Rhode Island

Rhode Island’s women’s basketball team rolls over Stonehill; how did the new players do?

URI women’s basketball coach Tammi Reiss speaks after the Rams’ win

The Rhode Island women’s basketball team opens the season with a 68-45 win over Stonehill on Monday night.

SOUTH KINGSTOWN — This first meeting between the University of Rhode Island women and Stonehill went about how you might expect.

The Rams played in the Atlantic 10 tournament championship game last season. The Skyhawks won just four times and are entering only their third year in Division I.

The result on this Monday night at the Ryan Center was a predictable one. URI muscled its way to a 68-45 victory, with a reworked rotation smothering the visitors at the defensive end and on the glass.

“Pretty pleased with how we executed,” URI coach Tammi Reiss said. “Really asked the team to come out and just play hard. Let the game come to them. And they did that.”

Stonehill shot just 33.3% from the field, including 2-for-18 from beyond the arc. The Skyhawks committed 25 turnovers and put only two players in double figures. Portsmouth native Kylie Swider and Brooke Paquette each hit for 15 points — their teammates went a combined 5-for-28 from the floor.

“Everyone wants to play offense,” Reiss said. “When that’s not flowing, will you do the other things? Tonight that’s what they did — and that’s who they are.”

The Rams were led by a nice debut from San Diego transfer Harsimran Kaur. She finished with a game-high 19 points and 11 rebounds in 26 minutes. Kaur needed just this opening night to equal her one start with the Torreros last season. She came up a field goal shy of her career-high 21 points in a March game against Pepperdine.

“This team, these girls, just make it easy for me to jump in and lead,” Kaur said. “I would give all the credit to my team and my coaches. They let me be comfortable in my own skin.”

Kaur claimed an immediate role after the departures of frontcourt regulars Mayé Touré (Utah) and Tenin Magassa (Oklahoma State). Hawa Komara added 10 points and 13 boards while Anaelle Dutat chipped in four points and seven rebounds.

“Watching all the film on her and her capabilities, I knew that she could be a double-double,” Reiss said. “It was finding someone who could replace Mayé and have an impact for our team.”

How will URI generate some perimeter offense?

Sophia Vital’s 3-pointer with 4:51 left in the second quarter was the team’s first field goal outside the paint. The Rams were just 4-for-17 from deep and didn’t make a free throw until Sophie Phillips knocked down her second of two with 3:24 to play in the first half.

“It really was just settling down,” Reiss said. “That first game is always a little tight — a lot of missed layups, a lot of miscues, getting the jitters out.”

Ines Debroise finished with eight points and seven assists against only one turnover in 24 minutes. She combined with Dutat and Komara to average just 10.3 points per game last season. They’ll need to produce before Palmire Mbu (NCAA requirements) is cleared after the season’s third game and freshman Ayanna Franks finds her way.

“My job is to be the point guard,” Debroise said. “Just get to know all of my teammates and know where I can put them in the best position to score.”

URI (1-0) put this one away late in the first half.

It was a 20-20 game after Swider knocked down a jumper along the right baseline with 6:01 to play in the second quarter. Stonehill (0-1) was on the wrong end of a 17-3 run over the rest of the half, with the Rams allowing just 1-for-8 shooting.

“They play hard for you,” Reiss said. “I told them the most important thing tonight was how hard we played.”

Franks collected a team-high three steals, one of eight URI players who notched at least one. Kaur racked up four blocked shots before halftime, nearly half of the 10 recorded by the Rams in the game.

bkoch@providencejournal.com

On X: @BillKoch25

Rhode Island

RI Lottery Powerball, Numbers Midday winning numbers for March 4, 2026

The Rhode Island Lottery offers multiple draw games for those aiming to win big.

Here’s a look at March 4, 2026, results for each game:

Winning Powerball numbers from March 4 drawing

07-14-42-47-56, Powerball: 06, Power Play: 4

Check Powerball payouts and previous drawings here.

Winning Numbers numbers from March 4 drawing

Midday: 2-7-4-4

Evening: 7-6-0-2

Check Numbers payouts and previous drawings here.

Winning Wild Money numbers from March 4 drawing

08-11-12-18-24, Extra: 15

Check Wild Money payouts and previous drawings here.

Winning Millionaire for Life numbers from March 4 drawing

12-13-36-39-58, Bonus: 03

Check Millionaire for Life payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your prize

- Prizes less than $600 can be claimed at any Rhode Island Lottery Retailer. Prizes of $600 and above must be claimed at Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920.

- Mega Millions and Powerball jackpot winners can decide on cash or annuity payment within 60 days after becoming entitled to the prize. The annuitized prize shall be paid in 30 graduated annual installments.

- Winners of the Millionaire for Life top prize of $1,000,000 a year for life and second prize of $100,000 a year for life can decide to collect the prize for a minimum of 20 years or take a lump sum cash payment.

When are the Rhode Island Lottery drawings held?

- Powerball: 10:59 p.m. ET on Monday, Wednesday, and Saturday.

- Mega Millions: 11:00 p.m. ET on Tuesday and Friday.

- Lucky for Life: 10:30 p.m. ET daily.

- Millionaire for Life: 11:15 p.m. ET daily.

- Numbers (Midday): 1:30 p.m. ET daily.

- Numbers (Evening): 7:29 p.m. ET daily.

- Wild Money: 7:29 p.m. ET on Tuesday, Thursday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Rhode Island editor. You can send feedback using this form.

Rhode Island

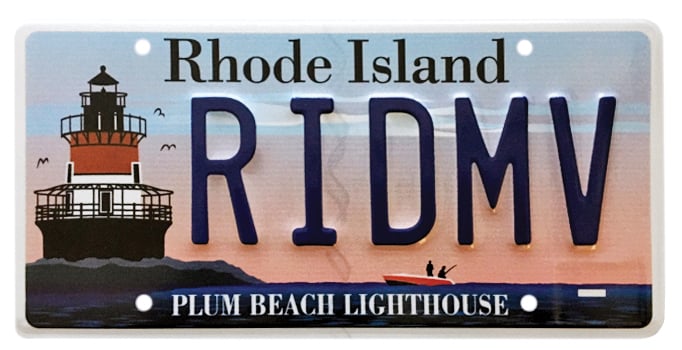

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

Rhode Island

Rhode Island AG to unveil long-awaited report on Diocese of Providence clergy abuse

PROVIDENCE, R.I. — Rhode Island Attorney General Peter Neronha will release on Wednesday findings from a multiyear investigation into child sexual abuse in the Diocese of Providence.

According to the attorney general’s office, the report will detail the diocese’s handling of clergy abuse over decades.

While the smallest state in the U.S., Rhode Island is home to the country’s largest Catholic population per capita, with nearly 40% of the state identifying as Catholic, according to the Pew Research Center.

Neronha first launched the investigation in 2019, nearly a year after a Pennsylvania grand jury report found more than 1,000 children had been abused by an estimated 300 priests in that state since the 1940s. The 2018 report is considered one of the broadest inquiries into child sexual abuse in U.S. history.

Neronha’s investigation involved entering into an agreement with the Diocese of Providence to gain access to all complaints and allegations of child sexual abuse by clergy dating back to 1950. Neronha’s office said in 2019 that the goal of the report was to determine how the diocese responded to past reports of child sexual abuse, identify any prosecutable cases, and ensure that no credibly accused clergy were in active ministry.

Rhode Island State Police also helped with the investigation.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin3 days ago

Wisconsin3 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks