Crypto

Scams and Cryptocurrency Can Go Hand in Hand

When one among our college students informed us they had been going to drop out of faculty in August 2021, it wasn’t the primary time we’d heard of somebody ending their research prematurely.

What was new, although, was the rationale. The scholar had turn out to be a sufferer of a cryptocurrency rip-off and had misplaced all their cash—together with a financial institution mortgage—leaving them not simply broke, however in debt. The expertise was financially and psychologically traumatic, to say the least.

This pupil, sadly, just isn’t alone. At the moment there are tons of of thousands and thousands of cryptocurrency homeowners, with estimates predicting additional speedy development. Because the variety of individuals proudly owning cryptocurrencies has elevated, so has the variety of rip-off victims.

We research behavioral economics and psychology—and not too long ago printed a e book in regards to the rising downside of fraud, scams, and monetary abuse. There are explanation why cryptocurrency scams are so prevalent. And there are steps you possibly can take to cut back your probabilities of turning into a sufferer.

Crypto takes off

Scams are usually not a latest phenomenon, with tales about them relationship again to biblical occasions. What has basically modified is the convenience by which scammers can attain thousands and thousands, if not billions, of people with a press of a button. The web and different applied sciences have merely modified the principles of the sport, with cryptocurrencies coming to epitomize the forefront of those new cybercrime alternatives.

Cryptocurrencies—that are decentralized, digital currencies that use cryptography to create nameless transactions—had been initially pushed by “cypherpunks,” people involved with privateness. However they’ve expanded to seize the minds and pockets of on a regular basis individuals and criminals alike, particularly through the COVID-19 pandemic, when the worth of varied cryptocurrencies shot up and cryptocurrencies turned extra mainstream. Scammers capitalized on their reputation. The pandemic additionally brought about a disruption to mainstream enterprise, resulting in higher reliance on options resembling cryptocurrencies.

A January 2022 report by Chainanalysis, a blockchain knowledge platform, suggests in 2021 near US$14 billion was scammed from traders utilizing cryptocurrencies.

For instance, in 2021, two brothers from South Africa managed to defraud traders of $3.6 billion from a cryptocurrency funding platform. In February 2022, the FBI introduced it had arrested a pair who used a faux cryptocurrency platform to defraud traders of one other $3.6 billion.

You may marvel how they did it.

Pretend investments

There are two important forms of cryptocurrency scams that have a tendency to focus on completely different populations.

One targets cryptocurrency traders, who are usually energetic merchants holding dangerous portfolios. They’re principally youthful traders, below 35, who earn excessive incomes, are nicely educated, and work in engineering, finance, or IT. In most of these frauds, scammers create faux cash or faux exchanges.

A latest instance is SQUID, a cryptocurrency coin named after the TV drama Squid Recreation. After the brand new coin skyrocketed in value, its creators merely disappeared with the cash.

A variation on this rip-off includes attractive traders to be among the many first to buy a brand new cryptocurrency—a course of known as an preliminary coin providing—with guarantees of huge and quick returns. However not like the SQUID providing, no cash are ever issued, and would-be traders are left empty-handed. In actual fact, many preliminary coin choices turn into faux, however due to the complicated and evolving nature of those new cash and applied sciences, even educated, skilled traders will be fooled.

As with all dangerous monetary ventures, anybody contemplating shopping for cryptocurrency ought to observe the age-old recommendation to totally analysis the supply. Who’s behind the providing? What is understood in regards to the firm? Is a white paper, an informational doc issued by an organization outlining the options of its product, out there?

Within the SQUID case, one warning signal was that traders who had purchased the cash had been unable to promote them. The SQUID web site was additionally riddled with grammatical errors, which is typical of many scams.

Shakedown funds

The second fundamental kind of cryptocurrency rip-off merely makes use of cryptocurrency because the fee technique to switch funds from victims to scammers. All ages and demographics will be targets. These embrace ransomware circumstances, romance scams, pc restore scams, sextortion circumstances, Ponzi schemes, and the like. Scammers are merely capitalizing on the nameless nature of cryptocurrencies to cover their identities and evade penalties.

Within the latest previous, scammers would request wire transfers or present playing cards to obtain cash—as they’re irreversible, nameless, and untraceable. Nonetheless, such fee strategies do require potential victims to depart their properties, the place they could encounter a 3rd occasion who can intervene and probably cease them. Crypto, then again, will be bought from wherever at any time.

Certainly, Bitcoin has turn out to be the most typical foreign money requested in ransomware circumstances, being demanded in near 98% of circumstances. In response to the U.Okay. Nationwide Cyber Safety Heart, sextortion scams typically request people to pay in Bitcoin and different cryptocurrencies. Romance scams concentrating on youthful adults are more and more utilizing cryptocurrency as a part of the rip-off.

If somebody is asking you to switch cash to them by way of cryptocurrency, it is best to see an enormous crimson flag.

The Wild West

Within the subject of monetary exploitation, extra work has been achieved to check and educate aged rip-off victims, due to the excessive ranges of vulnerability on this group. Analysis has recognized frequent traits that make somebody particularly weak to rip-off solicitations. They embrace variations in cognitive means, training, risk-taking, and self-control.

After all, youthful adults can be weak and certainly have gotten victims, too. There’s a clear have to broaden training campaigns to incorporate all age teams, together with younger, educated, well-off traders. We consider authorities have to step up and make use of new strategies of safety. For instance, the rules that at present apply to monetary recommendation and merchandise may very well be prolonged to the cryptocurrency atmosphere. Information scientists additionally want to higher monitor and hint fraudulent actions.

Cryptocurrency scams are particularly painful as a result of the chance of retrieving misplaced funds is near zero. For now, cryptocurrencies haven’t any oversight. They’re merely the Wild West of the monetary world.

Crypto

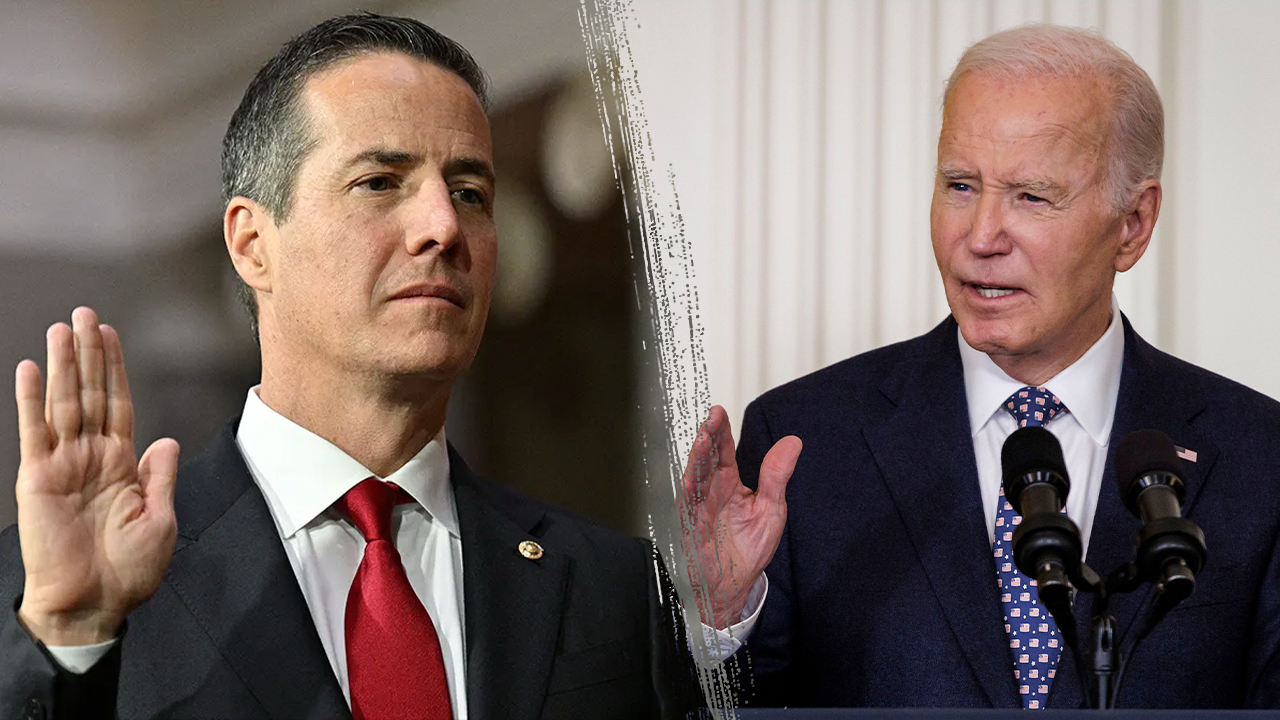

US Rep. Bryan Steil to chair House cryptocurrency subcommittee

A Wisconsin congressman will head the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence.

Bryan Steil, a Republican representing the 1st Congressional District in southeast Wisconsin, was appointed to the role Thursday.

His subcommittee’s jurisdiction includes things like mobile banking and non-fungible tokens, or NFTs. It’ll also be the first stop for legislation on cryptocurrency.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

Digital currencies have a murky federal regulatory status. That allowed President Joe Biden’s Securities and Exchange Commission Chair Gary Gensler to go after the crypto industry.

The industry responded by spending over $130 million in 2024’s election cycle through its PAC, Fairshake.

It spent $764,206 to independently help re-elect Steil, according to campaign finance database OpenSecrets.

In a statement, Steil said “technologies like financial apps, digital assets, and machine learning revolutionize our economy,” adding that he looks forward to continuing “to provide the rules of the road to move our economy into the future.”

Steil was appointed to his new role by House Financial Services Chair French Hill, R-Arkansas. Hill’s top campaign contributors include the CEOs of the crypto exchange platform Coinbase and the Charles Schwab Corporation.

One of his legislative priorities has been a bill that would set up clearer, crypto-friendly federal financial regulations, which passed the House with bipartisan support in May. He called Steil “instrumental” in passing that bill, and in overturning an SEC rule requiring crypto exchanges to list their digital assets as liabilities on their balance sheets.

Now, the Janesville native will oversee hearings and votes on new crypto-related legislation.

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.

Crypto

Which Crypto To Buy Right Now? 10 Best Cryptocurrency Coins For 2025

As Ripple’s XRP ongoing legal troubles continue to keep traders on edge, Polkadot (DOT), Ethereum (ETH), Ethena (ENA), and Cardano (ADA) remain steady. Meanwhile, Injective (INJ), Optimism (OP), Uniswap (UNI), and Tron (TRX) show mixed signals in trading activities. In the middle of all this, whispers of a new market disruptor are growing louder—JetBolt (JBOLT), making headlines with its blazing presale and zero-gas technology. With over 250 million JBOLT tokens already sold, JetBolt’s momentum is undeniable.

With everything from groundbreaking ecosystems to cross-chain powerhouses, the question remains: which crypto to buy right now? Would established crypto coins or rising blockchain superstars dominate 2025? Let’s explore why JetBolt, Polkadot, XRP, Ethereum, Ethena, Optimism, Injective, Uniswap, Cardano, and Tron are the 10 best cryptocurrency coins for 2025.

Which Crypto To Buy Right Now? A Quick List

- JetBolt (JBOLT): Surging new altcoin empowering gas-free transactions, AI intelligence and staking.

- Ethena (ENA): Redefining stablecoins with decentralized innovation.

- Optimism (OP): Scaling Ethereum with lightning-fast rollups.

- Injective (INJ): Unlocking limitless decentralized trading possibilities.

- Uniswap (UNI): Revolutionizing DeFi through seamless token swaps.

A Deep Dive Into the 10 Best Cryptocurrency Coins For 2025

- JetBolt (JBOLT)

JetBolt (JBOLT) is shaking up the crypto world, skyrocketing its way onto traders’ radar as one of the 10 best cryptocurrency coins for 2025 to buy right now. The buzz? Zero gas fees. JetBolt’s game-changing tech, built on the Skale Network, eliminates gas fees entirely, delivering lightning-fast, gas-free transactions that are already turning heads across the crypto space.

This revolutionary feature could also supercharge creativity. Developers can now launch and create dApps, SocialFi platforms, and blockchain gaming ventures without worrying about skyrocketing gas fees holding back innovation.

But that’s not all—JetBolt goes beyond just being another zero-gas token. With an AI-driven crypto tool delivering the latest crypto news and market data straight to its platform, JetBolt is showcasing how blockchain technology and artificial intelligence can go hand-in-hand to add a new functionality to crypto.

Turning it up a notch, JetBolt’s easy-to-earn staking mechanism turns ordinary staking into an electrifying experience. With its sleek, user-friendly Web3 wallet, joining is as effortless as a few clicks. And the twist: staking isn’t just about locking in tokens—it’s about active participation. Engage within the ecosystem and stakers earn even more rewards.

Meanwhile, JetBolt’s presale numbers don’t lie. Over 250 million JBOLT tokens have already been scooped up, with whales diving in to secure their piece of this zero-gas action. In addition, JetBolt’s Alpha Boxes, an exclusive presale perk that boosts batch token purchases by up to 25%, have been flying off the shelves, creating a frenzy that shows no signs of slowing down.

In a world where high gas fees and slow transactions plague most blockchains, JetBolt delivers something truly revolutionary. With every cutting-edge feature thoughtfully designed to resonate with modern and future crypto users, JetBolt quietly sets the bar higher for what blockchain networks can deliver—blending innovation and ease of use into a whole new crypto experience.

- Polkadot (DOT)

Polkadot (DOT) has dropped over 5% in the past week to $6.71 amid $1.23 million in long liquidations. Despite the dip, its advanced parachain technology and expanding ecosystem position Polkadot as a key player in 2025’s multichain future, with crypto analysts targeting $20 soon.

- Ripple (XRP)

Ripple’s (XRP) price holds at $2.34 with a $134.48 billion market cap. Crypto analysts anticipate a $3 breakout, driven by Ripple’s renewed U.S. expansion amid regulatory optimism under Trump. Its focus on blockchain-based CBDC solutions positions XRP as a key player for 2025.

- Ethereum (ETH)

Ethereum (ETH) trades at $3,319.97 following a 10% drop after the Foundation’s 100 ETH sale. Key support stands at $3,061, with resistance at $3,500. Despite short-term bearish momentum, Ethereum’s dominance in DeFi, staking, and upcoming Danksharding upgrade makes it a top contender for 2025.

- Ethena (ENA)

Ethena (ENA) faces bearish momentum, trading at $0.9295 with a $2.81 billion market cap. The Death Cross and oversold RSI signal risks, though possible rebounds could push Ethena toward $1.01.

Meanwhile, Trump’s World Liberty Financial putting in millions in Ethena has fueled bullish sentiment, signaling growing institutional interest. This strategic move could boost ENA’s credibility and adoption, providing holders possible stability and long-term value.

X posts by Panos highlight Trump’s World Liberty Financial purchasing millions of dollars in Ethena (ENA)

In addition, its unique stablecoin protocol expansion strengthens Ethena’s DeFi appeal, further establishing it as one of the top picks for 2025.

- Optimism (OP)

Optimism (OP) trades at $1.79 with a $2.41 billion market cap. Despite recent bearish sentiment, its Bedrock upgrade, reducing transaction costs by 40%, positions Optimism as a key Ethereum Layer 2 solution. Crypto analysts eye $2.20 resistance and possible $3.00 targets for OP.

- Injective (INJ)

Injective (INJ) is now priced at $21.18 with key support at $22 and resistance near $26. A breakout from its descending channel hints at possible bullish trajectories. Injective’s unique focus on decentralized derivatives trading and cross-chain liquidity positions it among 2025’s top cryptocurrencies.

- Uniswap (UNI)

Uniswap (UNI) struggles with a 0.33% daily dip, trading at $12.99 with a $7.8 billion market cap. Despite bearish trends, its innovative decentralized exchange model and Layer 2 scaling solutions could drive renewed interest, positioning UNI as a top 2025 contender.

- Cardano (ADA)

Cardano (ADA) now trades at $0.9286 with a $32.67 billion market cap. Crypto analysts predict a price range of $1.50 to $2.50 in 2025, depending on key support levels and market sentiment. Cardano’s Hydra upgrade pledges scalability, boosting adoption across decentralized applications.

- Tron (TRX)

Tron (TRX) is holding just a little above key support at $0.245, currently pinned at $0.2463. A possible breakout above $0.2700 could push TRX’s prices toward $0.40. Recent partnerships and its ISO 20022 integration further position Tron as a top blockchain for institutional adoption.

What is the best crypto to buy right now in 2025?

While nothing in crypto is ever guaranteed, JetBolt (JBOLT) stands out as one of the top choices for the best cryptocurrency coins to buy right now. With its zero-gas technology, crypto-earning staking model, and AI-powered functionality, JetBolt is leading the way in redefining user-friendly blockchain experiences. JetBolt’s ongoing presale success—with whales already snapping up over 250 million JBOLT tokens—also signals growing excitement around its ecosystem.

What are the 10 best cryptocurrency coins for 2025?

Based on recent price movements and market insights, here are the top 10 best cryptocurrency coins for 2025:

- Ethereum (ETH)

- Cardano (ADA)

- JetBolt (JBOLT)

- Tron (TRX)

- Polkadot (DOT)

- Ripple (XRP)

- Uniswap (UNI)

- Injective (INJ)

- Optimism (OP)

- Ethena (ENA)

This list of the best cryptocurrencies to buy right now for 2025 include coins with strong ecosystems, utility, and continued development.

In Summary: 10 Best Cryptocurrency Coins to Watch for 2025

Major crypto names like Ethereum (ETH), Ripple’s XRP, Cardano (ADA), and Polkadot (DOT) remain dominant, but breaking news highlights JetBolt’s (JBOLT) presale success and groundbreaking innovations as whale activity surges. Meanwhile, Ethena (ENA), Optimism (OP), Injective (INJ), Uniswap (UNI), and Tron (TRX) also make the list with key developments and strong ecosystems driving interest. Whether through staking rewards, blockchain scalability, or decentralized applications, these cryptocurrency coins deliver unique propositions worth following closely in the coming months.

Explore JetBolt’s game-changing technology and seize the presale excitement by visiting:

JetBolt’s Official Website: https://jetbolt.io/

JetBolt on X: https://x.com/jetboltofficial

Please note that this write-up is not financial advice. Remember that all cryptocurrencies are volatile. Always do your research and consult experts before navigating the unpredictable world of digital assets. No future performance is ever guaranteed, so always exercise caution.

Crypto

U.S. Senate to Launch Cryptocurrency Subcommittee, Lummis Tapped as Chair

The U.S. Senate Banking Committee, under the leadership of Senator Tim Scott (R-S.C.), is poised to establish a dedicated cryptocurrency subcommittee to advance discussions on digital asset regulation and industry oversight, according to a report by Fox News.

The formation of this subcommittee, modeled after a similar House panel created in 2023, marks a pivotal step toward a more structured approach to crypto legislation at the federal level.

A Senate aide told Fox News that Wyoming Senator Cynthia Lummis, a staunch advocate for cryptocurrency, is the tentative choice to chair this groundbreaking panel. The selection of Lummis, pending a committee vote next Thursday, signals a shift in the Senate’s approach to digital assets. Alongside her nomination, the subcommittee members, representing both Republican and Democratic sides, will also be finalized through the same voting process.

Lummis, known for her vocal support of Bitcoin, has described the asset as “freedom money” and has advocated for its potential to hedge against inflation and enhance financial independence.

She previously proposed a plan for the US to acquire a significant stake in the total Bitcoin supply through a 1-million-unit purchase program over a set period. “Establishing a strategic Bitcoin reserve to bolster the U.S. dollar with a digital hard asset will secure our nation’s standing as the global financial leader for decades to come,” Lummis said at the time.

Her leadership could steer the subcommittee toward developing a more balanced regulatory framework, fostering innovation while ensuring market integrity.

Senator Tim Scott first hinted at the possibility of forming a crypto-focused subcommittee during the Wyoming Blockchain Symposium last August. “Wouldn’t it be kind of cool if we had a subcommittee on the Banking Committee… so that we bring more light to the conversation, more hearings on the industry, so that we get things done faster?” Scott remarked, highlighting his vision for streamlined legislative action.

This move comes as Scott replaces outgoing Chair Senator Sherrod Brown (D-Ohio), who maintained a more critical stance on cryptocurrency. Brown frequently called for stricter oversight, citing concerns about crypto’s role in enabling illicit activities and circumventing sanctions. The change in leadership, coupled with the creation of a dedicated subcommittee, could lead to a friendlier regulatory environment for digital assets under the new administration.

Notably, the subcommittee will include other crypto-friendly lawmakers such as Senator Bill Hagerty (R-Tenn.) and newly elected Senator Bernie Moreno (R-Ohio), both vocal supporters of blockchain technology and cryptocurrency. Moreno, who defeated Brown in the November elections, has vowed to champion crypto-friendly policies in the Senate.

Crypto Regulators Depart Amid Policy Shifts With the departures of key figures, the regulatory landscape for digital assets faces its most dramatic upheaval in years, just as a pro-crypto administration prepares to take office.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics6 days ago

Politics6 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health5 days ago

Health5 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades