Finance

Reconsidering personal finance decisions amid spiralling inflation

“Somebody’s sitting within the shade as we speak as a result of somebody planted a tree, a very long time in the past” – these phrases of knowledge by Warren Buffet aptly summarise the essence of private finance planning, particularly the facility of long-term investments. A sturdy monetary planning as we speak is one’s strongest defend from the uncertainties of the long run. Because the world continues to grapple with market volatility, fast inflation and uncertainty looming massive after the pandemic, it’s time to rethink monetary choices. Retail inflation in India has been pointing north for fairly a while now. Whereas it marginally eased by clocking 7.01% in June, the speed nonetheless surpasses the RBI’s tolerance restrict of 6% for six consecutive months.

These figures signify the direct influence on one’s monetary planning or the shortage thereof. These components illustrate a urgent want for investing and constructing a sizeable corpus to safe one’s future. If you happen to’ve been a reluctant investor and haven’t allotted your funds for additional development, you could be cognizant of the influence of each inflation and depreciation. On one hand, your cash is ill-equipped to endure the rising price of inflation, alternatively, by not investing, you might be holding on to a always depreciating and devaluing asset. Whereas it’s nice to plan your funds for a lifetime, given the uncertainty of life, it’s equally vital to plan to your dependents. And so, parking your cash in the suitable investment-cum-insurance merchandise is a non-negotiable monetary determination now.

Beating actual detrimental curiosity for conventional buyers

Fairly understandably, investing won’t be for everybody, extra so, for individuals who have no idea the right way to navigate a risky market. Typically, the financial savings on this case are earmarked for conventional choices like FD. Whereas this was an awesome possibility till a couple of years in the past with an 8-9% return price, the falling rates of interest lately don’t make it so interesting anymore. Add the tax factor and the inflation price to your positive factors, and also you may really be taking a look at getting actual detrimental returns. As an alternative, risk-sensitive buyers can discover choices like assured return plans the place they will allot their financial savings to satisfy long-term life targets, like retirement planning or kids’s schooling. What makes them higher? Larger price of return, tax-free curiosity, fastened price of return no matter the market fluctuations and tax advantages because of the insurance coverage factor.

Gaining from the upside of the market alongside safety

If you’re somebody who likes to faucet the potential of compounding, there are fairly a couple of choices that can fetch you this together with a monetary security web. Unit-linked Insurance coverage Plans (Ulips) are one such possibility chosen by optimistic buyers. Relying available on the market, this instrument can reap a 12-15% price of return which matches a good distance in assembly your milestones. Even with the pliability and ease of liquidity, the investor ought to nonetheless take a leap of at the least 15-20 years in the event that they need to make the most effective of this funding. They will even simply swap between fairness and debt as per their desire, which makes this feature perfect for individuals who have a good concept of the market situations.

Safeguarding the way forward for your dependents

The world is riddled with uncertainties and no quantity of anticipation can predict what can go incorrect at any level. Whereas one can’t forestall an unlucky occasion, one can absolutely plan and put together forward to avert any adversities. Due to this fact, insurance coverage has change into an indispensable factor of economic planning now. There are a number of nice funding choices out there, however the distinctive promoting proposition of investment-cum-insurance merchandise is the worth they proceed to offer even in your absence. These plans be sure that the household will get the life cowl to satisfy rapid in addition to long-term bills within the unlucky occasion of the policyholder’s premature demise. What’s extra? If you happen to make these investments to your kids, additionally they include a novel waiver of premium options. What this implies is that in case of the coverage proposer’s demise, the premiums shall be waived off and borne by the insurance coverage firm.

Given the present macro setting, you will need to rigorously contemplate every of those components earlier than you proceed to take a position your precious, hard-earned cash. There are different such merchandise as effectively, just like the Capital Assure that allow you to mix the assured return with the market-linked return and have the most effective of each worlds. Relying in your desire and desires, don’t forget to reassess your funding choices for max advantages.

Disclaimer

Views expressed above are the creator’s personal.

END OF ARTICLE

-

A journey unfinished: India@75 has a lot to have fun however the full vary of freedoms out there to elites eludes most

-

India is, ultimately, on the upswing: We might not develop at greater than 5% yearly, however that’s nonetheless good in a slowing international financial system

-

At 75, India wants to speak: A few of our issues want dialogue, between events, between communities, between ideologues

-

Saffron seek for Muslim vote: BJP’s outreach to Pasmandas is electorally and ideologically sensible, however it received’t be easy crusing

-

Spot the obscenity: A college that fires a professor for a personal photograph in a swimsuit, teaches very twisted classes

-

Error of remission: Gujarat authorities had greater than sufficient grounds to not launch Bilkis case convicts

-

Time to take away Pakistan as an concept from Kashmiri minds

-

A narrative of personal success and public failure: Except it fixes its establishments, India is not going to change into a developed nation in 25 years

-

GDP and our judges: Courts are intervening in financial coverage issues in a means that’s costing India large

-

Will we change into wealthy? Per capita revenue shall be in high 10% of all economies

Finance

Minnesota voters back half of school finance levies, reelect most board incumbents

About half the Minnesota districts that asked voters for more money on Election Day got it.

In Northfield, the school district’s $121 million three-question funding request saw full approval, meaning school leaders will be able to move forward with building a new gymnasium, classroom addition and geothermal heating and cooling system.

Minneapolis voters OK’d a $20 million technology spending levy for the financially strapped public school district.

Voters across the state were willing to renew existing levies for building maintenance and upgrades, and for technology. It was a different story, though, when they were asked to pay more for day-to-day operating costs.

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Thirty districts this year asked voters to approve levies for daily costs, including 28 that put questions on ballots this week. Only 40 percent of those requests were OK’d — one of the lowest approval rates since 1980.

“One of the things that really stuck out to us is people were willing to vote to maintain. They weren’t interested in increasing their local property taxes,” said Kirk Schneidawind, executive director of the Minnesota School Boards Association.

Schneidawind said he believes that’s a reflection of how Minnesotans feel about the economy.

“The general default for many voters is, ‘I’m going to vote no if I don’t understand it or don’t know about it,’” Schneidawind said. “People, in their mind, the economy, prices of things and costs of things have gone up. And inflation, even though it’s been coming down, it’s still impacting their pocketbook. And I think perhaps folks saw that or felt that and weren’t supportive of new increases for our public schools.”

Statewide, 45 districts put some sort of financial question on their local ballots this year with 51 percent approved.

School boards

More than 300 Minnesota school districts sought to fill open school board seats this election. In places where incumbents were on the ballot, voters elected to keep them at a rate of nearly 87 percent.

While this year’s competition wasn’t as intense as in recent years, many districts had multiple candidates on their ballots. Behind those candidates were organizations spending time and money on training and endorsements.

The Minnesota Parents Alliance, a conservative organization launched in 2022, endorsed nearly 130 candidates in 56 Minnesota districts in its voter guide. Teacher unions backed nearly 100 candidates in 33 districts. The School Board Integrity Project, a progressive organization launched last year, endorsed 45 candidates in 27 districts.

In the 29 districts where there were candidates from both the Minnesota Parents Alliance and the teachers union or School Board Integrity Project facing off, 31 Minnesota Parents Alliance-endorsed candidates won and 50 union or School Board Integrity Project-endorsed candidates won.

Education Minnesota president Denise Specht claimed victory in an emailed statement, saying union-backed candidates won nearly 75 percent of their races.

Leaders of the Minnesota Parents Alliance also focused on wins, pointing to wins in 56 percent of races with endorsed candidates and seats gained in 47 school boards and majorities gained on boards in Elk River, Lakeville, Forest Lake and Prior Lake, MPA leader Cristine Trooien said in a statement.

Here are the results in a few districts MPR News tracked on Tuesday.

Prior Lake-Savage

In 2022, the open seats on this suburban district’s school board were hotly contested by opposing slates of candidates who staked out sides in a tug of war that involved organized parent groups, teacher unions, networks of political donors and families worried school equity efforts were in jeopardy.

This year there were six candidates running for three open seats. The candidates — just one of whom was seeking reelection — were divided into those backed by the local teacher union versus those who received endorsements from the Minnesota Parents Alliance.

Two of the Minnesota Parents Alliance candidates won, backed by a local parents group that sank at least $1,800 in the election. Just one union-endorsed candidate won, meaning this school board, come January, will be led by a majority of MPA-endorsed candidates.

Voters in this district also rejected the school system’s request for a levy to help pay for daily operations.

Brainerd

In Brainerd, there were seven candidates running for three seats. Only one didn’t secure endorsements from either the Minnesota Parents Alliance or the local teacher union. All union-endorsed candidates were incumbents. Of those, two won reelection. The third open seat was filled by a Minnesota Parents Alliance-backed candidate.

In the 2022 election cycle, Brainerd saw a frenzy of school board campaign spending with candidates racking up nearly $80,000 in disbursements on advertising, mailers and signs. This year, the spending has come way down and is now closer to $11,000.

The three election winners will oversee a district serving at least 6,000 students in north-central Minnesota.

Fergus Falls

Nine candidates were running to fill three seats in this west-central Minnesota district where nearly 3,000 students attend school. Three union-endorsed candidates, supported by about $2500 in union campaign spending, beat out three Minnesota Parents Alliance-endorsed candidates.

Lakeville

In Lakeville, nine candidates vied to fill three seats on a board overseeing district-level decisions for more than 12,000 students in this Twin Cities outer ring suburb.

Campaign finance reports from August and September show close to $20,000 spent on the board elections, mostly from the teachers union. The six endorsed candidates were backed by either the local teachers’ union or the Minnesota Parents Alliance, none of whom are incumbents.

One union candidate and two Minnesota Parents Alliance candidates won, meaning alliance-backed members will hold a board majority come January.

Osseo

In the Twin Cities suburban district of Osseo, there were six candidates running to fill three open board seats. None of the candidates were incumbents. They raised at least $9,000 between them for websites, business cards, flyers, T-shirts, signs and other campaign spending.

This district’s current board has been the site of clashes over policies regarding gender inclusion, instruction and LGBTQ+ pride flags.

On Tuesday voters backed two union and School Board Integrity Project candidates and one Minnesota Parents Alliance candidate.

St. Francis

In St. Francis, in the northern Twin Cities exurbs, there were 10 candidates running for four open school board seats. The Minnesota Parents Alliance and local teachers union each endorsed four candidates, none of whom was an incumbent.

The winners were evenly split — two union-endorsed candidates and two Parents Alliance-endorsed candidates won.

Rosemount-Apple Valley-Eagan

This metro-area district saw two candidates competing in a special election to fill a single school board seat. The local teachers union spent more than $90,000 to support their endorsed candidate, who won the seat.

Finance

Germany's Scholz fires ‘egotistic’ finance minister

STORY: :: November 6, 2024

:: Berlin, Germany

:: Germany’s Scholz sacks finance minister

Christian Lindner, seeks confidence vote

:: He says Lindner broke his trust

‘too many times’ and blocked lawmaking

:: Olaf Scholz, German Chancellor

“Ladies and gentlemen, I have just asked the President for the dismissal of the Finance Minister. I feel forced to take this step in order to avert damage from our country. We need a government that is able to act, that has the strength to make the necessary decisions for our country. That’s what was important to me in the past three years. That’s what’s important to me now. I have made another comprehensive offer to the Free Democrats coalition partner at noon today how we can close the gap in the federal budget without throwing our country into chaos.”

“Too many times did Finance Minister Lindner block laws irrelevantly. Too many times did he act to serve his clientele and party. Too many times did he break my trust. Even the agreement on the budget was withdrawn by him after we had agreed on it in long negotiations. There is no basis of trust for further cooperation. This way, serious government work is impossible.”

“In the very first week of the parliamentary session in the new year, I will call for the confidence vote so that the Bundestag can then vote on it on January 15. That way, parliamentarians can decide if they want to pave the way for a snap election. That election could then take place at the latest by the end of March while respecting the rules of the constitution.”

After firing Finance Minister Christian Lindner of the Free Democrats (FDP) party, Scholz is expected to head a minority government with his Social Democrats and the Greens, the second-largest party.

He would have to rely on cobbled-together parliamentary majorities to pass legislation and he plans to hold a parliamentary confidence vote in his government on Jan. 15.

The collapse of Scholz’s three-way alliance caps months of wrangling over budget policy and Germany’s economic direction, with the government’s popularity sinking and far-right and far-left forces surging.

“We need a government that is able to act, that has the strength to make the necessary decisions for our country,” Scholz told reporters.

Scholz said he fired Lindner for his obstructive behaviour on budget disputes, accusing the minister of putting party before country and blocking legislation on spurious grounds.

The move comes a day after the election of Republican Donald Trump as U.S. president, with Europe scrambling to form a united response on issues from possible new U.S. tariffs to Russia’s war in Ukraine and the future of the NATO alliance.

Finance

Look out for these personal finance pain points in the U.S. election aftermath

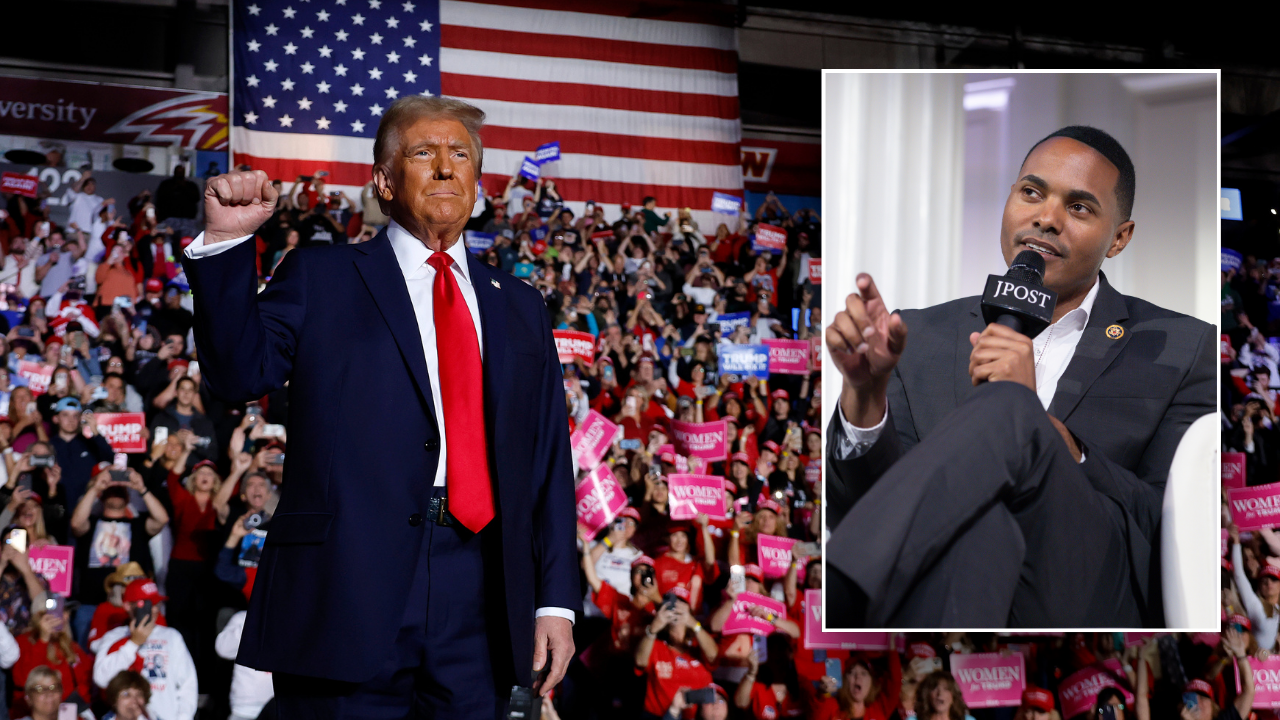

The rally for stocks and crypto following Donald Trump’s U.S. election win is a head fake that diverts attention from several investing and personal finance pain points ahead.

Mr. Trump was seen as better for stocks than Democratic candidate Kamala Harris, and he’s thought to be a booster of crypto currency. The S&P 500 and several cryptocurrencies surged in morning trading on Wednesday, but signs of trouble were there if you looked for them in the bond market.

Investors sold U.S. Treasury bonds, which has the effect of making bond yields rise. Why we care about bond yields in the United States: They have a big influence on bonds here in Canada and, in turn, on the cost of mortgages.

Mortgage rates are well off their recent peaks, but still well above the level where many homeowners locked in several years ago. Waves of these homeowners will renew mortgages in the next 12 months, and they have to be wondering how much more they’ll be required to pay. Events in the bond market suggest further mortgage rate cuts aren’t imminent, a point worth noting if you’re on the housing market sidelines waiting for lower borrowing costs.

Stocks rise and fall on expectations for corporate profits, while bonds are dependent on how investors view economic prospects, including inflation. Mr. Trump’s plan to introduce tariffs on imports is considered inflationary because it will increase the cost of imported goods, while also potentially slowing growth.

Something else investors worry about is the creditworthiness of bond issuers, an area where the United States is generating concern through its US$35-trillion debt. Neither Mr. Trump nor Ms. Harris focused on government debts and deficits in the election campaign, but his policies were judged as adding more to overall debt levels. There’s justifiable concern about Canadian government’s finances, but the U.S. is in worse shape.

Without attention to government debt in the United States, it’s possible that bond yields could rise from current levels. The Bank of Canada and U.S. Federal Reserve will keep lowering their benchmark interest rates, which in turn will push down rates for variable-rate mortgages, lines of credit and floating-rate loans. But bond yields are a bigger influence on fixed-rate mortgages, which happen to be a popular pick right now.

A takeaway for homeowners from these developments is that variable-rate mortgages are worth a look. If you go variable, each Bank of Canada rate cut – and there are several expected over the remainder of this year and next – will lower your borrowing costs.

Another post-election pain point is the Canadian dollar, which has dropped to 71.9 US cents as of Wednesday morning from 74.2 US cents in late September. Part of the reason for that is that money flows are drawn to the higher interest rates in the United States. A five-year Canada bond had a yield of 3.1 per cent early Wednesday, while a comparable U.S. Treasury bond had a yield of 4.3 per cent.

But Canada’s lack of economic competitiveness also contributes to its dollar weakness. If a Trump government offers tax cuts to business and removes regulations, then we may see additional downward pressure on the dollar. Now seems a good time to buy some U.S. currency if you plan to head south this winter.

Stocks had a great run Wednesday morning on the Trump win, but the comparative returns for the U.S. and Canadian markets suggests another pain point. The S&P 500 was up 1.7 per cent by late morning, while the S&P/TSX composite index was up just 0.3 per cent.

In addition to being seen as friendly for business, Mr. Trump is also regarded as someone who will have policies favouring the mega-size tech companies that are dominant in the S&P 500 and non-existent in the S&P/TSX composite.

The Canadian market has benefited lately from a rebound in blue-chip dividend stocks, but that was driven by the decline in interest rates on bonds. Sticky bond yields could limit near-term gains for dividend stocks.

The rally in the price of bitcoin, ethereum, dogecoin and other cryptocurrencies was a win for investors holding these speculative assets. But if you’re a traditioal investor or money manager who has avoided them, prepare for FOMO, or fear of missing out. Crypto remains a non-essential portfolio holding, but has the potential to move beyond that if it becomes more widely adopted.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

-

Business5 days ago

Carol Lombardini, studio negotiator during Hollywood strikes, to step down

-

Health6 days ago

Health6 days agoJust Walking Can Help You Lose Weight: Try These Simple Fat-Burning Tips!

-

Business5 days ago

Hall of Fame won't get Freddie Freeman's grand slam ball, but Dodgers donate World Series memorabilia

-

Business1 week ago

Business1 week agoWill Newsom's expanded tax credit program save California's film industry?

-

Culture4 days ago

Culture4 days agoYankees’ Gerrit Cole opts out of contract, per source: How New York could prevent him from testing free agency

-

Culture3 days ago

Culture3 days agoTry This Quiz on Books That Were Made Into Great Space Movies

-

Business1 week ago

Business1 week agoApple is trying to sell loyal iPhone users on AI tools. Here's what Apple Intelligence can do

-

Culture1 week ago

Culture1 week agoTry This Quiz on Spooky Novels for Halloween

/static.texastribune.org/media/profiles/Isabela_Ocampo_Restrepo.jpg)