Reporting by Manya Saini and Jaiveer Shekhawat in Bengaluru and Stephen Nellis in San Francisco; additional reporting by Max Cherney in San Francisco and Echo Wang in New York; Editing by Anirban Sen and Stephen Coates

World

SoftBank-backed Arm reveals revenue decline in US IPO filing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CIBW7XDCQ5ITVK6TPPPYMQO5CQ.jpg)

FILE PHOTO-The Arm Ltd logo and a U.S. flag are seen in this illustration taken March 6, 2023. REUTERS/Dado Ruvic/Illustration/File Photo Acquire Licensing Rights

Aug 21 (Reuters) – SoftBank Group Corp’s (9984.T) Arm Holdings Ltd reported a 1% fall in annual revenue due to a slowdown in smartphone sales, after the chip designer disclosed the paperwork for an initial public offering that is expected to be the largest of the year.

Arm’s stock market launch is expected to bring back to life a lackluster IPO market, which has over the last year seen several high-profile startups postpone their listing plans due to market volatility.

For the year ended March 31, Arm’s sales declined to $2.68 billion, hurt mainly by a slump in global smartphone shipments. Sales for the quarter ended June 30 fell 2.5% to $675 million.

Arm said that more than 50% of its royalty revenue for the most recent fiscal year came from smartphones and consumer electronics. The global smartphone market is on track to hit a decade low this year, according to Counterpoint Research. Arm’s modest decline in revenue, despite heavy reliance on smartphones for royalties, suggests that its per-chip rates have increased.

The company, whose chip technology powers most smartphones including iPhones, did not reveal the number of shares it is planning to sell and the valuation it will seek. Reuters has previously reported that SoftBank plans to sell about 10% of Arm’s shares in the IPO and seek a valuation of between $60 billion and $70 billion for the chip designer.

Arm was earlier planning to raise between $8 billion to $10 billion from the IPO, but is now expected to raise less capital, after SoftBank bought the 25% stake in Arm it did not directly own from its Saudi-backed Vision Fund, Reuters first reported earlier in August. SoftBank confirmed the deal with the Vision Fund in its filing on Monday.

SECOND CRACK AT IPO

Founded in 1990, Arm was launched as a joint venture between Acorn Computers, Apple Inc (AAPL.O) (when it was known as Apple Computer), and VLSI Technology. The company was publicly listed on the London Stock Exchange and the Nasdaq from 1998 until 2016 when SoftBank took Arm private for $32 billion.

SoftBank began preparations for an IPO of Arm after a deal to sell the company to Nvidia Corp (NVDA.O) for $40 billion collapsed last year over objections from U.S. and European antitrust regulators.

Arm makes money from upfront licensing fees for technology and then a royalty paid on each chip sold by Arm’s customers. The company has been expanding those royalty revenues, saying that the newest version of its technology has the “potential to drive our royalty opportunity per device even higher,” according to its filing.

Arm said 24% of its revenue came from China in its most recent fiscal year. That is broadly in line with many other companies in the semiconductor industry, but Arm’s revenue all comes through Arm China, a separate company in which it has only an indirect 4.8% stake.

“The fact that Arm China operates independently of us exposes us to significant risks. Arm China’s value to us as a customer is dependent on Arm China’s business results, which are, in turn, subject to substantial risks that are outside of our control,” Arm said in its filing.

Earlier in August, Reuters reported that SoftBank had held talks with several technology companies, including Amazon.com (AMZN.O) and Nvidia (NVDA.O), which are considering investing in Arm’s IPO.

Arm’s listing is expected to provide a much-needed boost to the IPO market, with big names including grocery delivery service Instacart, marketing automation firm Klaviyo, and German sandal maker Birkenstock expected to go public in the coming weeks.

Arm said it expects to list on the Nasdaq and trade under the ticker symbol ‘ARM’.

Barclays (BARC.L), Goldman Sachs (GS.N), JPMorgan Chase (JPM.N), and Mizuho Financial Group (8411.T) are the lead underwriters for the offering. Arm, which picked a total roster of 28 banks for the IPO, has not picked a traditional “lead left” bank and will split underwriter fees evenly among the top four banks.

Our Standards: The Thomson Reuters Trust Principles.

World

Top US Senate Democrat to block Trump DOJ nominees over Qatar airplane

World

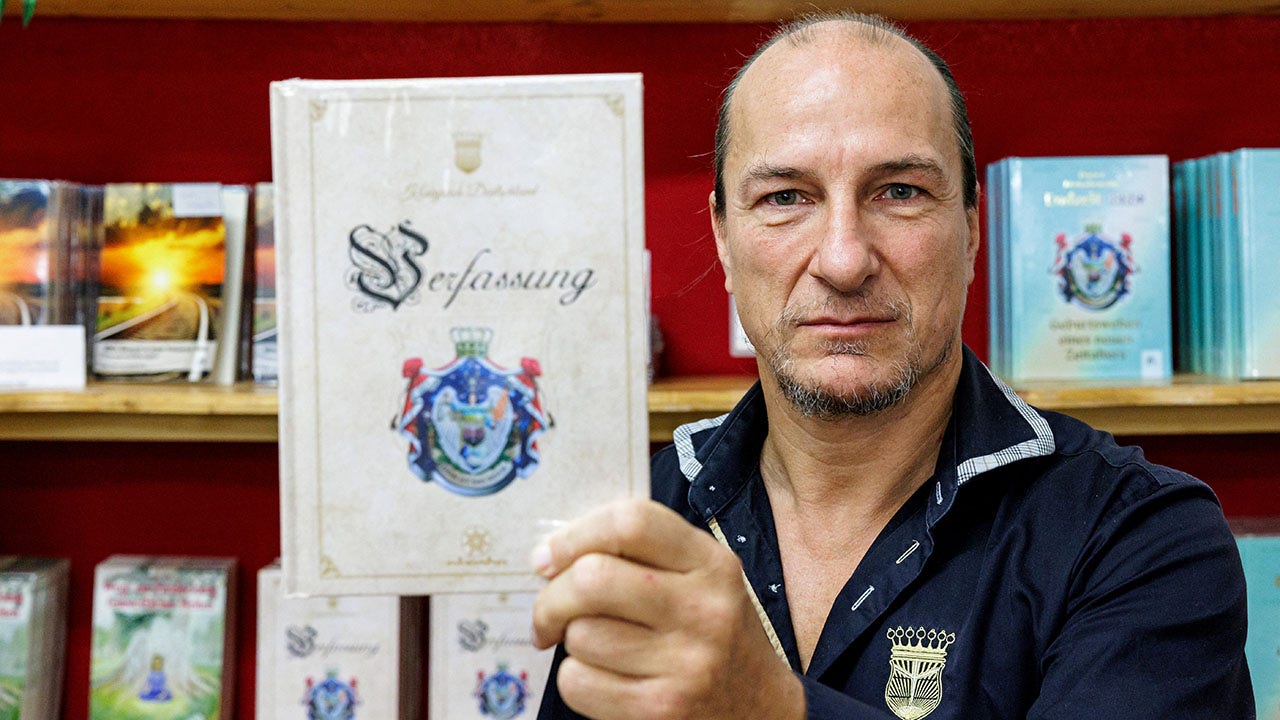

Self-proclaimed 'king of Germany' arrested in plot to overthrow government

The self-styled “king” of Germany and three of his senior “subjects” were arrested for attempting to overthrow the state, according to media reports.

Peter Fitzek, 59, was taken into police custody during morning raids conducted Tuesday in seven German states, the BBC reported.

Fitzek’s group, the Reichsbürger, or “citizens of the Reich,” has also been banned by the government.

TRUMP CELEBRATES CONSERVATIVE PARTY WIN IN GERMANY

Peter Fitzek, the self-proclaimed head of the so-called “Kingdom of Germany,” poses for a photo with the kingdom’s constitution in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP via Getty Images)

The group’s aim is to establish the Königreich Deutschland, or “Kingdom of Germany.”

“I have no interest in being part of this fascist and satanic system,” Fitzek previously told the news outlet in a 2022 interview.

Reichsbürgers reportedly have their own currency, flag and identification cards and want to set up separate banking and health systems.

The Reichsbürger undermined “the rule of law,” said Alexander Dobrindt, Germany’s interior minister, by creating an alternative state and spreading “antisemitic conspiracy narratives to back up their supposed claim to authority,” the news report states.

GERMANY’S NEW LEADER LOOKS TO DISTANCE EUROPE FROM TRUMP

Peter Fitzek, the self-proclaimed head of the so-called “Kingdom of Germany,” shows the paper currency he created himself in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP)

He said the group finances itself through crime.

Fitzek, who claims to have thousands of “subjects,” denied having violent intentions but also called Germany “destructive and sick.”

In 2022, dozens of people associated with the Reichsbürger were arrested for plotting to overthrow the German government in Berlin. They were accused of planning a violent coup, which included kidnapping the health minister in an effort to create “civil war conditions” to bring down German democracy, according to the BBC.

Self-made identity and banking documents of the so-called “Kingdom of Germany” are pictured in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP via Getty Images)

Once dismissed as eccentric by critics, the group is now seen within Germany as a serious threat as the far right has grown politically over the past decade, the report said.

World

Costa calls for reforms in Bosnia to ensure EU membership progress

After his trip to Belgrade, European Council President António Costa visited Sarajevo on Tuesday as part of his Balkans tour. He was given a warm reception upon his arrival before meeting with Bosnia’s presidency.

In a statement, the European Council chief announced that the EU “remains committed” to the country’s European future. He also praised Željka Cvijanović, Denis Bećirović, and Željko Komšić — members of the Western Balkan country’s three-way presidency — for their role in maintaining stability and security in the country and the region.

Recently, tensions have been brewing domestically over the leader of the entity of the Republika Srpska (RS), Milorad Dodik’s actions, which the state-level authorities denounced for undermining the country’s constitutional order.

Western powers and the EU have condemned Dodik for his provocations after he had suggested that the Dayton Agreement, the peace agreement that formally ended the Bosnian War in 1995, had outlived its purpose.

In his statement, Costa underlined the importance of the Dayton accords, set to mark its 30th anniversary this year.

“And this year, on the 30th anniversary of Srebrenica genocide and the Dayton (and) Paris Agreement, I believe that it is an important message to remember,” said Costa.

Costa also outlined that some reforms are needed to ensure Bosnia remains on the path to EU membership.

“We need the approval of two judiciary laws, the appointment of a chief negotiator, and the adoption of the reform agenda to move towards on the Bosnia and Herzegovina in the European path.”

Bosnia is the only country that does not benefit from the EU’s Growth Plan for the Western Balkans. Costa stressed that implementing these reforms is of paramount importance to ensure that Bosnia’s citizens benefit from the EU plan.

“I would like to see Bosnia and Herzegovina joining the other Western Balkans partners in profiting from all that the European Union has to offer,” the Council president noted.

Costa will next travel to Montenegro and Albania on Wednesday, for meetings with President Jakub Milatović in Podgorica and President Bajram Begaj in Tirana. He’ll conclude his tour with a visit to Skopje in North Macedonia, where he will meet Prime Minister Hristijan Mickoski.

Additional sources • AP

-

Austin, TX4 days ago

Austin, TX4 days agoBest Austin Salads – 15 Food Places For Good Greens!

-

Education1 week ago

Education1 week agoIn Alabama Commencement Speech, Trump Mixes In the Political

-

Technology1 week ago

Technology1 week agoBe careful what you read about an Elden Ring movie

-

Culture1 week ago

Culture1 week agoPulitzer Prizes 2025: A Guide to the Winning Books and Finalists

-

World6 days ago

World6 days agoThe Take: Can India and Pakistan avoid a fourth war over Kashmir?

-

Education1 week ago

Education1 week agoUniversity of Michigan President, Santa Ono, Set to Lead University of Florida

-

Technology6 days ago

Technology6 days agoNetflix is removing Black Mirror: Bandersnatch

-

Politics1 week ago

Politics1 week agoEPA chief Zeldin announces overhauls to bring agency back to Reagan-level staffing