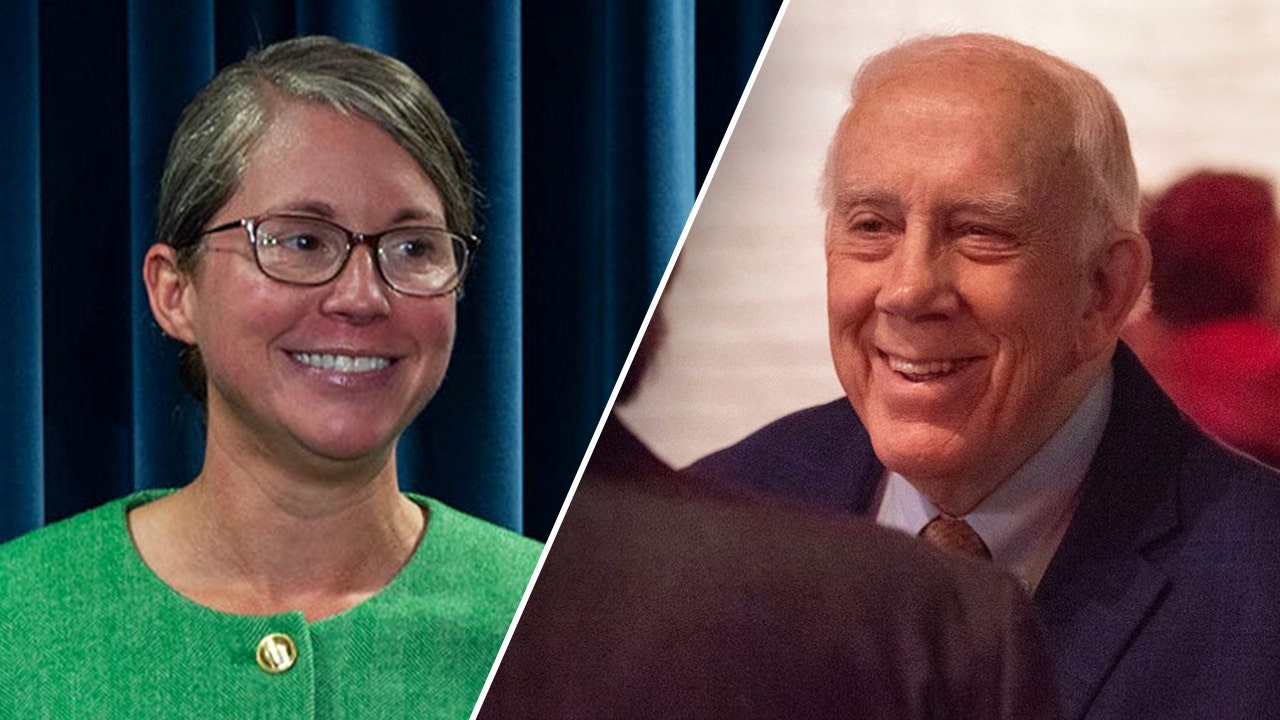

As 2022 involves a detailed, BizTimes Milwaukee managing editor Arthur Thomas caught up with Rose Oswald Poels, president and chief government officer of the Wisconsin Bankers Affiliation, to speak about how the state’s banks carried out this yr, and the outlook for 2023. The next dialog is edited for size and readability.

BizTimes: What sort of yr has 2022 been for Wisconsin banks?

Rose Oswald Poels: “Total, it has been a extremely good yr for the banking business. We proceed to make loads of loans, we’ve loads of liquidity, deposit balances are nonetheless excessive, they’ve been trickling off within the final couple of months, however for many of the yr they’ve remained at unusually excessive ranges, in order that simply signifies that banks have that rather more cash to lend out into their communities.

“As I discussed, we’re beginning to see just a little drop off in deposit balances. It’s gradual, actually not something drastic, however I believe as individuals are actually feeling the pinch of upper costs in meals prices, vitality prices, issues that actually hit our pocketbooks day by day, we’re seeing shoppers spending their extra financial savings to pay for some historically primary requirements.”

Does that work in each instructions? Individuals are preserving cash in financial savings as a result of there’s inflation, they usually know, ‘I’m in all probability going to want that cash,’ in order that they’re much less more likely to go spend it on discretionary issues. On the identical time, they begin consuming into their financial savings as a result of prices are going up.

Poels: “Yeah, I believe with the dramatic enhance in rates of interest and type of the affect that’s having on costs typically, the second half of this yr, we’ve seen shoppers be just a little extra cautious of their spending and utilizing their cash to pay for requirements. Bank card balances are going up, however that doesn’t imply they’re not nonetheless procuring. I believe retail numbers are nonetheless trying very sturdy and positively from a financial institution’s perspective, mortgage defaults, for instance, and bank card defaults, are nonetheless very, very low, so there’s no speedy concern that buyers are imprudently spending their cash. They’re being cautious, at the very least right here in Wisconsin, and our banks are seeing that mirrored in common funds on all varieties of loans.”

What has the rising rate of interest atmosphere meant for financial institution funds?

Poels: “For many banks, I believe they’ve been capable of make the most of the better web curiosity margin. … The loans which are variable fee in nature, they can reprice these as rates of interest have gone up, they usually haven’t needed to enhance their deposit rate of interest payouts on the identical tempo. With competitors being what it’s, charges are going up for CDs and financial savings accounts to profit shoppers, however they’re not going up at fairly the identical tempo that mortgage charges are. Within the brief time period, banks are actually benefiting from that better unfold in web curiosity margin after frankly dwelling with years of getting actually tight web curiosity margin, so it’s just a little little bit of contemporary air for our members to see that unfold develop just a little. How lengthy it’s going to keep actually does stay to be seen. Are we going to be in a recession subsequent yr? Will shoppers wrestle to maintain tempo with their mortgage funds like they’re doing right this moment?”

Speak about that potential recession for 2023. How is the well being of banks heading into this era of uncertainty?

Poels: “Banks right this moment are in a really sturdy, wholesome place. I discussed earlier the excessive deposit balances, total capital ranges are very wholesome going into what might be a recession subsequent yr, so they’re in a really sturdy place to climate some hurdles within the type of better shopper mortgage defaults and funds. In addition they are very effectively diversified.”

How has mortgage demand advanced over the course of the yr and the place do your members see it heading into subsequent yr?

Poels: “Throughout this yr, total lending has been sturdy. Undoubtedly noticed the decline in dwelling mortgage lending, so these numbers quarter-over-quarter and even year-over-year are down. Ag lending, typically, is just a little bit down as effectively. That’s not fully stunning. Farmers are also in a really wholesome, sturdy money place, and so loads of farmers have chosen to make use of their financial savings as an alternative of borrowing to place crops within the floor or to pay for some gear. After which business mortgage demand continues to be up just a little bit.

“I believe heading into 2023 – now that we’ve had the election and for probably the most half issues are typically establishment – I believe individuals at the very least perceive what the subsequent few years politically appear to be, which at all times brings just a little extra stability to enterprise house owners and their choice making. Looking forward to 2023, we count on enterprise mortgage demand to proceed to stay regular. I believe we’ll proceed to see slower dwelling mortgage lending and rates of interest proceed to rise. The Fed is actually forecasting they’re going to maintain going up, it does put stress on the housing market.

“Total, bankers are predicting a recession subsequent yr, so I believe they’re additionally ensuring they handle their very own monetary statements to have the ability to stand up to a few of that. To the extent that perhaps there’s rather less mortgage demand than what the previous few years have seen – significantly in dwelling mortgage lending – they need to make changes perhaps on the expense aspect with a view to assist mitigate and preserve their total monetary image sturdy. They’re positively making changes, however as I stated earlier, they’re very effectively positioned for this potential recession.”

On lending practices and willingness to lend cash, how has that advanced over the course of this yr and the place do you see that going subsequent yr? Are there going to be typically tighter situations going ahead?

Poels: “The broad tips of credit score underwriting haven’t actually modified for banks all through time, frankly, however clearly individuals’s particular person conditions do change, and so, as they undergo a threat overview of a enterprise borrower or a shopper borrower, they’re trying to make it possible for that particular person is in monetary place themselves. Have they got marketing strategy? How lengthy have they been in enterprise? Have they got financial savings that assist stand up to some emergency state of affairs? Are there provide chains nonetheless affecting this specific enterprise, and what does that appear to be for his or her revenues forward? After which doing a little type of stress testing in opposition to the enterprise itself on how effectively they’re capable of stand up to a recession if one would come.”

Anything to spotlight in regards to the outlook for banking heading into subsequent yr?

Poels: “The one different space is the merger exercise of the banking business. This yr, we positively noticed a reasonably wholesome tempo of merger exercise; we had 12 introduced mergers this yr of a Wisconsin financial institution. Trying forward, I do suppose we’ll proceed to see mergers happen, I do suppose it’s going to decelerate a bit due to the financial atmosphere and because it turns into just a little extra unsure what a financial institution’s personal stability sheet may appear to be, which impacts pricing of a financial institution after they’re trying to promote. So, I count on M&A exercise to proceed, however perhaps not fairly on the tempo that it was this yr.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)