Minutes of the Federal Reserve’s assembly in early February present that some officers had been apprehensive a few then-recent easing in monetary situations.

Forward of the Jan. 31–Feb. 1 assembly, shares had strengthened and bond yields had slipped after three months of fine inflation information.

Of their dialogue, a “quantity” of Fed officers famous that monetary situations had eased, “which some famous may necessitate a tighter stance of financial coverage,” the minutes confirmed.

When requested about simpler monetary situations at his press convention after the assembly, Fed Chairman Jerome Powell didn’t register alarm.

“Our focus shouldn’t be on short-term strikes however on sustained modifications to broader monetary situations” which “have tightened very considerably over the previous 12 months,” he stated.

On the assembly, the Fed hiked its benchmark fee by 25 foundation factors to a variety of 4.5%-4.75%. Solely a”few” Fed officers needed a 50 foundation level transfer. Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard have already stated they had been in that small camp.

General, the minutes present that every one Fed officers had been supporting additional will increase within the rates of interest.

There have been indicators of some divisions rising.

“A number of” Fed officers thought the dangers to the financial outlook “had been turning into extra balanced,” suggesting excessive inflation was not the only focus.

However “a quantity” of Fed officers stated that if the extent of rates of interest was not excessive sufficient to sluggish the financial system, it may halt latest progress in moderating inflation and lead inflation to stay above the Fed’s goal for an extended interval. The general public may begin to count on larger inflation, these officers stated.

There have been different attention-grabbing nuggets within the minutes

- The Fed employees forecast nonetheless expects actual GDP development “to sluggish markedly this 12 months and the labor market to melt.”

- A “few” officers had been apprehensive that worldwide stresses had the potential to transmit to the U.S. monetary system.

- A “quantity” of Fed officers confused that “a drawn-out interval of negotiations to boost the federal debt restrict may pose important dangers to the monetary system and the broader financial system.”

Shares

DJIA,

SPX,

remained barely larger after the minutes had been launched. The yield on the 10-year Treasury notice

TMUBMUSD10Y,

was down 4 foundation factors at 3.91%.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

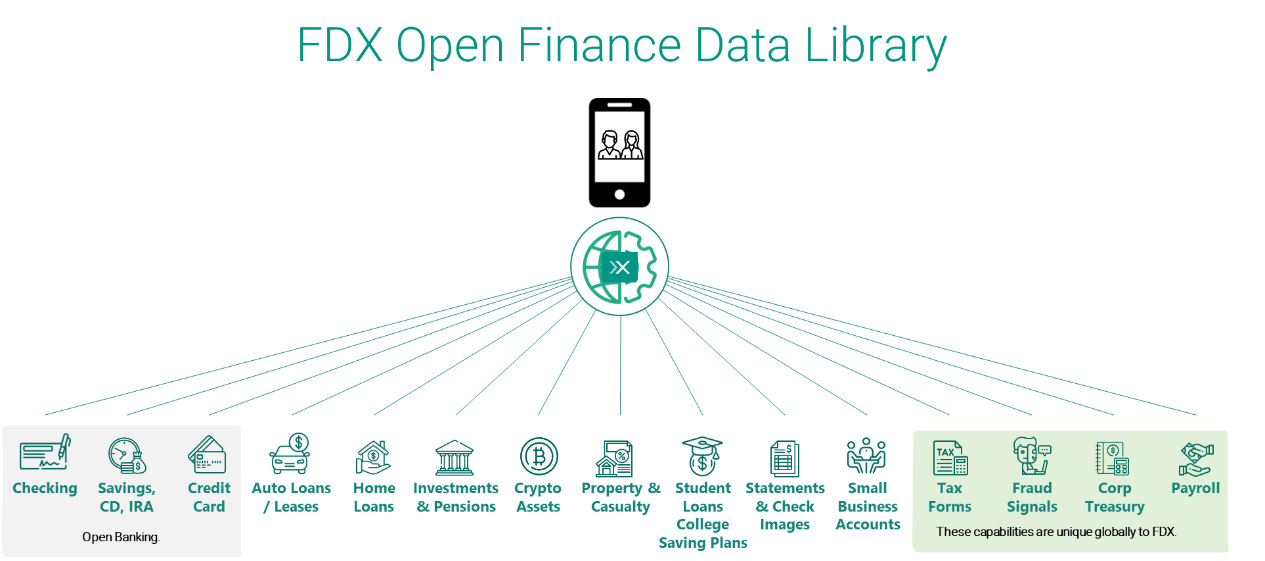

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25626687/DSC08433.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)