Crypto

SBF sought ‘justifications’ for missing funds, ex-FTX lawyer testifies: ‘I was shocked’

Cryptocurrency exchange FTX’s former top lawyer testified on Thursday that its founder Sam Bankman-Fried asked him to come up with “legal justifications” for why it was missing $7 billion in customer funds four days before the company declared bankruptcy.

Can Sun, FTX’s former general counsel, testified at Bankman-Fried’s fraud trial that the company on Nov. 7, 2022, asked investment fund Apollo for emergency capital to cover a wave of customer withdrawals.

After Apollo requested FTX’s financial statements, Sun testified, either Bankman-Fried or another executive sent him a spreadsheet indicating the cryptocurrency exchange was billions of dollars short of being able to satisfy customer withdrawals and that it also was owed billions of dollars by Bankman-Fried’s crypto-focused hedge fund Alameda Research.

“I was shocked,” said Sun, who testified under a non-prosecution agreement in the third week of the trial in Manhattan federal court.

Sun told jurors that after FTX shared the spreadsheet with Apollo, Bankman-Fried pulled him aside at the Bahamas luxury apartment complex where the 31-year-old former billionaire lived and told him Apollo had asked for a legal justification for the missing funds.

“He asked me to come up with legal justifications,” Sun testified. “It basically confirmed my suspicion that had been rising all day that FTX did not have the funds to satisfy customer withdrawals, and that they had been misappropriated by Alameda.”

Sun said he told Bankman-Fried later that day that he could not identify any legal justifications. FTX declared bankruptcy on Nov. 11, 2022, leaving customers with billions of dollars of losses.

Apollo on Thursday declined to comment.

Sun’s testimony could complicate Bankman-Fried’s defense that he had a good-faith belief that Alameda’s use of FTX customer funds was appropriate.

Bankman-Fried stands accused of looting billions of dollars in FTX customer funds to make investments, donate to US political campaigns and prop up Alameda. Bankman-Fried has pleaded not guilty to two counts of fraud and five counts of conspiracy. He could spend decades in prison if convicted.

Prosecutors have said Bankman-Fried funneled FTX customer funds to Alameda. The hedge fund then lent $2.2 billion to Bankman-Fried and other executives, according to a document shown at trial on Thursday. The executives used those loans to make venture investments, buy real estate and donate to political campaigns, according to prosecutors.

Sun also testified that Bankman-Fried told him that the company had kept its customer funds safe and separate from its own assets, and that he never approved the lending of FTX customer funds to Alameda. Sun said he was involved in “documenting” loans from Alameda to Bankman-Fried and the other executives, but he did not know they came from customer funds.

Sun said that after learning of the shortfall he questioned Bankman-Fried and former FTX engineering chief Nishad Singh about it, but did not receive straight answers. Sun said Bankman-Fried was “typing away on his computer” during the meeting, while Singh appeared pale.

“It looked like his soul had been plucked away from him,” Sun said of Singh, who pleaded guilty to fraud and testified against Bankman-Fried on Monday and Tuesday.

Singh testified that Bankman-Fried kept up profligate political spending and venture investing for months after it became clear FTX was short billions of dollars.

Singh said he had been suicidal around the time of FTX’s collapse.

In cross-examination, Bankman-Fried’s lawyer Mark Cohen asked Sun about a section of FTX’s terms of service stating that some users’ funds could be “clawed back” to cover other users’ losses.

Cohen also pressed Sun on his decision not to quit in the summer of 2022, when he learned that Alameda was exempt from a procedure that automatically liquidated FTX customers’ positions if their trades were losing money.

Sun said he did not know that exemption was what enabled Alameda to withdraw billions of dollars from FTX until Singh told him on the night of Nov. 7.

The trial is due to resume on Oct. 26, when the prosecution is expected to rest its case.

Crypto

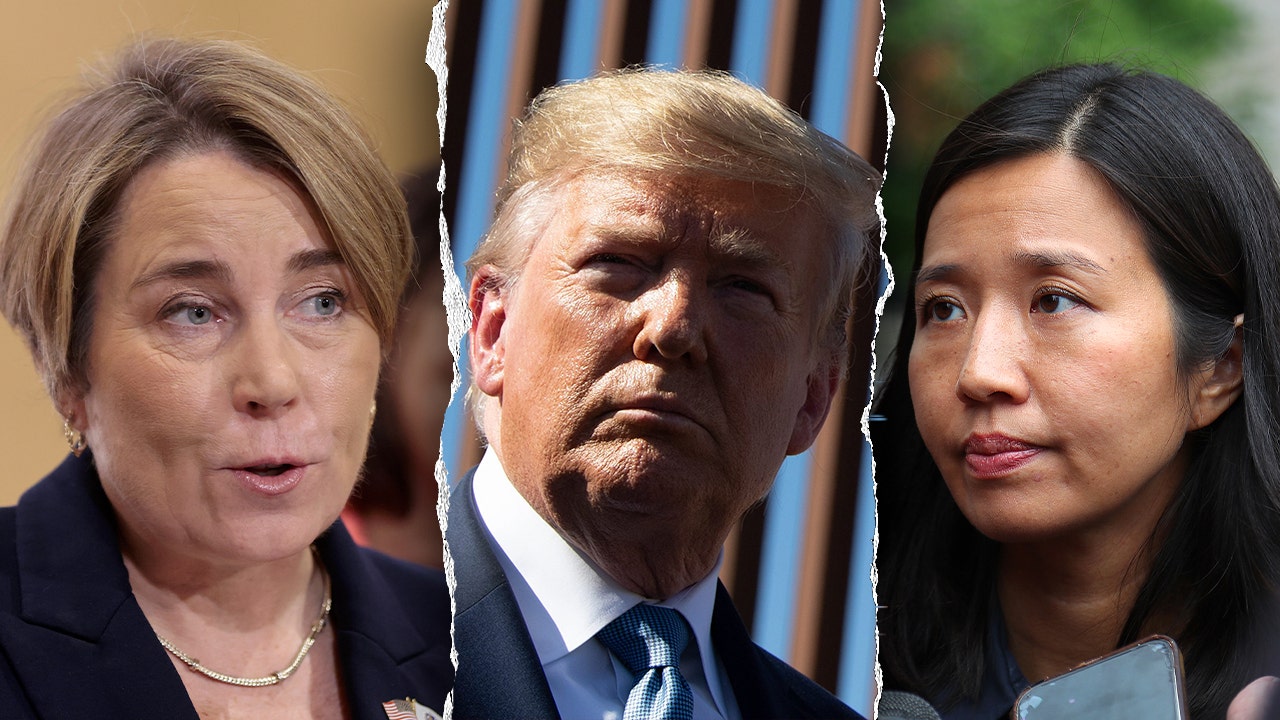

Bitcoin nears $100,000 as investors bet on crypto-friendly Trump policies

World’s popular digital currency rises as high as $99,073 on expectations Trump will ease legal and regulatory hurdles.

Bitcoin is nearing the $100,000 mark as crypto enthusiasts bet that United States President-elect Donald Trump will usher in a more welcoming regulatory environment for digital assets.

The world’s most popular digital currency rose as high as $99,073 on Thursday, extending its surge since Trump’s re-election on November 5.

The commodity has risen more than 60 percent since election day as investors anticipate Trump’s incoming administration to ease regulatory and legal hurdles to its use.

Trump, who called the asset a “scam” during his first term, accepted campaign donations in cryptocurrency, and has pledged to make the US “the crypto capital of the planet” and accumulate a national bitcoin reserve.

Trump and his three sons in September also announced the launch of their own crypto business, World Liberty Financial, which investors have taken as a promising sign of the president-elect’s belief in the sector.

In another bullish signal for the sector on Thursday, United States Securities and Exchange Commission (SEC) chair, Gary Gensler, who was widely disliked among crypto investors for his aggressive enforcement actions targeting the sector, confirmed that he would step down in January.

Trump had pledged to fire Gensler on “day one” of his administration, though the president does not have the authority to remove the SEC chair before the end of his or her term.

While viewed by supporters as a ticket to big returns and financial freedom, Bitcoin and other cryptocurrencies are known for their volatility and have faced government crackdowns in several parts of the world.

After climbing to a record high of $69,000 in late 2021, Bitcoin plunged to less than $16,000 over the following year.

The commodity burst past its previous peak in March after gaining more than 300 percent since November 2022.

Crypto

Shemaroo Entertainment and PWR Chain Announce Strategic Partnership to Revolutionize India’s Digital Entertainment through Blockchain Innovation – Press release Bitcoin News

Crypto

WisdomTree launches ETP focused on XRP cryptocurrency

WisdomTree has launched a new cryptocurrency exchange-traded product (ETP), the US asset manager announced today, with a focus on the XRP digital currency.

The new WisdomTree Physical XRP (XRPW), joins the firm’s $1.1bn lineup of physically backed cryptocurrency products, designed to provide European investors with a straightforward, regulated means of investing in digital assets without direct ownership.

The XRP asset, native to the XRP Ledger (XRPL), has carved out a unique role for itself in the digital currency landscape, as a blockchain optimised for cross-border payments and high-speed transactions.

-

Business1 week ago

Column: OpenAI just scored a huge victory in a copyright case … or did it?

-

Health1 week ago

Health1 week agoBird flu leaves teen in critical condition after country's first reported case

-

Business5 days ago

Business5 days agoColumn: Molly White's message for journalists going freelance — be ready for the pitfalls

-

World1 week ago

Sarah Palin, NY Times Have Explored Settlement, as Judge Sets Defamation Retrial

-

Politics4 days ago

Politics4 days agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

Science2 days ago

Science2 days agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology4 days ago

Technology4 days agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle5 days ago

Lifestyle5 days agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs