Nebraska

Norfolk Case Highlights Post-Roe Privacy, Abortion Issues

A regulation professor stated a controversial abortion case in Norfolk highlights the bounds of on-line privateness and suggests some authorized questions raised by the overturning of Roe v. Wade.

Prices have been filed towards a Norfolk Nebraska teenager and her mom for acquiring medicine to abort a 23-week outdated fetus, then attempting to burn it and bury the stays. Nebraska regulation prohibits abortions 20 weeks after fertilization.

Among the many gadgets of proof within the case are Fb messages between {the teenager} and her mom, which has raised considerations about on-line privateness. Mailyn Fidler, an assistant professor on the College of Nebraska School of Regulation, stated these considerations are well-founded.

“Just about something you do on-line, regulation enforcement can have entry to in the event that they, you recognize, get a possible trigger search warrant. So, Fb messages, web shopping historical past, your Google searches, textual content messages, all of these things is truthful sport,” Fidler stated.

Fidler stated one of the best factor folks can do to guard their privateness is utilizing end-to-end encryption, which Fb provides, though it’s not the default setting.

Fb’s father or mother firm, Meta, has stated the search warrants it received within the Norfolk case didn’t point out abortion, however that authorities had been investigating the alleged unlawful burning and burial of a stillborn toddler.

Fidler stated circumstances involving acquiring abortion tablets on-line and out-of-state are prone to turn out to be widespread.

“We are going to see this type of search warrant go to tech firms to assemble proof about that sort of factor, if states are all in favour of prosecuting ladies for that. I feel we will see plenty of litigation on that to find out how a lot a state can regulate interstate commerce,” she stated.

And he or she stated the case factors out an issue in making legal guidelines.

“You have got horrible information. After which you’ve legal guidelines which are supposed to use in each state of affairs. And so it may be difficult to separate information from the regulation, however I encourage of us to try this since you by no means know what the subsequent circumstance goes to be,” she stated.

Nebraska

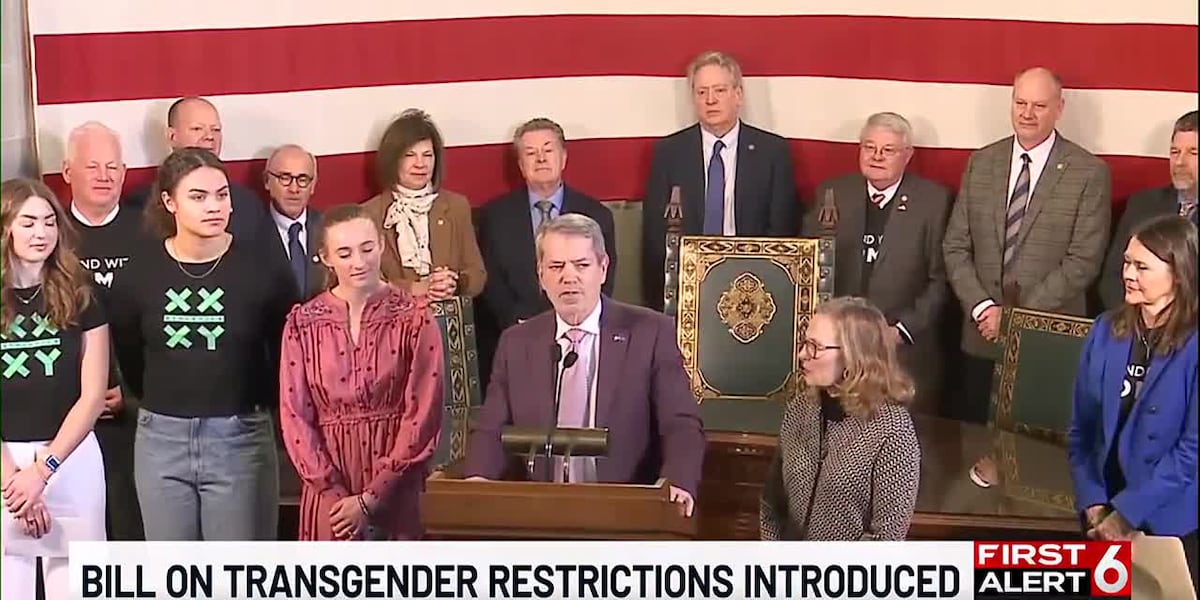

Nebraska athletes express their support for a bill aimed at limiting transgender athletes

LINCOLN, Neb. (WOWT) – Friday, Senator Kathleen Kauth introduced Legislative Bill 89, or Stand with Women Act.

Sen. Kauth was joined by Governor Jim Pillen and advocates for the bill which aims to impact all schools, colleges, and state agencies.

Its expands portions of the Women’s Bill of Rights passed by Gov. Pillen through Executive Order in 2023.

If passed, LB 89 would create a definition of the male and female genders. It would also require people to use the bathroom and locker rooms according to that definition.

“Honestly, my heart just mostly breaks for the trans community because I believe a lot of them resorted to that community was because people weren’t listening when they were crying,” said Nebraska volleyball player Rebekah Allick.

“People weren’t listening when they were asking for help and they were confused. The questions is not what God condemns us for but is when we make those active decisions to defy him.”

The bill would also create restrictions for participation in sports. Prohibiting trans men and women from playing sports alongside the gender they identify with.

LB 89 would also require sports teams to adhere to its definition of what a male and female are when adding athletes to their rosters.

“We see those opposed to allowing men into women sports locker rooms, restrooms, and prisons, we see the people opposed to it as the problem. So, my question is just in how this short amount of time, how have we gotten to this extreme?” said Nebraska softball player Jordyn Bahl.

“I believe that a big part of the answer to that is just extremism across the board. There’s been extreme demand but there is also been extreme consequences for saying no to insanity that has been pushed upon us.”

ACLU of Nebraska Policy Director Scout Richters says the bill is a further escalation from the Sports and Spaces Act which failed last year.

“It will impact trans Nebraskans, if enacted it will impact them at any touch point they have with a government agency or in using identification that doesn’t correspond with their gender identity,” said Richters. “So, each of those things are harmful and damaging and again invites harassment and violence and attempts to erase those identities.”

She says every Nebraskan deserves to be themselves and bills like that undermine it. Richters worries it could lead to further attacks and discrimination against the trans community.

”As a woman it is very upsetting to have your identity as a women used to discriminate against a group of Nebraskans,” said Richters. “There are many other efforts and bills that could be enacted to improve the lives of women. So, to deem this bill what they’ve called it is very insulting and upsetting.”

Richters plans to continue educating voters as the bill continues to evolves.

Sen. Kauth says she doesn’t have the 33 votes she needs right now but believes she can get them.

LGBTQ+ advocacy group OutNebraska issued a statement about the proposed bill.

“LB89 goes way beyond the defeated Sports and Spaces Ban and escalates the potential dangers to our community,” said Abbi Swatsworth, executive director of OutNebraska. “The best approach to ensuring the safety and wellbeing of all, both transgender and non-transgender people alike, is not LB89.”

Copyright 2025 WOWT. All rights reserved.

Nebraska

George Norris still has lessons for today's leaders • Nebraska Examiner

George Norris charted a path for us with a vision of unity and fairness, but for the past 40 years, oligarchs and partisans have steered us astray, leaving us a nation divided.

As our forefathers warned, partisanship and money have poisoned our democracy. It’s time to reclaim Norris’ vision and re-embrace his philosophy.

John F. Kennedy, in a 1958 speech, lamented that biographers often focused on presidents and generals but should go “below the summit” and shine light on senators and party leaders who helped shape our history and heritage, but are largely forgotten. He specifically referenced George Norris.

The citizens of our country, and especially the citizens of Nebraska, often overlook what an extraordinary leader we were fortunate enough to have represent us. Norris served Nebraska in Congress and the Senate from 1903 to 1943.

A fierce independent, he dismantled the power of party bosses, most notably Speaker of the House Joe Cannon, who had been wielding near-dictatorial control over the U.S. House in the early 1900s. Norris’ actions helped create a more decentralized and democratic federal government.

As the architect of the 20th Amendment to the U.S. Constitution, Norris shortened the “lame duck” period between elections, enhancing government efficiency and accountability. He also stood against war when it was deeply unpopular to do so. Norris was one of only six senators to vote against entering World War I, arguing that the war served corporate interests more than the cause of peace.

This courageous stance exemplified his willingness to stand alone for his principles, even when it was politically costly.

Norris is perhaps best known for his role in creating the Tennessee Valley Authority (TVA) and the Rural Electrification Administration (REA). These initiatives lifted poor and rural Americans from a near-medieval existence, ushering them into an electrified era that transformed their lives, work, and incomes. Norris took on powerful private utility interests to make these landmark achievements a reality.

Despite his legacy, Norris was a victim of political retribution. In the 1950s, 160 historians evaluated the greatest legislators in U.S. history, selecting five to be honored with permanent portraits in the U.S. Capitol.

Norris was ranked as the greatest senator, yet Nebraska’s Republican senators, Carl Curtis and Roman Hruska, blocked his inclusion due to his support for Franklin D. Roosevelt. This glaring injustice remains unaddressed, but there is hope it may someday be rectified.

Norris brought his philosophy of prioritizing the public good over party politics back to Nebraska when he championed the establishment of the state’s Unicameral Legislature in 1937. He argued that a single-house, nonpartisan Legislature would limit the influence of party politics while enhancing efficiency, transparency, and accountability.

He believed this system gave Nebraskans greater power and access to their representatives, driven by his conviction that the salvation of the state is in the watchfulness of the people.

Norris’ legacy is a powerful reminder of what it means to lead with courage and principle. He defied party lines, corporate interests, and popular opinion to champion democracy and the common good. Today, we see too few leaders fighting those same battles, nationally or within our state.

George Norris is not just a central figure in Nebraska’s history. He is a model of integrity and independence for the entire nation. His life and work deserve recognition and celebration. He exemplifies the profound impact one determined individual can have.

As we honor Norris this month, let us also follow his example and continue striving for a government that champions democracy, peace, and the common good. Now is the time to uphold his legacy and ensure our government remains by, of and for the people.

Wesley Dodge, an attorney with over 35 years of legal experience in Nebraska, serves on the Board of Directors for Common Cause Nebraska and Better Ballots Nebraska. He also heads a group called Represent Us Omaha. Dan Osborn is a Navy veteran, a former nonpartisan U.S. Senate candidate and a former labor union leader based in Omaha.

Nebraska

Bill introduced to plug ‘missing year’ of Nebraska property tax relief • Nebraska Examiner

LINCOLN — Lawmakers have formally introduced a “fix” to Nebraska’s summer special session changes to a key property tax relief program, which closed off some tax relief for Nebraskans.

State Sen. Brian Hardin of Gering introduced Legislative Bill 81 on Thursday, a promise he and five other lawmakers made in October. The legislation would allow all Nebraskans to claim a credit on any property taxes paid in 2024 when they file their tax returns this spring, in the middle of the 90-day legislative session. The aim is to make whole the people who missed out on claiming an income tax credit for property taxes assessed in December 2023.

LB 81 would offer a one-time extension for the income tax credit program established in 2020 and designed to offset K-12 school taxes, which make up the majority of local property taxes.

The credits will now be immediately applied against school taxes on property tax statements, beginning in December 2024.

For some Nebraskans who didn’t know about the program previously or weren’t able to request the relief, it will be the first time they benefit from the program. About 50% of such eligible credits were left unclaimed.

“[The] challenge is that, in so doing, we did not realize that, inadvertently, we caused a problem as we set about the solution,” Hardin said at an afternoon news conference in the Nebraska State Capitol Rotunda.

“It’s lovely to get that shot in the arm right now because most of us got lowered rates for this year,” Hardin added. “We’re looking at that saying, ‘Hey, that’s good.’ The problem is when you look across those years, 2023 is missing.”

‘Making life more miserable’

Hardin and State Sens. Danielle Conrad of Lincoln and Tom Brandt of Plymouth, who cosponsored LB 81, were among 40 lawmakers to vote to pass legislation during the special session to “front-load” the existing relief program so more people received it. But the change closed the door for relief on 2024 tax returns for anyone who decided to pay property taxes assessed in December 2023 in arrears, or throughout 2024.

“We didn’t realize it at the time but what ended up effectively happening is we ended up making life more miserable,” Hardin said, saying about 85% of Nebraskans didn’t pay their 2023 assessed taxes by December 31, 2023. One person who did pay early: Gov. Jim Pillen.

The legislation, as written, would not be limited to taxes assessed in December 2023 taxes. It would include anyone who paid their 2024 property taxes assessed just last month, if they paid by Dec. 31, 2024.

Implementing LB 81 would cost up to $750 million, plus the allowable growth rate of all real Nebraska property, as determined by the Nebraska Department of Revenue. The actual cost of the fix would likely be less because not all Nebraskans would request the additional year’s credit.

Meanwhile, the state is facing a more than $432 million projected budget shortfall by summer 2027 that lawmakers must tackle.

Hardin said lawmakers might draft an amendment to limit the additional relief to the desired fix: to target only the taxpayers who lost out on the credit for property taxes paid in 2023 if they didn’t pay those taxes by Dec. 31, 2023.

“There was no sleight of hand going on by the Revenue Committee or anyone involved in that process,” Hardin said. “We truly didn’t realize that what we made was an expensive error, but we’re saying: Here’s an opportunity for us to talk about it and fix it.”

‘Nobody had a crystal ball’

Former State Sen. Lou Ann Linehan of Omaha, as chair of the Revenue Committee, led LB 34 through the special session for the tax credit changes she championed four years prior. Linehan, a former six-year chair of the Revenue Committee, and her successor as committee chair, State Sen. Brad von Gillern of Omaha, have said the cash flow to taxpayers is improved by the special session’s changes.

“Nobody had a crystal ball that that was going to happen, that LB 34 was going to happen the way that it happened,” von Gillern told reporters. “To say that anybody prepaid their taxes knowing that they were going to get a ‘double dip’ on this is not reasonable.”

Linehan and von Gillern have noted that if the relief program is funded twice in the same year, the double $750 million credit has a total $1.5 billion price tag.

Hardin envisions paying for the one-time extension of tax credits using billions of dollars sitting in Nebraska agency cash funds, “sweeping the accounts” and recouping money that he said departments were “hoarding.”

‘The people’s money’

The effort to plug the “missing year” of relief that led to LB 81 was in part drafted by another former lawmaker before he was term-limited this week: Steve Erdman of Bayard.

‘A missing year’: No income tax credits for Nebraskans to offset school property taxes paid in 2024

Erdman was among the first to identify what he saw as a “retroactive property tax increase,” to the tune of 20-22% for some Nebraskans he said, shortly after the special session ended in August, as first reported by the Nebraska Examiner.

He and two other term-limited senators were the sole opponents of LB 34, largely for wanting more relief, not, as Erdman described the changes, “a decrease in the increase” of property taxes.

“You can go on forever and never make up that loss,” Erdman said in October of the “skipped” relief. “The question I have is, ‘Whose money is it?’ It’s the people’s money.”

The EPIC Option

Erdman drafted the legislation for his western Nebraska partner, Hardin, who also is taking the mantle from Erdman on seeking to more broadly rewrite Nebraska’s tax code by eliminating property, income and corporate taxes (the “EPIC Option”) and creating a wholesale consumption tax, but not on groceries.

“EPIC is alive and well,” Erdman told the Examiner last week. “The next effort that we put forward will be a far more involved and specific plan on how to get this on the ballot.”

Erdman says it takes time to make “big, bold changes,” but supporters aren’t deterred because of decades of inadequate policies and have learned how to improve their efforts. They are “more focused today than they were before.”

“Going forward, we will have a whole new look,” he continued. “I think it’ll be an opportunity for the Nebraska people that are being taxed out of their homes and farms and businesses to understand that there’s only one option, and that’s to change the whole system.”

Tax relief priority in rural Nebraska

Brandt said property tax relief is top of mind for his constituents.

“They want to know what happened,” Brandt said, adding that the 85% of Nebraskans who didn’t pay their 2023 taxes by the end of that calendar year are in rural districts.

“I would like to tell the people of the state: We’re here,” he continued. “We’re trying to make a difference.”

State Sen. Jana Hughes of Seward said farmers in her district also preplan how they’ll pay their taxes and are good about claiming the income tax credit when available. The Nebraska Farm Bureau has been pushing for an LB 81-style fix.

“They didn’t know the rules were changing,” Hughes said, adding the quick fix left taxpayers in the hole without time to choose their next steps, who might have paid early if they had known.

Finding the money

The special session was the longest and most expensive in state history, costing $173,134 over 17 days, based on a deficit budget request made after the special session. That’s a daily cost of $10,184.35, the highest of any special session in Nebraska.

LB 81 would require an early hearing and would need to be passed, and signed into law, by the time Nebraskans start turning in their tax returns this spring.

Hardin would also need at least 33 lawmakers, regardless if the bill is filibustered, for his bill to take effect for this tax season. And he would need Pillen’s blessing.

Conrad said that in a state budget of more than $12 billion, lawmakers can find the money while also closing the projected budget shortfall.

“It is easily ascertainable to find resources to make it right for Nebraska taxpayers,” Conrad said. “If indeed there is a political will, if indeed there is consensus, we have to come together to make things right for Nebraskans who were negatively impacted by the special session.”

GET THE MORNING HEADLINES.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics6 days ago

Politics6 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health5 days ago

Health5 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades