Crypto

North Korean crypto hacks down 80% but that could change overnight: Chainalysis

Cryptocurrency stolen by North Korea-linked hackers is down a whopping 80% from 2022 — but a blockchain forensics firm says it isn’t necessarily a sign of progress.

As of Sept. 14, 2023, North Korea-linked hackers have stolen a total of $340.4 million worth of cryptocurrency, down from a record $1.65 billion reported funds stolen in 2022.

“The fact that this year’s numbers are down is not necessarily an indicator of improved security or reduced criminal activity,” Chainalysis said in a Sept. 14 report. “We must remember that 2022 set a dismally high benchmark.”

“In reality, we are only one large hack away from crossing the billion-dollar threshold of stolen funds for 2023.”

Over the past 10 days, North Korea’s Lazarus Group has been linked to two separate hacks — Stake ($40 million) on Sept. 4 and CoinEx ($55 million) on Sept. 12, combining for a loss of over $95 million.

With the latest two hacks, North Korea-linked attacks have made up for about 30% of all crypto funds stolen in hacks this year, noted Chainalysis.

North Korea turns to dubious exchanges, mixers

Meanwhile, Chainalysis has found that North Korean hackers have become increasingly reliant on certain Russian-based exchanges to launder illicit funds over the last few years.

The firm said North Korea has been using various Russian-based exchanges since 2021. One of the largest laundering events involved $21.9 million in funds transferred from Harmony’s $100 million bridge hack on June 24, 2022.

United States-sanctioned cryptocurrency mixers Tornado Cash and Blender have also been used by Lazarus Group in the Harmony Bridge hack and other high-profile hacks committed by the group.

We’ve observed instances of DPRK-linked hackers sending funds to Russian services since 2021. But this year’s transfer of $21.9M stolen from Harmony to a high-risk Russian exchange is an escalation of that activity. You can see examples of some of those transactions below. pic.twitter.com/S9cDxlk9Hu

— Chainalysis (@chainalysis) September 14, 2023

Related: FBI flags 6 Bitcoin wallets linked to North Korea, urges vigilance in crypto firms

The United Nations is making an effort to curtail North Korea’s cybercrime tactics at the international level — as it is understood North Korea is using the stolen funds to support its nuclear missile program.

Meanwhile, the firm hopes increased smart contract audits will make life tougher for these hackers.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Crypto

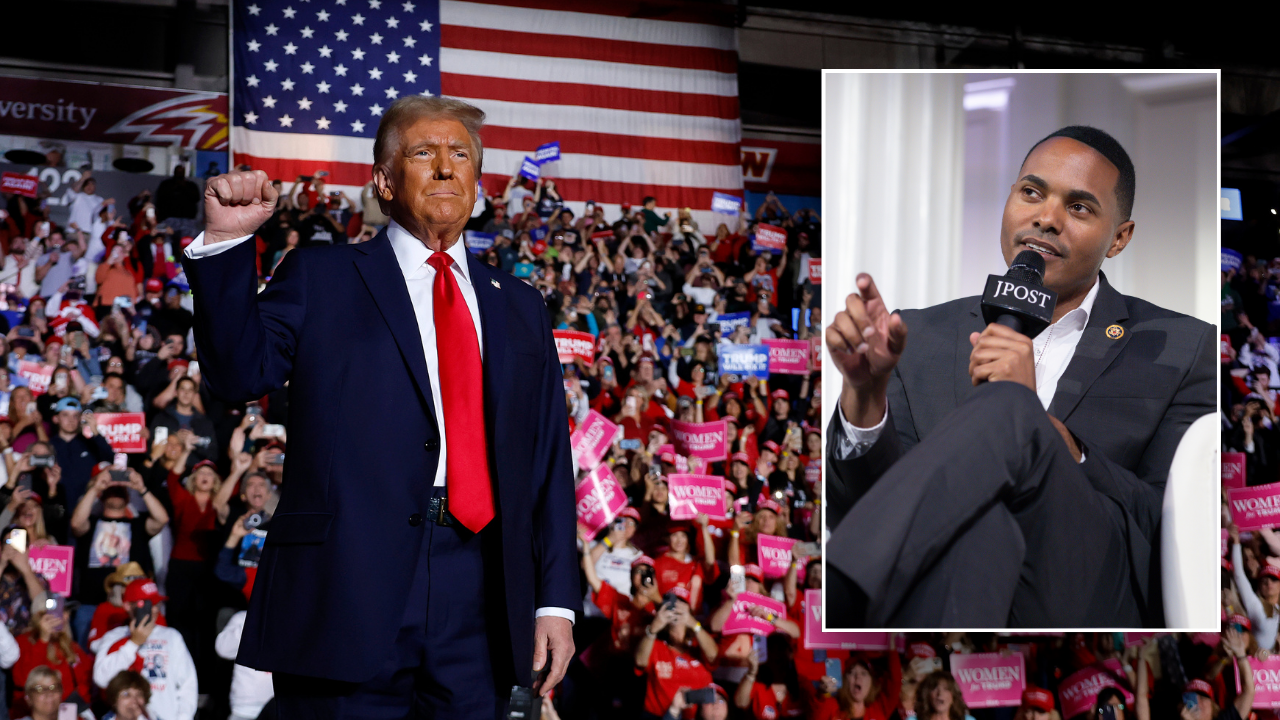

US polls 2024: Crypto sector expects smooth ride as Gensler’s SEC departure promises regulatory shift under Trump regime | Stock Market News

The crypto industry poured millions of dollars into the presidential and congressional races, but its most salient election victory is likely to be the departure of US Securities and Exchange Commission Chair Gary Gensler.

The former Goldman Sachs banker has led the strongest regulatory crackdown on the digital-asset industry, slapping dozens of cases against crypto companies and traders large and small, including financial behemoths Coinbase Global Inc. and proprietary trading firm DRW Holdings LLC.

President Donald Trump’s decisive victory ensures a pullback on crypto-related enforcement once he takes office. In July, Trump pledged to fire Gensler on the first day of his second administration while headlining a Bitcoin conference in Nashville.

The SEC has often touted its success in court in obtaining judgments that align with its view that decades-old securities laws apply to the upstart digital asset class. It’s also notched some significant fines against some of the biggest names in the industry. In April, the agency won a massive $4.5 billion fine and disgorgement from Terraform Labs, a stablecoin issuer, and founder Do Kwan. The agency hasn’t yet released its annual enforcement report for fiscal 2024 actions. Still, in the prior year, the agency brought 46 such cases, a more than 50% increase from the year prior, according to a report by consulting firm Cornerstone Research.

“Some crypto cases have been legit fraud cases and I hope those continue and I hope we get more of them,” said J.W. Verret, professor at George Mason University’s Antonin Scalia Law School in Arlington, Virginia. “A lot of crypto cases have been registration only, foot fault cases when registration is impossible.”

The next SEC chair is expected to push forward new regulations that will modify existing securities laws or enable digital asset companies to become compliant with rules that Gensler has long admonished them for flouting. That will also serve to rein in enforcement.

Bipartisan crypto legislation that supports that goal is now a stronger prospect, with the Senate set to be in Republican control.

“We expect that both the Trump administration’s and new Congress’ approach to crypto regulation to be much more constructive,” said Jack Inglis, chief executive officer of the Alternative Investment Management Association, a London-based trade group representing hedge funds and private equity firms.

That means policies “recognizing the need to embed crypto in the broader financial services framework while taking account of the technological differences with traditional finance leading to a more bespoke approach in many areas,” he said.

The SEC’s enforcement cases against crypto companies have centered on whether their products fit within the decades-old definition of a security, as laid out in the US Supreme Court’s opinion SEC v. W.J. Howey Co. That hasn’t been a good approach, according to William McLucas, a former SEC enforcement director, now a partner at WilmerHale. McLucas spoke during a securities enforcement conference in Washington on Wednesday.

“That can’t be the solution because whether you like crypto or you don’t like crypto it’s not going away,” McLucas said. “The enforcement cases that have been brought are what they are, but they keep bringing them, and we keep seeing crypto products,” he said.

Digital assets were a focus of 18% of all the tips, complaints and enforcement referrals at the agency in fiscal year 2024, the regulator’s Inspector General said in a recent report. The agency’s Office of Investor Education and Advocacy received nearly 6,000 such complaints during that same period, more than double any other type of complaint, the IG said.

Gensler Departure

Despite Trump’s vow to boot Gensler from office immediately, it may boil down to whether the SEC chair resigns by inauguration day. Some of Gensler’s fiercest critics in financial services are already calling for his immediate resignation.

“Last night the people voted for this country to take a new direction, and Chairman Gensler should respect that vote by stepping down from his position immediately,” said Chris Iacovella, president and chief executive officer of the American Securities Association, which represents regional brokers and other financial services firms.

If Gensler follows Washington tradition and departs, it would leave the agency split 2-2 along party lines until a new chair can be confirmed. That would stymie further aggressive enforcement, particularly with Hester Peirce, dubbed “Crypto Mom” still a commissioner.

One crypto industry executive, who requested to speak on background to speak frankly, said they anticipate Gensler may still want to file cases against companies like Uniswap and OpenSea that have already received “Wells notices” — an enforcement process formally notifying a company they’re under SEC investigation.

But other enforcement cases could be slow-rolled. Agency staff, aware that an incoming SEC chair, particularly one who back’s Trump’s vow to shrink the size of the federal government, might look unkindly on employees taking aggressive actions in the months leading up to a change in leadership and policy, the industry executive said.

The SEC declined to comment.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess

Crypto

There’s another big winner of the US election: cryptocurrency

As soon as it became apparent that Donald Trump was going to win the presidency, bitcoin’s price began to rally. A few hours before the Republican candidate declared victory, and with leads in all of the crucial swing states, the world’s most valuable cryptocurrency hit a new all-time high.

Reaching above $75,000 for the first time in its history, the cryptocurrency’s sudden surge came from Trump’s promise to support the crypto industry if elected. It marked a 50 per cent increase in bitcoin’s price since August, when Trump briefly lost ground to Kamala Harris in the polls.

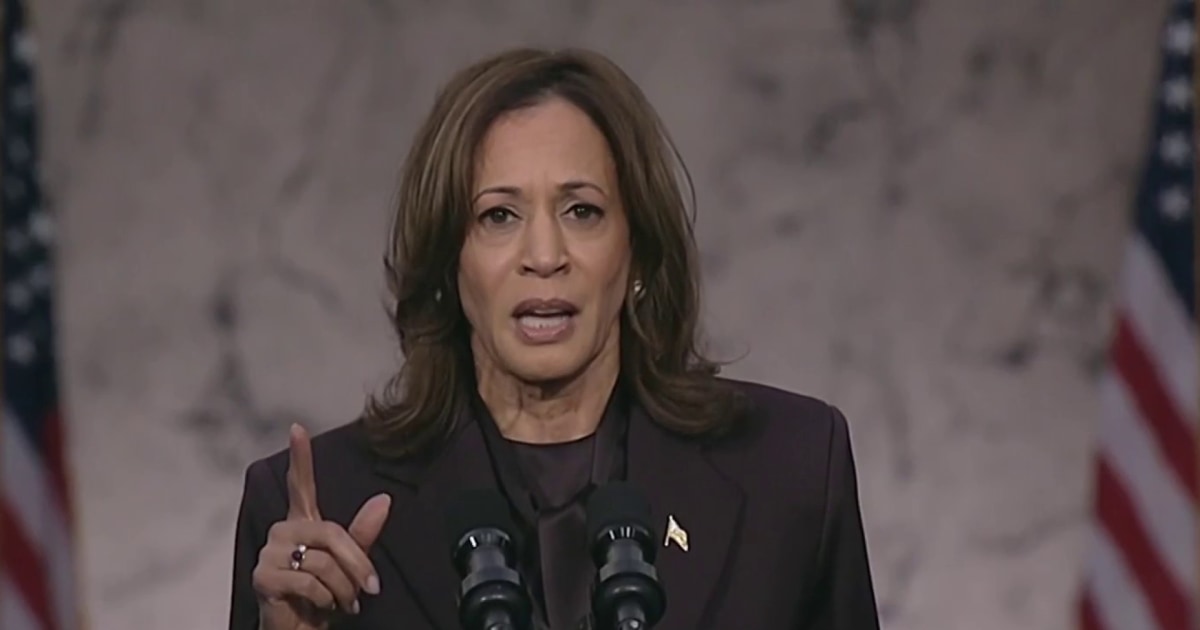

The Democratic candidate had also reached out to the crypto space, saying last month that she would build an “opportunity economy” that ensures regulatory frameworks that protect cryptocurrency owners, however many high-profile figures within the industry had pegged their hopes on the more vocal candidate.

The former president had pitched himself as a pro-crypto candidate, despite previously dismissing bitcoin as a “scam against the dollar” and claiming its value was “based on thin air” during his time in office.

In an effort to court the ever-growing segment of voters that own crypto – estimated to be around 50 million in the US – Trump pledged to protect cryptocurrency from “Elizabeth Warren and her goons” and fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, who has taken an aggressive approach to digital currency regulation.

During an appearance at the Bitcoin 2024 Conference in Nashville in July, Trump said he would set up a bitcoin treasury from the significant stockpile amassed by the government in seizures from financial criminals.

“For too long our government has violated the cardinal rule that every bitcoin knows by heart: Never sell your bitcoin,” he said.

Further boosting bitcoin’s price on Wednesday was the prospect of a Republican-controlled Senate, which will make it easier for the Trump administration to introduce the policies and regulation he claimed he would deliver.

“The bitcoin treasury plan is one step closer to reality. While there are a lot of moving parts to bitcoin‘s success, the immediate price increase reaction to Trump’s initial win announcement indicates significant market confidence,” said Danny Scott, chief executive of CoinCorner.

“If he follows through on his crypto pledges, we can expect a lasting impact on bitcoin. For starters, a bitcoin treasury plan will kick-start more awareness and education campaigns, which is a much-needed boon for the bitcoin community. Nation states will almost certainly have to react to the US doing this and gain some exposure to bitcoin themselves. It may very well trigger an arms race of nations.”

The broader crypto market also experienced a significant boost from political developments in the US, adding more than $250 billion to its overall market cap to take it above $2.45 trillion for the first time since July.

One of the biggest gains came from dogecoin, which has rallied more than 50 per cent since Sunday.

The memecoin is a favourite of Elon Musk, who is expected to play some kind of role in Trump’s administration having been one of his most vocal supporters during the campaign.

The tech billionaire has previously said that dogecoin has the potential to become the “currency of the internet” and even referenced it in his proposed ‘Department Of Government Efficiency’, or DOGE, that aims to untangle federal bureaucracy.

“In addition to the general positivity for cryptocurrencies, speculators are betting on Musk’s potential position in the new administration,” said Alex Kuptsikevich, chief market analyst at FxPro. “The Tesla founder and head of X has maintained the recognition of one of the first meme coins for many years.”

Crypto

Bitcoin price jumps to record high, tops $75,000 as Donald Trump looks set to return as 47th US President | Stock Market News

Bitcoin Price Today: Increasing chances of a victory for former US president Donald Trump in the US Presidential Elections 2024 gave a leg up to the bitcoin prices on Wednesday, November 6, with the major cryptocurrency hitting a fresh high and crossing the $75,000 mark for the first time.

Bitcoin price jumped over 8% today to a record $75,371.69, surpassing its previous high of $73,797.98 scaled in March this year.

The rally comes as Trump is seen as more supportive of cryptocurrencies than Democratic Presidential candidate Kamala Harris.

According to a report by AFP, Trump has pledged to make the United States the “bitcoin and cryptocurrency capital of the world” and to put tech billionaire Elon Musk in charge of a wide-ranging audit of governmental waste.

Other cryptocurrencies such as Ethereum, Solana, Dogecoin, Cardano and Shiba Inu also saw strong buying action, rallying up to 12%.

US Elections 2024

While the results are not yet completely known and will take a few days for the officials to count all votes, investors are already anticipating a Republican win. The Republicans have taken control of the Senate for the first time in four years although results of the House elections are not yet in.

Catch all the LIVE updates on US Presidential Elections 2024 here

270 electoral votes are needed to win the presidency, and Donald Trump is leading with electoral 247 votes as against Harris’ 210.

Trump won Georgia, a state that had voted for Democrats in 2020 but is traditionally a Republican stronghold. His win in North Carolina also made it harder for Vice President Kamala Harris to secure enough votes.

Meanwhile, Donald Trump already declared victory in the 2024 election during a speech in West Palm Beach, promising to lead the United States into a “golden age.”

“This was a movement like nobody’s ever seen before, and frankly, this was, I believe, the greatest political movement of all time. There’s never been anything like this in this country, and maybe beyond,” Trump said.

Ripple Effect

Signs of a possible Trump victory not only bolstered Bitcoin but also powered a rally in US stocks, the US dollar index along with the Indian stock market.

The US Dollar Index rose 1.9% to 105.30, its highest level in almost four months. Meanwhile, futures for the S&P 500 gained 1.7% and Dow Jones Industrial Average rose 1.8%. Nasdaq composite future was 1.8% higher, signalling a strong start for the US markets later today.

Back home, Indian benchmark indices – Sensex and Nifty – rallied over 1% each, led by gains in IT and banking packs.

Disclaimer: The views and recommendations above are those of individual analysts or broking companies, not Mint. We advise investors to check with certified experts before making any investment decisions.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess

-

Business5 days ago

Carol Lombardini, studio negotiator during Hollywood strikes, to step down

-

Health6 days ago

Health6 days agoJust Walking Can Help You Lose Weight: Try These Simple Fat-Burning Tips!

-

Business5 days ago

Hall of Fame won't get Freddie Freeman's grand slam ball, but Dodgers donate World Series memorabilia

-

Business1 week ago

Business1 week agoWill Newsom's expanded tax credit program save California's film industry?

-

Culture4 days ago

Culture4 days agoYankees’ Gerrit Cole opts out of contract, per source: How New York could prevent him from testing free agency

-

Culture3 days ago

Culture3 days agoTry This Quiz on Books That Were Made Into Great Space Movies

-

Business1 week ago

Business1 week agoApple is trying to sell loyal iPhone users on AI tools. Here's what Apple Intelligence can do

-

Culture1 week ago

Culture1 week agoTry This Quiz on Spooky Novels for Halloween