Finance

Full steam ahead on new consumer ‘duty’, Britain’s finance watchdog says

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YPZPL64RTNLADM4BDVLV6AFJ6U.jpg)

LONDON, Feb 22 (Reuters) – New guidelines to guard retail shoppers of monetary merchandise, reminiscent of insurance coverage or mortgages, will come into power in July on schedule regardless of some “resistance” from the monetary providers trade, Britain’s Monetary Conduct Authority (FCA) stated on Wednesday.

The Client Obligation rule seeks to alter tradition at banks, insurers and funding corporations, to attract a line beneath retail mis-selling scandals going again to the Eighties, from endowment mortgages to pensions and cost safety insurance coverage (PPI).

“The deadline of 31 July is not going to be moved, and we’re right here to assist,” Sheldon Mills, FCA govt director for competitors and shoppers, informed a convention.

“Ask your self the apparent query: is your services or products designed to ship good outcomes for shoppers… Any punitive exit charges or unfair expenses that want eradicating?”.

Mills stated there had been some “preliminary resistance”, however onerous work now ought to imply fewer costly errors down the road. The FCA stated enforcement of the brand new regime can be “pragmatic” initially.

Newest Updates

View 2 extra tales

Services nonetheless being bought to prospects should comply from July 31, whereas these closed to new prospects are required to conform a 12 months later.

“After the deadline, we are going to take a realistic strategy and can assist those that are taking their last steps in direction of assembly the requirements of the Obligation,” Mills stated.

No person will probably be punished for previous actions or omissions so so long as they’re put proper by July for merchandise nonetheless on provide, Mills stated.

Companies supervised by the FCA are required to behave to ship good outcomes for retail prospects to keep away from foreseeable hurt and act in good religion, a extra particular goal than the present, broader goal of treating prospects pretty.

Companies should nominate a board member to “champion” the brand new responsibility firm-wide, from designing a product to promoting it, even by means of third-party distributors.

Final month the FCA stated a survey of corporations confirmed some wouldn’t be prepared by July until they pace up preparations, and Mills stated the FCA will survey 600 smaller corporations subsequent to test on their readiness.

Reporting by Huw Jones. Modifying by Jane Merriman

Our Requirements: The Thomson Reuters Belief Rules.

Finance

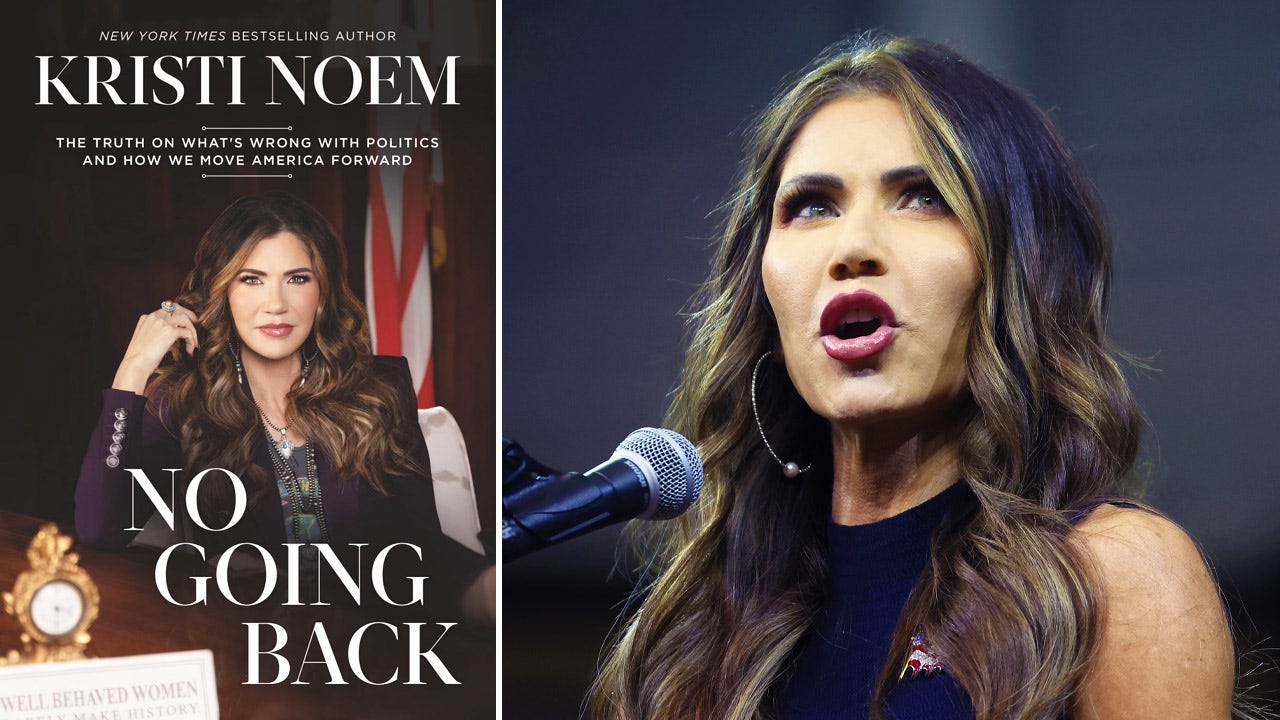

Campaign finance offender lost seven bids for office but wins mercy from elections panel • Rhode Island Current

A perennial candidate for state and local office will be the first offender of state campaign finance requirements to have his fines reduced.

The Rhode Island Board of Elections on Tuesday voted 3-0 to slash financial penalties owed by former candidate Daniel Grzych by nearly 90%. Grzych, a Providence resident, ran unsuccessfully as an independent for seven state and local races spanning 2002 to 2014. He previously owed more than $71,000 in fines to the state elections board for submitting late the regular financial reports required during his time as a candidate.

Now, he’ll owe just $6,600 — three times the amount he spent over the five campaigns during which he missed reporting deadlines. The board’s decision Tuesday marks the first time using newly enacted regulation change giving the appointed elections panel more leeway to reduce fines for offenders. The rule change adopted in 2023 relies on a formula based on the number of violations to cap fines at a lower amount while letting the elections board close campaign finance accounts so fees don’t keep accruing.

Under the formula included in the updated state rules, Grzych could have had his fine reduced to about $28,000, said Ric Thornton, the board’s campaign finance director.

However, given Grzych’s actual spending during his span of failed candidacies — amounting to $2,200, all of which was self-funded — Ray Marcaccio, the board’s attorney suggested an even lower fine.

“The purpose for the regulation is to make sure whatever we do by way of fine and penalty is proportional to the offense that occurred,” Marcaccio said. “The way the statute was written, a lot of these daily amounts continue to accrue almost exponentially.”

Indeed, 93% of the $6.1 million in unpaid financial penalties for late or missing campaign reports as of September come from just 15% of the offenders, with many of the top violators unable to pay, or unreachable, according to data provided by Thornton. Grzych once held the dubious distinction of a spot in the top 10 list of violators with the largest outstanding fines, according to an Associated Press story in 2015. As of September 2023, Grzych dropped to the 25th ranking, though the amount of overdue penalties was unchanged.

In an only-in-Rhode Island moment, former Rep. John DeSimone, who defeated Grzych in the 2012 Democratic primary for the House District 5 seat, is now the attorney for his former political opponent. The pair appeared together before the Board of Elections to explain the circumstances that led to Grzych’s late filings and subsequent lack of response to notices about his overdue payments.

“He never had a sophisticated campaign,” DeSimone said. “As I recall, he had a dump truck that he put signs on and drove it around. That was the extent of his campaign.”

Grzych also explained how personal health issues as well as responsibilities caring for ailing family members swallowed his attention over the ensuing 20 years, making him unaware of the overdue fines for late campaign finance reports, despite the many certified mail notices he was sent.

“I don’t want to say I was dumb, but I didn’t know all the facts,” Grzych, 71 said. “ I lost track of a lot of things over the last 20-something years.”

He never had a sophisticated campaign. As I recall, he had a dump truck that he put signs on and drove it around. That was the extent of his campaign.

– Former Rep. John DeSimone, attorney representing Daniel Grzych

He is also facing foreclosure for the Providence home he owns with two other people, after they stopped making payments on their $170,000 mortgage loan beginning in 2020, according to the complaint filed by HSBC Bank in June 2023 in Providence County Superior Court. As of Tuesday, $230,000 remains on the mortgage payment, though a pending agreement selling the property for $320,000 is expected to close soon, John DeSimone said.

The Rhode Island Board of Elections, which is named as a party of interest in the case because it has a lien on the property stemming from Grzych’s outstanding fines, has spent more than $1,000 on court and legal fees as well as certified mail notifying Grzych of his outstanding fines, Thornton said.

Board member Louis DeSimone abstained from the vote due to the appearance of conflict of interest; he is John DeSimone’s first cousin, though he said they have no economic ties. Board members Diane Mederos, Randall Jackvony and Michael Connors were absent from the meeting.

Prior to the vote, the board also met behind closed doors for 45 minutes to discuss the foreclosure case, but did not take any votes shared during the public session.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Finance

FIS Launches Embedded Finance Platform for Financial Institutions and Businesses

FIS has launched an embedded finance platform designed for use by financial institutions, businesses and software developers.

The new “Atelio by FIS” platform can help any company collect deposits, move money, issue cards, send invoices, fight fraud, forecast cash flows and better understand customer behavior, the company said in a Tuesday (May 7) press release.

“Our scale, distribution and continued investment in technology have given us the foundation to unlock our financial capabilities to a wider audience and power the next generation of financial innovation,” Tarun Bhatnagar, president of platform and enterprise products at FIS, said in the release.

Atelio delivers existing FIS financial technology via components that are easy to embed in a secure and compliant manner, according to the release.

The platform builds on the company’s history of service to the financial services industry, its technology and its expertise in risk and compliance, offering these resources as a service, the release said.

With these capabilities, financial institutions, businesses and software developers can deliver financial offerings to their customers at the point where they are needed, per the release.

One company that is already building on Atelio is College Ave, which used the platform to launch a new financial product for college students, according to the release.

“We wanted a product that could bring together an account, credit card and payments into a single experience, and Atelio allowed us to offer a custom solution through our platform in a simple and secure process, which has been hugely beneficial to us in meeting our customers’ needs,” Karen Boltz, head of product management at College Ave, said in the release.

PYMNTS Intelligence has found that embedded finance creates better experiences for consumers by making their interactions with brands seamless, convenient and personalized.

This is important because 49% of consumers said they would probably quit an online purchase if they encountered difficulty checking out and a lack of payment choice, according to “How Nonfinancial Brands Can Benefit from Offering Embedded Financial Services,” a PYMNTS Intelligence and Galileo collaboration.

The report also found that 88% of companies that offer embedded finance said it increased customer engagement.

Finance

Taiwan finance group SinoPac enters race in Cambodian banking

TAIPEI — The Taiwanese financial conglomerate SinoPac Holdings is entering the Cambodian banking industry by acquiring a local institution that is majority-held by Western investors, the latest example of the diversification of Taiwanese investment into Southeast Asia.

SinoPac announced over the weekend that its subsidiary Bank SinoPac will acquire 100% of Amret, Cambodia’s largest microfinance deposit-taking institution by total assets, from existing shareholders.

-

World1 week ago

World1 week agoRussian forces gained partial control of Donetsk's Ocheretyne town

-

Movie Reviews1 week ago

Challengers Movie Review

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma

-

Politics1 week ago

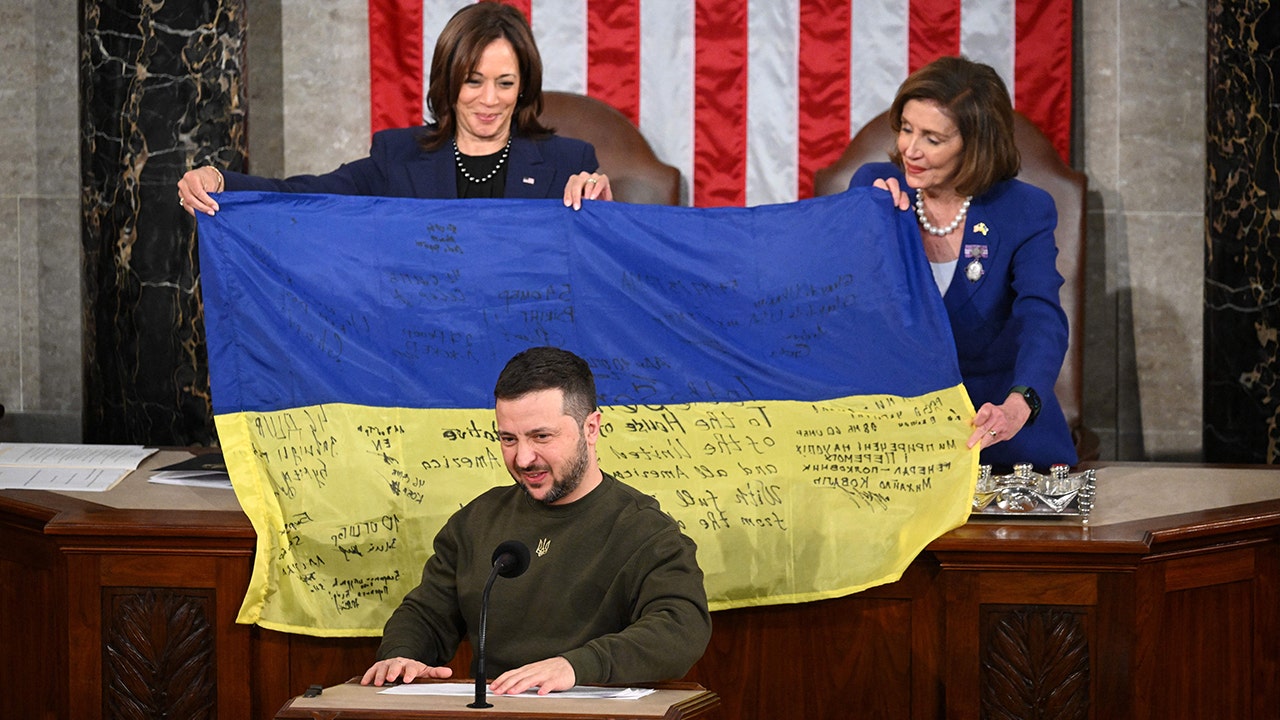

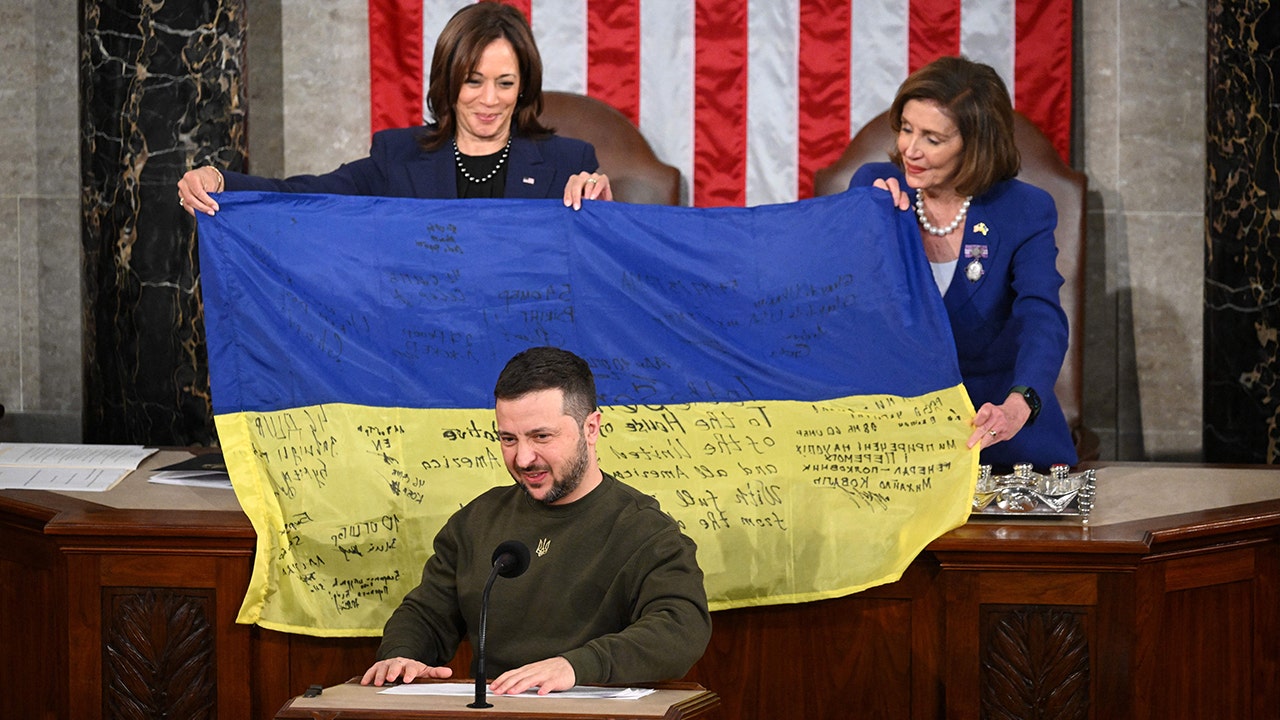

Politics1 week agoWashington chooses its wars; Ukraine and Israel have made the cut despite opposition on right and left

-

Politics1 week ago

Politics1 week agoDems disagree on whether party has antisemitism problem

-

Politics1 week ago

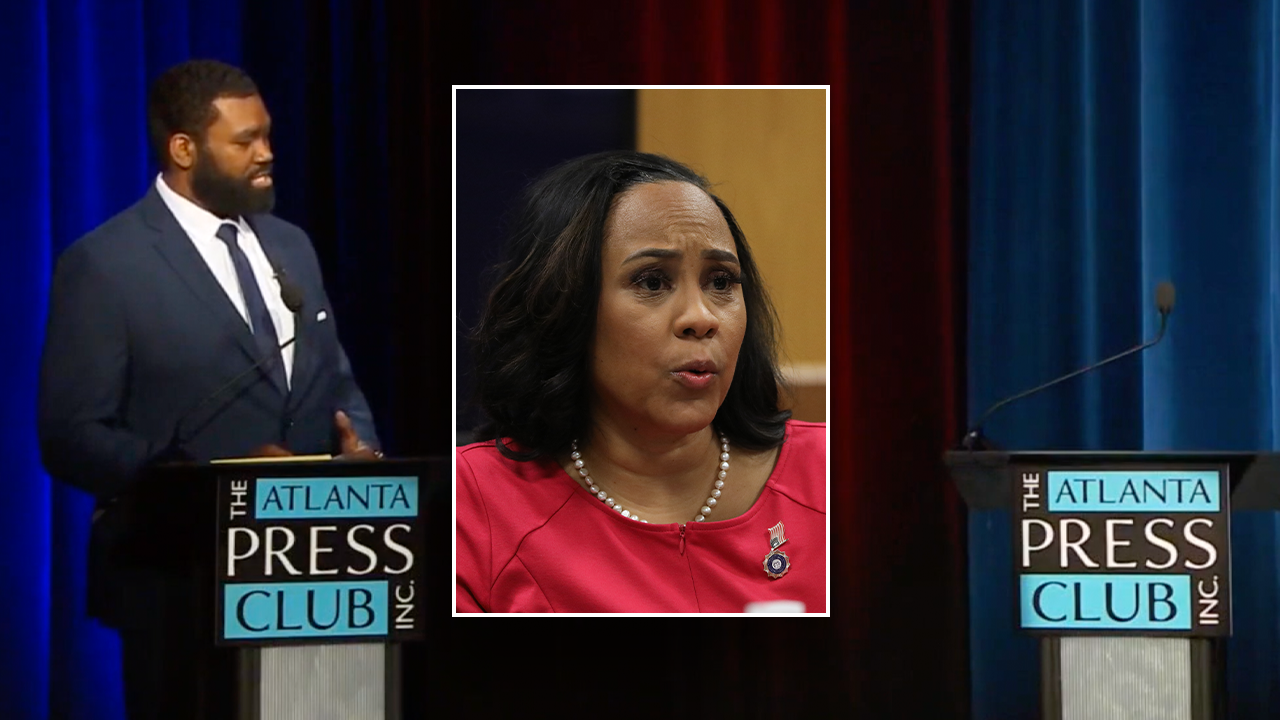

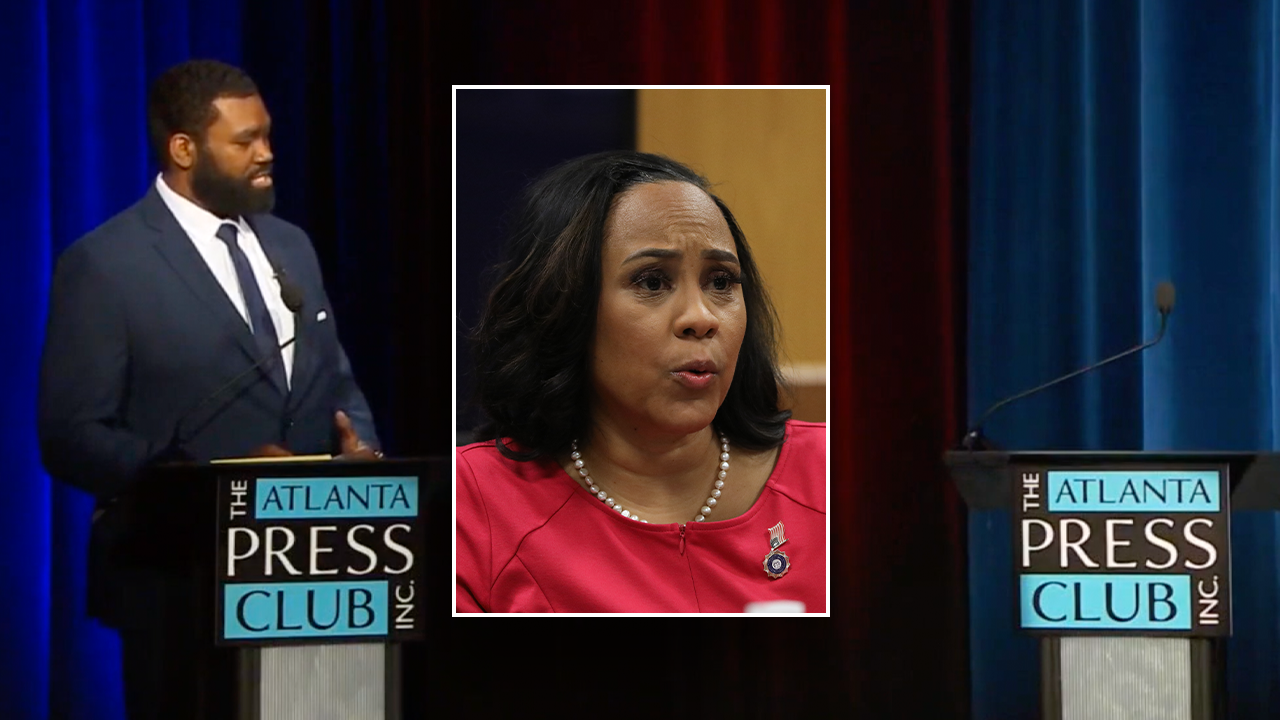

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/N25JQMRBVNBM7M4VJKLIRTKF2Q.png)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/QLSANFH2N5CFBP5DXWTDU6TUDQ.png)

:quality(70)/d1hfln2sfez66z.cloudfront.net/12-13-2023/t_06566ba26b6c432da33cc196017f08b1_name_Chatt.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/W4FR7SY5IVIHJCEV4VVWJUR6MI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EDG6KXYIC5JLZBYKIG2E2SLZ6A.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/PSAAH3L5CREKTNU2F7C3L7DJFE.jpeg)