Crypto

Liberal senator drafts crypto bill to regulate ‘stablecoins’ and China’s digital yuan

The usage of cryptocurrency is on the rise and the shortage of regulation within the sector might threaten Australia’s nationwide safety, based on Liberal senator and crypto advocate Andrew Bragg.

Senator Bragg will introduce a personal member’s invoice when parliament subsequent sits, together with new guidelines governing crypto exchanges, and Chinese language banks coping with e-yuan in Australia.

“The Chinese language authorities is piloting what they name the digital yuan, which is a digital type of forex, and so they’re at the moment trialling that exterior of China as effectively, with the UAE [United Arab Emirates], Hong Kong and Thailand,” he advised RN Breakfast host Patricia Karvelas on Monday.

“That forex, if it grew to become widespread within the Pacific, and even inside Australia, would give the Chinese language state monumental energy, financial and strategic energy that it does not have at this time.

“So I feel we should be ready for that. We have to know extra about this digital forex, so the invoice establishes reporting necessities in that regard.”

China far forward of Australia on digital currencies

China was the primary main financial system to discover the usage of digital currencies in 2014, and is way forward of its international friends.

It has been conducting restricted trials of the e-yuan over the previous three years.

Nevertheless, China has but to launch the digital forex throughout its inhabitants of 1.4 billion folks — which is seen by critics as a method to ramp up state management of the funds system.

Crypto

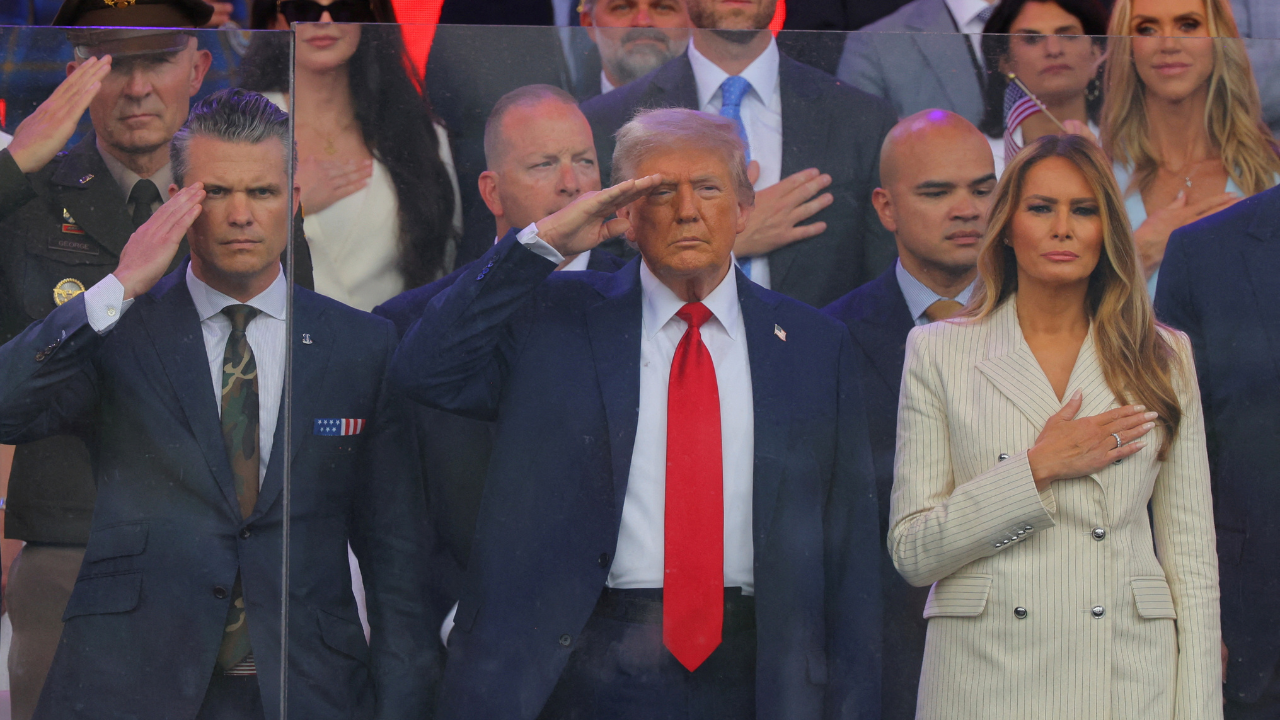

Donald Trump Reports Nearly $60 Million Income from Cryptocurrency Venture

Former US President Donald Trump has disclosed nearly $60 million in income from his involvement in a cryptocurrency venture, shedding light on how he and his family continue to benefit from the digital asset industry. The Financial Times reported on Friday that Trump’s annual financial disclosure reveals $57.4 million earned through World Liberty Financial (WLF), a cryptocurrency enterprise backed by Trump alongside his sons Donald Jr. and Eric.

The detailed filing, exceeding 200 pages and published by the US Office of Government Ethics, shows Trump holds 15.75 billion governance tokens in WLF, granting him substantial voting rights in the operation. The cryptocurrency venture stands as one of Trump’s largest income sources, alongside revenues from books and real estate investments.

Trump’s financial ties to the crypto sector have drawn increasing scrutiny amid ongoing concerns about potential conflicts of interest. The White House did not immediately respond to requests for comment on the disclosures.

World Liberty Financial revealed in January that it had successfully sold 21 billion tokens during a public sale, reaching its target of raising $1 billion. Notably, a 2024 filing with the US Securities and Exchange Commission identified Trump’s special envoy, Steve Witkoff, as a “promoter” of the WLF project.

Trump’s vocal support for cryptocurrencies has helped drive market enthusiasm, pushing bitcoin prices above $100,000 per coin. Under SEC Chair Paul Atkins, several high-profile crypto-related legal cases have been dropped, further easing regulatory pressure on the industry.

Additionally, Trump has actively promoted his own $TRUMP memecoin via social media and hosted a gala last month honoring its major holders. The Trump family media company recently announced plans to launch an exchange-traded fund (ETF) directly holding bitcoin and revealed intentions to raise $2.5 billion to establish a “bitcoin treasury.”

At a bitcoin conference in Las Vegas last May, Eric Trump and Donald Trump Jr. praised cryptocurrencies as “cheaper,” “faster,” “safer,” and “more transparent” than traditional fiat currencies, signaling the family’s continued commitment to expanding their digital asset footprint.

Crypto

Trump Declared Over $600 Million in Income From Cryptocurrency and Business – Reuters

US President Donald Trump has released his financial statement. According to the document, he received over $600 million in income from cryptocurrencies, golf clubs, licensing and other businesses. This was reported by Reuters, writes UNN.

Details

The financial declaration was signed on June 13 and did not contain information about the period it covers. At the same time, some data in the declaration suggest that it was until the end of December 2024, which excludes most of the money raised by the Trump family’s cryptocurrency ventures.

According to the publication’s calculations, Trump declared assets worth at least $1.6 billion in total.

He previously stated that he had transferred his businesses to a trust managed by his children, but the published data indicate that income from these sources still goes to the president, which has led to accusations of conflicts of interest.

Some of Trump’s businesses in areas such as cryptocurrency are benefiting from changes in US policy under his leadership and have become a source of criticism, Reuters writes.

One meme coin issued by the president earlier this year – $TRUMP brought in approximately $320 million in commissions, although it is not publicly known how this amount was distributed between the Trump-controlled organization and its partners.

The feud between Trump and Musk caused Tesla’s stock to crash, with a market value drop of $150 billion.

06.06.25, 09:15 • 3708 views

In addition to the meme coin commissions, the Trump family earned more than $400 million from World Liberty Financial, a decentralized financial company. In his declarations, Trump indicated $57.35 million from the sale of World Liberty tokens.

The American president’s fortune also includes a significant stake in Trump Media&Technology Group (DJT.O), which owns the Truth Social social network, the report said.

In addition to assets and income from his business projects, Trump declared at least $12 million in income in the form of interest and dividends from passive investments totaling at least $211 million, according to Reuters calculations.

Trump’s three golf resorts in Jupiter, Doral and West Palm Beach, and a private members’ club in Mar-a-Lago, brought Trump at least another $217.7 million in income. Trump National Doral, a large golf center in the Miami area, was the Trump family’s largest source of income – $110.4 million.

Trump also received royalties from various deals – $1.3 million from Greenwood Bible, the “only Bible officially endorsed by Lee Greenwood and President Trump”, and $2.8 million from Trump Watches, $2.5 million from Trump Sneakers and Fragrances.

According to Reuters, the declaration often only indicates ranges of asset and income values, and the lower limit was used for calculations, so the real value of Trump’s assets and income is most likely even higher.

Trump changed his approach to deportations: raids on farms, hotels and restaurants have been stopped – NYT14.06.25, 10:18 • 2808 views

Crypto

Kevin O’Leary Explains Which Cryptocurrency Is a Smarter Bet: Bitcoin or Ethereum

The cryptocurrency market offers hundreds of different investment options, but two of them control most of the action: bitcoin and ethereum. As recently as last year, the combined market cap of both platforms made up more than 70% of the global crypto market, according to U.S. News & World Report.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Read Next: 13 Cheap Cryptocurrencies With the Highest Potential Upside for You

Check Out: 5 Types of Cars Retirees Should Stay Away From Buying

So which is a better bet for investors? During a recent interview with CoinDesk, businessman and “Shark Tank” star Kevin O’Leary suggested his preference.

Also see five reasons you need at least one bitcoin.

O’Leary shared during the interview that his preference is bitcoin. “If you want exposure to crypto volatility, it’s bitcoin,” O’Leary said. “There’s a lot of people that say, ‘I don’t need anything else … I’ll just buy bitcoin.’ And they haven’t been wrong … I think it’ll be very hard to dethrone it.”

As for ethereum, O’Leary spent much of his time bemoaning its lack of speed and efficiency.

“Goodness, ETH is slow,” he said. “I’m sorry, but it’s slow, and I think a lot of people know that. And the more transactions get piled on it, it doesn’t get any better.”

Learn More: Coinbase Fees: Full Breakdown of How To Minimize Costs

O’Leary has plenty of company in backing bitcoin over ethereum.

Part of bitcoin’s allure is that it has become a dominant crypto force in both size and name recognition. It has grown so big that it recently leapfrogged Google parent Alphabet to rank as world’s sixth-largest asset by market cap, The Market Periodical reported.

From a pure investment standpoint, bitcoin has definitely been the better bet recently. Its price is up about 12% in 2025 as of June 13 and has gained about 56% over the past year. In contrast, ethereum’s price is down about 23% in 2025 and has lost more than 27% over the past year.

If you’re new to crypto, it’s important to understand the differences between bitcoin and ethereum, because it’s not an apples-to-apples comparison.

As U.S. News reported, bitcoin’s network uses a proof-of-work verification system. Ethereum, on the other hand, uses a proof-of-stake system, which U.S. News called “less energy-intensive.” Additionally, the main purpose of bitcoin is to serve as a digital currency that’s an alternative to other currencies, while ethereum is a platform that runs smart contracts, U.S. News explained.

According to VanEck, a New York-based investment management firm, both bitcoin and ethereum have seen their prices fluctuate significantly over the years. Despite that, VanEck noted that bitcoin has been the outperformer, remaining more stable than ethereum.

-

West1 week ago

West1 week agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoiFixit says the Switch 2 is even harder to repair than the original

-

Movie Reviews1 week ago

Movie Reviews1 week agoPredator: Killer of Killers (2025) Movie Review | FlickDirect

-

Politics1 week ago

Politics1 week agoA History of Trump and Elon Musk's Relationship in their Own Words

-

Finance1 week ago

Finance1 week agoChinese lenders among top backers of “forest-risk” firms

-

News1 week ago

News1 week agoA former police chief who escaped from an Arkansas prison is captured

-

World1 week ago

World1 week agoUkraine: Kharkiv hit by massive Russian aerial attack

-

Technology1 week ago

Technology1 week agoThere are only two commissioners left at the FCC