North Dakota

North Dakota Charities Oppose Tribes’ Efforts to Gain iGaming Rights

Posted on: October 24, 2022, 12:16h.

Final up to date on: October 24, 2022, 12:56h.

North Dakota charities that depend on charitable gaming to fund their applications are talking out. They’re in opposition to Gov. Doug Burgum’s (R) plans to increase the state’s Class III gaming compacts with its 5 federally acknowledged Native American tribes that function casinos.

Burgum, who’s persevering with to try to restore strained state relations with North Dakota’s tribes — six years after the extended 2016 protests over the Dakota Entry Pipeline that passes beneath the Missouri River close to the Standing Rock Sioux Reservation –is finalizing new Class III gaming phrases with the tribes.

North Dakota’s Class III gaming compacts, the contractual agreements that permit the tribes to function Las Vegas-style slot machines, desk video games, and in-person sports activities betting on their sovereign lands, are set to run out on the finish of the yr.

Burgum desires to permit the Three Affiliated Tribes (Mandan, Hidatsa, and Arikara nations), Spirit Lake Nation, Standing Rock Sioux Tribe, Turtle Mountain Band of Chippewa Indians, and Sisseton-Wahpeton Oyate Nation to function web casinos with interactive slots and desk video games. The governor, who’s in his second time period, moreover believes the tribes ought to be given on-line sports activities betting rights.

Charitable Backlash

Whereas Class III gaming compacts in lots of states require tribes to share a portion of their web gaming earnings with the state, North Dakota solely requires that its Native American entities cowl the state’s prices of regulating tribal gaming.

North Dakota’s 5 tribal teams say the added gaming choices would higher guarantee the tribes’ financial sovereignty. Representatives from the state’s charitable gaming business say authorizing iGaming and on-line sports activities betting — which might primarily present authorized playing choices throughout the state — would significantly damage charitable gaming.

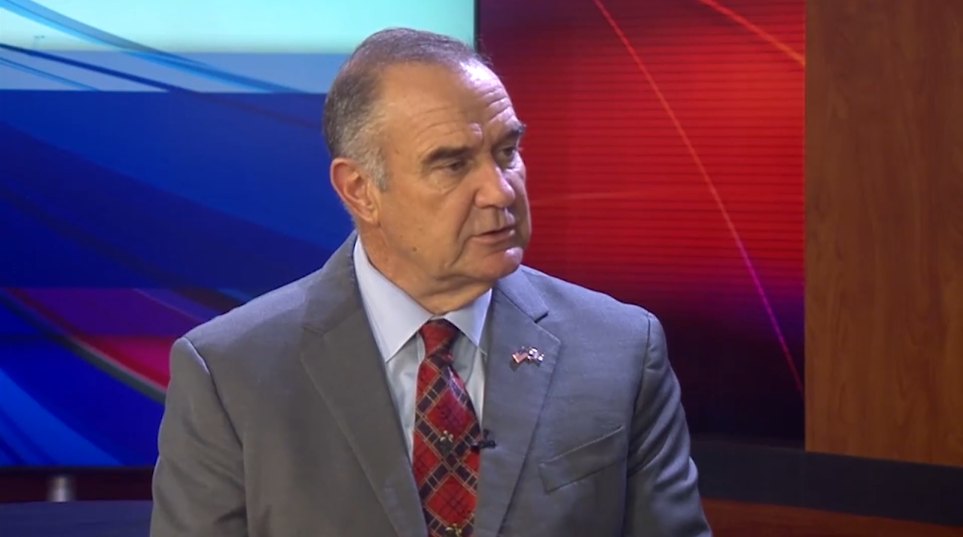

Mike Motschenbacher, the manager director of the North Dakota Gaming Alliance, which lobbies the state on behalf of charitable gaming pursuits, says authorized tribal iGaming and on-line sports activities betting “would completely devastate our business.”

Motschenbacher stated in a latest op-ed that state charities raised about $73 million within the newest fiscal yr from charitable gaming operations. The cash supported quite a lot of applications, together with meals for seniors, veterans applications, and youth actions.

“Taking away the flexibility for North Dakota charities to proceed to offer these providers to North Dakota residents by making a monopoly for the advantage of one group will not be good coverage for our state, particularly because the tribes are usually not required to pay any taxes to North Dakota ought to this subject be accepted by the governor,” Motschenbacher opined in The Jamestown Solar.

Governor Says Charities Have Higher Hand

Burgum has countered the charitable gaming business’s opposition to increasing the Class III compacts. He argues that North Dakota charities had been dealt a successful hand in 2017 when the state accepted digital pull-tab machines. The gadgets look and sound like slot machines.

Final week at a public listening to on the state Capitol concerning tribal gaming, the governor fired again at Motschenbacher when he contended that offering the tribes iGaming and on-line sports activities betting would put the state’s charities at a aggressive drawback.

I simply need to say that I don’t assume the information would assist your assertion that the tribes have the benefit,” Burgum stated.

Annual charitable gaming proceeds greater than doubled after e-pull tabs had been accepted.

North Dakota

Fargo insurance agent fined by state disputes giving kickbacks

BISMARCK — A Fargo insurance agent facing the largest fine ever imposed by the North Dakota Insurance Department says the state agency misrepresented what led to the fine.

Tyler Bjerke, a representative for Midwest Heritage Insurance and Valley Crop Insurance, has been fined $136,500 and his license to sell insurance in North Dakota has been placed on probation for four years for violating a law that limits gifts to clients and potential clients, according to the order finalizing the penalties.

The per person limit means insurance agents can give a gift of $200 to a client couple, said Insurance Department spokesperson Jacob Just.

The Insurance Department said Bjerke gave 182 pub-style tables to clients and potential clients valued at $213.95.

Bjerke doesn’t dispute the cost but contends that he originally ordered the tables from China in July 2022 at a price of $199.95 per set. He said in September 2022, he was told that the price had gone up to $213.95 due to port fees and tariffs.

He said he tried to cancel the order but would have lost a $20,000 deposit.

“I made a business decision based on $14.95 over the gift allowance and thought that no one would care about $14.95,” he said in the email. “This was $2,720.90 over the limit and I was fined $136,500, $750 per violation.”

Insurance Commissioner Jon Godfread said in a statement that licensed insurance agents aren’t allowed to give high-value gifts to consumers “because it essentially boils down to bribing clients for business.”

“Insurance should only be sold based on the competitive coverage options and premiums offered by an agent, not by those who can offer kickbacks in exchange for business,” Godfread said.

Bjerke said the pub tables were for clients with “man-caves, shops, lake homes, etc.” as a way to thank clients he considers family members.

“For the insurance commissioner to mention that gifts are kickbacks in exchange for business is a gross misrepresentation of what occurred,” Bjerke said.

The Insurance Department also found that Bjerke hosted a concert by the band Sawyer Brown in February 2023 with free admission to clients and potential clients, with the value also exceeding the $100 limit. Prosecution of that case was deferred as a condition of Bjerke’s license being placed on probation.

Bjerke said the band was booked as part of a company and client celebration after a day of training sessions that included updates from the U.S. Department of Agriculture, which administers crop insurance programs, and U.S. Sen. John Hoeven, R-N.D., a crop insurance advocate. He said there were no tickets to the event.

Bjerke said he tried multiple times to meet with the Insurance Department and complied with their request for four years of company records.

He said the Insurance Department has a vital role to play in creating an equal playing field for North Dakota insurance agents, but he said he believes his agency was targeted.

Jeff Kleven, executive director of Independent Insurance Agents of North Dakota, said these kinds of violations should be taken seriously and can hurt the reputation of the industry.

Kleven said every licensed insurance agent is aware of the rules on gifts.

“It’s part of the test,” he said.

This story was originally published on NorthDakotaMonitor.com

______________________________________________________

This story was written by one of our partner news agencies. Forum Communications Company uses content from agencies such as Reuters, Kaiser Health News, Tribune News Service and others to provide a wider range of news to our readers. Learn more about the news services FCC uses here.

North Dakota

Obituary for Delmar Zimmerman at Feist Funeral Home

North Dakota

Bankruptcies for North Dakota and western Minnesota published Jan. 11, 2025

Filed in U.S. Bankruptcy Court

North Dakota

Cherie A. Paulin and Rafael Paulin Gordillo, doing business as North Plains Repair, Grand Forks, Chapter 13

Sarah E. Benson, Grand Forks, Chapter 7

Kelly Edward Leidholm, Garrison, Chapter 7

Susan Lorraine Hauck, Dodge, Chapter 7

Minnesota

Bankruptcy filings from the following counties: Becker, Clay, Douglas, Grant, Hubbard, Mahnomen, Norman, Otter Tail, Polk, Traverse, Wadena and Wilkin.

Ariana Barbara Kay Krecklau, formerly known as Ariana Kimble, and Taylor Jacob Krecklau, Moorhead, Chapter 7

Jay William and Ashley Carol Dunbar, Verndale, Chapter 7

Gene Michael and Stacey Lynn Berglund, East Grand Forks, Chapter 7

Micah David Gorder, Frazee, Chapter 7

Paul Monroe and Mikel Lee Sire, Moorhead, Chapter 7

Chapter 7 is a petition to liquidate assets and discharge debts.

Chapter 11 is a petition for protection from creditors and to reorganize.

Chapter 12 is a petition for family farmers to reorganize.

Chapter 13 is a petition for wage earners to readjust debts.

Our newsroom occasionally reports stories under a byline of “staff.” Often, the “staff” byline is used when rewriting basic news briefs that originate from official sources, such as a city press release about a road closure, and which require little or no reporting. At times, this byline is used when a news story includes numerous authors or when the story is formed by aggregating previously reported news from various sources. If outside sources are used, it is noted within the story.

-

Politics1 week ago

Politics1 week agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health1 week ago

Health1 week agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology4 days ago

Technology4 days agoMeta is highlighting a splintering global approach to online speech

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft

-

Science2 days ago

Science2 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

News1 week ago

News1 week agoTrump Has Reeled in More Than $200 Million Since Election Day

-

News1 week ago

News1 week agoThe U.S. Surgeon General wants cancer warnings on alcohol. Here's why

-

World1 week ago

World1 week agoCalls for boldness and stability at Bayrou's first ministers' meeting