Cryptocurrency is usually purchased and bought on exchanges, the place folks can commerce it for different digital belongings or standard fiat cash.

There are dozens of crypto exchanges with excessive buying and selling quantity, and due to this fact, choosing the right one generally is a bit overwhelming, particularly for novices.

However, newbie or not, you wouldn’t need to transfer your hard-earned cash to an unreliable or unsafe platform. So, what are the most secure crypto exchanges? Let’s discover out beneath.

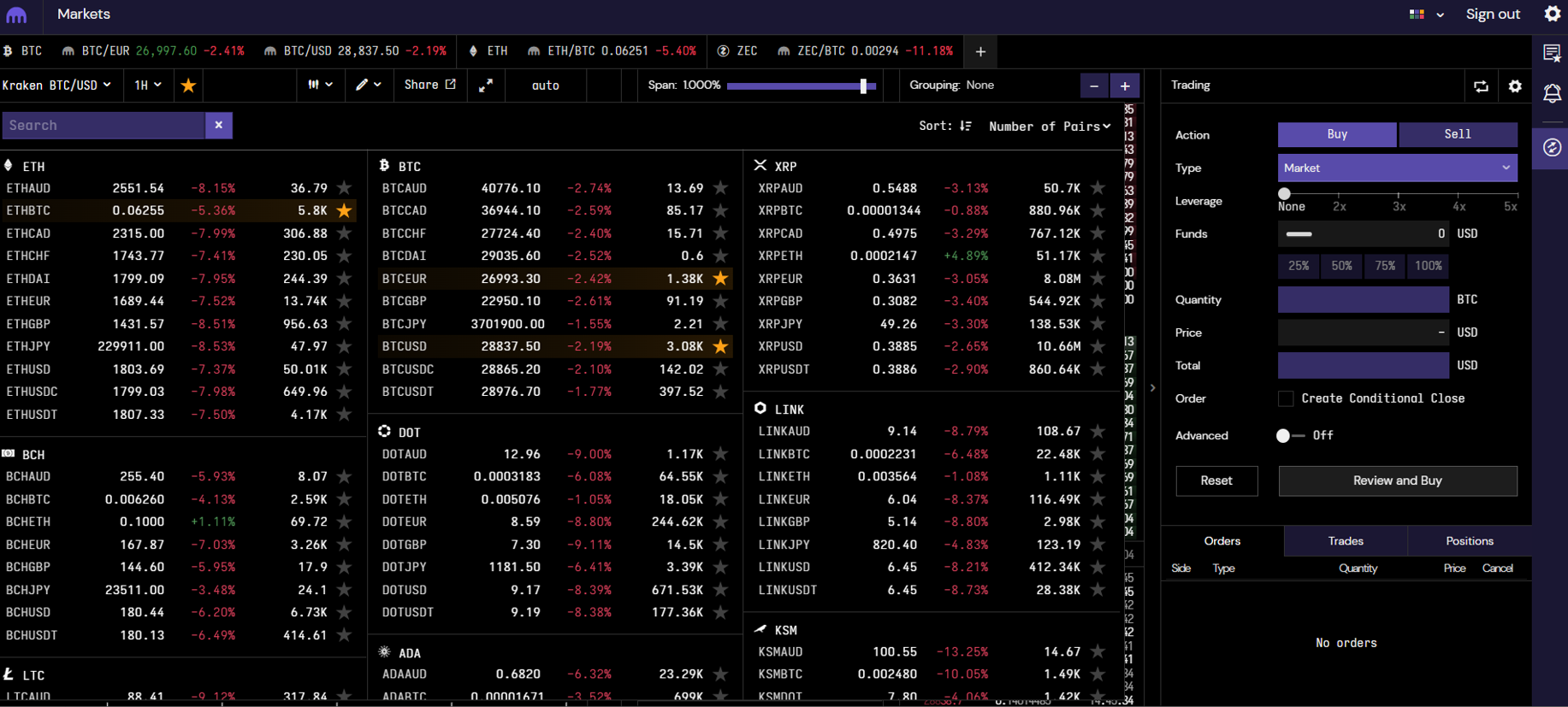

Launched in 2011, Kraken is one probably the most widely-available crypto buying and selling platforms on this planet, supporting all nations besides North Korea, Cuba, and Iran.

Regardless of the worldwide availability, Kraken has not compromised on the safety entrance to fulfill the demand. In reality, it is likely one of the most safe crypto exchanges on the market. Like all dependable exchanges, Kraken shops the overwhelming majority of consumer deposits offline. Its servers are surveilled by armed guards, whereas worker entry to them is strictly managed.

What’s extra, Kraken encrypts all delicate consumer info and has sturdy safety in opposition to cyberattacks in place. And when it comes to user-level security measures, it makes use of two-factor authentication, e mail confirmations for withdrawals, and so on.

Kraken is good for these not too snug with sharing their id: Solely the “Professional” verification degree requires leaping by way of verification hoops, so newbie and intermediate merchants can begin utilizing their accounts instantly.

Maybe extra importantly, Kraken has gone one step additional than most exchanges concerning security, launching Kraken Safety Labs, a crew of specialists tasked with bettering the platform’s cybersecurity profile.

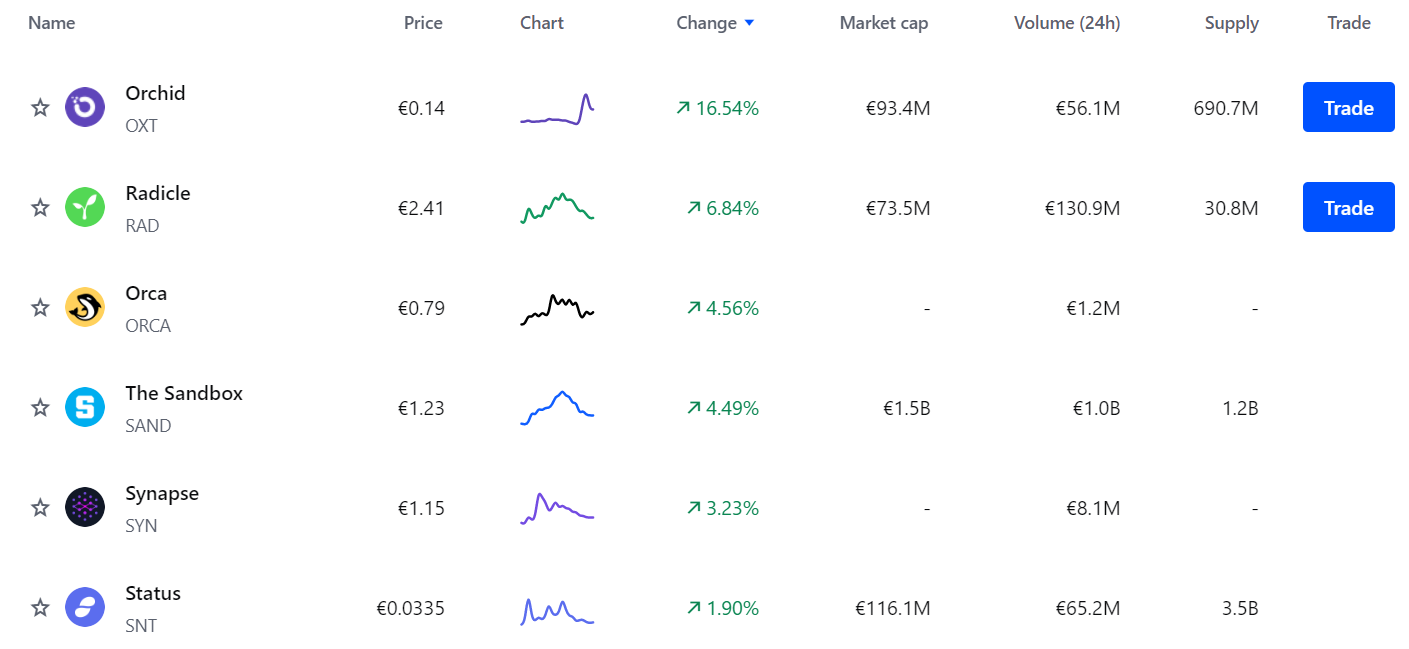

Based in 2014, Gemini has positioned itself in the marketplace as a security-focused cryptocurrency change, implementing varied inventive mechanisms to guard merchants’ funds.

For a begin, Gemini retains most of its crypto in chilly wallets or {hardware} wallets, which aren’t related to the web and are due to this fact not weak to hacking and breaches.

There aren’t any non-public keys at Gemini’s places of work. As a substitute, the keys are geographically distributed at safe information facilities—entry to which is restricted.

Moreover, Gemini is insured, so within the occasion of a breach—whether or not by an worker or an out of doors actor—your funds can be secure.

So, what are the downsides?

Gemini is regulated by the New York State Division of Monetary Providers, which suggests the change has to gather details about customers. This additionally implies that you have to present your full title, tackle, and proof of id when making a buying and selling account on the platform.

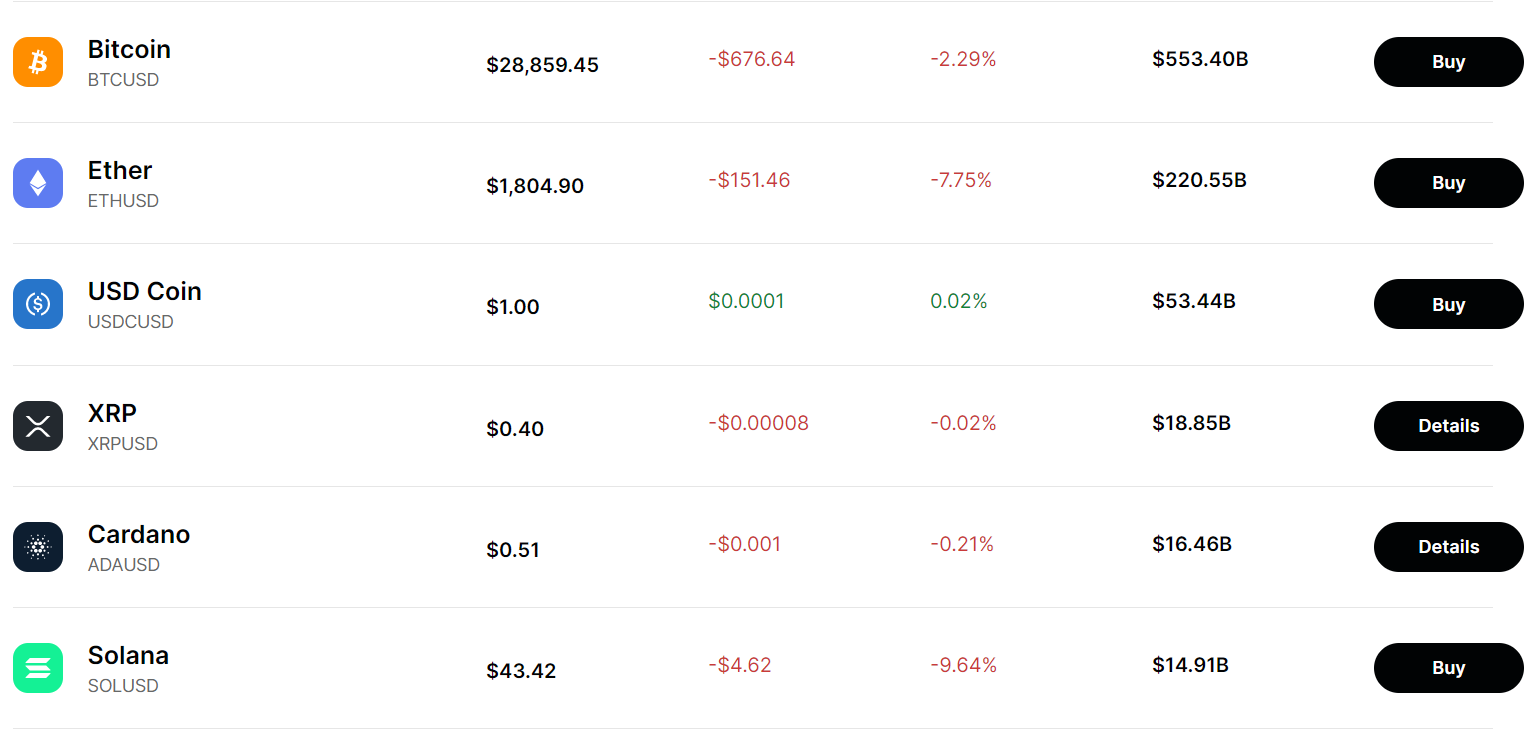

Coinbase has lengthy been a well-liked selection for skilled merchants in addition to novices, and it is one of many largest cryptocurrency exchanges by buying and selling quantity.

Like Gemini, Coinbase shops most of its crypto offline in a chilly pockets. Moreover, the corporate claims that 98 p.c of the deposits are saved in guarded amenities.

All digital belongings on Coinbase are insured in opposition to cybersecurity breaches and theft, although the insurance coverage doesn’t cowl any losses ensuing from consumer error.

Coinbase accounts have multi-factor authentication enabled, which provides one other layer of safety and helps forestall breaches and phishing assaults.

Coinbase helps buying and selling over 100 cryptocurrencies, however charges are comparatively excessive in comparison with different exchanges. Moreover, identical to Gemini, Coinbase just isn’t precisely an nameless platform, and you will have to confirm your id to have the ability to commerce on it.

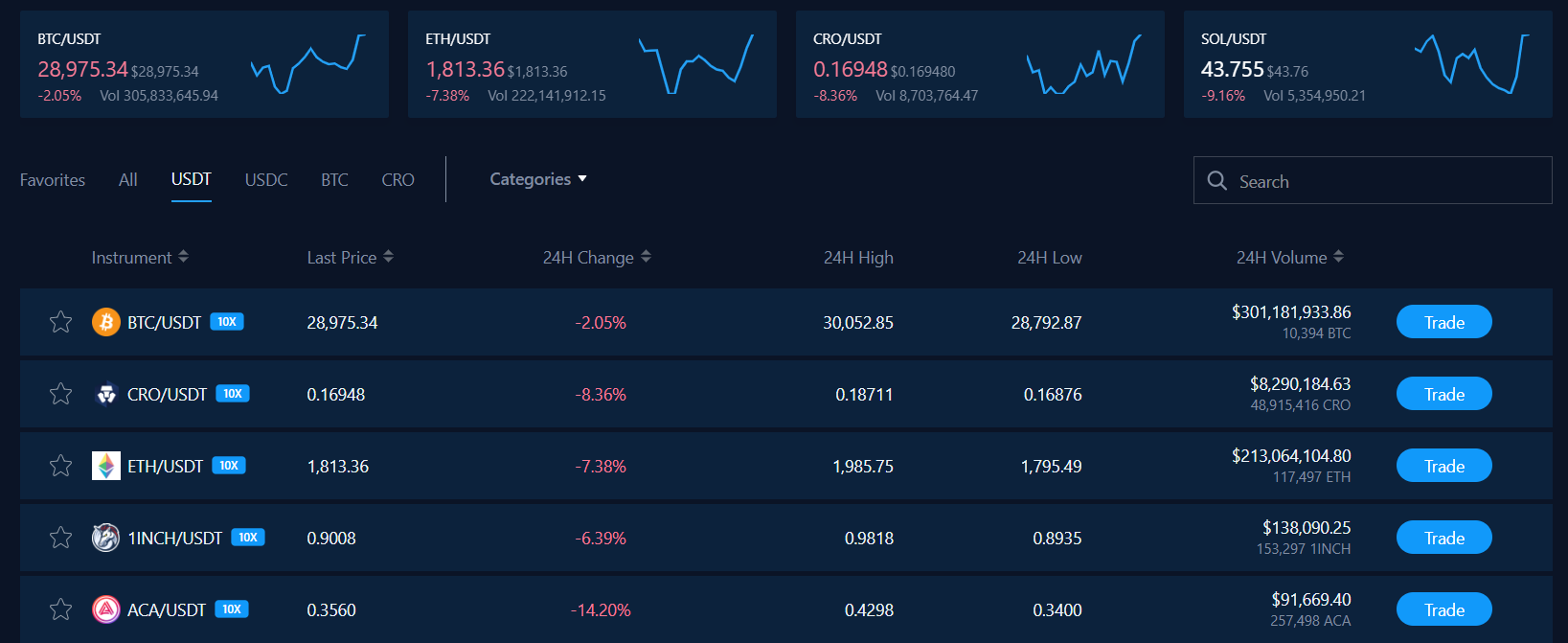

Primarily based in Singapore, Crypto.com has expanded in recent times, amassing thousands and thousands of latest customers and having stars comparable to Matt Damon seem in its commercials. However what’s its security profile like?

Crypto.com shops one hundred pc of consumer cryptocurrencies offline, whereas its {hardware} storage is insured by $750 million in opposition to theft and bodily injury.

Multi-factor authentication and withdrawal safety are in place to guard consumer funds. The previous contains biometric and e mail verification, so you may have a number of choices for authentication.

Crypto.com really needed to show its dedication to securing consumer funds in January 2022, when it suffered a breach with hackers stealing round $30 million of cryptocurrency.

As Forbes reported on the time, the corporate was capable of cease most unauthorized withdrawals and absolutely reimbursed affected clients in the long run. It has since launched further security options.

A brand new participant on the crypto scene, Binance was launched in 2017 by Chinese language-Canadian businessman and investor Changpeng Zhao. Since then, it has grown quickly and is now the biggest crypto change on this planet by buying and selling quantity.

Binance is greater than first rate with regards to safety as effectively. The platform retains most consumer funds and belongings in chilly storage. Moreover, all withdrawals and password reset makes an attempt are monitored, whereas any uncommon exercise leads to withdrawals being suspended for as much as 48 hours.

Delicate consumer information is encrypted, and there are a number of strict sign-in protocols in place, together with two-factor authentication, safety notifications, and SMS and e mail verification.

On the draw back, the verification course of is pretty complicated, and the platform itself just isn’t too beginner-friendly, with the US model being extra restricted than others.

Binance suffered a minor safety breach in 2019, with roughly $40 million value of cryptocurrency stolen from the platform (the each day buying and selling quantity on Binance is usually within the tens of billions). Fortuitously, the corporate dealt with the breach effectively, instantly providing a full refund to affected customers, as per Asia Instances.

What Is the Most Safe Crypto Change?

Gemini, Coinbase, Crypto.com, Kraken, and Binance are all comparatively safe platforms, and so long as you comply with primary safety protocols, your funds must be secure on both of them, however none of them are good.

Furthermore, the cryptocurrency business continues to be in its infancy, so fraud and safety breaches are extra prevalent than one would really like them to be. The digital belongings market is notoriously unstable, and privateness options inherent to most cryptocurrencies have attracted all types of criminals.

However no matter which crypto change you select, arguably the very best factor you are able to do to safe your funds and belongings is to withdraw them to your individual pockets. Holding most of your funds on an change or in a digital pockets is, in some methods, asking for hassle.

Learn Subsequent

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)