Education

Biden’s Big Dreams Meet the Limits of ‘Imperfect’ Tools

WASHINGTON — President Biden’s transfer this week to cancel pupil mortgage debt for tens of hundreds of thousands of debtors and cut back future mortgage funds for hundreds of thousands extra comes with an enormous catch, economists warn: It does nearly nothing to restrict the skyrocketing price of school and will very properly gasoline even quicker tuition will increase sooner or later.

That draw back is a direct consequence of Mr. Biden’s choice to make use of govt motion to erase some or all pupil debt for people incomes $125,000 a yr or much less, after failing to push debt forgiveness by means of Congress. Consultants warn that faculties may simply sport the brand new construction Mr. Biden has created for larger schooling financing, cranking up costs and inspiring college students to load up on debt with the expectation that it’s going to by no means should be paid in full.

It’s the newest instance, together with power and well being care, of Democrats in Washington in search of to handle the nation’s most urgent financial challenges by working towards the artwork of the attainable — and ending up with imperfect options.

There are sensible political limits to what Mr. Biden and his get together can accomplish in Washington.

Democrats have razor-thin margins within the Home and Senate. Their ranks embrace liberals who favor wholesale overhaul of sectors like power and schooling and centrists preferring extra modest adjustments, if any. Republicans have opposed practically all of Mr. Biden’s makes an attempt, together with these of President Barack Obama beginning greater than a decade in the past, to increase the attain of presidency into the financial system. The Supreme Courtroom’s conservative majority has sought to curb what it sees as govt department overreach on points like local weather change.

In consequence, a lot of the construction of key markets, like faculty and medical health insurance, stays intact. Mr. Biden has scored victories on local weather, well being care and now — pending attainable authorized challenges — pupil debt, usually by pushing the boundaries of govt authority. Even progressives calling on him to do extra agree he couldn’t impose European-style authorities management over the upper schooling or well being care techniques with out the assistance of Congress.

The president has dropped whole sections of his coverage agenda as he sought paths to compromise. He has been left to leverage what seems to be essentially the most highly effective software at the moment accessible to Democrats in a polarized nation — the spending energy of the federal authorities — as they search to deal with the challenges of rising temperatures and impeded entry to larger schooling and well being care.

Arindrajit Dube, an economist on the College of Massachusetts Amherst who consulted with Mr. Biden’s aides on the coed mortgage subject and supported his announcement this week, mentioned in an interview that the debt cancellation plans had been essentially incomplete as a result of Mr. Biden’s govt authority may attain solely up to now into the upper schooling system.

“That is an imperfect software,” Mr. Dube mentioned, “that’s nevertheless one that’s on the president’s disposal, and he’s utilizing it.”

However as a result of the insurance policies pursued by Mr. Biden and his get together do comparatively little to have an effect on the costs shoppers pay in some components of these markets, many specialists warn, they danger elevating prices to taxpayers and, in some circumstances, hurting some shoppers they’re attempting to assist.

“You’ve achieved nothing that adjustments the construction of schooling” with Mr. Biden’s pupil mortgage strikes, mentioned R. Glenn Hubbard, a Columbia College economist who was the chairman of the White Home Council of Financial Advisers underneath President George W. Bush. “All you’re going to do is elevate the value.”

Mr. Hubbard mentioned Mr. Biden’s group had made comparable missteps on power, well being care, local weather and extra. “I perceive the politics, so I’m not making a naïve remark right here,” Mr. Hubbard mentioned. “However fixing by means of subsidies doesn’t get you there — or it will get you such market distortions, you actually ought to fret.”

Mr. Biden mentioned on Wednesday that his administration would forgive as much as $10,000 in pupil debt for particular person debtors incomes $125,000 a yr or much less and households incomes as much as $250,000, with one other $10,000 in aid for individuals from low-income households who acquired Pell grants at school.

What’s within the Inflation Discount Act

What’s within the Inflation Discount Act

A substantive laws. The $370 billion local weather, tax and well being care package deal that President Biden signed on Aug. 16 may have far-reaching results on the setting and the financial system. Listed here are among the key provisions:

He additionally introduced plans to restrict how a lot lower-income college students must pay every month on their pupil loans, together with a promise that individuals who keep on with a month-to-month cost plan is not going to pay extra curiosity on their balances.

Mr. Biden mentioned the strikes would reopen a path to a middle-class life for hundreds of thousands of People struggling to make mortgage funds.

Critics of the strikes — and even some supporters — say that by solely focusing on what college students pay, and never what faculties cost, Mr. Biden has successfully given faculties an invite to lift their costs even quicker than they have already got been. Common tuition and costs at public, nonprofit faculties and universities rose 10 % from 2010 to 2020 after adjusting for inflation, the Schooling Division reviews. For personal faculties, the rise was practically twice as a lot.

Colleges that already cost excessive costs, together with for college students from lower-income backgrounds, may elevate them additional and encourage college students to tackle extra loans with the concept the federal government will ultimately forgive them, mentioned Melissa Kearney, a College of Maryland economist who directs the Aspen Financial Technique Group.

Mr. Biden’s plans, she mentioned, will even “perpetuate the issue of scholars attending faculties and packages that cost excessive charges even when pupil outcomes are awful.”

“If individuals know their loans shall be forgiven, they are going to be much less cautious of enrolling in these sorts of low-return, high-risk packages,” she mentioned.

Democrats have additionally discovered they need to slim their efforts to get main financial laws by means of Congress. On well being care, the trade-off has been improved entry to care, however at continued excessive price.

Greater than a decade after Democrats expanded entry to medical health insurance for hundreds of thousands of People by means of the Inexpensive Care Act, the USA nonetheless spends twice as a lot per capita on medical care as a typical rich nation.

Democrats’ efforts to impose value caps on some components of the well being care system have been much less profitable than the get together’s efforts to increase Medicaid and enhance subsidies for insurance coverage purchased by means of the federal authorities.

Some researchers had hoped that increasing entry to care would scale back per-person well being spending by offering preventive take care of beforehand uninsured sufferers to assist them keep away from costlier sickness. These hopes haven’t come to fruition, mentioned Katherine Baicker, the dean of the College of Chicago’s Harris Faculty of Public Coverage, who research the economics of well being care. And because of this, prices have remained excessive for taxpayers.

“Insurance policies which might be designed to unravel one downside,” like increasing well being protection, she mentioned, “should be real looking concerning the financing that goes together with it.”

Mr. Biden and Democrats made one other try this month to rein in well being prices, imposing limits on prescription drug spending by means of Medicare in a sweeping invoice referred to as the Inflation Discount Act. That invoice additionally consists of essentially the most formidable effort by the federal authorities to scale back the greenhouse gasoline emissions which might be driving local weather change: practically $400 billion in spending and tax incentives meant to encourage the expansion of wind and photo voltaic electrical energy, electrical autos and different emissions-limiting applied sciences.

These measures be a part of a rising record of administration efforts to manage emissions throughout the financial system. However for a number of causes, most notably the political difficulties of taxing shoppers, the invoice didn’t impose a tax on fossil fuels.

Many environmental economists have moved away from their long-held view that such taxes are the easiest way to scale back emissions. However most of them nonetheless say elevating the value of fossil fuels, in hopes of discouraging their use, is a crucial complement to authorities subsidies of low-carbon fuels — a part of a balanced weight-reduction plan, so to talk, that yields a quicker, extra environment friendly transition away from planet-warming oil, gasoline and coal.

The political perils of excessive gasoline costs all however assured Mr. Biden wouldn’t pursue a tax on fossil fuels. However White Home officers have additionally grown more and more bullish on the concept rules and subsidies are sufficient to fulfill his objective of chopping emissions 50 % from 2005 ranges by the top of the last decade.

“I don’t see this as a missed alternative on the local weather facet,” mentioned Brian Deese, the director of Mr. Biden’s Nationwide Financial Council, “a lot as a historic effort to handle local weather change primarily based on a brand new strategy.”

Biden aides have extra brazenly acknowledged the holes in his pupil debt plans, successfully conceding that faculties and universities may speed up tuition will increase to reap the benefits of extra beneficiant assist until Congress intervenes.

In negotiations towards what grew to become his well being and local weather invoice, Mr. Biden dropped plans for larger schooling entry, together with federally funded group faculty. Bharat Ramamurti, a deputy director of the Nationwide Financial Council, informed reporters on the White Home on Friday that the Schooling Division had taken steps underneath Mr. Biden to crack down on “abusive” larger schooling establishments, however he mentioned way more wanted to be achieved.

“We imagine the division ought to have much more authority to go after dangerous actors and to carry faculties accountable,” Mr. Ramamurti mentioned, “and we’re desperate to work with Congress to advance any proposals alongside these strains.”

Ms. Kearney, the College of Maryland economist, mentioned Congress may assist dampen tuition will increase by reducing how a lot college students may borrow in federal loans, making it tougher for faculties and packages to cost elevated costs.

Beth Akers, a senior fellow on the conservative American Enterprise Institute in Washington, mentioned Congress ought to go a regulation that ties faculties’ eligibility for pupil grants and loans to the labor market outcomes of their alumni — a transfer faculties would make certain to struggle.

“Colleges that ship their graduates or nongraduates into the labor pressure with out the power to earn wages that might justify their price needs to be minimize out of the system,” she mentioned.

The liberal author Matt Bruenig urged a direct set of federal value controls for larger schooling in a chunk for the Individuals’s Coverage Challenge suppose tank, writing that Mr. Biden’s new plans to scale back funds for lower-income debtors in years to come back will encourage college students to take out “the utmost quantity of debt attainable.”

In such a system, Mr. Bruenig wrote, “we may have the federal government to additionally play a a lot greater position in setting faculty costs.”

Margot Sanger-Katz contributed reporting.

Education

Four Fraternity Members Charged After a Pledge Is Set on Fire

Four fraternity members at San Diego State University are facing felony charges after a pledge was set on fire during a skit at a party last year, leaving him hospitalized for weeks with third-degree burns, prosecutors said Monday.

The fire happened on Feb. 17, 2024, when the Phi Kappa Psi fraternity held a large party at its house, despite being on probation, court documents show. While under probation, the fraternity was required to “demonstrate exemplary compliance with university policies,” according to the college’s guidelines.

Instead, prosecutors said, the fraternity members planned a skit during which a pledge would be set on fire.

After drinking alcohol in the presence of the fraternity president, Caden Cooper, 22, the three younger men — Christopher Serrano, 20, and Lars Larsen, 19, both pledges, and Lucas Cowling, 20 — then performed the skit, prosecutors said.

Mr. Larsen was set on fire and wounded, prosecutors said, forcing him to spend weeks in the hospital for treatment of third-degree burns covering 16 percent of his body, mostly on his legs.

The charges against Mr. Cooper, Mr. Cowling and Mr. Serrano include recklessly causing a fire with great bodily injury; conspiracy to commit an act injurious to the public; and violating the social host ordinance. If convicted of all the charges, they would face a sentence of probation up to seven years, two months in prison.

Mr. Larsen himself was charged. The San Diego County District Attorney’s office said that he, as well as Mr. Cooper and Mr. Cowling, also tried to lie to investigators in the case, deleted evidence on social media, and told other fraternity members to destroy evidence and not speak to anyone about what happened at the party.

All four men have pleaded not guilty.

Lawyers representing Mr. Cooper and Mr. Cowling did not immediately respond to messages requesting comment on Tuesday. Contact information for lawyers for Mr. Serrano and Mr. Larsen was not immediately available.

The four students were released on Monday, but the court ordered them not to participate in any fraternity parties, not to participate in any recruitment events for the fraternity, and to obey all laws, including those related to alcohol consumption.

The university said Tuesday that it would begin its own administrative investigation into the conduct of the students and the fraternity, now that the police investigation was complete.

After it confirmed the details, the dean of students office immediately put the Phi Kappa Psi chapter on interim suspension, which remains in effect, college officials confirmed on Tuesday.

Additional action was taken, but the office said it could not reveal specifics because of student privacy laws.

“The university prioritizes the health and safety of our campus community,” college officials said in a statement, “and has high expectations for how all members of the university community, including students, behave in the interest of individual and community safety and well-being.”

At least half a dozen fraternities at San Diego State University have been put on probation in the last two years, officials said.

Education

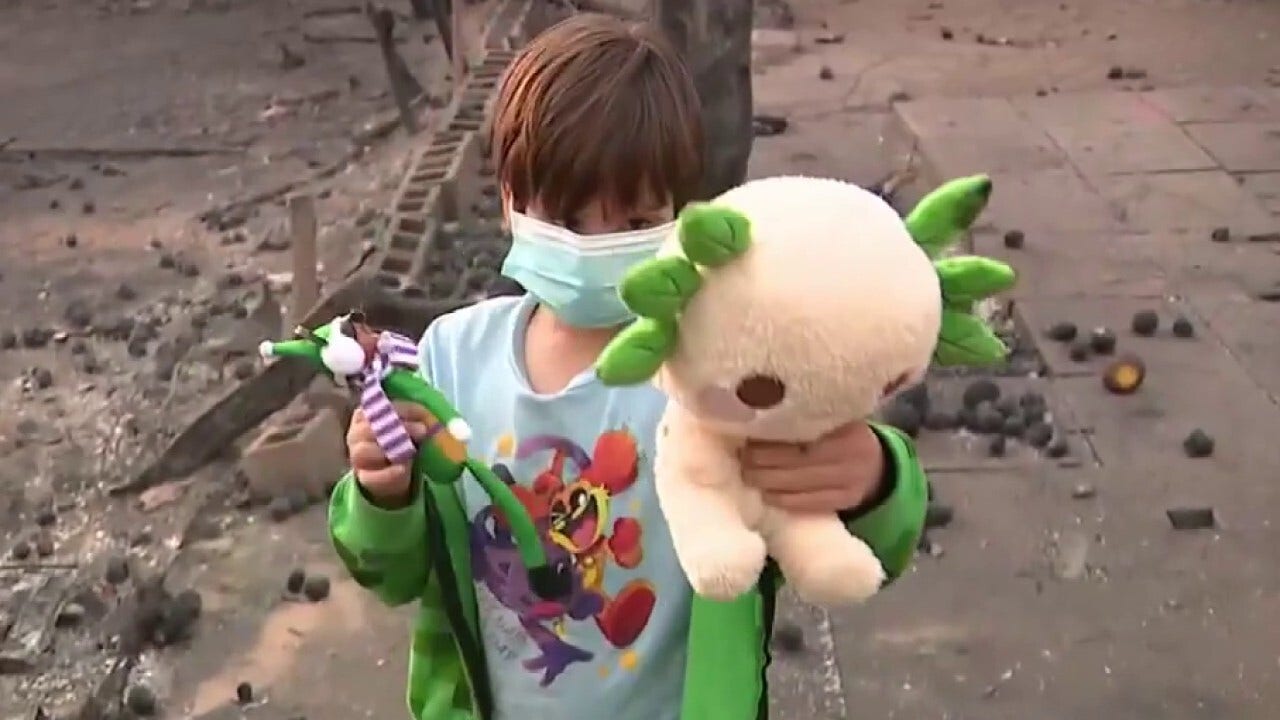

Video: Several Killed in Wisconsin School Shooting, Including Juvenile Suspect

new video loaded: Several Killed in Wisconsin School Shooting, Including Juvenile Suspect

transcript

transcript

Several Killed in Wisconsin School Shooting, Including Juvenile Suspect

The police responded to a shooting at a private Christian school in Madison, Wis., on Monday.

-

Around 10:57 a.m., our officers were responding to a call of an active shooter at the Abundant Life Christian School here in Madison. When officers arrived, they found multiple victims suffering from gunshot wounds. Officers located a juvenile who they believe was responsible for this deceased in the building. I’m feeling a little dismayed now, so close to Christmas. Every child, every person in that building is a victim and will be a victim forever. These types of trauma don’t just go away.

Recent episodes in Guns & Gun Violence

Education

Video: Biden Apologizes for U.S. Mistreatment of Native American Children

new video loaded: Biden Apologizes for U.S. Mistreatment of Native American Children

transcript

transcript

Biden Apologizes for U.S. Mistreatment of Native American Children

President Biden offered a formal apology on Friday on behalf of the U.S. government for the abuse of Native American children from the early 1800s to the late 1960s.

-

The Federal government has never, never formally apologized for what happened until today. I formally apologize. It’s long, long, long overdue. Quite frankly, there’s no excuse that this apology took 50 years to make. I know no apology can or will make up for what was lost during the darkness of the federal boarding school policy. But today, we’re finally moving forward into the light.

Recent episodes in Politics

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics5 days ago

Politics5 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health4 days ago

Health4 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades