Finance

Turkey’s Inflation Turnaround Is Almost Over With Dive Below 50%

Article content material

(Bloomberg) — Turkey’s inflation in all probability slowed beneath 50% for the primary time in additional than a yr and will plateau at that degree, with dangers for worth stability rising because the nation goes to the polls this month.

Article content material

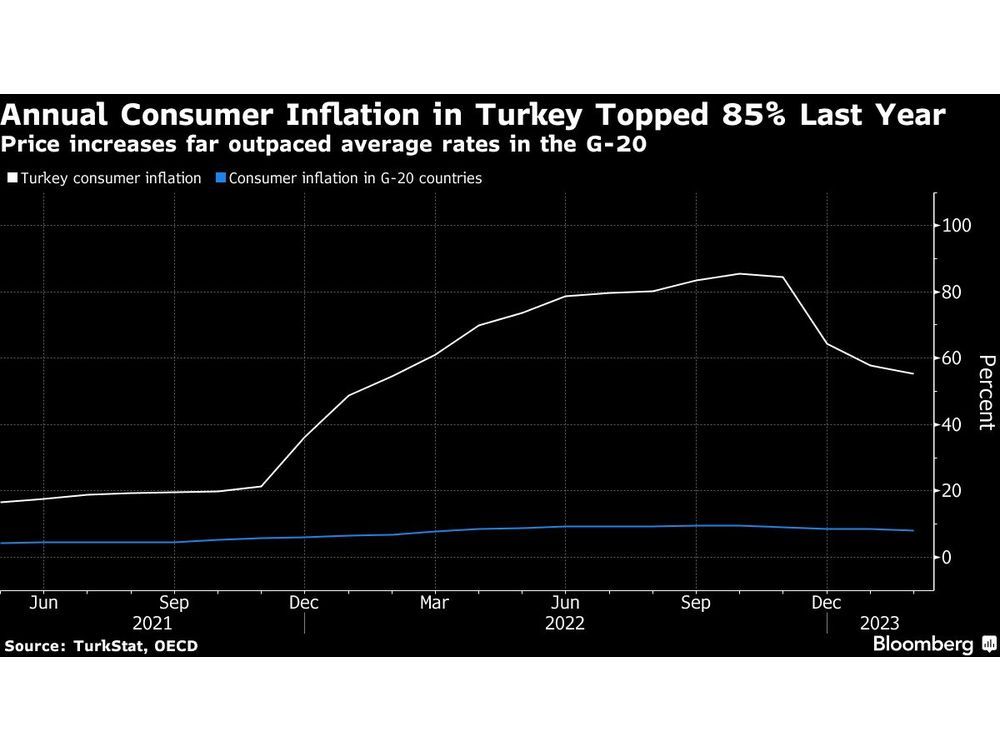

Although authorities have caught with ultra-loose insurance policies that helped push annual inflation above 85% in 2022, cheaper power prices and the statistical impact of a excessive base final yr imply costs have been cooling off at a steep tempo.

Article content material

Inflation has nearly halved since peaking in October to achieve an annual 44.1% final month, down from 50.5% in March, in response to the median forecast of economists surveyed by Bloomberg. A separate ballot discovered worth progress will hover round 44% this quarter and subsequent earlier than ending the yr barely increased.

Shopper inflation was probably beneath 45% in April, Treasury and Finance Minister Nureddin Nebati stated in a televised speech this week. Turkey’s statistics company will report the info on Wednesday.

Article content material

Essential to the outlook is the result of the vote lower than two weeks away as President Recep Tayyip Erdogan faces the stiffest problem of his 20 years in energy. Underneath his stewardship, Turkey has pursued an unorthodox method and slashed rates of interest within the perception it will maintain again worth positive aspects.

Proof on the contrary has been in plain view for months. And whereas the headline determine is in decline, core inflation — which strips out risky objects like power and meals — continues to be operating sizzling in an indication worth pressures stay elevated.

Including to pressure on inflation, the federal government has been ramping fiscal spending after the lethal earthquakes in February and with the method of elections.

A unified opposition of six political events has promised that, if elected, it will decide to inflation focusing on by a set of extra standard insurance policies and probably wind down the rules and backdoor interventions used to regular the lira.

Article content material

What Bloomberg Economics Says…

“The rise in public spending, together with post-quake rebuilding, and the central financial institution’s unfastened stance, will probably feed into increased worth positive aspects. In our view, that may restrict the decline within the annual inflation fee, because it offsets the damping impression coming from base results. We see inflation hovering above 40% for the remainder of the yr.”

— Selva Bahar Baziki, economist. Click on right here to learn extra.

On Thursday, central financial institution Governor Sahap Kavcioglu will current this yr’s second quarterly inflation report, the place he might revise projections for 2023 and 2024.

Policymakers most just lately forecast worth progress will finish this yr at 22.3% — greater than 4 occasions increased than the central financial institution’s official goal — after which gradual to eight.8% in 2024.

The lira’s efficiency might decide a lot of what occurs subsequent, with mounting expectations for a depreciation after the Could 14 elections posing a menace to shopper costs. The Turkish forex is among the many worst performers in rising markets thus far this yr with a drop of virtually 4% in opposition to the greenback.

“A lira adjustment post-election and potential changes in wages and administered costs will probably weigh on inflation momentum,” ING Financial institution economists together with Muhammet Mercan stated in a report.

—With help from Joel Rinneby.

Finance

Big Players Maneuver In Global Finance And Industry

What’s going on here?

From hostile takeovers to strategic acquisitions, major financial and industrial players are making bold moves to bolster their market positions. Spanish bank BBVA, Swiss private bank Julius Baer, and British IT services group Redcentric are all in high-stakes negotiations for potential mergers.

What does this mean?

BBVA’s €12.23 billion hostile takeover bid for Sabadell marks a major potential consolidation in the Spanish banking sector, despite opposition from Madrid. Julius Baer’s talks with EFG International highlighted competition in Swiss private banking, though discussions have ceased. In IT services, Redcentric’s negotiations with Milan-listed Wiit SpA could lead to a substantial acquisition. Additionally, private equity firm Carlyle is preparing to sell aerospace manufacturer Forgital, signaling increased activity in the aerospace sector. Also, Deutsche Bahn is advancing in the bidding process for its logistics subsidiary Schenker, with four contenders still vying for it.

Why should I care?

For markets: Strategic consolidations and divestments.

These moves reflect broader trends of consolidation and strategic realignment across industries. BBVA’s bold bid for Sabadell and Criteria’s acquisition of a 9.4% stake in ACS for €983 million signify aggressive strategies to capitalize on market opportunities. Carlyle’s plan to sell Forgital and Saudi Aramco’s in Repsol’s renewable energy division highlight the growing focus on portfolio diversification and sustainability.

The bigger picture: Global shifts in financial and industrial landscapes.

These developments indicate profound changes in the global financial and industrial sectors. KKR’s likely approval to acquire Telecom Italia’s fixed-line network without EU antitrust conditions signals a favorable regulatory climate for strategic deals. On the flip side, the Italian government’s decree for state broadcaster RAI to possibly merge its tower unit, RaiWay, with EI Towers shows the fluidity of managing national strategic assets. Meanwhile, Coventry Building Society’s £780 million purchase of Co-operative Bank underscores ongoing consolidation in the British banking sector.

Finance

Commodity price volatility presents ‘substantial’ challenges: Finance Ministry

Bengaluru: The Union Finance Ministry said on Friday that the ongoing geo-political upheavals and the resultant volatility in prices of commodities globally, continues to be a cause of concern on the economic front, but added that there are enough macro-economic buffers to navigate these challenges.

“The unrelenting geopolitical tensions and volatility in global commodity prices, especially of petroleum products, present substantial multi-frontal challenges,” the ministry said in its latest Monthly Economic Review (MER), for the month of April 2024.

Nonetheless, the expectation is that the macro-economic buffers nurtured and strengthened during the post-Covid management of the economy will help the India navigate these challenges reasonably smoothly, the MER stated.

India’s retail inflation for April declined to a 10-month low of 4.83%, the second consecutive month below the 5% level. This was primarily due to easing of core inflation, even as food prices remained elevated.

There has been a continued decline in retail inflation since December 2023. It has been within the Reserve Bank of India’s (RBI) tolerance range of 2-6 per cent for the seventh month in a row. However, it has been above the central bank’s medium-term target of 4 per cent for 54 consecutive months.

Primarily due to the ongoing conflict in the Middle-East, prices of the benchmark Brent crude have risen more than 6 per cent year-to date.

On Wednesday, the MER stated that as per all available high-frequency data, the strong performance of the Indian economy in 2023-24 has carried onto the current April-June quarter (Q1 of 2024-25).

“The Indian economy closed FY24 strongly with its growth surpassing market expectations, despite strong external headwinds. Early indications suggest a continuation of the economic momentum during the first quarter of FY25,” it stated.

It said that industrial activity is gaining momentum and fixed investment is gathering pace on the back of the focus the government’s capital spending. “The forward-looking surveys of the Reserve Bank also indicate improving consumer confidence and industrial outlook,” the report said.

Published 24 May 2024, 22:45 IST

Finance

City of Lawton announces new Finance Director

LAWTON, Okla. (KSWO) – The City of Lawton has announced Rebecca Johnson as the city’s new Finance Director.

According to a press release from the city, Johnson’s experience includes service as a utility supervisor for the City of Norman, auditor for the Public Utility Division of the Oklahoma Corporation Commission, and most recently the Finance Director for the City of Duncan.

Johnson will begin her new role on June 3.

You can read the full press release here:

Copyright 2024 KSWO. All rights reserved.

-

Politics1 week ago

Politics1 week agoVulnerable Dem incumbents move to the center in key swing states as Biden panders to far-left base

-

World1 week ago

World1 week ago‘Monstrous crime’: World reacts to attack on Slovakia’s prime minister

-

News1 week ago

News1 week agoHow a migrant aid group got caught up in a right-wing social media thread : Consider This from NPR

-

Politics1 week ago

Politics1 week agoSouthern border migrant encounters decrease slightly but gotaways still surge under Biden

-

World1 week ago

World1 week agoSlovakia PM Robert Fico in ‘very serious’ condition after being shot

-

Movie Reviews1 week ago

Movie Reviews1 week agoIs Coppola’s $120M ‘Megalopolis’ ‘bafflingly shallow’ or ‘remarkably sincere’? Critics can’t tell

-

Movie Reviews1 week ago

Movie Reviews1 week agoGuruvayoor Ambalanadayil movie review: This Prithviraj Sukumaran, Basil Joseph-starrer is a total laugh riot

-

World1 week ago

World1 week agoTaiwan grapples with divisive history as new president prepares for power