Denver, CO

Teen learns fate for ‘senseless’ blaze that killed Denver family of five, including toddler and infant

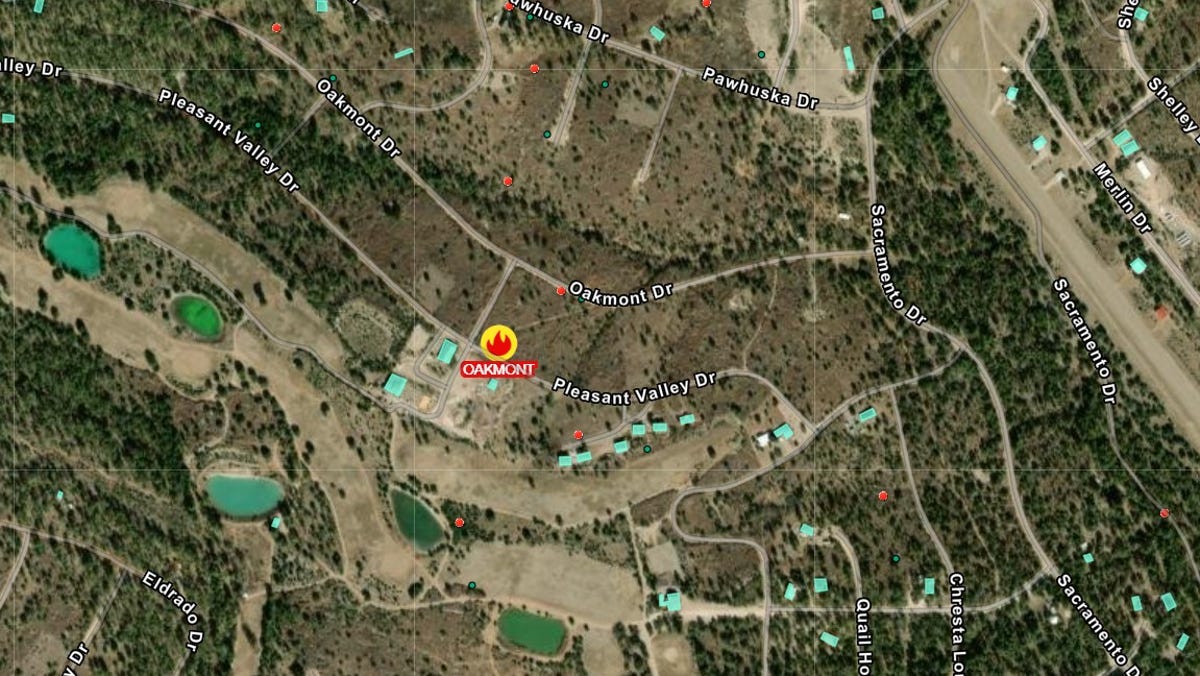

One of the three teens who killed five Senegalese family members — including a baby and a toddler — when he set a blaze to their Denver home was sentenced to 40 years behind bars Friday.

Gavin Seymour, 19, was handed the maximum possible term for the second-degree murder charge after dozens of grieving family members spoke against the murderous teen.

He pleaded guilty last month for setting fire to the house in the middle of the night in August 2020, killing Djibril Diol, 29, his wife Adja Diol, 23, and their daughter Khadija Diol, 1, along with Djibril’s sister, Hassan Diol, 25, and her 6-month-old daughter Hawa Baye.

“Even if you kill five sheep or goats, you should get a maximum sentence,” Hanady Diol, father to Djibril and Hassan, told the court through a translator over the phone from Senegal, the Dever Post reported.

“This person here, they are talking about 40 or 30 years. That just means there is no justice there. There is no judging that the people who died are human beings.”

Seymour was 16 when he carried out the dastardly act, which prosecutors said was at the direction of friend Kevin Bui, who mistakenly thought someone who had stolen his phone lived in the home.

The two 16-year-olds and Dillon Siebert, then 14, planned the fire for weeks, according to investigators.

Only three people escaped the fire by jumping from the second floor of the home.

KDVR

Djibril Diol tried to lead his wife and 1-year-old daughter through the flames, making it down a set of stairs before they collapsed not far from the door out, prosecutors said.

Seymour knew he and his friends had killed the family the following morning — online records showed he read news about the deaths and searched for information about the prison sentence for murder.

It took several months for investigators to pin down the teenagers, who were identified after police obtained a search warrant asking Google for which accounts had searched the home’s address within 15 days of the fire.

“This is by far the worst, most senseless murder investigation I have ever investigated,” Denver police Detective Neil Baker said in court

“I can’t think of any other one that is more deserving of a maximum sentence allowed… There are five victims. Two were babies.”

Seymour accepted a plea deal in January that set a sentencing range of between 16 and 40 years.

He apologized in court Friday for his role in the fire.

“If I could go back and prevent all this I would,” Seymour said. “There is not a moment that goes by that I don’t feel extreme guilt and remorse for my actions. … I want to say how truly sorry I am to the family members and community for all the harm I’ve done.”

Siebert, who was 14 at the time of the fire, was 17 when he was sentenced in February 2023 to three years in juvenile detention and seven years in a state prison program for young inmates.

Bui faces multiple counts of first-degree murder and is next due in court on March 21.

Denver, CO

Timberwolves 106 – 99 Nuggets summary, stats, scores and highlights | NBA Game 1

Joker in is comfort zone

For as good as Nikola Jokic is in the regular season, he is even better in the playoffs. He has the luxury of having fantastic players around him, but that is in large part because of how easy the Serbian makes the game. Taking nothing away from Aaron Gordon, or Michael Porter Jr. or Kentavious Caldwell-Pope are are great players, but they are better players when Nikola Jokic is on the court. In the first round, he averaged 28.2 points, 16.2 rebound and 9.8 assists to lead the NBA in each category though one round. Against Minnesota, he is going to be going up against a two time Defensive Player of the Year, Karl-Anthony Towns, and Naz Reid as second and third defensive options.

Denver, CO

LetsGoDU: Denver Women’s Lacrosse Stifles Furious UConn Comeback Bid to Earn BIG EAST Tournament Title

10th ranked/#1 seed Denver (15-3, 6-0) capped an undefeated BIG EAST regular season by winning the BIG EAST Tournament against #2 seed UConn,16-14. DU built a 9-1 lead but had to withstand a 4th-quarter tie with the Huskies to escape with the win and the BIG EAST title.

Denver reeled off five straight goals to open the first quarter of play. Caroline Colimore and Sloane Kipp scored for Denver in the first two minutes to race out to a quick lead. Julia Gilbert took a feed from Kipp to keep the run going at 10:33. Four minutes later, Olivia Ripple found the back of the net for the Pioneers. Kipp Sloane finished off the first-quarter scoring outburst in the final two minutes to build a 5-0 lead.

Denver followed the same recipe to start the second quarter when Ryan Dineen scored in the first minute. UConn’s Susan Lafountain finally broke the ice at 11:43 to temporarily stop the DU run. Denver responded with three straight goals by three different Pioneers – Jane Early, Gilbert and Kyra Obert to build a 9-1 lead. Denver was coasting to the title, right? Wrong. In the final 5:11 before halftime, the Huskies woke up with three goals of their own by Kate Shaffer (free position), Shaffer again (man-up) and Madelyn George. The Huskies were chipping away at the massive deficit.

The teams traded goals in the third quarter with both scoring four goals. Denver opened the scoring three minutes into the period when Julia Gilbert found paydirt. UConn scored two minutes later but DU’s Jane Early responded to retain the five-goal edge, 10-5. UConn scored again at 7:13 but Caroline Colimore responded a minute later with a DU tally. Denver countered another Husky goal when Jane Early scored after a Denver draw control and feed a half minute after the UConn goal. Under a minute to go in the third period, the Huskies Kate Shaffer scored to draw within five goals, 13-8.

Denver looked to be on cruise control heading into the final 15 minutes but UConn had other ideas. UConn started to chip away at DU’s five-goal lead. Abby Charron scored in the first minute to start the ball rolling for UConn. Less than a minute later, Caroline Colimore scored for Denver to regain the 5-goal margin. The Huskies then reeled off two straight goals at 10:16 and 9:16 to cut DU’s advantage to three goals as UConn started to gain momentum and confidence. In the final five minutes, the Huskies buried three more goals, a five-goal run in all, to knot the score 14-14. With under two minutes to go, Denver forced a turnover and called a timeout. The ball went into Ryan Dineen with a feed to Julia Gilbert who buried the shot, 15-14, with a minute to go. Gilbert, the hero of the game for DU, secured the draw control as DU took fouls and ran clock. Colimore added the icing on the cake with a goal as time expired for a final score 16-14.

DENVER SURVIVES. 😬@DU_WLAX scores twice in the final minute after @UConnWLAX pulled all the way back.

DENVER WINS THE @BIGEAST. pic.twitter.com/zB7UinIYNp

— USA Lacrosse Magazine (@USALacrosseMag) May 4, 2024

DU outshot the Huskies 28-18 along with only 7 turnovers to 17 for the Huskies. However, UConn was efficient in the offensive zone to make it a game. Colimore and Gilbert had four goals each. Sloane Kipp had two goals and six assists. Kate Shaffer had five goals and three assists to pace the Huskies.

The NCAA selection show is on Sunday at 7:00 pm MT when Denver will learn their NCAA seeding and opponent.

Denver, CO

It was already tough, but a jump in mortgage rates and higher home prices are making it even harder to buy a home in metro Denver.

Builders are finally making a dent in the state’s housing shortfall, especially for apartments. But home prices and mortgage rates continue to outpace income gains, and affordability is worsening rather than improving.

“The story with interest rates is that they are only exacerbating the problem,” said Steven Byers, chief economist with the Common Sense Institute in Denver. “The fact is that wages aren’t keeping up with these huge jumps in home prices.”

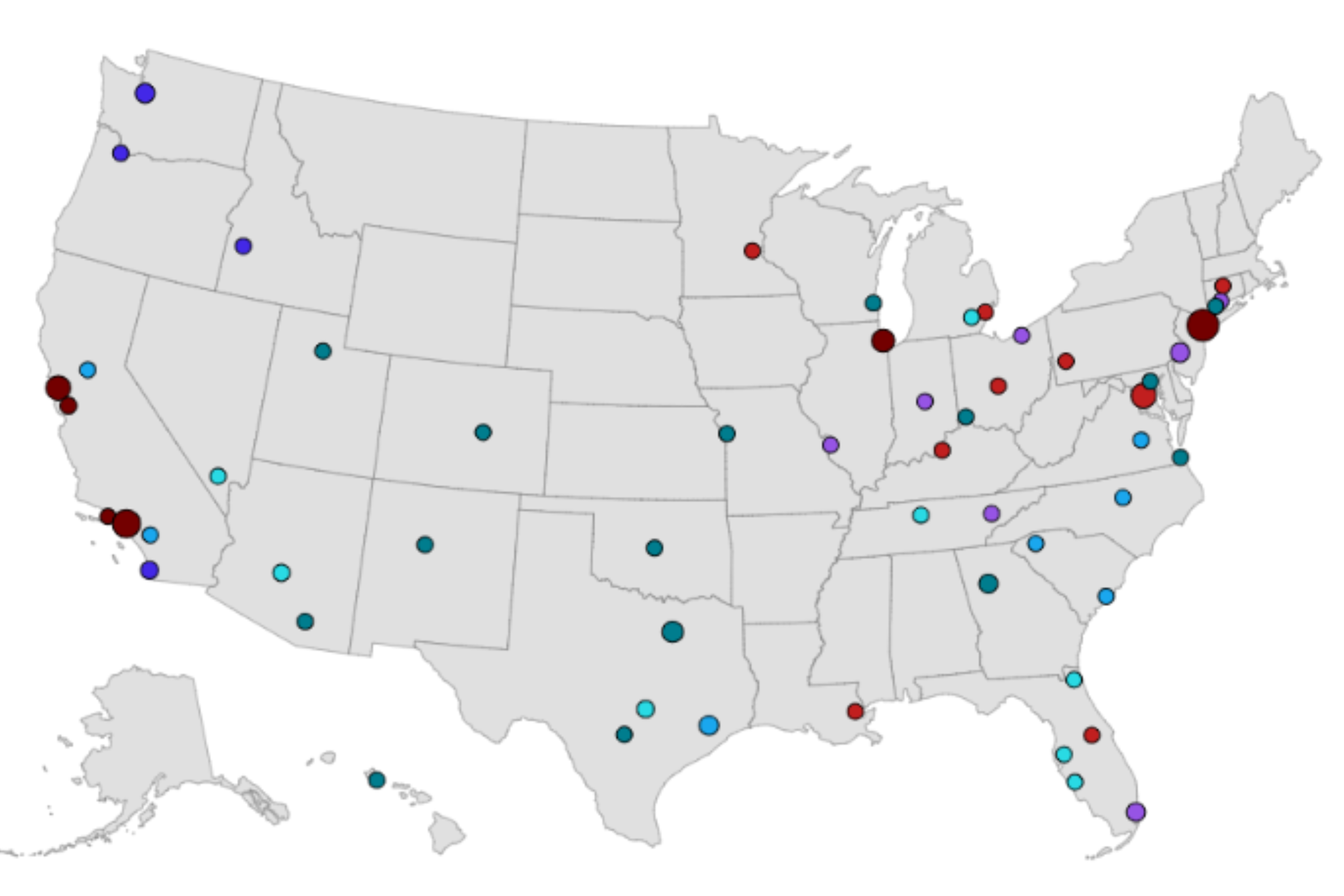

For the first time since July 2022, home prices in all major U.S. metros, including Denver, rose year-over-year, reports brokerage firm Redfin. The S&P CoreLogic Case-Shiller Index for Denver has home prices up 2.7% the past year through February.

After five weeks of increases, the average interest rate charged on a 30-year loan reached 7.22%, the highest level since Thanksgiving, according to Freddie Mac.

Purchasing a home was hard before, and it is only getting harder. In 2011, a buyer in Colorado could expect to work 44 hours a month on average to cover the mortgage payment. That bar moved up to 96 hours last year, a 118% increase, according to CSI’s Colorado Housing Competitiveness Index, which Byers co-authored.

Things are only slightly better for renters. They had to work 45 hours on average to cover the monthly rent in 2011. Now they have to work 87 hours. Colorado tenants devote more hours of work a month to meet the rent than do residents of any other state, according to the CSI report.

After the Great Recession, metro Denver became a hot spot for young professionals and tech workers looking to relocate. Demand for housing outstripped supply, causing home prices and rents to rise. Net domestic migration has fallen the past two years, as more people pick up and leave and fewer move in, Byers said. Higher housing costs have made the state less attractive.

That is both good and bad. Slower population growth should reduce pressure on the housing market and give builders time to catch up, stabilizing home prices and rents over time. But it also leaves employers and the larger economy, long dependent on importing the talent it needs, vulnerable. If the economy stalls, those struggling with higher living costs could pay the price.

Of the 50 largest U.S. metro areas, only six have median home prices that align with median incomes, according to a study from Clever Real Estate. Denver had the 8th biggest gap between in the amount of income needed to attain a median-priced home.

Zillow places the typical home value in metro Denver at just shy of $561,000 in December. Assuming a 20% downpayment and at current mortgage rates, an annual income of $167,562 would be required to buy that home, according to the Clever Real Estate study.

But here’s where it gets painful. The median income for metro Denver households is $98,975 a year, resulting in a shortfall of $68,587. Denver residents earn above-average incomes, but the higher pay isn’t enough to cover way above-average housing costs.

Wages tend to be lower in other parts of the state, and the affordability “gap” statewide is a little larger at $69,587. Colorado’s median home price is $531,900, not too far behind the metro Denver median price. With 20% down, that requires an income of $158,889, according to Clever Real Estate. The median household income statewide is $89,302.

Absent outside help, first-time buyers are often hard-pressed to put 20% down. That would require $112,200 on the typical home in Denver. What could someone putting 10% down and making the median income in Denver afford after the recent jump in mortgage rates? Clever Real Estate puts that amount closer to $270,000 to $280,000.

Good luck finding that. Out of 6,458 single-family home closings in metro Denver in the first three months of the year, only 50 involved a home priced below $300,000, according to the Denver Metro Association of Realtors.

Buyers of condos and townhomes face better odds, with 452 out of 2,343 sales this year below $300,000. But even there, only 20% of listings are affordable to households earning a median income. Only 5.7% of sales, homes or condos, were attainable.

The hurdle is even higher for new home buyers. The median new home price in Colorado is about $650,000, according to a study from the National Association of Homebuilders. Only one in five households in the state can afford something at that price point. Two million households in the state can’t afford to purchase a new home at the middle price point.

Renting cheaper now, but costly long-term

Most renters have limited options when it comes to buying in metro Denver. But in their favor, renting offers a substantial discount over buying right now, according to a separate analysis from Bankrate, the personal finance website.

The typical monthly payment for the median-priced home is around $3,627 in metro Denver, including the mortgage payment, property taxes and insurance. By contrast, the typical rent is $2,027 when looking at a rent index from Zillow that combines apartment, condo and home rents.

Renting was cheaper than buying in all 50 metros studied, but Denver had the ninth largest gap at $1,600. That 79% premium was much larger than the 36.6% premium to own nationally.

“I wouldn’t say rent is affordable, but between buying and renting, renting is the lesser of the two evils,” said Alex Gailey, lead data reporter at Bankrate and the author of the analysis.

In an ideal world, renters would sock away that extra money as emergency savings. After that, savings would be invested in the stock market, which has provided a higher return than owning a home over time. If an employer matches a retirement plan contribution, that would translate into an automatic 50% return off the bat.

But most renters probably won’t follow that strategy, leaving them vulnerable long-term, Gailey acknowledges. If an area isn’t losing population, homes should rise in value even after accounting for repairs and maintenance.

That equity can be poured into buying a bigger home down the road, or it can help fund expenses in retirement or be passed onto children and heirs, building inter-generational wealth. Also, mortgage payments can be locked in, while a rent payment can’t.

“You are building equity for yourself rather than for someone else,” said Jen Ankrum, director of sales for KB Home in Colorado, when asked about the message the company shares with renters looking to buy.

First-time buyers account for about half of the sales at KB Home, which strives to provide a high-quality, energy-efficient home priced below the competition. Even with the heavy focus on first-timers, about a third of buyers make under $100,000, a third make $100,000 to $150,000 and a third make more than that amount.

Normally, the housing market tries to find an equilibrium, offsetting rising interest costs with slower price gains or even price declines. But demographics have prevented that from happening. Millennials, born between 1981 and 1996, are now the nation’s largest generation at 72 million. They are behind schedule compared to prior generations when it comes to buying homes and pushing hard to acquire them even if the conditions aren’t favorable.

Markets where more millennials relocated to have housing markets under the most pressure. A little more than six in 10 homebuyers in metro Denver are millennials — only San Francisco and San Jose in California and Boston have a higher share of millennial buyers, according to a study from loan portal LendingTree.

None of those markets would be considered affordable. In Denver, millennial buyers on average made a downpayment of $70,710 and borrowed $456,805 to purchase a home, LendingTree reports.

“A big reason why millennials concentrate in expensive housing markets is because those areas often have robust and relatively high-paying job markets,” said Jacob Channel, a senior economist at LendingTree and author of the report.

Large tech companies are reducing their headcounts and a recession, when it comes, could accelerate layoffs. What happens if those high-paying jobs go away but the high mortgage payments don’t? But Channel doesn’t see a systemic risk to the housing market.

“While there are doubtlessly some millennials who are currently stretched too thin and must contend with the prospect of downsizing or, in the worst case, foreclosure, the number of people struggling isn’t large enough for there to be a serious risk to the broader housing market,” Channel said.

Get more real estate and business news by signing up for our weekly newsletter, On the Block.

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoSpanish PM Pedro Sanchez suspends public duties to 'reflect'

-

News1 week ago

News1 week agoAmerican Airlines passenger alleges discrimination over use of first-class restroom

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Science1 week ago

Science1 week agoMosquito season is upon us. So why are Southern California officials releasing more of them?

-

Movie Reviews1 week ago

Movie Reviews1 week agoCity Hunter (2024) – Movie Review | Japanese Netflix genre-mix Heaven of Horror