Sendi Jia, a designer running her own studio between Beijing, China, and London, England, says she mainly uses AI generators like DALL-E to make fake photos for background panels or websites when her clients don’t have access to real ones. That’s helped clients with limited budgets, but it’s also exposed just how much of the creative process AI can replace. Recently, a potential client working in a university contacted Jia about creating the logo for a new project. Then, they changed their mind. They had used AI to make it, they said.

Technology

Watch out: Biggest data breaches of 2024, so far

From big banks to car dealerships, 2024 has been a banner year for data breaches. Yes, I mean that in the worst way possible. I’d be shocked if there’s any American left unexposed at this point. Here are some companies that may have exposed your data.

New! For the first time ever, the award-winning Kim Komando Show is available as a podcast. Find it now in your favorite podcast player.

National Public Data breach: 2.9 billion people exposed

Hard to imagine much worse than a background-check company being hacked. Their entire job is to dig up and collect non-public data. A lawsuit claims it was National Public Data’s negligence that exposed 2.9 billion people. Details include Social Security numbers, full names and addresses. Hacking group ASDoD put the database of the stolen information up for sale for $3.5 million. No word yet on any ransom payment.

2.7 BILLION RECORDS LEAKED IN MASSIVE US DATA BREACH

Through a process called scraping, NPD collects and stores personal data from “non-public sources” to perform background checks. In other words, the company gathers information that wasn’t willingly (or knowingly) handed over.

Depending on what happens in court, NPD could be required to purge personal data of impacted individuals and to encrypt all collected data going forward.

Ascension ransomware attack: Up to 140 hospitals

In May, an employee at one of the country’s biggest healthcare systems accidentally downloaded malware. What happened next was a cyberattack avalanche.

Ascension runs 140 hospitals in 19 states and Washington, D.C. On May 8, they detected unusual activity within their network. The disruption quickly became so bad that Ascension had to shut down emergency rooms and reroute patients.

Emergency sign outside hospital

Hackers got their hands on 7 of Ascension’s 25,000 servers; who was impacted is still under investigation. Ascension recently said around 500 individuals were affected, but I’m willing to bet the final number will be a lot higher.

CDK global attack: 15,000 car dealerships

One of the biggest car dealership software companies got hit with a double whammy in June. CDK, used by 15,000 dealerships for payroll and finance tasks, shut down its systems after back to back cyberattacks on the 18th and 19th. Rumor has it the ransom payment was worth tens of millions of dollars.

The shutdown majorly disrupted dealership operations and sales. One Lexus dealership in New Jersey reported new car sales down 50% in June.

Change Healthcare attacks

20 TECH TRICKS TO MAKE LIFE BETTER, SAFER OR EASIER

Change Healthcare, a tech firm owned by UnitedHealth, is used by thousands of pharmacies, hospitals and healthcare facilities to receive payments and process claims.

One attack discovered in late February caused massive disruptions for weeks throughout the U.S. healthcare system. UnitedHealth paid a whopping $22 million ransom to Russian cybercriminal group BlackCat to stop them from sharing the data they stole.

Then another gang of crooks, RansomHub, claimed they stole data, too. In April, UnitedHealth said a “substantial proportion” of Americans’ data was exposed. Estimates say as much as a third of all Americans were impacted. That includes sensitive medical data, including test results, diagnoses and images.

AT&T breach: 73 million customers

In March, AT&T disclosed that hackers stole data from “nearly all” current and former customers. The data goes back as far as 2019 and includes some really personal information, including Social Security numbers. They reportedly paid hackers a $370,000 ransom to delete the information.

Honorable mention

- Advance Auto Parts (July): Personal information of over 2.3 million individuals was stolen.

- Roku (April): Through “credential stuffing” aka using logins leaked in other breaches, hackers accessed around 591,000 accounts. No financial info was accessed.

- Truist Bank (June): Hacking group Sp1d3r stole information about 65,000 employees and posted it for sale online.

- Tile (June): Life360, the company behind Tile tracker devices, reported a breach that included names, addresses, email addresses, phone numbers and device identification numbers.

- Ticketmaster (June): This one impacted 560 million customers; data included names, addresses, phone numbers, email addresses, order history and partial payment info.

- Dropbox (May): Attackers accessed Dropbox Sign’s development environment, compromising customer information.

- TeamViewer (July): Employee directory data, including names and encrypted passwords, was exposed.

Locked down

You can’t stop a hacker from breaching a major company, but you can protect yourself from the fallout.

HOW TO SCORE CHEAP STUFF (TO KEEP OR RESELL)

Double-check all healthcare communications. If you receive an explanation of benefits (EOB) or a bill for services you didn’t receive, contact your health care provider and insurance company ASAP. It likely means someone is using your benefits for their own healthcare.

Treat email requests with caution. Be skeptical of anything that seems super urgent. It’s OK to slow down for safety. My rule of thumb: If it’s a strange written request, like a text or email, I make a phone call.

Be wary of “old friends” who appear out of nowhere. It could be a hacker who happens to have a little (stolen) info. Take time to confirm they are who they say they are.

Make a list of exposed data. Keep this digitally or just on a Post-it. Be suspicious of anyone who references it in an email or phone call. Say the company you financed your car through was hacked. Alarm bells should raise if you get a call out of the blue that there’s a major issue with your loan.

(ISSOUF SANOGO/AFP via Getty Images)

Update your PIN and banking login credentials. Even if they weren’t involved directly in the breach, hackers can use your personal info to access it. Keep an eye on your bank and credit card statements for anything out of the ordinary. Set up banking alerts on your phone while you’re at it.

Freeze your credit. This will keep scammers from opening a credit card or loan in your name. Like setting up a fraud alert, you’ll need to contact each of the three credit bureaus.

Get tech-smarter on your schedule

Award-winning host Kim Komando is your secret weapon for navigating tech.

Copyright 2024, WestStar Multimedia Entertainment. All rights reserved.

Technology

Graphic artists in China push back on AI and its averaging effect

Chinese graphic artists are rapidly experiencing the impact of image generators on their day-to-day work: the technology enables copycats and profoundly shifts clients’ perception of their work, specifically in terms of how much that work costs and how much time it takes to produce. Freelance artists or designers working in industries with clients that invest in stylized, eye-catching graphics, like advertising, are particularly at risk.

Long before AI image generators became popular, graphic designers at major tech companies and in-house designers for large corporate clients were often instructed by managers to crib aesthetics from competitors or from social media, according to one employee at a major online shopping platform in China, who asked to remain anonymous for fear of retaliation from their employer.

Where a human would need to understand and reverse engineer a distinctive style to recreate it, AI image generators simply create randomized mutations of it. Often, the results will look like obvious copies and include errors, but other graphic designers can then edit them into a final product.

“I think it’d be easier to replace me if I didn’t embrace [AI],” the shopping platform employee says. Early on, as tools like Stable Diffusion and Midjourney became more popular, their colleagues who spoke English well were selected to study AI image generators to increase in-house expertise on how to write successful prompts and identify what types of tasks AI was useful for. Ultimately, it was useful for copying styles from popular artists that, in the past, would take more time to study.

“I think it forces both designers and clients to rethink the value of designers,” Jia says. “Is it just about producing a design? Or is it about consultation, creativity, strategy, direction, and aesthetic?”

“You might get a good result, but there will inevitably be dozens or even hundreds of poor ones … Personally, I see [AI image generators] as more of a toy than a tool.”

At ad agencies, for example, graphic designers work on comprehensive strategies for campaigns, aiming to create iconic, recognizable visual identities across a variety of formats. As such, AI image generators are less useful because they don’t produce anything particularly unique, according to Erbing, a graphic designer in Beijing who has worked with several ad agencies and asked to be called by his nickname.

“Each project faces different problems, and designers are there to solve specific problems, not to create identical visuals,” he says. “Sometimes, the process of thinking through a project takes longer than actually creating the visuals.”

When faced with more complex tasks, AI’s utility dwindles. Image generators are capable of creating many images, but that does not replace the work of understanding what an ad campaign needs to establish a visual identity and communicate what it is the client is selling and why people should buy it. Then, translating those concepts to the AI productively is its own challenge. Among graphic designers in China, there’s a joke that using an AI image generator is like gacha, referring to addictive games where users spend money to receive randomized items and find out what they won.

“You might get a good result, but there will inevitably be dozens or even hundreds of poor ones,” Erbing says. “Personally, I see [AI image generators] as more of a toy than a tool.”

Across the board, though, artists and designers say that AI hype has negatively impacted clients’ view of their work’s value. Now, clients expect a graphic designer to produce work on a shorter timeframe and for less money, which also has its own averaging impact, lowering the ceiling for what designers can deliver. As clients lower budgets and squish timelines, the quality of the designers’ output decreases.

“There is now a significant misperception about the workload of designers,” Erbing says. “Some clients think that since AI must have improved efficiency, they can halve their budget.”

But this perception runs contrary to what designers spend the majority of their time doing, which is not necessarily just making any image, Erbing says.

Erbing, like other designers, hopes AI image generators can become more useful to graphic designers in the future, and notes that people’s perception of their usefulness outpaces their actual application. In the meanwhile, it is twisting the clients’ view of the usefulness of the artists themselves.

Technology

Effortless golf with AI smart caddie that follows you

NEWYou can now listen to Fox News articles!

If you’ve ever found yourself juggling clubs, bags and gear while trying to keep your focus on your golf game, the Robera Neo might just be the solution you didn’t know you needed.

This AI-powered smart caddie is designed to follow you around the course, carrying your clubs effortlessly and freeing you up to concentrate on your swing. It’s not just another electric cart; it’s a great blend of technology that learns your movements, navigates the course and even offers swing analysis if you opt for the premium model.

Sign up for my FREE CyberGuy Report

Get my best tech tips, urgent security alerts and exclusive deals delivered straight to your inbox. Plus, you’ll get instant access to my Ultimate Scam Survival Guide — free when you join.

AI TENNIS ROBOT COACH BRINGS PROFESSIONAL TRAINING TO PLAYERS

Robera Neo AI-powered smart caddie (Robera)

What makes the Robera Neo different from other golf caddies?

The Robera Neo stands out because it doesn’t require you to steer it or use a remote control. Thanks to its advanced time-of-flight camera and artificial intelligence, it recognizes you and follows you automatically. This means no more fumbling with controls or worrying about obstacles like trees or bunkers.

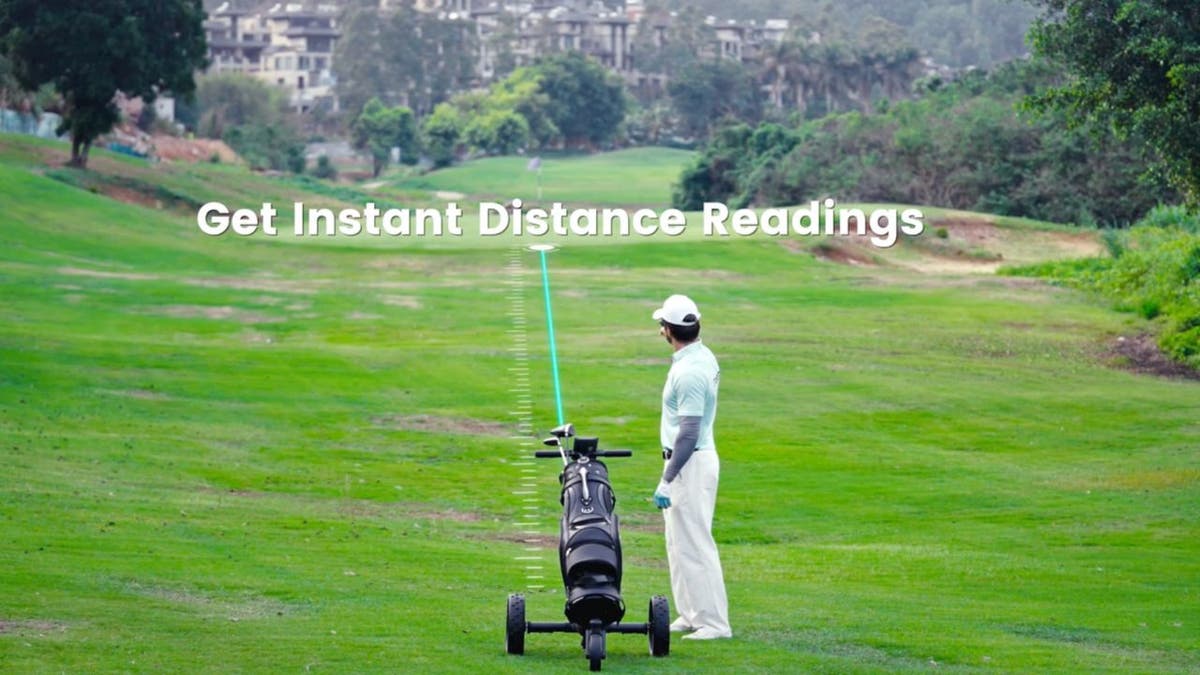

The Neo uses GPS to map out the course, so it knows the best path to take, saving you time and energy as you move from hole to hole.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Robera Neo AI-powered smart caddie (Robera)

AI TENNIS ROBOT COACH OFFERS PRO-LEVEL TRAINING ANYTIME, ANYWHERE

How does gesture control and smart navigation work?

One of the coolest things about the Neo is how naturally it responds to you. A simple wave of your hand tells it to start following or to stop, so you don’t have to break your focus or reach for a remote. It’s like having a caddie who just gets you.

Plus, with multi-frequency GPS, the Neo can access thousands of course maps and navigate with ease. You can even tell it where to go by tapping on your phone or using voice commands, and it will get there ahead of you, ready with your clubs in tow.

Robera Neo AI-powered smart caddie (Robera)

ROBOTS STEP INTO THE RING FOR THE FIRST-EVER BOXING MATCH

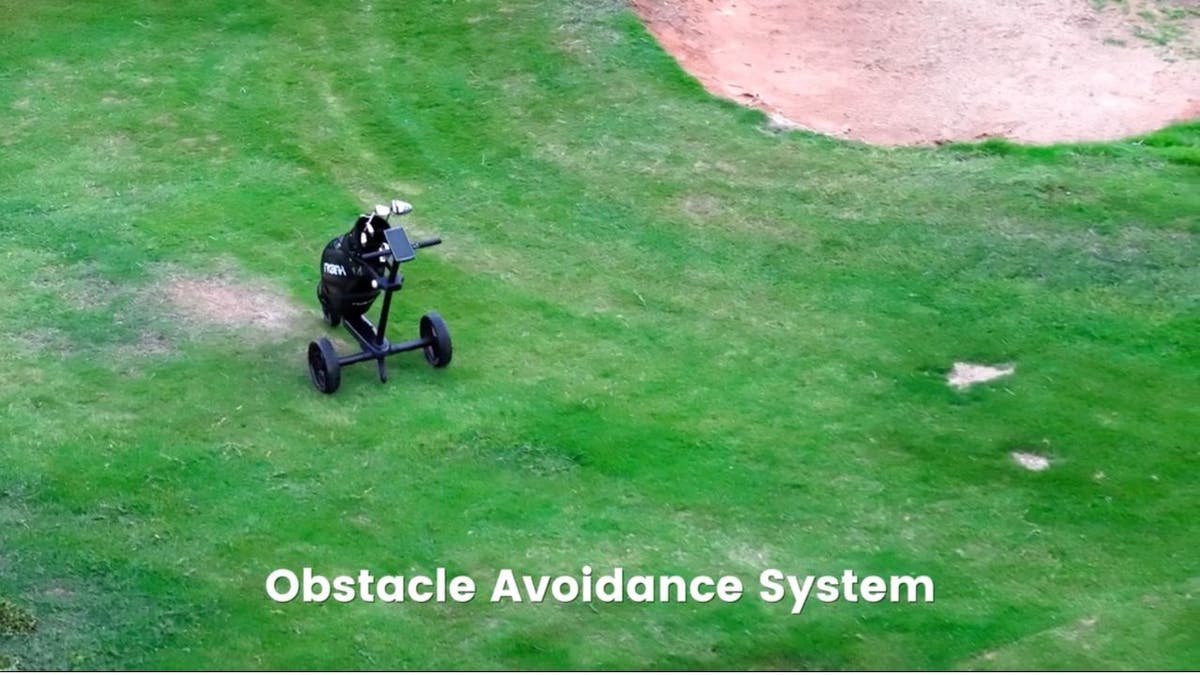

Avoiding obstacles and planning efficient routes

The Neo doesn’t just blindly follow you. It’s smart enough to spot obstacles and plan around them. Whether it’s a tree, a bunker or a water hazard, the caddie charts a safe and efficient path. After you hit your ball, you mark its new location on the GPS map, and the Neo calculates the best way to get to you. This smart routing can save up to a third of the battery’s power, so you can keep playing without worrying about running out of juice.

HOW TO LOWER YOUR CAR INSURANCE COSTS IN 2025

Robera Neo AI-powered smart caddie (Robera)

NEW MOBILE ROBOT HELPS SENIORS WALK SAFELY AND PREVENT FALLS

Remote summon and handling tough terrain

Ever lost sight of your cart? With the Robera Neo, you can summon it from up to 328 feet away. It will navigate tricky terrain and come find you with no problem. And if your course has hills, the Neo can handle slopes of up to 25 degrees, so it won’t leave you hanging when the going gets steep.

Robera Neo AI-powered smart caddie (Robera)

BEST EARLY AMAZON PRIME DAY 2025 DEALS

Lightweight, durable and ready for any weather

The Neo is built to be lightweight and durable, making it easy to carry and tough enough for any weather conditions. Weighing in at under 33 pounds, it folds up for simple transport and storage. Its waterproof rating ensures that rain won’t slow you down, so you can keep playing no matter the weather.

Battery life is impressive; the standard model will last for about 27 holes, while the premium Tablet model can handle 36 holes or up to eight hours on a single charge. When it’s time to recharge, fast charging gets you back on the course in about four and a half hours.

Robera Neo AI-powered smart caddie (Robera)

BEST MISTING FANS TO STAY COOL IN THE HEAT

Features for every type of golfer

If you just want a smart caddie that follows you and navigates the course, the Robera Neo Vision model has you covered, complete with a handy app for real-time updates and notifications. For those who want a little extra, the Neo Tablet model adds a bright touchscreen and a built-in camera that analyzes your swing, giving you instant feedback to help improve your game as you play.

Robera Neo AI-powered smart caddie (Robera)

HOW TO KEEP YOUR DOG SAFE AND COOL IN HOT WEATHER

Solutions for golf courses and commercial use

Golf courses can benefit from the Neo Drive version, which offers precise full-course navigation and a web-based management system. This lets operators monitor carts in real time, dispatch them remotely and set virtual boundaries to keep things running smoothly. It’s a smart way to manage fleets and enhance the overall player experience.

Robera Neo AI-powered smart caddie (Robera)

Pricing and availability

Both the Vision and Tablet models are available at about 40% off through a Kickstarter crowdfunding campaign, priced at $1,799 and $2,399, respectively. Each package includes the caddie, battery, charger and app access, and they come with a two-year manufacturer’s warranty. If all goes as planned, shipping will start in July 2025.

SUBSCRIBE TO KURT’S YOUTUBE CHANNEL FOR QUICK VIDEO TIPS ON HOW TO WORK ALL OF YOUR TECH DEVICES

Robera Neo AI-powered smart caddie (Robera)

Kurt’s key takeaways

The Robera Neo blends smart technology and practical design to create a golf caddie that truly makes your game easier and more enjoyable. Whether you’re a casual player who wants to ditch the heavy lifting or a serious golfer looking for real-time swing feedback and intelligent navigation, the Neo offers features that fit a wide range of needs. While backing a crowdfunding project always involves some risk, the positive response so far suggests this could be a reliable addition to your golf gear. If you’re ready to focus on your game and let your caddy do the heavy work, the Robera Neo is ready to follow you every step of the way.

Are you ready to let cutting-edge AI take the weight off your shoulders, or do you prefer sticking with the traditional way of carrying your clubs? Let us know by writing us at Cyberguy.com/Contact

For more of my tech tips and security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter

Ask Kurt a question or let us know what stories you’d like us to cover

Follow Kurt on his social channels

Answers to the most asked CyberGuy questions:

New from Kurt:

Copyright 2025 CyberGuy.com. All rights reserved.

Technology

Microsoft’s Xbox PC launcher gets going with Steam, Epic, and other games showing up

Microsoft announced earlier this week that it would start testing its new aggregated gaming library on the Xbox app for Windows, and it’s now starting to show up for testers today. This new library experience lists Steam, Battle.net, Ubisoft, Epic Games Store, and Riot Games titles that are all installed on a PC from various other launchers — much like GOG Galaxy.

I’ve been trying out the experience today and found that Microsoft automatically detects installed games and lists them in your library in the Xbox app, along with a relevant thumbnail or icon, and the name of the launcher where the game was installed from. While the thumbnails could do with some work in this beta app, you’ll get an option to play the game or see it in the relevant launcher. You can also hide games from these different PC stores if you don’t want to see them listed in the Xbox app.

This integration simply lists the games and you won’t get Xbox achievements or any additional functionality in these titles. The consolidated library is part of Microsoft’s effort to make the Xbox app on Windows the home of PC gaming, and to improve the handheld experience of Windows.

Speaking of Microsoft’s work to improve the Windows handheld experience, I’ve had multiple people tip me this week that the “Xbox full-screen experience” settings have randomly appeared on their existing ROG Ally devices. While the settings have appeared, the experience isn’t live yet and nothing happens if you try to enable it.

Microsoft confirmed to The Verge earlier this month that existing devices like the ROG Ally will get this full-screen Xbox experience at some point soon, and it looks like the company is already starting to test that on some devices. I’m confident this is a bug showing the settings, as the new ROG Xbox Ally devices aren’t due until later this year and they’ll launch with this new experience first.

If you’re interested in testing the new consolidated library you don’t need to wait until later this year. You just need to have the Xbox test app installed, which is as simple as downloading the Xbox Insider Hub on PC, joining the PC gaming preview in the app, and then updating the Xbox app in the Microsoft Store.

-

Arizona1 week ago

Arizona1 week agoSuspect in Arizona Rangers' death killed by Missouri troopers

-

Business1 week ago

Business1 week agoDriverless disruption: Tech titans gird for robotaxi wars with new factory and territories

-

Technology1 week ago

Technology1 week agoSenate passes GENIUS stablecoin bill in a win for the crypto industry

-

Business1 week ago

Business1 week agoProtesters are chasing federal agents out of L.A. County hotels: ‘A small victory’

-

Technology1 week ago

Technology1 week agoSpaceX Starship explodes again, this time on the ground

-

Technology7 days ago

Technology7 days agoMeta held talks to buy Thinking Machines, Perplexity, and Safe Superintelligence

-

Technology6 days ago

Technology6 days agoSamsung’s Galaxy Watch 7 has returned to its lowest-ever price

-

News1 week ago

News1 week agoVideo: Inside Trump’s Shifting Stance on Iran