Crypto

Neo-Nazi Use Of Cryptocurrency In The Russia-Ukraine War May Be Catalyst Prompting Government Regulation

Cryptocurrency has turn out to be more and more mainstream in recent times, and all facets of it at the moment are coated day by day intimately by the overwhelming majority of media shops. Nonetheless, one group of customers that has come to rely closely on cryptocurrency expertise – not solely as an funding alternative but additionally due to narrowing choices for conducting monetary exercise – are neo-Nazi and white supremacist teams, a lot of that are concerned in prison actions within the U.S. and worldwide. Nonetheless, their reliance on and widespread use of cryptocurrency have attracted little or no consideration from authorities or the banking business.

Current Examples Of Neo-Nazi And White Supremacist Use Of Cryptocurrency

Highlighting how these teams and their followers have been specializing in cryptocurrency, Buffalo shooter Payton Gendron’s 180-page manifesto, which he posted on a variety of boards resembling 4Chan and 8Chan previous to his Could 14 assault, included a bit titled “About Cash: Fiat, Crypto, and Steel.” He beneficial cryptocurrency as a method to “escape fiat,” stating that fiat forex “offers central banks higher management over the economic system” and indicating that the central banks are managed by the Jews. Including that it “is sort of precious in the best way that one can commerce on-line with it simply,” he went on to say that it ought to, nevertheless, not be held indefinitely, and must be transformed to valuable metals, as a result of “Jews hate it if you convert pretend cash [i.e. cryptocurrency] to actual cash, due to this fact it’s best to do it.”

Following the assault, the veteran neo-Nazi U.S.-based web site Day by day Stormer – talked about by Gendron in his manifesto as contributing to his radicalization – was faraway from its server and went offline. Inside days, it had returned with a Rwandan URL and continues to fundraise in Bitcoin and Monero, with a graphic on the high of the web page stating “Needed – Preventing {Dollars}” and “Donate to the Day by day Stormer.”

Hardly a day goes by that the MEMRI Home Terrorism Risk Monitor (DTTM) analysis group’s monitoring doesn’t see a brand new neo-Nazi or white supremacist group or particular person start to make use of crypto. They accomplish that for a spread of functions, as mentioned later on this article.

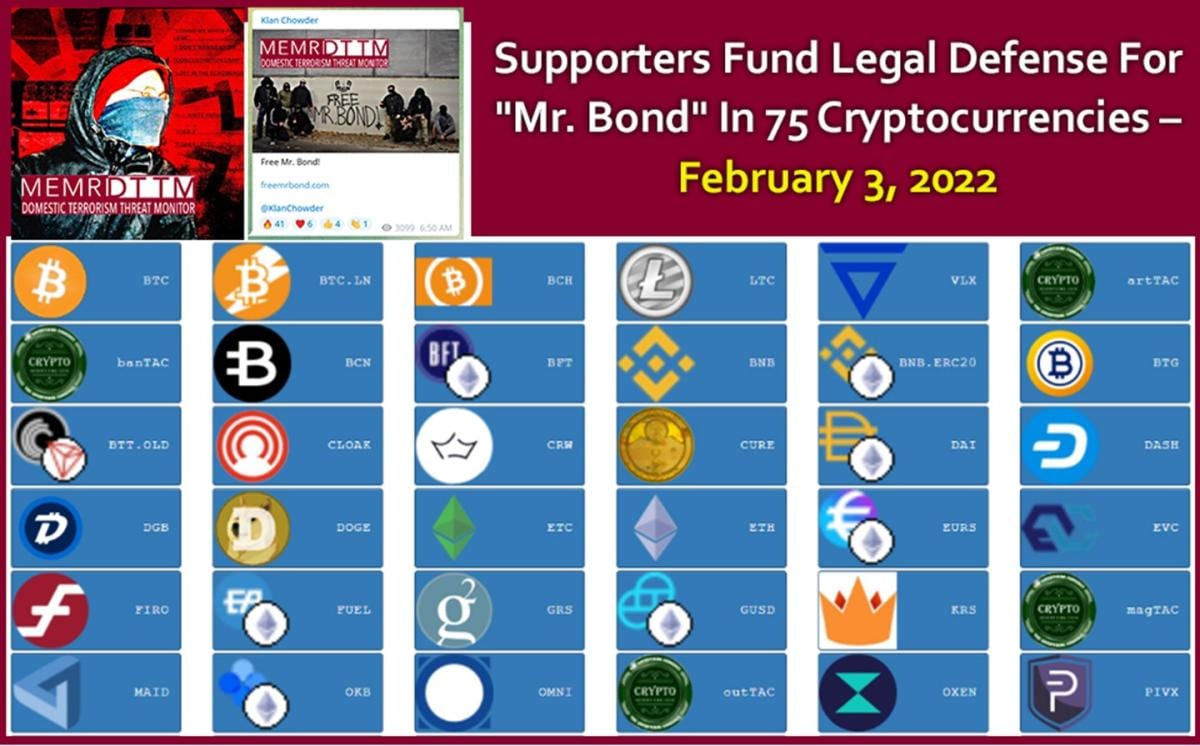

In Austria, notable latest examples of how home terrorist teams, neo-Nazis, and white supremacists are utilizing cryptocurrency embrace elevating funds for the authorized protection of Austrian neo-Nazi rapper Mr. Bond, who was sentenced to jail for 10 years for posting neo-Nazi songs on-line – certainly one of which was used as a soundtrack for a livestream of an antisemitic assault, during which two individuals have been killed. His supporters are accepting 75 totally different cryptocurrencies to pay his authorized bills.

Within the UK, the white supremacist “Patriotic Various” group, part of the rising far-right fringe within the nation, is soliciting donations in cryptocurrency to fund its manufacturing and nationwide distribution of stickers and flyers selling its “DRAMA” marketing campaign for “Demographic Alternative Consciousness.” Among the many cryptocurrency it accepts are Bitcoin, Ethereum, Bitcoin Money, Litecoin, and Monero.

Within the U.S., supporters of a preferred U.S.-based neo-Nazi group that creates extremist movies and posts on the extremist Gab platform, have begun fundraising in Bitcoin to help the group’s exercise. Every video they put up features a QR code that goes on to its Bitcoin handle for donations.

In Australia, many influential neo-Nazis now in jail proceed to solicit donations in cryptocurrency for his or her bail, attorneys’ charges, and so forth. As one distinguished neo-Nazi lately posted on Telegram, “Because of everybody’s beneficiant help, we handle to get collectively sufficient funds to cowl the in depth ‘Hearings, Mentions, Contests, and Bail Functions.’”

Moreover, on the main neo-Nazi discussion board Stormfront, which seems to be hosted within the U.S., there was persevering with dialogue of and requests for funding in a cryptocurrency for whites, to “function a coffer to help pro-White organizations.” A discussion board member wrote, on Could 8: “The concept is to create a cryptocurrency that runs on DeFi (decentralized finance) and is bought on DEXes (decentralized exchanges). This can contain an preliminary providing… to lift cash for the undertaking. After that, the objective is to get the coin listed on as many DEXes as potential to extend quantity. This coin would have one utility solely: [to] function a coffer to help pro-White organizations.”

Current U.S. Authorities Dialogue On Chance That Russians Will Use Cryptocurrency To Evade Sanctions

The Russia-Ukraine battle is highlighting the extent to which neo-Nazis and white supremacists have migrated to cryptocurrency. Using cyber finance within the battle has already gotten the eye of presidency leaders concerned in monetary regulation, and it has already been a topic of elevated dialogue. However information of how extremists are utilizing cryptocurrency within the battle, because it develops, will very doubtless show to be a catalyst for rules for the crypto business, which has been a subject of debate for a while.

At a latest listening to of the Home Monetary Companies Committee, Federal Reserve Chairman Jerome Powell mentioned that the Russia-Ukraine battle “underscored the necessity for Congressional motion on digital finance, together with cryptocurrencies.” Moreover, Senate Banking Committee members identified the “rising issues that Russia may use cryptocurrencies to avoid the broad new sanctions it faces,” in a March 2 letter to Treasury Secretary Janet Yellen. It must be famous that Russian vitality committee head Pavel Zavalny did say in an interview that his nation is keen to just accept Bitcoin in change for oil and gasoline exports.

These and different latest actions culminated in President Biden’s signing of a long-awaited govt order addressing the nationwide safety dangers of “illicit” misuse of cryptocurrency on March 9 and emphasizing the need of “regulation, oversight, [and] regulation enforcement motion.” Nonetheless, the order included no concrete enforcement or regulation insurance policies. Hopes that Biden’s order would suppress nefarious makes use of of cryptocurrency have been dashed, and a few noticed it as prone to additional delay actual motion.

Nonetheless, all this exercise has not thought-about the precise function cryptocurrency is taking part in within the Russia-Ukraine disaster. Whereas it has been used legitimately within the battle – the response to Ukrainian authorities requests for donations now totals over $100 million – not all cryptocurrency use within the battle is lawful. The identities of a few of these utilizing it, as soon as recognized, may very well be a catalyst within the push for regulation.

Forthcoming MEMRI DTTM Research On Neo-Nazi And White Supremacist Use Of Cryptocurrency

A forthcoming main research by the MEMRI Home Terrorism Risk Monitor (DTTM) undertaking, which has been researching neo-Nazi and white supremacist use of cryptocurrency for the previous two years, features a chapter about exercise within the Russia-Ukraine battle. The report, titled “The Eye of the Storm: [Domestic] Terrorists Utilizing Cryptocurrency – Half II,” and the chapter, element the platforms the place they solicit, switch, and pay in cryptocurrency, and what they use it for – activism, coaching, planning assaults and extra.

Excerpt From The DTTM Research’s Chapter On Extremists’ Use Of Cryptocurrency In The Russia-Ukraine Struggle

Cryptocurrency is proving indispensable to neo-Nazis within the battle for conducting their monetary affairs. Earlier this month, the neo-Nazi “Illiberal Ukrainian” channel on Telegram promoted a fundraising marketing campaign accepting “all kinds of cryptocurrencies” to help its members preventing in Ukraine.

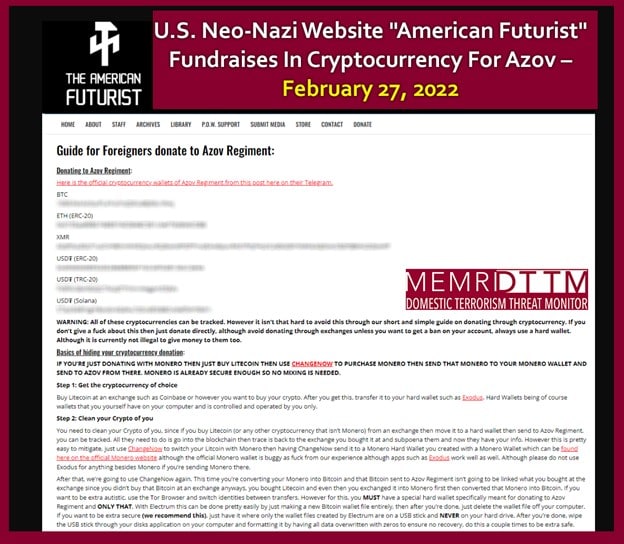

Highlighting such a fundraising, on its Telegram channel, the neo-Nazi accelerationist “American Futurist,” which is affiliated with veteran American neo-Nazi James Mason and the violent neo-Nazi Atomwaffen Division, expressed its help for “Ukrainian Nationwide Socialist teams such because the Azov Regiment.”[1] On February 25, the channel asserted {that a} soon-to-emerge “anti-Russian insurgency” in Ukraine would “100%” be Nationwide Socialist. On February 27, it posted its crypto pockets addresses for individuals to donate and a information to donating to Azov in Bitcoin Ethereum, Monero and others.

European Neo-Nazis Are Supporting Fellow Neo-Nazis With Cryptocurrency In The Struggle – The Instance of Defend Finland and Karpatska Sich

European neo-Nazi and white supremacist teams and their supporters are utilizing cryptocurrency extensively, and are fundraising primarily by way of the encrypted messaging app Telegram, which is utilized by virtually each main neo-Nazi and white supremacist group worldwide. These teams, from everywhere in the West, are utilizing the platform to advertise fundraising campaigns by like-minded teams in each Russia and Ukraine, soliciting donations in Bitcoin, Monero, Ethereum, and others.

For the reason that begin of the battle, a Finnish neo-Nazi channel on Telegram, Defend Finland, has been sharing posts selling the fundraising marketing campaign of the Ukrainian ultranationalist neo-Nazi Karpatska Sich militia. Karpatska Sich, which has been actively recruiting international volunteers, promotes acts of mass violence in help of its neo-Nazi ideology, and maintains shut ties with teams in Serbia, Hungary, Poland, and the remainder of Europe. Its fundraising posts listing Bitcoin, Ethereum, and Tron pockets addresses for donating.

Teams throughout Europe are additionally selling the fundraising marketing campaign, together with in France. Karpatska Sich is only one of a variety of Ukrainian neo-Nazi and paramilitary teams which are straight soliciting donations, as are their supporters; others embrace Centuria and Freikorps.

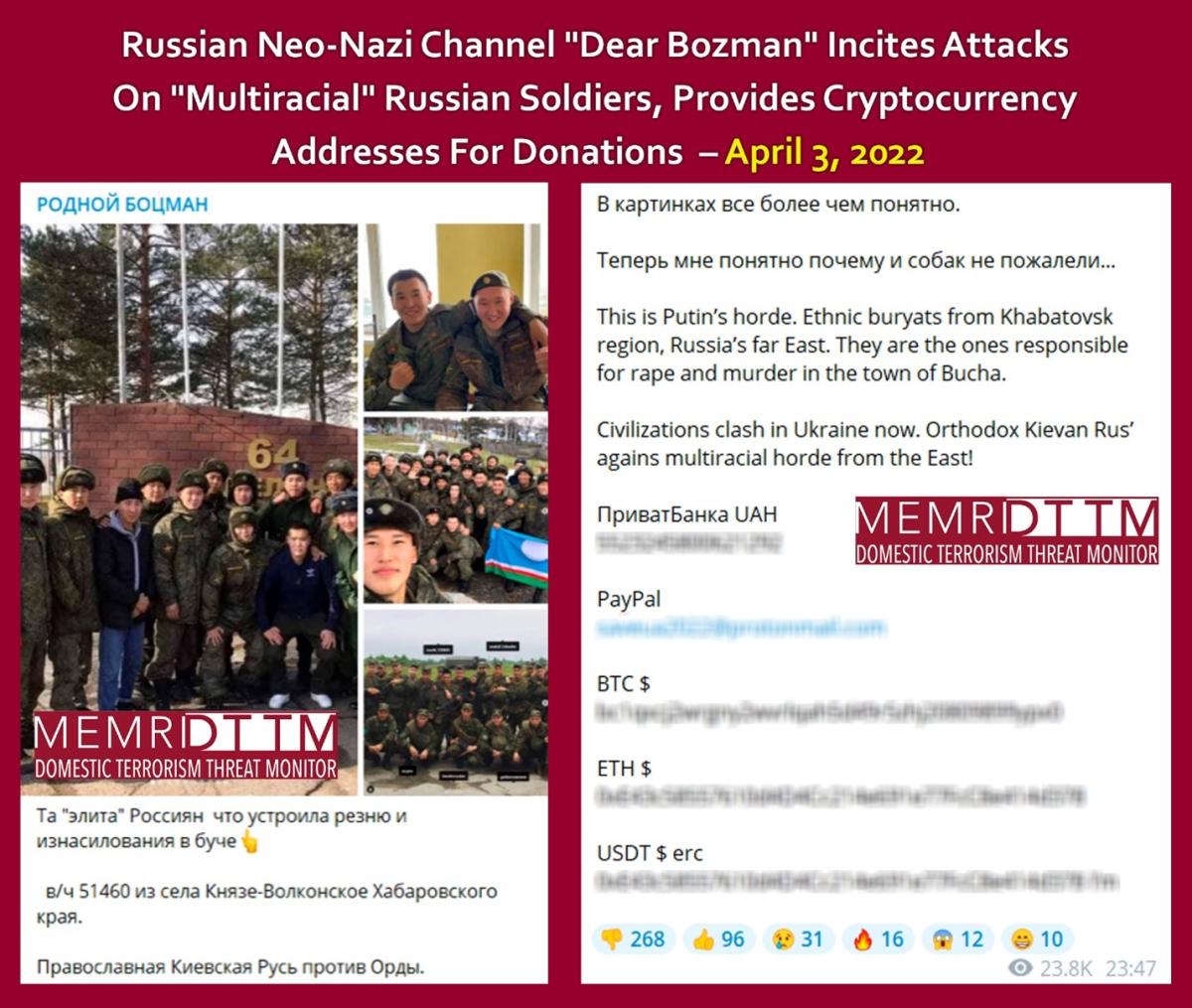

Moreover, on April 3, the Russian neo-Nazi Telegram channel “Expensive Bozman,” that’s run by an notorious Belarusian-Russian neo-Nazi, incited Orthodox Russians in Kyiv, Ukraine to assault “multiracial” Russian troopers, and offered its Bitcoin, Ethereum, and Tether addresses for donations.

MEMRI DTTM Research Paperwork How Whole Neo-Nazi White Supremacist Motion Makes use of Cryptocurrency – From Outdated-College David Duke To New Era Proud Boys

Cryptocurrency use by old-school neo-Nazis resembling former KKK Grand Wizard David Duke in addition to by new-generation tech-savvy extremists just like the Proud Boys elevated dramatically after the January 6, 2021 Capitol assault. At the moment, main banking and monetary establishments shut down these extremists’ entry to their providers, basically making it the one viable various.

Supporters of imprisoned home terrorists, together with high-profile killers resembling Charleston church shooter Dylann Roof and Pittsburgh synagogue shooter Robert Bowers, are utilizing donations in cryptocurrency to pay for his or her commissary and different bills. Cryptocurrency can be how they’re now paying for his or her livestreams, podcasts, and web sites.

For a greater understanding of how these teams make the most of cryptocurrency, have a look at a November 2021 Telegram put up by The Base – the U.S.-based neo-Nazi group led by Rinaldo Nazzaro which Australia has designated a terrorist group – soliciting donations with hyperlinks to its Bitcoin and Monero wallets. Within the put up, Nazzaro, a former U.S. intelligence contractor and now lives in Russia, wrote that these donations are used for members’ journey bills and coaching, buying “specialised gear,” and networking.

These and different actions which are being funded by cryptocurrency embrace planning assaults, buying weapons, and acquiring drones, thermal imaging gear, bulletproof vests, and cellphones. On the bottom in real-world battle conditions, the extremists are gaining expertise in fight, guerilla warfare, explosives, sniper exercise – and, in fact, how you can fund them with cryptocurrency. These abilities and this expertise may finally be turned in opposition to Western governments. Ukraine may very well be for these extremists what Afghanistan was for the jihadi motion within the Eighties.

Neo-Nazi Use Of Cryptocurrency In The Russia-Ukraine Struggle Could Immediate Authorities To Regulate It

So far, neo-Nazis and white supremacists have had no bother selling and sharing their Ukraine-connected cryptocurrency fundraising campaigns. There was no point out of intervention on the a part of authorities – or on the a part of the crypto business itself. Probably, neither is totally conscious of the extent of this exercise.

*Steven Stalinsky is Government Director of MEMRI (Center East Media Analysis Institute) and co-author of “The Eye of the Storm – [Domestic] Terrorists Utilizing Cryptocurrency Half II: Following In Jihadis’ Footsteps, Neo-Nazis Flip To Cryptocurrency.” Over the previous three years he has written extensively about terrorist utilization of cryptocurrency and his analysis on this has been printed and mentioned within the New York Occasions, Washington Publish, The Hill and for a lot of different publications. He additionally authored a serious 2019 research on jihadi use of cryptocurrency.

[1] The difficulty of the Azov Battalion, whose roots are undeniably neo-Nazi, has been the topic of a lot debate. It was integrated into Ukraine’s Nationwide Guard, and it has been reported that there at the moment are Jewish fighters in its ranks; in April 2002 it was reported that it was utilizing an anti-armor weapon that Israel helped develop. On the identical time, neo-Nazis from all over the world have gone to struggle with it in opposition to Russia, promoted and expressed help for it, and solicited donations for it. From the start of the Russia-Ukraine battle, the MEMRI DTTM has monitored this huge neo-Nazi help for Azov, together with from U.S.-based leaders and teams. It must be famous that in keeping with the Russian narrative, Russia is preventing Ukraine to “denazify” it, with a selected give attention to Azov.

Crypto

Bears, Bulls and Regulations Shape Crypto’s 2025 Aspirations | PYMNTS.com

The global cryptocurrency market is capitalized at over $3 trillion. Much of that value is concentrated at the top, among a few key digital tokens.

Bitcoin, as the first and most widely recognized cryptocurrency, plays a central role in the sector’s valuation, commanding a substantial share. At its highest, bitcoin’s market capitalization has approached $2 trillion, representing roughly two-thirds of the landscape’s overall market value.

Bitcoin topped $100,000 as 2024 came to a close, but has skidded down double digits from its peak of over $108,000 around two weeks ago.

This concentration of value at the top has implications for the overall market’s volatility, innovation and the evolution of altcoins, with bitcoin often setting the tone for broader market trends. It also raises questions about the future of crypto market dynamics as new technologies and use cases continue to emerge.

With the news that the Tether stablecoin’s (USDT) market cap fell more than 1% to $137.24 billion this week, the largest decline since the crash of the FTX exchange in November 2022, understanding the impact of regulations on the marketplace is becoming crucial for businesses looking to capture efficiencies and advantages from the use of tokens such as stablecoins.

After all, USDT is supposed to maintain a stable, flat value of $1. As of reporting, the stablecoin is a smidge below that value, sitting at $0.9993. The decline comes after several European Union-based crypto exchanges removed USDT due to compliance issues with the EU’s Markets in Crypto-Assets (MiCA) regulation that took full effect on Dec. 30 (the actual law around stablecoins kicked in six months ago).

Per the MiCA regulations, stablecoin issuers must hold an e-money license in at least one EU member state in order to operate across the 27-nation bloc. Tether, which has faced controversy throughout its history, has yet to apply for an e-money license.

Read more: What Was Crypto’s Biggest 2024 Story? Hint: It Wasn’t Named Elon

The Role of Institutional Adoption

In 2025, the cryptocurrency market may find itself at a crossroads. If the bulls are right, the industry could see substantial growth, with more institutional investment, regulatory clarity and real-world use cases for cryptocurrencies. However, if the bears prevail, we may witness a volatile market, regulatory crackdowns and a continued struggle to overcome the technology’s shortcomings.

The bullish optimism surrounding institutional adoption is one of the strongest driving forces. In 2025, financial institutions, banks and even central banks are expected to play a significant role in legitimizing cryptocurrencies. Global financial giants are already eyeing blockchain for solutions like cross-border payments and settlement systems, providing liquidity for crypto markets and solidifying their utility in traditional finance.

Stablecoins — digital currencies pegged to traditional assets like the U.S. dollar — are likely to become a common mode of transaction. With major players in FinTech, like PayPal and Visa, already integrating cryptocurrencies into their platforms and experimenting with stablecoins, real-world use cases could soon be as easy as tapping a credit card.

Read also: Why Banks Might Want to Have a Blockchain Strategy

The Bearish Argument: Volatility, Regulatory Shadows

Perhaps the biggest concern for crypto’s future is government regulation. The lack of clear rules around cryptocurrencies has been a major deterrent for mainstream adoption.

PYMNTS covered on Nov. 25 how cryptocurrencies, and more specifically their underlying blockchain technologies, have gone from a solution in search of a problem to a solution in hopes of some regulatory clarity. Of course, that clarity may come when cryptocurrency companies and other firms embrace and invest in, rather than resist, appropriate guardrails for their industries.

The dynamic situation at home in the U.S. has even led to people like venture capitalist Marc Andreessen arguing that banks are cutting ties with customers on the political right, or with industries such as the cryptocurrency sector.

Writing about the issue earlier this month, PYMNTS argued that while Andreessen’s claims might resonate with the frustrations held by many corners of the cryptocurrency and FinTech sectors, the reality could be far more nuanced than a political assault on those industries.

“After all, innovation typically moves faster than regulation, and the growing strain between traditional banks and future-fit FinTech and crypto firms can also be in part chalked up to the inevitable consequence of outdated regulatory frameworks, stricter know your customer (KYC) and anti-money laundering (AML) standards, as well as heightened fraud risks,” that report said.

Crypto

Launch the next big cryptocurrency presale inspired by Dogecoin with Blocksync

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Dogecoin’s rise shows the power of community; Blocksync helps launch crypto projects with secure tools and growth strategies.

Dogecoin started as a joke, yet it became one of the most iconic cryptocurrencies, proving the power of relatability, community, and creativity. For anyone who has dreamed of launching their own crypto project inspired by Dogecoin’s journey, now is the time to act. With the 2025 cryptocurrency market set for explosive growth, launching a presale today gives users the opportunity to secure funding, attract investors, and build a loyal community.

Blocksync is here to turn visions into reality. From designing secure smart contracts to building intuitive presale platforms and executing high-impact marketing campaigns, Blocksync provides all the tools and expertise crypto enthusiasts need to create the next big cryptocurrency success story.

The Dogecoin phenomenon and what it means

Dogecoin’s rise to prominence stemmed from its simplicity, humor, and the strong community it fostered. What began as a lighthearted project quickly grew into a global movement, attracting both retail and institutional investors. Its success showed the world that even seemingly playful ideas could have serious staying power in the blockchain space.

If people are inspired by Dogecoin’s story, they can launch their own cryptocurrency project that combines fun with functionality. Blocksync helps create a presale that aligns with users’ vision, offering investors both entertainment and robust blockchain solutions.

Custom smart contracts for a secure launch

At the core of every successful cryptocurrency is a reliable and transparent smart contract. Blocksync specializes in creating customized smart contracts tailored to users’ project’s specific needs.

The contracts support multiple blockchain ecosystems, including Ethereum, Binance Smart Chain, and Solana, ensuring that the project appeals to a diverse audience of investors. These contracts prioritize decentralization and security, giving backers confidence that their contributions are handled responsibly.

With Blocksync’s expertise, the project gains the technical foundation it needs to launch securely and attract investor trust.

Professional presale platforms that engage investors

The presale platform is the first impression potential investors will have of the project. Blocksync creates custom presale platforms that combine professional design with intuitive functionality, ensuring the platform captivates and converts visitors.

Key features include:

- Integrated cryptocurrency payment gateways for seamless transactions.

- Real-time tracking of presale progress to build transparency and excitement.

- Responsive designs optimized for mobile and desktop users.

By providing a user-friendly and visually appealing experience, Blocksync ensures the platform reflects the professionalism and vision of the cryptocurrency.

Marketing strategies to build community and momentum

Dogecoin’s success was fueled by its viral nature and strong community engagement. Blocksync’s marketing experts craft strategic campaigns that maximize visibility and attract investors to the project.

Blocksync’s approach includes:

- Social media campaigns tailored to the project’s unique tone and style.

- Collaborations with influencers to amplify the message.

- Press releases and partnerships with top-tier crypto media outlets to establish credibility.

By leveraging platforms like Twitter, TikTok, and Reddit, Blocksync helps the project gain the attention and excitement it needs to thrive in the competitive crypto market.

Future-proof solutions for long-term growth

While virality drives initial success, sustainability ensures the project’s longevity. Blocksync provides future-proof blockchain solutions to position users’ cryptocurrency for growth and scalability.

Its services include multi-chain compatibility, staking mechanisms, token utility enhancements, and DeFi integrations. These features ensure the token remains relevant and valuable long after the presale ends.

Comprehensive support for the cryptocurrency journey

Launching a cryptocurrency involves balancing technical development, platform design, and marketing execution. Blocksync simplifies the process by offering end-to-end support, allowing users to focus on building their community and refining their vision.

Blocksync’s comprehensive services include:

- Developing secure smart contracts tailored to the project’s needs.

- Designing and building professional presale platforms.

- Crafting targeted marketing strategies to drive visibility and engagement.

- Integrating advanced blockchain features for scalability and innovation.

With Blocksync handling the details, users can confidently launch their cryptocurrency presale knowing every aspect has been expertly managed.

Why choose Blocksync?

Blocksync is a trusted partner for blockchain innovators, combining technical expertise, creative problem-solving, and strategic marketing to deliver standout presale projects. The team has a proven track record of helping entrepreneurs bring their visions to life and navigate the complexities of the cryptocurrency market.

Whether users are inspired by Dogecoin’s humor and community spirit or want to introduce groundbreaking new features, Blocksync ensures their project stands out and succeeds in the 2025 crypto market.

For more information on Blocksync, visit the official website and Telegram.

Partner with Blocksync today to design, develop, and launch a presale that captures investor interest, builds community, and positions the cryptocurrency for long-term success.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Crypto

Frax Partners With Securitize on New Stablecoin | PYMNTS.com

Decentralized stablecoin cryptocurrency protocol Frax Finance launched a stablecoin that it said offers “unprecedented” transparency and custody.

The frxUSD stablecoin is a rebranded evolution of the company’s flagship FRAX stablecoin and will leverage BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize, Frax said in a Thursday (Jan. 2) press release.

The new stablecoin offers direct fiat redemption capabilities and enhanced compliance with U.S. financial systems, according to the release.

“By partnering with Securitize to access and leverage BlackRock’s BUIDL Fund we are setting a new standard for stablecoins,” Frax Finance Founder Sam Kazemian said in the release. “frxUSD combines the transparency and programmability of blockchain technology with the trust and stability of BlackRock’s prime treasury offerings.”

In this new collaboration around the stablecoin, BUIDL will become an enshrined custodian asset for minting and redeeming frxUSD; the stablecoin will be backed by cash, U.S. Treasury bills and repurchase agreements held in BUIDL; and frxUSD will offer seamless fiat on/off-ramping capabilities via the BUIDL infrastructure, per the release.

“Tokenized real-world assets provide an excellent bridge between traditional finance and decentralized finance, bringing institutional-grade investments on-chain with unprecedented transparency and efficiency,” Securitize Co-Founder and CEO Carlos Domingo said in the release. “This collaboration exemplifies the next stage in financial evolution, demonstrating how traditional and decentralized systems can work together to redefine asset management strategies.”

Stablecoins are emerging as a powerful tool bridging the gap between traditional financial technology and the world of cryptocurrencies, PYMNTS reported in October.

As cryptocurrencies designed to maintain a stable value by being pegged to a reserve asset (usually a fiat currency like the U.S. dollar or the euro), stablecoins are able to offer the efficiency and transparency of blockchain technology while providing the familiarity and stability of fiat currencies.

In another, separate development, it was reported Thursday that stablecoin leader Tether has seen its market value decline amid new European Union (EU) cryptocurrency rules, with the company’s USDT having its sharpest weekly drop in two years.

USDT had reached a record market value in mid-December but declined after several EU-based exchanges and Coinbase removed the stablecoin due to compliance issues with the EU’s Markets in Crypto-Assets (MiCA) regulation that took full effect on Dec. 30.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

Business1 week ago

Business1 week agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health6 days ago

Health6 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology6 days ago

Technology6 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World1 week ago

World1 week agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics1 week ago

Politics1 week agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Business2 days ago

Business2 days agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Politics1 week ago

Politics1 week ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons