Crypto

Why calling a bottom for bitcoin, or any cryptocurrency, is so misleading

/cloudfront-us-east-1.images.arcpublishing.com/tgam/NTM6XKLUWRMXZKRSZCV7AWSH4Q.JPG)

Bitcoin BT*1 bulls have at all times been exuberant – that’s desk stakes in crypto land. However currently their enthusiasm has morphed into one thing much more fanatical. It’s one factor to hype a market that’s making individuals wealthy, and one other factor solely to scream about its superiority whereas buyers are getting hosed.

To their credit score, the latest hype does look somewhat completely different. It isn’t plagued by rocket-ship emojis any extra, which used to represent the crypto sector’s astronomical progress. The purpose now’s to revive confidence by calling a backside for the market’s ferocious downturn.

Bitcoin and ether, the 2 hottest cryptocurrencies, have tumbled in waves since November, and each time a brand new swell hits, the believers swear this one will set a flooring.

“Seems like now we have hit max ache and uncertainty within the crypto market,” Barry Silbert, the founding father of Digital Forex Group, wrote final week on Twitter, which serves as a public message board for the sector. “We’re shopping for BTC right here,” he tweeted, utilizing bitcoin’s image. “Let’s go!”

These may be comforting phrases for anybody making an attempt to make sense of the downturn, notably so for unsophisticated retail buyers. However the reality is it’s almost unattainable to name a backside. Anybody suggesting a flooring has fashioned is delivering advertising and marketing strains moderately than any actual evaluation.

This isn’t one thing particular to the crypto sector. Analysts and buyers have tried to name bottoms for shares for a lot of a long time. There may be a complete business of technical analysts, generally referred to “chartists,” who make fancy graphs that attempt to present when the market is about to show.

However for crypto the duty is so difficult that’s there’s arguably no level in making an attempt. The sector is so younger that there are hardly any established norms.

How the crypto crash uncovered the sector’s lies – and left retail buyers within the lurch

Celsius Community ‘will take time’ to revive transactions, as a number of U.S. states launch investigations into crypto agency amid business tailspin

Whereas the inventory market is susceptible to bouts of exuberance, there are no less than methods to measure its levels of insanity. The value-to-earnings ratio, or P/E, could also be too blunt of a device to make day-to-day buying and selling selections, however it’s invaluable for an information set that spans a long time. Over time now we have realized that shares valued at greater than 15 occasions their earnings may be thought of costly, and something buying and selling under that stage is reasonable – although some industries have their very own idiosyncrasies.

The psychological position such benchmarks play is usually undervalued, as a result of the behavioural-finance area, which helps to clarify why people make such irrational selections, remains to be in its infancy. However the analysis is compelling sufficient to know that these markers are essential when panic units in, as a result of they supply buyers with a map of kinds.

The crypto sector, in the meantime, has but to endure a full enterprise cycle. And whereas bitcoin was created in 2009, so it has technically been round for greater than a decade, it by no means actually went mainstream till the pandemic hit. Meaning the business exploded in reputation in an period rife with monetary anomalies – ultra-low rates of interest arguably being the obvious.

Till lately, it was defensible to attract some conclusions primarily based on bitcoin’s earlier buying and selling patterns, however any credibility for this argument disappeared when the speed hikes began. The crypto sector has by no means endured rising charges – and this cycle received’t be short-lived, so there is no such thing as a holding out hope for a fast price reversal within the close to future. U.S. Federal Reserve governors have been making it clear that killing inflation issues greater than anything on their agenda, even when which means beginning a recession.

Issue within the affect of leverage within the crypto sector, and calling a backside will get exponentially tougher. Final yr, Michael Saylor, one of the vital outlandish bitcoin lovers, famously instructed remortgaging your home to spend money on the cryptocurrency.

It isn’t simply that debt has been used to spend money on crypto property, which complicates issues now that borrowing prices are rising. There’s additionally virtually no visibility into the place the debt lies, or what has been pledged as collateral.

Some crypto lenders, resembling Celsius Community, have frozen property previously few weeks, and nonetheless nobody actually is aware of why. That uncertainty is troublesome. If bitcoin has been pledged as collateral way over was assumed, it may trigger the sector to spiral downward as a result of so many property shall be tied to one thing that has misplaced 70 per cent of its value in seven months.

After which there’s the looming menace of tighter regulation, which is a close to certainty. Retail buyers acquired caught up within the hype and suffered main losses, and which means extra enforcement, and extra guidelines, are coming as a result of their losses typically present the political capital wanted for a crackdown. Couple this with the truth that among the basic arguments for getting cryptocurrencies, resembling bitcoin serving as a hedge towards inflation, are getting debunked and it is extremely possible there shall be much less demand for crypto on the opposite aspect of this rout.

The crypto sector has lengthy prided itself on being considerably completely different from conventional markets, however there’s an outdated adage that applies to requires market bottoms: By no means catch a falling knife. It’s simply as apt for this nascent sector – and crypto’s knife is especially sharp.

Your time is efficacious. Have the High Enterprise Headlines publication conveniently delivered to your inbox within the morning or night. Join at the moment.

Crypto

Bitcoin notches record weekly close after highest-ever daily close candle

Bitcoin has notched its highest-ever weekly close as crypto market momentum continues and the cryptocurrency is again nearing its all-time high.

Bitcoin (BTC) has closed at a weekly gain for the past six weeks in a row, and its most recent close at midnight UTC on May 18 was its highest weekly close ever at just below $106,500, according to TradingView.

Its last highest weekly close was in December when it reached $104,400. It later went on to reach an all-time high of $109,358 on Jan. 20, according to TradingView.

Bitcoin is now less than 3% away from its peak price and has gained 2% over the past 24 hours to trade around $104,730 at the time of writing.

Bitcoin also posted its highest-ever close in a 24-hour period on May 18. However, this is not the largest daily gain Bitcoin has made.

“Bitcoin just had its highest daily candle close… ever,” investor Scott Melker posted to X on May 19.

With a daily close above $105,000, “Bitcoin will develop a brand new higher high,” said analyst Rekt Capital.

Bitcoin’s weekly gains over the past six weeks are mirroring its gains in November when it added $30,000 in three of its largest weekly candles ever.

It has added around $12,000 so far in May, climbing from $94,000 to over $106,000 before it pulled back to around $105,400.

Related: BTC price to $116K next? Bitcoin trader sees ‘early week’ all-time high

Additionally, Arete Capital partner “McKenna” said the Coinbase premium had returned, which measures US sentiment by comparing the difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT equivalent.

The “strength of this bid on a Sunday night feels strange,” they said, adding its “possible someone knows some important news dropping next week.”

Bitcoin’s CAGR cools down

On May 18, analyst Willy Woo dived into Bitcoin’s compound annual growth rate (CAGR), noting that it was trending downward as the network continues to store more capital.

“BTC is now traded as the newest macro asset in 150 years, it’ll continue to absorb capital until it reaches its equilibrium,” he said.

Woo compared it to long-term monetary expansion of 5% and GDP growth of 3%, estimating that Bitcoin’s annual growth rate will be around 8% in around 15 to 20 years when it has settled.

“Until then, enjoy the ride because almost no publicly investable product can match BTC performance long term, even as BTC’s CAGR continues to erode.”

Magazine: Arthur Hayes $1M Bitcoin tip, altcoins ‘powerful rally’ looms: Hodler’s Digest

New regulations threaten the security of the personal data of cryptocurrency users and may expose them to “physical danger,” the platform at the center of last week’s Paris kidnapping attempt has claimed.

“A ticking time bomb,” said Alexandre Stachtchenko, director of strategy at French platform Paymium, referring to the way information must now be collected during cryptocurrency transfers under EU rules.

He did not directly link this to a kidnapping attempt on Tuesday which, according to a police source, targeted the daughter and grandson of Paymium’s chief executive.

“If there is a leak of one of these databases from which I can find out who has money and where they live, then the next day it is on the dark web, and the day after there is someone outside your home,” Stachtchenko said. Data theft is commonplace. On Thursday, the leading cryptocurrency exchange in the United States, Coinbase, said criminals had bribed and duped their way into stealing digital assets from its users, then tried to blackmail the exchange to keep the crime quiet.

Instead of paying up, Coinbase informed US regulators about the theft and made plans to spend between $180 million and $400 million to reimburse victims and handle the situation.

Following the kidnapping attempt, Paymium issued a statement urging authorities to immediately reinforce the protection of companies within the sector, after other similar incidents this year.

Founded in 2011 and presenting itself as a European pioneer of bitcoin trading, Paymium also cited “the highly dangerous aspects of certain financial regulations, either recently adopted or in the making.”

It added, “With the unprecedented organization of massive and sometimes disproportionate collection of personal data, public authorities contribute to putting the physical safety of millions of cryptocurrency holders in France, and more widely in Europe, at risk.” In its sights are rules which came into force at the end of 2024 and which extended the Travel Rule in place for traditional finance transfers to include crypto assets.

The rules now require platforms to gather details about the beneficiary and, in return, transmit certain information about the customer to the receiving institution, including their name and postal address.

Also to be disclosed is the “address” of a customer’s cryptocurrency wallet, which shows details of their account and transactions, said Stachtchenko.

Such sensitive data is sometimes exchanged and stored insecurely by certain players.

Regulatory changes to tighten the rules on the crypto sector aim to “prevent the financial system from being used for corruption, money laundering, drug trafficking” among other criminal activities, said Sarah Compani, a lawyer specializing in digital assets.

Data collection is carried out by parties including banks, insurance companies and crypto-service providers, which are “supervised” and subject to heavy “security obligations, particularly IT and cybersecurity,” said William O’Rorke, a lawyer at cryptocurrency firm ORWL.

In 2027, European anti-money laundering regulations will restrict the use of wallets and cryptocurrencies that allow the holders to remain anonymous.

It follows a French law adopted last month to fight narcotrafficking, which targets anonymization devices such as the cryptocurrency “mixers” used to render funds untraceable.

There are many “legitimate interests” in having such tools however, said cybersecurity expert Renaud Lifchitz. He noted that they are sometimes used by journalists, or by activists opposed to an authoritarian regime which controls the traditional banking system.

The debate is more “political” than “security-related,” argued O’Rorke.

The recent kidnappings and attempted kidnappings can be explained above all by a “somewhat nouveau riche” and “ill-prepared” cryptocurrency sector, he said.

Since 2014, software developer Jameson Lopp has recorded 219 physical attacks targeting cryptocurrency users.

© 2025 AFP

Citation:

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

Cryptoeconomy enabler Coinbase Global (COIN) rallied 16% over the past five days to celebrate its public listing on the S&P 500 index, scheduled for next week.

Coinbase’s addition to the S&P 500 marks a historic milestone as the first cryptocurrency exchange included in the index, symbolizing a step toward mainstream acceptance of crypto. This move is expected to boost institutional interest and attract new capital, especially through passive funds that must buy S&P 500 components, effectively making Coinbase and, by extension, Bitcoin (BTC), a “must-own” investment.

However, while rosy developments are nice to see for existing shareholders, I remain neutral on the stock due to risks like potential overvaluation, declining earnings, revenue concentration, and increasing competition.

Bernstein analyst Gautam Chhugani, who holds a Buy rating on Coinbase, estimates that its inclusion in the S&P 500 could attract approximately $16 billion in passive and active fund inflows, potentially boosting the stock further. However, with Coinbase’s market capitalization already having surged by $10 billion, much of this anticipated inflow may be priced in. The focus now shifts to the company’s underlying fundamentals.

Coinbase earns revenue through transactions, subscriptions, and services, mostly coming from transaction fees such as spreads and retail trading fees. In its Q1 2025 earnings report published earlier this month, Coinbase saw a 10% decline in trading volume, leading to total revenue of $2 billion—a 10% drop quarter-over-quarter—and transaction revenue falling 19% quarter-over-quarter to $1.3 billion. The company attributed this decline to crypto market volatility and ongoing uncertainty. Ultimately, much of Coinbase’s performance remains closely linked to the health and activity of the cryptocurrency market.

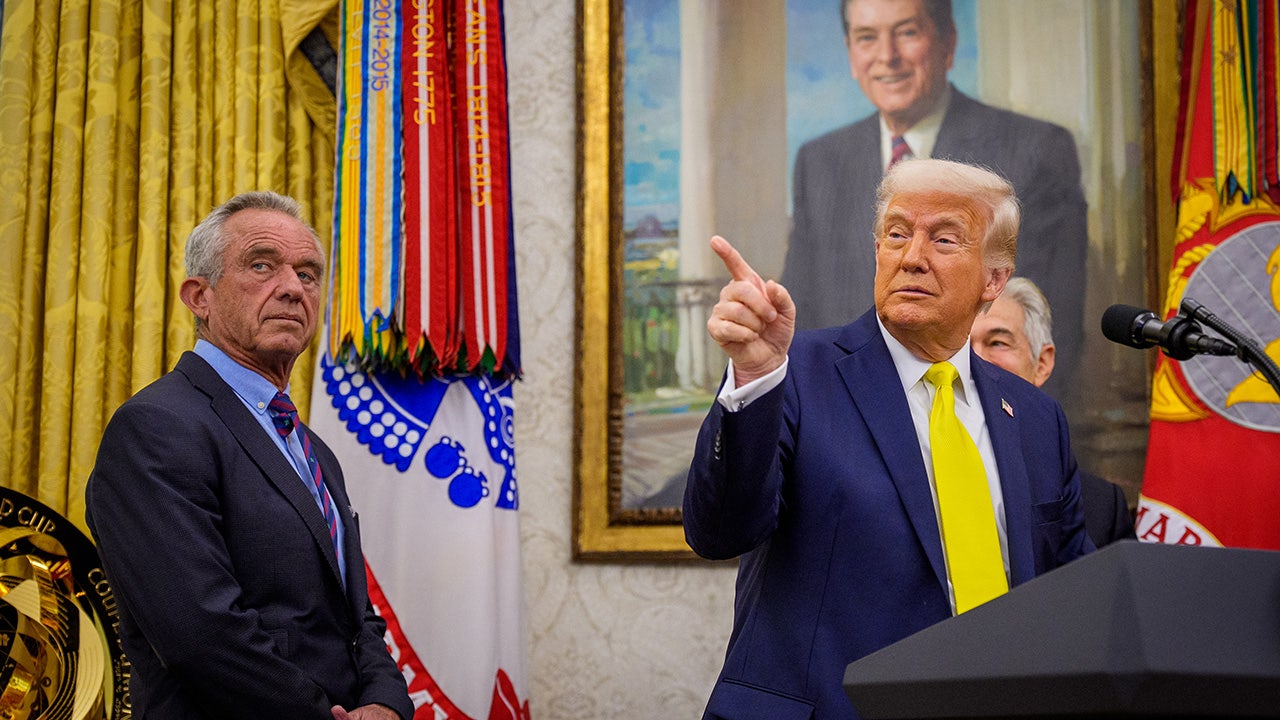

Widespread adoption of cryptocurrency will inevitably require government involvement. Crypto enthusiasts hoped President Donald Trump, a vocal supporter of cryptocurrencies, would help legitimize the space. However, meaningful legislation has yet to materialize, and Trump’s so-called “Strategic Bitcoin Reserve,” which doesn’t involve actual cryptocurrency purchases, fell short of expectations.

Best Austin Salads – 15 Food Places For Good Greens! President Trump takes on 'Big Pharma' by signing executive order to lower drug prices As Harvard Battles Trump, Its President Will Take a 25% Pay Cut In-N-Out Burger adds three new California locations to list of 2025 openings DHS says Massachusetts city council member 'incited chaos' as ICE arrested 'violent criminal alien' Why Trump Suddenly Declared Victory Over the Houthi Militia Mexico is suing Google over how it’s labeling the Gulf of Mexico Republicans say they're 'out of the loop' on Trump's $400M Qatari plane dealCrypto

Paris kidnap bid highlights crypto data security risks

Name and address

‘Nouveau riche’

Paris kidnap bid highlights crypto data security risks (2025, May 18)

retrieved 18 May 2025

from https://techxplore.com/news/2025-05-paris-kidnap-highlights-crypto.html

part may be reproduced without the written permission. The content is provided for information purposes only.

Crypto

Coinbase Global Stock (COIN) Prepares for S&P 500 Listing With 16% Spike