San Francisco transportation officers need Waymo and Cruise to sluggish the growth of their robotaxi providers within the metropolis attributable to security considerations, as reported earlier by NBC Information. In two letters written to the California Public Utilities Fee (CPUC), the officers on San Francisco County’s Transportation Authority say the growth of both service “is unreasonable,” citing current incidents involving stopped driverless automobiles blocking site visitors and obstructing emergency responders.

Technology

San Francisco wants to slow robotaxi rollout over blocked traffic and false 911 calls

/cdn.vox-cdn.com/uploads/chorus_asset/file/24393819/1238159388.jpg)

The GM-backed Cruise and Alphabet-owned Waymo are at present the one firms permitted to supply driverless rides to passengers in San Francisco. In June, Cruise received a allow to cost for rides in its autonomous automobiles (AV) between 10PM and 6AM, whereas Waymo obtained a allow to supply absolutely driverless rides just a few months later. In contrast to Cruise, Waymo nonetheless can’t cost for driverless rides, because it’s nonetheless awaiting an extra allow from the CPUC.

Now that each firms have had their absolutely driverless automobiles on San Francisco streets for a number of months, we’re beginning to see the automobiles’ response — or lack thereof — to complicated site visitors conditions.

In July, a gaggle of driverless Cruise automobiles blocked site visitors for hours after the automobiles inexplicably stopped working, and the same incident occurred in September. In the meantime, a driverless Waymo automobile created a site visitors jam in San Francisco after it stopped in the course of an intersection earlier this month. The Nationwide Freeway Site visitors Security Administration opened an investigation into Cruise final December over considerations concerning the automobiles blocking site visitors and inflicting rear-end collisions with exhausting braking.

“A sequence of restricted deployments with incremental expansions — moderately than limitless authorizations — provide one of the best path towards public confidence in driving automation and business success in San Francisco and past,” the letter reads.

Firefighters say they may solely cease a Cruise automobile from working over the hose after “they shattered a entrance window” of the automotive

Nonetheless, metropolis officers additionally specific concern over the best way driverless automobiles cope with emergency automobiles. Final April, officers say an autonomous Cruise automobile stopped in a journey lane and “created an obstruction for a San Francisco Hearth Division automobile on its solution to a 3 alarm hearth.”

Months later, a Cruise AV “ran over a hearth home that was in use at an energetic hearth scene,” and one other Cruise automobile virtually did the identical at an energetic firefighting scene earlier this month. Firefighters say they may solely cease the automobile from working over the hose after “they shattered a entrance window” of the automotive. Different incidents contain Cruise calling 911 about “unresponsive” passengers on three separate events, just for emergency providers to reach and discover that the rider simply fell asleep.

“Cruise’s security file is publicly reported and consists of having pushed tens of millions of miles in a particularly complicated city atmosphere with zero life-threatening accidents or fatalities,” Cruise spokesperson Aaron Mclear tells The Verge.

Whereas the San Francisco Transportation Authority helps the growth of driverless expertise, it desires extra transparency and extra safeguards put in place. Officers say firms ought to be required to gather extra knowledge concerning the efficiency of the automobiles, together with how typically and the way lengthy their driverless automobiles block site visitors. It additionally desires to limit AV firms from working on San Francisco’s “downtown core streets” throughout peak journey hours till they show that they will constantly function “with out important interruption of road operations and transit providers.”

Even nonetheless, Cruise is seeking to function its paid robotaxi service in San Francisco 24 / 7. Whereas the corporate gained approval from the California Division of Motor Automobiles in December, it’s nonetheless ready for the inexperienced mild from CPUC. Each firms already provide rides in Phoenix, Arizona, and Cruise introduced its robotaxi service to Austin, Texas, too.

“These letters are a typical a part of the regulatory course of, and now we have lengthy appreciated a wholesome dialogue with metropolis officers and authorities companies in California,” Waymo spokesperson Katherine Barna says in an announcement to The Verge. “Waymo may have the chance to answer in our submission to the CPUC subsequent week.”

Technology

Senate passes GENIUS stablecoin bill in a win for the crypto industry

In a 68-30 vote on Tuesday evening, the Senate overwhelmingly passed the GENIUS Act with bipartisan support. Eighteen Democrats joined the majority of Republicans in passing the bill, which is the first to establish a federal regulatory framework for stablecoins, crypto tokens that are pegged to the value of the US dollar.

Its passage had not always been assured. Back in May, nine Democrats who’d previously supported the GENIUS Act suddenly reversed course, asking to revise the bill’s text, and days later, Senators Elizabeth Warren (D-MA) and Ron Wyden (D-WA) successfully killed an attempt to bring the bill to a floor vote by citing several current events involving the Trump family’s crypto ventures, including a controversial dinner for people holding large amounts of their memecoin $TRUMP.

Warren, the ranking member of the Senate Banking Committee and a longtime consumer protection hawk, ultimately voted against the final version of the GENIUS Act. During a June 11th floor speech, she stated that the bill did not have adequate regulatory guardrails in place to prevent corruption: “It would make Trump the regulator of his own financial company and, importantly, the regulator of his competitors.”

It’s a win, however, for the burgeoning digital assets industry, which has poured hundreds of millions into the political influence game in Washington, hiring political consultants and even a few Members of Congress on their behalf. In an interview prior to Tuesday’s vote, Seth Hertline, Head of Global Policy at the crypto wallet company Ledger, described the GENIUS Act as a political bellwether for the industry as a whole. “If the GENIUS Act derails, everything behind it derails,” he told The Verge.

Technology

Fake Venmo accounts are stealing donations from real charities

NEWYou can now listen to Fox News articles!

Apps like Venmo, Zelle, Cash App, and PayPal have changed how we move money. They are fast and convenient, but with that ease comes exposure. If you send funds to the wrong person, they are likely gone for good. There is often no real path to recovery, especially when the recipient disappears behind a fake username and an unresponsive support system.

This vulnerability becomes even more dangerous in moments of crisis. During natural disasters, high-profile social movements, or health emergencies, people are moved to give. Scammers know this and exploit the impulse. One such scam involved a fake Venmo account pretending to collect donations for a Minnesota nonprofit after the death of George Floyd. The account looked legitimate, but the funds never reached the organization.

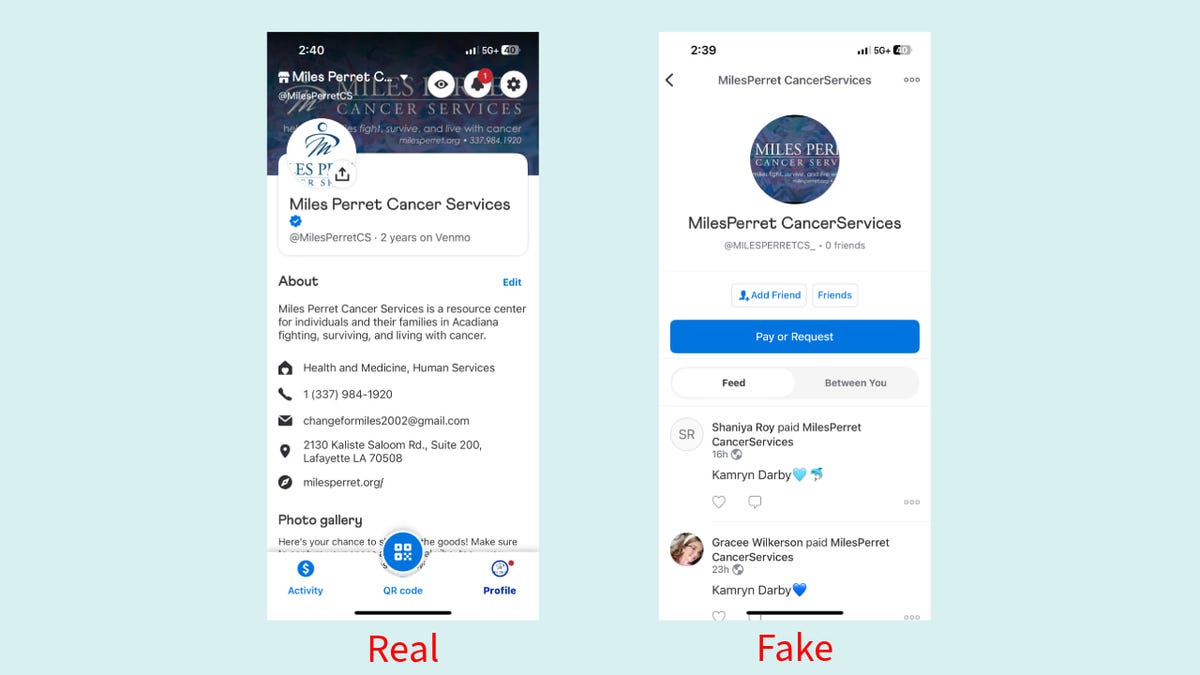

A similar scam is targeting Miles Perret Cancer Services, a nonprofit based in Louisiana. Scammers have created a fraudulent Venmo account that closely mimics the legitimate Venmo handle of the cancer nonprofit organization. They are using this fake account to trick well-meaning donors into sending money, believing they are supporting the real charity.

Sign up for my FREE CyberGuy Report

Get my best tech tips, urgent security alerts, and exclusive deals delivered straight to your inbox. Plus, you’ll get instant access to my Ultimate Scam Survival Guide free when you join.

Zelle and Venmo apps (Kurt “CyberGuy” Knutsson)

Fake Venmo account mimics real charity: How 1 character can fool you

Miles Perret Cancer Services (MPCS) provides support to families facing cancer diagnoses. They recently discovered that a fraudulent Venmo account is impersonating their official one. Their real handle is @milesperretcs. The scammer’s account uses @milesperretcs_, a nearly indistinguishable copy.

To the average person, the difference is invisible. That is precisely what makes it dangerous.

“We reported this account through the app more than 24 hours ago,” Timothy Rinaldi, executive director of MPCS, told Cyberguy. “There has been no follow-up from Venmo. We tried the live chat option, but it was abruptly closed with no resolution.”

Instead of helping, Venmo routed Rinaldi through generic FAQs and legal disclaimers. Even after he was connected with a live support agent, the responses were standard scripts. He was told that the issue had been escalated, but no one could provide a timeline beyond a vague window of three to five business days.

Real and fake Venmo accounts (Kurt “CyberGuy” Knutsson)

FBI WARNS OF SCAM TARGETING VICTIMS WITH FAKE HOSPITALS AND POLICE

Charity scams on Venmo: How scammers trick donors using fake accounts

Fake Venmo accounts have been used in recent years to exploit donation drives for hurricane relief, animal shelters, medical funds, and other causes. The formula is simple. Take a known nonprofit, tweak the username slightly, and ride the momentum of goodwill. By the time anyone catches on, the money is gone and the damage is done.

The incident involving MPCS is not an isolated case. In December 2024, Final Victory Animal Rescue, a nonprofit based in South Carolina, discovered a Venmo account impersonating the organization and collecting donations intended for the real charity. The group’s general manager, Michael Sniezek, confirmed the account had been receiving funds from unsuspecting donors before the issue was flagged.

In another case, Alone No More Dog Rescue, a Phoenix-based nonprofit, posted on Facebook that fraudulent Venmo accounts had been targeting its past donors, sending them payment requests and soliciting additional funds under false pretenses.

MPCS has filed a report with the Federal Trade Commission, but there is no guarantee of quick resolution. The fraudulent account remains active as of press time. It is unclear how much has already been lost or whether Venmo will recover and return any of it.

A hacker at work (Kurt “CyberGuy” Knutsson)

THIS IS WHAT YOU ARE DOING WRONG WHEN SCAMMERS CALL

Venmo confirms fake accounts were removed and shares how to stay safe

Venmo confirmed that the imposter accounts were removed promptly after being reported. They recommend reporting suspicious activity directly within the Venmo app and contacting customer support for further assistance.

To help users avoid future scams, Venmo encourages everyone to review its official security tips on how to recognize impersonation attempts and learn how to spot and avoid charity-related scams.

They also shared the following tips to help users verify real Venmo profiles and stay safe when sending money:

- Double-check the Venmo username (handle): Look closely for misspellings, extra characters or attempts at impersonation.

- Use Venmo QR codes: Scan QR codes directly from the Venmo app to ensure you’re sending money to the right person.

- Donate only to verified Venmo charity accounts: These are vetted and marked with verification badges. You can find them here.

Heed Venmo’s automatic warnings: If Venmo flags a payment as suspicious, pause and verify before sending money. These alerts are designed to protect you from scams.

How to avoid Venmo scams: 11 expert tips to protect your money

Scammers aren’t just targeting charities. They’re after anyone and everyone. Here are a few ways to protect yourself and keep your hard-earned money safe.

1) Always access the payment app from the official app or website, and not from any third-party platforms or services.

2) Look at the security settings that the payment app offers and make sure they’re all set to the highest and most protective settings.

3) Consider using a personal data removal service to protect your privacy and reduce your risk of scams. Scammers who target payment apps like Venmo, Zelle, Cash App, and PayPal often rely on information found on data broker and people-search sites to craft convincing impersonations or phishing attempts. These sites can list your name, address, phone number, and even connections to organizations you support, making it easier for fraudsters to trick you or others into sending money to fake accounts.

Personal data removal services work by automatically removing your information from hundreds of data broker sites, making it much harder for scammers to find and misuse your details. By scrubbing your data from these sources, you lower your risk of being targeted in payment app scams and reduce the likelihood that someone could impersonate you or a nonprofit you care about. Check out my top picks for data removal services here.

Get a free scan to find out if your personal information is already out on the web

4) Create a strong, unique and complex password for each of your mobile payment apps and change it often. Consider using a password manager to generate and store complex passwords. Get more details about my best expert-reviewed password managers of 2025 here.

5) Enable two-factor authentication, which means that you need to enter a code or use your fingerprint or face to unlock your account to prevent unauthorized access. This way, even if someone knows your password, they can’t log in without your device or confirmation.

6) Lock your device and log out of your apps. You should always lock your phone with a password, PIN, pattern, fingerprint, or face. Never share your password, PIN, or security code with anyone. You should also log out of your mobile payment apps after each use and turn off the auto-login feature. This way, even if someone takes or borrows your device, they can’t access your mobile payment apps without your approval.

7) Verify the identity and legitimacy of the sender or receiver. You should always check the name, photo, username, and contact information of the person or organization you are sending money to or receiving money from before accepting or sending any payment requests. You should also confirm the reason and amount of the transaction before you agree to it. If you are not sure or have any doubts, you should contact the person or organization directly through another way, such as a phone call, text message, or email, but only if you know for sure that those forms of communication are legitimate. You should never send money or give your account details to anyone you don’t know or trust, or anyone who asks you to do so out of the blue.

8) Link your Venmo to a credit card as opposed to a debit card, so you can dispute a charge from scammers more easily. However, keep in mind, linking a credit card to your payment app can provide additional protection in the event of fraud, but this can come with extra costs in terms of transaction fees.

9) Try not to keep a balance in your money-transferring apps. You have a much better chance of being helped by your bank or credit card company when it comes to fraud than you do from a money-transferring app.

10) Use strong antivirus software and never click on links from unknown sources, especially when an email or text appears to have come from the payment App. Protect yourself from accidentally clicking on malicious links by running antivirus software on your device.

The best way to safeguard yourself from malicious links that install malware, potentially accessing your private information, is to have antivirus software installed on all your devices. This protection can also alert you to phishing emails and ransomware scams, keeping your personal information and digital assets safe. Get my picks for the best 2025 antivirus protection winners for your Windows, Mac, Android and iOS devices.

11) Monitor your account activity and report any suspicious or unauthorized transactions. You should set up notifications from your payment app and your bank via text or email, and check your account activity regularly. Look for any signs of fraud, such as payments you didn’t make or receive, or changes to your account settings or information.

Kurt’s key takeaway

Unlike traditional banks, which are bound by federal consumer protection laws and fraud resolution timelines, peer-to-peer payment apps operate in a much looser regulatory environment. Services like Venmo often state in their user agreements that they are not responsible for mistaken or unauthorized payments unless there is clear evidence of account compromise or technical malfunction. Venmo’s only suggestion here was to respond to a support ticket and wait. There was no emergency fraud hotline, no dedicated contact for nonprofits, and no indication that urgent action would be taken. Payment apps that allow donations to flow as quickly as a text message must also bear the responsibility of keeping those transactions safe. When a nonprofit has to beg for support just to protect its own identity, something is broken.

Should payment platforms be held responsible for losses caused by impersonation scams? Let us know by writing to us at Cyberguy.com/Contact.

For more of my tech tips and security alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a question or let us know what stories you’d like us to cover.

Follow Kurt on his social channels:

Answers to the most-asked CyberGuy questions:

New from Kurt:

Copyright 2025 CyberGuy.com. All rights reserved.

Technology

OpenAI awarded $200 million US defense contract

OpenAI is officially on the Pentagon’s payroll. The Department of Defence announced a $200 million contract with OpenAI to provide the US government with new artificial intelligence tools, including those used for proactive cyber defense.

In a post outlining its latest contracts, the DoD said that OpenAI “will develop prototype frontier AI capabilities to address critical national security challenges in both warfighting and enterprise domains.” The work will primarily be completed in the Washington, DC region with an estimated completion date of July 2026.

OpenAI said in a new blog post that the DoD contract is its first partnership under a new initiative to provide its AI technology to workers across federal, state, and local governments. The company is offering custom models for national security on “a limited basis,” according to the announcement, with OpenAI saying that all use cases must comply with its policies and guidelines. OpenAI’s current usage policy bans its services from being used to “develop or use weapons” and “injure others or destroy property.”

“This contract, with a $200 million ceiling, will bring OpenAI’s industry-leading expertise to help the Defense Department identify and prototype how frontier AI can transform its administrative operations, from improving how service members and their families get health care, to streamlining how they look at program and acquisition data, to supporting proactive cyber defense,” OpenAI said.

This isn’t the first time OpenAI has bedded down with the military, having entered a partnership with Anduril Industries in December 2024 to integrate its AI software into the defense tech company’s counterdrone systems. The new one-year DoD contract is antithetical to earlier versions of OpenAI’s terms of service that banned its technology from being used for “military and warfare” — a prohibition removed by the company last year.

-

News1 week ago

News1 week agoA former police chief who escaped from an Arkansas prison is captured

-

Technology1 week ago

Technology1 week agoXbox console games are suddenly showing up inside the Xbox PC app

-

Politics1 week ago

Politics1 week agoVideo: Why the U.S. Brought Back Kilmar Abrego Garcia

-

Technology1 week ago

Technology1 week agoMassive DMV phishing scam tricks drivers with fake texts

-

World1 week ago

World1 week agoColombia’s would-be presidential candidate shot at Bogota rally

-

Nebraska1 week ago

Nebraska1 week agoNebraska makes top five for elite class of 2026 offensive tackle

-

Politics1 week ago

Politics1 week agoNational Guard to be deployed in Los Angeles County as anti-ICE protests rage: border czar Tom Homan

-

World1 week ago

Russia continues to accuse Ukraine of delaying planned exchange of dead fighters