North Dakota

North Dakota Sinks U.S. April Oil Production

bjdlzx

A visitor submit by Ovi.

All the oil (C + C) manufacturing information for the US state charts comes from the EIAʼs Petroleum Provide month-to-month PSM.

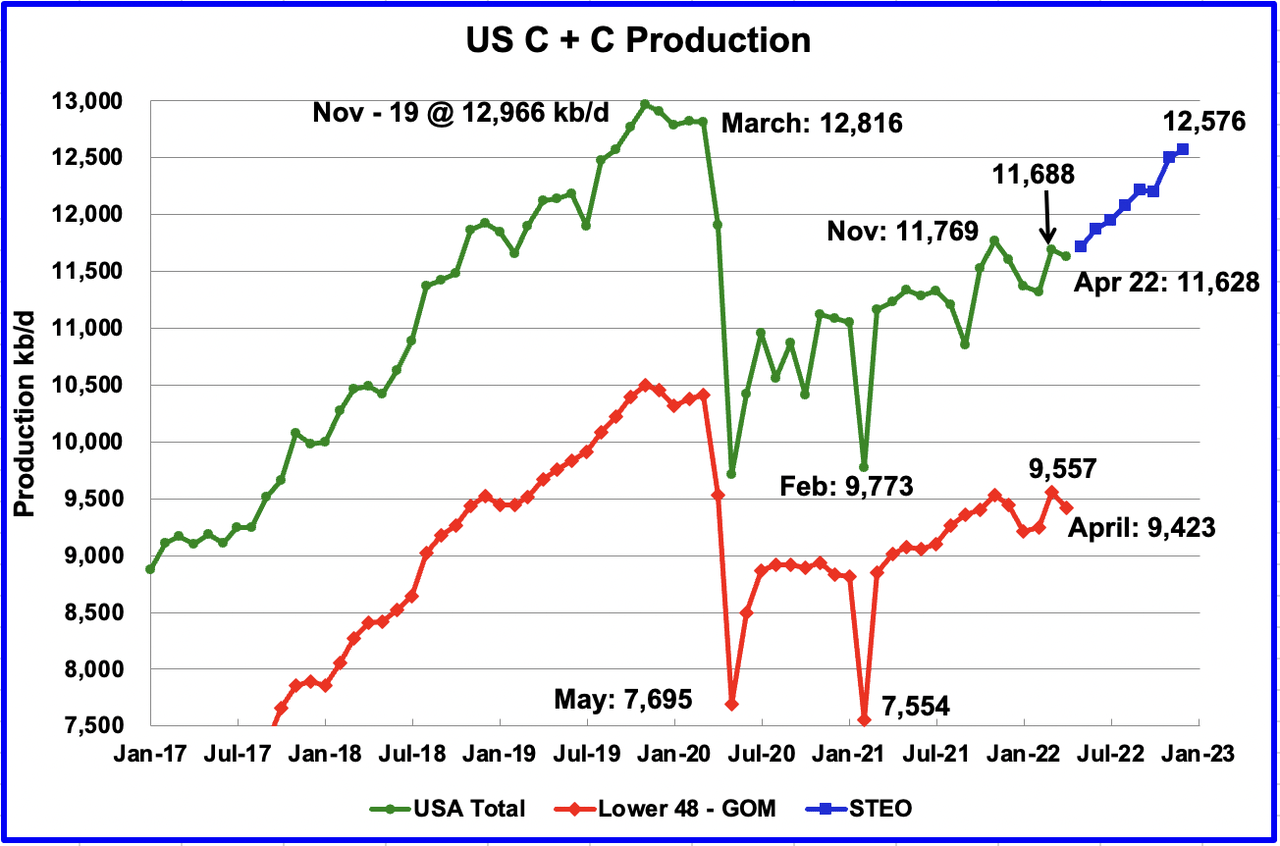

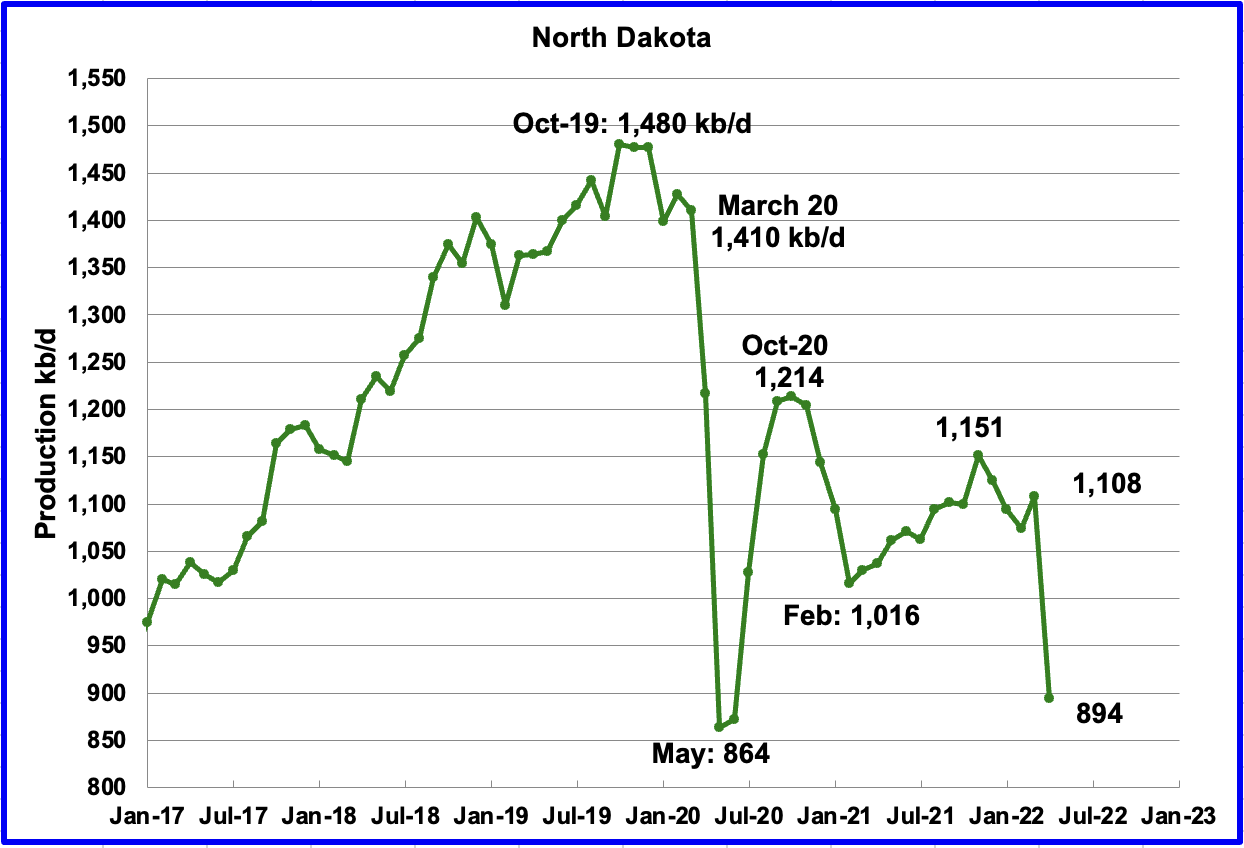

U.S. April manufacturing decreased by 60 kb/d to 11,628 kb/d, after March was revised up from 11,655 kb/d to 11,688 kb/d. The most important manufacturing enhance got here from the GOM whereas North Dakota dropped by 214 kb/d.

Whereas total US manufacturing was down, a clearer indication of the well being of US onshore oil manufacturing may be gleaned by trying extra carefully on the On-shore L48 states. Within the On-shore decrease 48, April manufacturing decreased by 134 kb/d to 9,423 kb/d.

The blue graph, taken from the June 2022 STEO, is the manufacturing forecast for the US from Might 2022 to December 2022. Output for December 2022 is anticipated to be 12,576 kb/d, a revision of 108 kb/d increased than was forecast within the Might STEO report. From Might 2022 to December 2022, manufacturing is anticipated to extend by 863 kb/d or at a median fee of 123.3 kb/d/mth.

It ought to be famous that the STEO did forecast a decline of 137 kb/d for April.

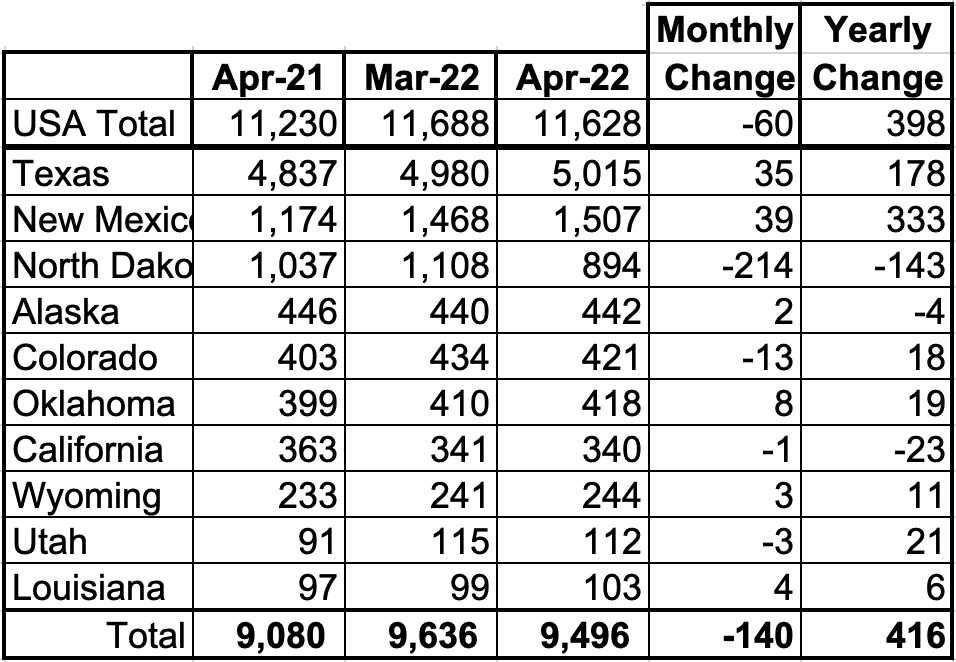

Oil Manufacturing Ranked by State

Listed above are the ten states with the biggest US manufacturing. These 10 accounted for 81.7% of all US oil manufacturing out of a complete manufacturing of 11,628 kb/d in April 2022.

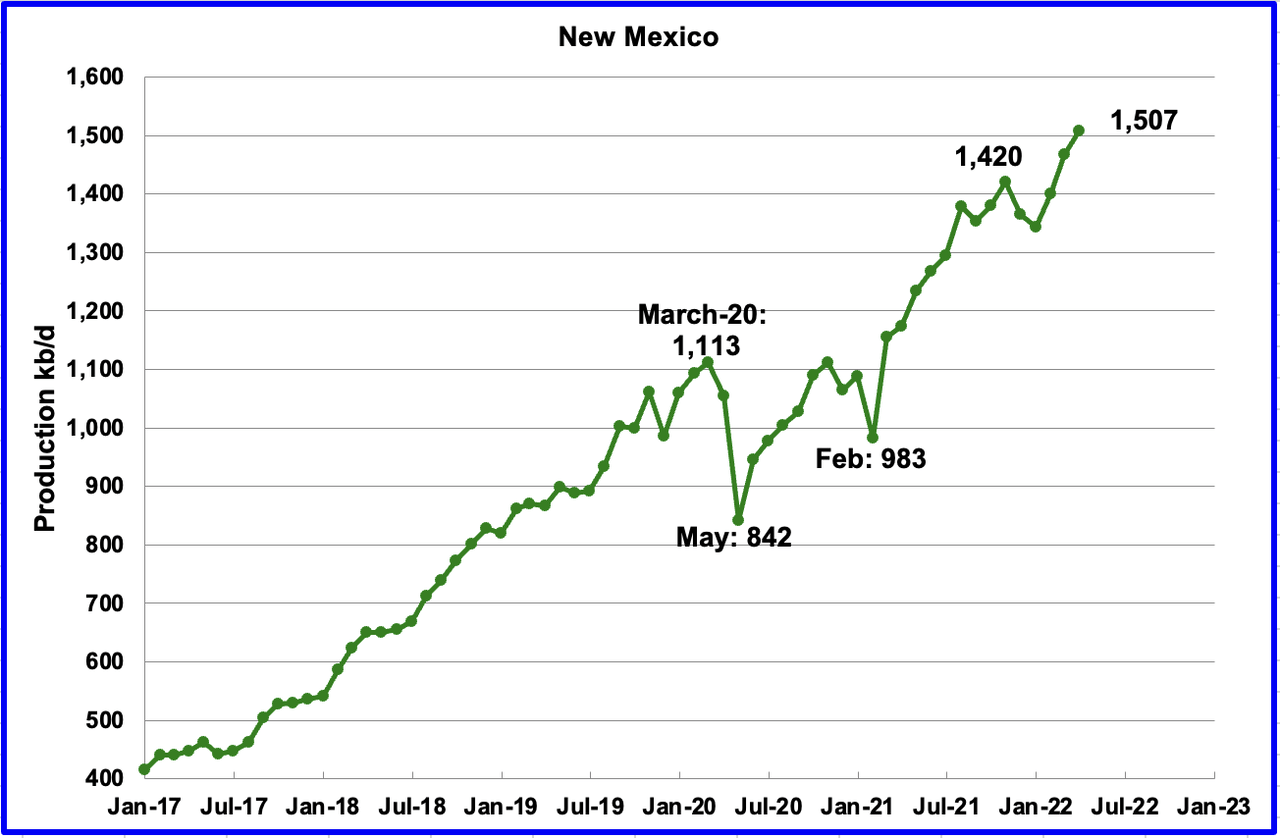

On a YoY foundation, US manufacturing elevated by 416 kb/d with the bulk having come from New Mexico.

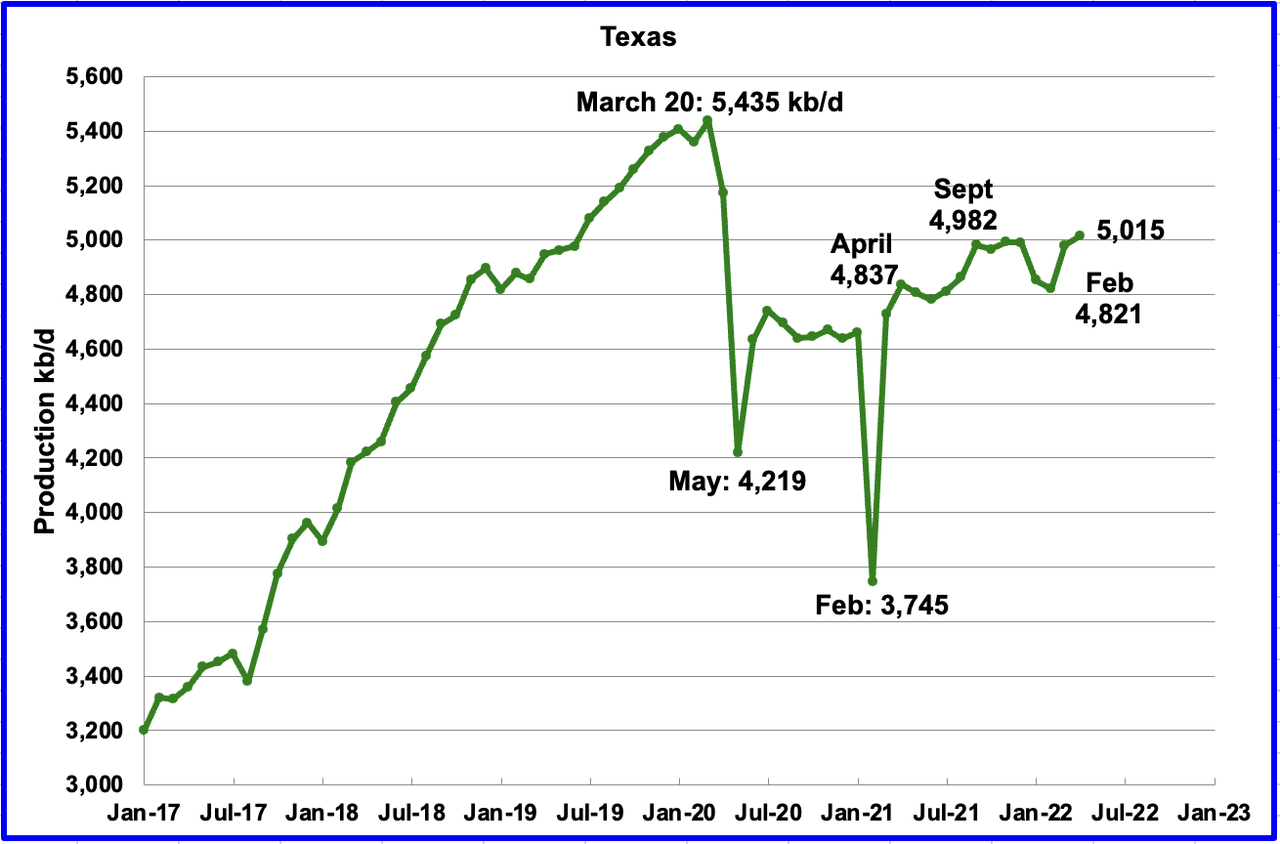

Texas manufacturing elevated by 35 kb/d in April to five,015 kb/d from 4,980 kb/d in March.

In September 2021 there have been 204 Hz oil rigs working in Texas. By the final week of April 2022, 293 oil rigs have been working, a rise of 89 rigs and manufacturing simply elevated by 33 kb/d.

April’s New Mexico manufacturing elevated by 39 kb/d to a different report 1,507 kb/d. By December 2021 to the tip of April, near 90 rigs have been in operation within the New Mexico Permian. Nevertheless, in June, operational rigs exceeded 100. The latest manufacturing enhance is because of extra wells being accomplished than drilled.

North Dakota’s April output was 894 kb/d, a lower of 214 kb/d from March. In keeping with this supply, the drop was as a consequence of a extreme chilly winter storm.

“Again-to-back blizzards in April led to vital drops in power manufacturing. Helms says the business is just now simply beginning to recuperate from the blizzards, that means manufacturing numbers in Might will not see a lot change.”

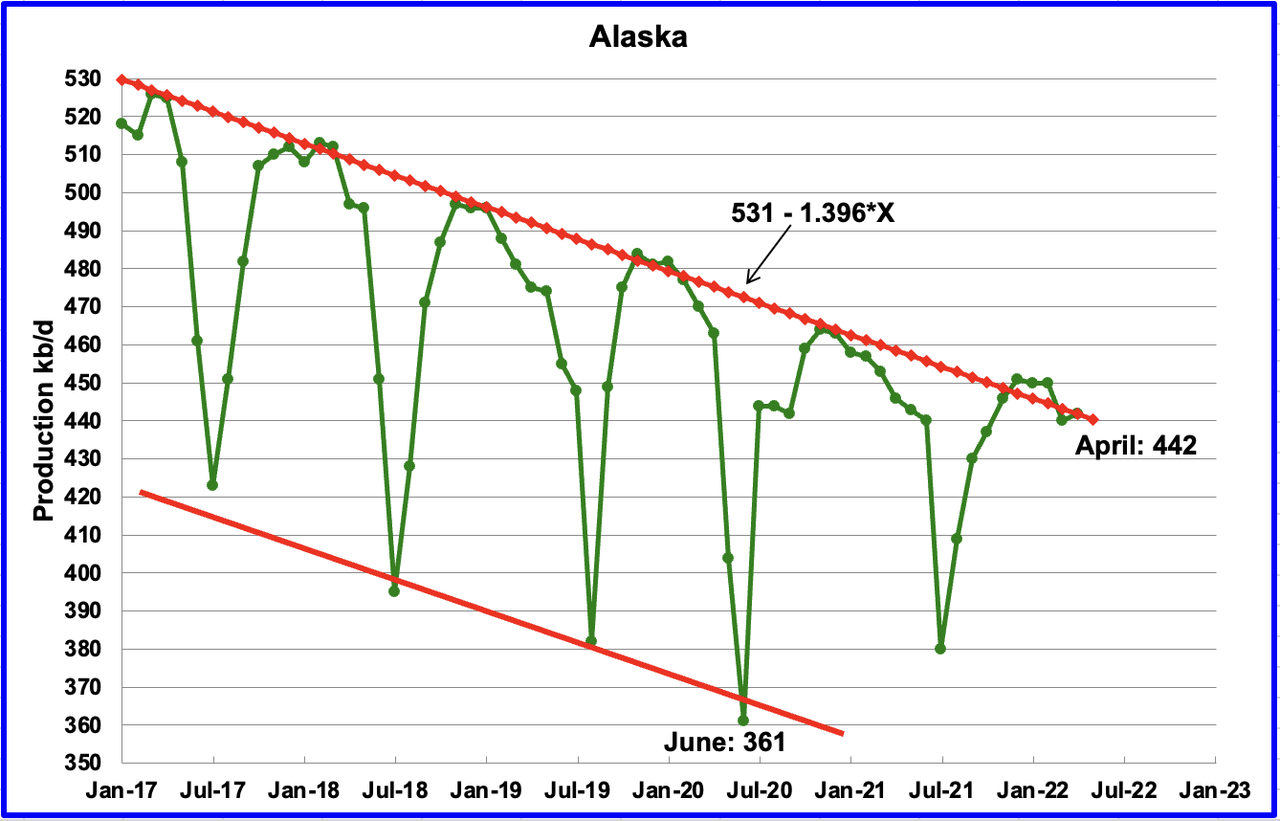

Alaskaʼs April output elevated by 2 kb/d to 442 kb/d.

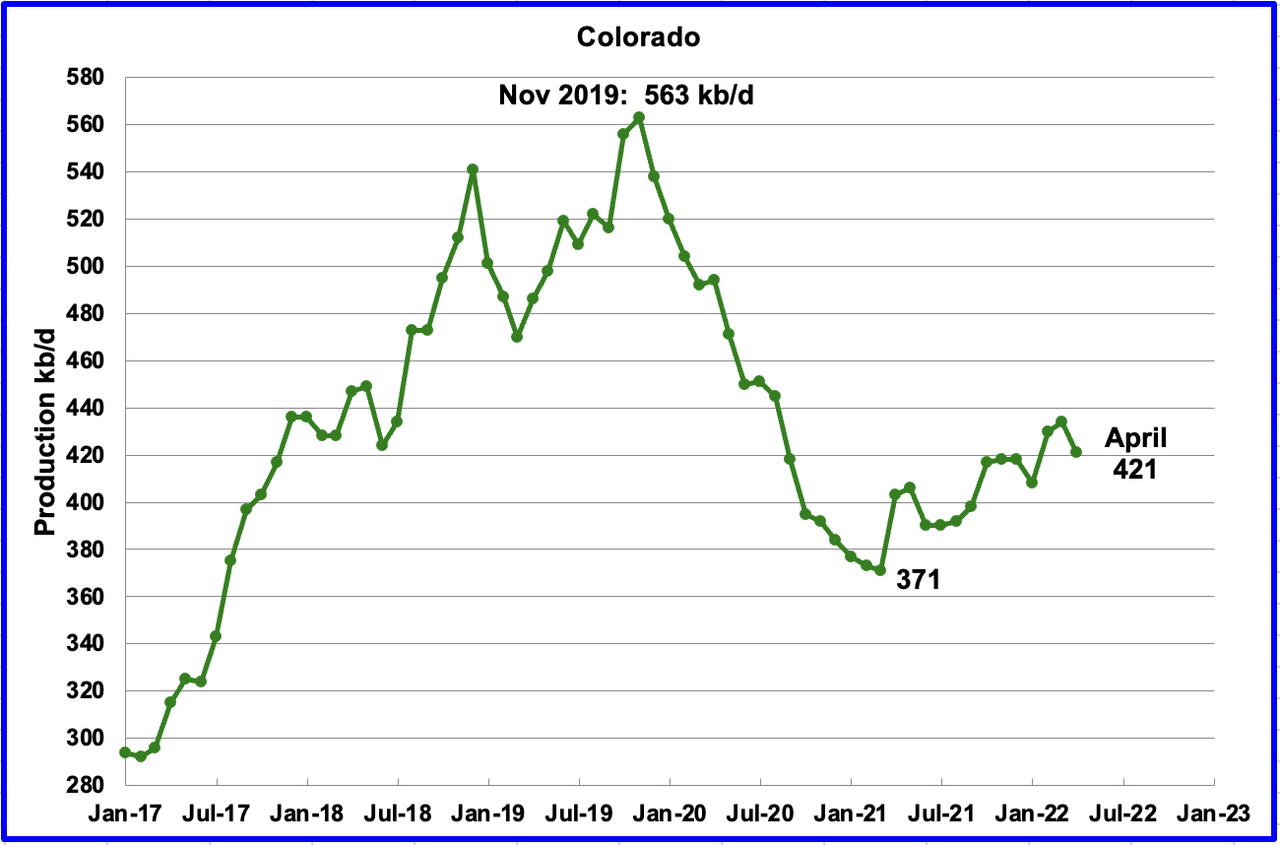

Coloradoʼs April manufacturing decreased by 13 kb/d to 421 kb/d. A latest Colorado report estimates little progress probably in Colorado for 2022.

“Oil and gasoline drilling exercise has inched upwards in Colorado because the Russian invasion of Ukraine despatched costs hovering earlier this 12 months, however investor calls for and provide constraints – not state or federal coverage – will probably restrict manufacturing progress by at the very least the tip of the 12 months,” a brand new Colorado Faculty of Mines evaluation concludes.

The quarterly report on oil and gasoline markets from the varsity’s Payne Institute for Public Coverage discovered that little has modified because the weeks following Russia’s invasion, when a number of massive producers working in Colorado assured Wall Avenue traders they’d use excessive oil costs to extend dividends and inventory buybacks, not develop manufacturing.

“The highest precedence for the U.S. public oil and gasoline firms stays to ship increased monetary returns to shareholders,” learn the report launched final week.

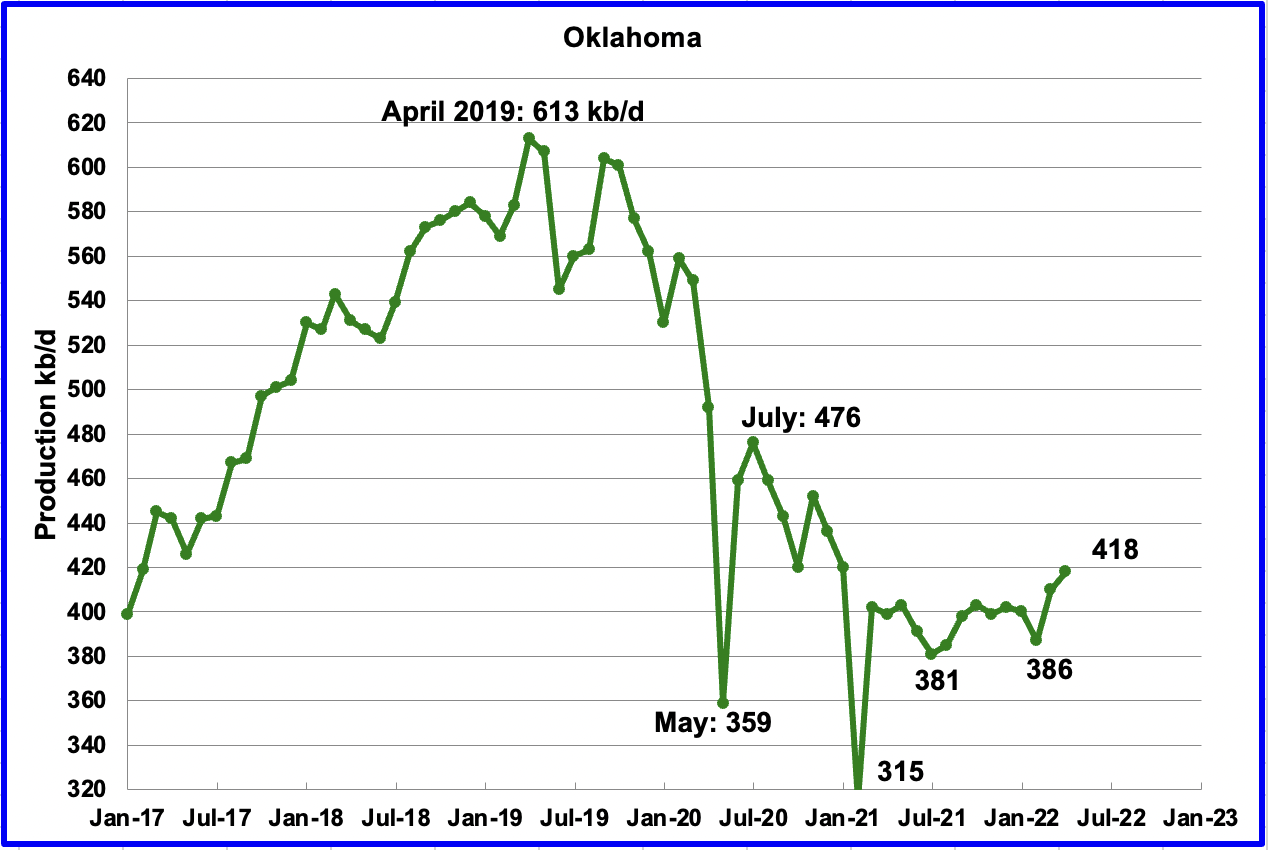

Oklahoma’s output in April elevated by 8 kb/d to 418 kb/d. April’s output broke out above the 400 kb/d stage it has been fighting since September 2021. From January to April, near fifty rigs have been working in Oklahoma.

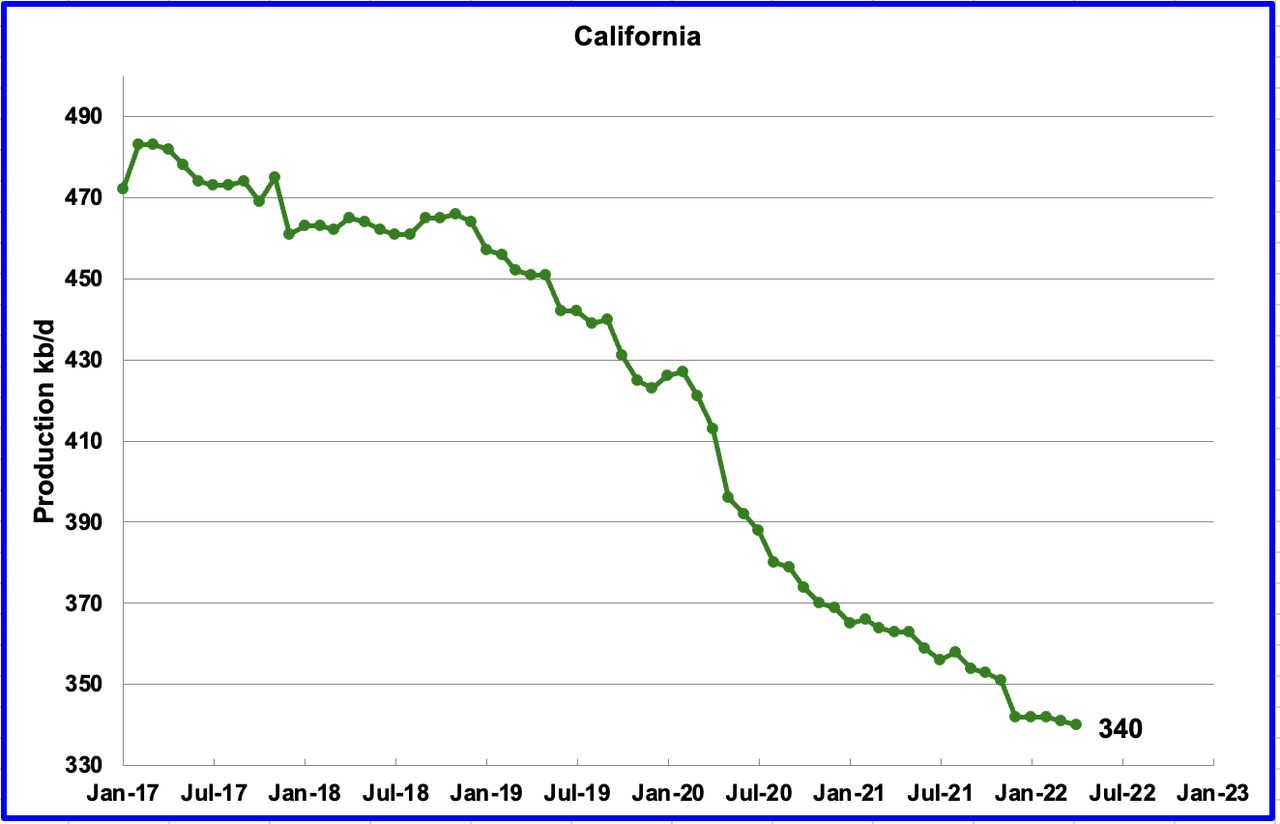

Californiaʼs sluggish output decline continued in April. Output decreased by 1 kb/d to 340 kb/d.

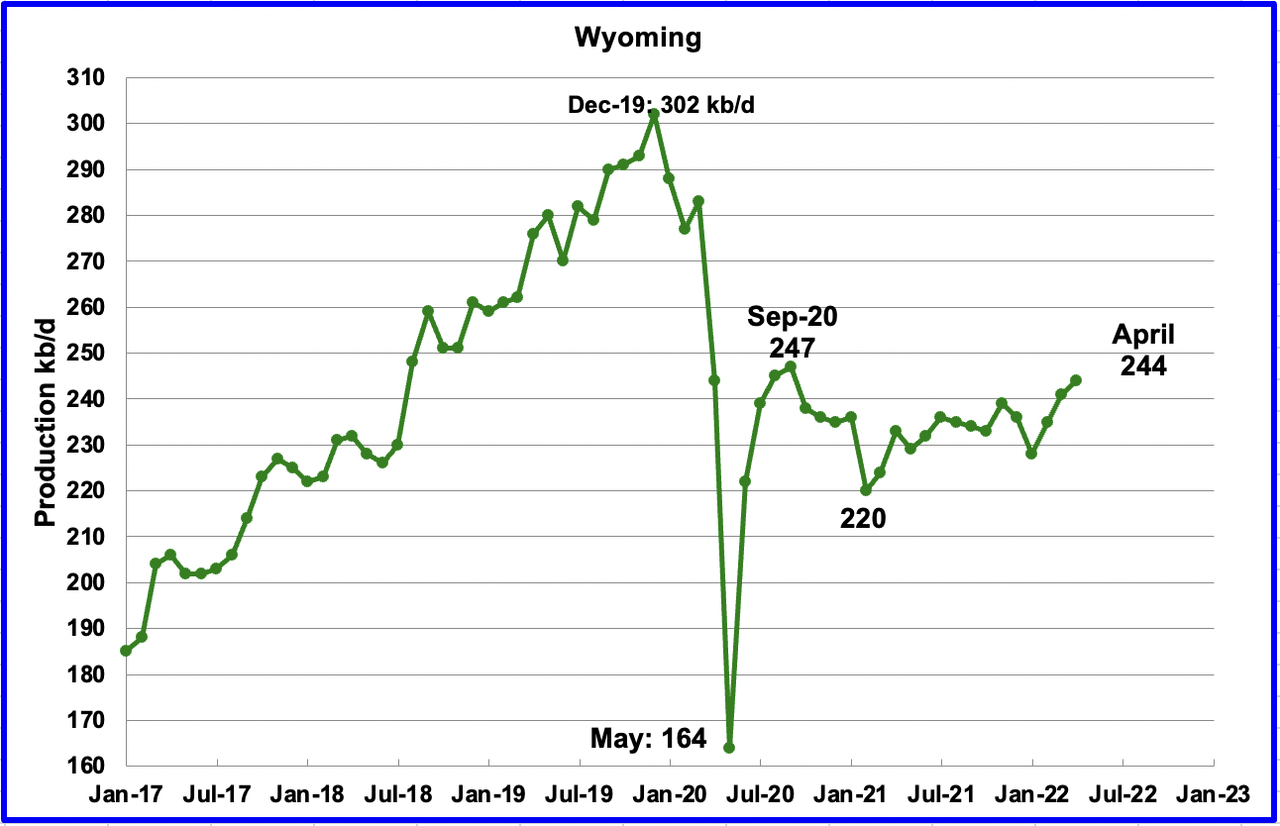

Current revisions to Wyoming’s oil manufacturing by the EIA present that it has been on an uptrend from the low of 220 kb/d in February 2021. In keeping with this supply, the rise is expounded to elevated drilling.

“Pete Obermueller, president of the Petroleum Affiliation of Wyoming, instructed the Joint Minerals, Enterprise and Financial Growth Committee on Monday that the state’s drilling rig depend is slowly rising and reached 21 this week. (Baker Hughes, which tracks rigs otherwise, reported Friday that Wyoming had 18.)

The present rig depend “clearly is healthier,” Obermueller mentioned. “Nonetheless not the place we would prefer to be, however we’re shifting in the suitable path.”

In April, Wyoming’s output elevated by 3 kb/d to 244 kb/d, up 24 kb/d from February’s 2021 output of 220 kb/d.

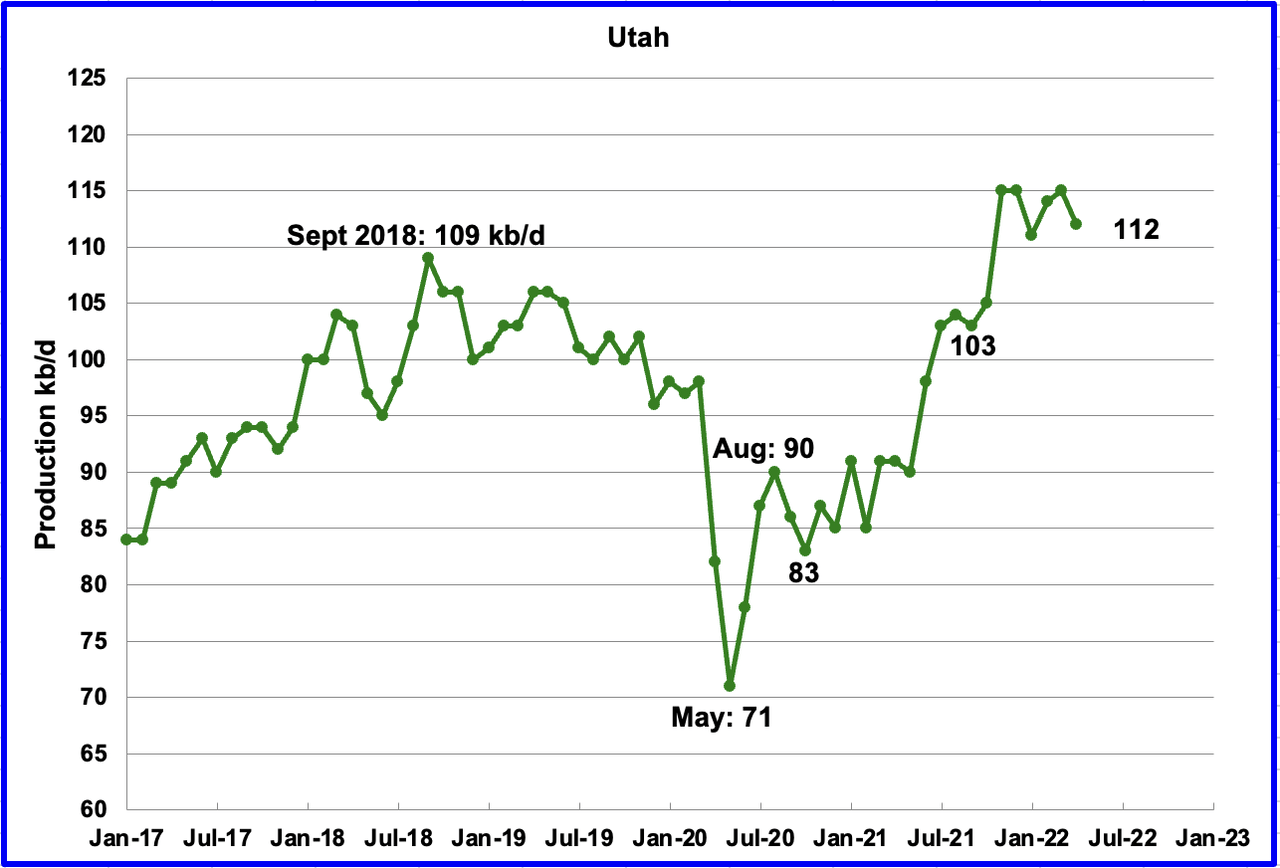

Utah’s manufacturing enhance from the low of 71 kb/d in Might 2020 seems to have stopped in December 2021. April’s manufacturing decreased by 3 kb/d to 112 kb/d.

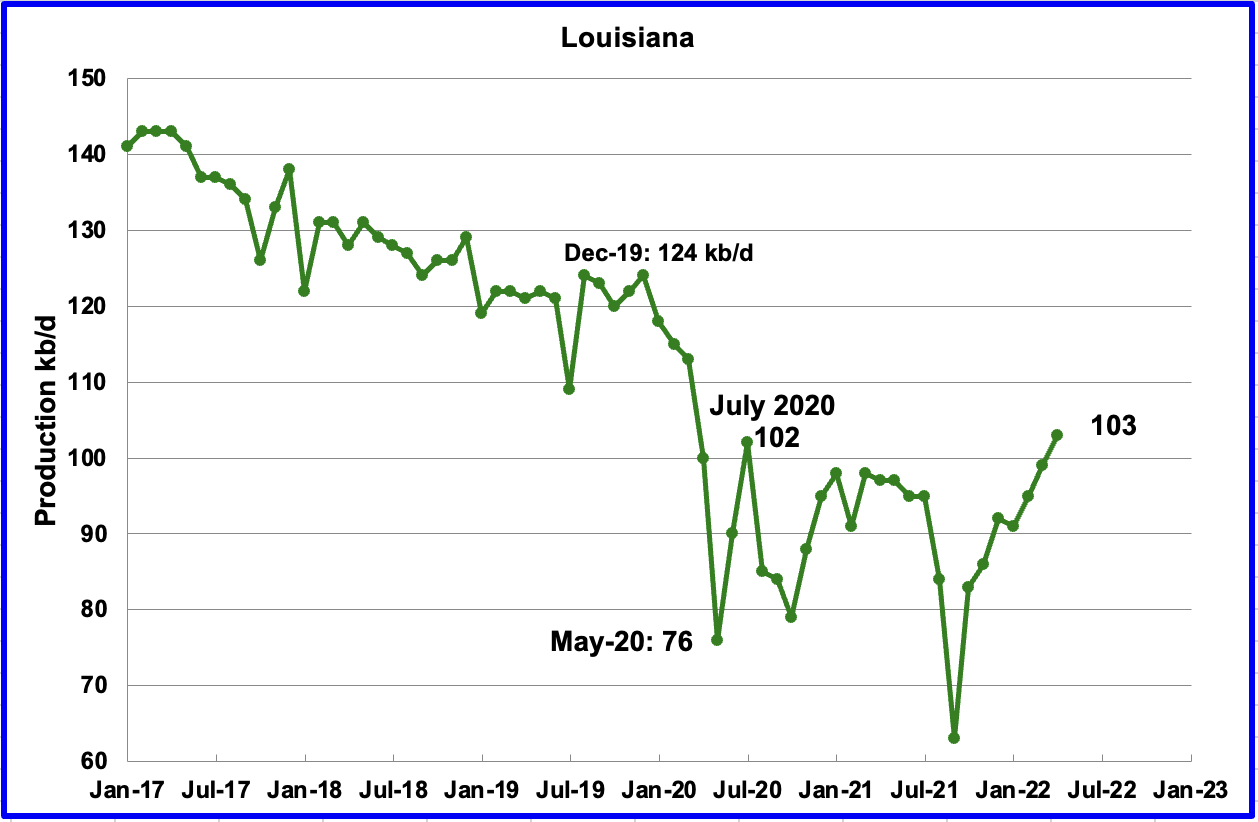

Louisiana’s output elevated by 4 kb/d to 103 kb/d in April. Louisiana, one of many hardest hit states by Hurricane Ida in late August 2021, appears to have absolutely recovered from the inflicted harm since manufacturing has elevated each month since then.

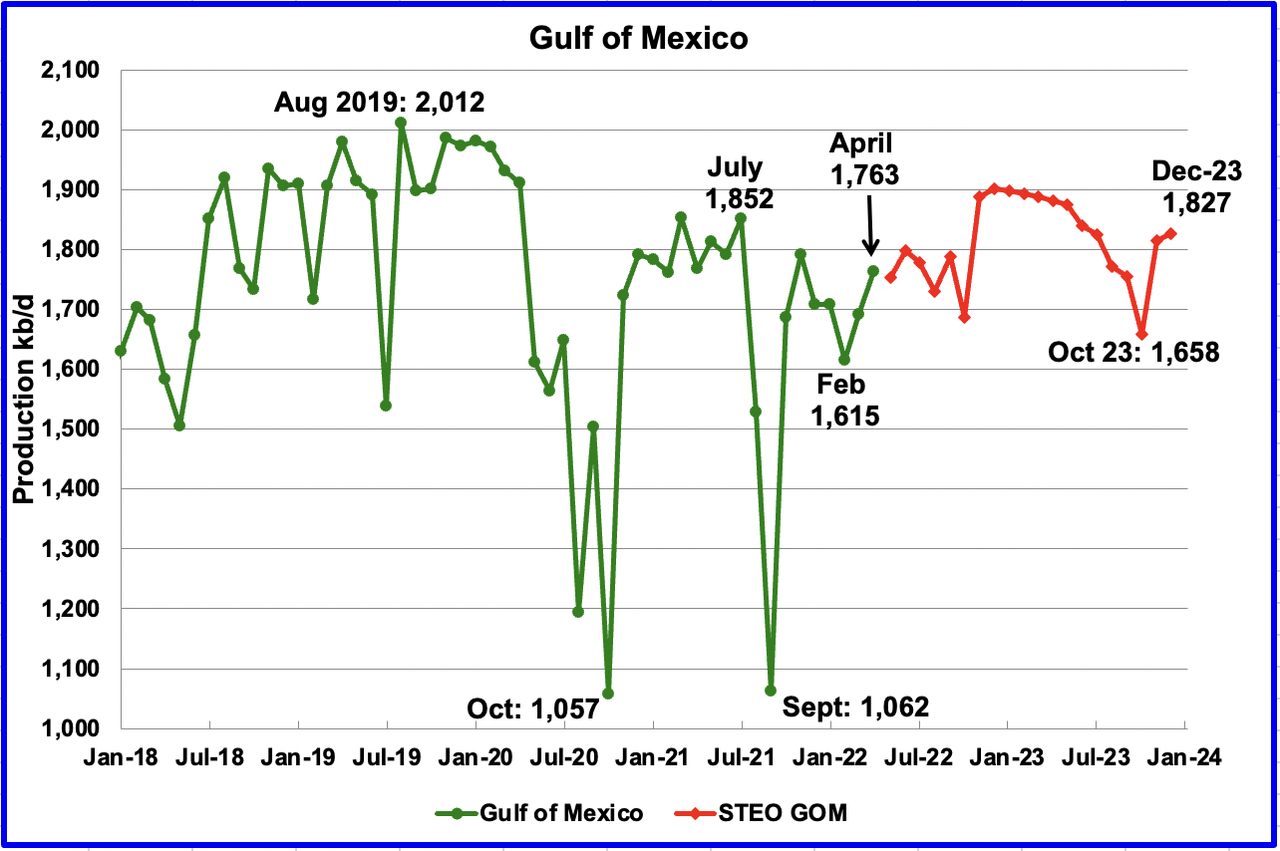

GOM manufacturing elevated by 72 kb/d to 1,763 kb/d in April. If the GOM was a state, its manufacturing would usually rank second behind Texas.

The June 2022 STEO projection for the GOM output has been added to this chart and tasks output might be 1,827 kb/d in December 2023. That is 29 kb/d increased than projected within the Might report. For Might 2022, the STEO is projecting little change in output.

The rise within the GOM output close to year-end is because of Shell’s Vito platform coming on-line.

Vito is anticipated to come back on-line previous to year-end. The challenge as sanctioned requires supply of a peak 100,000 BOPD through eight subsea manufacturing wells tied right into a single manifold. Nevertheless, a second chapter to the Vito story is already nicely underway.

To be able to seize all it might of the anticipated 300 million bbl of reserves on the subject, Shell is planning a waterflood challenge for Vito that ought to take closing funding choice (FID) roughly a 12 months after the sector comes on stream. The water flood not solely calls for added topsides tools to be squeezed onboard the smaller host, however three extra wells are additionally deliberate. The present plan has these wells being initially used as producers earlier than being transformed to water injectors, based on Stacy Fresquez, Shell’s Vito waterflood challenge supervisor.

A Completely different Perspective On US Oil Manufacturing

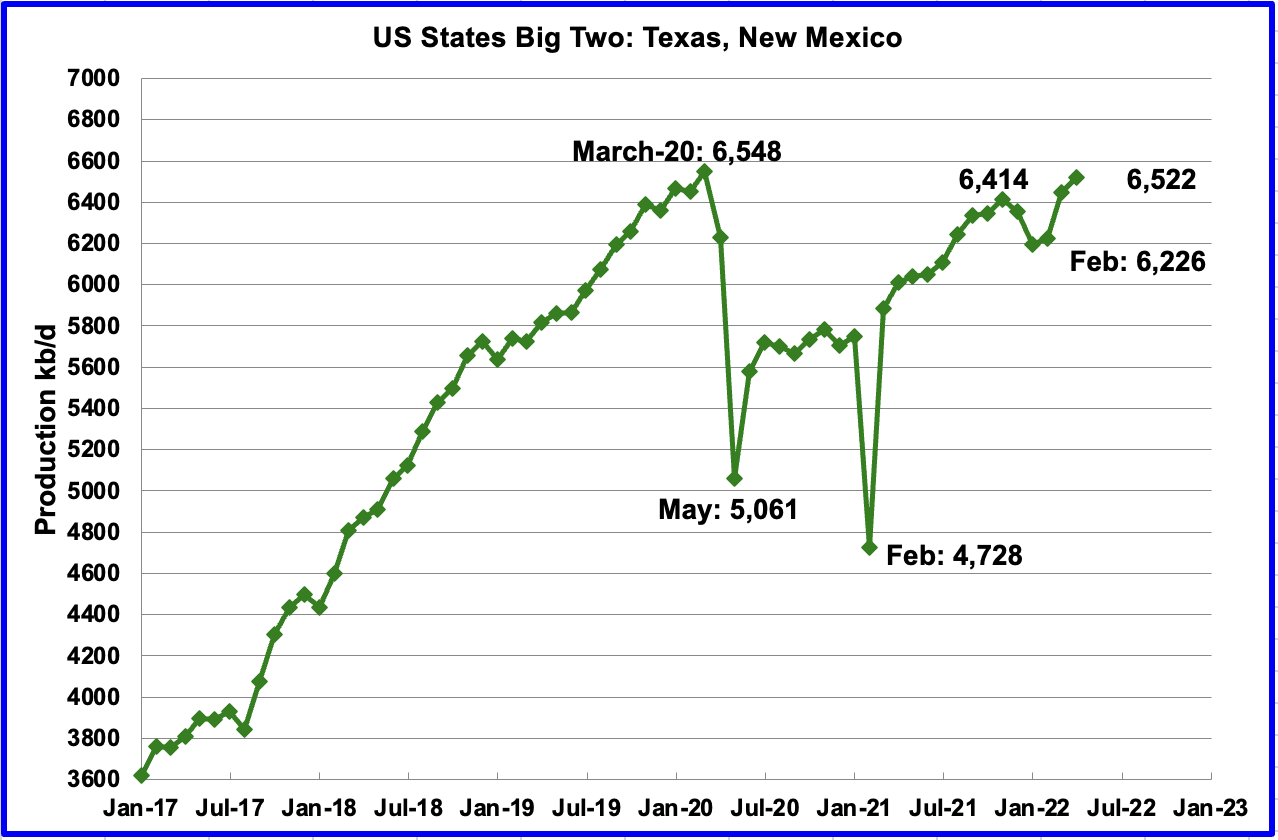

The Massive Two states, mixed oil output for Texas and New Mexico.

Oil manufacturing for The Relaxation

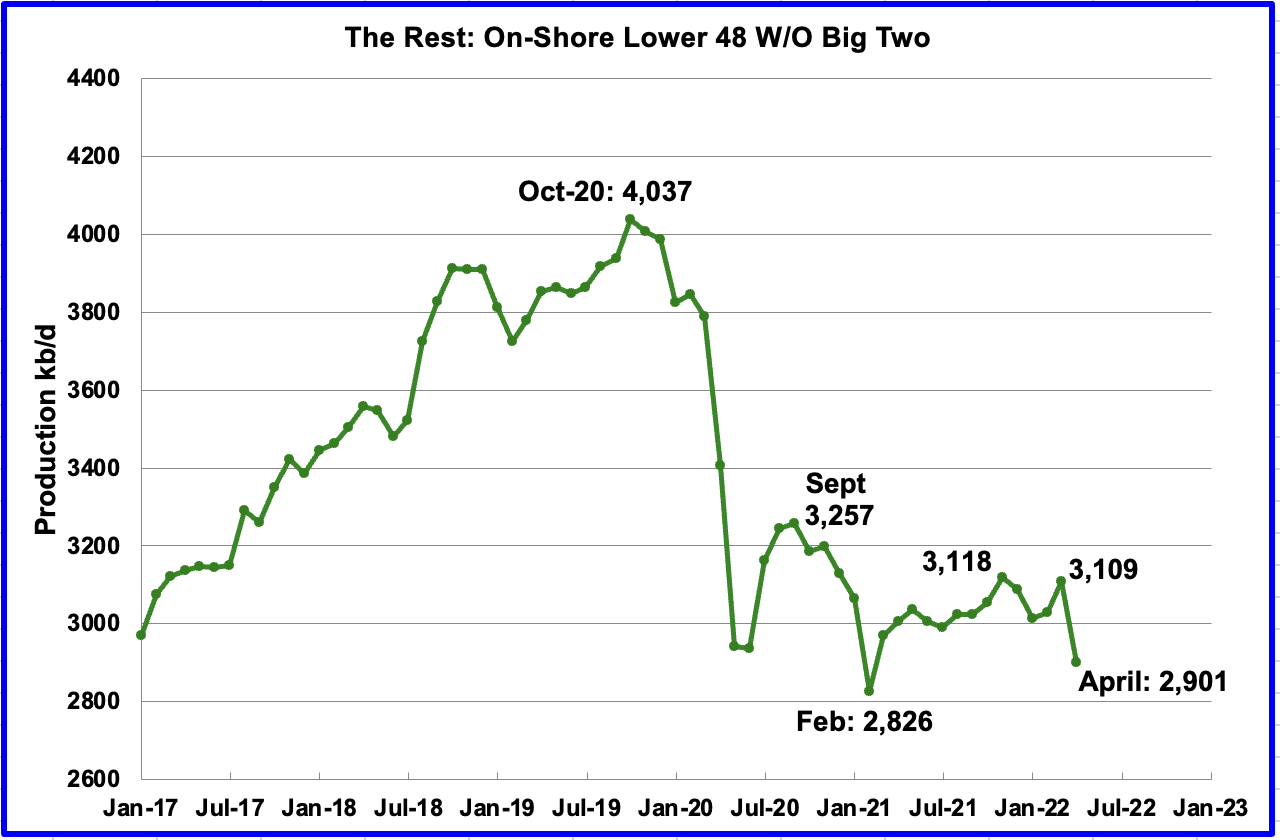

To get a unique perspective on US oil manufacturing, the above two charts have segregated US state manufacturing into two teams, “The Massive Two” and the “On-Shore L48 W/O Massive Two” or The Relaxation.

April manufacturing elevated within the Massive Two states by a mixed 74 kb/d, with Texas including 35 kb/d and New Mexico including 39 kb/d.

Over the previous 12 months, manufacturing within the Relaxation seems to be holding regular at shut to three,000 kb/d. Nevertheless, in April manufacturing decreased by 208 kb/d to 2,901 kb/d primarily as a result of 214 kb/d lower in North Dakota.

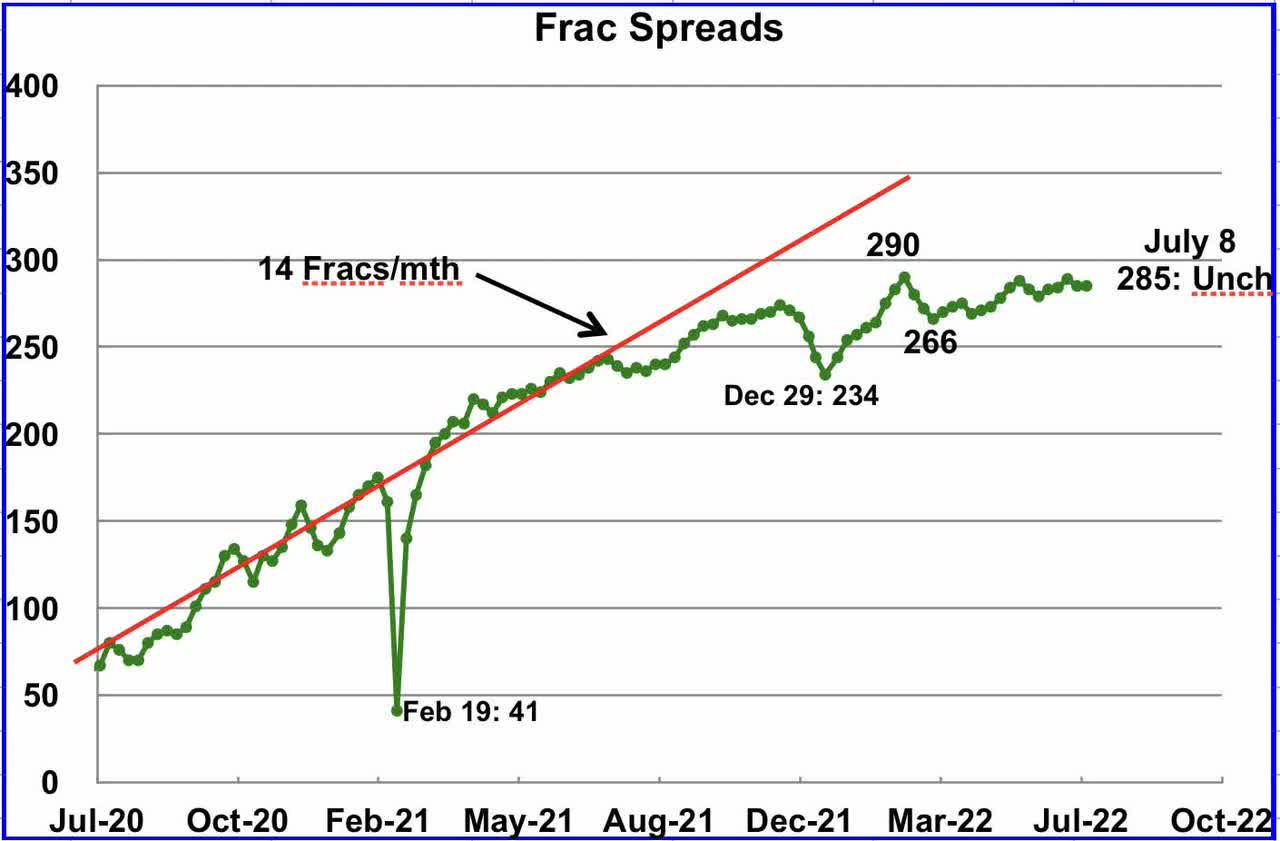

Frac Spreads

Frac spreads have been unchanged at 285 for the week ending July 285. Frac spreads sometimes don’t change a lot on the week following an extended weekend.

Notice that these 285 frac spreads embody each gasoline and oil spreads.

The oil rig depend for the week ending July 4 elevated by 2.

LTO Might Replace

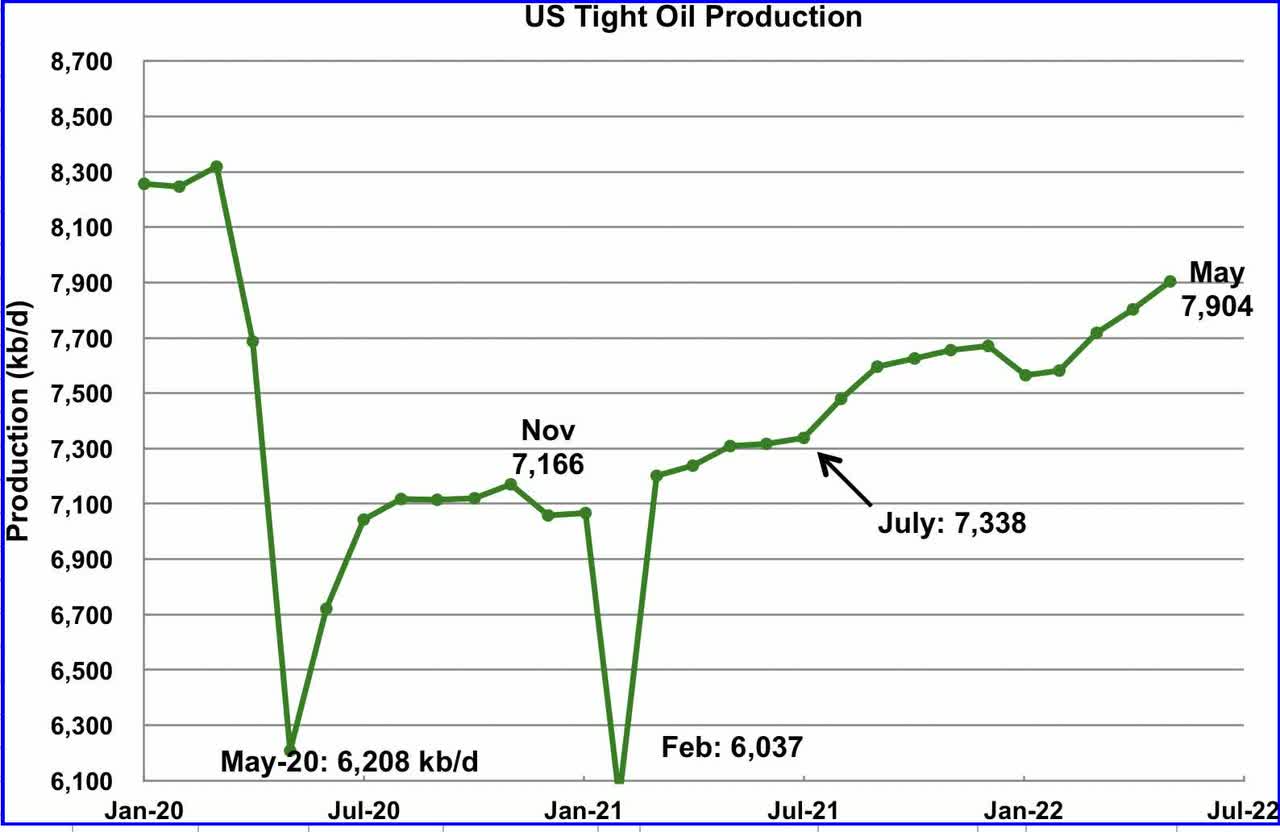

The EIA’s LTO database gives data on LTO manufacturing from seven tight oil basins and some smaller ones. The June 2022 report updates tight oil manufacturing to Might 2022.

Because of technical difficulties, the EIA simply launched the June LTO report on July 8, 2022.

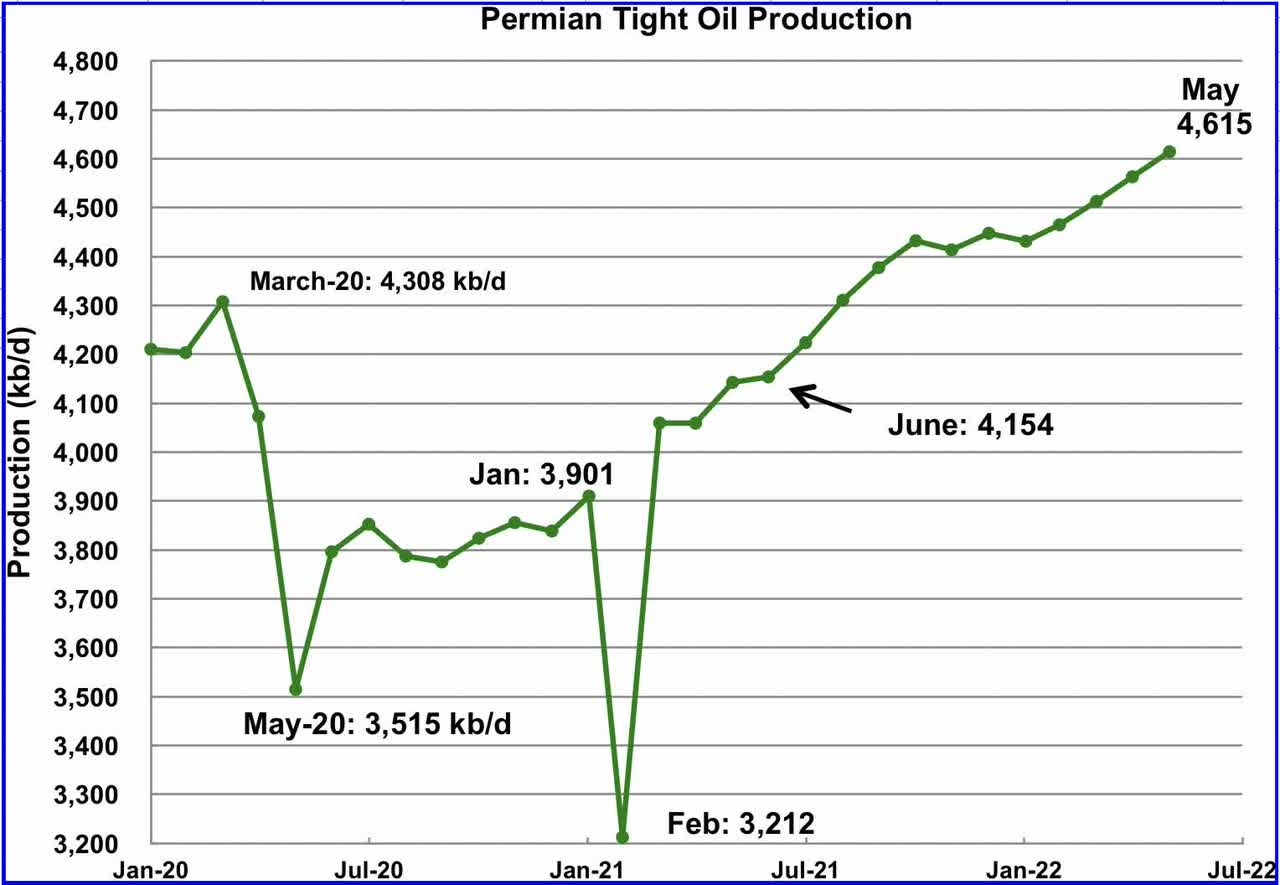

The EIA’s June LTO report made upward revisions to the Might manufacturing forecasts reported within the earlier submit. The largest revision in output occurred within the Permian from January to April 2022 within the order of 100 kb/d.

Might’s LTO output elevated by 101 kb/d to 7,904 kb/d. April’s output was revised up by 98 kb/d.

Might’s output elevated by 52 kb/d to 4,615 kb/d and is 307 kb/d increased than the excessive of 4,308 kb/d recorded in March 2020. April’s output was revised up by 92 kb/d.

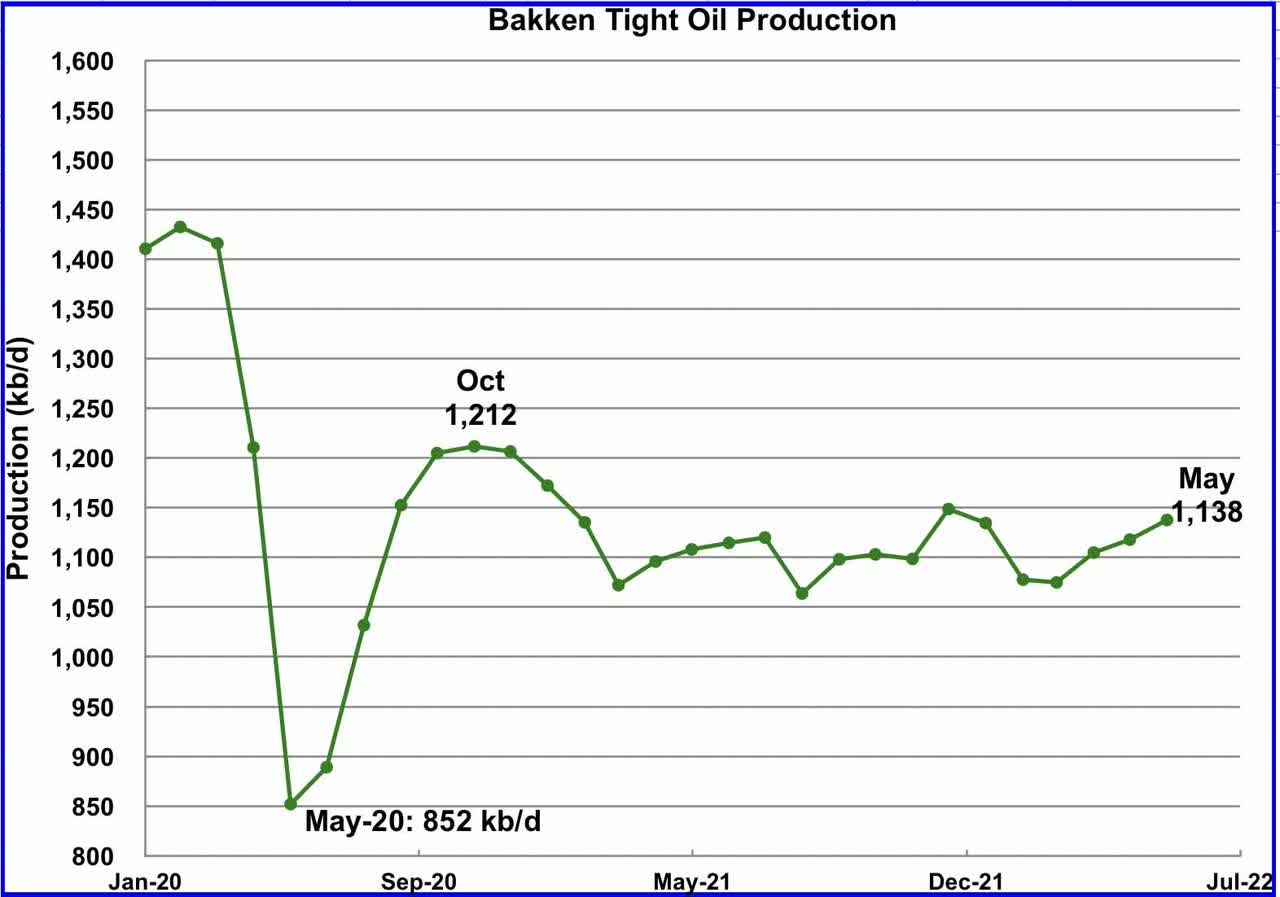

The Bakken’s Might LTO output elevated by 20 kb/d to 1,138 kb/d. Notice the EIA reported a drop of 214 kb/d in April for North Dakota within the manufacturing charts above. Will the April drop present up within the July report?

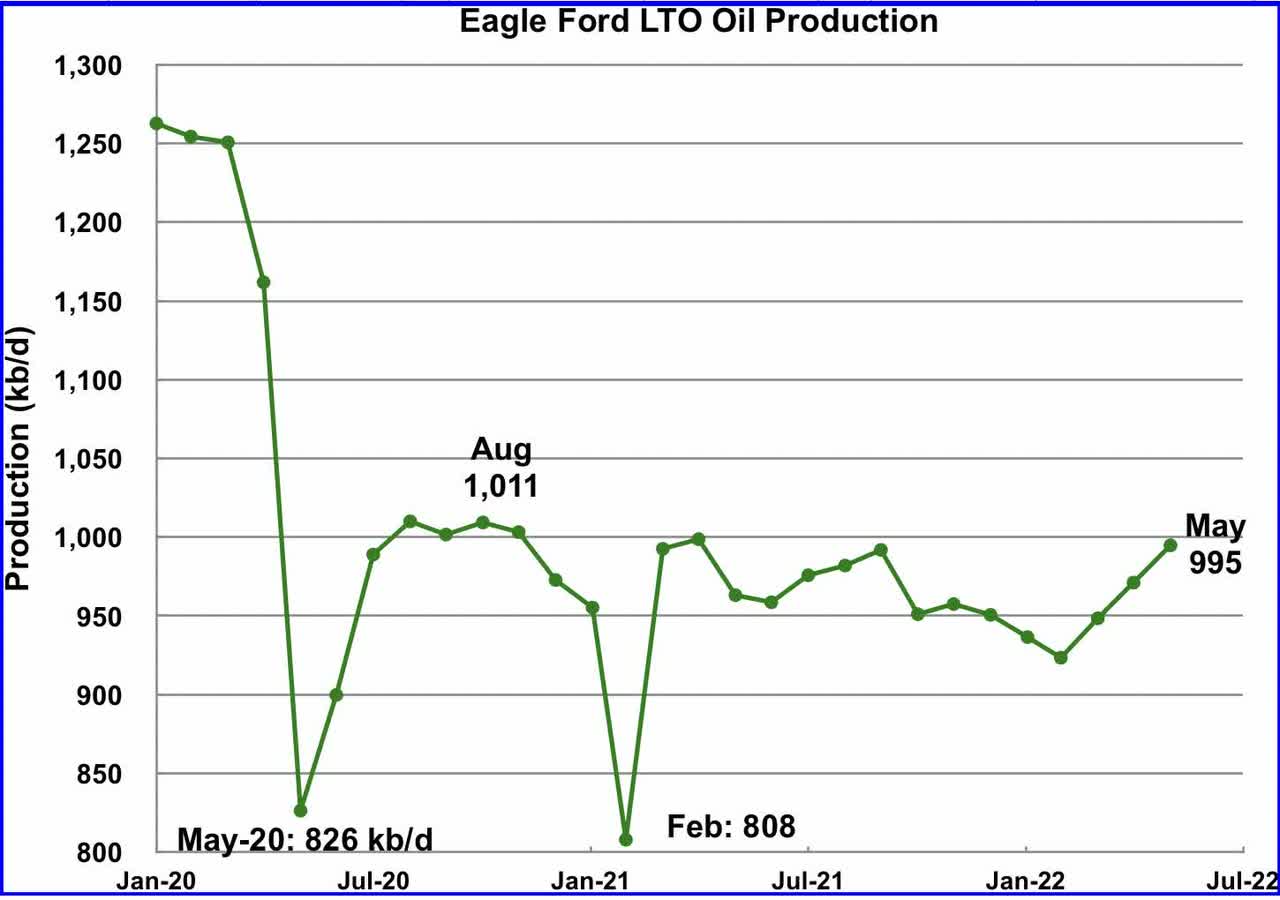

The Eagle Ford basin manufacturing elevated by 24 kb/d to 995 kb/d in Might.

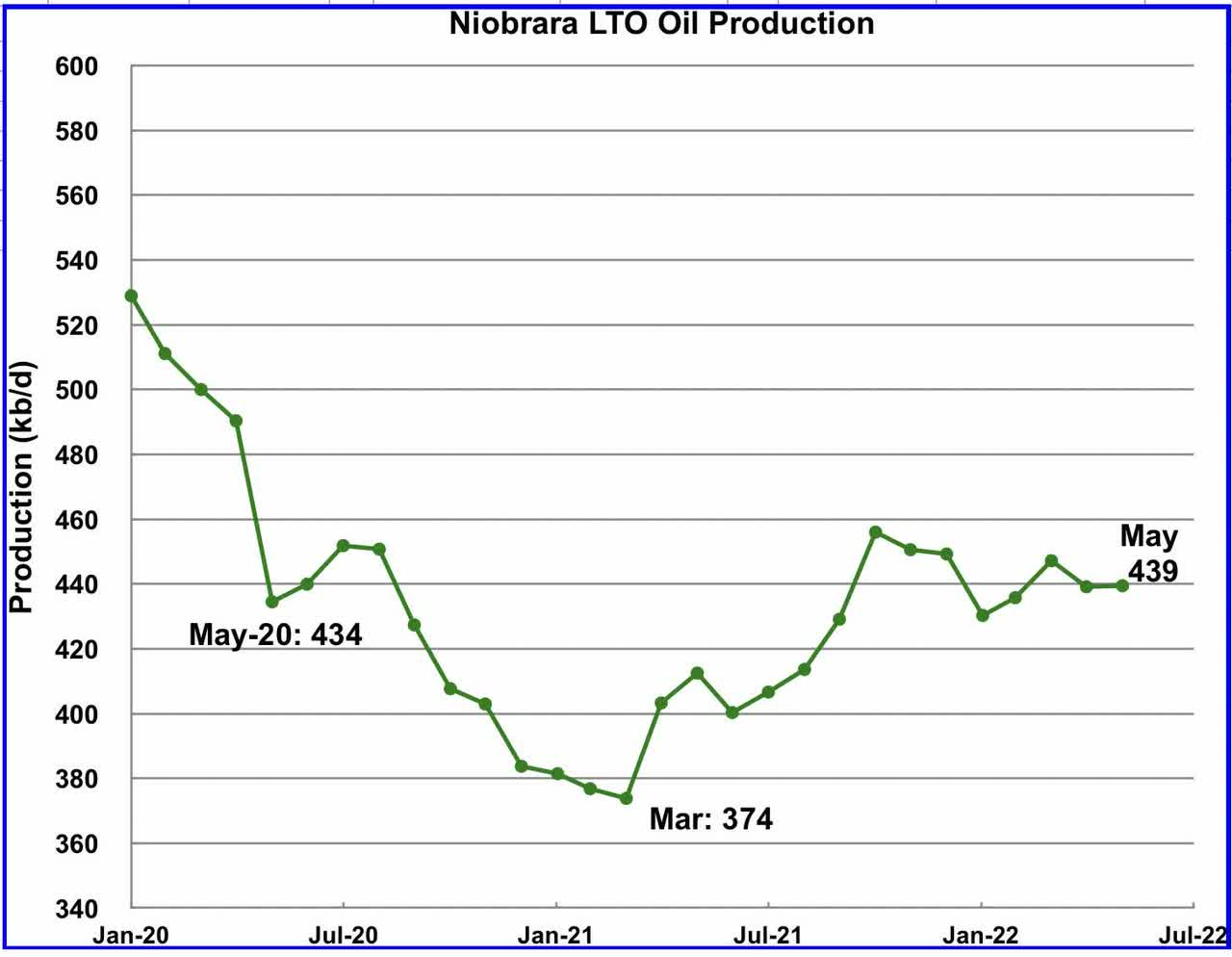

After rising manufacturing from March 2021 to October 2021, output within the Niobrara started to drop in November 2021. Might’s output was unchanged at 439 kb/d.

Authentic Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Searching for Alpha editors.

North Dakota

Lawmakers advance bill to replace North Dakota drones made by foreign adversaries

BISMARCK — Lawmakers unanimously advanced a bill aimed at replacing over 300 Chinese-made drones used by North Dakota agencies due to security concerns, though development of drone infrastructure in the bill drew scrutiny from lawmakers.

House Bill 1038

would create a $15 million program to replace all drones used by North Dakota agencies that do not comply with the

National Defense Authorization Act

and the

American Security Drone Act of 2023.

In short, any drones that are manufactured in adversarial countries would be replaced.

For North Dakota, that would be 307 of the 353 drones — or 86.97% — used by state agencies, according to a survey administered by the North Dakota University System.

All 307 drones that would be replaced are from China, according to the survey, specifically from a company called DJI, according to bill sponsor Rep. Mike Nathe, R-Bismarck.

During his testimony to the appropriations committee, Nathe said that DJI has roughly 90% of the hobby market, 70% of the industrial market and 80% of the first responder market in the U.S., something he said was “very disturbing” to him.

“Even if out of the 307 we have one of these that are bad, it’s worth doing,” Nathe said. “So, these drones are flying all over our state. They’re flying over our communities, our air bases, our missile sites, our oil fields and God knows if they’re collecting data and transmitting that. And that is not only a security risk for North Dakota but also for the country.”

Nathe said North Dakota agencies are using Chinese drones because they are cheap.

“Why do we have so many of these in our inventory? And we’re not the only state, every other state is – has as many of these as we do,” Nathe said. “And the answer is they’re cheap. Cheaper than U.S. stuff, and they’re easy to fly and they’re very consumer-friendly. And they are not just years ahead, they’re like generations ahead of the (U.S.) manufacturers.”

Despite this, he said he has not had any pushback from state agencies on the proposed bill.

The program would be run by the Grand Forks-based

Northern Plains Unmanned Aircraft System (UAS) Test Site

. Under the proposed bill, the test site would find and pay for drones that could serve the same function of the Chinese drones currently used by agencies, then organize training on the new drones for agencies’ personnel and inspect and dispose of the Chinese-made drones.

Agencies would be able to continue using the drones they have until a replacement drone from a U.S. manufacturer or a manufacturer in a country friendly to the U.S. has been found by the test site, Nathe said.

Some members of the committee questioned how much it would cost to replace the current drones. Frank Mattis, director of UAS integration at Thales and newly minted chair of the

North Dakota UAS Council

, said that it would likely cost more than $10,000 per drone to replace the current DJI drones used by state agencies.

Thales is a company partnered with the state and the Northern Plains UAS Test Site to develop the

Vantis

system. The system, simply put, is a radar system that tracks and identifies drones, which allows them to operate beyond the line of sight of pilots.

The second part of HB 1038 would allocate $11 million to develop an FAA radar data enclave and engage in a first-of-its-kind one-year pathfinder program where the FAA would share radar data with Vantis that would extend the system’s reach over most of the state.

Northern Plains UAS Test Site Deputy Executive Director Erin Roesler said the system covers 3,000 square miles and with the FAA data would cover 56,000 square miles — an expansion that would cost the state $255 million to develop without the FAA’s assistance.

The hope, according to those in support of the bill, is that Vantis with the FAA’s data would become the guideline for a national drone infrastructure system.

According to Mattis, this would be the first time the FAA shared unfiltered radar data with an organization outside of the federal government.

The data is not classified as “top secret” or “secret,” Mattis said, but it does rise to a level of importance where it needs to be protected. The $11 million would pay for the training, screening of personnel, and physical and cybersecurity upgrades to the test site that would allow them to house and utilize the data.

Several lawmakers on the committee questioned how and when the state would see a return on the $11 million investment in Vantis.

Roesler said that Vantis should be viewed as an infrastructure project and that its value comes from the opportunities it will create.

She said that state agencies and other drone operators must create their own often costly and redundant systems to operate drones the way Vantis allows for. Creating this shared-use infrastructure lowers the barrier for agencies and companies to use drones in new ways.

Rep. David Richter, R-Williston, told a story about a hospital in his part of the state using a drone to deliver medicine across Lake Sakakawea to a remote area as an example of the use of drone infrastructure.

“We build highways and then people use them,” Richter said. “We are building a highway and people will use it.”

The bill was given a unanimous “do pass” recommendation by the committee and will be carried to the floor for a vote by Nathe.

North Dakota

European potato company plans first U.S. production plant in North Dakota

Screen Capture: https://agristo.com/timeline

Agristo, a leading European producer of frozen potato products, is making big moves in North America. The company, founded in 1986, has chosen Grand Forks, North Dakota, as the site for its first U.S. production facility.

Agristo has been testing potato farming across the U.S. for years and found North Dakota to be the perfect fit. The state offers high-quality potato crops and a strong agricultural community.

In a statement, Agristo said it believes those factors make it an ideal location for producing the company’s high-quality frozen potato products, including fries, hash browns, and more.

“Seeing strong potential in both potato supply and market growth in North America, Agristo is now ready to invest in its first production facility in the United States, focusing on high-quality products, innovation, and state-of-the-art technology.”

Agristo plans to invest up to $450 million to build a cutting-edge facility in Grand Forks. This project will create 300 to 350 direct jobs, giving a boost to the local economy.

Agristo is working closely with North Dakota officials to finalize the details of the project.

Negotiations for the plant are expected to wrap up by mid-2025.

For more information about Agristo and its products, visit www.agristo.com.

Agristo’s headquarters are located in Belgium.

North Dakota

Audit of North Dakota state auditor finds no issues; review could cost up to $285K • North Dakota Monitor

A long-anticipated performance audit of the North Dakota State Auditor’s Office found no significant issues, consultants told a panel of lawmakers Thursday afternoon.

“Based on the work that we performed, there weren’t any red flags,” Chris Ricchiuto, representing consulting firm Forvis Mazars, said.

The review was commissioned by the 2023 Legislature following complaints from local governments about the cost of the agency’s services.

The firm found that the State Auditor’s Office is following industry standards and laws, and is completing audits in a reasonable amount of time, said Charles Johnson, a director with the firm’s risk advisory services.

“The answer about the audit up front is that we identified four areas where things are working exactly as you expect the state auditor to do,” Johnson told the committee.

The report also found that the agency has implemented some policies to address concerns raised during the 2023 session.

For example, the Auditor’s Office now provides cost estimates to clients before they hire the office for services, Johnson said. The proposals include not-to-exceed clauses, so clients have to agree to any proposed changes.

The State Auditor’s Office also now includes more details on its invoices, so clients have more comprehensive information about what they’re being charged for.

The audit originally was intended to focus on fiscal years 2020 through 2023. However, the firm extended the scope of its analysis to reflect policy changes that the Auditor’s Office implemented after the 2023 fiscal year ended.

State Auditor Josh Gallion told lawmakers the period the audit covers was an unusual time for his agency. The coronavirus pandemic made timely work more difficult for his staff. Moreover, because of the influx of pandemic-related assistance to local governments from the federal government, the State Auditor’s Office’s workload increased significantly.

Gallion said that, other than confirming that the changes the agency has made were worthwhile, he didn’t glean anything significant from the audit.

“The changes had already been implemented,” he said.

Gallion has previously called the audit redundant and unnecessary. When asked Thursday if he thought the audit was a worthwhile use of taxpayer money, Gallion said, “Every audit has value, at the end of the day.”

The report has not been finalized, though the Legislative Audit and Fiscal Review Committee voted to accept it.

Audit of state auditor delayed; Gallion calls it ‘redundant, unnecessary’

“There was no shenanigans, there were no red flags,” Sen. Jerry Klein, R-Fessenden, said at the close of the hearing.

Forvis representatives told lawmakers they plan to finish the report sometime this month.

The contract for the audit is for $285,000.

Johnson said as far as he is aware Forvis has sent bills for a little over $150,000 so far. That doesn’t include the last two months of the company’s work, he said.

The consulting firm sent out surveys to local governments that use the agency’s services.

The top five suggestions for improvements were:

- Communication with clients

- Timeliness

- Helping clients complete forms

- Asking for same information more than once

- Providing more detailed invoices

The top five things respondents thought the agency does well were:

- Understanding of the audit process

- Professionalism

- Willingness to improve

- Attention to detail

- Helpfulness

Johnson said that some of the survey findings should be taken with a “grain of salt.”

“In our work as auditors, we don’t always make people happy doing what we’re supposed to do,” he said.

YOU MAKE OUR WORK POSSIBLE.

GET THE MORNING HEADLINES.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics6 days ago

Politics6 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health5 days ago

Health5 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades