Finance

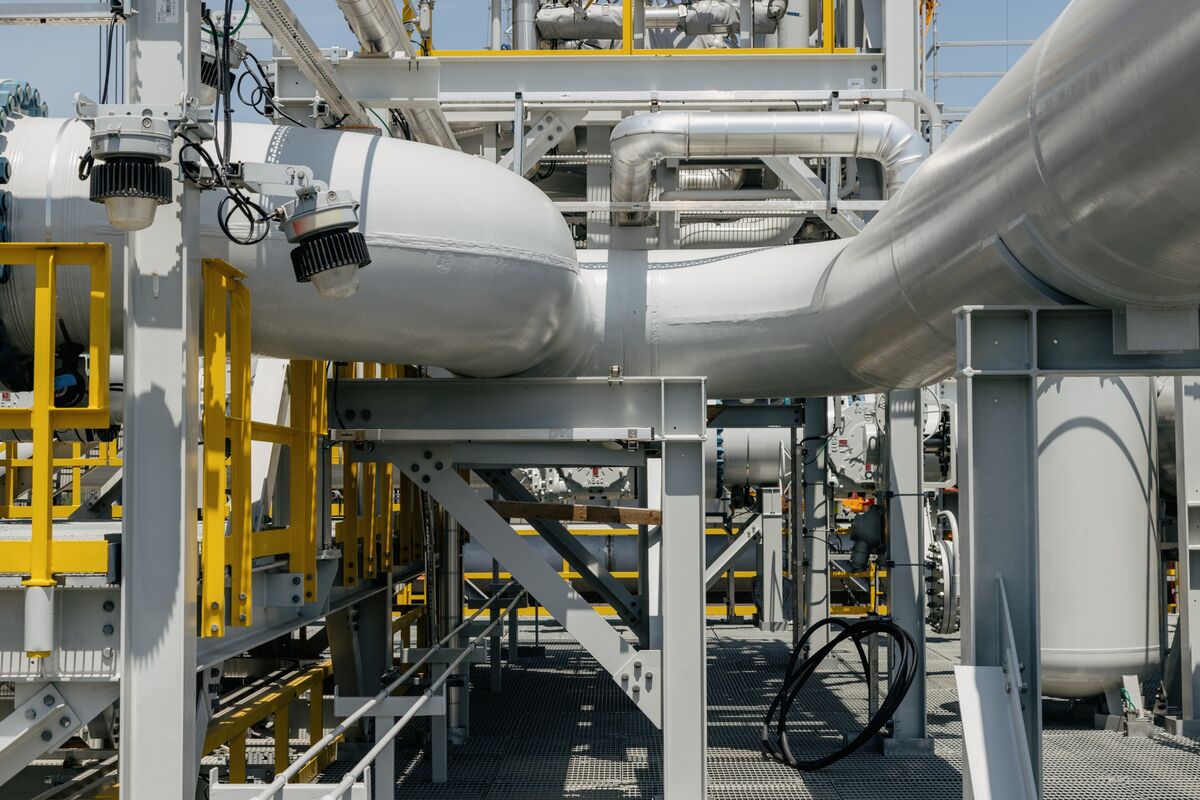

How to finance the building of a new climate infrastructure

Entrepreneurs with concepts for addressing local weather change typically run into financing hurdles. This may occur initially, when they’re making an attempt to take an thought from the lab to a prototype, or it occurs a number of phases on, when it comes time to construct a facility at business scale.

This latter stage is usually a “second valley of loss of life” for local weather initiatives. That’s as a result of the quantity of financing wanted at this level is greater than a enterprise or growth-equity fund would supply, whereas larger conventional project-finance or infrastructure funds typically discover the potential returns of financing these buildings don’t warrant the funding danger.

Analysis performed since early final yr by the non-profit Prime Coalition was not too long ago printed in a report, Limitations to the Well timed Deployment of Local weather Infrastructure. It particulars 4 areas the place main gaps in financing can stymie entrepreneurs and what to do about it.

To know the issue, take into consideration solar energy. The know-how to provide vitality from the solar was invented within the Nineteen Seventies, but it surely took many years for photo voltaic initiatives to grow to be mainstream, says Karine Khatcherian, creator of the Prime report and who’s now at Closed Loop Companions’ Personal Fairness Fund. Incentives had been required to construct amenities, and as extra photo voltaic was deployed, prices got here down considerably. “We are able to’t wait 40 years for all that to occur with each know-how,” Khatcherian says.

The query is whether or not catalytic capital – that’s, affected person, risk-tolerant funding financing designed to have a constructive affect with out essentially realizing a market return – can assist to speed up innovation by decreasing or eliminating dangers “or by stepping in earlier than others can,” she says.

Lengthy-term financing

The primary two gaps Prime’s analysis recognized centre on initiatives with lengthy know-how cycles akin to what photo voltaic skilled, in that they’re concepts that should be scaled as much as show their business viability. An instance might be a business scale facility to scale back the carbon emissions related to the manufacturing of cement, in accordance with the report.

Local weather innovators can run into hassle if they’re on the “late demonstration” stage, the place mission growth and development prices for deploying their concepts can complete greater than $20m, or when they’re in search of financing for a first-of-a-kind, or Foak, business mission, the report mentioned.

Foak initiatives are the primary business initiatives to be realised from an thought. They “are supposed to be worthwhile, [to] reveal the mission could be commercially possible, and are the reference for the upcoming initiatives,” the report mentioned. However, they “nonetheless have a lot higher danger and uncertainty than ‘confirmed’ initiatives,” Khatcherian says.

As soon as a Foak facility is constructed, points can come up – comparable to value overruns or issues with efficiency high quality – that require the development of 1 or two or three extra amenities to construct the required monitor report to show financial feasibility, she says.

The third financing hole happens with small, distributed initiatives that don’t require the development of a single massive facility. Consider rooftop photo voltaic, or ground-source heating options – initiatives that want a couple of million {dollars} to fund a couple of small installations.

Returns for these initiatives gained’t be excessive sufficient to attract enterprise funding, and mission finance or infrastructure funds usually look to spend money on far larger initiatives, given the analysis required to analyse each regardless of the scale. “It’s onerous to make the economics work,” Khatcherian says. “It’s simpler [for investors] when [an entrepreneur] can combination 20 initiatives directly.”

The fourth hole is the problem in financing early growth prices, comparable to shopping for actual property, conducting pre-engineering design, or securing permits. For some, “there’s a whole lot of work that must be carried out earlier than a mission is prepared for development,” Khatcherian says. “If any of those steps don’t succeed, that might kill a mission and that’s a danger project-finance buyers usually don’t face.”

Bridging the Hole

Catalytic capital might probably get entrepreneurs over these early hurdles, complementing different private and non-private sector buyers and philanthropists in shifting know-how improvements via this “second valley of loss of life”, in accordance with the report.

Due to the urgency of the local weather disaster, the report considers the chance that catalytic capital might finance 100% of the hole. Beneath this situation, affect buyers would step in after all of the dangers of the mission are addressed, offering funds for the catalytic buyers to redeploy into one other mission, Khatcherian says.

Or, catalytic buyers might present only a slice of help tailor-made to a selected danger, comparable to first-loss fairness in opposition to value overruns. Or they might present below-market debt to enhance the economics of a mission to the purpose mainstream buyers step in, she says.

A perfect resolution in Khatcherian’s view is “blended finance,” the place catalytic capital is pooled with development capital and mission finance that may be deployed the place wanted relying on the hole being addressed.

Prime’s analysis additionally discovered that local weather innovators may benefit from instruments comparable to accelerators that facilitate entry to funders and technical help, and from an advisory group crammed with specialists comparable to engineers, operations specialists, contractors, and others who can assist entrepreneurs get via these difficult early growth phases.

With this analysis in hand, Prime now’s taking a look at creating a brief listing of potential investees throughout the subsequent 5 months or so, Ananth Pharshy, a senior adviser to Prime’s Early Local weather Infrastructure programme says. They’re additionally starting to listen to from philanthropists.

“There’s great curiosity,” he says. “Individuals on this house for some time intuitively perceive the issue, that Foak and demonstration initiatives are having problem getting funded. The philanthropic neighborhood is saying ‘we’re able to go whenever you’re prepared.’”

Deal with initiatives

Prime plans Foak initiatives between now and the fourth quarter of 2023. They’ll have “a selected give attention to initiatives that will face the capital hole most acutely, have the best potential to scale back [greenhouse gas] emissions, reveal that our participation will assist usher in different finance-first buyers, and may bridge to follow-on deployment of the identical or comparable options”, Sarah Kearney, Prime’s founder and govt director, mentioned in an emailed assertion.

Kearney mentioned Prime will experiment with investing in several mission sizes, industries, and capital buildings as a complement to their analysis. “From there, we’ll have a greater understanding of whether or not and the way Prime would possibly construct a extra everlasting program round early local weather infrastructure within the years forward,” she mentioned.

From Penta

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

Finance

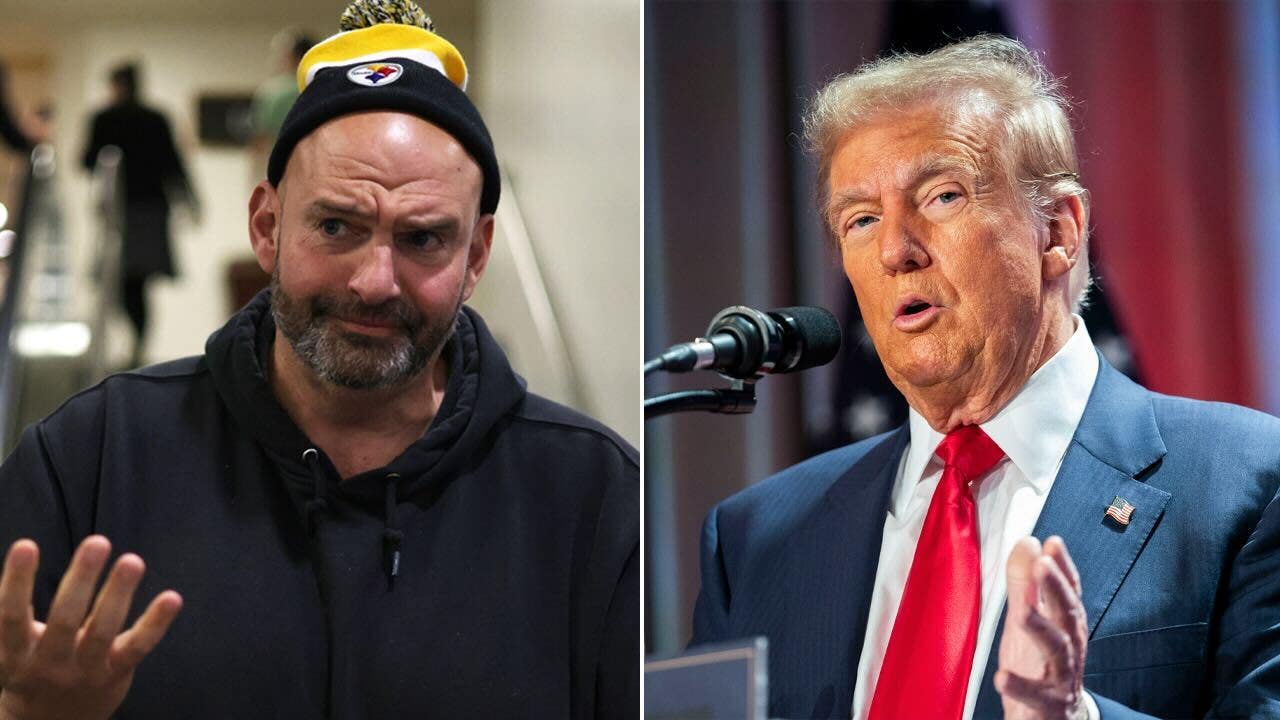

Personal finance guru Dave Ramsey warns over 'mind-blowing' Christmas debt

Personal finance expert Dave Ramsey joined ‘Fox & Friends’ to discuss the Federal Reserve possibly cutting interest rates and how Americans can avoid overspending during the holidays.

Holiday spending is putting a big strain on American wallets and leaving some in debt well past the holiday season; however, personal finance expert Dave Ramsey said ‘mind-blowing’ debt can be avoided.

“The average over the last several years has been that people pay their credit card debt from Christmas into May,” The Ramsey Solutions personality shared during an appearance on “Fox & Friends” on Wednesday. “So it takes them about half the year to come back, and because they don’t plan for Christmas… it sneaks up on them like they move it or something.”

According to a study conducted by Achieve, the average American will spend more than $2,000 for the 2024 holiday season, breaking down the outflow of cash into travel and holiday spending on hosting parties, food, clothing, and other gifts.

STOP OVERSPENDING OVER THE HOLIDAYS AND START THE NEW YEAR OFF FINANCIALLY STRONG

Another recent survey by CouponBirds indicated that parents will spend an average of $461 per child and that 49% of parents will go into debt to pay for this Christmas.

Ramsey Solutions’ Dave Ramsey says “you won’t overspend” if you stick to a Christmas budget. (Getty Images)

The Ramsey Solutions personality balked at the amount of money shelled out for the season while explaining that the holiday should not come as a shock, and that spending for it should be planned out.

“Those numbers are mind-blowing when you look at the averages there. That’s a lot of money going out,” Ramsey added, “all in the name of happiness comes from stuff, and it doesn’t.”

He also weighed in and agreed on advice from fellow expert, Ramsey Solutions personality and daughter Rachel Cruze, who suggested making a list of people to shop for and noting how much to spend on each.

FOX Business’ Lauren Simonetti details the holiday shopping season on ‘Cavuto: Coast to Coast.’

“You know, I’m old, and I met a guy from the North Pole,” the expert joked. “He said ‘make a list and check it twice,’ so Rachel’s right.”

Ramsey followed up by expanding on his daughter’s suggestion: “If you do that, and you put a name beside it, and then you total up those dollar amounts, you have what’s called a Christmas budget.”

“If you stick to that, you won’t overspend,” “The Ramsey Show” host remarked.

National Retail Federation CEO Matt Shay reacts to the latest report that holiday spending is expected to reach $989B this year.

The money guru pointed out what he sees as problematic with the holiday season – not taking a shot at Christmas itself – but referring back to the spending issues.

“The problem with Christmas is not that we enjoy buying gifts for someone else. That’s a wonderful thing,” he reassured. “The problem is we impulse our butts off, and we double up what we spend because the retailers make all their money during this season.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ramsey concluded by advising shoppers to be wary of retailers and to not be ensnared by their marketing strategies.

“They’re great merchandisers,” he warned. “They’re great at putting stuff in front of us that we hadn’t planned to buy.”

READ MORE FROM FOX BUSINESS

Ramsey Solutions personality Jade Warshaw breaks down the latest economic data that shows consumer credit card debt is piling up amid a jump in spending.

Finance

Can AI Solve Your Personal Finance Problems? Well …

Switch the Market flag

for targeted data from your country of choice.

Open the menu and switch the

Market flag for targeted data from your country of choice.

Need More Chart Options?

Right-click on the chart to open the Interactive Chart menu.

Use your up/down arrows to move through the symbols.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps