Tags on this story

Blockchain, BNB Chain, Bored Ape Yacht Membership, cryptopunks, Digital Artwork, Ethereum, Immutable X, Mutant Ape Yacht Membership, NFTs, Non-fungible tokens, Polygon, Solana

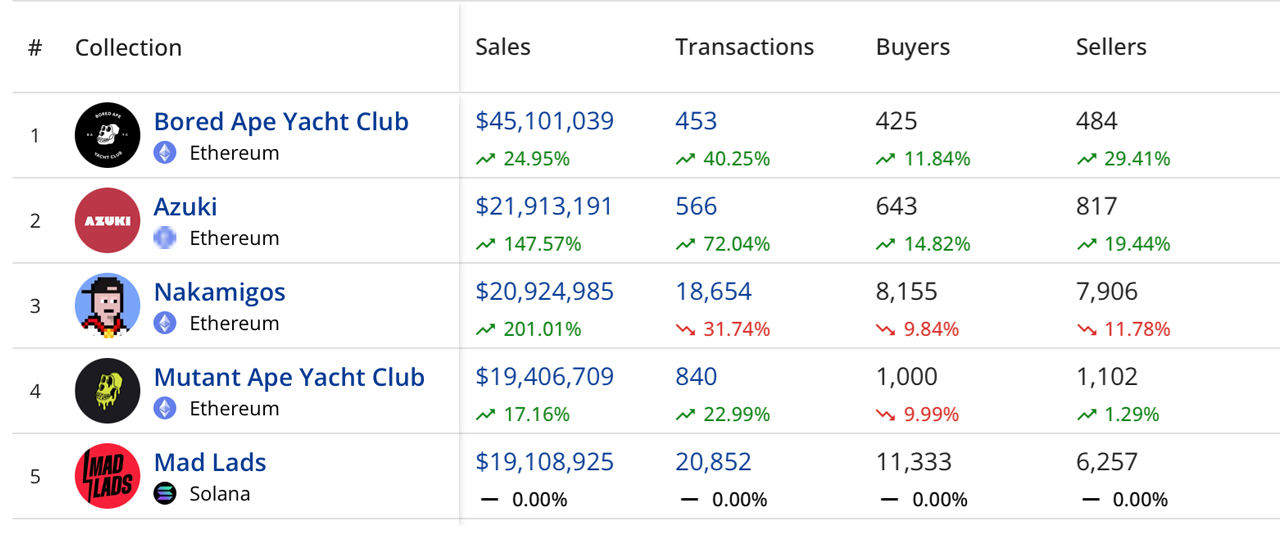

Gross sales of non-fungible tokens (NFTs) have declined by 5.76% over the previous 30 days, in accordance with the most recent NFT gross sales statistics. The info reveals that the gross sales determine stood at $732.13 million in April, which is $44.75 million decrease than the $776.88 million recorded in March.

NFT gross sales surpassed $1 billion in each January and February 2023; nonetheless, gross sales figures declined in March and April. Based on cryptoslam.io’s newest NFT gross sales knowledge for April, the gross sales stood at $732.13 million, which is 5.76% decrease than the earlier month.

Out of this quantity, Ethereum-based NFT gross sales dominated the market, accounting for $485 million in trades. Nevertheless, Ethereum NFT gross sales declined by 19% in April in comparison with March figures.

In the meantime, Solana-based NFT gross sales recorded $88.16 million, down 6.78% from final month. The highest 5 blockchains with probably the most NFT gross sales in April, following Ethereum and Solana, had been Polygon, Immutable X, and BNB Chain, as per the most recent knowledge.

In the course of the month of April, Polygon witnessed a surge in gross sales by 22.75%. In the meantime, Arbitrum, the sixth-largest blockchain when it comes to NFT gross sales, noticed gross sales spike by 78.35%, amounting to $10.29 million. When it comes to NFT collections, Bored Ape Yacht Membership (BAYC) emerged because the chief with $45.10 million in gross sales.

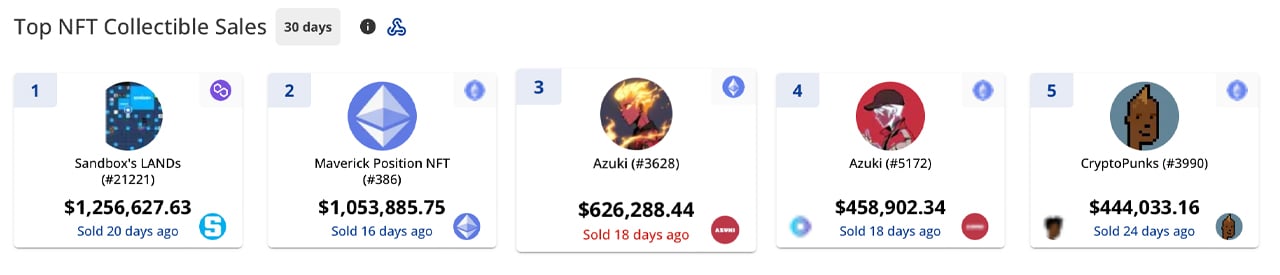

Azuki NFTs secured the second spot with $21.91 million in gross sales over the previous month. Nakamigos, Mutant Ape Yacht Membership, and Mad Lads adopted BAYC and Azuki when it comes to NFT gross sales. Sandbox’s Land #21,221 emerged because the top-selling NFT prior to now month, with a sale value of $1.256 million, roughly 20 days in the past.

The second most costly NFT sale in April was Maverick Place #386, which fetched $1.05 million, 16 days in the past. Azuki #3,628 secured the third spot on the checklist, promoting for $626K, 18 days in the past, adopted by Azuki #5172, which was acquired for $458K. The fifth most costly NFT sale in April was CryptoPunk #3,990, which offered for $444K, 24 days in the past.

As of Sunday, April 30, 2023, nftpricefloor.com studies that the gathering with the very best flooring worth is Cryptopunks, presently standing at round 49.99 ether. Just under Cryptopunks is Bored Ape Yacht Membership (BAYC), with a flooring of round 48.69 ether. The ground values of the highest collections following Cryptopunks and BAYC embody Mutant Ape Yacht Membership, Azuki, and Otherdeed.

What do you suppose the long run holds for the NFT market, and the way do you suppose the decline in gross sales figures in March and April will impression the business going ahead? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

To the crypto company Tether, the account was identified only by a 31-character string: TTAHMdqoom4f2VTWniroPWQHcTRZ4ca.

It’s a cryptocurrency wallet address, one of more than 300 million around the world that have held Tether tokens and make up a global unregulated payments network. Unlike a bank or fintech company, Tether collects no personal information about most of its users. Anyone can open a crypto wallet and move money with Tether quickly, cheaply and anonymously.

Bitcoin adjacent stocks got a substantial lift after the cryptocurrency’s price jumped over $104,000 on Friday.

Bitcoin mining behemoth, Mara Holdings (NASDAQ: MARA) was the biggest and most vocal, climbing by 13 per cent. It was followed closely by Riot Platforms (NASDAQ: RIOT), MicroStrategy Inc (NASDAQ: MSTR) at 7 per cent and Coinbase Global Inc (NASDAQ: COIN) at 5 per cent.

The original cryptocurrency’s good fortunes have been at the behest of Donald Trump’s election victory, based on the optimistic take that the incoming administration will take a more favourable approach to crypto, and Bitcoin in particular.

In December, Trump appointed Paul Atkins to lead the Securities and Exchange Commission. Atkins, who previously served as an SEC commissioner under President George W. Bush, has recently focused on digital assets. He is set to replace Gary Gensler, widely regarded as a crypto critic. Trump will also likely replace several SEC commissioners whose terms are set to expire during his administration.

Furthermore, crypto advocates and holders will soon shape U.S. policy on the emerging technology, following a series of nominations and advisory appointments by President-elect Donald Trump, who takes office on Monday.

The crypto industry, after years of battling lawsuits and enforcement actions by the U.S. government, hopes the Trump administration will signal a policy shift. Officials will vet political appointees for potential conflicts, and some appointees have pledged to sell their interests.

The industry will host a sold-out black-tie ball in Washington on Friday, with ticket prices ranging from USD$2,500 to USD$10,000. David Sacks, serving as Trump’s artificial intelligence and crypto czar, plans to attend.

Read more: BlackRock launches Bitcoin ETF in Canada

Read more: Cryptocurrency fugitive Do Kwon extradited to US

The reasons for the optimism surrounding the cryptocurrency’s future don’t necessarily begin and end with Trump either.

The president-elect has filled his inner-circle with a number of different cryptocurrency friendly personalities, most of whom are well-known and well-respected in the space.

Scott Bessent, a billionare hedge fund manager, is Trump’s pick for Treasury Secretary. He has expressed favourable views on cryptocurrency. According to a financial disclosure filed last month, Bessent holds shares in a BlackRock bitcoin exchange-traded fund valued between $250,001 and $500,000.

“Crypto is about freedom and the crypto economy is here to stay,” he said in July. “I think everything is on the table with bitcoin.” ‘

In a letter to the U.S. Treasury last week, Bessent stated he would divest his interests in the fund and other investments within 90 days of his confirmation.

Further, Trump selected Tesla’s chief and the world’s richest man to lead a government cost-cutting initiative called the Department of Government Efficiency (DOGE).

Elon Musk, a longtime advocate for cryptocurrencies like bitcoin and dogecoin, has significantly influenced their prices through his public comments and the actions of his companies. The acronym for Musk’s cost-cutting agency, DOGE, references dogecoin, now the seventh-largest cryptocurrency with a circulation value of $4.5 billion, according to CoinGecko.

In 2021, Tesla purchased $1.5 billion in bitcoin, making it one of the largest companies to invest in cryptocurrency before selling most of its holdings. By September 2024, Tesla reported holding $184 million in unspecified digital assets, according to a financial statement. Musk did not respond to a request for comment via Tesla regarding his personal cryptocurrency holdings.

Read more: Tether Limited sets up first brick and mortar office in El Salvador

Read more: Cryptocurrency fugitive Do Kwon extradited to US

Vice President-elect J.D. Vance held between USD$250,001 and USD$500,000 in bitcoin as of August 2024, according to a financial disclosure.

Vance co-founded the venture capital firm Narya, which has invested in Strive, Ramaswamy’s asset management company, and the video platform Rumble, as indicated on its website. In November, Rumble announced plans to allocate its excess cash reserves to bitcoin. The company also received a USD$775 million investment from stablecoin firm Tether last year.

When asked for comment on the crypto stances of Vance and Trump’s sons, Trump-Vance transition spokesperson Brian Hughes stated—without providing evidence—that bureaucrats in Washington had attempted to stifle innovation with increased regulation and higher taxes.

“President Trump will deliver on his promise to encourage American leadership in crypto and other emerging technologies,” he said in a statement.

Finally, set to collaborate with Musk at DOGE, former presidential candidate and entrepreneur Vivek Ramaswamy is the founder of Strive Asset Management.

Strive reported managing over USD$1 billion in assets as of September, and filed last month to launch an exchange-traded fund (ETF) that invests in corporate bonds for bitcoin investments.

In November, the company launched a wealth management arm aimed at integrating bitcoin into Americans’ investment portfolios, according to a press release from Ramaswamy.

In June 2023, Ramaswamy disclosed holding between $100,001 and $250,000 in bitcoin and between $15,001 and $50,000 in ether, a smaller cryptocurrency.

.

Like Mugglehead on Facebook

joseph@mugglehead.com

The Canberra region has about 39 cryptocurrency ATMS, but for locals who haven’t engaged with digital currency before their presence can be confusing.

Cryptocurrencies, or cryptos, are digital tokens that allow people to make payments directly to each other through an online system.

The ATMS were created as an alternative payment method to remove the middleman of banks through a de-centralised system.

When transferring crypto, thousands of computers worldwide verify the transfer, instead of one bank.

Bought and sold on digital marketplaces called exchanges, cryptocurrencies don’t have any intrinsic monetary value — they are worth whatever people are willing to pay for them at the market on a given day.

Currently, Bitcoin is both the most popular crypto and the crypto with the highest monetary value, at about $150,000 per coin.

So if the main purpose of crypto is to be digital, why do crypto ATMs exist, and are they useful?

There is no tangible data on how many Australians are accessing the ATMs, however as of last July, according to YouGov, about 1.3 million NSW residents, 801,000 Victorians, 850,000 Queenslanders, 294,000 South Australians, and 462,000 WA residents said they currently owned crypto.

Award-wining technology journalist and founder of technology publication Pickr, Leigh Stark, told ABC Radio Canberra the primary function of a crypto ATM is to turn real money into digital money, or vice versa.

In order to use a crypto ATM a person must already have a crypto wallet that can generate a QR code.

At a crypto ATM the digital currency can be bought, sold, or both, but Mr Stark said most only offer access to between five and 10 of the major cryptocurrencies — almost always including Bitcoin.

Selling cryptocurrency through a crypto ATM means swapping it for its current market value in cash or with a debit card.

You can also buy cryptocurrency with cash or a debit card at a crypto ATM.

Mr Stark said he didn’t know “if there’s necessarily a need” for cryptocurrency ATMs.

“I can understand why some people might want to take some of their money out of it, so effectively turning a digital coin that only exists on the internet into hard money, that kind of makes some sense to me,” he said.

“But buying crypto through it, I’m not entirely sure I understand that — largely because of the amount of exchanges that exist online.

“I feel like they would be a better approach for actually buying crypto, not even just because of the money transfer, but also because there are a lot more options for what you invest in on an online exchange.”

Loading…

Mr Stark warned taking money out from some crypto ATMs was taxable, and it was up to a user to remember and file.

“So the ATMs, effectively, they still have to abide by Australian government regulation regarding how they work,” he said

“But the whole thing about crypto and managing to take your money out of it, it qualifies as part of the capital gains tax.

“Not all crypto ATMs work that way, but if you take your money out, you have to remember what you did as a form of event, and file that information later on.”

Mr Stark said because a Bitcoin ATM usually only offered access to a selection of major cryptocurrencies, their usefulness depends on what exchanges a person invests in.

And they don’t all support selling, which is how a person can get money from them.

“Not every Bitcoin ATM works as a form of exchange, that’s for selling currency and they don’t all do that.

“In fact, far fewer support selling than they do buying.”

A Localcoin branded Bitcoin ATM in Canberra. (ABC News: David Sciasci)

Mr Stark said crypto ATMs in the Canberra region typically accepted a maximum of $25,000 in cash, but he suspected the majority of users wouldn’t be carrying that much cash with them.

But he said much smaller amounts were not uncommon.

“I mean the reality is, if you put in 20 bucks, that’s 0.000013 of a single Bitcoin,” he said.

“[But] you absolutely could buy that small amount of crypto, and that’s quite normal.”

Mr Stark said often people begin buying crypto in these very small amounts and then decide whether to buy more depending on whether its value increases.

“Crypto is kind of the wild wild west of finance, depending on what type of coin you get, whether it’s one of the big ones like Bitcoin or one of the small ones like Shiba Inu or Ethereum, or anything like that, you might end up with a small amount that spirals into a big one,” he said.

“You might be one of those success stories, it seems highly unlikely, but you could be just waiting for it to get higher and higher.”

In order to use the financial proceeds of crime, or ‘dirty money’, it first needs to be laundered to hide its illegal origins.

Cryptocurrency offers a sophisticated way to do this by turning it into digital currency.

However, every crypto transaction is recorded on a blockchain — essentially a publicly available, online ledger — so to make the dirty money truly clean, the crypto is then put through a mixer service.

These services mix cryptocurrency together from a number of different users, which obscures the transaction trails and makes it very difficult to trace the original source.

Leigh Stark says if someone is asking you to buy them Bitcoin, it’s most likely a scam. (ABC News: David Sciasci)

Mr Stark said it wouldn’t shock him if Bitcoin ATMs were being used for criminal enterprises like money laundering or money mule activities.

“I’ve not seen it, but likewise, I’ve also never seen anyone actively use a Bitcoin ATM before,” he said.

“I’ve never had a reason to, and that’s kind of the point.

“But maybe I’m coming at the wrong times, maybe there are people coming through with $25,000 at 1am and I just have no idea.”

As for using them in scams, Mr Stark said that was less about the ATMs and more about cryptocurrency as a whole.

He said if someone is asking you to get Bitcoin for them “it’s probably a scam”.

“There are a lot of different scams out there, and Australians lose billions every year, but yes, if somebody has asked you to buy them crypto or said that you need to give them crypto in order to get something in return, it’s very likely a scam,” Mr Stark said.

“Some of the Bitcoin ATMs have been used for things like that, and so now the Australian government is effectively trying to track and work out how those actually work in relation.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

Meta is highlighting a splintering global approach to online speech

Metro will offer free rides in L.A. through Sunday due to fires

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

Amazon Prime will shut down its clothing try-on program

Mapping the Damage From the Palisades Fire

Mourners Defy Subfreezing Temperatures to Honor Jimmy Carter at the Capitol

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

L’Oréal’s new skincare gadget told me I should try retinol

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

Super Bowl LIX will stream for free on Tubi

Why TikTok Users Are Downloading ‘Red Note,’ the Chinese App