Finance

Embedded finance in healthcare: The proverbial sword to cut your healthcare expenses

What if paying for healthcare meant that you simply all the time had the cash out there — on faucet, able to be paid, to any clinic or hospital? For any well being or medical service. For anybody in your loved ones — no restrictions and all the time out there?

What if this transaction was by means of a frictionless ‘instrument’? Like, by means of the swipe of a card, or the scan of a QR code by means of your mobile phone, with on the spot affirmation? And what if this instrument acts as a service for a no-cost or low-cost medical mortgage, reimbursement funds out of your employer, or funds out of your healthcare financial savings, perhaps even your medical insurance?

This then could be an expertise enabled by ‘embedded finance’ in your healthcare transaction, i.e., the seamless integration of monetary companies right into a transaction equation between you and the healthcare supplier (hospital or clinic) or service provider (pharmacy).

Healthcare bills have been the only greatest motive for Indians dropping under the poverty line yearly, even earlier than the latest pandemic. Embedded finance focuses on disrupting the huge healthcare funds that Indians make from their pockets, basically from their financial savings or borrowings. A March 2021 report by NITI Aayog (Govt. of India) put this quantity at a jaw-dropping $72 Billion.

Nonetheless, after we consider healthcare funds, we naturally take into consideration prices for important care on the hospital. We fail to recall the quite a few funds we make to buy medicines, well being checks, or dental remedies. All of those are coupled with bills incurred for remedies which are non-emergency, akin to eye care, hair remedies, pores and skin procedures, assisted being pregnant, and extra. Collectively such medical bills would fall underneath the class of ‘elective procedures’ and even ‘OPD.’

OPD and elective procedures are seldom coated by a medical insurance coverage, assuming you even have one. With 3 out of 4 Indians being both un-insured or under-insured, a majority of us Indians routinely pay for such ‘non-critical’ medical procedures from our pockets, contributing to the staggering development of this piece of the $112 Billion healthcare companies market in India.

Think about then the ‘frictionless’ transaction expertise described above, if you’re on the dentist, getting these ‘Invisalign’ enamel aligners to your teenage daughter, or paying to your pet’s therapy on the veterinarian. The facility of embedded finance in healthcare is that it places the facility again in your palms — the payer of healthcare companies.

By aggregating banks, lenders, fee techniques, and extra by means of an environment friendly fee system, embedded finance has the facility to consolidate the healthcare payer’s wants whereas lubricating the circulation of cash to the healthcare supplier. This works nicely for the supplier too, who will get their buyer’s cash sooner than earlier than (since Clients or Sufferers won’t defer therapy for the shortage of cash), enhancing their money flows and doubtlessly decreasing prices.

There’s vital motion on this business already, with worldwide gamers like Good day Walnut or PayZen from the US, CarePay from Africa, and Aya Care from Canada making a critical affect of their respective markets. Nearer to dwelling, QubeHealth (the writer is the Co-Founder) is quickly making a dent in India, offering a No-Value EMI choice on healthcare funds to staff of corporates that enroll with it.

Embedded Finance is not an experimental expertise. It’s lengthy been utilized by ‘Purchase Now Pay Later’ and different monetary expertise corporations to allow frictionless transactions between the payer and the service provider. The distinction although has been that this innovation has been largely restricted to retail and associated sectors. Solely now’s it being utilized to an business ripe for disruption — healthcare.

Fixing the healthcare drawback for India begins by fixing the healthcare financing drawback first. By way of embedded finance in healthcare, we now have the chance to broaden entry to healthcare and supply higher choices to the sufferers searching for care. To the healthcare suppliers, it means elevated income, as sufferers usually tend to opt-in for elective procedures, higher cashflows, and nearer relationships with their sufferers.

As we emerge from the pandemic years, the heightened consciousness amongst people about healthcare funds can solely sharpen this proverbial sword of embedded finance.

Disclaimer

Views expressed above are the writer’s personal.

END OF ARTICLE

Finance

Minnesota voters back half of school finance levies, reelect most board incumbents

About half the Minnesota districts that asked voters for more money on Election Day got it.

In Northfield, the school district’s $121 million three-question funding request saw full approval, meaning school leaders will be able to move forward with building a new gymnasium, classroom addition and geothermal heating and cooling system.

Minneapolis voters OK’d a $20 million technology spending levy for the financially strapped public school district.

Voters across the state were willing to renew existing levies for building maintenance and upgrades, and for technology. It was a different story, though, when they were asked to pay more for day-to-day operating costs.

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Thirty districts this year asked voters to approve levies for daily costs, including 28 that put questions on ballots this week. Only 40 percent of those requests were OK’d — one of the lowest approval rates since 1980.

“One of the things that really stuck out to us is people were willing to vote to maintain. They weren’t interested in increasing their local property taxes,” said Kirk Schneidawind, executive director of the Minnesota School Boards Association.

Schneidawind said he believes that’s a reflection of how Minnesotans feel about the economy.

“The general default for many voters is, ‘I’m going to vote no if I don’t understand it or don’t know about it,’” Schneidawind said. “People, in their mind, the economy, prices of things and costs of things have gone up. And inflation, even though it’s been coming down, it’s still impacting their pocketbook. And I think perhaps folks saw that or felt that and weren’t supportive of new increases for our public schools.”

Statewide, 45 districts put some sort of financial question on their local ballots this year with 51 percent approved.

School boards

More than 300 Minnesota school districts sought to fill open school board seats this election. In places where incumbents were on the ballot, voters elected to keep them at a rate of nearly 87 percent.

While this year’s competition wasn’t as intense as in recent years, many districts had multiple candidates on their ballots. Behind those candidates were organizations spending time and money on training and endorsements.

The Minnesota Parents Alliance, a conservative organization launched in 2022, endorsed nearly 130 candidates in 56 Minnesota districts in its voter guide. Teacher unions backed nearly 100 candidates in 33 districts. The School Board Integrity Project, a progressive organization launched last year, endorsed 45 candidates in 27 districts.

In the 29 districts where there were candidates from both the Minnesota Parents Alliance and the teachers union or School Board Integrity Project facing off, 31 Minnesota Parents Alliance-endorsed candidates won and 50 union or School Board Integrity Project-endorsed candidates won.

Education Minnesota president Denise Specht claimed victory in an emailed statement, saying union-backed candidates won nearly 75 percent of their races.

Leaders of the Minnesota Parents Alliance also focused on wins, pointing to wins in 56 percent of races with endorsed candidates and seats gained in 47 school boards and majorities gained on boards in Elk River, Lakeville, Forest Lake and Prior Lake, MPA leader Cristine Trooien said in a statement.

Here are the results in a few districts MPR News tracked on Tuesday.

Prior Lake-Savage

In 2022, the open seats on this suburban district’s school board were hotly contested by opposing slates of candidates who staked out sides in a tug of war that involved organized parent groups, teacher unions, networks of political donors and families worried school equity efforts were in jeopardy.

This year there were six candidates running for three open seats. The candidates — just one of whom was seeking reelection — were divided into those backed by the local teacher union versus those who received endorsements from the Minnesota Parents Alliance.

Two of the Minnesota Parents Alliance candidates won, backed by a local parents group that sank at least $1,800 in the election. Just one union-endorsed candidate won, meaning this school board, come January, will be led by a majority of MPA-endorsed candidates.

Voters in this district also rejected the school system’s request for a levy to help pay for daily operations.

Brainerd

In Brainerd, there were seven candidates running for three seats. Only one didn’t secure endorsements from either the Minnesota Parents Alliance or the local teacher union. All union-endorsed candidates were incumbents. Of those, two won reelection. The third open seat was filled by a Minnesota Parents Alliance-backed candidate.

In the 2022 election cycle, Brainerd saw a frenzy of school board campaign spending with candidates racking up nearly $80,000 in disbursements on advertising, mailers and signs. This year, the spending has come way down and is now closer to $11,000.

The three election winners will oversee a district serving at least 6,000 students in north-central Minnesota.

Fergus Falls

Nine candidates were running to fill three seats in this west-central Minnesota district where nearly 3,000 students attend school. Three union-endorsed candidates, supported by about $2500 in union campaign spending, beat out three Minnesota Parents Alliance-endorsed candidates.

Lakeville

In Lakeville, nine candidates vied to fill three seats on a board overseeing district-level decisions for more than 12,000 students in this Twin Cities outer ring suburb.

Campaign finance reports from August and September show close to $20,000 spent on the board elections, mostly from the teachers union. The six endorsed candidates were backed by either the local teachers’ union or the Minnesota Parents Alliance, none of whom are incumbents.

One union candidate and two Minnesota Parents Alliance candidates won, meaning alliance-backed members will hold a board majority come January.

Osseo

In the Twin Cities suburban district of Osseo, there were six candidates running to fill three open board seats. None of the candidates were incumbents. They raised at least $9,000 between them for websites, business cards, flyers, T-shirts, signs and other campaign spending.

This district’s current board has been the site of clashes over policies regarding gender inclusion, instruction and LGBTQ+ pride flags.

On Tuesday voters backed two union and School Board Integrity Project candidates and one Minnesota Parents Alliance candidate.

St. Francis

In St. Francis, in the northern Twin Cities exurbs, there were 10 candidates running for four open school board seats. The Minnesota Parents Alliance and local teachers union each endorsed four candidates, none of whom was an incumbent.

The winners were evenly split — two union-endorsed candidates and two Parents Alliance-endorsed candidates won.

Rosemount-Apple Valley-Eagan

This metro-area district saw two candidates competing in a special election to fill a single school board seat. The local teachers union spent more than $90,000 to support their endorsed candidate, who won the seat.

Finance

Germany's Scholz fires ‘egotistic’ finance minister

STORY: :: November 6, 2024

:: Berlin, Germany

:: Germany’s Scholz sacks finance minister

Christian Lindner, seeks confidence vote

:: He says Lindner broke his trust

‘too many times’ and blocked lawmaking

:: Olaf Scholz, German Chancellor

“Ladies and gentlemen, I have just asked the President for the dismissal of the Finance Minister. I feel forced to take this step in order to avert damage from our country. We need a government that is able to act, that has the strength to make the necessary decisions for our country. That’s what was important to me in the past three years. That’s what’s important to me now. I have made another comprehensive offer to the Free Democrats coalition partner at noon today how we can close the gap in the federal budget without throwing our country into chaos.”

“Too many times did Finance Minister Lindner block laws irrelevantly. Too many times did he act to serve his clientele and party. Too many times did he break my trust. Even the agreement on the budget was withdrawn by him after we had agreed on it in long negotiations. There is no basis of trust for further cooperation. This way, serious government work is impossible.”

“In the very first week of the parliamentary session in the new year, I will call for the confidence vote so that the Bundestag can then vote on it on January 15. That way, parliamentarians can decide if they want to pave the way for a snap election. That election could then take place at the latest by the end of March while respecting the rules of the constitution.”

After firing Finance Minister Christian Lindner of the Free Democrats (FDP) party, Scholz is expected to head a minority government with his Social Democrats and the Greens, the second-largest party.

He would have to rely on cobbled-together parliamentary majorities to pass legislation and he plans to hold a parliamentary confidence vote in his government on Jan. 15.

The collapse of Scholz’s three-way alliance caps months of wrangling over budget policy and Germany’s economic direction, with the government’s popularity sinking and far-right and far-left forces surging.

“We need a government that is able to act, that has the strength to make the necessary decisions for our country,” Scholz told reporters.

Scholz said he fired Lindner for his obstructive behaviour on budget disputes, accusing the minister of putting party before country and blocking legislation on spurious grounds.

The move comes a day after the election of Republican Donald Trump as U.S. president, with Europe scrambling to form a united response on issues from possible new U.S. tariffs to Russia’s war in Ukraine and the future of the NATO alliance.

Finance

Look out for these personal finance pain points in the U.S. election aftermath

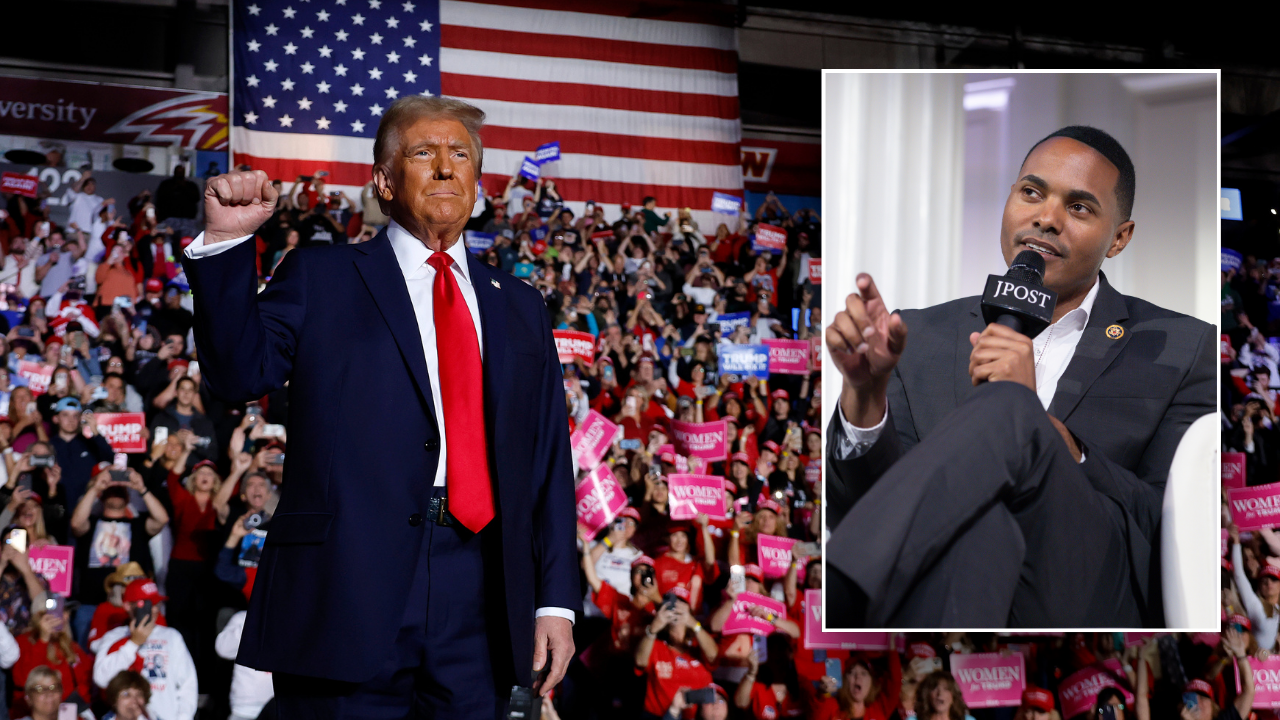

The rally for stocks and crypto following Donald Trump’s U.S. election win is a head fake that diverts attention from several investing and personal finance pain points ahead.

Mr. Trump was seen as better for stocks than Democratic candidate Kamala Harris, and he’s thought to be a booster of crypto currency. The S&P 500 and several cryptocurrencies surged in morning trading on Wednesday, but signs of trouble were there if you looked for them in the bond market.

Investors sold U.S. Treasury bonds, which has the effect of making bond yields rise. Why we care about bond yields in the United States: They have a big influence on bonds here in Canada and, in turn, on the cost of mortgages.

Mortgage rates are well off their recent peaks, but still well above the level where many homeowners locked in several years ago. Waves of these homeowners will renew mortgages in the next 12 months, and they have to be wondering how much more they’ll be required to pay. Events in the bond market suggest further mortgage rate cuts aren’t imminent, a point worth noting if you’re on the housing market sidelines waiting for lower borrowing costs.

Stocks rise and fall on expectations for corporate profits, while bonds are dependent on how investors view economic prospects, including inflation. Mr. Trump’s plan to introduce tariffs on imports is considered inflationary because it will increase the cost of imported goods, while also potentially slowing growth.

Something else investors worry about is the creditworthiness of bond issuers, an area where the United States is generating concern through its US$35-trillion debt. Neither Mr. Trump nor Ms. Harris focused on government debts and deficits in the election campaign, but his policies were judged as adding more to overall debt levels. There’s justifiable concern about Canadian government’s finances, but the U.S. is in worse shape.

Without attention to government debt in the United States, it’s possible that bond yields could rise from current levels. The Bank of Canada and U.S. Federal Reserve will keep lowering their benchmark interest rates, which in turn will push down rates for variable-rate mortgages, lines of credit and floating-rate loans. But bond yields are a bigger influence on fixed-rate mortgages, which happen to be a popular pick right now.

A takeaway for homeowners from these developments is that variable-rate mortgages are worth a look. If you go variable, each Bank of Canada rate cut – and there are several expected over the remainder of this year and next – will lower your borrowing costs.

Another post-election pain point is the Canadian dollar, which has dropped to 71.9 US cents as of Wednesday morning from 74.2 US cents in late September. Part of the reason for that is that money flows are drawn to the higher interest rates in the United States. A five-year Canada bond had a yield of 3.1 per cent early Wednesday, while a comparable U.S. Treasury bond had a yield of 4.3 per cent.

But Canada’s lack of economic competitiveness also contributes to its dollar weakness. If a Trump government offers tax cuts to business and removes regulations, then we may see additional downward pressure on the dollar. Now seems a good time to buy some U.S. currency if you plan to head south this winter.

Stocks had a great run Wednesday morning on the Trump win, but the comparative returns for the U.S. and Canadian markets suggests another pain point. The S&P 500 was up 1.7 per cent by late morning, while the S&P/TSX composite index was up just 0.3 per cent.

In addition to being seen as friendly for business, Mr. Trump is also regarded as someone who will have policies favouring the mega-size tech companies that are dominant in the S&P 500 and non-existent in the S&P/TSX composite.

The Canadian market has benefited lately from a rebound in blue-chip dividend stocks, but that was driven by the decline in interest rates on bonds. Sticky bond yields could limit near-term gains for dividend stocks.

The rally in the price of bitcoin, ethereum, dogecoin and other cryptocurrencies was a win for investors holding these speculative assets. But if you’re a traditioal investor or money manager who has avoided them, prepare for FOMO, or fear of missing out. Crypto remains a non-essential portfolio holding, but has the potential to move beyond that if it becomes more widely adopted.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

-

Business6 days ago

Carol Lombardini, studio negotiator during Hollywood strikes, to step down

-

Health7 days ago

Health7 days agoJust Walking Can Help You Lose Weight: Try These Simple Fat-Burning Tips!

-

Business5 days ago

Hall of Fame won't get Freddie Freeman's grand slam ball, but Dodgers donate World Series memorabilia

-

Business1 week ago

Business1 week agoWill Newsom's expanded tax credit program save California's film industry?

-

Culture4 days ago

Culture4 days agoYankees’ Gerrit Cole opts out of contract, per source: How New York could prevent him from testing free agency

-

Culture3 days ago

Culture3 days agoTry This Quiz on Books That Were Made Into Great Space Movies

-

Business1 week ago

Business1 week agoApple is trying to sell loyal iPhone users on AI tools. Here's what Apple Intelligence can do

-

Culture1 week ago

Culture1 week agoTry This Quiz on Spooky Novels for Halloween