Pennsylvania

Before Considering New School Vouchers, Josh Shapiro Should find Answers to Questions About The Old Ones

Earlier than opening up new vouchers, Josh Shapiro wants to look at the outdated ones.

Whereas Governor-elect Josh Shapiro considers opening up extra faculty vouchers in Pennsylvania, unanswered questions stay concerning the voucher program that Pennsylvania already has.

Pennsylvania has a pair of tax credit score scholarship applications, Instructional Enchancment Tax Credit (EITC) and Alternative Scholarship Tax Credit (OSTC). These applications permit contributors to pay cash into scholarship applications for personal and non secular faculties and credit score these contributions in opposition to their state tax invoice.

This system has been in place for over twenty years; greater than $2 billion has been spent on non-public faculty tuition scholarships, leaving a hefty gap in state revenues.

However that $2 billion has disappeared right into a black field, a program that has little transparency or accountability. A report from Training Voters of Pennsylvania lays out the questions which have gone unanswered.

Scholarship organizations quantity within the a whole lot in Pennsylvania, many related to only one faculty. They’re allowed to maintain 20% of the funds donated for scholarships, a beneficiant sum in comparison with most different states with comparable applications. In these states, the lower is between 5% and 10%; Florida permits solely 3%. There are not any rules or reporting necessities for these organizations concerning what they do what that 20% lower.

Pennsylvania’s tax credit score scholarships should not designed to serve solely low-income college students. The eligibility cut-off is family earnings of $99,676 plus $17,017 per youngster. This system could properly serve some variety of low-income college students, however no one is aware of, as a result of the state prohibits accumulating that data. Pennsylvania has no concept who, precisely, is being served by these applications.

Are these scholarships getting used to assist college students “escape” low-performing faculties to attend a personal faculty? No person is aware of. We do know that the scholarships can be utilized to fund tuition for college kids who have been already enrolled in a personal faculty, which means that there is no such thing as a discount in bills for public schools-just a discount in income.

An evaluation in 2019 discovered that in 151 faculties that ran their very own tax credit score scholarship group, 57 faculties enrolled no low-income college students in any respect.

Moreover, there is no such thing as a auditing requirement, so the state additionally has no concept if scholarships are being supplied to college students who don’t meet the earnings requirement. Nor are there any checks on facet offers by which folks might commerce contributions in return tuition cuts. Is it doable to make use of this method to launder a portion of your individual youngster’s tuition by passing it via a scholarship group and thereby getting a tax credit score from the state? In all probability, however no one is checking to see.

We have no idea what number of college students want the voucher funds with a view to afford non-public faculty. We have no idea what number of college students are denied scholarships due to a scarcity of program funds, nor what number of apply however don’t get the funds as a result of the college rejects the coed. That’s an actual risk, as non-public and non secular faculties accepting these funds are free to discriminate in opposition to college students for causes similar to intercourse, disabilities, sexual orientation, spiritual beliefs, socioeconomic standing, and gender id or expression.

We have no idea which districts the scholars come from, however we do know that the faculties that obtain funds are clustered primarily in six Pennsylvania counties (out of 67). And we all know that these faculties embrace a few of the most costly elite faculties within the state. The Training Voters report gives the instance of AIM Academy, which acquired $1.3 million in scholarship funds for 96 college students; that signifies that the scholars was funded by the state at $13.5 thousand per pupil, leading to a charge of funding greater than that of 97% of scholars attending public faculty.

As a result of the state doesn’t accumulate data on particular person recipients, we additionally do not know what academic outcomes are being achieved. Are scholarship recipients getting a greater schooling than they might have if that they had attended public faculty? We do not know.

Supporters of tax credit score scholarship applications argue that the state just isn’t funding this system as a result of the funds by no means touched the state’s fingers. As Kentucky’s Supreme Court docket simply discovered, that argument doesn’t maintain water. Taxpayers are taking over the tax legal responsibility of contributors and filling the hole both via elevated taxes or decreased providers.

In terms of Pennsylvania’s EITC/OSTC program, we don’t know who it serves, the place the cash goes, if the restricted guidelines are being noticed, or if taxpayers are getting any academic bang for his or her buck.

Says Training Voters Government Director Susan Spicka, “It could be wildly irresponsible for state lawmakers or Governor-elect Shapiro to entertain any conversations about increasing faculty vouchers with out first conducting an intensive examination of Pennsylvania’s present EITC/OSTC voucher applications.”

Contemplating Shapiro’s curiosity in voucher applications, Spicka provides, “The ONLY voucher dialogue in Harrisburg within the New Yr ought to be centered on analyzing Pennsylvania’s present EITC/OSTC voucher applications to find out if $2 billion in spending has produced any profit to the commonwealth over the previous 20 years.”

Pennsylvania

Concert held to benefit Pennsylvania Theatre of Performing Arts

Pennsylvania

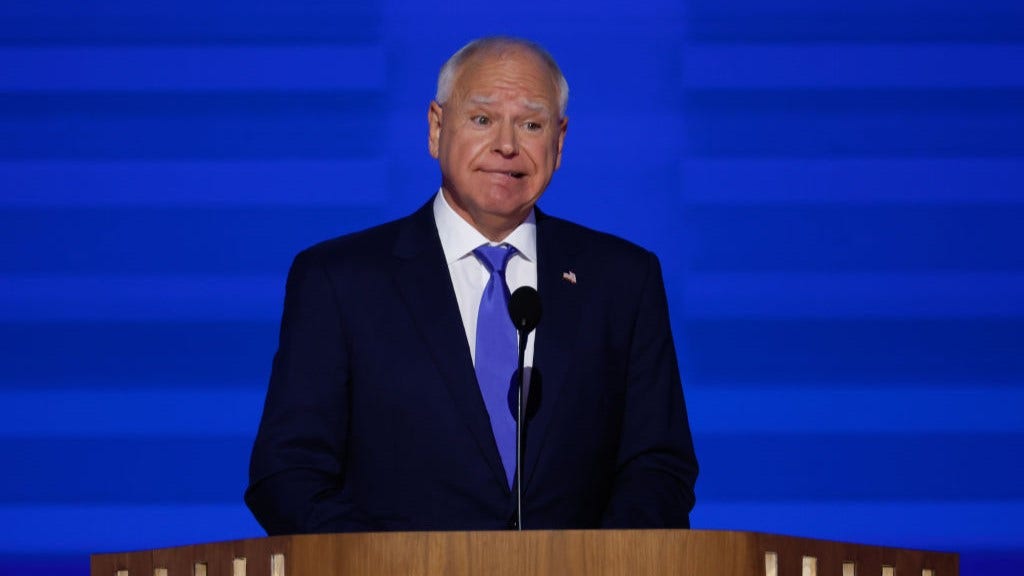

Trump to hold rally in Erie as Pennsylvania becomes key 2024 battleground

)

Of the seven competitive states that both Trump and Vice President Kamala Harris, his Democratic rival, have a realistic shot at winning, Pennsylvania is the most populous and awards the most votes in the Electoral College, which in turn is used to select the overall winner of the election.

read more

Donald Trump, the Republican presidential candidate is set to hold a rally in Pennsylvania today, his fourth campaign stop in the state this month. Erie, located in the northwest corner of Pennsylvania, will host the former president at 2 pm local time.

This rally comes one month after his running mate, US Senator JD Vance held a similar event in the same city. Trump has another rally scheduled in western Pennsylvania for October 5.

Pennsylvania has emerged as a crucial battleground state in the 2024 election, with many of Trump’s allies considering it the most important state to win. The state’s significance stems from its large population and the substantial number of electoral votes it awards, making it a critical factor in determining the overall winner of the election.

In fact, among the seven competitive states that both Trump and Vice President Kamala Harris have a realistic chance of winning, Pennsylvania stands out as the most populous and electorally valuable.

Trump allies broadly believe that if the former president beats Harris there, he is likely to return to the White House. But if Trump loses to Harris in Pennsylvania, the vice president has the inside track, in their opinion.

In a reflection of the stakes, Harris and Trump have spent hundreds of millions of dollars on ads in Pennsylvania in the months before the election, more than any other state in both gross and per capita terms.

Erie, the site of Trump’s rally, is a battleground inside a battleground. Erie County is one of two Pennsylvania counties that favored Trump in the 2016 election against Democratic candidate Hillary Clinton before favoring President Joe Biden against Trump in 2020.

Trump narrowly won the state and the election overall in 2016, before losing both in 2020.

This time around, Pennsylvania is again competitive, according to surveys. Harris leads Trump by 1.6 percentage points in the state, according to an average of polls maintained by polling and analysis website FiveThirtyEight. That difference is well within almost all polls’ margin of error.

Trump’s next rally in Pennsylvania, on Oct. 5, will take place in Butler, about 100 miles (160 km) south of Erie. That town was the site of a failed assassination attempt on Trump in July. A bullet grazed the former president’s ear.

With inputs from agencies.

Pennsylvania

JD Vance crisscrosses battleground Pennsylvania at a rally in Newtown, Bucks County

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

-

News1 week ago

News1 week agoVideo: Who Are the Black Swing Voters?

-

Politics1 week ago

Politics1 week agoDem lawmakers push bill to restore funding to UN agency with alleged ties to Hamas: 'So necessary'

-

News1 week ago

News1 week agoFour killed, dozens injured in Alabama shooting

-

News1 week ago

News1 week agoElection 2024 Polls: Florida

-

News1 week ago

News1 week agoMoney for cutting-edge climate technology could dry up in a second Trump term

-

World1 week ago

World1 week agoCritics slam landmark EU competitiveness report as 'one-sided'

-

Politics1 week ago

Politics1 week agoSecret Service protection bill passes House unanimously after Trump assassination attempts

-

/static.texastribune.org/media/files/5e5395400eb1f412fb6d97a439483caf/SpaceX%20Brownsville%20MGO%2005.jpeg)

/static.texastribune.org/media/files/5e5395400eb1f412fb6d97a439483caf/SpaceX%20Brownsville%20MGO%2005.jpeg) News1 week ago

News1 week agoCards Against Humanity says in new lawsuit that SpaceX has destroyed some of its South Texas property