Finance

SEC commissioner on NIL deals: ‘We’re seeing just straight payments’

Alabama soccer head coach Nick Saban alleged that Texas A&M is paying its gamers. In the meantime, Texas A&M head coach Jimbo Fisher has denied the claims, as a substitute telling reporters to look into how Alabama runs its sport-dominating operation.

Whereas the general public bickering between two school soccer giants offered a humorous offseason second, their argument highlighted a a lot bigger concern with the state of identify, picture, and likeness (NIL) within the NCAA.

“There are some regarding traits,” Southeastern Convention Commissioner Greg Sankey instructed Yahoo Finance. “We’re not seeing identify picture and likeness exercise — we’re seeing simply straight funds. And I feel it is vital that we recenter ourselves on what’s purported to be occurring right here and the need to maintain that exercise out of recruitment to learn younger folks economically however to take action in a wholesome manner.”

Yahoo Finance spoke with Sankey and 5 NCAA Division I athletic administrators in regards to the state of NIL on the Sports activities Enterprise Journal Sports activities Enterprise Awards on Could 18. Their considerations and references to “chaos” rang true over the next 24 hours as Saban claimed Texas A&M “purchased each participant on their staff,” and Fisher urged reporters “dig into” how Saban has been so profitable all through the years.

The general public show of displeasure with NIL insurance policies comes as collectives, typically organized by rich college donors, have taken over the NIL trade with direct funds to gamers no matter what their identify, picture and likeness is price. A Miami participant lately signed a $800,000 deal across the time he transferred. ESPN reported a Boston School receiver was flashed six-figure offers to entice him to switch. If both supply was made previous to the choice to switch, it will be a direct violation of NCAA insurance policies.

“We really feel like we’re in a little bit little bit of disaster, a little bit little bit of chaos,” Penn State Athletic Director Sandy Barbour, who was named Athletic Director of the 12 months on the occasion, instructed Yahoo Finance. “I feel ‘chaos’ is the phrase that’s been used and so, I feel we’ve obtained to discover a answer fairly rapidly.”

The answer possible gained’t come anytime quickly, although. Sankey doesn’t imagine a lot will change inside the market previous to kickoff of the 2022 season in August. With state legal guidelines impacting some colleges, and never others, conferences are hamstrung concerning regulation. Faculties need to stay aggressive and have a compelling curiosity to stretch the foundations so far as attainable.

Primarily, the onus is positioned on the NCAA, which simply launched new NIL steering on Could 9. The brand new tips present up to date definitions of boosters and collectives and point out that the NCAA plans to clamp down on boosters and collectives paying recruits.

Nonetheless, school directors have questioned the NCAA’s effectivity in shutting down criminality. Monitoring the recruiting exercise of 130 groups generally is a logistical nightmare. On prime of that’s the NCAA’s monitor file, or lack thereof, on the subject of laying down the regulation (See: the years-long school basketball FBI probe that’s led to restricted punishment for sure applications which are nonetheless successful nationwide championships).

Sankey instructed Yahoo Finance he doesn’t imagine the NCAA alone can clear up the issue. He and coaches like Saban have as a substitute referred to as on Congress to develop broad guidelines.

“We have been clear in regards to the want for a nationwide commonplace and that you will have congressional exercise,” Sankey stated. “And whether or not or not Congress sees that as a necessity, the safety and help of school sports activities in a wholesome manner, is a part of the dialog that is not going to regulate anytime quickly.”

Sean Frazier, athletic director at Northern Illinois College, is assured that every part will “stage itself out” on the finish of the day.

“All people simply must relax,” Frazier instructed Yahoo Finance. “The sky is just not falling and we’ll get again to enterprise.”

Comply with Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube

Finance

AI is too ‘sociopathic’ to give financial advice, MIT researchers say

The problem with AI in the context of it being used as a financial advisor is that it is “inherently sociopathic,” according to a Business Insider article which cited an MIT research report.

Also Read: Japan wants its hardworking citizens to try a 4-day workweek due to labor shortage

Why is AI sociopathic?

While human financial advisors give clients recommendations using a behavioral lens, since people don’t always make rational or unbiased financial decisions, AI can easily argue on both sides of an argument because neither side has any weight to it.

How is AI used by financial advisors at the moment?

Nearly 40% of human financial advisors use generative-AI tools for the job, according to a report from data-analytics firm Escalent, which added that this was mostly for boosting productivity, generating content, and for marketing functions.

Also Read: New FASTag design launched to crack down on large vehicles using smaller vehicle tags to pay less toll

Examples include Canadian startup Conquest Planning using a financial-planning software with an AI architecture known as a blackboard system for storing information about tax rules, cash-flow mechanics, retirement-account structures, fiduciary rules, and more, according to the article, which added that another example would be Los Angeles-based wealth manager Arynton Hardy, who uses AI regularly to save time on data entry, portfolio monitoring, and other back-office tasks.

How can AI be made more useful for giving financial advice?

A method to make AI more empathetic to the client is by making it ask simple questions like “How are you doing?” before dispensing personalized financial advice, according to Andrew Lo, a professor of finance at the MIT Sloan School of Management and the director of the Laboratory for Financial Engineering, who co-authored the report.

The AI could also use audio or video from the client to identify emotional cues, like stress or fear, in their voice or facial expressions, he added.

“We think we’re about two or three years away before we can demonstrate a piece of software that by SEC regulatory guidelines will satisfy fiduciary duty,” the article quoted him as saying.

Also Read: Did the Tatas really have to merge Vistara with Air India?

Finance

Harris's proposed unrealized capital gains tax is unlikely to pass: CIO

Unrealized capital gains tax proposals may be floating back into the zeitgeist as the Harris presidential campaign marches on, but for some, the noise around it is much ado about nothing.

“I don’t think this unrealized thing is going to have much momentum because it is a very onerous process to come up with those numbers,” Raymond James chief investment officer Larry Adam told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (see video above or listen here).

“You start putting biases of what you think [something] is worth versus the reality,” said Adam. “That becomes a very difficult equation to really put into a place.”

We’ve seen unrealized capital gains tax proposals before, but they’ve met plenty of resistance.

Most recently, the Biden administration proposed an unrealized capital gains tax for those with a net worth of over $100 million. The proposal could affect more than 10,600 people in the US, according to estimates.

But, unlike a capital gains tax, which is imposed on a sold item, deploying an unrealized capital gains tax is a trickier move.

Stifel chief Washington strategist Brian Gardner said in a recent client note that under an unrealized capital gains tax system, “ranking illiquid assets would not only be complicated but controversial,” adding that there would also need to be a way to provide taxpayers with “rebates for future losses.”

While analysts scratch their heads about the subject, an unrealized capital gains tax also has plenty of tomato throwers. Donald Trump called it “beyond socialism,” telling a crowd of small-business owners, “You will be forced to sell your restaurant immediately.”

Trump’s onetime US Commerce Secretary, Wilbur Ross, concurred.

“Frankly, I think it’s a ridiculous proposal,” Ross said on Opening Bid.

Tesla (TSLA) CEO Elon Musk also had negative statements to share on the topic, proclaiming an unrealized capital gains tax would lead to “bread lines and ugly shoes.”

While Trump and Musk might deliver their messages to pack a wallop and make voters think, concerns aren’t necessarily unfounded.

Raymond James’s Adam has considered tax proposals made by both candidates, and thinks that regardless of the administration in office, higher taxes could impact households by almost $2,000. “[It] could be a big impact and a drag on the economy,” he said.

Both Harris and Trump face challenges given the expiration of a significant portion of the 2017 tax cuts at the end of 2025. Trump has proposed an additional extension of provisions from 2017 and potentially more tax cuts.

Harris proposed expanding the child tax credit and supported no increase in the capital gains tax, while taxing those making over $400,000 annually more.

While the presidential race is anyone’s game at this point, Adam isn’t that worried about an unrealized capital gains tax and the potential market losses. “[There’s] a low probability of it passing,” he said. “It’s pretty hard to mark to market every single year for your taxes.”

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

This embedded content is not available in your region.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Finance

Insider Sale: President Brian Hole Sells Shares of Willis Lease Finance Corp (WLFC)

On August 30, 2024, President Brian Hole sold 1,187 shares of Willis Lease Finance Corp (NASDAQ:WLFC), as reported in a recent SEC Filing. Following this transaction, the insider now owns 96,589 shares of the company.

Willis Lease Finance Corp specializes in the leasing of spare commercial aircraft engines, aircraft, and other aircraft-related equipment to airlines, aircraft engine manufacturers, and maintenance, repair, and overhaul providers worldwide.

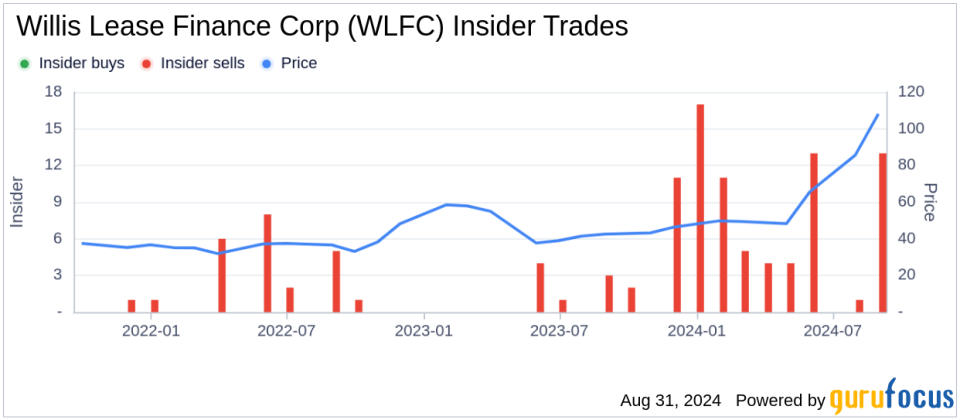

Over the past year, Brian Hole has engaged in multiple transactions involving the company’s stock, selling a total of 24,570 shares and purchasing none. This recent sale is part of a broader trend observed within the company, where there have been 82 insider sells and no insider buys over the past year.

Shares of Willis Lease Finance Corp were priced at $106.17 on the day of the transaction. The company currently holds a market cap of approximately $772.655 million. The price-earnings ratio stands at 8.41, which is below the industry median of 17.98.

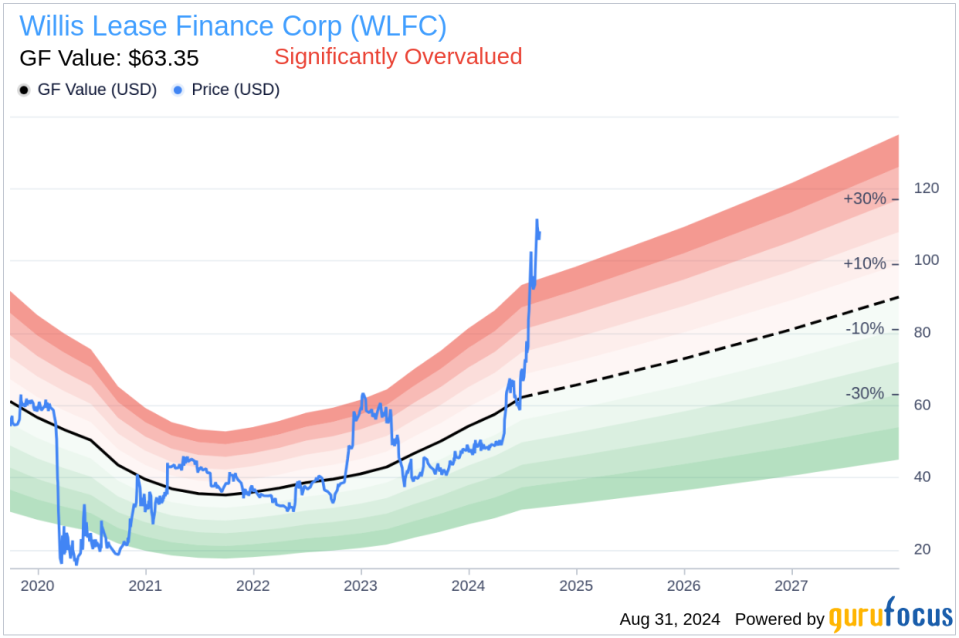

According to the GF Value, the intrinsic value estimate for Willis Lease Finance Corp is $63.35 per share, making the stock significantly overvalued with a price-to-GF-Value ratio of 1.68.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

This sale by the insider might be of interest to current and potential investors, providing insight into insider confidence and valuation perspectives at Willis Lease Finance Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

-

Connecticut1 week ago

Connecticut1 week agoOxford church provides sanctuary during Sunday's damaging storm

-

Technology1 week ago

Technology1 week agoBreakthrough robo-glove gives you superhuman grip

-

Politics1 week ago

Politics1 week ago2024 showdown: What happens next in the Kamala Harris-Donald Trump face-off

-

News1 week ago

News1 week agoWho Are Kamala Harris’s 1.5 Million New Donors?

-

Politics1 week ago

Politics1 week agoTrump taunted over speculated RFK Jr endorsement: 'Weird as hell'

-

Politics1 week ago

Politics1 week agoVivek Ramaswamy sounds off on potential RFK Jr. role in a Trump administration

-

World6 days ago

World6 days agoPortugal coast hit by 5.3 magnitude earthquake

-

Politics1 week ago

Politics1 week agoHouse GOP demands elite universities counteract 'dangerous' anti-Israel protests in the fall semester