Finance

Visits set for Vice Chancellor for Finance, Operations and Administration finalists

Starting Monday, Oct. 31, and persevering with till Thursday, Nov. 10, campus will conduct ultimate in-person interviews within the seek for the Vice Chancellor for Finance, Operations and Administration. Campus management invitations all within the campus group to take part within the course of and to supply suggestions on the 4 finalists.

Every finalist might be on campus for 2 days, assembly with campus constituencies. Throughout their go to, every finalist will give a 30- to 40-minute public town-hall discuss, which might be adopted by a 40- to 50-minute moderated Q&A. Distant attendees will have the ability to ask questions in actual time through chat. All UC Santa Cruz college, workers and college students are invited to attend these talks.

College students are additionally invited to attend a 50-minute student-only lunch assembly with every finalist. Attendees should RSVP to attend a lunch session.

The title and particulars of every finalist might be launched one week previous to their two-day interview. This data could be discovered on-line. You will have to be signed in to your UC Santa Cruz account to entry this data. To respect candidate privateness and the integrity of the method, please don’t share candidate names, curriculum vitaes, go to schedules, or associated hyperlinks exterior of the UC Santa Cruz group.

Click on on the dates under for details about the finalists and their visits.

The Vice Chancellor for Finance, Operations and Administration is a key place at UC Santa Cruz, as this chief is entrusted with a variety of obligations. Faculties, Housing and Instructional Companies; Monetary Affairs; Bodily Planning, Improvement and Operations; Danger and Security Companies; Workers Human Assets; and Sustainability are all models inside the division. The place was beforehand often known as Vice Chancellor for Enterprise and Administrative Companies. The title of the division and the place have been modified this summer time to raised mirror the division’s key capabilities.

For extra particulars in regards to the recruitment course of, go to the Vice Chancellor for Finance, Operations and Administration recruitment web page. When you’ve got particular questions not addressed on the positioning, contact Lauren Morgan, Senior Chief Human Assets Supervisor, at llmorgan@ucsc.edu.

Finance

Government finance statistics: net financial worth

The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. The difference between the stock of financial assets and the stock of liabilities is called net financial worth.

At the end of the first quarter of 2025, the EU net financial worth stood at -€8 948 billion or -49.4% of the gross domestic product (GDP). Compared with the end of the fourth quarter of 2024, the EU net financial worth increased by €72 billion. Compared with the end of the first quarter of 2024, the EU net financial worth decreased by €213 billion.

This information comes from data on quarterly government finance published by Eurostat today. This article presents a handful of findings from the more detailed Statistics Explained article.

Source dataset: gov_10q_ggfa

The net financial worth can change due to transactions or due to other economic flows (mainly price changes, also known as holding gains or losses). The main liabilities on the EU general governments’ balance sheets are debt securities. As these instruments are traded on the financial markets, their value changes over time and can be volatile.

At the end of the first quarter of 2025, the continued EU general government deficit (net financial transactions, measured as transactions in financial assets minus the transactions in liabilities, -€166 billion) contributed negatively to the evolution of net financial worth. However, at the EU level, compared with the fourth quarter of 2024, the net financial worth improved due to the financing of the deficit being off-set by positive revaluation of financial assets (+€137 billion), notably equity, as well as negative revaluations of liabilities (-€101 billion), notably debt securities.

Finance

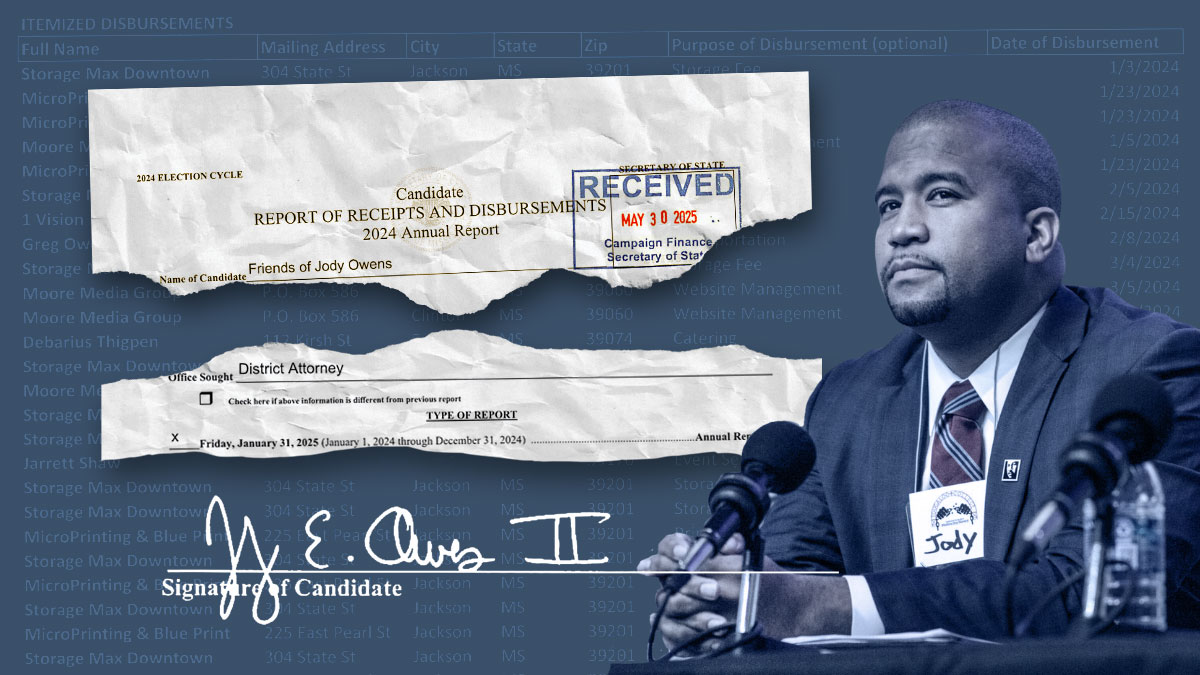

Indicted Jackson prosecutor's latest campaign finance report rife with errors

Finance

Fed independence faces a ‘showdown’ between Trump & the market

00:00 Speaker A

I also want to ask about what’s going on with economic data and the Federal Reserve, guys. Um, Ed, what are you hearing there in D.C.? Right? There is now some reporting out there that Kevin Hassett is kind of the front-runner to potentially take Jay Powell’s place at the Federal Reserve. What are you hearing and what’s the kind of vibe in Washington around this decision?

00:43 Ed

So, Julie, the way I’d view this is that President Trump always loves competition. You know, he came to some of his most recent national prominence by having the Apprentice show. And so, my expectation is that President Trump is going to keep multiple people in the running. Kevin Hassett certainly is in there. Kevin Warsh is in there. I’d put Christopher Waller, who’s already on the Fed board, as well as Treasury Secretary Bessant. I’m watching to see if there’s an opening on the Fed. If a governor steps down, like Michael Barr, now that he’s no longer vice chair for supervision, does one of these individuals get onto the board? I’m also watching for Waller as there are rate decisions here in July and September. Is there going to be a dissent? You generally don’t see dissents among Fed governors, but as you’re auditioning for that role, showing that you would be much more dovish is something that President Trump is going to be looking for and could move him up the list of potential Fed chairs come May of next year.

02:26 Speaker A

Yeah, I think the Apprentice Federal Reserve edition is something that no one asked for, uh, guys. I don’t know, Dory, like, in terms of market reaction to all of this, um, you know, we’ve seen rates kind of remain range-bound here as we get numbers like CPI yesterday and PPI today. But do you think at some point that this competition is going to start to really come to bear in the bond market?

03:25 Dory

Uh, yeah, I think we have a showdown coming. Uh, most people in the marketplace want to preserve the independence of the Fed, and when I say that, I mean that both ways, not just from Trump’s standpoint, but from the Fed’s standpoint. I’ve always said the Fed is, in my mind, Powell being a little political in some of his rate cuts early last year. Having said that, the market has always anticipated for the last couple of years anyway, uh, more rate cuts than actually should have happened or did happen. And I think we’re falling into that trap, and so is Trump as well. I’m kind of a wait-and-see kind of guy right now. I do think the next Fed chair is going to be one of those type of interviews, hey, I’m Donald Trump and I believe this, and if you believe this, I’d like to have you as Fed chair. That points to Hassett being the, uh, being, being there. And, uh, I think that’s going to get some criticism from the market. I think we need that independence. We need good independent valuation. Uh, and, and, you know, I think cutting too soon, soon could be, uh, extremely dangerous when we all know that our deficit is out of control, our debt is out of control, and we don’t want to become a Venezuela.

-

Politics1 week ago

Politics1 week agoConstitutional scholar uses Biden autopen to flip Dems’ ‘democracy’ script against them: ‘Scandal’

-

Politics1 week ago

Politics1 week agoDOJ rejects Ghislaine Maxwell’s appeal in SCOTUS response

-

Health1 week ago

Health1 week agoNew weekly injection for Parkinson's could replace daily pill for millions, study suggests

-

Culture1 week ago

Culture1 week agoTest Your Knowledge of French Novels Made Into Musicals and Movies

-

News1 week ago

News1 week agoSCOTUS allows dismantling of Education Dept. And, Trump threatens Russia with tariffs

-

Business1 week ago

Musk says he will seek shareholder approval for Tesla investment in xAI

-

Business1 week ago

Business1 week agoShould You Get a Heat Pump? Take Our 2-Question Quiz.

-

Sports1 week ago

Sports1 week agoEx-MLB pitcher Dan Serafini found guilty of murdering father-in-law