Alaska

Brad Keithley’s chart of the week: The impact on Alaska families of broadening the funding base

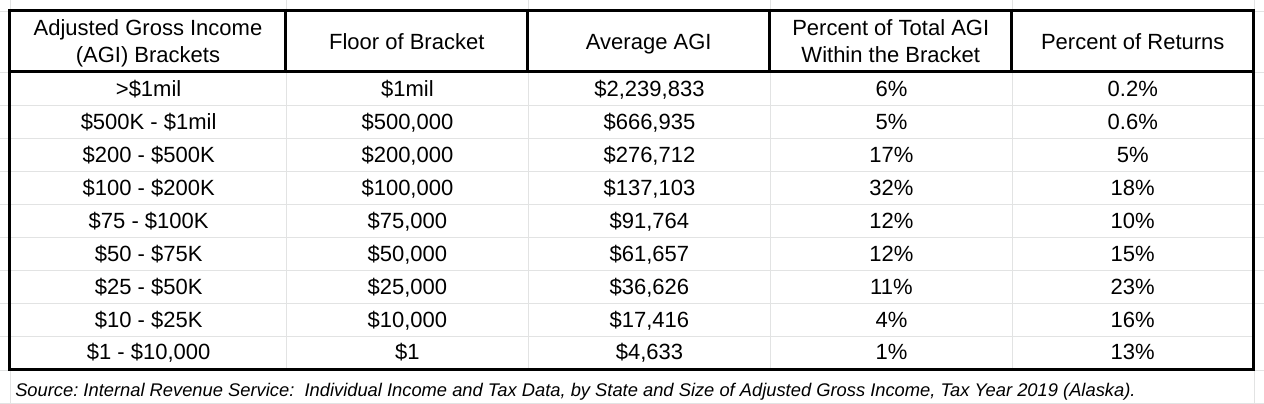

Usually once we take a look at the distributional influence of assorted Alaska funding choices we use the evaluation developed by the Institute on Taxation and Financial Coverage (ITEP) and utilized in its April 2017 and February 2021 experiences for the legislature.

However as a result of it’s tough to make use of these instruments to take a look at the distributional influence of choices past these analyzed within the experiences, just lately we have now been spending extra time utilizing the uncooked numbers contained within the public summaries of Inside Income Service knowledge on which ITEP’s evaluation largely relies. The latest public summaries cowl tax 12 months 2019.

In its uncooked kind, the IRS knowledge isn’t damaged down into the identical quintiles – low, decrease center, center, higher center and high 20% – as ITEP develops and makes use of for its evaluation. Slightly, the IRS knowledge is summarized two methods, relying on the kind of data lined.

The primary is by cumulative percentiles – high 1%, high 5%, high 10%, high 25%, high 50%, high 75%, and by subtraction, the underside 25%. The second is by Adjusted Gross Earnings (AGI) ranges of various sizes, starting from lower than $1 on the backside, to $1 million and extra on the high.

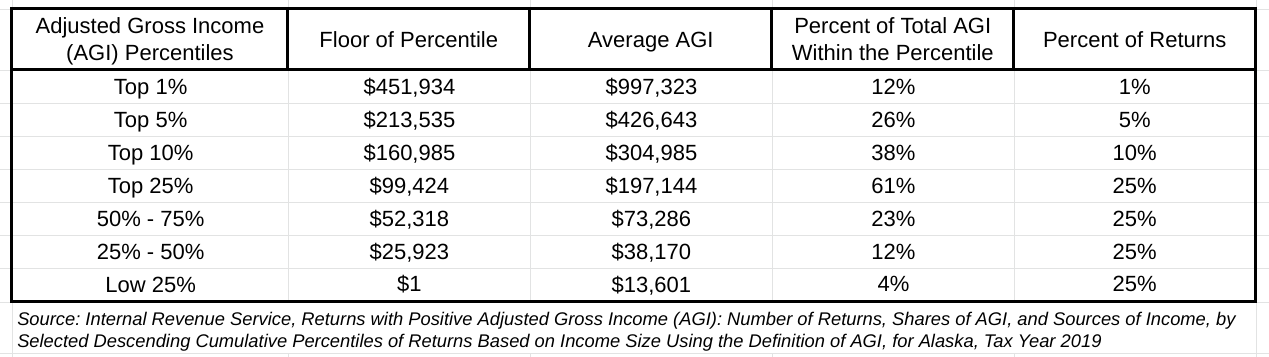

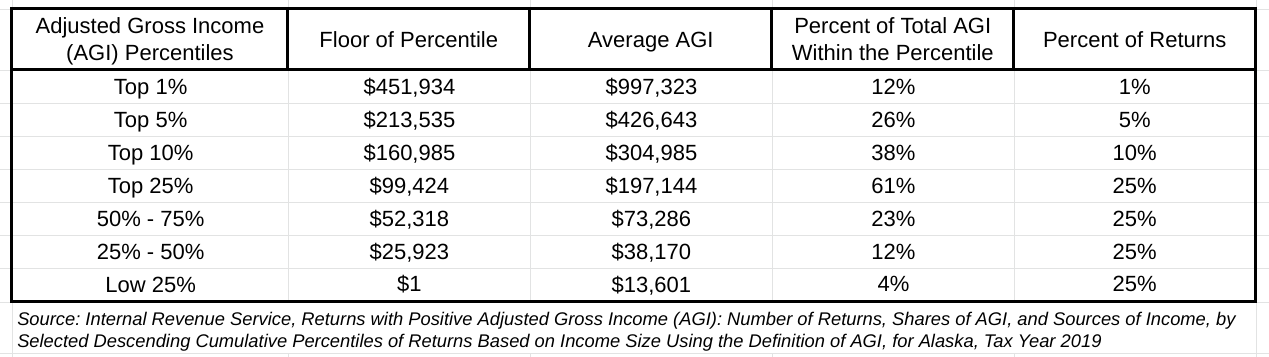

Here’s what the breakdown seems to be like from the angle of percentiles:

The vary of the highest 1% of Alaska households begins at an AGI of $451,934, has a median AGI of $997,323 and on their very own represents 12% of complete Alaska adjusted gross earnings.

The highest 10% begins at $160,985, has a median AGI of $304,985 and represents greater than a 3rd – 38% – of Alaska adjusted gross earnings.

The highest 25% begins at $99,424, has a median AGI of $197,144 and represents nicely greater than half – 61% – of Alaska adjusted gross earnings.

The center 50% (from the twenty fifth to seventy fifth percentiles) ranges between $25,923 and fewer than $99,424, has a median AGI of $55,728 and, though it consists of roughly 50% of Alaska households, represents solely a few third – 35% – of Alaska adjusted gross earnings. Put one other method, within the mixture, the center 50% represents nearly the identical share of Alaska AGI when it comes to proportion as the highest 10%.

The low (backside) 25% has an AGI of lower than $25,923, a median AGI of $13,601 and represents solely 4% of Alaska adjusted gross earnings, lower than a 3rd of that managed by the highest 1% alone.

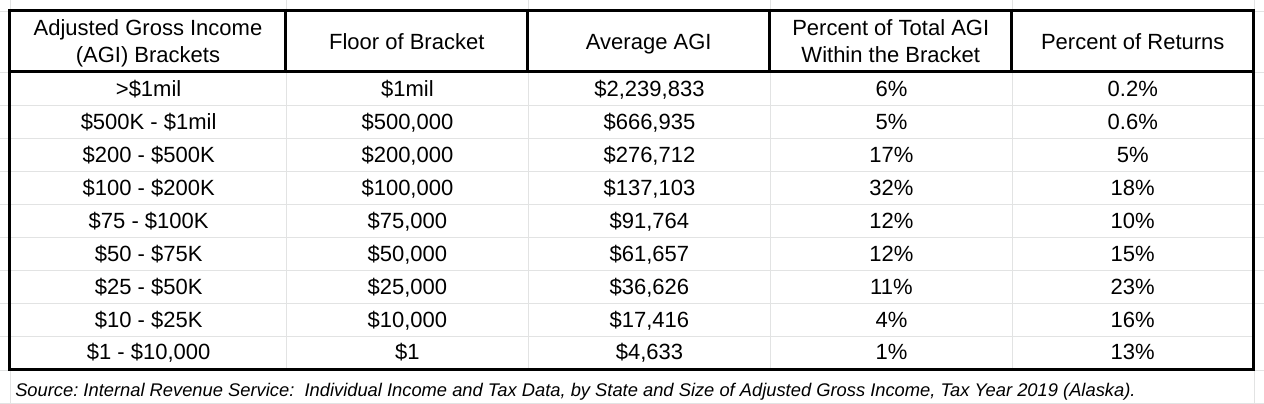

As useful as it’s in broadly describing the financial situation of Alaska households, nonetheless, the IRS’ percentile breakdown doesn’t include sufficient data to finish a few of the distributional evaluation we do. For these, we flip to the breakdown by earnings ranges.

The usefulness of this knowledge is that it additionally comprises the variety of people falling in every bracket. We use it when our evaluation requires including again to earnings the quantity diverted to authorities (i.e., taxed) in any given 12 months via reductions within the Everlasting Fund Dividend (PFD).

We have now used that knowledge on this week’s evaluation, which focuses on demonstrating how regressive PFD cuts actually are, and the constructive influence for the overwhelming majority of Alaska households which might outcome from broadening the bottom from which revenues are being raised.

In our view, PFD cuts are a type of focused earnings tax. When distributed, PFDs add to non-public earnings. Diverting a portion of that personal earnings as an alternative to authorities suits the basic definition of a tax. As a result of it falls solely on PFDs, it’s a focused tax on PFD earnings.

Each the 2016 research by the College of Alaska-Anchorage’s Institute of Social and Financial Analysis (ISER) for the then-administration of former Governor Invoice Walker and the 2017 research by ITEP for the Legislature make the purpose that PFD cuts are regressive – the quantity diverted to authorities as a share of earnings will increase as earnings decreases.

However typically we don’t assume readers and policymakers admire simply how vastly regressive they are surely.

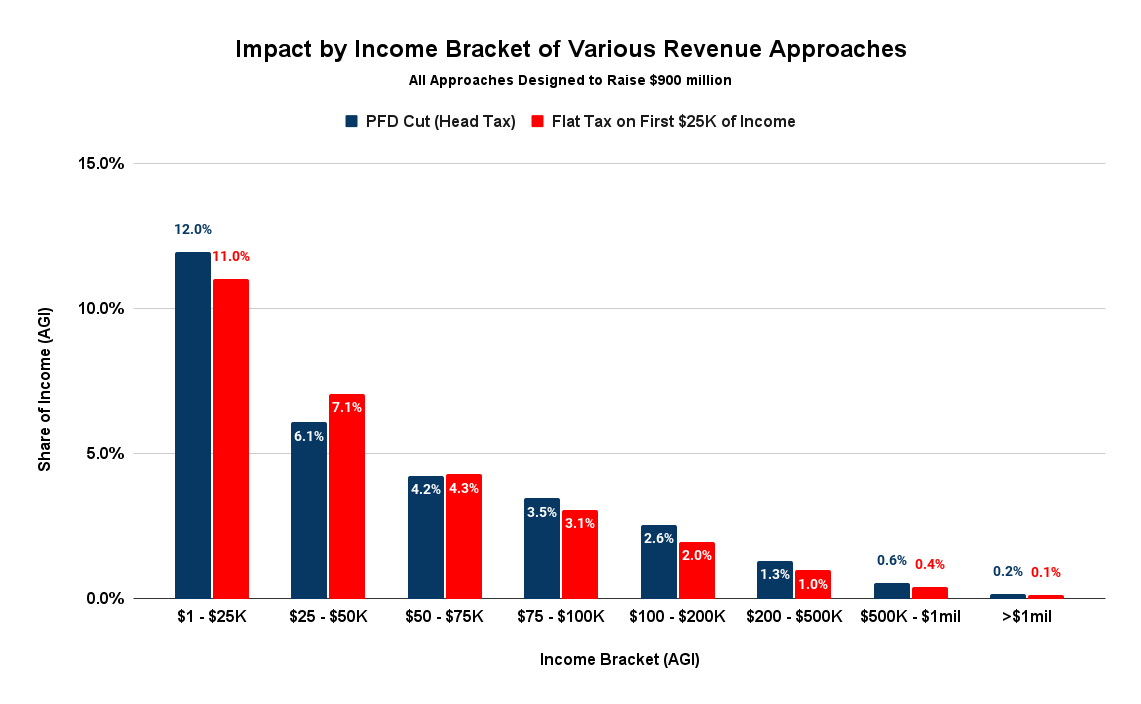

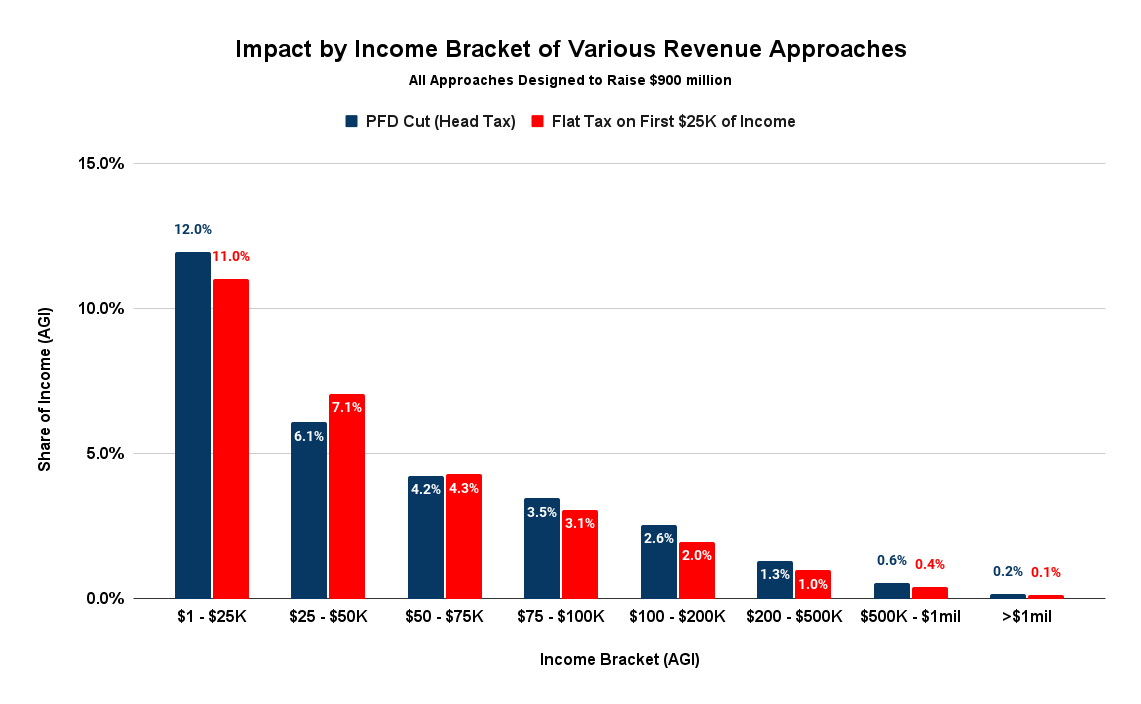

To assist drive that time residence this week we have now achieved an evaluation to find out what kind of extra typical earnings tax would produce a comparable regressive slope to PFD cuts. Taxes based mostly on the “first xx quantity” of earnings – just like the social safety payroll tax (which relies on the primary $147,000 of wage and wages) – are extra regressive than these extra broadly based mostly. The decrease the edge the extra regressive the tax.

Throughout the confines of the 2019 knowledge, it seems a tax that applies solely to the primary $25,000 of earnings, an extraordinarily low threshold, comes closest to replicating PFD cuts.

As a result of the tax would fall solely on the primary $25,000 of earnings, each millionaires and people with solely $25,000 in earnings would pay the identical tax. As a result of it taxes all the earnings of these with $25,000 in earnings or beneath whereas solely a declining share of these in brackets above them, it’s clearly a tax that impacts center and decrease earnings households the toughest.

Together with earnings obtained by residents, non-residents with Alaska sourced earnings and including again the roughly $900 million in PFD cuts made that 12 months (as a result of the evaluation raises the cash by substituting the tax as an alternative), Alaska had roughly $29 billion in Adjusted Gross Earnings in 2019. By limiting the tax to the primary $25,000, nonetheless, the tax would apply solely to $8.1 billion of that. Of that, roughly 7% could be earnings obtained by non-residents; the remaining 93% could be earnings obtained by Alaskan households.

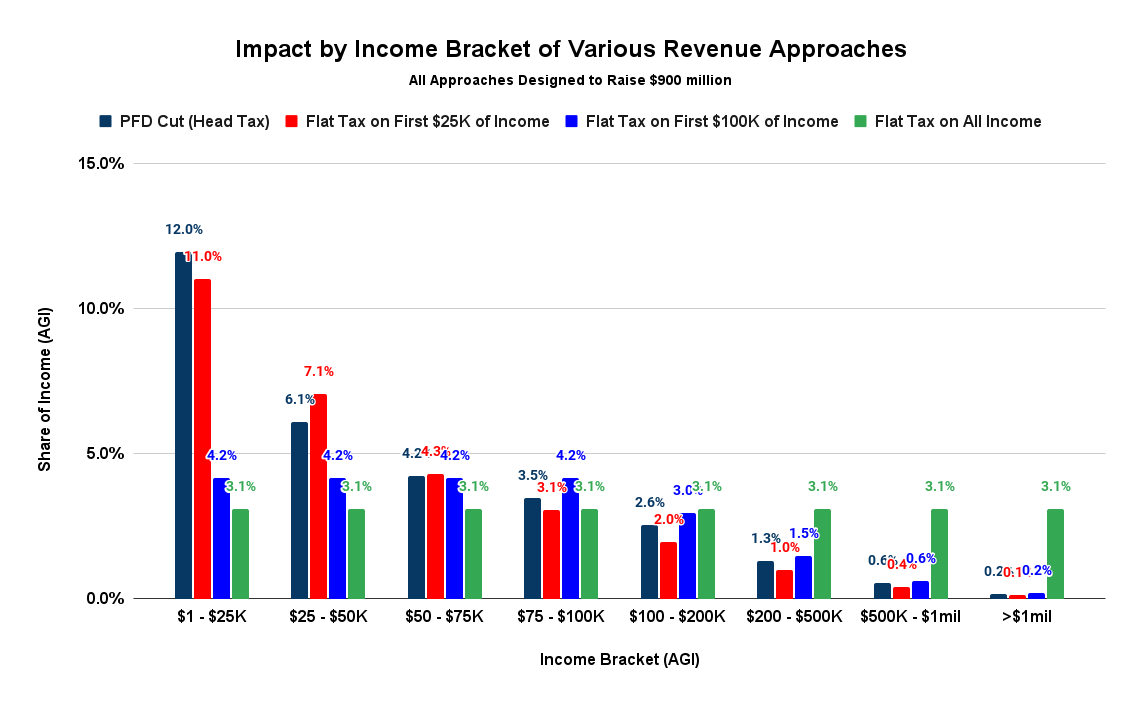

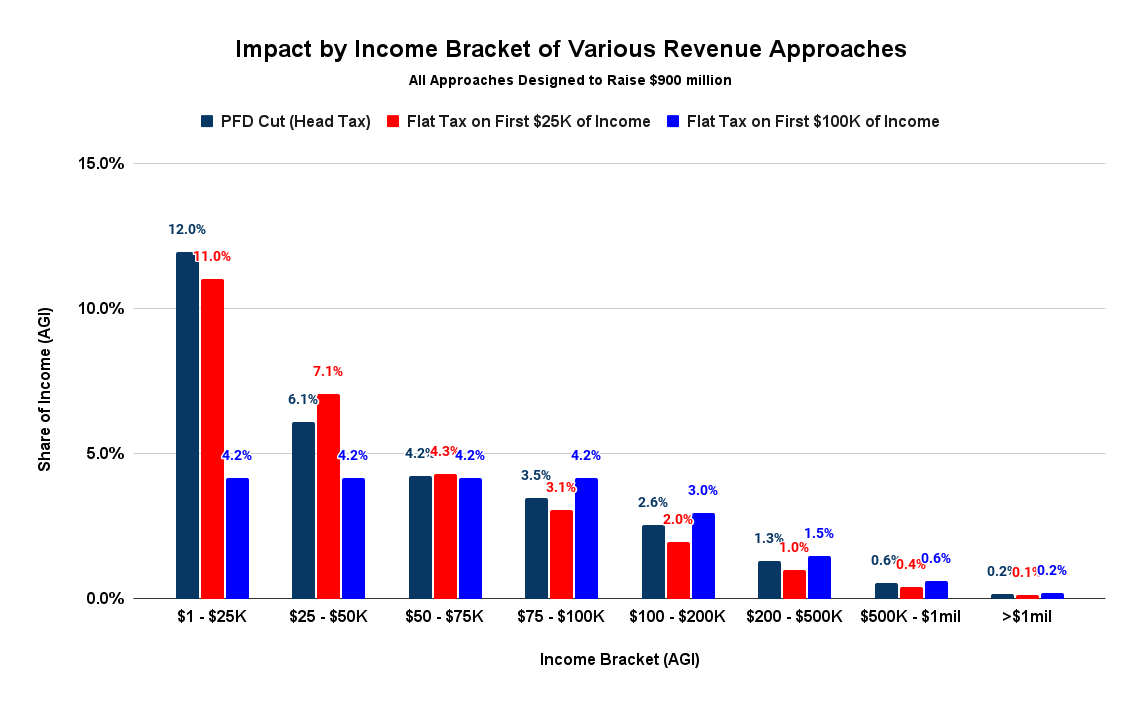

Listed below are the efficient tax charges on Alaskan households at numerous earnings ranges of elevating $900 million in income in that method (in crimson), in comparison with utilizing PFD cuts (in darkish blue).

Whereas there are some variations, the regressive slope is near that ensuing from PFD cuts. In essence, an earnings tax on solely the primary $25,000 of earnings is a tough practical equal of PFD cuts.

Beneath that method, households with better than $1 million in earnings (750 Alaska households fall into that class) would pay $2,750 in taxes. On common, that’s 0.1% of their earnings. These with incomes between $50,000 – $75,000 would pay the identical quantity. On common, nonetheless, that’s 4.3% of their earnings. These with incomes of $25,000 would pay the very same tax of $2,750. On common, nonetheless, that’s 11% of their earnings. These falling beneath $25,000 would pay the identical 11% of no matter their earnings is.

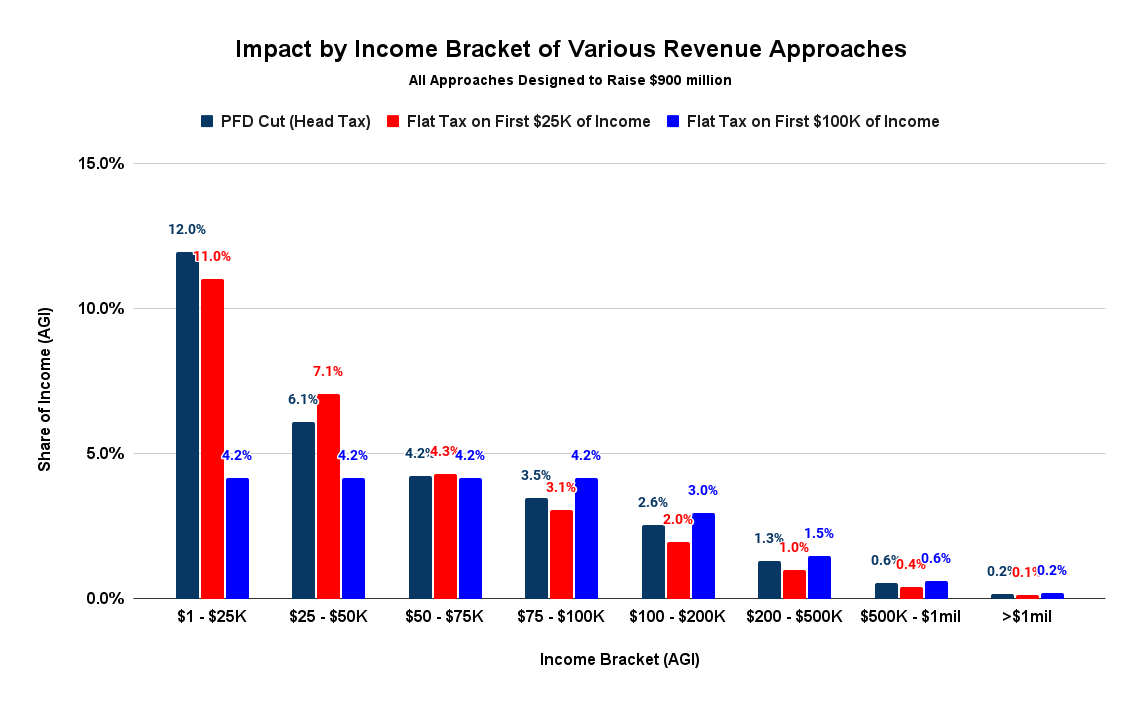

As mentioned above, though nonetheless regressive, tax approaches that broaden the income base through the use of the next threshold are much less regressive than these with decrease thresholds.

To exhibit the change in influence from broadening the tax base, we have now checked out what the impact could be if as an alternative of the primary $25,000, a tax was imposed on the primary $100,000 of earnings (in gentle blue). Utilizing that threshold would broaden the bottom from $7.9 billion to $20.4 billion. As anticipated, the slope improves dramatically.

On common, households with better than $1 million in earnings would pay $4,200 in taxes, which on common is 0.2% of their earnings, as an alternative of 0.1%. These with incomes $100,000 and beneath all would pay the identical 4.2% of their earnings, decrease for many center and decrease earnings Alaska households than below the earlier (first $25K of earnings) and PFD reduce approaches.

It’s clear that broadening the bottom from taxing solely the primary $25,000 to the primary $100,000 definitely would make the influence throughout the total vary of Alaska households extra equitable.

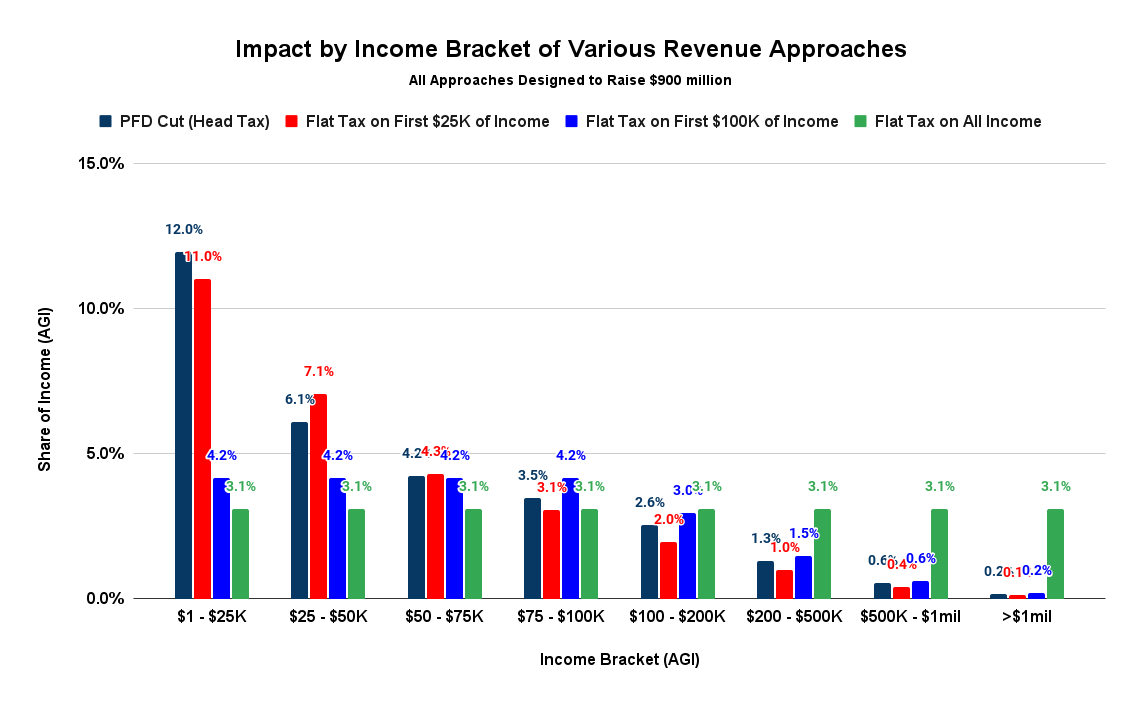

However probably the most equitable method, by far, outcomes from broadening the bottom additional to incorporate the total $29 billion in Alaska earnings (inexperienced).

Elevating the identical $900 million on that base would end in a flat fee throughout the board of solely 3.1%. Taking a look at that on a percentile foundation, that’s decrease for greater than 75% of Alaska households than both PFD cuts or a tax on the primary $100,000 of earnings.

And whereas it’s a increased fee than both of these two options for the lower than 25% of Alaska households with greater than $100,000/12 months in adjusted gross earnings, it’s nonetheless decrease than the speed which might be charged the remaining 75+% of Alaska households below both PFD cuts or a tax solely on the primary $100,000.

In brief, it’s equitable throughout the board.

Generally once we do these analyses some will accuse us of advocating “wealth envy,” searching for increased charges on increased incomes than outcome from PFD cuts or different, related regressive approaches.

There’s no reality to that, in any respect. Our motivation comes from a completely totally different place.

As ISER famous in its 2016 research, extra regressive approaches not solely extra closely burden center and decrease earnings households, additionally they “have a bigger antagonistic impact on expenditures,” and thru that, the economic system. Our push for extra equitable funding approaches is solely to place ALL Alaska households on a extra degree enjoying area relating to paying for presidency, and to pursue a fiscal coverage which has a low antagonistic influence on the general economic system.

These actually involved in regards to the antagonistic influence of fiscal measures on Alaska households and the Alaska economic system ought to push for a lot much less regressive approaches than that at the moment getting used to fund Alaska authorities. The least impactful are these which remove regressivity completely.

Brad Keithley is the Managing Director of Alaskans for Sustainable Budgets, a challenge targeted on creating and advocating for economically strong and sturdy state fiscal insurance policies. You possibly can comply with the work of the challenge on its web site, at @AK4SB on Twitter, on its Fb web page or by subscribing to its weekly podcast on Substack.

Alaska

Experts recommend preparing in case of Southcentral power outages as storm approaches

ANCHORAGE, Alaska (KTUU) – With a storm approaching and high winds in the forecast for a portion of Southcentral Alaska, experts recommend preparing for potential power outages and taking safety precautions.

Experts with the State of Alaska, Division of Homeland Security and Emergency Management recommended taking the initiative early in case of power outages due to strong weather.

Julie Hasquet with Chugach Electric in Anchorage said Saturday the utility company has 24/7 operators in case of outages.

“We watch the weather forecast, and absolutely, if there are power outages, we will send crews out into the field to respond,” Hasquet said.

She echoed others, saying it’s best to prepare prior to a storm and not need supplies rather than the other way around.

“With the winds that are forecast for tonight and perhaps into Sunday, people should just be ready that it could be some challenging times, and to be aware and cautious and kind of have your radar up,” Hasquet said.

For the latest weather updates and alerts, download the Alaska’s Weather Source app.

See a spelling or grammar error? Report it to web@ktuu.com

Copyright 2025 KTUU. All rights reserved.

Alaska

The 2025 Alaska Music Summit comes to Anchorage

ANCHORAGE, Alaska (KTUU) – More than 100 music professionals and music makers from Anchorage and across the state signed up to visit ‘The Nave’ in Spenard on Saturday for the annual Alaska Music Summit.

Organized by MusicAlaska and the Alaska Independent Musicians Initiative, the event began at 10 a.m. and invited anyone with interest or involvement in the music industry.

“The musicians did the work, right,” Marian Call, MusicAlaska program director said. “The DJ’s who are getting people out, the music teachers working at home who have tons of students a week for $80 an hour, that is real activity, real economic activity and real cultural activity that makes Alaska what it is.”

Many of the attendees on Saturday were not just musicians but venue owners, audio engineers, promoters and more, hence why organizers prefer to use the term “music makers.”

The theme for the summit was “Level Up Together” a focus on upgrading professionalism within the musicmaking space. Topics included things like studio production, promotion, stagecraft, music education policy.

“We’re kind of invisible if we don’t stand up for ourselves and say, ‘Hey, we’re doing amazing stuff,‘” Call said.

On Sunday, participants in the summit will be holding “office hours” at the Organic Oasis in Spenard. It is a time for music professionals to network, ask questions and share ideas on music and music making.

“You could add us to the list of Alaskan cultural pride,” Call said. “You could add us to your conception of being Alaskan. That being Alaskan means you wear Carhartts, and you have the great earrings by the local artisan, and you know how to do the hand geography and also you listen to Alaskan music proudly.”

The event runs through Sunday and will also be hosted in February in Juneau and Fairbanks.

See a spelling or grammar error? Report it to web@ktuu.com

Copyright 2025 KTUU. All rights reserved.

Alaska

Legislative task force offers possible actions to rescue troubled Alaska seafood industry • Alaska Beacon

Alaska lawmakers from fishing-dependent communities say they have ideas for ways to rescue the state’s beleaguered seafood industry, with a series of bills likely to follow.

Members of a legislative task force created last spring now have draft recommendations that range from the international level, where they say marketing of Alaska fish can be much more robust, to the hyper-local level, where projects like shared community cold-storage facilities can cut costs.

The draft was reviewed at a two-day hearing in Anchorage Thursday and Friday of the Joint Legislative Task Force Evaluating Alaska’s Seafood Industry. It will be refined in the coming days, members said.

The bill that created the task force, Senate Concurrent Resolution 10, sets a deadline for a report to the full Legislature of Jan. 21, which is the scheduled first day of the session. However, a final task force report may take a little longer and be submitted as late as Feb. 1, said Senate President Gary Stevens, R-Kodiak, the group’s chair.

The draft is a good start to what is expected to be a session-long process, said Rep. Louise Stutes, R-Kodiak, a task force member.

“We can hit the ground running because we’re got some good solid ideas,” Stutes said in closing comments on Friday. The session can last until May 20 without the Legislature voting to extend it.

Another task force member, Sen. Jesse Bjorkman, R-Nikiski, urged his colleagues to focus on the big picture and the main goals.

“We need to take a look at how we can increase market share for Alaska seafood and how we can increase value. Those two things aren’t easy, but those are the only two things that are going to matter long term. Everything else is just throwing deck chairs off the Titanic,” he said Friday.

Many of the recommended actions on subjects like insurance and allocations, if carried out, are important but incremental, Bjorkman said. “If the ship’s going down, that stuff isn’t going to matter,” he said.

Alaska’s seafood industry is beset by crises in nearly all fishing regions of the state and affecting nearly all species.

Economic forces, heavily influenced by international turmoil and a glut of competing Russian fish dumped on world markets, have depressed prices. Meanwhile, operating costs have risen sharply. Climate change and other environmental factors have triggered crashes in stocks that usually support economically important fisheries; Bering Sea king and snow crab fisheries, for example, were closed for consecutive years because stocks were wiped out after a sustained and severe marine heatwave.

In all, the Alaska seafood industry lost $1.8 billion from 2022 to 2023, according to the National Oceanic and Atmospheric Administration.

Those problems inspired the creation of the task force last spring. The group has been meeting regularly since the summer.

The draft recommendations that have emerged from the task force’s work address marketing, product development, workforce shortages, financing, operating costs, insurance and other aspects of seafood harvesting, processing and sales.

One set of recommendations focuses on fisheries research. These call for more state and federal funding and an easy system for fisheries and environmental scientists from the state, federal government and other entities to share data quickly.

The draft recommends several steps to encourage development of new products and markets for them, including non-traditional products like protein powder, nutritional supplements and fish oil. Mariculture should be expanded, with permitting and financing made easier, according to the draft.

The draft recommendations also propose some changes in the structure of seafood taxes levied on harvesters and processors, along with new tax incentives for companies to invest in modernization, product diversification and sustainability.

Other recommendations are for direct aid to fishery workers and fishing-dependent communities in the form of housing subsidies or even development of housing projects. Shortages of affordable housing have proved to be a major challenge for communities and companies, the draft notes. More investment in worker training — using public-private partnerships — and the creation of tax credits or grants to encourage Alaska-resident hire, are also called for in the draft recommendations.

Expanded duties for ASMI?

The Alaska Seafood Marketing Institute, the state agency that promotes Alaska seafood domestically and internationally, figures large in the draft recommendations.

The draft calls for more emphasis on the quality and sustainability of Alaska fish and, in general, more responsibilities for ASMI. An example is the recommended expansion of ASMI’s duties to include promotion of Alaska mariculture. That would require legislation, such as an early version of bill that was sponsored by outgoing Rep. Dan Ortiz, I-Ketchikan. It would also require mariculture operators’ willingness to pay into the program.

But ASMI, as it is currently configured, is not equipped to tackle such expanded operations, lawmakers said. Even obtaining modest increases in funding for ASMI has proved to be a challenge. A $10 million increase approved by the Legislature last year was vetoed by Gov. Mike Dunleavy, who cited a failure by ASMI to develop a required plan for the money.

The governor’s proposed budget released in December includes an increase in state money for ASMI, but his suggestion that $10 million in new funding be spread over three years falls far short of what the organization needs, Stevens said at the time.

Incoming House Speaker and task force member Bryce Edgmon, I-Dillingham, said there will probably be a need to reorganize or restructure ASMI to make it more autonomous. That might mean partnering with a third party and the creation of more managerial and financial independence from whoever happens to be in political office at the time, as he explained it.

“The umbilical cord needs to be perhaps cut to some degree,” Edgmon said on Friday, during the hearing’s public comment period. The solution could be to make ASMI more of a private entity, he said.

“Because the world is changing. It’s a global marketplace. We need to have ASMI to have as large a presence as possible,” he said.

But for now, ASMI and plans for its operations have been constricted by political concerns. “People are afraid of how it’s going to go back to the governor’s office,” Edgmon said.

Federal assistance

U.S. Sen. Lisa Murkowski, R-Alaska, spoke to the task force on Thursday about ways the federal government could help the Alaska seafood industry.

One recent success, she said, is passage of the bipartisan Fishery Improvement to Streamline Untimely Regulatory Hurdles post Emergency Situation Act, known as the FISHES Act, which was signed into law a few days earlier.

The act establishes a system to speed fisheries disaster aid. It can take two to three years after a fisheries disaster is declared for relief funds to reach affected individuals, businesses and communities, and that is “unacceptable,” Murkowski said. The bill addresses that situation, though not perfectly. “It’s still not the best that it could be,” she said.

Another helpful piece of federal legislation that is pending, she said, is the Working Waterfronts Bill she introduced in February. The bill contains provisions to improve coastal infrastructure, coastal energy systems and workforce development.

More broadly, Murkowski said she and others continue to push for legislation or policies to put seafood and fisheries on the same footing as agriculture. That includes the possibility of fishery disaster insurance similar to the crop insurance that is available to farmers, she said.

But getting federal action on seafood, or even attention to it, can be difficult, she said.

“It is a reality that we have faced, certainly since my time in the senate, that seafood has been viewed as kind of an afterthought by many when it comes to a food resource, a source of protein,” she said.

Inclusion of seafood in even simple programs can be difficult to achieve, she said. She cited the U.S. Department of Agriculture’s decision, announced in April, to include canned salmon as a food eligible for the Special Supplemental Nutrition Program for Women, Infants, and Children, also known as WIC. She and others had been working for several years to win that approval, she said.

Tariffs a looming threat

Seafood can also be an afterthought in federal trade policy, Murkowski said.

Tariffs that President-elect Donald Trump has said he intends to impose on U.S. trade partners pose a serious concern to Alaska’s seafood industry, she said.

“The president-elect has made very, very, very, very clear that this is going to be a new administration and we’re going to use tariffs to our advantage. I don’t know what exactly to expect from that,” she said.

In the past, tariffs imposed by the U.S. government have been answered with retaliatory tariffs that cause problems for seafood and other export-dependent industries.

Jeremy Woodrow, ASMI’s executive director, has similar warnings about tariffs, noting that about 70% of the Alaska seafood, as measured by value, is sold to markets outside of the U.S.

“We tend to be, as an industry, collateral damage in a lot of trade relationships. We’re not the main issue. And that usually is a bad outcome for seafood,” he told the committee on Thursday.

To avoid or mitigate problems, Alaska leaders and the Alaska industry will have to respond quickly and try to educate trade officials about tariff impacts on seafood exports, Woodrow said.

Task force members expressed concerns about impacts to the export-dependent Alaska industry.

“If we raise tariffs on another country, won’t they simply turn around and raise tariffs on us?” asked Stevens.

Tariffs on Chinese products, which Trump has suggested repeatedly, could cause particular problems for Alaska seafood, Stutes said. She pointed to the companies that send fish, after initial processing, to China for further processing in preparation for sale to final markets, some of which are back in the U.S.

“If there is a huge tariff put on products going and coming from China, that would seem to me to have another huge gut shot to those processors that are sending their fish out for processing,” Stutes said.

Bjorkman, a former high school government teacher, said history shows the dangers of aggressive tariff policies.

The isolationist “America-first” approach, as carried out at turns over the past 150 years, “hasn’t worked out very well. It’s been real bad,” Bjorkman said.” As an alternative, he suggested broader seafood promotions, backed by federal or multistate support, to better compete in the international marketplace.

YOU MAKE OUR WORK POSSIBLE.

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics1 week ago

Politics1 week agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health6 days ago

Health6 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoSouth Korea extends Boeing 737-800 inspections as Jeju Air wreckage lifted

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology3 days ago

Technology3 days agoMeta is highlighting a splintering global approach to online speech

-

World1 week ago

World1 week agoWeather warnings as freezing temperatures hit United Kingdom

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft