Latest knowledge exhibits that Kentucky’s Unemployment Insurance coverage Belief Fund is getting into into 2023 in a stronger place than in earlier years, due to laws handed by the Basic Meeting and championed by the Kentucky Chamber. As well as, UI tax contributions paid by employers will stay on the state’s most favorable charge schedule in 2023 as an alternative of accelerating.

In accordance with U.S. Treasury knowledge, Kentucky closed out quarter three of 2022 with greater than $700 million within the Fund. All advantages paid out to unemployment claimants in Kentucky derive from the UI Belief Fund, which is funded by taxes paid by Kentucky employers and enterprise homeowners.

The present energy of the UI Belief Fund is necessary given Kentucky’s lengthy historical past of insolvency. The federal authorities releases annual reviews highlighting the solvency ranges of belief funds throughout all 50 states. Federally-designated solvency relies on the power of a state’s belief fund to pay out advantages to unemployment claimants throughout recessions. Kentucky’s UI Belief Fund has not met federally-designated solvency ranges since 1974. The one different state to have skilled insolvency for an extended time period is Pennsylvania, which final reached solvency in 1971. Some states within the southeast area – like Georgia, North Carolina, and Florida – have been thought-about solvent as lately as 2019.

An bancrupt belief fund will increase the chance of a state needing to request federal help throughout recessions. Usually, when a state’s belief fund is depleted, that state has to request a mortgage from the federal authorities known as a Title XII advance. These advances, whereas essential to proceed offering advantages, may be expensive. They’re repaid by states with curiosity (typically) and may result in increased tax charges for employers within the state. Throughout the peak of the COVID-19 pandemic in 2020, Kentucky’s UI Belief Fund was depleted, operating down a stability of greater than $600 million, which employers had constructed up by means of a number of years of elevated tax charges and contributions. Kentucky was one among a number of states that obtained a Title XII advance to proceed paying out advantages.

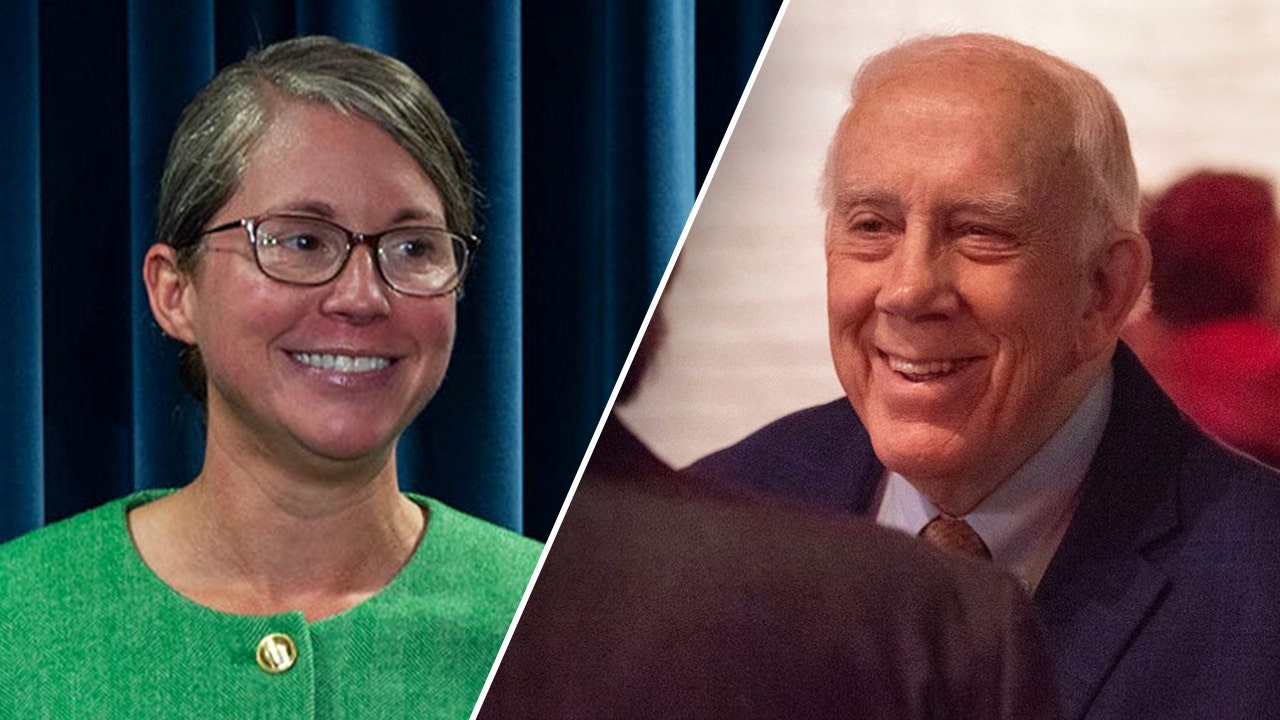

On account of laws championed by Kentucky State Consultant Russell Webber in 2021 and 2022, the Basic Meeting appropriated parts of the state’s federal reduction {dollars} to replenish the UI Belief Fund and stored employer contribution charges at aggressive ranges. These appropriations, mixed with common contributions made by employers, have helped the UI Belief Fund attain its present stability.

A powerful belief fund stability not solely prepares a state to climate a recession and reduces the chance of a state needing to request a federal mortgage but additionally retains employer UI tax charges aggressive with different states. Belief fund well being is without doubt one of the key components in figuring out an employer’s UI tax contribution charge in Kentucky.

On the entire, Kentucky’s common employer contributions charges in 2021 have been barely decrease than the nation as an entire – $236 per coated worker vs. $295 respectively – however increased than neighboring states like Indiana ($187), Tennessee ($78), Missouri ($143), and Virginia ($113). Different measurements of common employer contribution charges present Kentucky nearer according to nationwide charges but nonetheless increased than most neighboring states. Analysis organizations just like the Tax Basis have thought-about Kentucky’s general unemployment insurance coverage tax construction to be one of many least aggressive within the nation. Nonetheless, Kentucky’s present Belief Fund stability will guarantee employers will proceed paying UI taxes beneath the state’s best charge schedule in 2023. Had the Belief Fund been at a decrease stage on the finish of quarter three of 2022, employers might have confronted a charge improve of $75 per coated worker on common, totaling $128 million.

“Sustaining aggressive UI tax charges is necessary to the state’s broader financial competitiveness,” stated Kentucky Chamber Middle for Coverage and Analysis Government Director Charles Aull. “An organization’s UI tax burden is one among quite a few components that form employer location or funding selections and contributes to the broader price of doing enterprise in a state.”

Regardless of the energy of Kentucky’s Belief Fund heading into 2023, the state possible nonetheless has a methods to go earlier than reaching federal solvency minimums. Heading into 2022, Kentucky’s Belief Fund had lower than 1 / 4 of the funds it wanted to succeed in federal solvency minimums, and its solvency ranking was among the many backside half of states. Way more work stays to be achieved to enhance the general well being of Kentucky’s Belief Fund.

“To succeed in federally designated solvency ranges, Kentucky employers might want to construct on the present stability by persevering with to make constant tax contributions to the Belief Fund. As well as, broader reforms to advantages from Home Invoice 4 handed within the 2022 session will go a great distance in serving to to maintain prices beneath management by extra effectively supporting re-employment amongst claimants,” stated Aull. “These two components collectively will assist guarantee Kentucky has a powerful and sustainable Belief Fund that is able to assist staff throughout financial downturns whereas conserving prices aggressive for employers.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25761998/bg33.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)