California

Whistleblower Seeks To Determine If Hunter Biden Paid California Taxes

Hunter Biden, son of US President Joe Biden, arrives at court for his trail on tax evasion in Los … [+]

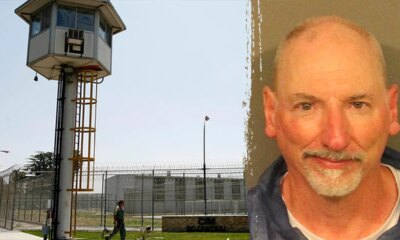

Thanks to the presidential pardon from his father, Hunter Biden will no longer have to worry about the federal charges he was facing for failure to pay federal income tax on millions of dollars in earnings. President Joe Biden’s December 1 pardon does not, however, immunize his son from prosecution for failure to pay state income tax. Whether or not Hunter Biden fulfilled his state tax obligations to California is a question now being pursued by a public whistleblower.

Hunter Biden was a resident of California, home to the highest top marginal income tax rate in the country at 13.3%, during the years for which he has pled guilty to federal tax evasion. While media coverage has focused on unmet obligations to the IRS, the prospect of unpaid state tax liabilities is a topic that has never received much attention. In early December, James Lacy, president of the United States Justice Foundation, filed a public complaint (Case Number 12024-14638) with the California State Auditor calling for an investigation of the California Franchise Tax Board in order to determine whether Hunter Biden filed and paid state taxes for the years he has pled guilty to federal tax evasion.

Given the amount of income on which Hunter Biden failed to pay federal taxes, it’s a potentially large sum of money that he also might have neglected to pay to the government of California, a Democrat-run state where taxpayers are on the hook for an estimated trillion dollars-worth of unfunded public pension liabilities and where employers were recently hit with a payroll tax hike triggered by Governor Gavin Newsom’s (D-Calif.) decision to not repay unemployment insurance loans taken out from the federal government during the pandemic.

“Californians who file their tax returns and timely pay their taxes deserve to know whether or not Hunter Biden has received any special treatment from the Franchise Tax Board regarding his tax liability,” said Lacy. “I am hoping my Whistleblower Complaint will draw attention to this issue and bring some transparency to whether our state tax system has acted fairly.”

“If Hunter Biden failed to pay federal taxes, it’s reasonable to suspect he also failed to pay applicable state income taxes for those years,” says Ryan Ellis, an IRS-enrolled agent. Lacy also called on the Governor to act, saying “Newsom should also reveal to California taxpayers whether or not Hunter Biden was secretly ‘pardoned’ from state tax liability and enforcement as well.”

California Combines High Tax Rates With Muscular Collection

Aside from the nation’s highest state income tax rate, California has long been considered the most aggressive state in the nation when it comes to taxing foreign-sourced income. “Unfortunately for the President’s son, not only did he face the highest state income tax rate, he was also dealing with a state whose tax law has the longest and most aggressive arm,” Ellis said. “Comparatively speaking, California is the most litigious state I have seen in terms of chasing people down for money. Only New York rivals them.”

“It doesn’t matter if the income was coming from the former Mayor of Moscow, a Chinese private equity firm, or a Ukrainian gas company, California tax obligations are global and would’ve applied for the years in which Hunter Biden was a Golden State resident,” added Ellis, who runs his own tax preparation business and is president of the Center for a Free Economy.

The Department of Justice noted in a September 5 press release that “Hunter Biden engaged in a four-year scheme in which he chose not to pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019 and to evade the assessment of taxes for tax year 2018 when he filed false returns.” While Hunter Biden won’t face repercussions for skipping out on those federal tax obligations thanks to the pardon from his father, that doesn’t shield him from state level prosecution for failure to pay taxes to California.

Why would a person pay state taxes on income for which it’s known they did not pay federal taxes owed? That question and the desire to answer it is behind the complaint recently filed with the State Auditor. Fortunately for Hunter Biden, California tax authorities and the California press corps have thus far demonstrated little interest in answering that question.

Hunter Biden also doesn’t have to worry about the most recent state wealth tax proposal introduced Sacramento. That’s because Governor Newsom confirmed earlier this year that he opposes the latest wealth tax bill introduced by California legislators. That should be welcomed news for Hunter Biden, who purchased a $142,000 sports car with funds provided by a Kazakh businessman, and who received a 3.16 carat diamond from a Chinese businessman, both of which would be prime targets of the sort of wealth tax sought by some California lawmakers.

In his 2023 State of the Union Address, President Biden promoted his effort to make “the wealthiest and the biggest corporations begin to pay their fair share. That message was echoed throughout 2024 by Vice President Kamala Harris (D), Senator Chuck Schumer (D-N.Y.), and other prominent Democrats. Any politician who wants to continue calling for stricter gun control and higher tax burdens on the rich, however, will have a hard time doing so in the future if they declined to comment when the President’s son was let off the hook for failing to pay taxes on millions in income and violating of gun laws.

California

San Jose Mayor Matt Mahan officially announce run for California governor

Watch CBS News

California

Six planets to align in “planetary parade” above California. Here’s how to see it.

A rare celestial event will be taking place in the sky above California on Saturday night, as six planets are expected to be visible in what is being called a “planetary parade.”

Look towards the western horizon 30-60 minutes after sunset. Mercury, Venus, Jupiter, and Saturn will all be lined up along an arc, visible to the naked eye creating a literal parade of planets.

The alignment only occurs every few years, with the next one not until 2028.

Mars, Jupiter, and Saturn are frequently seen in the night sky, but the addition of Venus and Mercury make this planet lineup particularly noteworthy.

In the San Francisco Bay Area, there will be some cloud coverage Saturday evening, but it should be in the high levels of the atmosphere so hopefully the horizon remains clear. In Los Angeles and San Diego, the forecast is expected to be clear.

Meanwhile, the planetary parade may not be visible in the northern part of the state, with cloudy conditions expected Saturday night in Sacramento, and possible showers and thunderstorms in Eureka and Redding.

People with telescopes and binoculars will also be able to see Uranus and Neptune as well.

For amateur astronomers, this also would be a fun time to test out your telescope skills by checking out Jupiter’s many moons or Saturn’s rings.

Please note that if your view is obscured by buildings, trees or hills, you won’t see the parade because it will appear very low on the horizon.

The nontechnical term is Parade of Planets, but the technical term is planetary alignment. Basically, it’s just the name for what happens when the planets and sun line up in the sky, these happen during events called oppositions and conjunctions.

Opposition is the term for when a planet is directly opposite the Earth from the Sun. Meanwhile, conjunction is when they are aligned with each other and is when we get the best views of the planets.

California

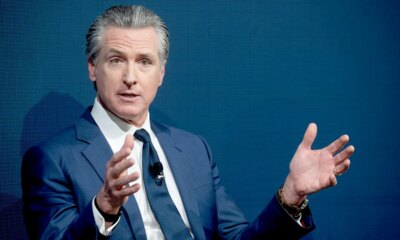

‘Trump’s not enough. And he knows he’s not enough’: California governor Gavin Newsom on populism, ‘purity tests’ and whether he’ll run for the presidency

When you think of the politician Donald Trump isn’t, when you think of the norm he broke, the archetype he shattered, you might well picture a man who looks a lot like Gavin Newsom. Tall and handsome, hair coiffed just so, with a blond wife and four photogenic kids at his side, Newsom, who has been the governor of California since 2019 and is often described as the frontrunner to be the Democratic nominee for the White House in 2028, looks the way professional politicians, and especially presidential candidates, look in the movies.

It’s dogged Newsom for years, that look of his, perennially suggesting that he is, in the words of one California newspaper, “too ambitious, too slickly handsome, and too patrician-seeming”, especially for a populist age that cherishes the authentic and has no truck with anything either phoney or “elite”. The elite tag especially has hung around Newsom’s neck for decades, thanks to the fact that his ascent to the top of California politics has seemed smooth and unbroken, apparently eased by a childhood spent in the orbit of the Getty family, when that name was a byword for astronomical wealth.

Now Newsom is bent on busting those myths, laying out in a new memoir a reality that confounds the public image. Sceptics will of course assume that this is just another classic politician move: the book that precedes a campaign for national office. Even so, few readers of Young Man in a Hurry will come away thinking of its author as the “Prince Gavin” of his rivals’ caricature. Instead they will see a man, now 58, whose story is far more complex, and interesting, than the haircut and smile would have you believe – one whose life might just have equipped him to win the most powerful office in the world.

When we speak, in a conversation that will range from a devastating family history to his knack for a stunt – handing out kneepads at Davos to those politicians and corporate titans he accuses of abasing themselves before Trump – he makes his interest in the US presidency clearer than ever, even if he doesn’t quite say outright that he’s running. If there was so much as a scintilla of doubt about his intentions before we talk, not a trace of it is left afterwards. What’s more, Gavin Newsom leaves some valuable clues pointing not only to how he would seek the presidency of the United States – but why.

Via a videocall from his office in Sacramento – the same office, he points out, where “Governor Reagan, not president yet, Ronald Reagan used to reside” – he tells me that the new book “wasn’t done cynically”, that it “wasn’t done intentionally” as a political ploy; that, in fact, it came out of a rejection. In his telling, he had submitted a more conventional politician’s memoir – detailing his handling of California’s wildfires, the pandemic and “Trump 1.0” – with just one chapter on his own upbringing. The publisher read that chapter and said, “Hold on. I didn’t know anything about this.” What she had read ran so “completely counter” to what she had previously thought – the Newsom born with a presumed silver spoon in his mouth – that she demanded more.

This is what she had learned from those pages. That, yes, Newsom’s father had served as consigliere to Gordon Getty, whom he had known since high school and, in that capacity, became exceptionally close to the family, to the point where he and his two children, Gavin and sister Hilary, would feel at home at the Getty mansion on San Francisco’s Gold Coast, and would frequently accompany the clan on outrageously lavish trips abroad. Newsom describes it all: the teenage trips on “the Jetty”, the Gettys’ private plane; being kitted out by a tailor with the clothes he would need to be a house guest of the king of Spain; that time in Venice when he arrived by gondola at yet another party in a 16th-century palazzo, only to be greeted by the debauched face of Jack Nicholson. “Well, well,” said the actor, “if it isn’t the Getty boys.” The young Newsom didn’t correct him.

But, the governor now tells me, “To work for them doesn’t make you them.” For all his decades in the Gettys’ service, William Newsom “never made much money”. He was paid a salary, but it was not enormous. “It wasn’t a financial relationship … it opened up the door of privilege and opportunity, but not wealth. My father passed with nothing.”

That, though, is not the half of it. After Newsom’s parents divorced when he was three, he was raised by his mother. She worked three jobs at once, one of them as a waitress, and took in lodgers and foster children for extra cash. Gavin and his sister were latchkey kids who shared a bedroom. “We were home alone for too many hours on too many days,” he writes. “We raised ourselves on giant bowls of mac and cheese and thought nothing of it.”

The timber of his family tree is riddled with alcoholism and depression. His mother chugged wine from a jug, while her own father was so badly damaged by his experience as a prisoner of war, held by the Japanese, that he once pulled a gun on his three children, telling them very calmly, “I am going to shoot all of you right now.” He eventually took his own life.

It can be hard to square all this with the Newsom persona California voters have known for so long. He was still in his 20s when appointed to his first citywide role in San Francisco by legendary mayor Willie Brown, whom Newsom succeeded in 2004. That year, Harper’s Bazaar ran a feature on “the new Kennedys”, which included a photo of Newsom in a tuxedo, lying on a rug alongside his then wife, TV host Kimberly Guilfoyle, also in evening wear, in the Getty mansion. The marriage would break up, Guilfoyle would go on to date Donald Trump Jr, and she is now the US ambassador to Greece, while Newsom would marry Jennifer Siebel, an actor and documentary film-maker from a Republican family. But the image lingered.

For some, the disconnect between that and the upbringing Newsom describes in his book is just too much. One former associate described it to the New Yorker as Newsom’s “I was born a poor Black child” story – a reference to the spoof opening monologue of Steve Martin’s 1979 comedy The Jerk. But Newsom is emphatic that “the press’s one‑dimensional portrait of me” is wrong, that he really did live in a “duality”, moving between two worlds: one of scarcity and struggle; the other of fabulous opulence – and that, if his memoir reads like a strange mashup of The Great Gatsby and Hillbilly Elegy, that’s just how it was.

Even those reluctant to concede Newsom his hardscrabble roots have to allow that he did face one obstacle that, on its own, puts the lie to the notion of his career as a smooth ride. He has what he calls a “learning disability”, in the form of severe dyslexia. At school, he says, “I couldn’t read, I couldn’t spell, I couldn’t write.” (He is upfront that his memoir is ghostwritten.) He was sure he was stupid – “a gimpy geek with a bowl cut” – and he was regularly bullied. (They’d call him “New‑scum”, the same word hurled at him by Trump.) To this day, he can only read laboriously, underlining almost every word, then copying out the underlined passages to a notepad, and then copying those out on index cards, which he keeps in a voluminous filing system. He cannot read from an Autocue, at least not in a way most people would recognise as reading.

“We would never be having this conversation if it wasn’t for the gift of dyslexia,” he tells me. It didn’t feel like a gift at the time, but now he can see the effect it’s had. He is a “politician that doesn’t read speeches. You’ve never seen me read a written text in a speech. I don’t look up and down. I’m off script all the time.” In the age of populism, that’s a boast. Given that authenticity is probably the single most prized quality in politics, and that the opposite of authentic is scripted, Newsom is happy to tell you he is literally incapable of being scripted.

It’s had other effects, too. He can’t easily read words, so, “as a consequence, you have to make up for that. You have to read the room. You have to have some emotional intelligence. You feel things.” Besides, having to stand before audiences without the crutch of a text inevitably brings “anxiety and insecurity. And you try to make up for that. And the only way you can make up for that is hard work and grit. And you got to practise. So there’s this notion of reps and resiliency.”

No one disputes Newsom’s work ethic. As he puts it, “You’re just not going to outwork me. I mean, you may think you’re going to outwork me, but you’re not. I’m going to read 10 times more. It may take me 10 times longer to read … [but] I’m going to have to come prepared because, you know, I can’t fake it. I can’t dial it in, and I can’t dial up someone else’s words that are put on a piece of paper, like so many others in my racket, in politics. And so I’m going to spend 10 hours for 10 minutes.”

The tuxedo photoshoot made him look like a playboy – and his dating life as a divorcee mayor in the 2000s kept the San Francisco gossip columnists busily happy – but he is in fact a swot: studying ahead of every meeting, ploughing through papers on his 90-minute commute, underlining and writing out lines. That’s what he means by reps. For him, taking in information is like lifting weights: it requires repetition.

The result is a wonkishness that, again, hardly fits the show pony image. When he appeared as a guest on New York Times journalist Ezra Klein’s podcast, the two went several rounds on modular construction and the role of off-site manufacture in addressing the housing crisis. Newsom is a politician who feeds on a policy-rich diet.

That habit was shaped thanks to a brief but formative part of his career, one that sets him apart from his likely rivals for the 2028 Democratic nomination. Straight out of college, which he had reached only because he had made himself – through hours and hours of practice – a decent baseball player, a left-arm pitcher, Newsom founded a business. A wine store called PlumpJack, in homage to Falstaff, which he set up in San Francisco and where he put his hands-on work ethic to intense use. (In the book, Newsom is at pains to make clear that though Gordon Getty was an early investor, he was one of seven or eight, each giving a modest $15,000.)

PlumpJack proved a great success. It would eventually become an operation with four wineries, two boutique hotels, seven restaurants and bars, two clothes shops and 700 employees – among them, until her death at age 55 via an assisted suicide, which Newsom concedes was then illegal under California law, Newsom’s mother. Its co-presidents are Newsom’s sister Hilary and their cousin.

Newsom says it was building that business that made him a magpie for the ideas of others, agnostic as to their origin, interested solely in what brought success. “Part of being an entrepreneur,” he tells me, “is always casing other people’s joints, constantly figuring out where your competition is going, what they’re about to do, what are the trend lines … I took that and applied it to politics.”

He’s making a point about policy and the search for best practice, but the political application goes wider than that. For one thing, if Newsom is the nominee in 2028, Republicans will struggle to run what has long been one of their favourite lines against Democratic opponents: that they have never run a business, never created a job, that all they’ve known is politics. His business record is one more way in which Newsom might be able to appeal to red state voters as well as blue state ones. Yes, he is the governor of one of the most liberal states in the union, having been mayor of one of the most liberal cities in the country, the mere words “San Francisco” usually enough to whip up a rightwing crowd. But, as the veteran Democratic strategist James Carville told the New Yorker, Newsom can get around that: “Part of his selling will have to be, I can play in the middle of the country – I can play freshwater and I can play saltwater.”

The family he has today will help. Like so much else about him, it’s a duality. At first glance, it could have been designed to delight a Fox audience: the slim, blond wife alongside four kids, aged 10 to 16 – two daughters, Montana and Brooklynn, and two sons, Hunter and Dutch. But the blue state crowd will warm to the fact that Siebel has chosen to be known as the first partner of California, rather than first lady; that her documentaries interrogate themes that include the under-representation of women in positions of power and American notions of masculinity. (Newsom’s book describes the day Siebel told him about her experience at the hands of Harvey Weinstein: in 2022 she testified in court that, 17 years earlier, Weinstein had raped her in a hotel room.)

Newsom’s record is itself a duality. At one point, he tells me, “You’re talking to one of the most progressive politicians in the United States.” As if addressing the Democratic core voters who will choose a 2028 standard bearer in primaries, he rattles off the evidence, starting with the act that first made him a national figure, when just weeks after becoming mayor in 2004, he authorised the first same-sex marriages in US history, prompting thousands of lesbian and gay couples from across the country to head to City Hall in what became known as the “winter of love”. (John Kerry, his party’s presidential nominee that year, was said to have blamed Newsom’s move for his defeat, by galvanising conservatives and evangelical Christians to vote against him.)

But Newsom is just clearing his throat. He ticks off his tally of progressive achievements. “We have universal healthcare in California, regardless of immigration status and regardless of pre-existing conditions or ability to pay. We have the highest minimum wage in the United States of America for healthcare workers: $25. Fast-food workers: $20. $16.90 for everybody else.” He talks about the threat that extreme inequality between rich and poor now poses to the republic; one of his lines is, “We’ve got to democratise our economy to save our democracy.” He says that on so many issues that the New York mayor and progressive pin-up Zohran Mamdani and the left argue for, California has already forged ahead. “We’re being very aggressive calling out Trump and Trumpism, putting a mirror up to this president and punching him back in ways that are very aggressive, not just stylistically.”

He’s referring to Proposition 50, the statewide referendum Newsom pushed last November, urging Californians to agree to a redistricting plan that would give Democrats five more seats in the House of Representatives – to offset the five-seat advantage Republicans had given themselves by redrawing congressional boundaries in Texas. It was a huge gamble. Voters don’t always turn out for what can look like technical, procedural measures, and had Prop 50 lost, Newsom would have been tainted by failure, his electoral pull exposed as weak. Instead, it passed by a walloping 29 points. Overnight, Newsom had established himself as a – if not the – leader of the opposition, a Democrat not looking to split the difference but ready to take the fight to Trump and the Republicans.

And yet, that record sits alongside a résumé as a moderate Democrat, one that goes back just as long. Serving on the equivalent of San Francisco’s city council, in 2002 he antagonised the left with a scheme called Care Not Cash, which slashed payments to homeless people, using the money to fund housing and help with drug addiction and mental illness. He says it worked.

More recently, Newsom has angered the left again. Last year he launched a podcast, This Is Gavin Newsom. He knows it’s a cliche: “You roll your eyes. God, a politician, an American politician, with a podcast and a book.” But that’s not what riled many on his own side. It was his choice of guests. He has featured Steve Bannon and Maga-before-Maga talkshow host Michael Savage, whose longtime mantra was “borders, language, culture”. On his debut show, Newsom interviewed Charlie Kirk.

Naturally, Newsom was denounced for platforming – he puts the word in quotes – hate figures from the right. What’s more, on that first episode, Newsom mused that transgender athletes’ participation in professional women’s sports was “deeply unfair”. The backlash was immediate. Many detected a political calculation, Newsom signalling that he understood the much‑discussed vibe shift revealed by the defeat of Kamala Harris a few months earlier and pointedly breaking from the activist left of his party.

The governor insists it was nothing of the sort. His view was shaped, he says, by practical experience. Two years earlier, “we had some statewide championships in track and field, where there was a trans athlete that was successful in [defeating] another athlete. And there was tremendous controversy. We tried to accommodate for that and address the issue of fairness and some advantages that I think, by any objective standards, existed and persisted. And the difficulty was we couldn’t figure it out.” A year later, the issue recurred and, again, Newsom could not see a fair solution. “And so Charlie Kirk asked me a direct question, and I answered it.”

He says he’s sorry that he hurt the feelings of some on his own side, but he thinks the response he got teaches its own lesson. “Frankly, we were becoming a little too judgmental as a party … this idea that somehow you’re countenancing a point of view or perspective by engaging in conversations, that somehow you’re complicit … There was a purity test” – according to which nothing less than total orthodoxy on key issues is good enough. “I have a difference of opinion with my party on sports for transgender athletes. And there was tremendous judgment and condemnation for that point of view, somehow saying I’ve abandoned the LGBTQ community. I’ve walked away. I’m throwing them under the bus. I think it’s that kind of tonality that pulls people away.”

Newsom says he’s interested in finding those areas where Democrats and Republicans might come together. Just as likely, he wants to see where Democrats might win over former Republicans and gain their votes. He’s back to casing the competing joints, looking for the clues that Republican success in 2024 left behind. He consumes rightwing media, watching more Fox News than he ever watched MSNBC, now rebranded as MS NOW, and is particularly keen to work out how the right cuts through among young men. That’s a trick Democrats need to match.

Still, it’s a duality: Newsom simultaneously the most pugnacious Democrat on the playing field – trolling the president with Trump-style social media posts, complete with capital letters and multiple exclamation marks – and the advocate of building bridges that might connect blue and red America. That connection has to happen, he says, because “divorce is not an option”.

Can you be both at once: attack dog and unifier? Newsom thinks so. When I offer a range of apparently competing strategies for opposing Trump, some on the offensive, some aimed at accommodation, asking which he prefers, he answers, “All of them.” He sees no reason to choose.

“I mean, you can stand your ground, be firm, but also have an open hand, not a closed fist in terms of dealing with our common humanity. This notion that it’s got to be one or the other, that’s the tyranny of ‘or’ versus the genius of ‘and’ … I think there’s nuances in life. It’s not black and white. It’s not binary. I think that’s the way we need to approach life.”

He extends that – sort of – even to Trump himself. In the book, he describes an encounter during Trump’s first term, where the governor and the president rode on Air Force One together. The Trump that Newsom saw seemed eager, in private, to win him over, to josh with him, to be liked by him. He looked needy. Is Newsom saying he almost felt sorry for Donald Trump?

“He wants to be loved. He needs to be loved. Yes, he’s a narcissist. He’s desperate for it. He doesn’t care if he’s the heel or the hero, as long as he’s the star … He’s broken in many ways. That’s why he tried to break this country on January 6 … and why he will do more to destroy this republic, today, tomorrow and into the future. It’s a tragic story, but it’s a very human story.

“You know, I think it’s why he desperately needed to become president of the United States again. It’s why he’s trying to rename everything in his image. It’s never enough, because he’s not enough and he knows he’s not enough. And I think the remarkable thing is how easy it is to play on that. How easily our foreign adversaries are able to manipulate him.”

It’s one thing to play him, Newsom says, “but you also have to stand up to him. You’ve got to fight him, you’ve got to fight the bully. I felt like the [Mark] Carney [at Davos] speech represented that … [Emmanuel] Macron began to sort of lean into that. There’s a new tone and tenor.” He wants to see the post-1945 transatlantic alliance survive, he says, and that requires strength in the face of Trump. At Davos, he urged European leaders to realise that “grovelling to Trump’s needs” makes them “look pathetic on the world stage”.

We’ve talked for a while and the subject can be avoided no longer: is Gavin Newsom going to run for president? I remind him that he once said that it’s “better to be candid than be coy”. He laughs, adding, “I shouldn’t have said that” – and so I urge him to be candid now. An easy question first. He doesn’t have to tell me what he’s decided, but has he made up his mind about running?

“Absolutely, I have not.” He says he cannot know now what the moment will require in 2028. But he’s clear that, if he runs, he won’t be doing it to fill a psychic hole, like Trump. It won’t be to make up for a lack of parental love. For all her challenges, his mother “did give me a lot of hugs. And I was loved by my dad, despite the fact he could never say it.” If he does it, it will be because he thinks he can be “a solution to a problem”. He says that for a guy like him, who got a low SAT score of 960 – he urges me to look that up, to see how bad it is – even to be asked such a question is humbling. “And so I’m not going to say no, because I’d be lying by saying that, but I absolutely cannot say yes.”

I push him a bit more. What if the threat to democracy is as sharp in 2028 as he believes it is now?

He says “something shifted in me” at two points in 2025. One was in January, just ahead of Trump’s second term, when, as Newsom saw it, Trump tried to “weaponise” the California wildfires, seeking to extract political advantage from an opponent and a hostile blue state in distress. The second came in the summer, when Trump deployed the National Guard in Los Angeles, along with 700 active duty marines. They “were not sent overseas but were sent to the second largest city in the United States”.

That January, “I was experiencing something I was not prepared for. A president-elect trying to take down an American city, trying to take down an American politician in a way that I, frankly, was not prepared for. Six months later, with the National Guard, I just started to shift tonally, my temperament, my approach.”

He says that he’s on “the other side” of that shift. “There’s a freedom now that I feel. And I’m running around Davos with kneepads, taking shots at folks that I used to admire and respect that I feel have sold their souls. And this is an existential moment that goes to your question. If someone else doesn’t have that fire, that sense of purpose and mission, then, yeah, I could see myself stepping into that void.”

It’s not an announcement, but it’s not far off it. It comes from a man who has never lost an election and who always comes prepared. And he’s preparing right now.

-

World3 days ago

World3 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts4 days ago

Massachusetts4 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Denver, CO4 days ago

Denver, CO4 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana6 days ago

Louisiana6 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT