Finance

Warburg Pincus acquires 90% stake in Vistaar Finance

Private equity firm Warburg Pincus has acquired a controlling stake in Vistaar Finance, an NBFC lending to micro, small and medium enterprises in India, the firm said.

Warburg Pincus has acquired around 90% equity stake, for $250 million, through a combination of primary and secondary shares.

Former ICICI Bank executive Avijit Saha will be co-investing alongside Warburg Pincus and has been appointed chief executive officer.

“India is on course to becoming a $5 trillion economy over the next few years with the MSME sector playing a key role in achieving this goal. Warburg Pincus sees a significant opportunity in this space. Avijit has a long and successful track record in areas of rural, retail banking and SME credit. He also brings great strengths in building and scaling different business models, and we are excited to partner with Avijit in the further build-out of the Vistaar platform,” Narendra Ostawal, managing director, Warburg Pincus said.

Vistaar operates in 12 states, has around 40,000 customers, and more than 2,500 employees, and manages assets under management (AUM) of ₹3,150 crore as of March 2023. Post the transaction, Vistaar has a net worth of ₹1,210 crore with a capital adequacy of 37%, the company said.

Saha, a 30-year banking veteran was previously the head of rural and inclusive banking and president at ICICI Foundation.

“As Vistaar embarks on its next phase of growth, we will continue to build deeper understanding of specific customer segments and fulfil their financial needs through customised products,” Saha said.

Kotak Investment Banking acted as the exclusive financial advisor to this transaction.

Before ICICI, he worked at ICI Paints Ltd., Gurgaon, where he served as the business head for Refinish Business.

He is also a nominee director in FINO Payment Bank, and a nominee director in National E-Repository Limited (NERL)

Brahmanand Hegde and Ramakrishna Nishtala, the Founders of Vistaar Finance will be selling their shares in the transaction.

“It is a matter of great pride for us to have taken Vistaar Finance from being just an idea to becoming a leading NBFC in the MSME space. We have built this leading platform of MSME lending, over the last thirteen years, and we are delighted to hand over the baton to Avijit Saha to take it further to the next level of growth, supported by Warburg Pincus,” the duo said in a joint statement.

Other early investors in the company include Elevar Equity, Omidyar Network India, Saama Capital and Westbridge Capital.

After starting operations in April 2010, Benguluru-based Vistaar finance provides secured loans to micro, small and medium enterprises across 12 states with more than 200 branches and over 2,500 employees.

The company provides 100% secured lending across ticket size categories through business and housing loans and targets small businesses such as shops, small manufacturing units, power looms, kirana /general shops, and home-based industries, which do not have access to organised funding for growth, the firm said.

Download The Mint News App to get Daily Market Updates & Live Business News.

More

Less

Updated: 29 May 2023, 12:04 PM IST

Finance

Opposition blasts state attempt to assist major haredi school system in financial trouble

The coordinator of the opposition in Israel’s Knesset Finance Committee, MK Vladimir Beliak (Yesh Atid), criticized on Thursday reports that Prime Minister Benjamin Netanyahu had promised to assist a major haredi school system affiliated with United Torah Judaism MK and Knesset Finance Committee chairman, MK Moshe Gafni, that is currently under legal scrutiny for financial mismanagement.

In a post on X, Beliak wrote that he had received “more and more reports” that Netanyahu had promised to find funding to aid the private haredi school system known as the Hinuch Ha’atzmai (literally “Independent Education”) pay its employees’ salaries and social security benefits for the month of July.

The school system has been in financial trouble since a report in February by the Finance Ministry’s Accountant General Yahali Rotenberg laid out a series of financial irregularities. Beliak accused the prime minister of attempting to unlawfully assist the school system in order to prevent a political rupture with his political ally, at least until the end of the Knesset summer session on July 28.

Beliak warned the “prime minister’s office, the head of the Knesset Finance Committee (Gafni) and all those who are involved in the matter – we are following closely. We will scour with an iron comb every relevant transfer (of funds) that arrives at the finance committee. We will conduct an uncompromising professional, parliamentary, and legal struggle, we will reflect the reality, and we will update regularly,” Beliak wrote.

Gafni threatened a number of weeks ago to quit his position as Knesset Finance Committee chair if a solution was not found to save the school system from bankruptcy, and the inability to do so could lead to a political rupture in the coalition. This could happen irrespective of another crisis regarding the end of the haredi exemption from IDF service.

Financial mismanagement led schools unable to pay salaries

Despite being privately run, the Hinuch Atzmai and its Shas-run counterpart, Bnei Yosef, enjoy special legal status and receive full state funding. The two systems have received over NIS three billion annually in state funding during the past few years, and they share characteristics with government bodies – they are directly connected to the government’s MERKAVA funding system, and they employ a finance-ministry-appointed accountant to run their finances. However, these school systems are not prone to the same level of oversight as public schools. The presence of the publicly appointed accountant has enabled the systems to avoid effective financial scrutiny, as they have argued that their finances are state-run and therefore not their responsibility.

However, the February report found that the Hinuch Haatzmai had bypassed its accountant and amassed a tax debt of over NIS 80 million, and another report found that the school system had accrued additional operational debts of over NIS 300m. The Hinuch Haatzmai is also facing dozens of challenges in court, including six class actions suits against alleged violations of employees’ rights, including unexplained salary deductions, unpaid work hours, and more. These legal challenges could lead to hundreds of millions of additional shekels of debt.

As a result, the Hinuch Haatzmai in May suffered a bank account foreclosure, and at first was unable to pay its employees’ salaries in June. The Finance Ministry agreed to loan the necessary funds for June, but the system now faces the same challenge for July.

Rotenberg in February threatened that if a solution was not found by July 1, the Hinuch Atzmai and Bnei Yosef school systems would be disconnected from the government’s MERKAVA funding system, and the finance ministry would remove its accountant. This would force the systems to employ independent financial management, and bear full responsibility if it failed to meet tax requirements and financial commitments.

However, Finance Minister Bezalel Smotrich, Minister in the Education Ministry Haim Biton (Shas), and representatives from the Justice Ministry have attempted in recent weeks to come up with an arrangement that would lead to closer oversight of the systems, while keeping them afloat financially by continuing full state funding. FINANCE MINISTRY representatives reasoned that if this did not happen, the Hinuch Hatzmai, which has over 100,000 students and thousands of employees, would collapse, and the state would need to intervene regardless.

Members of the opposition opposed such an arrangement, as did the Movement for Quality Government in Israel (MQG). In a letter dated July 2 to Rotenberg, Biton, Finance Ministry legal adviser Asi Messing, Attorney-General Gali Baharav-Miara, and State Comptroller Matanyahu Englman, MQG called on the Finance Ministry to “publish clarifications to the arrangement that was made, the alternatives that were examined, and the implications on state coffers.”

In an accompanying statement MQG said, “The new arrangement, the details of which have not yet been officially published, which is supposed to include the disconnection of the educational networks from the government’s Merkava system, the opening of separate bank accounts, and the hiring of accountants to supervise budgetary management, may even make the situation worse.”

MQG listed what it viewed as five problems in the arrangement:

First was “absence of substantive reform.” According to MQG, “The arrangement does not include significant structural or financial changes in the conduct of the networks.”

Second was “continued unlimited funding.” MQG argued that “despite the repeated warnings of the accountant-general and the attorney-general, the arrangement continues to allow funding of the private party-political educational networks, without a complete disconnection from the government budgets and without a plan to repay their debts.”

MQG described the third problem as “increasing the state’s responsibility without compensation.” According to MQG, under the new arrangement, “The state takes on additional responsibility for the conduct of the networks, without requiring them to act in accordance with the rules of proper administration and the curricula of the ministry of education.”

The fourth problem, according to MQG, was a “lack of transparency,” as “the details of the arrangement and its consequences for the public have not been officially published, which raises serious concerns about the integrity of the process.”

Finally, MQG pointed out that Biton himself was the former manager of Bnei Yosef, and therefore was caught in a conflict of interest and should not have been involved in the negotiations.

MQG proposed the following steps:

“1. Full and transparent publication of the details of the arrangement that is being drawn up; 2. The establishment of a government inquiry committee to examine the set of relations between the state and the party-political education networks; 3. Re-examination of the funding model, incorporating the principles of transparency, equality and good governance; 4. Preventing the involvement of those who have a conflict of interest in the decision-making process; and 5. Creating a long-term plan to put the networks on a proper footing and to implement uniform standards throughout the education system.”

Gafni’s office said in response to a Jerusalem Post query that it “did not know” about the issue. The prime minister’s office did not respond.

Finance

Why Chinese banks are now vanishing

The savings and loan (S&L) crisis terrorised America’s banks for years. Starting in the mid-1980s, a mix of aggressive lending growth, poor risk controls and a property downturn contributed to the collapse or consolidation of over 1,000 small lending institutions. China’s smallest banks are now suffering from many of the same ailments. But until recently few have collapsed or merged with others.

That is starting to change. In the week ending June 24th, 40 Chinese banks vanished as they were absorbed into bigger ones. Not even at the height of the S&L crisis did lenders disappear at such a clip.

Finance

Bajaj Finance share price gains as AUM spikes 31%, new loans booking grow 10% YoY in Q1 | Stock Market News

Bajaj Finance share price gained over a percent in early trade on Thursday after the non-banking finance company (NBFC) reported a strong business update for the first quarter of FY25.

Bajaj Finance’s total assets under management (AUM) grew by 31% to ₹354,100 crore as of June 30, 2024, as compared to ₹270,097 crore as of June 2023.

AUM in Q1 FY25 grew by approximately ₹23,500 crore, Bajaj Finance said in a regulatory filing.

The NBFC’s new loans booked recorded a 10% year-on-year (YoY) growth at 10.97 million in the quarter ended June 2024 as against 9.94 million in the same period last year.

The company resumed sanction and disbursal of loans under ‘eCOM’ and ‘Insta EMI Card’ and issuance of EMI cards after the RBI removed the restrictions on these businesses on 2 May 2024.

Deposits book in Q1FY25 increased 26% to ₹62,750 crore as compared to ₹49,944 crore, YoY.

Bajaj Finance said its customer franchise increased to 88.11 million in June 2024 from 72.98 million in June 2023. In Q1 FY25, the customer franchise increased by 4.47 million.

Moreover, net liquidity surplus stood at approximately ₹16,200 crore at the end of June quarter, it said, adding that the company’s liquidity position remains strong.

Bajaj Finance shares have recently gained momentum, rising over 11% in the past month. Despite this uptick, Bajaj Finance stock has underperformed this year, delivering no returns year-to-date (YTD) and declining more than 7% over the past twelve months.

At 9:20 am, Bajaj Finance shares were trading flat at ₹7,251.00 apiece on the BSE.

-

Politics1 week ago

Politics1 week agoOakland mayor breaks silence after FBI raid: ‘I have done nothing wrong’

-

News1 week ago

News1 week agoWhere Joe Biden and Donald Trump Stand on the Issues

-

Politics1 week ago

Politics1 week agoPopular Republican and Trump running mate contender makes first Senate endorsement in 2024 races

-

News1 week ago

News1 week agoToplines: June 2024 Times/Siena Poll of Registered Voters Nationwide

-

Politics1 week ago

Politics1 week agoFox News Politics: Trump Ungagged…Kinda

-

Politics1 week ago

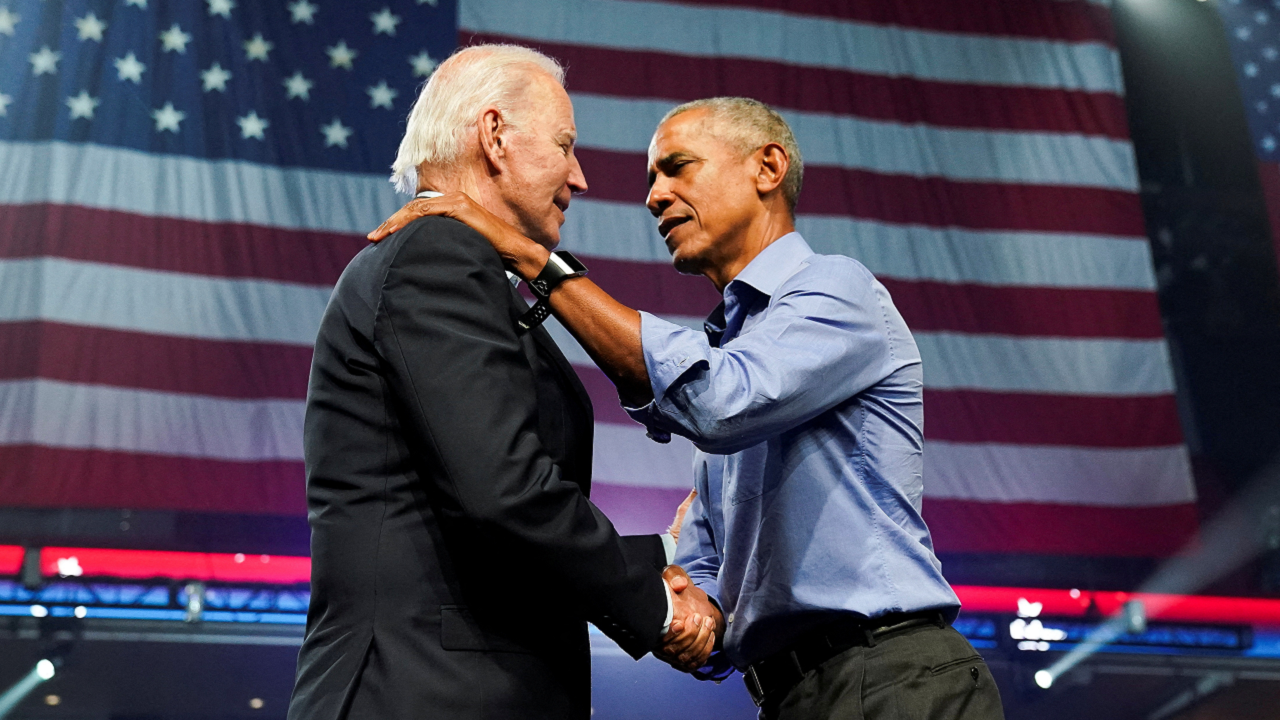

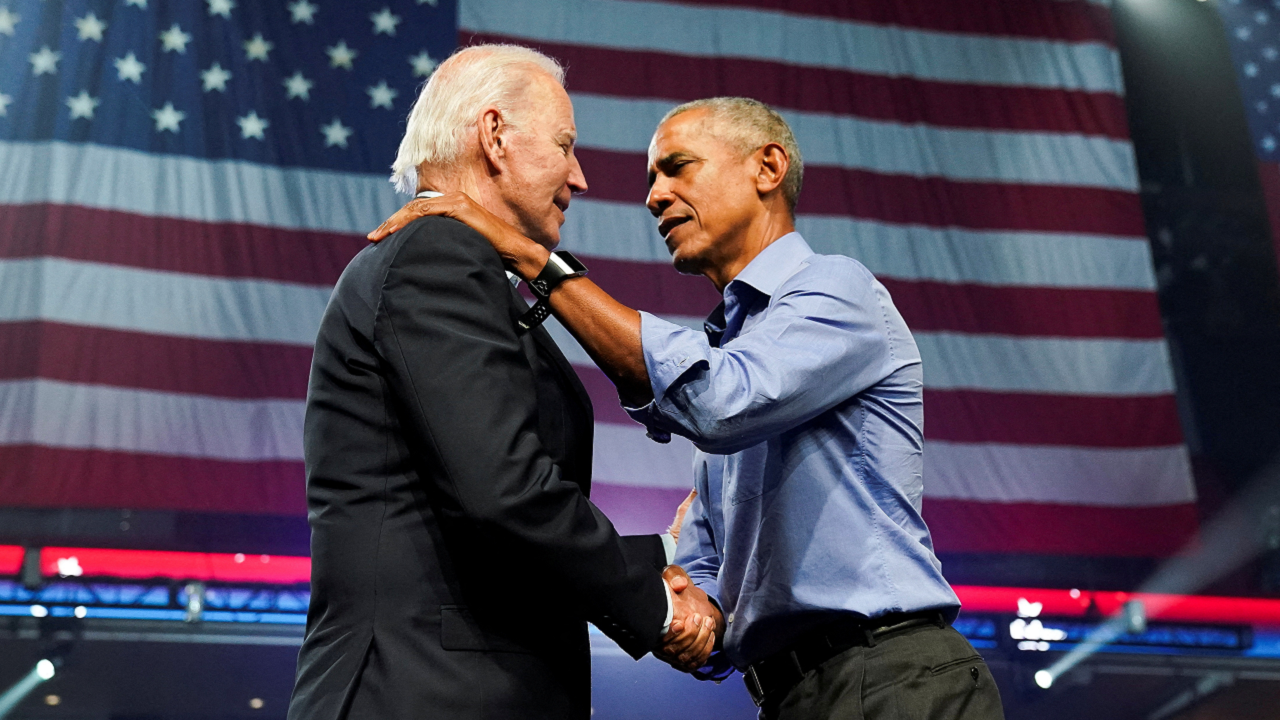

Politics1 week agoObama again stepping into role as Joe's closer ahead of Trump v Biden rematch

-

News1 week ago

News1 week agoIowa floodwaters breach levees as even more rain dumps onto parts of the Midwest

-

News5 days ago

News5 days agoVideo: How Blast Waves Can Injure the Brain