New Hampshire

Business Tax Reduction Brings Out Partisan Divide in N.H. Senate – InDepthNH.org

By THOMAS P. CALDWELL, InDepthNH.org

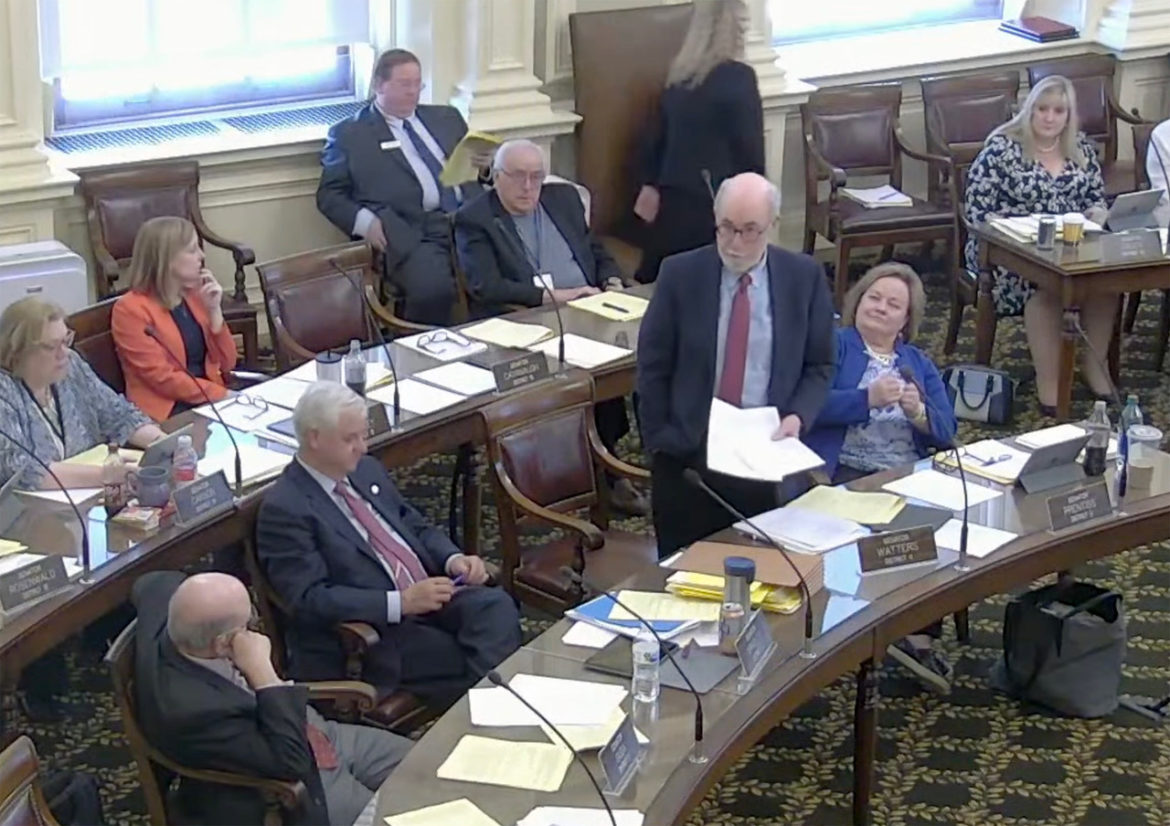

CONCORD — A invoice to cut back the Enterprise Earnings Tax price and ship cash to native communities prompted an prolonged dialogue on the ground of the state Senate on Thursday, with Republicans and Democrats sharing alternate views on why state revenues are doing so properly.

Home Invoice 1221 would decrease the enterprise income tax price from 7.6 % to 7.5 %, and the modification by Methods and Means would use the state’s surplus funds for a one-time contribution to municipalities equal to 7.5 % of their contributions to the state retirement fund.

Sen. Bob Giuda, R-Warren, chair of the Senate Methods and Means Committee, mentioned New Hampshire’s sound funds insurance policies have led to a state surplus of $252 million, regardless of actions in Washington, D.C., that he blamed for inflicting inflation and excessive gasoline costs, placing the nation on the sting of a recession.

“The modification clearly stipulates that it’s the intent of the legislature that it is a one-time appropriation of the state surplus funds to municipalities,” Giuda mentioned, “and its supposed use is the discount of native property taxes.”

Sen. Cindy Rosenwald, D-Nashua, mentioned that, whereas she helps the modification, it solely helps for one yr.

“It has a catchy title,” she mentioned: “the property tax aid act of 2022. … It is going to give a one-year infusion of money which may lead to barely decrease tax payments in December. It may additionally lead to really zero property tax aid as a result of there’s no requirement that the cash be used to decrease taxes.”

Rosenwald has lengthy fought to revive state help of the retirement fund that covers academics, police, and firefighters, saying cities and cities had been enticed to take part within the New Hampshire Retirement System with the promise that the state would supply a portion of the price. That was deserted in 2011, leaving municipalities to select up your entire value of retirement contributions.

The one-time cost, she mentioned, “shouldn’t be accountable fiscal coverage. Cities and cities want predictability and sustainability, not a minimize one yr and a tax hike the following yr.”

She famous that the late Rep. “Renny” Cushing, who served as Home Democrat Chief, had tried for years to revive state funding of the retirement fund.

“We have to decide to serving to property taxpayers on an ongoing foundation that’s predictable,” Rosenwald mentioned.

When others joined to reward Cushing’s persistence within the matter, Wolfeboro Republican Sen. Jeb Bradley stood to remark, “It’s at all times fascinating, when there’s criticism of what’s prone to be a 24-to-nothing vote … The place did this come from? It was Governor [John] Lynch’s funds that was proposed, what, 11 years in the past, that the retirement subsidy would not be paid to cities and cities. That’s the place it got here from. Now we have now heard about accountable fiscal coverage and the way one way or the other this isn’t accountable fiscal coverage.”

He mentioned Washington’s fiscal coverage has created a 40-year excessive inflation price.

“It’s created New Hampshire households struggling to pay residence heating prices, fill their gasoline tanks, put meals on their tables, and all the different inflationary issues,” Bradley mentioned. “A myriad of things have gone into that irresponsible fiscal coverage coming from our nation’s capital.”

Bradley mentioned that, if the state is producing the identical sorts of surpluses subsequent yr, “I’m going to be … advocating for extra of this property tax aid sooner or later, however doing it responsibly, when it’s reasonably priced.”

Sen. Tom Sherman, D-Rye, took Bradley to activity: “It’s nice that each one 24 of us are prone to vote in favor of this,” he mentioned. “What I marvel at is how we will have totally different variations of historical past and totally different variations of actuality amongst colleagues. I believe after we have a look at inflation, that half that my good friend from District 3 forgot is a man named Putin. Price of vitality, value of inflation, COVID provide chain, not all of it, I’m certain. However let’s not take issues in isolation.

“Large surplus?” he continued. “We’ve acquired over $2 billion in federal funding, due to our federal delegation, senators Hassan and Shaheen, Congressman Pappas, Congresswoman Kuster. However we’re right here in New Hampshire, within the State Home, and we have now a actuality that all of us share, that we have now to take care of. So right here we’re passing a everlasting discount to the enterprise income tax, largely benefitting out-of-state giant companies, and we’re passing a one-time doable profit to the property tax, which might profit the overwhelming majority of New Hampshire residents and the overwhelming majority of our companies. Perhaps we should always flip that. Perhaps we should always embrace Renny’s invoice.”

Giuda mentioned decreasing the enterprise income tax fulfills a promise legislators made to companies years in the past.

“As has been repeatedly demonstrated over the past six years that I’ve been on this physique, after we cut back taxes, state revenues improve, and so they proceed to extend, and so they elevated by means of the recession,” Giuda mentioned. “These surpluses got here from strong tax coverage and good enterprise practices as we set the atmosphere for companies to flourish. And I’m actually uninterested in listening to the criticism of multinational companies that present tens of hundreds of good-paying jobs and advantages, together with household medical go away, for many of their staff who reside in our state.”

Sen. David Watters, D-Dover, countered, “Let’s take into consideration what occurred right here within the final couple of years. We introduced $10.6 billion {dollars} into the state from federal sources. We introduced $6 billion into New Hampshire entities, private and non-private, and grant funding of $10.7 billion in payroll safety, particular person help, unemployment, and $7 billion within the state. That boosted our economic system as properly.”

Watters added, “I’ll say, Mr. President, that I used to be a bit shocked to see this invoice come by means of with language that actually I’m used to seeing on a political flier. Now I do know it’s 2022, I do know it’s an election yr, however often once I see this language, it’s in a flier and I’ve a spot, a recycling bin, to place these in.”

After all of the dialogue, the Senate handed each the modification and the invoice as amended, sending it on to the Finance Committee for ultimate motion.

Bradley mentioned after the vote, “The $28 million our municipalities will obtain beneath the Property Tax Aid Act can be utilized to defray public worker retirement prices which can create direct aid to taxpayers. We’re strongly encouraging native officers to make use of this one-time cash for tax aid as an alternative of elevated spending.”

New Hampshire

Why are the New Hampshire Ice Castles so blue?

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

New Hampshire

New Hampshire Ice Castles get unexpected boost from Mother Nature

NORTH WOODSTOCK, NH – The Ice Castles in North Woodstock, New Hampshire, are set to open this weekend, inviting visitors to enter a world of frosty enchantment.

Why are the Ice Castles blue?

With towering ice walls, sparkling tunnels and glowing sculptures, the Ice Castles are a true winter masterpiece. As crews put the finishing touches on the attraction ahead of Friday’s opening, this year marks one of the attraction’s earliest starts on record.

What makes New Hampshire’s Ice Castles unique is their distinct blue hue, a result of the pristine water sourced from nearby rivers. This natural element enhances the beauty of the castle, which gleams a cool blue under daylight. But it’s after dark when the castles truly transform, illuminated by thousands of LED lights embedded in the ice, creating a magical, glowing spectacle.

What does it take to build the Ice Castles?

Crafting this frozen wonder is no easy feat. The process begins as early as October, with a dedicated team of artists and builders meticulously constructing the castles by hand. They use millions of icicles grown and frozen on-site, working tirelessly to bring the vision to life.

“Mother Nature is 100% the main architect,” said Luke Ely, assistant manager for Ice Castles New Hampshire. “We pretty much do a dance with her the entire season to get what we have today.”

This year’s early-season cold weather provided an unexpected boost, allowing the team to get ahead of schedule for Friday’s opening.

Reflecting on the allure of ice, Ely added, “You don’t see it in this medium too much. Most of the time, winter is kind of like looked at as a harsh, negative, just-get-through-it kind of time time, and ice is the main factor in all that. And being able to do something with it that’s more beautiful and graceful, I thing, draws a lot folks.”

The Ice Castles in New Hampshire aim to remain open through April, weather permitting. Visitors are encouraged to experience this seasonal wonder before Mother Nature decides to reclaim her icy masterpiece.

New Hampshire

Two hospitalized after ambulance crashes in New Hampshire

Two people who were inside an ambulance had to be taken to the hospital when the emergency vehicle crashed Monday evening.

Firefighters responded to the crash on Old Candia Road just before 7:00 p.m.

First responders arrived to find that the driver of the ambulance was not responsive and another person inside the ambulance also needed medical treatment. Both were transported to the Elliot Hospital.

Candia firefighters say one occupant has been discharged from the emergency department while the other has been admitted to the hospital in stable condition.

An initial investigation determined the driver suffered a medical emergency while it was returning to the station, veered into the opposite lane of travel, hitting several small trees and a traffic sign before crashing into a water-filled ditch.

The ambulance passenger was able to exit the crashed vehicle and helped to treat the driver until additional medical units arrived on the scene.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics7 days ago

Politics7 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics6 days ago

Politics6 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics5 days ago

Politics5 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health4 days ago

Health4 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades