Midwest

Biden-Harris border crisis slams Ohio town. Here's how state can fight back

NEWYou can now listen to Fox News articles!

Rural America is enduring some of the most devastating consequences of Biden’s border crisis. Springfield, Ohio – a small town of roughly 60,000 residents west of Columbus – is the latest example. Under President Biden’s leadership nearly 20,000 Haitians have resettled there. Now, the community is facing an emergency housing crisis.

On July 8, Springfield City Manager Bryan Heck sent a letter to Sens. Sherrod Brown, D-Ohio, and Tim Scott, R-S.C. – chairman and ranking member, respectively, of the U.S. Senate Committee on Banking, Housing, and Urban Affairs – alerting them to this crisis.

According to Heck, these Haitians have been resettled in the U.S. because of Biden’s parole program, which is supposed to be sparingly used, temporary and “only on a case-by-case basis for urgent humanitarian reasons or significant public benefit.”

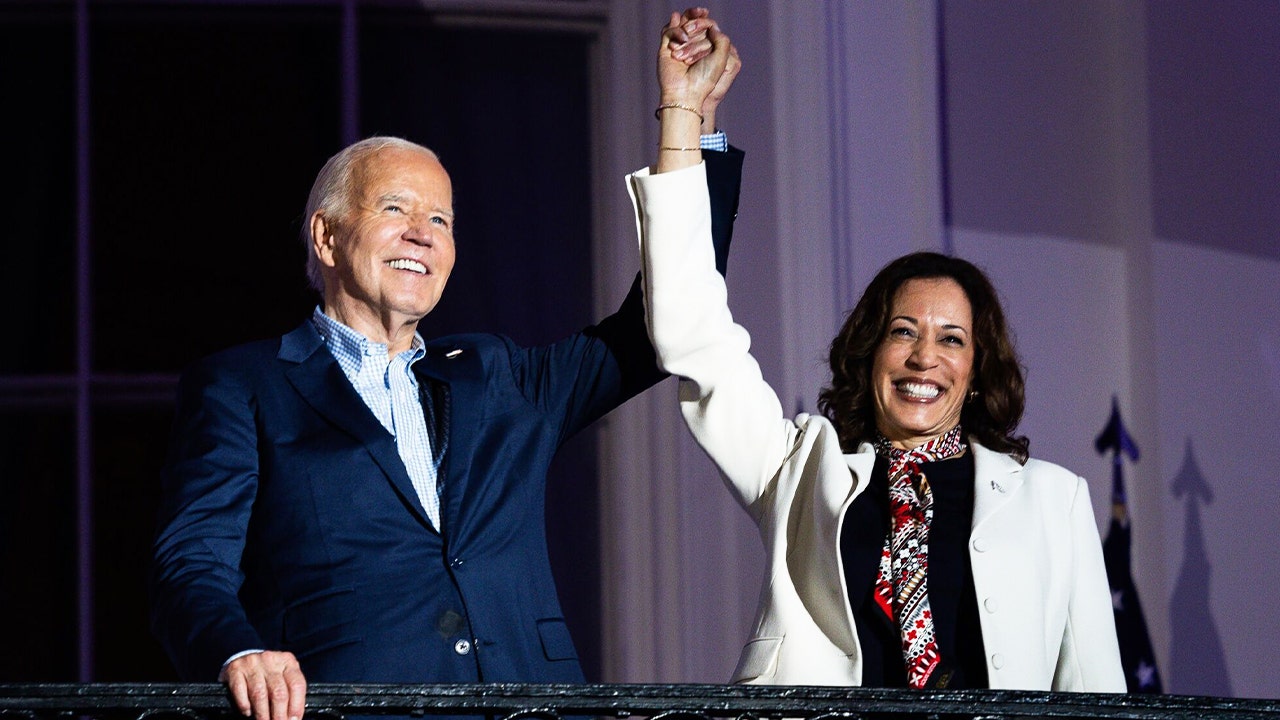

President Biden and Vice President Kamala Harris on the Truman Balcony of the White House on July 4, 2024. (Tierney L. Cross/Bloomberg via Getty Images)

Springfield has experienced a 33% increase in their population since Biden took office because of the surge of illegal aliens crossing our border. In comparison, from 2010 to 2020, Ohio’s population rose 2.3%, and Clark County’s population – where Springfield is located – decreased 1.7%.

HARRIS FAILED TO COMBAT ‘ROOT CAUSES’ OF ILLEGAL IMMIGRATION, FORMER BORDER PATROL UNION CHIEF SAYS

Setting aside concerns about crime and space in schools, a large and rapid increase in population for a midsize town can be ruinous for its residents, especially when affordable housing is already an issue for Americans nationwide.

Biden’s inflationary economic policies have made owning a home more difficult across the country, but his open border had only exacerbated the housing crisis, especially in places like Springfield.

In addition to competing for housing with millions of illegal aliens, Americans’ taxes are also directed to help immigrants with housing. For example, Michigan provides aliens a “newcomer rental subsidy” so they may afford housing. At a time when Americans are struggling financially, the politicians are putting illegal aliens first.

Thankfully, states like Ohio can fight back by enacting laws that make it more difficult for illegal aliens to reside in the state. While some commentators think that Ohio’s rural counties need more immigration, residents in Springfield and across the state can and should request that their politicians develop more responsible policies to protect their state.

VULNERABLE DEM SENATOR HIT WITH IMMIGRATION AD TYING HIS POLICIES TO HIS ‘NEW FRIEND’ KAMALA HARRIS

First, Ohio currently does not require use of the E-Verify system, nor does it have a law targeting employers’ business licenses for violating state immigration laws. Developing policies to require E-Verify and suspending business licenses work in tandem and would be a strategic first step since most illegal aliens come to the U.S. for economic opportunities.

Second, Ohio should adopt policies specifically prohibiting sanctuary jurisdictions. Ohio currently has two sanctuary jurisdictions – Hamilton County and Franklin County. Sanctuary jurisdictions are a threat to public safety because they protect criminal aliens by not communicating or cooperating with ICE.

Sanctuary jurisdictions also facilitate illegal aliens’ prolonged residence within the jurisdiction, which provides aliens more time to work, send money to their home country, and receive downstream benefits and equities here in the U.S., which aliens use as a shield against deportation. Mississippi has passed model legislation prohibiting sanctuary jurisdictions for illegal aliens in their state.

Third, Ohio does not currently have explicit laws prohibiting illegal aliens from receiving downstream benefits such as driver’s licenses, license plates, or business, commercial, and professional licenses. Complete proof of an alien’s legal status should be presented before obtaining any license. Creating laws with explicit language, like Alabama has done, is necessary to prevent any implications or ambiguity in the law.

FOREIGN-BORN POPULATION SHATTERS US RECORD AS ILLEGAL IMMIGRATION GOES UNCHECKED: STUDY

Fourth, Ohio should revise their definition of a state resident. Currently, Ohio defines “resident” as “an individual who is domiciled in this state.” The definition should include that state residents are U.S. citizens and lawful immigrants.

Fifth, Ohio should prohibit non-governmental organizations (NGOs) from obtaining or keeping state and local business licenses, contracts, and grants if they transport or assist with the facilitation of illegal alien smuggling.

NGOs, including faith-based organizations, have received billions of dollars to facilitate Biden’s mass illegal immigration crisis. While NGOs claim they are helping vulnerable populations, they are really participating in a global human-smuggling operation.

CLICK HERE FOR MORE FOX NEWS OPINION

The past three and a half years have seen a growing trend of states passing immigration legislation and joining lawsuits against the Biden administration’s open border agenda. Like other states, Ohio can take more control of preventing illegal immigration within its own state borders to protect Ohioans from the physical and economic adverse effects of mass illegal immigration.

Springfield’s suffering shouldn’t go unnoticed. If conservatives in Ohio and other states make proactive changes today, they can prevent crises tomorrow.

Read the full article from Here

Detroit, MI

Terrion Arnold ‘maintains complete innocence’ in kidnapping, theft case

I represent Mr. Terrion Arnold in connection with an incident that allegedly occurred on February 4, 2026, in Tampa, Florida, which resulted in the arrest of five individuals on serious felony charges.

To be clear, Mr. Arnold had no involvement whatsoever in the activities that led to those arrests. He did not participate in, nor was he present for, any conduct related to the alleged offenses. There is no evidence in police reports, text messages, or witness statements that implicates Mr. Arnold in any way.

In fact, after direct communication with the lead prosecutor, it has been confirmed that no charges have been filed against Mr. Arnold in connection with this matter.

Recent media coverage has referenced an Order issued by Circuit Judge J. Logan Murphy, which improperly suggests Mr. Arnold’s involvement in the incident. That same Order also incorrectly identifies Ms. Devalle as Mr. Arnold’s girlfriend. Both assertions are false, misleading, and entirely unsupported by the record.

Mr. Arnold categorically denies these unfounded claims and maintains his complete innocence. He was not involved in the crimes allegedly committed on February 4, 2026, in Tampa, Florida.

We strongly urge members of the media to refrain from perpetuating inaccurate or speculative narratives. The facts are clear, and they do not support any claim of wrongdoing by Mr. Arnold.

Milwaukee, WI

Sheriff’s Office backpedals on controversial facial recognition deal

Drone view shows Milwaukee’s County Courthouse

Built in 1931, Milwaukee’s historic County Courthouse is in dire need of repair and upgrades. Here’s a recent drone view of the MacArthur Square building.

The Milwaukee County Sheriff’s Office will not move forward on a potential deal to use facial recognition technology, Sheriff Denita Ball announced Friday.

In a statement on Feb. 27, Ball said after “thoughtful evaluation” and “meaningful dialogue” with community stakeholders and leaders, she decided to stop pursuing a contract with Biometrica, a Las Vegas-based company whose technology allows authorities to compare photos to a large database of photos for matches.

“While we recognize the potential of this software as an investigative tool, we also recognize that trust between the MCSO and the people we serve is important,” she said.

“My discussions with local advocates highlighted valid concerns regarding how such data could be accessed or perceived in the current national climate. This decision is not a retreat from innovation but rather an understanding that timing matters, too,” Ball said.

The Milwaukee Journal Sentinel reported on Feb. 17 that the Sheriff’s Office was on the verge of signing off on the use of facial recognition technology after news broke at a community advisory board meeting held by the office.

The update on the office’s sign-off on an intent to enter into a contract with Biometrica blindsided local officials and advocates because it contradicted earlier claims that the office had not moved forward with a controversial contract.

At the time, supervisors on the county’s judiciary and legislation committee called for more information from the Sheriff’s Office about the nature of the then-potential contract.

Supervisor Justin Bielinski, who chairs the committee, said Ball’s decision to step away from the deal was good news, but said he was still feeling wary.

“I would like to see more I guess,” he said of the two paragraph statement from Ball. “At what point would she reconsider, right?”

County Executive David Crowley, who is running for governor as a Democrat, had also voiced concerns about a possible contract when news came to light earlier this month.

After learning of Ball’s decision to not move forward with Biometrica, Crowley thanked community members who voiced concerns about facial recognition technology, saying he will “continue doing everything in my authority to ensure our residents’ First Amendment rights, civil liberties, and personal data are protected.”

In recent months, Milwaukee politicians and residents rebuffed local law enforcement’s efforts to pursue the use of such technology at both the city and county levels, with many citing concerns over racial bias and unjust surveillance of residents.

The Milwaukee County Board of Supervisors voted last summer to recommend the development of a policy framework for the use of facial recognition technology as worries about its use by local law enforcement grew in the community.

The policy emphasized that the use of such technology doesn’t “suppress First Amendment-related activities, violate privacy, or otherwise adversely impact individuals’ civil rights and liberties,” and called for a pause on acquiring new facial recognition technology until regulatory policies were in place to monitor any existing and new surveillance technology.

In early February, the Milwaukee Police Department paused its pursuit of facial recognition technology after almost a year of pushback from activists and some public officials at public meetings. The department also noted that community feedback was a part of its final decision as well as a volatile political climate amid the federal government’s immigration crackdown.

(This story was updated to add new information.)

Minneapolis, MN

Fan behind Anthony Edwards’ orange bracelet has beaten cancer

MINNEAPOLIS (FOX 9) – The story behind Anthony Edwards wearing a bright orange bracelet since last season has received a positive development, after Timberwolves fans learned Luca Wright has beaten leukemia.

Anthony Edwards, Luca Wright connection

What we know:

Last January, the 6-year-old Minnesotan met “Ant” for the first time following a game against the Detroit Pistons, proclaiming him to be his favorite player, and asking him to wear a bracelet that symbolizes leukemia awareness, resilience and support for those affected. During the interaction, the fan had created a sign with a to-do list: “1. Beat Cancer. 2. Be The Next MJ.”

Leukemia is a type of cancer that spreads throughout the bloodstream, infecting bone marrow and a person’s lymphatic system by rapid production of abnormal white blood cells that can’t fight infection.

Since then, the Wolves’ MVP has worn a bracelet that proclaims, “Love Like Luca” on it for every game he has played, vowing to wear it “until he hangs up his sneakers.”

Ant has gone on to explain how the gesture connected with him given that he lost both his mother, Yvette, and grandmother, Shirley, to cancer when he was 14 years old. The No. 5 jersey he wears currently is a tribute to them both.

Luca bracelet latest

Dig deeper:

More than a year later, Wolves fans have received the update they hoped for – now 7-year-old Luca has beaten his cancer.

What’s next:

Ant has since responded to the news with his own social media video, calling it “God’s gift” and saying, “Let’s do this Luca.”

No word yet on whether he intends to keep wearing the bracelet, though he’s previously said he has a stash of replacements near the team bench should one ever be broken.

The Source: Information provided by the Minnesota Timberwolves public relations department.

-

World2 days ago

World2 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts2 days ago

Massachusetts2 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Oklahoma1 week ago

Oklahoma1 week agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Louisiana5 days ago

Louisiana5 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Denver, CO2 days ago

Denver, CO2 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology6 days ago

Technology6 days agoYouTube TV billing scam emails are hitting inboxes

-

Technology6 days ago

Technology6 days agoStellantis is in a crisis of its own making