West

Seaside city resisting state Dems' attempt to force it into 'submission' over voter ID law

A conservative enclave in Southern California is embroiled in a legal dispute with the state’s liberal authorities over its voter ID law that was passed by more than 50% of the city’s voters.

Huntington Beach Mayor Gracey Van Der Mark told Fox News Digital the latest lawsuit from Sacramento authorities is just another targeted attack on the city’s values.

“I’m a person of color, I grew up in a low-income community in Los Angeles, and we all had IDs,” Van Der Mark told Fox News Digital in an interview Thursday. “And one thing that is really frustrating is they’re saying, people like me are too ignorant or incapable of getting an ID, and that’s insulting.”

“This is definitely government overreach,” she said.

California’s Democratic Attorney General Rob Bonta and California Secretary of State Shirley N. Weber filed a lawsuit last week against the beach city – which is roughly 35 miles south of Los Angeles – challenging its voter ID law, Measure A, which amends the city’s charter to allow voter ID requirements by 2026. It also includes a requirement for additional in-person voting locations.

CALIFORNIA SUES HUNTINGTON BEACH OVER VOTER ID LAW BACKED BY MAJORITY OF RESIDENTS

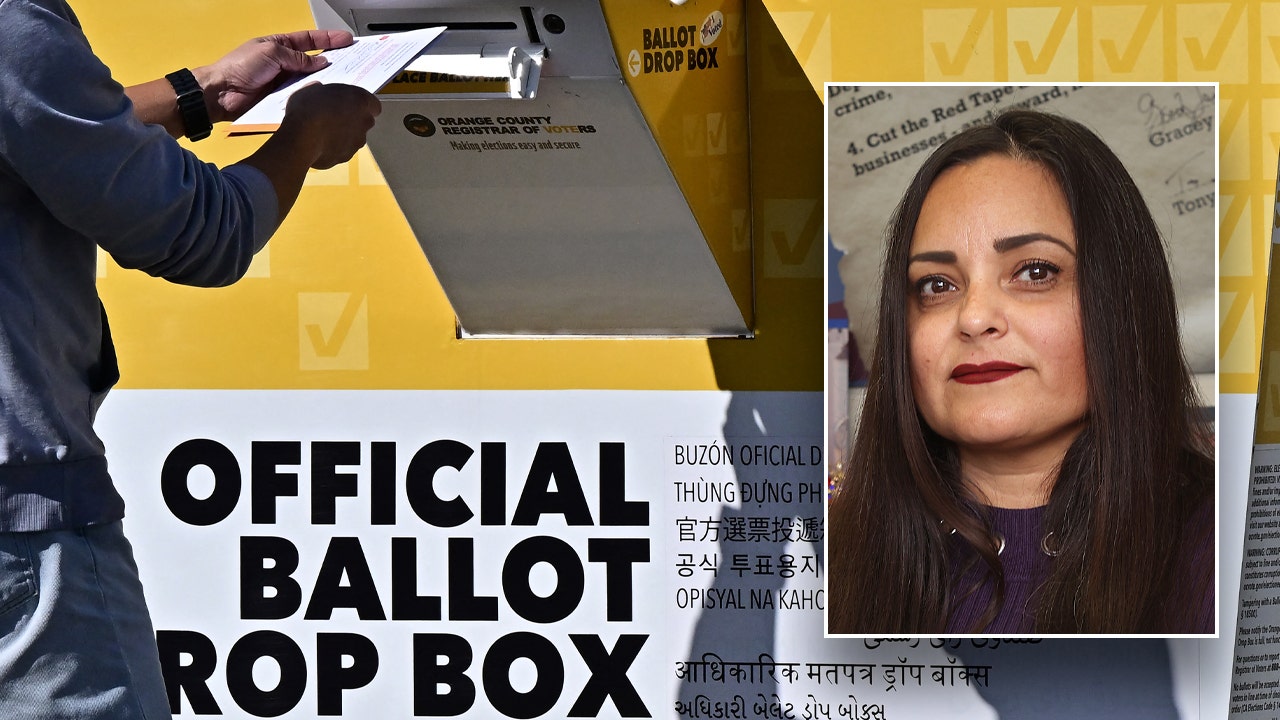

Huntington Beach Mayor Gracey Van Der Mark is defending the city’s voter ID law that voters passed in March 2024. (Getty Images)

“They’re telling us ‘it’s okay, we don’t need these measures of security,’ but we’re insisting on them,” Van Der Mark, elected in 2023, said. “So, they can sue us. We’re going to push forward and do what the people want us to do.”

In their lawsuit, Bonta and Weber argued that the city’s voter ID law “unlawfully conflicts and is preempted by state law.”

“The right to freely cast your vote is the foundation of our democracy and Huntington Beach’s voter ID policy flies in the face of this principle,” Bonta said in a statement.

He argued that state elections already contain “robust voter ID requirements with strong protections to prevent voter fraud.” He said the new requirements would disproportionately burden “low-income voters, voters of color, young or elderly voters, and people with disabilities.”

AG GARLAND PLEDGES TO FIGHT VOTER ID LAWS, ELECTION INTEGRITY MEASURES

Waves roll past the Huntington Beach Pier, epicenter of the city’s beach culture, in Huntington Beach, California, on Feb. 22, 2024. (Rick Loomis for The Washington Post via Getty Images)

The City Council, led by a politically conservative majority since 2022, stirred considerable debate by making contentious decisions on various issues recently, like the government-only flag protocol on city properties and removal of sexually explicit books in the public library.

“Sacramento is trying to make an example out of Huntington Beach,” Van Der Mark said. “They’re suing us every opportunity they can and every time we do something, they try to write bills to counter what we’re doing or to make what we’re doing illegal. So, I believe they’re trying to sway us into submission, and we’re not going to allow that to happen.”

LA MAYOR BREAK-IN SUSPECT WAS ‘TARGETING’ BASS, GASCON SAYS

California Attorney General Rob Bonta filed a lawsuit last week against Huntington Beach, challenging its voter ID law, Measure A. (Getty Images)

California officials first warned Huntington Beach officials to drop the voter ID proposal in September. The lawsuit argues that Measure A violates state law and is invalid because it conflicts with California’s Constitution, which grants charter cities the authority to govern “municipal affairs” but prohibits local laws from conflicting with statewide laws.

Under current California law, according to the AG’s office, “voter identity is established before registered voters get to the polls; at the polls, registered voters are only required to provide their name and address – no further identification is required.”

This is not the first time the state has threatened a conservative city over local laws passed. Last year, Bonta threatened several school districts over their parental notification policies.

Fox News’ Bradford Bretz and The Associated Press contributed to this report.

Read the full article from Here

Oregon

Arizona baseball loses to Oregon in Las Vegas

A change of scenery didn’t change Arizona’s luck on the diamond.

The UA lost 7-2 to unbeaten Oregon on Friday night at the Live Like Lou Las Vegas Classic, dropping to 1-8 on the season.

Arizona finished with five hits, all singles, with three by redshirt freshman Nate Novitske. The Wildcats’ runs came thanks to a dropped fly ball with the bases loaded in the top of the 4th inning.

They only trailed 4-2 at that point but in the bottom of the 5th starter Owen Kramkowski gave up a single and double and left with one out. Reliever Matthew Martinez then allowed a 3-run home run, the third of the night for Oregon.

Kramkowski allowed six runs in 4.1 innings, falling to 0-2.

Arizona did get a strong relief performance from lefty Maclain Roberts, who struck out four in 2.2 innings.

Oregon pitchers combined to strike out 19 UA batters, with freshman Cash Brennan whiffing five times and two others striking out thrice.

The UA will send sophomore righty Smith Bailey to the mound Saturday at 5 p.m. MT against Vanderbilt, which lost its tourney opener 9-4 to UC Irvine. It will be the first meeting with the Commodores since the opening night of the 2021 College World Series.

Utah

Why Utah Represents Arizona State’s True Turning Point

Arizona State basketball is at a crossroads. After back-to-back road losses to Baylor and TCU, the Sun Devils are suddenly fighting just to stay above .500.

Now, with Utah coming to town Saturday afternoon, this isn’t just another conference game. It feels bigger than that. It feels like the moment that decides whether this season still has life or if it quietly fades away.

The Danger of Falling Below .500

All season long, Arizona State has had one strange pattern.

Every time they dropped to .500, they responded with a win. They never let things spiral.

But now they’re sitting right on the edge again.

A loss to Utah would push them below .500 for the first time all year. That might not sound dramatic, but it matters for team morale.

Teams feel that shift. Confidence changes. Urgency changes. And with only a few games left before the Big 12 Tournament, there isn’t much time to recover.

That’s why this Utah game feels different.

Utah Is Playing Better — Especially on Defense

When these two teams met a few weeks ago, Utah was struggling.

Since then, they’ve improved. They’re still built around their top scorers, who combine for around 40 points per game, but the real difference lately has been defense.

Utah has started putting together more complete defensive performances. They’re contesting shots better. They’re finishing possessions. They’re not folding as easily in the second half.

That matters because Arizona State’s biggest issue right now isn’t effort, it’s physical depth.

The Real Niche Problem: Guard-Heavy and Worn Down

Here’s something that doesn’t get talked about enough: Arizona State’s roster balance is off.

Because of injuries, especially the likely season-ending absence of Marcus Adams Jr., the Sun Devils are extremely guard-heavy right now. More than half of the available players are guards. That creates matchup issues, especially against physical teams.

We saw it against TCU. They got to the free-throw line 36 times.

They won the physical battle. Even when their best scorer struggled, they still controlled the game inside.

ASU just doesn’t have the same frontcourt depth.

With only a few true bigs available and some undersized forwards playing bigger roles than expected, the team can get worn down.

Late in games, that shows up in missed rebounds, second-chance points, and tired legs.

It’s not about hustle. It’s about bodies.

Why Saturday Truly Matters

If Arizona State beats Utah, everything changes.

Suddenly, you’re heading into Senior Night against Kansas with momentum. Win that, and you’re talking about a possible 7–11 conference finish and a much better Big 12 Tournament matchup.

From there? Anything can happen.

But if they lose Saturday, the math and the hope get much harder.

That’s why this game isn’t just about Utah.

It’s about belief. It’s about roster limitations. And it’s about whether this team has one more push left in them before the season runs out.

Washington

The Fallout From the Epstein Files

The Department of Justice is facing scrutiny this week after it was revealed that records involving President Trump were missing from the public release of the Epstein files. On Washington Week With The Atlantic, panelists joined to discuss the ensuing political fallout for the Trump administration, and more.

“The key thing to remember about the Epstein story is that it is a case that has been mishandled for decades. The reason that we’re hearing about this now and why it’s exploding into public view is because, for the first time, Republicans in Congress and Democrats in Congress were willing to openly defy their leadership and call for the release of these files,” Sarah Fitzpatrick, a staff writer at The Atlantic, said last night. “That has never been done before, and I think it really is changing the political landscape in ways that we’re still just starting to learn.”

“What’s been so striking is how many of those very same Republicans who were calling for the release of those files, who had promised to get to the bottom of them, are now saying things that are just the opposite,” Stephen Hayes, the editor of The Dispatch, argued.

Joining guest moderator Vivian Salama, a staff writer at The Atlantic, to discuss this and more: Andrew Desiderio, a senior congressional reporter at Punchbowl News; Fitzpatrick; Hayes; and Tarini Parti, a White House reporter at The Wall Street Journal.

Watch the full episode here.

-

World3 days ago

World3 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts3 days ago

Massachusetts3 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Louisiana5 days ago

Louisiana5 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Denver, CO3 days ago

Denver, CO3 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT