In its lawsuit, the company whined about the sheer burden of handling an increase in shareholder resolutions, especially those on fraught topics such as the environment and social issues. Using what it described as an SEC estimate that it costs corporations $150,000 to deal with every submitted resolution, its annual meeting statement calculated that it has spent $21 million to manage 140 submitted resolutions.

A couple of points about that. First, the SEC didn’t estimate that every resolution costs $150,000 to manage. The SEC actually cites a range of $20,000 to $150,000 each.

Second, a quick look at the company’s financial statements gives the lie to its claim that shareholder resolutions are some sort of cataclysmic burden. Its statistics applied to the entire 10-year period from 2014 through 2023, not just a single year.

Over that decade, Exxon Mobil reported total profits of $204.3 billion. In other words, processing those 140 proposals — using the SEC’s highest estimate to arrive at $21 million — cost Exxon Mobil one one-hundredth of a percent of its profits, at most, to deal with shareholder proposals.

And it’s not as if those proposals clog up the annual meeting proxy — for this year’s meeting, only four proposals will be submitted to shareholder votes. Management opposes all four, big surprise.

As for whether companies such as Exxon Mobil have better uses for their money, the proxy statement doesn’t make a great case for every expenditure.

Last year, for instance, the company paid nearly $1.5 million in relocation expenses for its top executives, including about $500,000 for Woods, in connection with the move of its headquarters from the Dallas suburbs to the Houston suburbs, about a three-hour drive away. Over the last three years, Woods collected more than $81 million in compensation, so one can see why moving house would leave him strapped.

“As a shareholder, the one thing you ask for is to look at every expenditure in terms of its return on investment,” Minow told me. “It’s unfathomable that the return on investment of this lawsuit is in any way beneficial to the company.” She’s right: It’s certain that Exxon’s legal fees on this case already exceed the putative $150,000 expense it incurred dealing with the withdrawn proposal.

Exxon Mobil’s punitive lawsuit only hints at the lengths that the fossil fuel industry will go to preserve a business model facing an inexorable decline. The companies haven’t been shy about enlisting politicians to rid them of their turbulent shareholders (to paraphrase the medieval King Henry II).

In February, Sen. Bill Hagerty (R-Tenn.) introduced a measure dubbed the “Rejecting Extremist Shareholder Proposals that Inhibit and Thwart Enterprise for Businesses Act, or “RESPITE.” The act would overturn an SEC rule stating that resolutions dealing with “significant social policy issues” can’t be excluded from the annual proxy under the traditional “ordinary business” limitation.

Don’t expect them to be shy about demanding more latitude from a reelected President Trump. The Washington Post reported last week that Trump pledged to roll back Biden administration environmental policies if the oil executives meeting with him at Mar-a-Lago would raise $1 billion for his campaign. An Exxon Mobil executive was present, the Post reported.

Business

Wonderful Co. sues to halt California card-check law that made it easier to unionize farmworkers

The Wonderful Co. is escalating its battle against unionization of its job sites, looking to halt a new state law intended to streamline the farmworker unionization process. The move comes two months after the United Farm Workers utilized the provision to become the collective bargaining representative for employees of the company’s massive grapevine nursery in Kern County.

Wonderful, the $6 billion agricultural powerhouse owned by Stewart and Lynda Resnick, said Monday it is suing the state Agricultural Labor Relations Board, challenging the constitutionality of the state’s so-called card-check system, which Gov. Gavin Newsom signed into law in 2022. Under its provisions, a union can organize farmworkers by inviting them to sign authorization cards at off-site meetings, without notifying an employer, rather than voting by secret ballot at a designated polling place.

The company, whose portfolio includes such well-known brands as FIJI Water, Wonderful Pistachios and POM Wonderful, alleges in its lawsuit that the law deprives employers of due process on multiple fronts. Among them: forcing a company to enter a collective bargaining agreement even if it has formally appealed the ALRB’s certification of a union vote and presented what it believes is evidence that the voting process was fraudulent.

Wonderful said it was compelled to file its lawsuit now because, under the card-check law, the company faces a June 3 deadline to reach a collective bargaining agreement or have one dictated by the ALRB.

“Having been compelled into a constitutionally unlawful procedure that imposes a constitutionally illegitimate certification, Wonderful has no meaningful way to obtain plain, speedy or complete relief other than through an order of this Court declaring that, on its face, [this section of the labor code] is unconstitutional,” the lawsuit said.

The lawsuit, to be heard in Kern County Superior Court, seeks to enjoin the ALRB from enforcing the card-check law’s provisions.

The ALRB did not immediately respond to the The Times’ request for comment.

A spokesperson for Newsom’s office said staff members were still reviewing the complaint, but included in the response Newsom’s comments when he signed the legislation. “California’s farmworkers are the lifeblood of our state, and they have the fundamental right to unionize and advocate for themselves in the workplace,” his statement said in part.

UFW spokesperson Elizabeth Strater said the union was not surprised by Wonderful’s move.

“This is an unfortunate tactic, but it’s not surprising,” Strater said. “They’ll do pretty much anything to prevent workers from being empowered.”

William B. Gould IV, a professor of law emeritus at Stanford Law School, described the card-check system as “an excellent statute to challenge” because of the confusion and ambiguity surrounding some of its provisions and the “potential for contacts between organizers and employees” that could raise questions about whether workers were acting with free choice.

While he predicted Wonderful would have a “difficult time” making its case in California, he said the company could be aiming to take its argument to the conservative-leaning U.S. Supreme Court.

“To paraphrase Frank Sinatra, now we’re in a situation where anything goes,” said Gould, who served as chair of the ALRB from 2014 to 2017.

The lawsuit is the latest salvo in what’s been a tumultuous dispute over the UFW’s unionization campaign at the nation’s largest grapevine nursery.

In late February, the union filed a petition with the labor relations board, asserting that a majority of the 600-plus farmworkers at Wonderful Nurseries in Wasco had signed authorization cards and asking that the UFW be certified as their union representative.

Within days, Wonderful hit back with an explosive allegation: The company accused the UFW of baiting farmworkers into signing the authorization cards while helping them apply for $600 in federal relief for farmworkers who labored during the pandemic. And it submitted nearly 150 signed declarations from nursery workers saying they had not understood that by signing the cards they were voting to unionize.

The ALRB acknowledged receiving the worker declarations; nonetheless, the regional director of the labor board moved forward three days later to certify the union’s petition. She has said in subsequent hearings that she felt she had to move quickly under the timeline laid out in the card-check law, and that at the time she did not think the statute authorized her to investigate allegations of misconduct.

Wonderful appealed the certification, alleging the UFW engaged in fraud to obtain employee signatures on authorization cards. The UFW countered that Wonderful had intimidated workers into making false statements and had brought in a labor consultant with a reputation as a union buster to manipulate their emotions in the weeks that followed.

A hearing on Wonderful’s objections has been playing out before an independent hearing examiner for the past three weeks. The lawsuit seeks to pause the hearing, pending the outcome of the card-check suit.

The UFW, meanwhile, is pursuing its own complaint against Wonderful. The union has filed a formal complaint of unfair labor practices with the ALRB, alleging Wonderful held mandatory meetings where company leaders urged employees to reject the union, circulated an anti-union petition and misrepresented the union’s intentions.

-

World1 week ago

World1 week agoSpain and Argentina trade jibes in row before visit by President Milei

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

Politics1 week ago

Politics1 week agoFetterman says anti-Israel campus protests ‘working against peace' in Middle East, not putting hostages first

-

World1 week ago

World1 week agoGerman socialist candidate attacked before EU elections

-

News1 week ago

News1 week agoUS man diagnosed with brain damage after allegedly being pushed into lake

-

World1 week ago

World1 week agoGaza ceasefire talks at crucial stage as Hamas delegation leaves Cairo

-

Politics1 week ago

Politics1 week agoRepublicans believe college campus chaos works in their favor

-

Politics1 week ago

Politics1 week agoConservative beer brand plans 'Frat Boy Summer' event celebrating college students who defended American flag