Finance

A major shift in the economic narrative could be underway

The overarching narrative of the markets and economic system has been certainly one of sturdy demand assembly lagging provide, a dynamic that has prompted inflation to surge.

Whereas most indicators recommend these developments proceed to persist, a handful of anecdotes from the previous week recommend this narrative may very well be altering.

Indicators that inventories are now not depleted

Provide chain disruptions have been mirrored by depressed stock/gross sales ratios. The truth is, many companies have been complaining that gross sales can be stronger if solely they may preserve their cabinets stocked.

In line with a Census Bureau report printed Tuesday, enterprise inventories grew 2.0% in March from the prior month. The stock/gross sales ratio improved marginally to 1.27, however remained lean relative to historic ranges.

In earnings calls final week, nevertheless, retail behemoths Walmart and Goal steered this downside may very well be a factor of the previous for them.

“We like the truth that our stock is up as a result of a lot of it’s wanted to be in inventory on our aspect counters, however a 32% improve is greater than we would like. We’ll work by means of most or the entire extra stock over the following couple of quarters.” – Doug McMillon, CEO of Walmart“Whereas we anticipated a post-stimulus slowdown in these classes, and we anticipated the customers to proceed refocusing their spending away from items and providers, we did not anticipate the magnitude of that shift. As I discussed earlier, this led us to hold an excessive amount of stock, significantly in cumbersome classes, together with kitchen home equipment, TVs, and out of doors furnishings.“ – Brian Cornell, CEO of Goal

This putting chart from Bloomberg’s Kriti Gupta illustrates simply how aggressively among the large retailers have been about getting their inventories up.

This phenomenon the place firms go from being undersupplied to oversupplied is a known as the “bullwhip impact.” Bloomberg’s Joe Weisenthal explains:

“Demand booms. Firms aggressively order and even over-order in an effort to guarantee they’ve inventories. Then demand shifts. Immediately fears of shortages and empty cabinets flip into stock pileups, gluts and disinflation.”

There are two crucial issues to notice about what’s happening with these retailers.

First, they’re being impacted by the truth that customers are spending much less cash on tangible stuff and more cash on intangible experiences. The truth is, United Airways confirmed as a lot on Monday when it revised up its outlook for summer time journey.

Second, this has little to do with any sudden weak point in client spending. The truth is, Walmart and Goal every reported better-than-expected comparable retailer gross sales progress. The Census Bureau’s newest month-to-month retail gross sales report confirmed client energy economy-wide as gross sales climbed to a brand new document in April.

“[Customers’] spending capability continues to profit from elevated saving charges, excessive employment, and wholesome wage progress,” Goal’s Cornell stated.

Indicators that supply instances are enhancing

Because the demand for items rebounded, it took longer and longer to get orders delivered.

Nonetheless, these supply instances look like getting shorter.

In line with manufacturing surveys from the New York Fed and Philly Fed, suppliers’ supply instances indexes fell in Might to their lowest ranges in months.

Although, each of those surveys additionally signaled that manufacturing exercise was weakening within the mid-Atlantic. So, it’s potential that these shorter supply instances are extra a perform of slowing demand slightly than enhancements within the provide chain.

Indicators that labor shortages are receding

Walmart, the biggest personal employer within the U.S., echoed one thing just lately stated by Amazon, the nation’s second largest personal employer1:

“Because the omicron variant case depend declined quickly within the first half of the quarter, extra of our associates that had been out on COVID depart got here again to work sooner than we anticipated. We employed extra associates on the finish of final yr to cowl for these on depart, so we ended up with weeks of overstaffing.” – Doug McMillon, CEO of Walmart“With the emergence of the Omicron variant in late 2021, we noticed a considerable improve in achievement community staff out on depart, and we proceed to rent new staff to cowl these absences. Because the variant subsided within the second half of the quarter and staff returned from depart, we rapidly transitioned from being understaffed to being overstaffed, leading to decrease productiveness.“ Brian Olsavsky, CFO of Amazon

These statements are very comparable, although they replicate phenomena distinctive to large retail.

On the similar time, nevertheless, there was a pickup in anecdotes of hiring freezes and layoffs within the tech trade.2 On Tuesday, The Hollywood Reporter first reported that Netflix can be letting 150 staff go.

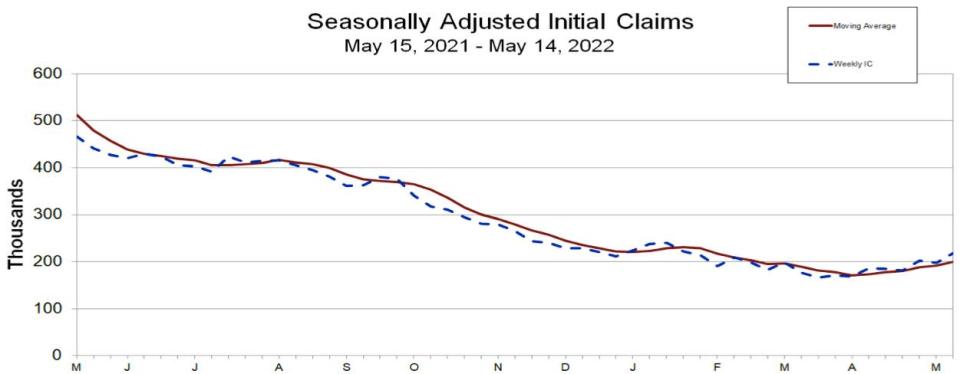

One of the crucial well-liked methods to trace labor market well being is the tally of preliminary claims for unemployment insurance coverage advantages, which will get reported weekly. Whereas the extent of claims stay close to 50-year lows, there was a slight uptick in current weeks.

Within the week ending Might 14, preliminary claims rose to 218,000, up 21,000 from the prior week. It’s the very best stage since January.

What this might imply for inflation

As a result of provide chain disruptions have endured for longer than many anticipated, the ensuing shortages have prompted inflation to be a lot hotter than what many anticipated.

And so, the Federal Reserve has responded by tightening financial coverage. They imagine that tighter monetary circumstances ought to cool the labor market, which ought to cool wage progress, which in flip ought to cool demand to a stage that’s extra consistent with provide. This could in the end cool inflation.

The presence of bloated inventories and shorter supply instances would recommend provide chains are now not an issue. And hiring freezes and layoffs recommend wage progress ought to cool. Assuming these anecdotes flip into financial developments, inflation ought to come down quickly after.

Zooming out

Once more, the headlines from final week are anecdotal, and the strikes within the financial information are fairly small.

Then once more, most large developments begin as anecdotes and small shifts within the information.

Because the story of the economic system unfolds, we’ll be holding a detailed eye on layoffs, preliminary claims, inventories, provider supply instances, order backlogs, and naturally the entire varied methods inflation is reported.

Extra from TKer:

Rearview ?

? ? Shares preserve falling: The S&P 500 declined 3.0% final week, marking its seventh straight week of losses. The index is now down 18.7% from its January 3 closing excessive of 4796.56. The S&P additionally touched an intraday low of three,810.32 on Friday, which is 20.9% under its January 4 intraday excessive of 4,818.62. For extra on market volatility, learn this and this. Should you wanna learn up on bear markets, learn this.

? Powell is hawkish: Federal Reserve Chair Jerome Powell warned that the central financial institution’s efforts to chill inflation could make for a bumpy experience within the economic system. “There may very well be some ache concerned in restoring worth stability,“ he stated at a Wall Road Journal occasion on Tuesday.

?? Financial information breaks data: Retail gross sales climbed to a brand new document in April. Industrial manufacturing exercise in April additionally rose to a brand new document stage. For extra on these reviews, learn this.

? Retail earnings whiff: As mentioned above, Walmart and Goal each reported first rate gross sales progress. Nonetheless, each firms struggled with rising prices and their earnings upset consequently. Walmart shares plunged 11.3% on their information. Goal shares crashed 24.9%.

? Mortgage charges tick down from their highs: The common fee for the 30-year fastened fee mortgage declined to five.25% from 5.30% the week prior, in line with Freddie Mac.

? Residence gross sales slip: Gross sales of previously-owned houses fell 2.4% in April to an annualized fee of 5.6 million models, in line with the Nationwide Affiliation of Realtors (NAR). “Larger house costs and sharply greater mortgage charges have lowered purchaser exercise,” NAR chief economist Lawrence Yun stated. “It appears like extra declines are imminent within the upcoming months, and we’ll probably return to the pre-pandemic house gross sales exercise after the outstanding surge over the previous two years.“

Up the street ?

As of late, it’s all about what’s happening with inflation. So, all eyes might be on Friday’s launch of the core PCE worth index, the Fed’s most well-liked gauge of inflation. Economists estimate the metric elevated by 0.3% in April from the month prior, reflecting a 4.9% soar from the prior yr.

The April sturdy items order report might be launched on Wednesday. Orders tied to enterprise funding had been at a document stage in March. Will the April report be simply as sturdy?

1. These ranks come from the Fortune 500 checklist.

2. Layoffs.fyi has been monitoring many of those tech and startup layoffs.

Learn the most recent monetary and enterprise information from Yahoo Finance

Comply with Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube

Finance

AI is too ‘sociopathic’ to give financial advice, MIT researchers say

The problem with AI in the context of it being used as a financial advisor is that it is “inherently sociopathic,” according to a Business Insider article which cited an MIT research report.

Also Read: Japan wants its hardworking citizens to try a 4-day workweek due to labor shortage

Why is AI sociopathic?

While human financial advisors give clients recommendations using a behavioral lens, since people don’t always make rational or unbiased financial decisions, AI can easily argue on both sides of an argument because neither side has any weight to it.

How is AI used by financial advisors at the moment?

Nearly 40% of human financial advisors use generative-AI tools for the job, according to a report from data-analytics firm Escalent, which added that this was mostly for boosting productivity, generating content, and for marketing functions.

Also Read: New FASTag design launched to crack down on large vehicles using smaller vehicle tags to pay less toll

Examples include Canadian startup Conquest Planning using a financial-planning software with an AI architecture known as a blackboard system for storing information about tax rules, cash-flow mechanics, retirement-account structures, fiduciary rules, and more, according to the article, which added that another example would be Los Angeles-based wealth manager Arynton Hardy, who uses AI regularly to save time on data entry, portfolio monitoring, and other back-office tasks.

How can AI be made more useful for giving financial advice?

A method to make AI more empathetic to the client is by making it ask simple questions like “How are you doing?” before dispensing personalized financial advice, according to Andrew Lo, a professor of finance at the MIT Sloan School of Management and the director of the Laboratory for Financial Engineering, who co-authored the report.

The AI could also use audio or video from the client to identify emotional cues, like stress or fear, in their voice or facial expressions, he added.

“We think we’re about two or three years away before we can demonstrate a piece of software that by SEC regulatory guidelines will satisfy fiduciary duty,” the article quoted him as saying.

Also Read: Did the Tatas really have to merge Vistara with Air India?

Finance

Harris's proposed unrealized capital gains tax is unlikely to pass: CIO

Unrealized capital gains tax proposals may be floating back into the zeitgeist as the Harris presidential campaign marches on, but for some, the noise around it is much ado about nothing.

“I don’t think this unrealized thing is going to have much momentum because it is a very onerous process to come up with those numbers,” Raymond James chief investment officer Larry Adam told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (see video above or listen here).

“You start putting biases of what you think [something] is worth versus the reality,” said Adam. “That becomes a very difficult equation to really put into a place.”

We’ve seen unrealized capital gains tax proposals before, but they’ve met plenty of resistance.

Most recently, the Biden administration proposed an unrealized capital gains tax for those with a net worth of over $100 million. The proposal could affect more than 10,600 people in the US, according to estimates.

But, unlike a capital gains tax, which is imposed on a sold item, deploying an unrealized capital gains tax is a trickier move.

Stifel chief Washington strategist Brian Gardner said in a recent client note that under an unrealized capital gains tax system, “ranking illiquid assets would not only be complicated but controversial,” adding that there would also need to be a way to provide taxpayers with “rebates for future losses.”

While analysts scratch their heads about the subject, an unrealized capital gains tax also has plenty of tomato throwers. Donald Trump called it “beyond socialism,” telling a crowd of small-business owners, “You will be forced to sell your restaurant immediately.”

Trump’s onetime US Commerce Secretary, Wilbur Ross, concurred.

“Frankly, I think it’s a ridiculous proposal,” Ross said on Opening Bid.

Tesla (TSLA) CEO Elon Musk also had negative statements to share on the topic, proclaiming an unrealized capital gains tax would lead to “bread lines and ugly shoes.”

While Trump and Musk might deliver their messages to pack a wallop and make voters think, concerns aren’t necessarily unfounded.

Raymond James’s Adam has considered tax proposals made by both candidates, and thinks that regardless of the administration in office, higher taxes could impact households by almost $2,000. “[It] could be a big impact and a drag on the economy,” he said.

Both Harris and Trump face challenges given the expiration of a significant portion of the 2017 tax cuts at the end of 2025. Trump has proposed an additional extension of provisions from 2017 and potentially more tax cuts.

Harris proposed expanding the child tax credit and supported no increase in the capital gains tax, while taxing those making over $400,000 annually more.

While the presidential race is anyone’s game at this point, Adam isn’t that worried about an unrealized capital gains tax and the potential market losses. “[There’s] a low probability of it passing,” he said. “It’s pretty hard to mark to market every single year for your taxes.”

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

This embedded content is not available in your region.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Finance

Insider Sale: President Brian Hole Sells Shares of Willis Lease Finance Corp (WLFC)

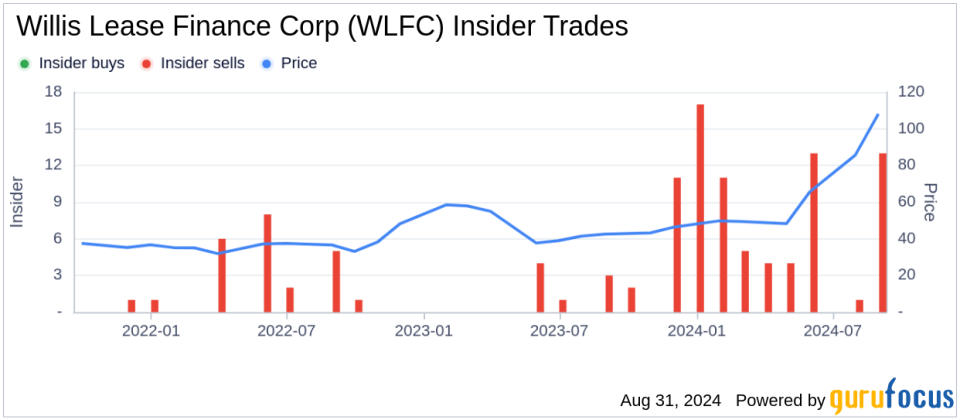

On August 30, 2024, President Brian Hole sold 1,187 shares of Willis Lease Finance Corp (NASDAQ:WLFC), as reported in a recent SEC Filing. Following this transaction, the insider now owns 96,589 shares of the company.

Willis Lease Finance Corp specializes in the leasing of spare commercial aircraft engines, aircraft, and other aircraft-related equipment to airlines, aircraft engine manufacturers, and maintenance, repair, and overhaul providers worldwide.

Over the past year, Brian Hole has engaged in multiple transactions involving the company’s stock, selling a total of 24,570 shares and purchasing none. This recent sale is part of a broader trend observed within the company, where there have been 82 insider sells and no insider buys over the past year.

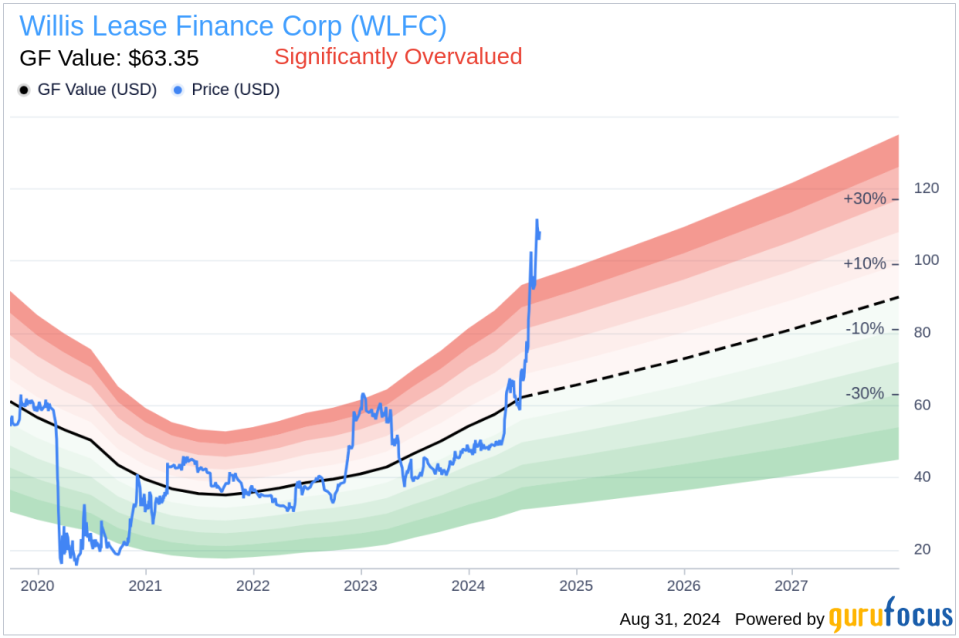

Shares of Willis Lease Finance Corp were priced at $106.17 on the day of the transaction. The company currently holds a market cap of approximately $772.655 million. The price-earnings ratio stands at 8.41, which is below the industry median of 17.98.

According to the GF Value, the intrinsic value estimate for Willis Lease Finance Corp is $63.35 per share, making the stock significantly overvalued with a price-to-GF-Value ratio of 1.68.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

This sale by the insider might be of interest to current and potential investors, providing insight into insider confidence and valuation perspectives at Willis Lease Finance Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

-

Connecticut1 week ago

Connecticut1 week agoOxford church provides sanctuary during Sunday's damaging storm

-

Technology1 week ago

Technology1 week agoBreakthrough robo-glove gives you superhuman grip

-

Politics1 week ago

Politics1 week ago2024 showdown: What happens next in the Kamala Harris-Donald Trump face-off

-

News1 week ago

News1 week agoWho Are Kamala Harris’s 1.5 Million New Donors?

-

Politics1 week ago

Politics1 week agoTrump taunted over speculated RFK Jr endorsement: 'Weird as hell'

-

Politics1 week ago

Politics1 week agoVivek Ramaswamy sounds off on potential RFK Jr. role in a Trump administration

-

World6 days ago

World6 days agoPortugal coast hit by 5.3 magnitude earthquake

-

Politics1 week ago

Politics1 week agoHouse GOP demands elite universities counteract 'dangerous' anti-Israel protests in the fall semester