Business

State takes final step to fix California's troubled home insurance market

The state released another regulation Monday aimed at easing California’s home insurance crisis that will allow insurers to charge homeowners higher premiums to protect themselves from catastrophic wildfire claims.

The rule is the last in a package of home insurance reforms spearheaded by Insurance Commissioner Ricardo Lara, and it will allow insurers to pass on to consumers the costs of reinsurance.

Insurers acquire reinsurance typically from other larger insurers in order to limit their payouts during huge wildfires and other catastrophic events.

This will be the first time in California that insurers can include the cost of reinsurance in their premiums, though it is a common practice in other states.

Insurers have been pulling back from the state’s home insurance market, citing wildfire losses, and the regulation is intended to make the market more attractive for home insurers.

“Californians deserve a reliable insurance market that doesn’t retreat from communities most vulnerable to wildfires and climate change,” Lara said in a statement. “This is a historic moment for California.”

The department said it will limit the costs to consumers by tying the reinsurance charges to an industry standard that can’t be exceeded.

In order to take advantage of the new rule, the department said that insurers will have to increase their writing of comprehensive home policies in wildfire-distressed neighborhoods by 5% every two years until their policies are equivalent to 85% of their statewide market share. That would mean that an insurer that has a 10% share of California’s home insurance market would have to write 8.5% of the policies in such neighborhoods.

The department released preliminary maps this year of the areas. Southern California neighborhoods include ZIP Codes in Malibu, Beverly Hills and other communities in mountainous areas. Homeowners in those areas have been increasingly flocking to the FAIR Plan, the state’s insurer of last resort, which does not offer comprehensive policies.

The 85% formula is similar to another key element of Lara’s reforms, which will allow insurers to use so-called “catastrophe models” in setting premium rates. The models are computer programs that attempt to predict the likelihood and costs of disasters, such as wildfires, using complex variables rather than just past losses. The industry maintains they are essential because climate change has made wildfires more common and costly.

The regulation was praised by the American Property Casualty Insurance Assn., a trade group for home, auto and business insurers, which called the step “one of several critically needed reforms to stabilize California’s insurance market.”

Consumer Watchdog, a Los Angeles group that has claimed Lara is too close to the industry, blasted the regulation, alleging that it will lead to 40% or higher increases in rates given experiences in other states and that it includes loopholes that don’t guarantee insurers will write more policies in wildfire neighborhoods .

“Tellingly the commissioner did not do a cost impact analysis of his plan on consumers. That’s because this plan is of the insurance industry, by the insurance industry, and for the industry,” Jamie Court, president of the group, said in a statement.

Lara’s spokesperson, Michael Soller, called the criticisms “hogwash,” saying the department’s goal is to “create stability and increase availability — and better risk management by insurance companies is key to those goals.”

Southern California this year experienced several large wildfires, including the 4,000-acre Franklin fire that destroyed 20 structures in Malibu and the nearly 20,000-acre Mountain fire that demolished 243 structures in Ventura County.

However, neither came close to the losses of a series of fires in 2017 and 2018, including the blaze that burned down much of the Sierra Nevada foothill community of Paradise. That fire scorched 153,000 acres, destroyed 18,800 structures and killed 85 people. Insurer losses topped $12 billion, including two fires in Southern California, according to the department.

Multiple insurers have stopped writing new home policies, and the state’s largest home insurer, State Farm General, said this year it would not renew policies for 72,000 California property owners. However, there recently was some good news when Farmers Insurance, citing Lara’s reforms, said it will boost the number of homeowners policies it writes and resume writing new policies for condominiums, renters and landlords.

The regulation released Monday still must undergo review by the Office of Administrative Law before it can become law.

Business

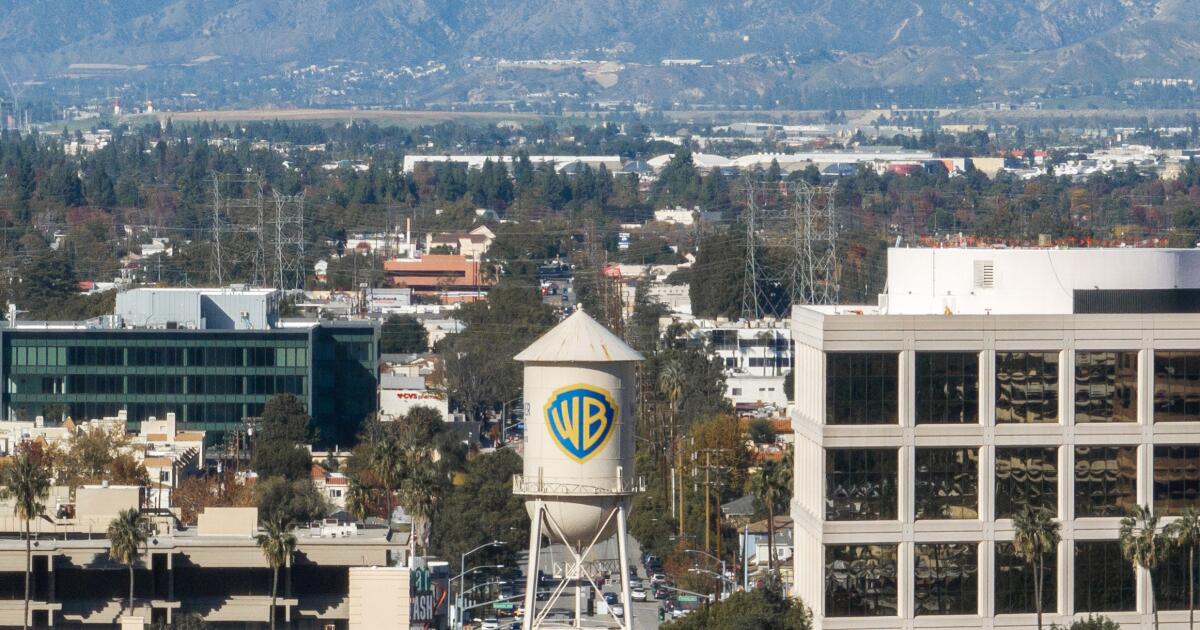

Netflix amends Warner Bros. deal to all cash in bidding war

Netflix has amended its proposed $72-billion purchase of Warner Bros. and HBO, converting it to an all-cash offer in hopes of defusing criticisms from rival bidder, David Ellison’s Paramount.

Netflix and Warner Bros. Discovery approved the change Monday, according to a regulatory filing. Warner board members previously had accepted Netflix’s $27.75-a-share cash-and-stock proposal for Warner’s Burbank studios and HBO streaming operations.

Paramount has complained that its $30-per-share offer for the entire company was higher, and thus, should be the winning bid. Paramount is appealing directly to Warner stockholders, asking them to sell their shares to Paramount by Wednesday.

Netflix stopped short of raising its bid above $27.75 a share, but the Los Gatos streaming giant agreed to pay the full amount in cash should it ultimately win Warner’s legendary studios behind such blockbusters as “Batman,” “The Matrix” and “The Big Bang Theory.” Netflix is not interested in Warner Bros. basic cable channels, which are scheduled to be spun off into a separate company.

Netflix said the change “simplifies the transaction structure, provides greater certainty of value for WBD stockholders, and accelerates the path to a WBD stockholder vote.”

The move was prompted, in part, because Netflix’s stock price has taken a major hit, eroding value in its proposal for Warner Bros.

The new terms neutralize one of Paramount’s primary criticisms: that the stock portion of the Netflix offer makes its bid inferior. Netflix’s shares have lost 29% since its pursuit of Warner Bros. came to light. Paramount shares have also declined about 29% over that time.

Warner Bros. Discovery board members have stuck with Netflix’s proposal — valued at $82.7-billion, including some debt — despite persistent overtures by Ellison’s Paramount.

Warner Bros.’ board “continues to support and unanimously recommend our transaction, and we are confident that it will deliver the best outcome for stockholders, consumers, creators and the broader entertainment community,” Ted Sarandos, co-CEO of Netflix, said in a statement Tuesday.

Warner Bros. Discovery said it would schedule a shareholder meeting. The vote could be held in April.

If the Netflix deal is approved, Warner shareholders would also receive stock in the new company, Discovery Global, which will be made up of Warner’s cable channels, including CNN, TBS, HGTV and Food Network. The spinoff is expected to be completed this summer, but the value of the channels is in doubt, giving Paramount ammunition to claim that its $30-a-share tender offer for the entire company was more lucrative.

Paramount, which has been pursuing the prized assets since September, has sued Warner in Delaware courts to obtain information about how Warner board members came up with a value for the cable channels.

Last week, a Delaware judge refused Paramount’s request for expedited proceedings.

On Tuesday, Warner Bros. separately addressed that Paramount criticism by outlining how it values its cable networks.

Warner Bros.’ advisors value the cable networks from as little as 72 cents a share to as much as $6.86 a share, according to the filing. Paramount has claimed those properties have no value even though cable networks account for most of Paramount’s own sales and profit.

The new company, Discovery Global, would have $17 billion of debt as of June 30, 2026. That would decrease to $16.1 billion by the end of the year. Warner and Netflix also tweaked the agreement so that Discovery Global will have $260 million less debt than initially planned as a result of stronger-than-expected cash flow last year.

The filing projects Discovery Global’s 2026 revenue would reach $16.9 billion and adjusted earnings of $5.4 billion before interest, taxes, depreciation and amortization.

In Tuesday’s announcement, Netflix touted its “strong cash flow generation,” which it said supported the revised all-cash transaction “while preserving a healthy balance sheet and flexibility to capitalize on future strategic priorities.”

Warner Bros. Discovery board members have cited Paramount’s highly leveraged proposal as a weak point, giving it another reason to award the company to the stronger firm, Netflix.

Paramount would need to come up with more than $94 billion in equity and debt to finance the deal.

The battle for Warner Bros. is one of the biggest media deals in the last decade and is expected to reshape the entertainment industry. Netflix emerged as a surprise suitor, entering the fray after Warner Bros. put itself up for sale in October.

Netflix has turned to Wall Street banks to help finance its deal. The company now has $42.2 billion of bridge loans in place, according to a filing Tuesday, a type of facility that is usually replaced with permanent debt like corporate bonds.

Netflix is scheduled to report fourth-quarter financial results on Tuesday after markets close.

Bloomberg News contributed to this report.

Business

Video: Has Trump Delivered on His Economic Promises?

new video loaded: Has Trump Delivered on His Economic Promises?

By Ben Casselman, Alexandra Ostasiewicz, Thomas Vollkommer and Joey Sendaydiego

January 19, 2026

Business

Trump administration sues California over law keeping oil wells from homes, schools

California communities and environmental justice groups worked for years to win a law to prevent new oil and gas wells from being drilled near where people live, work and gather. Now, the Trump administration is suing to overturn it.

In a lawsuit filed Wednesday in the U.S. District Court for the Eastern District of California, the U.S. Department of Justice challenged Senate Bill 1137, state legislation passed in 2022 that establishes a 3,200-foot minimum setback between new oil wells and “sensitive receptors,” defined as homes, schools, community centers, parks and playgrounds, healthcare facilities or any public building.

Under the law, existing wells that are close to these places can continue to operate, but must monitor emissions, control their dust and limit nighttime noise and light.

But the Trump administration says the law would “knock out” about one-third of all federally authorized oil and gas leases in California, amounting to unconstitutional state regulation of federal lands. In its complaint, the administration argues that federal law — specifically, the Mineral Leasing Act and the Federal Land and Policy Management Act — supersedes SB 1137, and asks that the court declare the state law unconstitutional and prevent it from being enforced.

While the majority of active wells in California are on private and state lands, the federal Bureau of Land Management administers more than 600 oil and gas leases within the state, according to the lawsuit. About 218 of those leases overlap with the buffer zones established by the law.

Officials with Gov. Gavin Newsom’s office said Thursday they had not yet been served with the lawsuit, but would defend SB 1137 and the health of California communities. Living near oil and gas wells has been linked to a range of adverse health issues stemming from air and water pollution that can be released by drilling and production, especially if a well is leaking badly.

“The Trump administration just sued California for keeping oil wells away from elementary schools, homes, daycares, hospitals, and parks,” said Anthony Martinez, a spokesman for the governor. “Think about that. SB 1137 creates a science-based buffer zone so kids can go to school, families can live in their homes, and communities can exist without breathing toxic fumes that cause asthma, birth defects, and cancer.”

The lawsuit advances an April executive order issued by President Trump titled “Protecting American Energy from State Overreach,” in which the president directed Atty. Gen. Pam Bondi to identify “burdensome and ideologically motivated” state and local regulations that threaten the development of domestic energy resources and take action to stop them.

“This is yet another unconstitutional and radical policy from Gavin Newsom that threatens our country’s energy independence and makes energy more expensive for the American people,” Bondi said in a statement. “In accordance with President Trump’s executive orders, this Department of Justice will continue to fight burdensome regulations that violate federal law and hamper domestic energy production — especially in California, where Newsom is clearly intent on subverting federal law at every opportunity.”

Environmental groups were quick to condemn the action. The oil and gas setback law was hard won after multiple earlier attempts were stymied by opposition from the petroleum industry and trade unions. Its implementation was briefly paused by a 2024 referendum effort led by the California Independent Petroleum Assn., which ultimately withdrew it in light of a groundswell of public resistance.

“Attempting to block the law that protects the air we breathe and the water we drink from oil industry pollution is the Trump administration’s latest attack on our state,” said Kassie Siegel, director of the Climate Law Institute at the nonprofit Center for Biological Diversity. “Big Oil backed down from their deceitful referendum campaign because Californians wouldn’t stand for it. This is a last-ditch attempt to overturn the law’s critical health protections. I’m confident this historic law will stand.”

Rock Zierman, chief executive of the California Independent Petroleum Assn., lauded the Trump administration’s challenge against what it described as an “arbitrary setback law.”

“Just as the state has tried to shut down duly permitted in-state production on private land in violation of the fifth amendment of the U.S. Constitution, so too has the state tried to usurp federal law by shutting down production of minerals owned by the U.S. taxpayers,” Zierman said in a statement Thursday. “We welcome the U.S. Department of Justice joining our fight against these illegal actions that are leading to increased foreign imports.”

The suit marks an escalation of Trump’s battle against Newsom and California over energy and environmental policies. The president, who received substantial donations from oil and gas companies during his 2024 presidential campaign, has moved to block the state’s tailpipe emission standards, clean vehicle targets and renewable energy projects, among other efforts.

Earlier this week, the Justice Department filed another lawsuit against two California cities, Petaluma and Morgan Hill, over ordinances that ban the use of natural gas in new buildings. Both cities said they have not enforced those bans in several years.

-

Montana1 week ago

Montana1 week agoService door of Crans-Montana bar where 40 died in fire was locked from inside, owner says

-

Minnesota1 week ago

Minnesota1 week agoICE arrests in Minnesota surge include numerous convicted child rapists, killers

-

Detroit, MI6 days ago

Detroit, MI6 days agoSchool Closings: List of closures across metro Detroit

-

Lifestyle6 days ago

Lifestyle6 days agoJulio Iglesias accused of sexual assault as Spanish prosecutors study the allegations

-

Oklahoma1 week ago

Oklahoma1 week agoMissing 12-year-old Oklahoma boy found safe

-

Education1 week ago

Education1 week agoVideo: Violence at a Minneapolis School Hours After ICE Shooting

-

Oregon1 week ago

Oregon1 week agoDan Lanning Gives Oregon Ducks Fans Reason to Believe

-

Sports2 days ago

Sports2 days agoMiami’s Carson Beck turns heads with stunning admission about attending classes as college athlete