Washington

Mt. Washington Pediatric Hospital leader to step down after 20 years | Maryland Daily Record

Sheldon Stein, Mt. Washington Pediatric Hospital’s president and CEO, will retire from the position in November 2022. (Submitted Picture/Mt. Washington Pediatric Hospital)

The longtime chief of Mt. Washington Pediatric Hospital in Baltimore will retire from his place on the finish of this 12 months, the hospital introduced Tuesday. Sheldon Stein led the hospital for 20 years, overseeing important development and the institution of many applications and initiatives.

“It’s onerous to place into phrases what this hospital means to me, nevertheless it has been an honor and a privilege to serve so many kids from Baltimore and past alongside our dedicated workers,” Stein mentioned within the announcement. “I’ve all the time seen myself as merely a facilitator to take away obstacles and supply sources in order that our passionate staff of medical doctors, nurses, clinicians, and help workers can present the very best quality of care potential. My success could be nothing with out the help of your complete MWPH neighborhood, whom I’ll miss dearly.”

All through Stein’s time as its chief, the hospital has grown greater than seven instances over, going from lower than $20 million in internet belongings to $144 million at present. It additionally grew from 151 workers to 550 and added new places in Prince George’s County and Harford County.

The hospital invested over $50 million in capital enhancements underneath Stein’s management, together with opening and rising an outpatient facility, the Jack & Mae Rosenberg Outpatient Heart, and increasing two inpatient models: the Sheila S. and Lawrence C. Pakula Heart for Toddler Specialty Care and the Phyllis C. Meyerhoff Heart for Pediatric and Adolescent Rehabilitation.

MWPH, which is celebrating its 100th anniversary this 12 months, is collectively owned by two of Maryland’s largest well being methods, the College of Maryland Medical System and Johns Hopkins Medication. The partnership was shaped in 2006, underneath Stein’s management.

Stein is finest identified among the many establishment’s workers for selling using revolutionary instruments, strategies and applications, the hospital mentioned. Throughout his tenure, the hospital launched a spread of latest applications, such because the Trauma and Therapeutic program, a behavioral well being program for youngsters and adolescents who’re experiencing or have skilled trauma, and Weight Sensible, a weight administration program for teens. Specialists from MWPH have been invited by the Kids’s Hospitals Affiliation to take part in a job pressure to develop finest practices for pediatric weight administration.

Stein has additionally acquired quite a few honors for his work as MWPH’s president and CEO, together with being named a Most Admired CEO by The Day by day File in 2016. A respiratory therapist by commerce, he joined MWPH as vp of affected person care companies in 1995, earlier than rising to chief working officer after which president and CEO.

MWPH’s Board of Trustees might be hiring a agency to launch a nationwide seek for the hospital’s subsequent chief, and Stein will stay in his position till November with a purpose to help with the search course of.

In his last months main the establishment, Stein will oversee MWPH’s largest-ever fundraising marketing campaign, Hope Heal Develop, which goals to lift $15 million by the tip of 2022. The funds will go in direction of expansions and renovations to the Rosenberg Outpatient Heart, the development of the Capacity Heart, and the institution of the MWPH Kids’s Fund, which might be used for the whole lot from gear upgrades to capital enhancements.

After he retires, Stein plans to golf, journey and spend extra time along with his grandchildren, based on MWPH’s announcement.

Washington

Live updates: Washington Capitals vs Minnesota Wild at Capital One Arena

The Washington Capitals, fresh off their New Year’s Eve victory over the Boston Bruins, will play their first game of 2025. And it will be a tough test.

Tonight the Caps will face a slick-skating Minnesota Wild team that plays excellent on the road. Minnesota leads the league in road wins (13) and road points (29).

They will also face future Hockey Hall of Fame goaltender Marc-Andre Fleury in net for perhaps the final time at Capital One Arena. Alex Ovechkin has lit up Fleury 27 times — the most of all his goalie victims. Also, I will never forget this moment.

Neither Kirill Kaprizov or Wild captain Jared Spurgeon will suit up for the Wild due to injury. Martin Fehervary is in for the Caps after absorbing a high stick from Tom Wilson.

The Capitals-Wild game is airing on Monumental Sports Network. Joe Beninati and a returning Craig Laughlin have the call. Puck drop is shortly after 7:00 pm.

Lines

Washington Capitals

Ovechkin

Strome

McMichael

Mangiapane

Eller

Miroshnichenko

Minnesota Wild

Johansson

Eriksson Ek

Hartman

Tunnel shenaigans

1st Period

Puck is dropped.

Huge glove save 21 seconds in by Charlie Lindgren. Wow.

🚨 1-0 Washington Capitals. WSH Goal: Tom Wilson (15). Assists: R. Sandin (12). Time: 10:19.

Sandin’s shot is saved by MAF, but the rebound falls right to Wilson’s skates for an easy put-in.

🚨 1-1 tie. MIN Goal: Ryan Hartman (15). Assists: Z. Bogosian (5), J. Eriksson Ek (11). Time: 11:24.

Hartman with a deflection in front of the net to tie 65 seconds later.

Tom Wilson gets cross-checked into Minnesota’s net. Then Marc-Andre Fleury cross-checks him out of it. Capitals go to the power play!

Oh NoOoOo

🚨 2-1 Minnesota Wild. MIN SHG: Yakov Trenin (3). Unassisted. Time: 19:07.

Poor stickhandling behind the net, Lindgren loses both the puck and his stick and Trenin scores a layup on his backhand.

At intermission: The Capitals are outshooting the Wild 13 to 11 and are out-attempting them 24 to 12 at five-on-five but go into break down 2-1.

2nd Period

Puck is dropped.

Another big early glove save by Lindgren. This time on Frederick Gaudreau 18 seconds in.

Tom Wilson to the box for roughing Brock Faber at 8:43.

Martin Fehervary loses a tooth. He looks like Ovi now. Oh no. Marat Khusnutdinov to the box for High-sticking – it’s a double minor.

🚨 2-2 tie. WSH PPG: Alex Ovechkin (18). Assists: D. Strome (30). Time: 15:08.

Alex Ovechkin scores again on Marc-Andre Fleury for 871st career goal, now 23 away from Wayne Gretzky’s all-time record

Ovi’s 871st career goal and 28th against MAF. 23 away from Gretzky.

At intermission: The game is tied 2-2. The Capitals are outshooting the Wild 21 to 18.

3rd Period

Puck is dropped.

Both teams are going hard for the next goal.

🚨 3-2 Washington Capitals. WSH Goal: Martin Fehervary (1). Assists: P. Dubois (24). Time: 05:34.

With Fleury bowled over by his own man, a missing-tooth’d Fehervary hits the back of the net for the first time this season. Huge goal.

Caps to the penalty kill after Nic Dowd takes an interference penalty on Mats Zuccarello at 6:20.

Penalty killed.

A Tom Wilson goal is taken off the board due to a high stick.

OH NO.

Seconds later…

🚨 3-3 tie. MIN Goal: Marco Rossi (15). Assists: R. Hartman (5), J. Brodin (10). Time: 11:19.

Rossi with a great redirect, then captures the rebound and scores.

Jakob Chychrun beats Fleury but hits the post with around three minutes remaining in the game.

Tom Wilson just misses scoring again after a great feed by PLD. The puck rolled on Wilson.

Capitals and Wild end regulation tied 3-3. To overtime we go. The Wild outshot the Capitals 32-31.

Overtime

Puck is dropped.

Matt Boldy in a foot race… and he hits the post!

John Carlson stopped at the last second by MAF after a huge rush of speed.

Shootout

This is the Capitals’ first shootout of the season.

❌ Dylan Strome is stopped by MAF.

❌ Mats Zuccarello is stopped by Lindgren.

❌ Pierre-Luc Dubois is stopped by MAF

✅ Matt Boldy beats Lindgren with a shot to the top corner past Lindgren’s glove.

❌ Alex Ovechkin is stopped by MAF.

Minnesota Wild win 4-3 (SO).

Skills competition sees Washington fall on home ice: Wild beat Capitals 4-3 (SO)

Comment below. Refresh for live updates during the game. The thread will be closed shortly after the game is completed.

Washington

We loved living in the DC area but moved to the Pittsburgh suburbs so we could finally save money and buy a house

- My husband and I lived in the DC metro area for nearly 20 years before we left.

- We grew up in Pennsylvania and moved to Pittsburgh so we could save for and buy a house.

- Although the DC metro area was great, we’re happy being homeowners in the Pittsburgh suburbs.

Although we grew up in Pennsylvania, my husband and I spent nearly 20 years building our lives in the Washington, DC, area.

We loved it and thought we’d live there forever, but our plans changed when we got married in 2021 and started looking to buy our first home.

We soon realized we couldn’t afford much in Rockville, Maryland, where we’d lived for eight years, or any other part of the DC metro area.

After pricing some homes, it dawned on us that we’d be about halfway to my hometown in Pittsburgh before we could even think about affording a decent house.

At that point, we thought, why not go back to our roots? So in 2022, after two decades in the DC area, we packed up our apartment and moved four hours north to Pittsburgh.

It was hard to save for a home when we lived in a high-cost-of-living area

Richard T. Nowitz/Getty Images

Although we loved living in a big city with plenty of choices for everything from grocery stores to transportation to museums and theaters, we struggled to save for a down payment while living in the DC area.

After all, those perks — and walkability — came with a fairly high cost of living. DC is one of the most expensive cities to live in in the US. Rockville was no bargain, either, with the cost of living there estimated to be 37% higher than the national average, according to Paycale.

Even ordering food or going on a dinner date was pricey — we couldn’t have a night out without spending at least $100.

On the other hand, Pittsburgh has long been considered one of the most affordable cities to live in and buy a home in.

When we left the DC area, we lived in an apartment in Pittsburgh for a year and a half and were actually able to save money while house hunting.

We also found way more houses within our budget here. According to Realtor.com, the median home price in Pittsburgh is about $259,000, compared to $619,000 in Rockville.

We’re now in our first home in a Pittsburgh suburb, and we love it

Eventually, we found a ranch home in a cozy neighborhood about 20 minutes from downtown Pittsburgh.

Although there’s not as much to do here as there was in Rockville, Pittsburgh has continued to win us over.

Our neighborhood is made up of a series of cul-de-sacs, and we were pleasantly surprised to see how close the neighbors on our street are.

We were welcomed with open arms and have enjoyed getting to know the friendly couples, sweet pets, and adorable children who live nearby.

Plus, it’s been great to live closer to more family members and attend more birthday parties and holiday gatherings without having to travel far.

Washington

Beijing Calls Washington’s Bluff on Strategic Metals

January 2, 2025

China’s latest export restriction lays bare the complex geopolitics behind President Trump’s proposed tariffs—and the green energy transition.

Earlier this December, the Chinese government announced that it would curb the export of several key industrial minerals, as well as certain types of graphite. The move came in the context of mounting pressure on China from Washington, and in anticipation of stringent tariffs that Donald J. Trump has promised to levy when he returns to the presidency next year.

Chinese government spokespeople have argued that curbing export of these minerals is in line with their government’s antiproliferation efforts. They have said that the materials are “dual use,” and that they might be used in manufacturing weapons. Officials in the United States have historically also argued the same thing about some of the minerals, such as graphite, which the US put under strict export controls in 2006.

Among the minerals are antimony (which is used in night-vision goggles and bullets), gallium (precision-guided weapons and radar systems), and germanium (powerful sensors that are mounted on tanks, ships and helicopters). Superhard metals like tungsten may also be included in the restrictions, as is graphite, a type of carbon familiar from its use in pencils. Certain types of graphite are used in gun barrels, and others are dispersed on the battlefield as a sort of smoke that confuses electromagnetic wave detection devices.

Most of these materials also have considerable civilian uses. For instance, graphite is used in the anodes, or negative electrodes, of almost all lithium-ion batteries. (If you’re reading this article on a battery-powered device, you’re probably using graphite in some form.) What export controls mean is that non-Chinese companies that use the material in products destined for the United States will have to apply for export licenses. Such licenses will be up to Chinese officials to grant or withhold.

China controls the vast majority of the processing of some of these materials—a fact that began to register widely in Washington only as tensions began to ramp up with China during the previous Trump administration. China, for instance, produces 61 percent of natural graphite and 98 percent of the world’s final processed graphite. Graphite is also a key material in the green energy transition and electric vehicles: Last year, some 50 percent of the world’s natural graphite went into electric vehicles.

Beijing has managed to extend its grip across the supply chain in recent years. Efforts have been made—most notably through Joe Biden’s Inflation Reduction Act—to create a supply chain for critical minerals that is independent of China, as well as the development of new technology that reduces the need for hard-to-get materials. But progress has been slow. “China is still set to be the dominant player,” said Tony Alderson, the senior anode and cathode analyst at Benchmark Mineral Intelligence, a specialist provider of supply chain and energy transition information. “I think the investment that they are putting in is huge, and it is more than the US with regard to the anode supply chain.” Despite paeans to progress from politicians in Europe and the US, 2024, he said, was “the year of delays,” and a widening gap between supply and demand for critical minerals in everywhere but China.

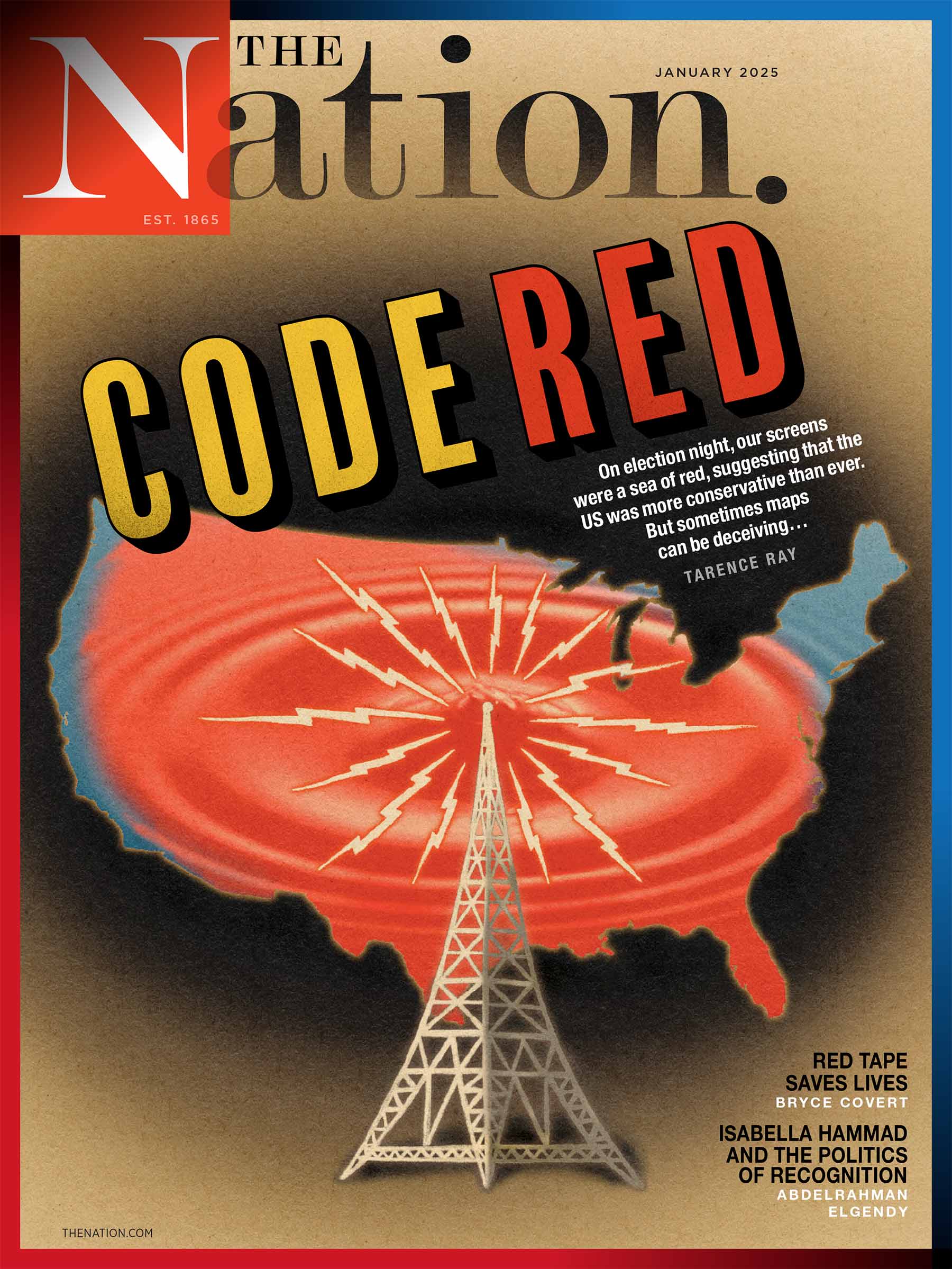

Current Issue

By banning the export of these minerals, the Chinese government is showing that it has leverage over critical parts of the supply chain for electronics. “We see it in the industry as a shot across the bow,” Michael R. Hollomon II, the commercial director at US Strategic Metals, a mining and processing firm focused on green transition materials, told me. He noted that the Chinese have enacted similar bans of critical minerals in the past, including a ban last year of specific gallium and germanium products. “The Chinese government have put their money where their mouth is.”

Markets have reacted to the news of the most recent reductions: The price of antimony surged 40 percent on news of China’s most recent export curbs. It was something that worried Gary Evans, the CEO of US Antimony Corporation, the only domestic processor of antimony. Evans, speaking on Fox Business, worried that high prices would cause businesses to be priced out of the market.

Hollomon said that the Biden administration had often talked about building a supply chain independent from China, but that promised projects were often not followed through on, and that funding was held up at critical stages. China, on the other hand, has been able to fund projects and drive down costs for Chinese firms through massive injections of state capital into the mining, processing and industrial use of critical metals and transition technology. “We’ve been playing with our hands tied behind our backs—that is the way the West has been operating for the last 15 years,” he said.

But there is a more fundamental question at play as well. The United States traditionally limited technology transfers to China because of copyright concerns: This year, President Biden imposed an 100 percent tariff on Chinese electric vehicles. The US government recently prepared restrictions on the import of AI technology into China (Beijing responded with an antitrust investigation into the US chip giant Nvidia), and Washington has been talking about “decoupling” from China for the last several years. In 2022, the US Department of Defense even released a 74-page report on “securing” the supply chain for materials used in military hardware. Chinese graphite is already subject to a 25 percent tariff in the US. (Last Wednesday, a North American trade association of active anode material producers asserted that such a tariff was “far too low” and asked the US government to levy a 920 percent tariff on Chinese graphite imports, a move that would double the cost of an electric vehicle Stateside.) Why would China help the United States build a supply chain that subverts its own interests and diminishes market share for Chinese companies?

In the critical metals and renewable energy space, there is growing apprehension over the use of tariffs in a part of the world economy in which China has become king. “To me,” Trump has said, “the most beautiful word in the dictionary is ‘tariff.’” He has even suggested he would impose tariffs of up to 60 percent on Chinese goods. But while Washington seems to think of tariffs as a one-way street, China’s most recent show of force shows that Beijing has considerable leverage, especially when it comes to materials that are used in electric devices and vehicles.

In the end of the day, costs from tariffs usually get passed on to the consumer. Trump, who used fears of inflation to galvanize his base during the last election, will be wary of policies that cause too many shifts in prices. Antimony, after all, is not just in bullets; it is used as a flame retardant in roofing across the US.

Popular

“swipe left below to view more authors”Swipe →

Perhaps rising costs will mean the next administration will be more amenable to striking a deal with China’s premier, Xi Jinping, an autocratic leader Trump reportedly admires. Elon Musk’s ties to China—around a half of Teslas are produced there, and the country is said to be the world’s second-largest market for the electric cars—might also complicate things. But that won’t solve the pressing issue of China’s domination of the supply chain for critical raw materials.

Industry players like Hollomon believe the incoming administration has the chance to spur domestic mining and processing through grants and streamlining regulations and building up the nation’s strategic reserve of minerals, many of which were sold off after the Cold War. But the outlook is also worrisome: increased tariffs have historically lead to retrenchment and stockpiling, which have tended to be ingredients in conflict. Even if such fears remain distant for now, a China in which the materials processing and battery industries are two bright spots in an otherwise bleak economic landscape is not likely to cede its primacy in those spaces any time soon.

More from The Nation

While the War on Terror has receded into the background of our lives, its premises and tactics remain all too readily available.

Karen J. Greenberg

Yoon Suk Yeol rose to power by courting antifeminists. Now young women are going to be his downfall.

Hawon Jung

China is considered the Big One by those in Trump’s entourage responsible for devising foreign policy.

Michael T. Klare

The eastern German city of Magdeburg mourns as the Alternative für Deutschland party sees an opportunity after one of its supporters plowed into a fairy-tale Christmas market.

Carol Schaeffer

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

Business1 week ago

Business1 week agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health5 days ago

Health5 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology5 days ago

Technology5 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World1 week ago

World1 week agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics1 week ago

Politics1 week agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Business2 days ago

Business2 days agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Politics1 week ago

Politics1 week ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons