Key Findings

- Alaska’s heavy reliance on oil and gasoline taxes and funding earnings creates excessive income volatility and complicates income forecasts.

- Various income streams can’t simply displace present sources. For instance, to boost as a lot of its income from an earnings tax as the common state does, Alaska would want to have earnings tax burdens 3 times as excessive as California’s.

- Alaskans expertise a higher-than-average price of residing, partially offset by larger wages, however this yields an extra federal earnings tax legal responsibility larger than the quantity residents of many different states pay in state earnings taxes.

- The financial literature demonstrates that earnings taxes promote outmigration and cut back in-state employment mobility, gross state product, funding, and innovation.

- Particular person earnings taxes have a twofold impact on small companies: straight as a tax on house owners’ earnings and not directly by driving up labor prices.

- Most states are decreasing reliance on particular person earnings taxes; 21 states have enacted or applied particular person earnings tax price cuts since 2021 whereas solely New York and the District of Columbia have raised charges.

- A state gross sales tax could be extra economically impartial, and the power to design one from scratch would enable lawmakers to keep away from among the design options that make the gross sales tax regressive.

- No new state tax shall be enough by itself; extra fiscal restraint shall be needed, maybe within the type of an enhanced spending cap.

Introduction

The worldwide pandemic put many plans on the backburner—some as a result of they ceased to be necessary in relative phrases, and others as a result of they ceased to matter in absolute phrases. For a lot of states, the pandemic period has been one among unexpectedly sturdy tax revenues, thus sidelining most speak of latest or larger taxes. For Alaska, with its relative geographic isolation and heavy reliance on the vitality business, fiscal reduction got here later. However it arrived nonetheless, on the wings of upper oil costs.

When oil costs had been in relentless decline, Alaska lawmakers had been broaching troublesome questions on whether or not the state required a brand new income supply, like an earnings or gross sales tax. However then the state’s massive reserve funds started yielding spectacular funding returns and oil income began flowing once more. The timeline was pushed again on any fiscal reckoning.

Lawmakers know, nevertheless, that there are nonetheless threats to the state’s income sources, and that their deliberations have been postponed, not canceled. This publication is about Alaska’s choices when the reprieve is over and unusual income developments reassert themselves.

Policymakers will as soon as once more debate implementing both an earnings tax or gross sales tax, restraining spending, or pursuing some mixture of those choices. Their deliberations must be guided by financial analysis and different states’ experiences, contemplating the trade-offs related to the proposed new taxes.

Each an earnings and a gross sales tax would create financial drag, however a person earnings tax would have a a lot bigger detrimental influence on the state’s competitiveness, development, and financial diversification. The pages that comply with doc the challenges lawmakers face, evaluation the financial literature on accessible tax choices, and deal with questions on thorny points surrounding the implementation of a brand new tax or novel concepts like seasonal taxation.

Alaska is one among 9 states with no wage earnings tax and one among 5 states with no state-level gross sales tax. Alaska and New Hampshire are the one states with neither. Maybe this distinction shall be maintained, or maybe not—however an earnings tax specifically has the potential to undermine a lot of what lawmakers want to accomplish.

Budgeting in a Distinctive Financial Surroundings

They don’t name Alaska “America’s Final Frontier” for nothing. The state, with its geographic isolation, local weather, plentiful pure sources, and distinctive employment patterns—to quote only some of the various methods Alaska provides variety to the U.S.—doesn’t readily reply to nationwide financial generalizations. The price of residing is larger. The price of offering authorities companies to a broadly dispersed, low-density inhabitants is markedly larger. The business combine is completely different. Residency patterns diverge from nationwide norms. It’s little surprise that the state charts its personal course in some ways, together with in state taxation.

Alaska is a state of plentiful sources, mixed with remoteness and a difficult topography. And lots of the state’s salient options—its oil and gasoline deposits, fisheries, and vacationer draw—lend themselves to extremely seasonal employment.

For each Alaska and the nation as an entire, January tends to be the low level in labor pressure participation, after non permanent employment to maintain up with the vacation rush has lapsed. Nationally, whereas summer season employment is barely about 2 % larger than January employment and peak employment comes on the finish of the 12 months, Alaska’s employment patterns are extremely seasonal, with July’s labor pressure 14 % bigger than January’s, on common, over the previous 20 years.[1]

All employment exists in symbiosis to some extent; companies take pleasure in innate complementarity. However Alaska’s financial system is closely depending on a number of key industries, with most of its different exercise falling into a variety of supportive companies. Not even one in 200 Alaskan wage earners is straight employed within the oil and gasoline business, but the business is liable for about 22 % of gross state product in any given 12 months, peaking at 37 % in 2008 and most just lately settling at 12 % in 2021.

Twelve % is sort of substantial, however not overwhelming. However, petroleum is predicted to account for an estimated 81 % of the state’s own-source non-investment income in FY 2023, and about 46 % of all own-source earnings (since funding earnings, mainly from previous oil revenues, is predicted to almost match new petroleum revenues). The business’s taxes contribute nicely above its relative share of the state’s financial system, as sizeable as its share is.

Alaska’s oil business employs comparatively few folks however makes a considerable contribution to gross state product. The state’s development has largely been in help industries—these exterior of primary industries like oil, fishing, and authorities, and which help Alaska’s largest industries—however this development is just not speedy sufficient to be transformative, and there are at present few, if any, candidates to affix Alaska’s quick listing of primary industries. This lack of financial variety exposes the state’s financial system—and state revenues—to extraordinary volatility. If a number of of the essential industries took a long-term hit, the state’s funding streams could be severely compromised.

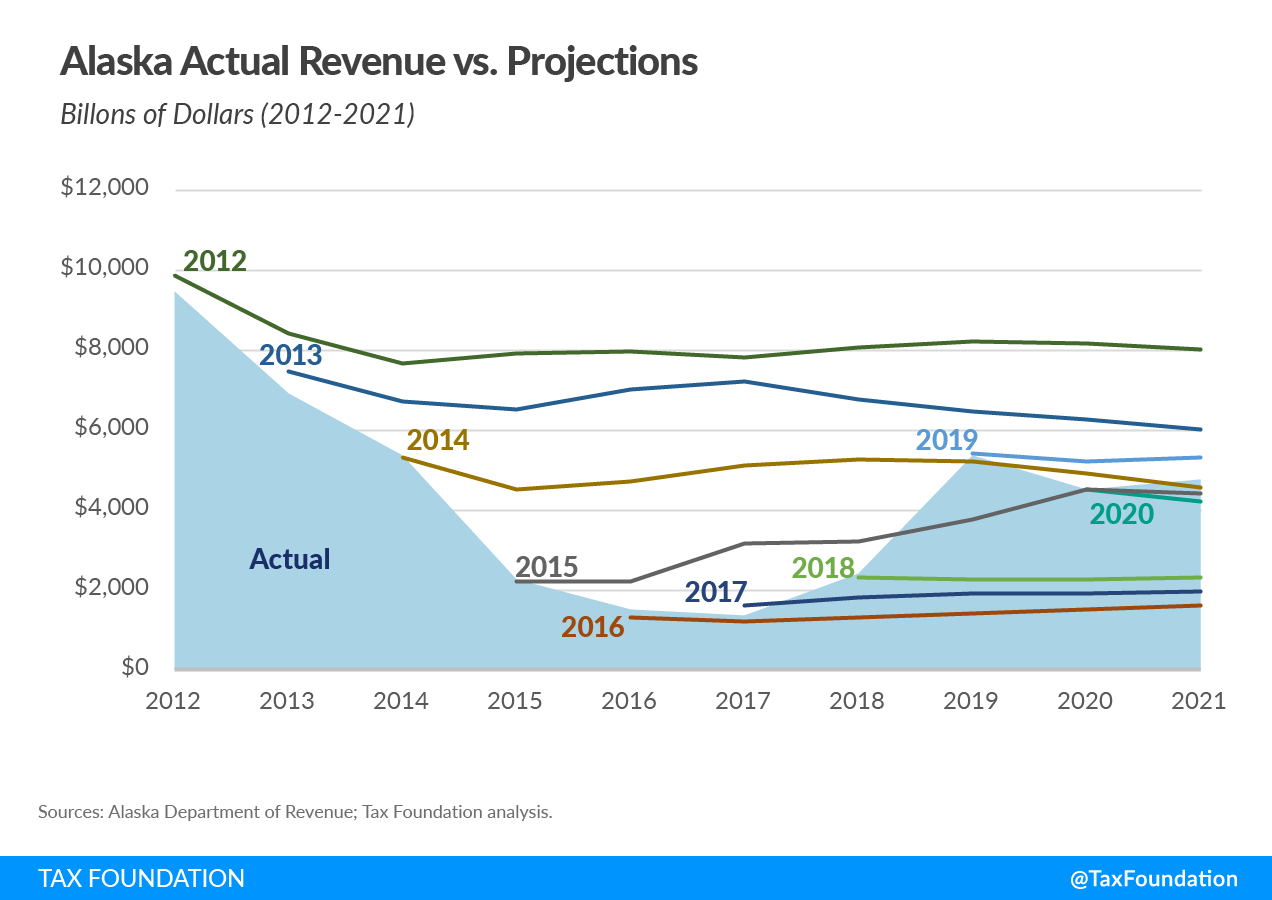

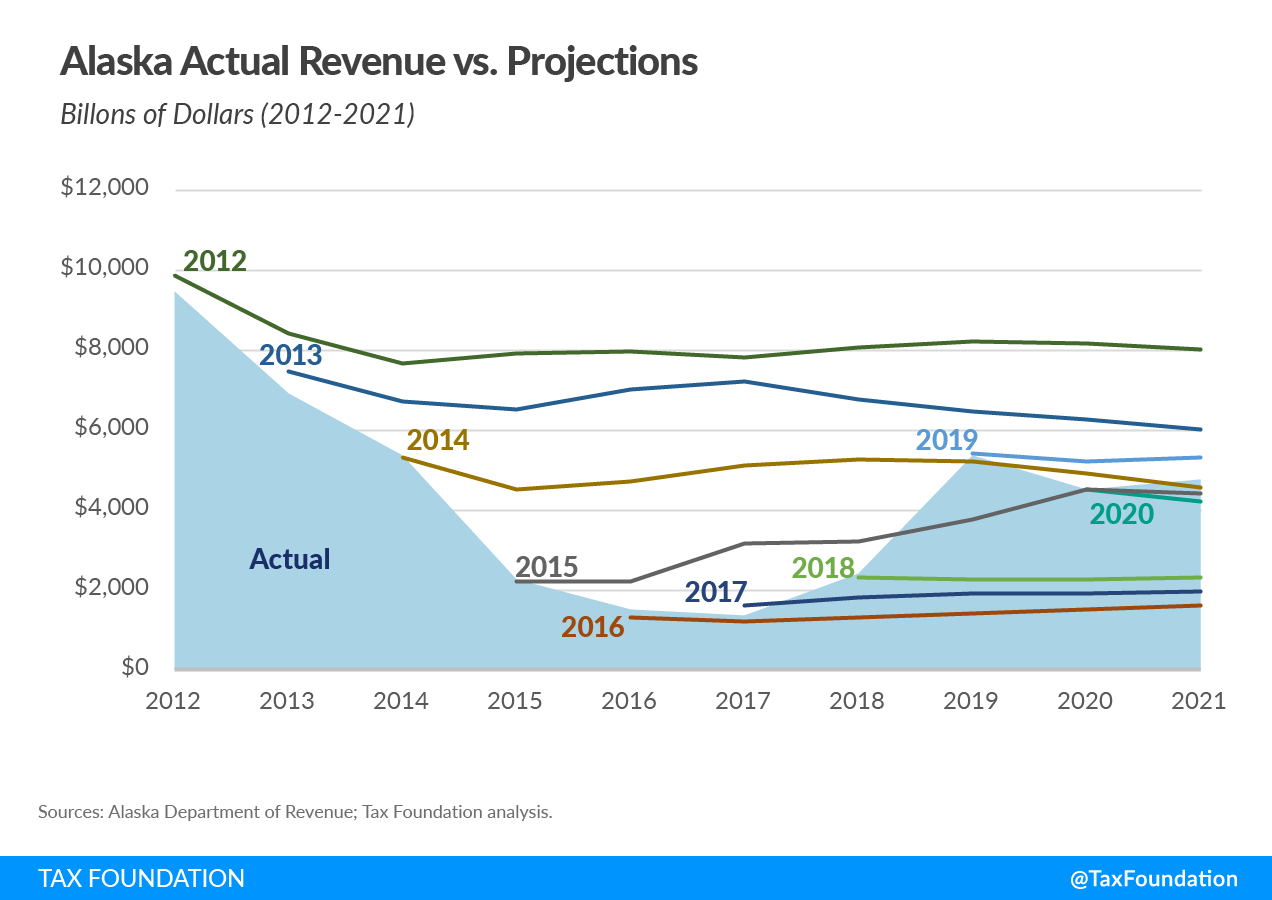

Alaska’s heavy reliance on the vitality sector is each a blessing and a curse, however it’s undeniably the bane of income forecasters and lawmakers making an attempt to undertake budgets that depend on some extent of income stability. The newest forecast for FY 2023 unrestricted basic fund income is a wholesome $8.3 billion, buoyed by excessive oil costs. As a result of the state releases 10-year income forecasts twice every year, that is solely the newest in an extended string of forecasts for FY 2023, and by far probably the most optimistic. Trying solely at spring forecasts, expectations for the present fiscal 12 months’s revenues have ranged from a low of $1.7 billion (2016 forecast) to the present excessive of $8.3 billion.[2]

Determine 3 reveals forecasts for the subsequent decade, drawn from 10-year forecasts from the previous decade. Distinct waves of outlooks are evident right here, and lawmakers bracing for what they anticipated as of the late 2010s can breathe a sigh of reduction proper now.

Although probably the most pessimistic forecasts didn’t come to fruition, the above chart is just not a case for the triumph of optimism both. Forecasters fully missed the bottoming out of the oil market within the mid-2010s. A spring 2011 forecast anticipated that Alaska would generate $8.3 billion generally fund income in 2017; the precise determine was one-sixth the expectation, at lower than $1.4 billion. Determine 4 reveals precise revenues in comparison with projections for FYs 2012 via 2021. Nearly invariably, forecasters assumed a basic continuation of no matter developments existed on the time they issued their estimates. Admittedly, it is extremely troublesome (maybe virtually not possible) to anticipate a decade’s value of oil worth fluctuations. However beneath Alaska’s present income construction, that’s the activity earlier than the state’s economists and the problem of lawmakers who should finances beneath this uncertainty and excessive fluctuation.

Lawmakers have responded to this income volatility by tapping the state’s in depth reserves, however these reserves usually are not limitless. They will clean even excessive fluctuations in annual income if expenditures hew towards the long-run common of the state’s revenues and the fluctuations proceed to revolve round a given imply. In observe, nevertheless, officers more and more worry that vitality markets will expertise a secular (i.e., long-term) decline, even when they nonetheless take pleasure in growth years like the present ones inside that broader pattern.

Alaska and the “Drawback” of Huge Numbers

Alaska’s state revenues largely derive from taxes on the petroleum business and from funding returns on the state’s substantial—however dwindling—reserve funds. The state’s lengthy expertise of maximum income volatility, mixed with reputable issues a few long-term secular decline in oil costs, has many policymakers exploring methods to diversify Alaska’s income sources.

The sheer magnitude of the income Alaska has historically—if not at all times reliably—reaped from oil and gasoline manufacturing (and funding returns on previous exercise) makes a fiscal rebalancing with any various supply of tax income exceedingly troublesome. Alaska state revenues approached $30 billion in FY 2021—about $117,000 per family. This isn’t a typographical error. The median family earnings in Alaska is $77,640, and whole private earnings within the state was $49.2 billion in FY 2021. Whereas some Alaskan incomes nicely exceed the median, Alaska’s state authorities revenues that 12 months had been 60.6 % of state whole private earnings.

In fact, FY 2021 was an anomalously good 12 months, the type of 12 months that will make discussions of extra sources of tax income moot. The state is barely projecting $16.4 billion in FY 2023, a swing of $14 billion.[3] However even then, state revenues must be about 34 % of state private earnings, in comparison with a nationwide common of lower than 13 %. Buoyed by oil and gasoline income and funding returns on deposits from prior receipts, Alaska has by far the best revenues per capita of all states, and conventional income instruments may modestly complement, however can’t come near changing any substantial lack of, Alaska’s distinctive income sources.

Alaska has had an earnings tax earlier than. Actually, so far it’s the solely state to have repealed a person earnings tax, doing so when the state’s oil fields began producing sufficient tax income to obviate the necessity for one. In 1980, the final 12 months Alaska’s earnings tax was in operation, it generated $100.5 million, with a prime price of a now-astonishing 14.5 %. Adjusting collections for inflation, an earnings tax with related parameters would solely have elevated state income by 1 % in FY 2021—a surprisingly modest impact for a tax with a prime price that will be the nation’s highest.

To place this in perspective, states with wage earnings taxes generate, on common, about 13.1 % of whole income (and 43.3 % of state tax collections) from the earnings tax. An Alaska earnings tax must elevate $4.5 billion a 12 months—over $17,600 per family—to have contributed that proportion to state collections in FY 2021, or about $2.5 billion in FY 2023 when the state tasks whole revenues of $16.4 billion. How excessive is $17,600 per family? In high-tax California, with a prime marginal price of 13.3 % on the best earners, and the place even a person making a bit of over $61,000 faces a 9.3 % marginal price, the earnings tax brings in lower than $6,450 per family.

Alaska’s particular person earnings taxes peaked as a share of tax income in 1975, when it was liable for 47 % of state tax collections, although a a lot smaller share of whole revenues. Precise collections peaked in 1977 after they accounted for practically 19 % of all state revenues. For the ultimate 15 years of the tax’s 22-year existence,[4] its common contribution to state revenues was about 9.5 %, although it fluctuated wildly from 2.8 to 18.8 %. Extra exactly, it was the denominator—whole income—that fluctuated so wildly. The state earnings tax, even when imposed at very excessive charges, didn’t generate practically sufficient income to clean over the volatility.

In FY 2023, solely 8 % of state income will come from non-petroleum and non-investment sources. That is considerably greater than within the financial growth 12 months of FY 2021, when all non-petroleum and non-investment sources accounted for lower than 3.5 % of income. The volatility is all too actual, however the sheer magnitude of those figures additionally demonstrates how troublesome it will likely be to offset any vital volatility, not to mention long-term decline, in revenues from present sources. This isn’t an argument in opposition to appearing: policymakers are proper to be involved in regards to the long-term viability of the present income combine. It’s, nevertheless, an argument for prudence, and significantly for guaranteeing that the financial prices of a brand new tax usually are not disproportionate to the modest contribution the brand new income makes to smoothing out state receipts.

Expenditure Constraints

Alaska’s structure incorporates an appropriation restrict, however its present parameters render it completely ineffectual. The state spending cap has existed for over 4 many years, but Alaska nonetheless spends way more than different states do, whether or not spending is measured per capita, as a share of earnings, or as a share of gross state product.

Nobody doubts that it’s extra expensive to supply authorities companies to sparsely populated areas and that all the things from roads to varsities to well being companies will price extra in Alaska. However when in 2020 the state spent 149 % of the nationwide common as a share of gross state product, 151 % as a share of non-public earnings, and 161 % of the per capita common, it isn’t troublesome to conclude that some constraints on future expenditure development are warranted.

Desk 1. State Expenditures Per Capita and as a Share of GSP and Private Revenue (2020)

| |

Per Capita Spending |

Share of Gross State Product |

Share of Private Revenue |

| |

Quantity |

Rank |

% |

Rank |

% |

Rank |

| Alabama |

$10,477 |

38 |

23.2% |

12 |

23.0% |

16 |

| Alaska |

$20,584 |

1 |

30.3% |

1 |

32.5% |

1 |

| Arizona |

$9,959 |

43 |

19.1% |

33 |

19.4% |

39 |

| Arkansas |

$9,621 |

48 |

22.2% |

19 |

20.2% |

31 |

| California |

$17,176 |

4 |

22.6% |

16 |

24.6% |

9 |

| Colorado |

$12,797 |

19 |

19.3% |

30 |

20.0% |

35 |

| Connecticut |

$12,578 |

22 |

16.4% |

47 |

16.2% |

49 |

| Delaware |

$13,421 |

12 |

17.6% |

46 |

24.0% |

11 |

| Florida |

$9,654 |

46 |

18.8% |

38 |

17.2% |

47 |

| Georgia |

$9,367 |

49 |

16.1% |

49 |

18.1% |

45 |

| Hawaii |

$13,883 |

10 |

24.3% |

8 |

24.4% |

10 |

| Idaho |

$9,030 |

50 |

19.9% |

27 |

18.7% |

43 |

| Illinois |

$12,934 |

17 |

19.3% |

31 |

20.9% |

27 |

| Indiana |

$10,252 |

41 |

18.5% |

41 |

19.8% |

36 |

| Iowa |

$12,680 |

20 |

20.8% |

23 |

23.9% |

12 |

| Kansas |

$11,398 |

28 |

19.1% |

34 |

20.5% |

30 |

| Kentucky |

$11,195 |

31 |

23.7% |

10 |

23.8% |

13 |

| Louisiana |

$11,482 |

26 |

22.7% |

14 |

22.6% |

17 |

| Maine |

$11,082 |

33 |

21.8% |

20 |

20.6% |

29 |

| Maryland |

$13,125 |

15 |

19.7% |

28 |

20.0% |

34 |

| Massachusetts |

$15,488 |

6 |

18.7% |

39 |

20.1% |

33 |

| Michigan |

$11,514 |

25 |

22.5% |

17 |

21.8% |

24 |

| Minnesota |

$13,678 |

11 |

20.9% |

22 |

22.3% |

22 |

| Mississippi |

$11,019 |

34 |

28.6% |

2 |

26.1% |

6 |

| Missouri |

$10,088 |

42 |

18.9% |

37 |

19.5% |

38 |

| Montana |

$11,138 |

32 |

23.5% |

11 |

21.0% |

26 |

| Nebraska |

$12,846 |

18 |

18.9% |

36 |

22.6% |

18 |

| Nevada |

$10,713 |

36 |

19.5% |

29 |

19.8% |

37 |

| New Hampshire |

$10,292 |

40 |

16.2% |

48 |

15.5% |

50 |

| New Jersey |

$12,637 |

21 |

19.0% |

35 |

18.0% |

46 |

| New Mexico |

$13,082 |

16 |

28.1% |

5 |

28.4% |

3 |

| New York |

$19,235 |

2 |

22.5% |

18 |

26.9% |

5 |

| North Carolina |

$10,305 |

39 |

18.3% |

43 |

20.2% |

32 |

| North Dakota |

$14,021 |

9 |

19.9% |

26 |

23.2% |

15 |

| Ohio |

$12,381 |

23 |

21.5% |

21 |

23.3% |

14 |

| Oklahoma |

$9,646 |

47 |

20.3% |

24 |

19.2% |

42 |

| Oregon |

$15,493 |

5 |

27.0% |

6 |

27.5% |

4 |

| Pennsylvania |

$13,407 |

13 |

22.6% |

15 |

22.1% |

23 |

| Rhode Island |

$13,233 |

14 |

24.0% |

9 |

22.6% |

19 |

| South Carolina |

$10,962 |

35 |

23.0% |

13 |

22.4% |

20 |

| South Dakota |

$9,866 |

44 |

16.0% |

50 |

16.5% |

48 |

| Tennessee |

$9,809 |

45 |

18.4% |

42 |

19.3% |

40 |

| Texas |

$10,691 |

37 |

17.6% |

45 |

19.3% |

41 |

| Utah |

$11,541 |

24 |

19.2% |

32 |

22.3% |

21 |

| Vermont |

$14,892 |

7 |

28.6% |

3 |

25.9% |

7 |

| Virginia |

$11,340 |

30 |

17.8% |

44 |

18.4% |

44 |

| Washington |

$14,547 |

8 |

18.6% |

40 |

21.7% |

25 |

| West Virginia |

$11,352 |

29 |

26.8% |

7 |

25.3% |

8 |

| Wisconsin |

$11,470 |

27 |

20.0% |

25 |

20.8% |

28 |

| Wyoming |

$17,994 |

3 |

28.6% |

4 |

28.8% |

2 |

| U.S. Common |

$12,761 |

— |

20.2% |

— |

21.6% |

— |

| Sources: U.S. Census Bureau; U.S. Bureau of Financial Evaluation; Tax Basis evaluation. |

That Alaska has an expenditure restrict,[5] supposed to curtail the expansion of presidency, is just not uncommon; most states do. They range, nevertheless, of their effectiveness, and Alaska’s appropriation restrict is especially toothless. It has many exclusions—some needed, others arguably not—and permits a rise of appropriations of 5 % per 12 months along with inflation and inhabitants change changes. With capital tasks excluded from the spending cap, and a really beneficiant development issue, it does little to constrain spending. And as a provision of basic legislation, it may be overridden inside the finances. In the meantime, the structure caps non-capital venture, non-Everlasting Fund appropriations at an inflation- and population-adjusted quantity that at present stands at roughly $12 billion, additionally sufficiently excessive to perform little.[6]

It’s troublesome to see how extra taxes alone can backfill the income Alaska stands to lose if there’s a long-term decline in oil costs or a discount in demand. Meaningfully constraining future development of presidency should be a part of the discount. This can require spending self-discipline and remodeling the state’s constitutional spending cap and statutory appropriations restrict from useless letters to precise coverage constraints.

Alaska’s Present Revenue Tax Premium

Dwelling in Alaska is just not low cost. Nationally, the median family earnings is slightly below $65,000. An Alaska family must earn virtually $20,000 greater than that—$84,427—simply to interrupt even on buying energy, given the state’s excessive price of residing. Salaries are likely to replicate this disparity, however the median family earnings ($77,790) is the equal of solely $59,885 nationally and comes with an extra $4,888 in federal earnings and payroll tax legal responsibility for a married couple ($6,679 for a single filer).[7]

A better price of residing is just not a tax, nevertheless it does carry tax implications as a result of extra federally taxable earnings is important to buy the identical life-style that decrease wages may buy elsewhere. The next desk reveals the extra federal earnings and payroll taxes imposed on Alaskans in comparison with the taxes imposed on incomes with the identical buying energy parity nationally. As an example, $50,000 in Alaska purchases as a lot as $38,491 nationally, and taxpayers face an extra $3,964 (single filers) in earnings and payroll taxes on that $11,509 distinction.

In fact, not all earnings is consumed—a minimum of not instantly. At decrease ranges of earnings, little or no is saved and functionally all earnings goes to current consumption, however larger earners have larger ranges of financial savings and funding. Whereas client prices are larger in Alaska, state residents have entry to the identical worldwide funding market as taxpayers anyplace else within the nation, so we ran the numbers a second time to yield a “consumption-adjusted” tax differential, considering the fee premium solely on the estimated share of earnings devoted to private consumption.

Desk 2. Alaskans Pay Extra Federal Taxes for the Similar Quantity of Buying Energy

| |

All Revenue |

|

Consumption-Adjusted |

| Revenue |

Single |

Married |

|

Single |

Married |

| $25,000 |

$1,571 |

$1,571 |

|

$1,571 |

$1,571 |

| $35,000 |

$2,199 |

$2,199 |

|

$2,199 |

$2,199 |

| $50,000 |

$3,964 |

$3,142 |

|

$3,850 |

$2,881 |

| $75,000 |

$6,439 |

$4,713 |

|

$5,177 |

$3,789 |

| $100,000 |

$8,804 |

$7,048 |

|

$7,437 |

$5,785 |

| $150,000 |

$13,569 |

$12,878 |

|

$8,521 |

$8,088 |

| Source: Tax Basis calculations. |

Notably, this federal tax differential ends in a tax wedge much like a high-rate earnings tax on the state stage, mapping to a standard graduated-rate schedule if the cost-of-living adjustment is utilized to all earnings, and with considerably extra erratic “marginal charges” if the adjustment is barely utilized to the share of earnings consumed. Even with the extra conservative strategy, nevertheless, most married filers face the equal of an extra 5 to six % on federal earnings and payroll taxes on the earnings essential to safe the identical buying energy as their non-Alaskan friends.

The median prime marginal earnings tax price within the states is about 5 %, and efficient charges are, in fact, decrease, that means that the extra federal earnings tax burden in Alaska will ceaselessly exceed the burden of a state earnings tax elsewhere. In different phrases, when incomes are adjusted for buying energy, Alaskans pay extra in earnings taxes than most residents of states that impose their very own earnings tax along with the federal one.

Desk 3. Alaskans Face an Implicit “Revenue Tax” As a result of Excessive Price of Dwelling

| |

Marginal Charge |

| Revenue |

|

All Revenue |

Consumption-Adjusted |

| > |

$0 |

|

5.8% |

5.8% |

| > |

$25,000 |

|

6.3% |

6.3% |

| > |

$50,000 |

|

6.3% |

5.8% |

| > |

$75,000 |

|

6.3% |

5.1% |

| > |

$100,000 |

|

7.0% |

5.8% |

| > |

$125,000 |

|

8.6% |

5.4% |

| Source: Tax Basis calculations. |

This premium does nothing for the state of Alaska’s backside line. The mere reality of its existence doesn’t resolve any of the issues that proposals to impose a state earnings tax are supposed to resolve. These added prices are, nevertheless, extremely salient to state taxpayers. They cut back fiscal capability and make any extra tax—however particularly an extra tax on earnings—tougher to bear.

The state and native tax (SALT) deduction can alleviate this burden considerably, however solely on the margin. Ought to Alaska impose a person earnings tax, residents may deduct their state earnings and native property tax burdens—as much as $10,000 per family beneath the present cap—from federal taxable earnings, which defrays the fee considerably, however nonetheless leaves Alaskans far worse off than they might be in different states the place the price of residing is decrease.

The SALT deduction, furthermore, is for the taxpayer’s alternative of property taxes plus earnings or gross sales taxes, however not each. Presently, Alaskans deduct their municipal gross sales taxes (sometimes recognized via a calculator and never based mostly on precise documentation of purchases) plus any native property taxes. If atop the present system of municipal gross sales taxes the state applied an earnings tax, most taxpayers would declare earnings and property taxes as an alternative, dropping the deduction for native gross sales taxes. Conversely, if Alaska adopted a state-wide gross sales tax, it will be deductible as well as to municipal gross sales tax burdens, as much as the $10,000 cap.

Revenue Tax Traits

When Alaska policymakers repealed the state’s earnings tax greater than 4 many years in the past, they didn’t turn into trendsetters. The state’s capability to dispose of its largest tax was distinctive to put and circumstances, and to today Alaska is the one state to have adopted after which repealed a tax on wage earnings. Two states, nevertheless, have just lately enacted laws repealing slender taxes on curiosity and dividend earnings. And, extra considerably, most states at the moment are reducing their earnings taxes.[8]

The median prime marginal price of state earnings taxes was a full 2 share factors larger in 1980 (when Alaska’s tax was repealed) than it’s in the present day.[9] Of the 44 states with any type of earnings tax in the course of the interval, 31 states and the District of Columbia have decrease prime marginal earnings tax charges now than they did in 1980, whereas solely 9 have larger charges. The latter class consists of Connecticut, which adopted its earnings tax in 1991, and Washington, which just lately adopted a tax on the capital positive factors earnings of excessive earners.

If something, the pattern towards earnings tax reductions has accelerated lately. Since January 2021, 21 states have enacted or applied particular person earnings tax price cuts, whereas solely New York and the District of Columbia have raised charges.[10]

Desk 4. States Enacting or Implementing Particular person Revenue Tax Charge Modifications Since 2021

| Charge Cuts |

Charge Will increase |

| 1 |

Arizona |

1 |

District of Columbia |

| 2 |

Arkansas |

2 |

New York |

| 3 |

Colorado |

|

|

| 4 |

Georgia |

|

|

| 5 |

Idaho |

|

|

| 6 |

Indiana |

|

|

| 7 |

Iowa |

|

|

| 8 |

Kentucky |

|

|

| 9 |

Louisiana |

|

|

| 10 |

Mississippi |

|

|

| 11 |

Missouri |

|

|

| 12 |

Montana |

|

|

| 13 |

Nebraska |

|

|

| 14 |

New Hampshire |

|

|

| 15 |

North Carolina |

|

|

| 16 |

Ohio |

|

|

| 17 |

Oklahoma |

|

|

| 18 |

South Carolina |

|

|

| 19 |

Tennessee |

|

|

| 20 |

Utah |

|

|

| 21 |

Wisconsin |

|

|

|

Notice: New Hampshire and Tennessee imposed earnings taxes solely on curiosity and dividend earnings. Tennessee repealed its tax and New Hampshire is within the means of phasing it out.

Sources: State statutes; Tax Basis analysis.

|

States’ latest price cuts are a pure and acceptable response to each sustained state income development and the improved mobility of people and companies as distant and versatile work preparations turned extra viable after the pandemic pressured an experiment with distant work. Staff have extra flexibility in selecting the place to reside, whereas employers can select to find someplace with fewer issues about entry to a certified white-collar workforce, since a minimum of a few of these hires might be made anyplace within the nation.

Realizing the brand new state of competitors, states are reducing taxes, and particular person earnings taxes specifically, recognizing them as a driver of location decision-making and a damper on funding and entrepreneurial exercise. However that is merely an acceleration of a longer-term pattern of decreasing earnings tax charges. When Alaska final imposed an earnings tax, it was one among 15 states (and the District of Columbia) with a prime price within the double digits. Right this moment, solely 4 states and the District of Columbia have a prime price that top. In 1979, solely 10 states had prime charges of 5 % or decrease. Right this moment, 16 do.

Furthermore, up to now 12 months and a half, 5 states have adopted laws transitioning their graduated-rate earnings taxes to single-rate taxes, with two extra states probably ready within the wings. This might convey the variety of states with flat taxes to 16.[11] Solely 5 states had flat taxes when Alaska final imposed an earnings tax and for the primary time since Alaska’s determination to jettison its earnings tax, full repeal of a number of states’ earnings taxes is now inside the realm of chance. Presently, 9 states forgo taxes on wage earnings. It’s more and more believable the listing may develop.

If Alaska considers an earnings tax now, it comes in opposition to the backdrop of states actively searching for to scale back their particular person earnings tax burdens and utilizing low (or no) earnings taxes as a significant aggressive benefit.

Classes from Different States

Solely two states have adopted a wage earnings tax up to now half-century: Connecticut and New Jersey. The New Jersey tax was adopted in 1976, a number of years earlier than Alaska’s repeal, whereas Connecticut didn’t implement a person earnings tax till 1991. In each states, the preliminary charges had been comparatively modest and the tax was bought as a solution to cut back different present tax burdens. And in each states, in the present day’s charges are excessive—extraordinarily excessive in New Jersey’s case—whereas taxpayers haven’t skilled any reduction on different taxes.

New Jersey lawmakers lengthy resisted an earnings tax. A front-page headline in The New York Occasions in Might of 1975 learn “Remaining Try and Enact Jersey Revenue Tax Fails”—and “last” actually appeared like the correct phrase. In a legislature with overwhelming Democratic majorities and a finances disaster precipitated partly by a brand new court docket mandate on a unique set of income streams for training funding, Senate Democrats rejected earnings tax proposals 4 instances in 10 months. It was the demise of the fourth proposal (for a 2.5 % flat tax) that led Senate President Frank Dodd to declare that “a state earnings tax is useless.”[12]

A 12 months later, after the state supreme court docket took the extraordinary step of closing all public colleges till the legislature authorised a unique funding stream for them (the court docket objected to the state’s heavy reliance on native property taxes), the earnings tax thought was now not useless. A divided legislature narrowly authorised a two-bracket graduated price tax with a prime price of two.5 %. Even lawmakers who voted for the tax disliked it and seemingly had no aspirations for it to do something greater than cut back reliance on native property taxes for varsity finance, in step with the court docket’s order. It was not supposed to fund different state governmental applications.

Right this moment, New Jersey’s prime marginal earnings tax price is 10.75 %. And whereas judicial selections did diversify training funding streams, this didn’t translate into decrease property tax burdens. New Jersey’s prime earnings tax price is tied with the District of Columbia’s for the third highest within the nation. However no tiebreaker is required on property taxes, the place New Jersey’s property taxes are far and away the nation’s highest, with an efficient price of two.21 % on owner-occupied housing, greater than double the nationwide common of 1.08 %.[13]

Connecticut’s property taxes are additionally anomalously excessive, rating fifth highest at 1.76 % of housing worth. And the gross sales tax, at 6.35 %, is hardly low. When Connecticut lawmakers grudgingly adopted an earnings tax in 1991, they did so to permit a discount in different taxes. Right this moment, what started as a flat 4.5 % earnings tax is now a seven-bracket tax with a prime price of 6.99 %. Over the tax’s first three many years (1991-2021), income elevated 136 % on an inflation-adjusted foundation.[14]

Like Alaska lawmakers, Connecticut coverage leaders had been cautious of an earnings tax, with then-Gov. Lowell Weicker (I) saying he would solely suggest an earnings tax as “a final resort.” However the state elevated its finances dramatically throughout an financial surge, leaving it unprepared for a income contraction throughout a recession. Common fund expenditures soared 62 % on an inflation-adjusted foundation between FY 1983 and FY 1991, so when the income growth got here to an finish, lawmakers had been left holding the bag. Regardless of fears that “imposing an earnings tax could be like pouring gasoline on a fireplace” throughout a recession, Weicker felt that he had little alternative. Weicker’s successor, who initially pledged to repeal the tax, as an alternative turned it right into a graduated price tax—initially a tax discount, because the prime price remained at 4.5 %. However as soon as the precept was admitted, extra modifications adopted, and by 2015, the highest price hit 6.99 %.

The overall pattern lately has been to scale back earnings taxes, not improve them. However the final two states that originally adopted comparatively low-rate earnings taxes, after which solely beneath protest, quickly found that their modest earnings taxes had been topic to vital upward strain and that slender preliminary functions quickly gave solution to extra expansionist visions of presidency. It’s a cautionary story for Alaska and another state contemplating the adoption of a brand new earnings tax.

The No PIT Benefit

9 states forgo broad-based earnings taxes. (One, New Hampshire, at present taxes curiosity and dividend earnings however is phasing out the tax, whereas one other, Washington, just lately adopted a restricted earnings tax on capital positive factors above $250,000.) Alaska’s earnings tax-free system has largely relied on revenues from oil and gasoline, an possibility not accessible to all states, however others—like Florida, New Hampshire, Tennessee, and Texas—have adopted completely different methods to keep away from taxing particular person earnings.

Over the previous decade, states that forgo earnings taxes have seen their populations develop at twice the nationwide price.[15] And the continued migration from high- to low-tax states, and significantly states with low-income taxes, is prone to speed up with the rising viability of telework post-pandemic. More and more, many individuals will be capable to reside wherever they need. Those that are extremely delicate to taxes will discover it simpler than ever to relocate to jurisdictions with decrease tax burdens, no matter the place their employer is situated. And employers themselves could have extra location flexibility as geography turns into much less of a constraint on their workforces.

In Alaska, this will likely imply that back-office workers of Alaska-based firms are now not certain to Alaska and will go away if their general price of residing—which might take each taxes and the Everlasting Fund Dividend under consideration—was decrease elsewhere. It may additionally imply, extra encouragingly, that folks drawn to Alaska’s pure magnificence may transfer to the state, both full-time or for a part of the 12 months, regardless of working for an employer situated elsewhere.

The PIT as a Tax on Small Enterprise

Alaska imposes a company earnings tax, which yielded 17,717 returns in FY 2020.[16] The federal authorities, with its company earnings tax, solely yielded 2,712 returns from Alaska. What accounts for the distinction? Tax apportionment.

The federal authorities doesn’t care in regards to the states to which an organization’s taxable earnings is sourced, so the two,712 company earnings tax returns it associates with Alaska are the C firms domiciled in Alaska. However Alaska itself—like all different states with company earnings taxes—is worried not solely with C firms based mostly in Alaska but in addition with out-of-state companies doing enterprise in Alaska. Many firms that aren’t domiciled in Alaska nonetheless have tax nexus within the state and generate earnings from gross sales sourced to the state, forming the idea of those tax obligations.

Whereas company earnings taxes are apportioned, particular person earnings taxes usually are not. As a result of they’re imposed on people, not entities, they supply earnings to both the place it’s earned or to the taxpayer’s residence. Most small companies are pass-through companies, whose house owners pay particular person earnings tax on their share of the enterprise’s earnings fairly than being topic to company earnings tax, that means that not solely would a person earnings tax be—amongst different issues—a tax on small companies, however not like the company tax, its major enterprise incidence could be on companies whose house owners reside or work in Alaska.

In FY 2019 (most up-to-date information), practically 78,000 Alaskans reported pass-through enterprise earnings on their federal earnings tax returns, a determine representing greater than one-in-five federal filers from Alaska.[17] Small companies are over 99 % of Alaska companies and make use of 52.4 % of Alaskans.[18] The overwhelming majority of those companies are pass-through companies that will be hit by a person earnings tax. Possession pursuits exterior the state couldn’t be taxed, aside from earnings these house owners earned whereas bodily current within the state.

Company earnings taxes fall on capital funding to a far larger (and extra detrimental) extent than particular person earnings taxes do, however a state’s company tax—a minimum of supplied it’s apportioned based mostly on gross sales (as Alaska’s is)—doesn’t uniquely burden in-state capital funding. The allocation of particular person earnings taxes on pass-through companies, nevertheless, tends to localize these prices of doing enterprise within the state, and the tax would fall on lots of the companies and industries that Alaska needs to advertise in service of financial diversification.

An Alaska earnings tax, subsequently, would have a twofold impact on small companies: first, it will improve the direct price of doing enterprise within the state by imposing a brand new tax on small enterprise house owners’ earnings, and second, it will improve labor prices, because the earnings tax additionally falls on labor and this burden could be borne, to various levels based mostly on employment elasticities, by each employers and workers.

Revenue Tax Volatility

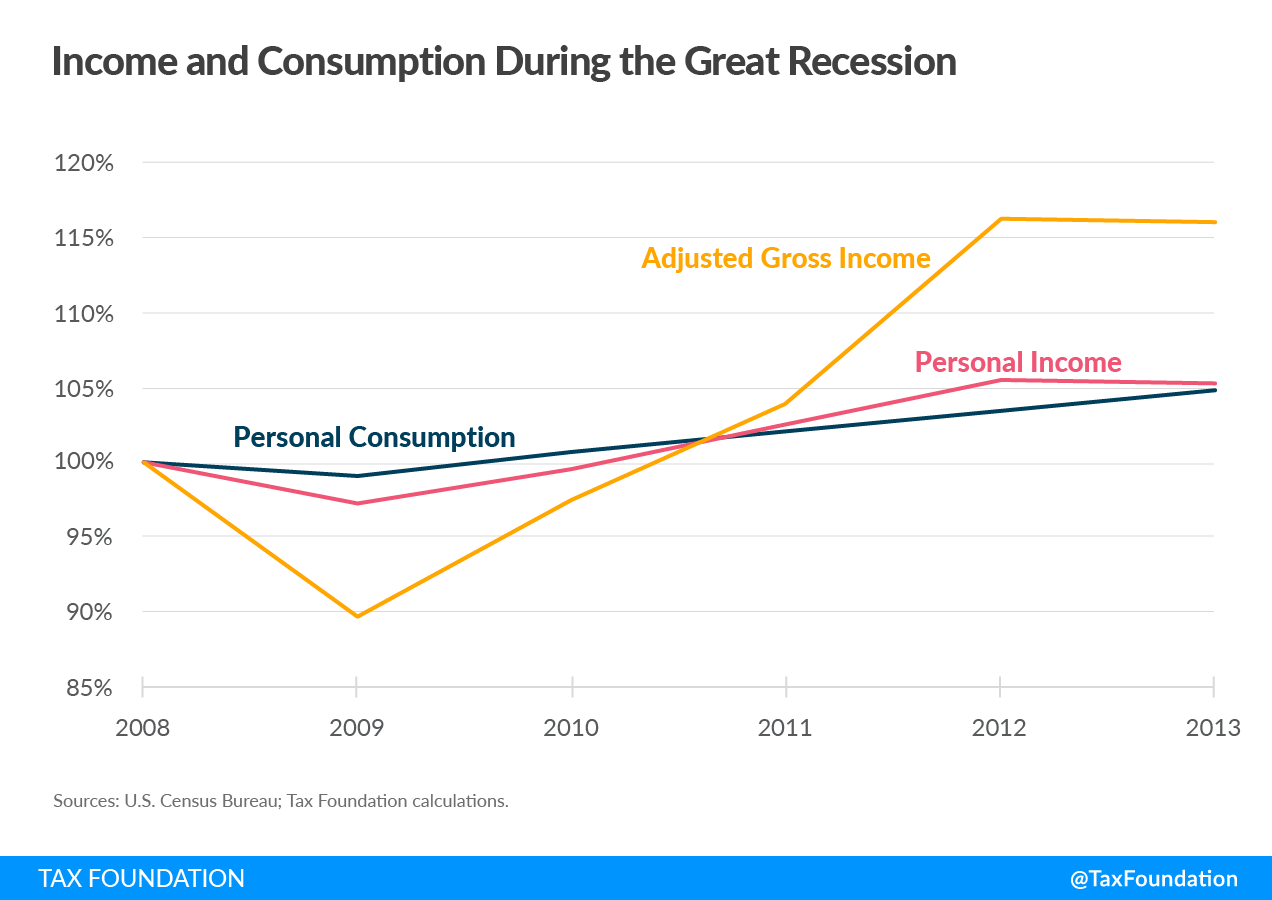

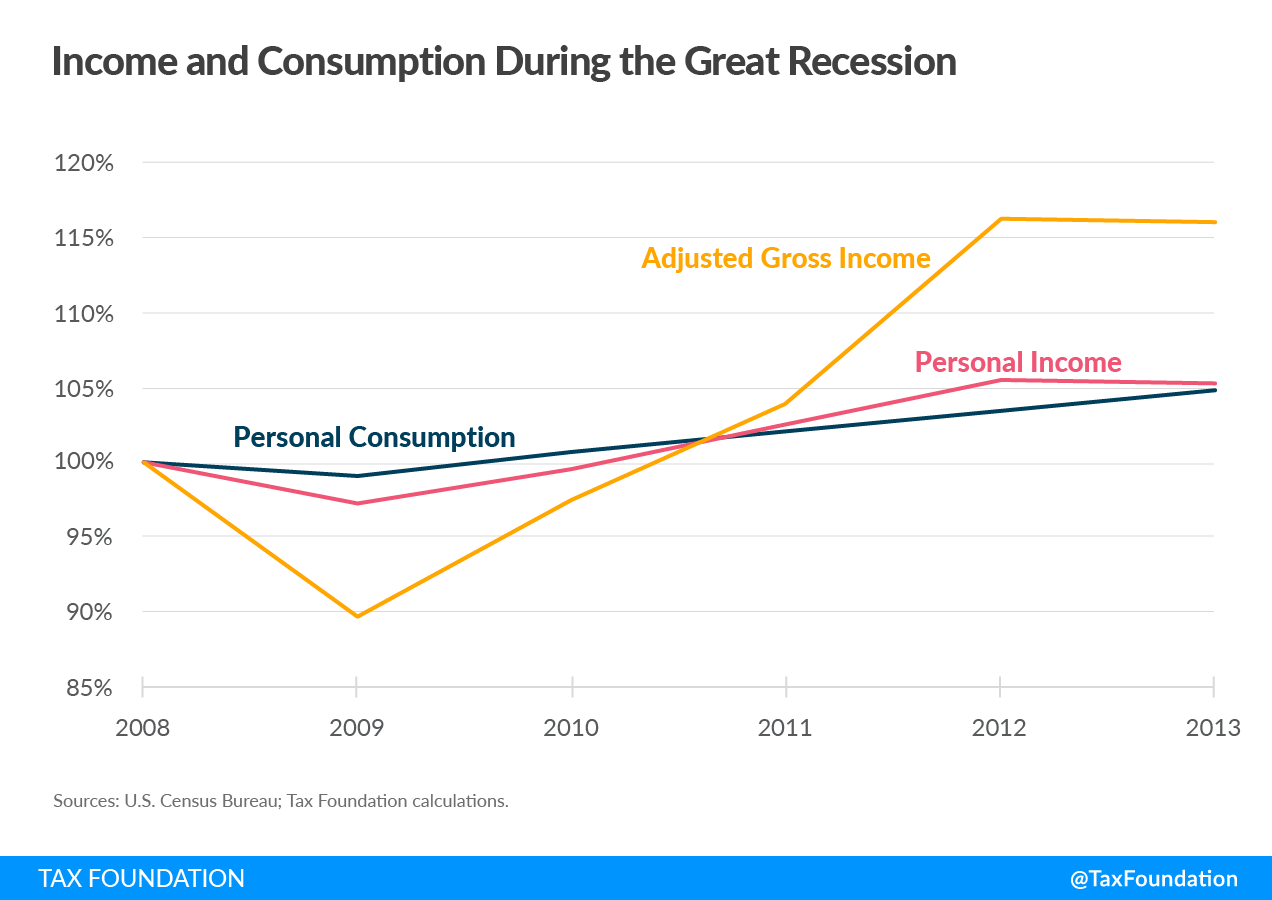

As a basic rule, earnings taxes are extra risky than consumption taxes, as might be seen from mixture state tax collections throughout the nation throughout and instantly after the Nice Recession. By 2010, basic gross sales taxes had declined 8 % from their 2008 peak, whereas particular person earnings taxes fell 16 % and company earnings tax collections plummeted 25 %.[19]

The relative stability of gross sales taxes in comparison with earnings taxes is just not distinctive to the Nice Recession. Whereas most individuals curtail some expenditures throughout an financial downturn, there’s solely a lot they’ll—or are prepared to—reduce. Even these with no wage earnings proceed to eat, supported by financial savings and governmental help, whereas these whose incomes decline are prone to cut back financial savings charges extra drastically than consumption. Company earnings tax collections are probably the most risky as a result of, even in a deep recession, most people earn taxable earnings, whereas firms might put up precise losses and thus don’t have any internet earnings to tax.

Each earnings and consumption fall when the financial system contracts, although private expenditures characterize a larger share of earnings throughout a downturn. Determine 6 beneath demonstrates the modifications in spending and earnings that underlie these fluctuations in tax collections. Private consumption expenditures had been comparatively steady all through the Nice Recession whereas private earnings declined solely barely extra. Adjusted gross earnings proved extraordinarily risky. This issues for tax collections.

The U.S. measure of non-public earnings consists of earnings from all sources, together with authorities. Throughout a recession, wage, wage, and funding earnings declines, however (sometimes untaxable or a minimum of much less taxed) governmental help tends to rise, offering a smoothing impact. Revenue that’s probably taxable, nevertheless, falls sharply. Most states start their very own particular person earnings tax calculations with adjusted gross earnings, and through an financial contraction, each gross earnings and the share of gross earnings that’s taxable (since earnings beneath sure ranges is usually excluded via deductions and exemptions) might be anticipated to say no.

The upshot is that earnings tax collections rise extra quickly than gross sales tax collections in good years however decline extra precipitously in unhealthy years. Revenue taxes are each extra risky and extra cyclical than consumption taxes. States attempt to hedge in opposition to this actuality by diversifying their different types of tax collections, sustaining wet day funds, and typically even limiting how a lot capital positive factors earnings specifically might be budgeted for, since capital positive factors realizations can vanish throughout an financial downturn.

Alaska’s problem is {that a} potential earnings tax is the hedge, fairly than the tax hedged in opposition to. It could be supposed to assist clean over declines in taxes from the oil and gasoline business and in funding returns. Sadly, it’s a tax ill-suited for the aim resulting from its personal volatility.

The Financial Implications of Revenue Taxation

That taxes have an effect on decision-making is among the many oldest recorded observations in political financial system. A few of the earliest texts in existence relate to taxes and there’s proof of tax arbitrage and tax-induced behaviors from the beginning. However taxes do greater than merely cut back client wealth or buying energy; simply as necessary is the motivation construction created by the manner taxes are imposed. Unsurprisingly, several types of taxes have distinct impacts on taxpayers and, consequently, on financial outcomes.

Each tax reduces financial returns. (A few of the authorities spending it facilitates, in fact, could also be wealth-creating.) However the impact is unequal. There may be fact to the adage that “no matter you tax, you get much less of,” so policymakers ought to think twice about what they select to tax, and the way.

Particular person earnings taxes fall on labor and funding. On the margin, they decrease the payoff to work, reducing the provision of labor whereas growing its price, and so they cut back each the returns to funding and the sources accessible to take a position.

An earnings tax might be conceptualized as a tax on consumption plus the change in financial savings, whereas a well-structured gross sales tax is a tax on earnings much less the change in financial savings. An earnings tax reduces the capability for future consumption; economically, it acts like a gross sales tax that will increase the price of future consumption, with every extra hour of labor producing fewer items sooner or later. Consumption taxes are way more economically impartial by comparability and the financial literature persistently finds that gross sales taxes are much less of an obstacle to financial development or location selections than earnings taxes.[20]

Consumption taxes additionally fall on suppliers of labor and capital, like earnings taxes, however they accomplish that neutrally and—a minimum of when well-designed—keep away from double-taxing these components. Gross sales taxes are sometimes destination-sourced, that means that they’re taxed the place a very good or service is consumed, not the place it’s produced. Thus, not like earnings taxes, they don’t discourage funding or job creation in a selected location.[21] Nonetheless, that is solely true insofar because the tax falls on last consumption; when the tax falls on enterprise inputs, it will increase the price of investing in-state.

Essentially the most strong physique of financial literature on earnings taxation focuses on relative ranges, not on presence or absence, of earnings taxation to supply proof of the results of marginal modifications in taxation. The literature is substantial and never monolithic in its findings, however general, analysis finds that the extra that earnings is taxed, the larger the outmigration, whereas the area experiences decrease ranges of financial development, funding, employment mobility, and even patent formation (a very good proxy for basic innovation).[22] Comparative evaluations likewise exhibit that, whereas all taxes can have these results to a point, the influence is heightened with earnings taxes versus gross sales or property taxes.

A sequence of papers by Organisation for Financial Co-operation and Growth (OECD) economists concluded that, of all the main taxes, company earnings taxes are probably the most dangerous to development, adopted by particular person earnings taxes, whereas consumption and property taxes are much less economically damaging. They discovered {that a} 1 % shift of tax revenues from earnings taxes to consumption and property taxes would improve gross home product (GDP) per capita by as a lot as 1 % in the long term, and that earnings taxes had been extra strongly related to decrease incomes than gross sales or consumption taxes.[23]

Ferede and Dahlby (2012) made the counterintuitive discovering that gross sales tax will increase are usually related to will increase in financial development, defined by the truth that these will increase usually changed earnings taxes and different taxes on funding, which had been much less pro-growth than their substitute.[24]

This discovering was in some methods anticipated by Mark, McGuire, and Papke (2000), whose analysis reveals {that a} 1 share level improve in a state’s particular person earnings tax price reduces annual inhabitants development charges by 0.81 share factors, whereas an identical 1 share level improve in native gross sales tax charges truly will increase the annual development price by 0.83 %, evidently as a result of residents favor the companies supplied by gross sales taxes greater than they dislike the tax—one to which they’re innately much less delicate—whereas the alternative is true for earnings taxes.[25]

Nguyen, Onnis, and Rossi (2021) studied the influence of each consumption and earnings taxes on earnings, non-public consumption, and funding. Their analysis revealed {that a} 1 share level reduce within the common earnings tax price resulted in a 1.5 % improve in GDP in a single 12 months’s time, together with a 4.6 % improve in non-public funding and a 1.6 % improve in non-public consumption. Conversely, consumption tax cuts of the identical magnitude had largely insignificant financial results, demonstrating the extra distortionary implications of earnings versus consumption taxes.[26]

Gentry and Hubbard (2002) discovered that workers had been much less prone to transfer to a greater job in states with excessive tax charges or excessive ranges of tax progressivity, in keeping with the decrease return to work beneath high-rate earnings taxes. The researchers additionally discovered a large and statistically vital relationship between wage development and tax progressivity, with progressive tax constructions inhibiting wage development within the state.[27]

Feldstein and Wrobel (1998) concluded that state and native governmental efforts to conduct redistribution via the tax code, and significantly via particular person earnings taxes, are considerably countervailed by tax-induced migration, with a nationwide leveling occurring as larger earners make the most of their excessive ranges of mobility to relocate out of states with excessive earnings taxes. Corporations are additionally incentivized to scale back the variety of higher-paying jobs whereas growing the variety of lower-paying jobs.[28]

Romer and Romer (2010) explored the connection between tax modifications and financial development. They targeted solely on exogenous modifications—these motivated by components apart from financial stabilization—to assist management for different variables which will have concurrently influenced financial circumstances. They discovered that “tax will increase are extremely contractionary,” and that an exogenous tax improve value 1 % of gross product (nationwide or state) resulted in an estimated 3 % decline in gross product after three years. They documented a big detrimental correlation between tax ranges and each private consumption expenditures and personal home funding, with funding falling by 12.6 % in response to a tax improve value 1 % of gross product.[29]

Mertens and Ravn (2013) performed an identical examine and located {that a} 1 share level reduce within the common private earnings tax price yielded a 2.5 % improve in gross product. Such a reduce additionally yielded larger employment, peaking at 0.8 share factors larger after 5 quarters, and with a better variety of hours labored per employee. within the common private earnings tax price, consumption elevated by 5 %. And one 12 months out, non-public nonresidential funding grew by 4 %, with the authors concluding that cuts within the particular person earnings tax price are “most likely one of the best fiscal funding” if the objective is “comparatively speedy job creation.”[30]

Rhee (2012) examined the connection between earnings tax progressivity and gross manufacturing. He discovered that the results had been vital, however not speedy: it takes time for people and companies to answer modifications within the tax code. Due to this fact, modifications in gross state product weren’t contemporaneous with the tax change, however (unsurprisingly) lagged it, as financial selections started to be affected by the upper earnings taxes.

Rhee’s examine didn’t establish a statistically vital relationship between progressivity and migration (although different research have discovered one), however he suggests an offsetting impact. Basically, states with high-rate or extremely progressive earnings taxes may even see out-migration of high-income people offset by the in-migration of lower-income people. This seems to be borne out by different research, which discover that high-rate earnings taxes have the best impact on the situation selections of excessive earners—significantly of entrepreneurs, who are usually probably the most delicate to larger ranges of taxation.[31]

Cloyne (2013) studied tax modifications in the UK, however with findings related to taxation elsewhere, discovering that on common, a 1 share level reduce in taxes as a proportion of GDP will increase GDP by 2.5 % after about three years. Such cuts are additionally related to a 3.3 % improve in wages above unusual developments. Two years in, funding elevated by 4.6 % and consumption rose by 2.9 %. [32]

Mertens and Olea (2013 and 2017) discovered that top earners are probably the most delicate to modifications in tax charges, although low earners reply to tax price modifications as nicely, simply with decreased depth. The researchers discovered that pass-through enterprise earnings is very aware of particular person earnings tax charges and that cuts in marginal charges led to will increase in gross product, decreases within the unemployment price, and a rise within the mixture hours labored. The latter change mirrored a mixture of larger employment ranges and a rise in hours labored by these already employed because the return to labor elevated.[33]

Notably, Mertens and Olea additionally present proof . They discovered that modifications in marginal tax charges led to almost proportional responses even when the common tax price remained the identical, whereas reductions in common tax charges with no lower in prime marginal charges didn’t have any statistically vital impact. Whereas there are actually significant real-world advantages to low charges on decrease ranges of earnings, the financial selections with the best bearing on financial development happen at larger earnings ranges. As at all times, selections occur on the margin—however they don’t stay there. The authors discovered that even when tax insurance policies solely straight benefited larger earners, they induced a rise in common incomes of decrease earners as nicely.[34]

Lastly, Akcigit et al. (2018) discovered that state earnings taxes have pronounced detrimental results on innovation, measured by the variety of patents filed and the variety of buyers residing in a state.[35]

These research solely scratch the floor of the literature on the financial results of taxation, and of earnings taxes specifically, however they’re broadly consultant. Revenue taxes (and will increase in earnings taxation) are related to vital reductions in gross product, employment, funding, consumption, and innovation, whereas the results of gross sales taxes are far much less pronounced. Each taxes take away cash from the non-public sector financial system, which essentially has an influence, however earnings taxes change incentive constructions in ways in which gross sales taxes largely keep away from. The distinction is profound.

Most states impose each a person earnings tax and a gross sales tax. However of these with solely one of many two, extra states go for a gross sales tax than an earnings tax—for good cause. If Alaska wants extra tax income, policymakers ought to keep in mind the distinct financial ramifications of every type of tax. Although Alaska is a rare state, it faces significant financial challenges. An earnings tax would double down on the components that impede the state’s financial development.

The Gross sales Tax Various

Forty-five states impose state-level gross sales taxes, and 37 states allow native gross sales taxes. 9 states have state-level gross sales taxes however prohibit native gross sales taxes. Alaska is the one state with municipal however not state-level gross sales taxation.

Most states adopted their gross sales taxes nicely earlier than Alaska’s statehood and the entire present 45 had finished so by 1969. Since then, Alaska, Delaware, Montana, New Hampshire, and Oregon (usually listed out of alphabetical order to create the acrostic NOMAD) have held out, although that resolve has begun to weaken in Montana, whereas some opponents of Oregon’s gross receipts tax would fairly undertake a gross sales tax.

Ought to Alaska take into account a significant new tax, the gross sales tax has benefits over an earnings tax. As a result of the tax is basically collected by retailers, not people, tax directors take care of far fewer payors—a real concern in a big, sparsely populated state the place administration and enforcement might be expensive. As a result of it’s imposed on consumption fairly than labor or funding (in distinction to a person earnings tax), its financial influence is smaller and collections are much less risky than beneath an earnings tax. Adopting a state gross sales tax would additionally provide an opportunity to unify assortment and administration—a problem and a possibility.

Each an earnings and gross sales tax present alternatives for tax exporting, the place a portion of the tax is paid by nonresidents. With an earnings tax, nonresidents could be taxed on earnings earned whereas current within the state, which might be vital in a state notable for its seasonal employment patterns. These revenues could be partially offset by the credit score Alaska must provide its personal residents for taxes they pay to different states when residing or working elsewhere for a portion of the 12 months.

With a gross sales tax, the exported tax burden will come from purchases by nonresident employees, vacationers, and others visiting the state. It is very important observe that beneath a typical destination-sourced gross sales tax, the tax could be imposed on any buy made in Alaska—even when ordered from an out-of-state enterprise—however not on transactions flowing from Alaska to different states. The upshot of this strategy, which is the norm in different states, is that Alaska companies usually are not deprived when promoting to shoppers in different states, and Alaska shoppers can’t have interaction in tax arbitrage by shopping for from an out-of-state firm.

Most different states get vacation spot sourcing proper, however usually fall quick of their definition of gross sales tax bases. Have been Alaska to undertake a state gross sales tax, this could characterize a possibility to design a clear tax code from scratch, fairly than importing the detritus that comes with practically a century of tinkering in lots of states. No tax code will ever be fully pure, however by coming into the sport late, Alaska policymakers would have the chance to be taught from different states, avoiding the pitfalls they’ve encountered and bypassing the accretion of particular curiosity exemptions which have stuffed most states’ tax codes over the many years.

Public finance students broadly agree on the next rules and observations of gross sales taxation, which we have now articulated beforehand as Alaska has contemplated its tax choices:

- A great gross sales tax is imposed on all last consumption, each items and companies.

- A great gross sales tax exempts all intermediate transactions (enterprise inputs) to keep away from tax pyramiding.

- Gross sales taxes must be destination-based, that means that tax is owed within the state and jurisdiction the place the great or service is consumed.

- The gross sales tax is extra economically environment friendly than many competing types of taxation, together with the earnings tax, as a result of it solely falls on current consumption, not saving or funding.

- As a result of lower-income people have decrease financial savings charges and eat a larger share of their earnings, the gross sales tax might be regressive, although broader bases that embody client companies (way more closely consumed by higher-income people) push in a progressive route.

- The gross sales tax scales nicely with the power to pay precept as a result of it grows with consumption and is subsequently extra discretionary than many different types of taxation.

- Consumption is a extra steady tax base than earnings, although the failure to tax most client companies in lots of states is resulting in a gradual erosion of gross sales tax revenues as companies turn into an ever-larger share of consumption.

Most states impose their gross sales taxes on bases that encompass most items—with economically vital coverage carveouts—and comparatively few companies. With restricted exceptions, most state gross sales taxes are imposed on transactions involving tangible property: home equipment however not apps, lighting fixtures however not landscaping. This was much less a aware alternative than an accident of historical past, a relic of the truth that so many gross sales taxes had been imposed in the course of the Nice Despair, when companies comprised a much smaller share of the financial system. It was administratively easier in that earlier period to focus virtually solely on retail gross sales, and even the later ones tended to comply with their lead.

Elsewhere, states grapple with questions that Alaska may reply from the beginning. In different states, e-books may be untaxed whereas paperbacks are taxable. A visit to a hair salon may yield a taxable buy of a bottle of conditioner, whereas the companies of the hair stylist are tax-exempt. Private companies, specifically, are likely to go untaxed, largely as a historic accident. And that’s vital, particularly as we transition to an ever extra service-oriented financial system.

Gross sales taxes must be broad-based in service of each financial neutrality and tax fairness. That’s, they need to not choose winners and losers firstly as a result of the tax code mustn’t unnecessarily intrude with financial decision-making by favoring some transactions and a few sellers over others. It also needs to keep away from selecting winners and losers as a result of this can be a potential supply of tax regressivity.

Gross sales taxes have two potential sources of regressivity: one, the propensity of lower-income people to eat a larger share of their earnings, and two, a scope of taxable consumption that’s extra prone to fall on the kinds of transactions that dominate the consumption of lower- and middle-income people.

Policymakers usually exempt or decrease charges on sure lessons of consumption as a progressive reform. The exemptions many states present for groceries are one such instance—although there’s cause to consider it might be ineffective. Ready meals are taxed at the usual price and many of the regressivity of taxing unprepared meals is addressed by the exemption for Supplemental Vitamin Help Program (SNAP) and Particular Supplemental Vitamin Program for Girls, Infants, and Kids (WIC) purchases, whereas the exemption is loved by high-income earners as nicely—who usually spend significantly extra on groceries.

Actually, evaluation by the Tax Basis and others reveals that lower-income taxpayers are literally higher off if groceries are included in gross sales tax bases (with exemptions for SNAP and WIC purchases in keeping with federal necessities), permitting for a decrease gross sales tax price, than if the general price is larger however groceries are exempt.[36] The decrease grocery price is designed to create progressivity however largely fails to take action.

There’s a extra simple solution to promote fairness inside the gross sales tax: taxing private companies. Consumption of non-public companies tends to be extra discretionary than consumption of products. Consequently, higher-income people spend a larger share of earnings on companies, that are ceaselessly untaxed. Sadly, most present state gross sales taxes are levied on all tangible property (items) until expressly exempted, however solely apply to companies if expressly enumerated within the statute.

States have been progressively increasing their gross sales tax bases, however tax insurance policies are ceaselessly path dependent. Increasing the gross sales tax base to new transactions might be practically as troublesome as creating the tax within the first place. Ought to Alaska decide to impose a gross sales tax, the state ought to start with as broad a base of non-public consumption as doable, avoiding politically difficult battles down the highway. In so doing, policymakers would undertake a extra steady gross sales tax than that which exists in most different states whereas avoiding the unintentional wrongs that favor some transactions over others and have a tendency to favor the wealthiest shoppers.

On the similar time, Alaska policymakers implementing a gross sales tax would need to keep away from the taxation of intermediate (fairly than last) transactions. To various levels, business-to-business transactions are taxed in each state with a gross sales tax, that means that the gross sales tax is commonly embedded within the last worth of a very good or service a number of instances over. This isn’t an ineluctable legislation of consumption taxes, nevertheless it has sadly been the truth in the US (one of many nation’s departures from how consumption taxes are applied in Europe and elsewhere).

A well-structured gross sales tax is imposed on all last client items and companies whereas exempting all purchases made by companies that shall be used as inputs within the manufacturing course of. This isn’t as a result of companies deserve particular remedy beneath the tax code, however as a result of making use of the gross sales tax to enterprise inputs ends in a number of layers of taxation embedded within the worth of products as soon as they attain last shoppers, a course of generally known as “tax pyramiding.” The result’s larger and inequitable efficient tax charges for various industries and merchandise, which is each nonneutral and nontransparent, hiding precise tax prices from shoppers.

Not solely would Alaska have a possibility to create a broad base from the beginning, making it extra proof against erosion than different states’ tax codes, however doing so would additionally yield the chance to standardize municipal gross sales taxes.

From the standpoint of compliance, administration, and good authorities, that is fascinating—although admittedly fairly troublesome. Alaska municipalities have gone their very own manner for a few years, and a state-established gross sales tax base, with state-run collections and disbursement, would shake up the established order. Nonetheless, a state-administered gross sales tax (the norm in different states) would dramatically cut back compliance prices whereas growing compliance charges.

Seasonal Taxation

For all the things there’s a season—together with taxes. However whereas “tax season” is historically simply when most individuals pay their taxes, some Alaska policymakers have toyed with the thought of creating tax legal responsibility seasonal as nicely, monitoring the inflow of tourism or seasonal employees. This mannequin already exists on the municipal stage, with cities like Nome and Ketchikan growing gross sales tax charges in the course of the summer season tourism season and reducing them for the remainder of the 12 months. Theoretically, the identical strategy could possibly be deployed on the state stage, or the tax could possibly be toggled on and off completely based mostly on the season.

However what’s theoretically doable is just not essentially good tax coverage. Alaska is just not the primary state to discover a two-tier tax system that will increase exporting to non-residents, however toggling a tax on and off could be new. States normally take extra modest steps, like making a homestead exemption for owner-occupied property however not for different property (which would come with trip houses) or having earnings tax deductions and exemptions which are solely accessible to state residents, however these approaches don’t range with the calendar.

Constitutionally, states might not discriminate in opposition to nonresidents in taxation. As an example, states couldn’t create an earnings or gross sales tax that solely utilized to nonresidents. They might, nevertheless, put a thumb on the size in favor of residents in lesser methods, or select tax regimes that functionally favor residents. The courts should adjudicate whether or not a selected tax’s design goes too far in concentrating on nonresidents, however the seasonal gross sales tax mannequin, whereas uncommon, has prevailed in some Alaska jurisdictions and is a minimum of not presumptively unconstitutional.

It’s, nevertheless, advanced and prone to affect client habits in vital methods. If the gross sales tax solely exists for six months out of the 12 months, then residents shall be strongly incentivized to delay making massive purchases till the gross sales tax is in abeyance. Except completely different guidelines exist for various merchandise, which creates much more complexity, one would count on Alaskans to disclaim themselves big-ticket gadgets like vehicles, home equipment, and huge electronics in the course of the months when the gross sales tax is in impact, ready for the speed to zero out.

A seasonal gross sales tax would, subsequently, cut back revenues greater than could be anticipated just by subtracting out sure months of gross sales. It may additionally create stock bottlenecks, as client demand for extra expensive client items fluctuates by season, and introduce added regressivity into the gross sales tax, since gadgets that could possibly be most simply shifted into the tax-free season would are usually extra discretionary (and typically luxurious) purchases, whereas on a regular basis purchases wouldn’t lend themselves as simply to such tax arbitrage.

Moreover, if Alaska desires to gather income from distant sellers—as certainly it will—this complexity would create substantial compliance burdens and preclude the state from becoming a member of the plurality of gross sales tax-collecting states within the Streamlined Gross sales Tax Governing Board, which exists to simplify multistate gross sales and use tax collections and remittance and assure a sure stage of uniformity in how gross sales taxes work.

Whereas seasonal gross sales taxes do exist on the municipal stage in Alaska, they’re removed from the norm, that means that native gross sales taxes may be owed year-round on transactions whereas state gross sales taxes are solely in place throughout sure months. This strategy would throw a wrench in any plans to consolidate gross sales tax administration on the state stage. Proper now, Alaska’s municipal gross sales taxes have to be complied with individually for in-state sellers, although a system has been launched to simplify the method for distant sellers. Even then, gross sales tax bases range by jurisdiction.

Solely three different states—Alabama, Colorado, and Louisiana—have various gross sales tax bases or native autonomy in gross sales tax administration, and all three acknowledge it as a considerable obstacle to tax compliance and are making efforts to consolidate administration on the state stage, in keeping with the observe of all different states with native possibility gross sales taxes. Alaska ought to search to do the identical—however a seasonal gross sales tax would stand in the way in which.

Conclusion

Alaska policymakers are understandably involved in regards to the long-term viability of the state’s overwhelming reliance on the oil and gasoline business for income, however the state’s distinctive financial system and geography, and low inhabitants density make among the “conventional” taxes much less environment friendly than they may be elsewhere. Any main tax shall be extra burdensome in Alaska than in a state with a extra typical financial system however, of the choices, a person earnings tax is the larger risk to Alaska’s future prosperity.

Alaskans already pay extra in federal earnings taxes than their friends within the decrease 48 states on equivalent buying energy, and a state earnings tax may undercut the diversification and development of the state’s financial system. The financial literature is obvious that earnings taxes are extra economically damaging than gross sales taxes. And the financial harms seem extra vital contemplating the comparatively modest improve in state income that might outcome from the imposition of such a tax.

Alaska policymakers will face troublesome selections within the coming years. But their aversion to adopting an earnings tax rests on sound rules. They’re proper to deal with it because the least engaging possibility.

[1] U.S. Bureau of Labor Statistics, Civilian Labor Drive Participation Charge dataset, https://www.bls.gov/.

[2] Alaska Division of Income, Tax Division, Income Sources Books and Forecasts, a number of years, http://tax.alaska.gov/applications/sourcebook/index.aspx.

[3] For income information and projections, see Alaska Division of Income, “Spring 2022 Income Forecast,” March 15, 2022, http://tax.alaska.gov/applications/documentviewer/viewer.aspx?1722r.

[4] There are information availability limits for among the early years of statehood, which might insert a specific amount of guesswork into averages. Starting with 1966 fairly than 1959 avoids these information gaps.

[5] Alaska Stat. § 37.05.540.

[6] Alaska Const. artwork. IX, § 16.

[7] Tax Basis calculations based mostly on U.S. Bureau of Financial Evaluation information.

[8] Katherine Loughead and Jared Walczak, “States Reply to Robust Fiscal Well being with Revenue Tax Reforms,” Tax Basis, July 15, 2021, https://taxfoundation.org/2021-state-income-tax-cuts/; Timothy Vermeer, “State Tax Reform and Reduction Enacted in 2022,” Tax Basis, July 13, 2022, https://taxfoundation.org/state-tax-reform-relief-enacted-2022/.

[9] The common fell by an identical quantity, 1.9 %.

[10] New York individually accelerated a price discount for middle- and upper-middle-income earners and adopted a brand new larger price on excessive earners. The state is included right here as elevating fairly than reducing charges, although arguably it did each.

[11] Jared Walczak, “States Inaugurate a Flat Tax Revolution,” Tax Basis, Sept. 7, 2022, https://taxfoundation.org/flat-tax-state-income-tax-reform/.

[12] Ronald Sullivan, “Remaining Try and Enact Jersey Revenue Tax Fails,” The New York Occasions, Might 16, 1975, https://www.nytimes.com/1975/05/16/archives/final-attempt-to-enact-jersey-income-tax-fails-last-ditch-attempt.html.

[13] Janelle Fritts, “Info & Figures 2022: How Does Your State Examine?” Tax Basis, March 29, 2022, https://taxfoundation.org/publications/facts-and-figures/.

[14] Ken Girardin, “Income Ratchet: Connecticut’s Revenue Tax at 30,” Yankee Institute, March 29, 2021, https://yankeeinstitute.org/2021/03/29/revenue-ratchet-connecticuts-income-tax-at-30/.

[15] Jorge Barro, Joseph Bishop-Henchman, and Russ Latino, “Higher Jobs Mississippi: Tax Construction for Progress,” Empower Mississippi, https://empowerms.org/wp-content/uploads/2021/02/Higher-Jobs-report-.pdf.

[16] Alaska Division of Income, Tax Division, “Annual Report 2021,” http://tax.alaska.gov/applications/applications/studies/AnnualReport.aspx?12 months=2021. The determine rose to 19,672 in FY 2021, however comparable FY 2021 information usually are not accessible on the federal stage.

[17] Inside Income Service Statistics of Revenue, Historic Desk 2, https://www.irs.gov/statistics/soi-tax-stats-historic-table-2.

[18] U.S. Small Enterprise Administration Workplace of Advocacy, “2020 Small Enterprise Profile: Alaska,” https://cdn.advocacy.sba.gov/wp-content/uploads/2020/06/04142939/2020-Small-Enterprise-Financial-Profile-AK.pdf.

[19] Jared Walczak, “Revenue Taxes Are Extra Unstable Than Gross sales Taxes Throughout an Financial Contraction,” Tax Basis, March 17, 2020, https://taxfoundation.org/income-taxes-are-more-volatile-than-sales-taxes-during-recession/.

[20] See Joseph Bankman and David A. Weisbach, “The Superiority of an Excellent Consumption Tax over an Excellent Revenue Tax,” Stanford Regulation Assessment 58:5 (April 2010): 1413; and Jens Matthias Arnold, Bert Brys, Christopher Heady, Åsa Johansson, Cyrille Schwellnus, and Laura Vartia, “Tax Coverage for Financial Restoration and Progress,” The Financial Journal 121:550 (February 2011): F59-F80.

[21] Douglas L. Lindholm and Karl A. Frieden, “After Wayfair: Modernizing State Gross sales Tax Programs,” State Tax Notes, Might 14, 2018, https://price.org/globalassets/price/state-tax-resources-pdf-pages/cost-studies-articles-reports/after-wayfair-modernizing-state-sales-tax-systems.pdf.

[22] The temporary survey of the literature that follows is partially tailored and abridged from Timothy Vermeer, “The Impression of Particular person Revenue Tax Modifications on Financial Progress,” Tax Basis, June 14, 2022, https://taxfoundation.org/income-taxes-affect-economy/.