Crypto

Opinion | What should cryptocurrency industry leaders do to convince policymakers in India?

By Neelam Rani and Jatinder Handoo

The bedtime childhood tales generally train life-long pertinent classes which have to be remembered irrespective of how outdated one grows. Most would recall the Aesop’s Fables’ basic “The Tortoise and the Hare”. Keep in mind how the swift and sensible hare in all his zeal and enthusiasm misplaced to the gradual but constant tortoise. Ethical of the story is maybe what leaders of cryptocurrency in India must anoint themselves with. It might want an proof based mostly sustained engagement over a interval with Indian policymakers and maybe no different time could possibly be higher than this one to implement the coverage prescription when Indian crypto market is already maybe at its lowest ebb after a decline out there sentiment publish 30% tax charge and 1% TDS announcement by the Indian authorities.

Don’t Rating a Self-Aim: By no means Upset the Crown

Just lately, at-least two attention-grabbing developments have taken place in India, which somewhat could possibly be termed because the self-inflicted jibes. The primary one was a reflection of sheer infancy in (mis)studying Indian public coverage sentiment in the direction of crypto and sensitivities related to funds system setting in India, when a senior government of a overseas crypto trade at a glitzy crypto occasion in Bengaluru on April 07,2022 publicly drew interlinkages between Reserve Financial institution of India (RBI) promoted Nationwide Funds Company of India Ltd (NPCI) funds system – Unified Funds Interface (UPI) for switch of funds to crypto exchanges in India. Remotely would have he anticipated his blithely spoken phrases can be a public coverage misadventure, which may additional intensify the pains of crypto-traders, the exchanges, and clients in India, making them a form of banking untouchables (at-least in notion).

Anticipating that many business and coverage analysts could (mis)interpret the assertion from overseas crypto trade government as if RBI had been paving cost rails for encouraging cryptocurrency transactions in India, promptly got here a public assertion from NPCI on the identical day clarifying that they weren’t conscious if UPI was getting used for buy of cryptocurrencies in India, after which many regulated banking & funds entities both stopped or distanced themselves from such transfers to crypto exchanges. When everybody in Indian coverage echelons is conscious that RBI isn’t in favour of personal cryptocurrencies in India, such a reference was undesirable and poorly timed.

The second jibe is a information relating to transferring out of the enterprise base by two founders of one of many largest Indian Crypto exchanges to Dubai. The founders reportedly have made the transition because of purported crypto unfriendly ecosystem in India. Such a mind drain isn’t a brand new phenomenon. In 2018 the exchanges like Vauld and Zebpay had shifted to Singapore. International locations with favorable crypto foreign money laws appeal to international expertise and work from wherever setting additional facilitates such transitions. Indian crypto exchanges that are already registered in Singapore are COIN DCX and Coin Change Kuber, others have both moved to USA, Cayman Islands, Malaysia, or Dubai.

Regtech and Digital Digital Asset Particular Financial Zones (SEZ) in India

Transactions carried out with cryptocurrencies are seen with an eye fixed of suspicion by coverage makers and financial offences cum legislation enforcement companies not simply in India however in lots of overseas nations. Based on a report of the legal professional basic’s cyber digital process drive of the USA division of justice, cryptocurrencies have been utilized by criminals to transact in unlawful commerce, fund terrorism and assist rouge states to make use of cryptos for funding cyber-attacks. But, in these nations, coverage makers try to foster room for digital asset ecosystem via specialised laws, which tells us one thing helpful – Authorities the world over will not be in opposition to the underlying expertise of blockchain or cryptocurrencies per se, however they’re completely involved in regards to the anonymity and a few attainable anti-law use circumstances of crypto currencies. Having stated it, round 35% mining of Bitcoins nonetheless takes place within the US (as on March 2022) and the Biden authorities in February 2022 handed an “Government Order on Making certain Accountable Improvement of Digital Property” to facilitate crypto ecosystem in USA. International locations like United Arab Emirates, the place Emirate of Dubai has performed it via Dubai Digital Property Regulatory Authority – a specialised company to control crypto and digital property. Dubai World Commerce Centre Authority (DWTCA) has additionally taken particular lead.

Within the Indian context, the regulatory void continues, thus comes the function of commerce associations and client organizations to have a sustained engagement with key coverage makers and different civil society stakeholders to work out mutually acceptable options which may present VDA market (NFTs, Metaverse, cryptocurrencies, DLTs and so forth.) an area to function in India with out being stifled. The onus of teaching and facilitation lies on commerce associations and related enterprise. The Indian Authorities should understand, in a digitally decentralized ecosystem with hyper connectivity, solely uncommon curbs like these in totalitarian states would make VDAs inaccessible to Indians. It’s at all times favorable that Indian customers select to transect in India based mostly exchanges underneath staggered KYC regime somewhat than transacting at exchanges with zero KYC and low or no controls. In a regulatory lull, many overseas buyers are sitting on fence and watching regulatory air to clear in India.

Motion from compliance to a voluntary market takes time. As India appears to be the latter one, a minimum of, what could possibly be performed within the meantime is the usage of regtech regime, related protocols, and international learnings to permit VDAs together with crypto exchanges for buying and selling in low-risk merchandise. Identical to Industrial Particular Financial Zones (SEZ) , Digital Digital Asset -SEZ could possibly be allowed in India and maybe enterprise use circumstances or Enterprise to Enterprise (B2B) transactions might even see mild of the day , as an preliminary step. If Indian Authorities fails to offer a flourishing setting to VDAs and different chain applied sciences together with cryptocurrencies , then taxing such property is akin to tax slave commerce of seventeenth century.

Change within the Storyboard – Beneficial Coverage For Quicker Adoption.

Harbingers of crypto and digital digital property advocacy in India have a severe and a visionary function to play to make VDAs a profitable coverage story India. As of now the coverage advocacy narrative is hovering largely round crypto-exchanges and crypto-currencies as a medium of trade or an asset (buying and selling). The complete narrative language and engagement technique would wish to maneuver round a large ecosystem to create future network-effects of the chain ecosystem . As soon as a VDA and crypto-tipping level is attained in India, networks will deal with foreign money use case itself, simply as we have now seen the case with digital or retail cellular funds in India. Whereas participating with policymakers and customers (enterprise and retail ) with a selected deal with crypto-currency , maybe can be a myopic and an irrational method.

The complete narrative and advocacy technique somewhat should be focussed on ecosystem degree alternatives like programmable enterprise fashions, sensible contracts, DeFI, NFTs, Metaverse, Third era Digital Ledger Applied sciences (DLTs) and so forth.

The main target of the crypto-ecosystem itself is already transferring from blockchain 1&2 to 3rd era blockchain, which signifies that inefficiencies of the previous are taken care of by the system itself (together with bitcoin, ether and so forth.). The narrative amongst crypto neighborhood members itself is shifting from vitality intensive Proof of labor based mostly protocol to inexperienced Proof of Stake based mostly protocols to make transactions and system extra inexperienced, clear , auditable and agile. Many corporations the world over are getting into into metaverse ecosystem to supply distinctive person experiences. Artists, buyers and lovers of artwork conspicuously have been shifting to NFT for previous few years. It’s tokenisation the place everyone seems to be bullish on.

Many sectoral consultants in a not too long ago held 3rd spherical desk dialogue on Blockchain organised by the European Enterprise College(EBU) Luxembourg agreed that ultimately the a number of block-chains will see interoperability and P2P use case of cryptocurrencies will internalise routinely considerations like removing of some black sheep to forbid unlawful transactions on DLTs.

Lastly, a story modelling pushed by the Huge Furry Audacious Aim (BHAG) for VDA business in India must be grand, visionary and optimistic , which can unlock potential via beneficial public coverage in India somewhat than statements and actions with unintended penalties. Valuing nuances and understanding the thought course of is the important thing. Motion from compliance to a beneficial market in India could take a while, however as soon as it occurs, the transformation will probably be big for enterprise and residents.

(Neelam Rani is Affiliate Professor and Jatinder Handoo is scholar at IIM Shillong. The views expressed above are these of the authors and never essentially of financialexpress.com).

Crypto

Usiacurí Pioneers Cryptocurrency Integration in Colombia with the Crypto District Initiative

- Usiacurí becomes Colombia’s first municipality to integrate cryptocurrencies like Bitcoin, Tether, and Tron into its economy.

- The “Crypto District” initiative is a partnership between Usiacurí’s municipality, Certika, Universidad de la Costa, and Corporación CienTech.

Usiacurí, a quaint coastal town in Colombia, has taken a pioneering step by becoming the country’s first municipality to legally incorporate cryptocurrencies into its local economy. Launched on June 21, this innovative move is part of the “Crypto District” project, a collaborative effort between the Usiacurí municipality, Certika, Universidad de la Costa, and Corporación CienTech.

This initiative allows the use of cryptocurrencies such as Bitcoin, Tether, and Tron for both tourists and local residents to conduct transactions. The integration of digital currencies into Usiacurí’s economy is aimed at addressing the needs of foreign tourists and adapting to the demands of an increasingly globalized and digital world.

As we have written in Crypto News Flash, it positions Usiacurí at the forefront of financial technology by enabling artisans and local businesses to transact using blockchain technology, thus providing a fast and secure payment method.

Beyond facilitating e-commerce, the project is designed to boost the local economy by enabling artisans and small businesses to seamlessly sell their goods and services using blockchain technology. This move is expected to transform how commercial transactions are conducted in Usiacurí, enhancing efficiency and security for both buyers and sellers.

The inspiration for the “Crypto District” came from Bitcoin’s adoption in El Salvador, which you can read more about in our coverage in Crypto News Flash, which was closely studied by Tito Crissien, the executive director of CienTech and an advisor at Universidad de la Costa. The university has been instrumental in the project, providing research and academic support through its studies on blockchain and its applications.

Crissien commented:

“The participation of the Universidad de la Costa was fundamental throughout the entire process, since through its teachers and researchers they have been strengthening the line of research into blockchain and its applications, such as this tool that “It allowed us to turn Usiacurí into the first municipality with a cryptocurrency district, generating more sales in its tourism and hotel sector.”

Usiacurí’s mayor, Julio Mario Calderón, expressed his enthusiasm about the initiative, highlighting its potential to attract visitors and establish the municipality as a key destination for cryptocurrency enthusiasts. According to reports, over 60 local artisans, three hotels, two tourist guide agencies, and seven restaurants are already participating in the project.

At the project’s launch, local artisans were equipped with cryptocurrency wallets and trained to conduct their first transactions. This initiative not only enhances Usiacurí’s tourism and hospitality sectors but also positions it as an innovative model for integrating crypto technology into municipal management and local commerce.

No spam, no lies, only insights. You can unsubscribe at any time.

Crypto

COVID-induced social isolation drove cryptocurrency investment up 75%

Lockdowns during the COVID-19 pandemic saw an exponential rise in cryptocurrency investments which was partially driven by the stress of social isolation, QUT researchers have found.

The study’s results have major implications for financial advisors, marketers and policymakers on how to curb excessive risk-taking among isolated individuals.

The article, “Social isolation and risk-taking behavior: The case of COVID-19 and cryptocurrency,” was published in the Journal of Retailing and Consumer Services.

Dr. Thusyanthy Lavan and Professor Brett Martin, from the QUT School of Advertising, Marketing and Public Relations, with overseas colleagues, studied the consumer interest in cryptocurrency during the pandemic.

Dr. Lavan said the team looked at the impact of the pandemic’s prolonged enforced social isolation coupled with economic instability that drove risk-taking behavior, particularly in cryptocurrency investment.

“At the beginning of the pandemic, in January 2020, market capitalization of these online currencies was about $191 billion but had surged to $769 billion by December 2020,” Dr. Lavan said.

“This shift is underscored by the significant increase in the Bitcoin price, up 700% from March 2020 to March 2021.

“The attraction of these high-risk investments could be linked to their perceived potential for high returns during times of economic instability and market volatility.

“A further factor might be people’s tendency to try to reinstate some control in their lives and gravitate toward more autonomous and seemingly empowering activities, such as trading in cryptocurrencies.

“With this in mind, our aim was to look for the broader psychological responses to social isolation that catalyzed these changes in consumer decision-making, particularly in adopting new, and potentially riskier behaviors.

“Previous research has established the direct effects of social isolation on risk-taking behavior in non-purchase situations such as sharing of personal information on social media, but this is one of the first studies to examine risky purchase behavior.”

Professor Martin said they conducted a survey in December 2022 during a lockdown period in Australia of 216 participants screened for awareness of and familiarity with cryptocurrency but who were not current investors.

“By focusing on potential future investors, we aimed to capture unbiased perceptions and insights into cryptocurrency investment decisions,” Professor Martin said.

“Our survey sought to identify how three psychological constructs—perceived stress, sense of control and neuroticism—might underlie the relationship between social isolation and risk-taking behavior.

“Perceived stress is a personal interpretation of stress regarding a situation in a person’s life they consider to be beyond their adaptive capacities, while sense of control reflects a person’s belief in their ability to influence events and outcomes in their life.

“Neuroticism is a tendency to experience negative emotional states such as anxiety and impulsiveness.

“Our analysis of the results showed that perceived stress, rather than a sense of control or neuroticism, plays a key role in driving risk-taking behaviors during periods of social isolation.

Professor Martin said the researchers were not criticizing cryptocurrency.

“To be clear, my recently published research has shown how the process of cryptocurrency investing can have a positive effect on peoples’ lives.

“In this project, we looked at the effect of lockdowns and isolation-induced risk-taking. This research can provide insights on developing better support strategies for vulnerable populations.”

The research team comprised Dr. Lavan, Professor Martin, and Professor Weng Marc Lim and Professor Linda Hollebeek from Sunway University, Malayasia.

More information:

Thusyanthy Lavan et al, Social isolation and risk-taking behavior: The case of COVID-19 and cryptocurrency, Journal of Retailing and Consumer Services (2024). DOI: 10.1016/j.jretconser.2024.103951

Provided by

Queensland University of Technology

Citation:

COVID-induced social isolation drove cryptocurrency investment up 75% (2024, June 25)

retrieved 25 June 2024

from https://phys.org/news/2024-06-covid-social-isolation-drove-cryptocurrency.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

Crypto

Cops dispose of seized cryptocurrency mining machines and contraband worth thousands in Johor

ISKANDAR PUTERI: The police dispose of almost six years’ worth of seized items, including bitcoin mining machines worth more than RM428,000, that are kept as evidence.

Iskandar Puteri OCPD Asst Comm M. Kumarasan said the disposal of evidence items was divided into four categories: bitcoin mining machines, contraband, gambling, and general items.

“The items involved 304 investigation papers that have been completed and have received court orders for them to be destroyed.

“All the items had been seized from 2019 up until May this year,” he said in his speech at Iskandar Puteri police district headquarters here on Tuesday (June 25).

ACP Kumarasan added that the seized cryptocurrency mining machines, valued at RM232,650, involved four investigation papers.

He said RM174,300 worth of seized contraband items from 48 investigation papers involving liquor, beer and illicit cigarettes would also be disposed of.

“Based on police investigations on contraband items, we found that most of those that buy fake liquors were immigrants working around here.

“I have instructed my men to continue carrying out inspections and operations at premises to put an end to selling contraband items within the Iskandar Puteri area,” he added.

ACP Kumarasan stated that there were 175 investigation papers in the gambling category. The seized items included computers, smartphones, and other electronic devices with a total value of RM18,000.

He added police would also dispose of general items involving 77 investigation papers, including chemical envelopes, a forensics envelope, sharp weapons, and other items worth RM3,500,” he said, adding that the total value of all seized items was RM428,450.

ACP Kumarasan urged the public to continue contacting the police with information on criminal activities in their area by contacting the Johor police hotline at 07-2212999.

-

News1 week ago

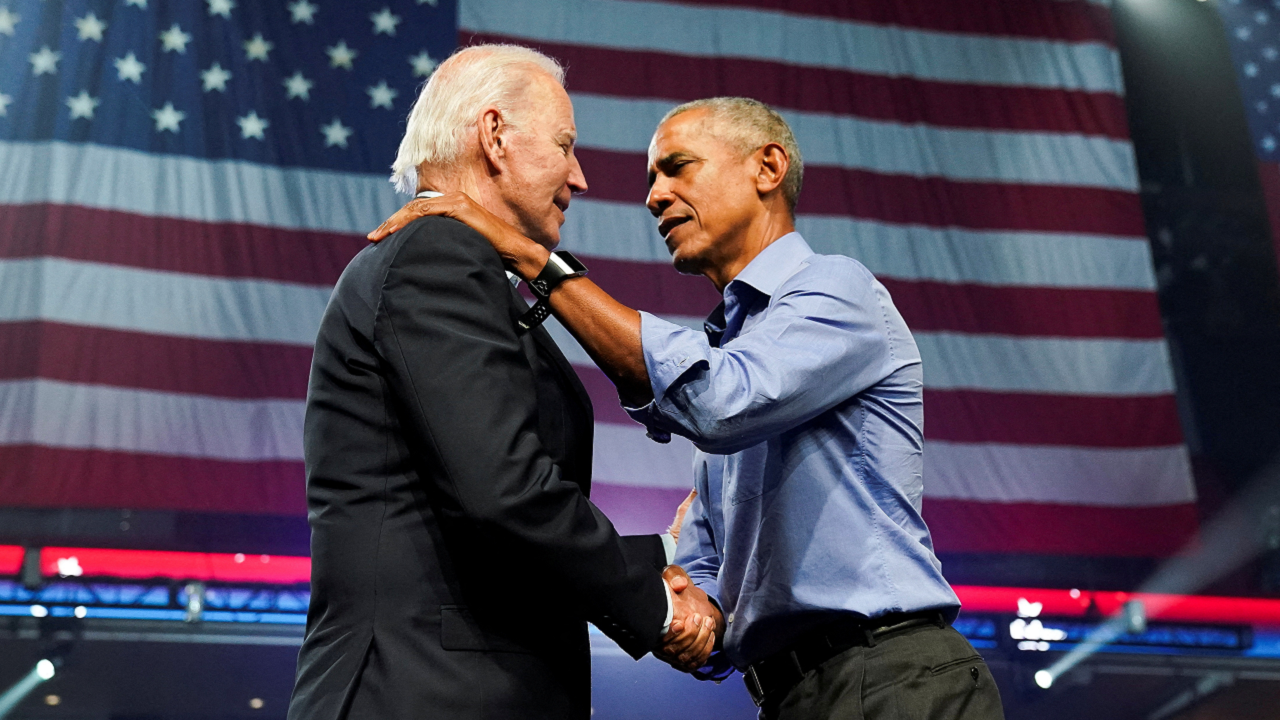

News1 week agoJoe Biden, Barack Obama And Jimmy Kimmel Warn Of Another Donald Trump Term; Star-Filled L.A. Fundraiser Expected To Raise At Least $30 Million — Update

-

News1 week ago

News1 week agoIt's easy to believe young voters could back Trump at young conservative conference

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 842

-

World1 week ago

World1 week agoSwiss summit demands 'territorial integrity' of Ukraine

-

World1 week ago

World1 week agoProtesters in Brussels march against right-wing ideology

-

News1 week ago

News1 week agoA fast-moving wildfire spreads north of Los Angeles, forcing evacuations

-

World1 week ago

World1 week agoAl-Qaeda affiliate claims responsibility for June attack in Burkina Faso

-

Politics1 week ago

Politics1 week agoJudge rules Missouri abortion ban did not aim to impose lawmakers' religious views on others