Your earlier pitch was all about potential, however now you’re within the late-stage finance enviornment, it’s time to give attention to efficiency.

As a founding father of a late-stage startup, you’ll be used to creating key choices to develop your online business. At this stage, it’s possible you’ve obtained your fundamental enterprise construction bedded in – gross sales, advertising, fulfilment and assist. The uncertainty of your online business success has diminished, however your capital wants have by no means been larger. Fortuitously, the extra steady your online business turns into, the extra financing choices you’ll have out there to you.

The query is, what’s one of the best ways to broaden your online business at this stage? Do you should go public to lift the mandatory funds, or are there different alternatives to finance your ambition?

Sophie Mao, a observe chief with the enterprise capital staff at LegalVision, advises on the authorized and company governance perspective of those questions for purchasers day-after-day. She not too long ago shared her key concerns for anybody establishing late-stage finance at Startup Every day’s From Concept to Unicorn occasion sequence. Right here’s what she needs you to give attention to.

Earlier than you increase

Work out one of the best ways to construction the deal

“To start with, one of many first concerns is the way you’re truly going to lift cash and the way you’re going to construction the deal,” stated Mao. “So individuals typically take into consideration late-stage financings as being fairness rounds. Nonetheless, it’s nonetheless fairly frequent for mature startups to do bridging rounds utilizing SAFEs or convertible notes.”

Priced fairness rounds

Priced fairness rounds can take a very long time to barter, leaving you with out adequate money. Generally they take so lengthy that the worth of your online business has elevated to the purpose that it’s important to renegotiate your share worth another time.

Convertible notes

As an alternative of providing shares to the buyers, you provide a convertible be aware, which is successfully a fixed-term mortgage to the corporate. On the finish of the time period, your buyers can select whether or not they’d choose to have their principal again plus curiosity, or whether or not they would reasonably the mortgage be transformed to shares in your organization.

SAFEs

SAFE stands for “Easy Settlement for Future Fairness”, and it’s a type of convertible safety. In trade for his or her cash, your investor receives the suitable to buy inventory in a future fairness spherical, topic to sure parameters set out within the SAFE.

Although they every have their setbacks, convertible notes and SAFEs will each make it easier to increase cash quicker, so they’re value wanting into.

Enterprise debt

That is the opposite kind of funding out there in a late-stage finance spherical. Enterprise debt takes the type of a time period mortgage, a facility, or a income mortgage.

“Enterprise debt isn’t one thing that’s actually an choice for early stage firms,” stated Mao. “You wouldn’t have achieved the constant money move required to show to a enterprise debt lender you could service the mortgage. But it surely could possibly be a very good choice for a later-stage firm, as a result of the upper rate of interest, and lender charges would possibly nonetheless be cheaper than giving freely fairness.”

You additionally restrict the upfront dilution concerned with doing an fairness spherical.

There are three essential forms of enterprise debt structuring:

- Time period mortgage – that is much like a standard financial institution mortgage in that by the tip of the set time period, you should have repaid the principal and accrued curiosity in full.

- Revolving credit score facility – this operates much like a bank card.

- Income mortgage – a hybrid between debt and fairness, reasonably than requiring mounted curiosity funds, repayments are tied to the borrower’s turnover.

Take into account your shareholder numbers

As your organization grows, new financing options might imply you danger going above the 50 shareholder cap for personal firms.

“Take into account whether or not it’s acceptable to implement sure constructions to handle that quantity,” suggested Mao. “[One example is] rolling your smaller buyers into some type of bear belief construction, the place the underlying buyers nonetheless get the advantage of their shares, however there’s only a single company trustee recorded on the corporate’s share register.”

Shield the rights of your buyers

It’s essential to prioritise the rights of main buyers and take into account limiting the flexibility for minority shareholders to decelerate or hinder your means to get issues achieved.

“Within the early days, it may not have been very burdensome to deal with all buyers equally in relation to issues like reporting necessities and pre-emptive rights on future capital raisers,” Mao famous. “However because the variety of buyers grows, it could possibly be a hindrance truly, and a big administrative burden in relation to closing a deal, when you do have minority shareholders which can be very sluggish or doubtlessly simply fully unresponsive.”

Secondary sale participation

If there’s excessive investor curiosity and the spherical is oversubscribed, there could also be a possibility for third-party buyers to buy shares off present shareholders.

“As a founder, this may be a extremely good alternative so that you can lastly take some money off the desk after working very onerous in making a number of sacrifices for a very long time,” stated Mao.

Usually, buyers are blissful to consent to structuring the deal to incorporate a secondary factor if it is sensible for the corporate and for the founders.

Doing the deal

Know your liquidation preferences

A liquidation choice is a clause in a contract that dictates who will get paid first within the occasion your organization goes beneath.

“As you develop and do a couple of rounds of capital elevating, you would possibly find yourself with a number of totally different lessons of choice shares,” Mao defined. “Which means one of many key phrases to barter in a brand new spherical is whether or not the brand new choice shares will rank equally with the choice shares of your present buyers or superior to them.”

Many startups assist equal rating choice shares as a matter of principal as a result of they like that buyers are all handled equally. Nonetheless, this can be a matter of weighing up the chance connected to your early-stage buyers approaching board when your startup was much less steady, with the chance connected to late-stage buyers most definitely placing in extra money.

“From a founder’s perspective, this may not be one thing that you simply really feel too strongly about both approach, as a result of sadly, if the corporate goes bust, you’re in all probability not going to get a lot cash on the finish of the day anyway,” famous Mao. However on the similar time, your present buyers might want to consent to any liquidation preferences in new finance contracts, as a result of it can range their present rights.

Construct in anti-dilution rights

Anti-dilution rights are constructed into convertible most popular shares to assist defend buyers from their funding doubtlessly dropping worth. For instance, if an investor buys shares at $10, and a later spherical sells for $5, then the preliminary investor can be issued with extra shares to regulate to the brand new worth. It’s not fairly that easy, although.

“In Australia, they’re practically at all times known as broad-based weighted common anti-dilution rights,” stated Mao. “Which signifies that buyers don’t get the complete adjustment of that decrease share worth that’s concerned in that down spherical, however they are going to get the advantage of a worth that’s someplace in between the value that they paid and the value of the down spherical.

“As you develop and undertake totally different financing rounds, try to be aware of how these anti-dilution rights work together with another pursuits that you’ve got in place inside the firm.”

Consider compelled exit provisions

One other consideration if you’re doing the deal is to think about compelled exit provisions. They’re turning into extra frequent in late-stage finance and phrases can range fairly extensively.

“It could possibly be so simple as requiring the corporate to contemplate what their choices are in good religion,” stated Mao. “Or it might go so far as permitting the lead investor to power the corporate to undertake an exit primarily based on recommendation that they’ve acquired from an advisor that they’ve put in place and a purchaser that they discover.”

After the deal is finished

Be aware of latest monetary reporting obligations

Many startups who increase bigger late-stage finance rounds will take care of Australian funds who’re early-stage enterprise capital restricted partnerships, or ESVCLPs. These are a kind of fund that may be very tax-effective and enticing for buyers, however they’re closely regulated. A few of these laws will impression the best way you handle your organization.

“Particularly, one of many necessities is that if an organization’s complete asset worth is greater than $12.5 million, they need to have a registered auditor and be getting ready audited monetary accounts,” suggested Mao. “This may be costly in comparison with what some firms are used to, however it may be an amazing alternative to mature the corporate’s reporting practices, get its affairs so as, and establish any points within the firm’s monetary and tax historical past and repair these as much as keep away from any nasty surprises, say if you get to an exit.”

Take into account the construction of ESOP gives

Mao’s remaining consideration for late-stage finance agreements was across the construction of ESOP (Worker Share Choice Plan) gives.

“Most startups in Australia utilise what’s known as the startup concessional guidelines for its ESOP and in making its ESOP gives to allow its workers to get tax concessions in reference to their fairness,” she defined. “One of many necessities beneath these guidelines is that a proposal of choices has to have an train worth, which is a minimum of equal to the market worth of the corporate’s bizarre shares on the time of the provide.”

You’ll need to both depend on the share worth of your most up-to-date spherical, or get a proper valuation to find out what the market worth is of your bizarre shares.

“Which means your workers will possible need to be paying much more for his or her fairness than they in any other case would have earlier than that,” warned Mao. It is a pure consequence of your organization’s development and worth, but it surely’s one thing you want your beneficial workers to be snug with.

For more information on Sophie Mao and LegalVision, head to legalvision.com.au

Watch Sophie’s From Concept to Unicorn session right here:

Concept to Unicorn

This text is delivered to you by Startup Every day in partnership with LegalVision.

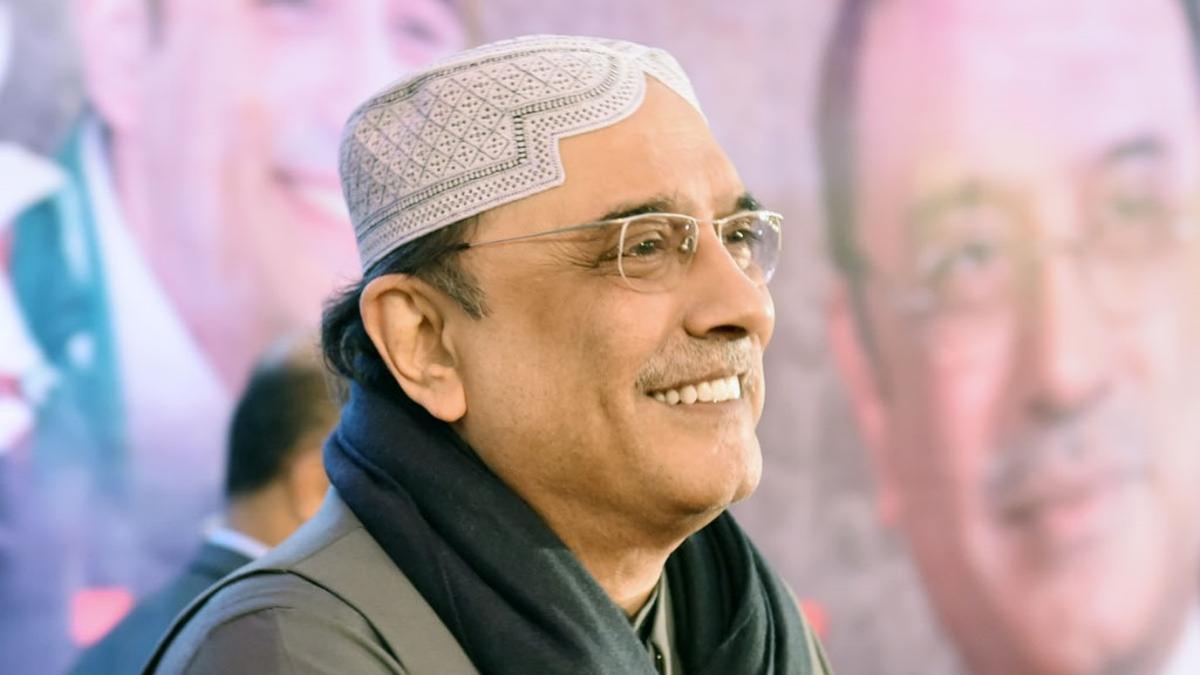

Characteristic picture: Sophie Mao, LegalVision