Crypto

Is cryptocurrency story over? 4 things crypto investors should know to navigate the high-risk arena

A. Promote all of them

B. E-book partial earnings

C. Purchase extra

D. Maintain for long run

It seems that many crypto traders ticked the final choice when the market was rallying in 2021. One in all them was like Bangalore-based senior IT skilled Sanjeev Mathur (see image). The worth of his crypto holdings rose from Rs.5 lakh to Rs.22 lakh however Mathur didn’t promote. “I didn’t want the cash, so there was no must promote,” he says.

In hindsight, that was a nasty choice. The crypto market may be very completely different from the inventory market the place costs are decided by fundamentals and holding for the long run has yielded excessive returns. Within the crypto market, costs are pushed by sentiments, and volatility will be unnerving. Final month, the Luna coin crashed to zero. Different cash are additionally down, some by nearly 80-90% from the 2021 peak (see graphic). Is that this the start of the tip for cryptos? The business doesn’t assume so. “Costs are pushed by sentiments. There can be bumps alongside the way in which, however we’re right here to play a long-term sport,” says Rajagopalan Menon, Vice-President, WazirX. Crypto costs have crashed, however Rajagopalan is assured that they may get well. “Bitcoin has misplaced 50% of its worth seven occasions up to now 12 years,” he says.

Others are placing up a courageous entrance as properly. “Like some other market, the crypto market can be cyclical. All asset lessons are in a downturn proper now, and the crypto market can be going by way of a bear section,” says Mridul Gupta, COO, Coin DCX. He factors out that although Bitcoin is down 75% from its 2021 peak, it’s nonetheless 10x increased than it was 5 years in the past.

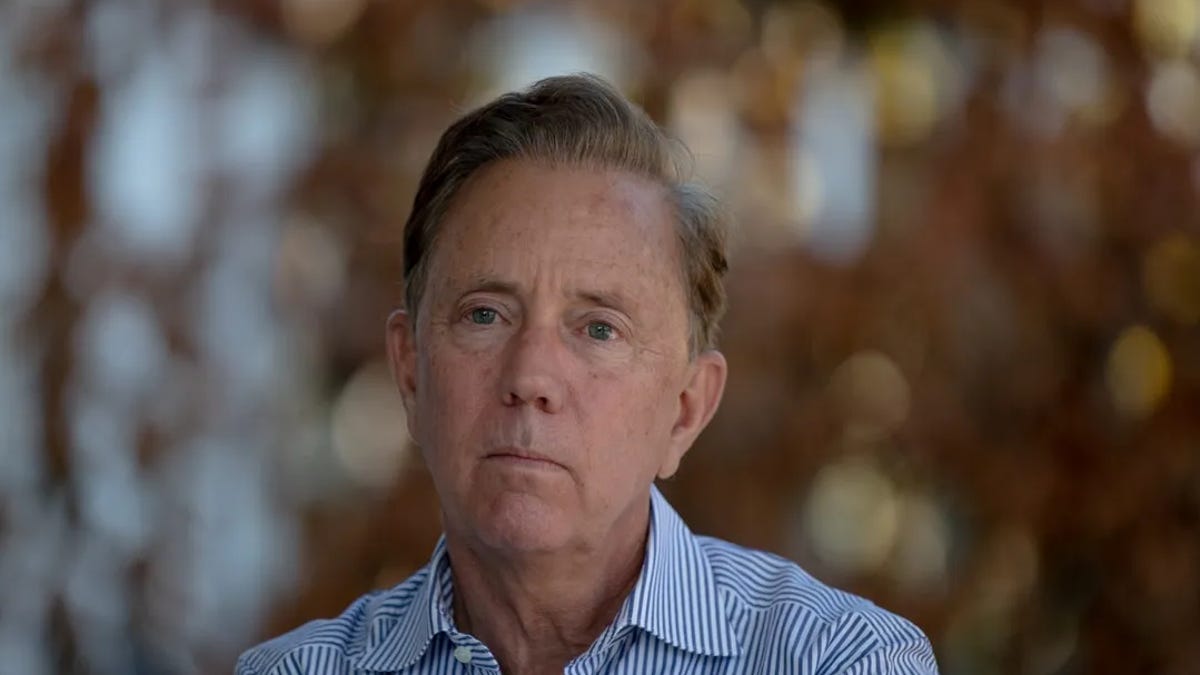

Sitting in his 16-storey flat in a leafy a part of Pune, software program engineer Anand Subramanian (see image) has pinned his hopes on the restoration. Subramanian, who used to speculate primarily in small financial savings schemes and insurance coverage insurance policies and a bit of in mutual funds, was lured into investing in cryptos when he noticed his associates and colleagues make large cash on this new area. His crypto portfolio is down nearly 60% and Subramaniam has vowed by no means to put money into cryptos once more.

Ready for higher fools

Like many different traders, Mathur and Subramaniam are ready for higher fools to purchase their cryptos. Little do they realise that even when the crypto market recovers, possibilities of reaching the 2021 ranges are pretty distant. The worldwide markets are in turmoil after the hike in rates of interest by the US Fed and the liquidity that boosted the markets through the previous two years is shortly drying up.

Again dwelling in India, the modifications within the tax guidelines for cryptos has additional dampened investor sentiments. This yr’s Price range has put a flat tax of 30% on all positive aspects, regardless of the earnings stage of the investor. That is very excessive in comparison with tax on different property and earnings sources. Capital positive aspects from shares and fairness funds are taxed at 10-15% and non-equity investments, property and gold taxed at 20% or marginal fee. However each rupee earned from cryptos can be taxed at 30%, even when the investor has no different earnings. Worse, losses from one crypto can’t be adjusted towards some other earnings and even the positive aspects from one other crypto. They can not even be carried ahead to subsequent years. So the federal government pockets 30% of the positive aspects whereas the losses are borne by traders.

One other main drawback is the 1% TDS that kicks in from 1 July. As per a notification issued final week, a vendor must deposit 1% of the transaction worth as TDS (see field). Although this can get adjusted towards the overall legal responsibility and will be claimed as a refund later, it is going to lock up liquidity. Because the CEO of a crypto trade identified, in simply 200-300 transactions your entire capital of an investor will get locked up in TDS. Excessive frequency merchants can be notably hit.

The tax guidelines had brought about a furore and the business sought amendments, however the authorities didn’t relent. Because of this, many buying and selling platforms that had mushroomed up to now two years have already folded up. Even these which might be functioning have seen a large 70-75% decline in buying and selling volumes.

The sharp decline in crypto costs has devastated Amit Kumar, a gross sales govt with a fintech firm based mostly in Gurgaon. Like Subramanian, he was additionally drawn into crypto buying and selling by the thrill round what the business likes to tout as an “rising asset class”. The distinction is that whereas Subramaniam put about 1% of his funding portfolio in cryptos, Kumar allotted nearly 24% to this untested avenue. Worse, he additionally satisfied some family members to put money into the crypto area. “My very own losses are dangerous sufficient, however I can stay with that. The losses incurred by my family members are worrying me to loss of life,” he says glumly.

Whereas traders like Amit Kumar have been badly singed, many others have made good cash from cryptos. Bhushan Mittal, who runs a cell accent store in Noida, entered the market in 2020 when costs weren’t purple scorching. Mittal hit the jackpot when Dogecoin zoomed from Rs.5 to Rs.50 in Might final yr. However Mittal didn’t let this success get into his head. As an alternative, he saved doing small trades and booked earnings often with out protecting lengthy positions. “If an funding has gone dangerous, I’m not afraid of reserving losses. It’s a part of the sport,” he says matter-of-factly.

That is sane recommendation certainly, particularly for traders like Amit Kumar who’re sitting on large losses. Because the Luna crash reveals, your total capital can get worn out in a day. Even a bluechip like Bitcoin is down 75% from its November excessive of Rs.54 lakh. “Enter this market provided that you may abdomen excessive variations and the implications of an funding going incorrect,” says Prableen Bajpai, Founder, FinFix Analysis and Analytics. Right here are some things that crypto traders ought to be mindful in the event that they don’t wish to get harm on this high-risk enviornment.

Don’t take very large bets

The crypto market is pushed largely by sentiments and tends to be very unstable. Costs can transfer 50-60% in a day, so don’t put very giant quantities on this avenue. Even when you’ve got a excessive threat urge for food, put solely a miniscule portion of your portfolio in cryptos. “Don’t put greater than 2% of your total portfolio in cryptos,” advises Vikram Subburaj, CEO, Giottus Cryptocurrency Alternate. Deep pocketed traders like Mathur perceive this. He solely put about 1% of his portfolio in cryptos. So whereas he has misplaced cash, the decline isn’t actually earth shattering for him.

Don’t make investments at one go

One other piece of recommendation comes proper out of the fairness fund playbook: don’t make investments giant quantities at one go. “How costs will transfer within the days to come back is anyone’s guess. So, traders ought to stagger their investments as a substitute of committing giant sums in lump sum. The SIP strategy will work greatest,” says Gupta of Coin DCX. The fractional investments in cryptos permit traders to place in fastened quantities each month. “Make investments Rs.500 a month in cryptos and perhaps 5-10 years down the road it might be sufficient to maintain your baby’s faculty training,” says Rajagopalan.

Stick with bluechips

There are nearly 200-odd cryptos on the market jostling to your consideration. There’s additionally a variety of unverified info on social media and self-styled analysts providing funding recommendation. As a rule, confirm the knowledge earlier than you make investments. And don’t get tempted into shopping for obscure cash. Greater cash could also be costlier however are extra steady. Examine the market cap and buying and selling volumes of the coin. A low market cap and insignificant day by day volumes are apparent purple flags.

Keep away from behavioural biases

Lastly, and most significantly, don’t fall into behavioural traps similar to anchoring and loss aversion. The worth ranges through the rally of 2021 is probably not achieved in a rush. If you’re ready to your cryptos to get well to these ranges, banish the thought. Additionally, contemplate reserving losses as a result of the market might keep sideways for longer than you assume.

The 1% TDS rule kicks in from 1 July. Right here’s how TDS will get deducted

The 1% TDS rule that kicks in from 1 July will apply solely when the worth or combination worth of the transactions by the individuals exceeds Rs.50,000 through the monetary yr.

The client of a digital digital asset (VDA) is required to deduct 1% TDS from the quantity paid to the vendor. If the PAN of the customer isn’t accessible, then TDS can be 20%. If the vendor has not fi led his tax return, TDS can be 5%.

If the transaction is instantly between purchaser and vendor with no third get together (trade) in between, the customer will deduct TDS if the quantity exceeds the edge restrict of Rs.50,000 in a monetary yr.

If the deal is routed by way of an trade, the trade must deduct tax on the time of transferring fee from purchaser to the vendor of the VDA. If the fee is finished on trade by way of a dealer, then TDS will be deducted both by trade or dealer.

To make sure that TDS isn’t deducted twice, there will be written settlement between the trade and dealer. The dealer shall be liable for deducting tax on such credit score/fee.

If the switch of VDA occurs through an trade and VDA is owned by the trade, then the customer of VDA can be required to deduct tax on the time of constructing fee. Nevertheless, it might occur that the customer doesn’t know that VDA is owned by the trade.

In such instances, the trade might enter right into a written settlement with the customer or his dealer that in all such transactions the trade could be paying the tax on or earlier than the due date for that quarter.

Exchanges could be required to furnish a quarterly assertion for all such transactions. Exchanges would even be required to furnish their tax returns and all transactions have to be included in these returns.

Crypto

Crypto’s Shocking Transformation: How Bitcoin Volatility Plummeted From 400% To 80%

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Bitcoin’s journey from digital experiment to mainstream investment has been marked by one defining characteristic: extreme price volatility. However, data from NYU Stern’s Volatility Lab reveals a remarkable transformation in how dramatically Bitcoin’s price swings, offering important lessons for today’s investors.

Between 2010 and 2017, Bitcoin experienced volatility that would make even the most seasoned traders nervous. During this period, annualized volatility frequently exceeded 200% and occasionally spiked above 400%. To put this in perspective, traditional stocks typically see volatility between 15-30% annually.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Don’t Miss:

This extreme volatility reflected Bitcoin’s status as an unproven digital asset with minimal institutional backing. Small trading volumes meant that even modest buy or sell orders could trigger massive price swings. News events, regulatory announcements, or technical developments could send prices soaring or crashing within hours.

The 2017 cryptocurrency bubble perfectly exemplified this era. Bitcoin’s price rocketed from under $1,000 to nearly $20,000 before crashing back down, creating the kind of volatility that attracted speculators while terrifying traditional investors.

Following the 2017-2018 market correction, something interesting began happening. Bitcoin’s volatility started declining meaningfully. Between 2018 and 2020, volatility generally ranged between 50% and 150% – still extreme by traditional standards, but a significant improvement from the earlier chaos.

This period coincided with several important developments: major companies began accepting Bitcoin payments, institutional investors started taking notice, and cryptocurrency exchanges became more sophisticated and regulated. These factors contributed to deeper liquidity and more stable price discovery.

Current data shows Bitcoin’s volatility has continued moderating, now typically ranging between 30%-80%. While this remains substantially higher than stocks or bonds, it represents a dramatic evolution from Bitcoin’s early days.

Crypto

Cryptocurrency Stocks To Follow Now

Crypto

Norfolk bank poised to revolutionize finance as cryptocurrency regulations evolve

Patrick Gerhart, President of Banking Operations at Telecoin, shared insights with News Channel Nebraska on how this development will reshape the financial landscape for Nebraskans. “The GENIUS Act will provide much-needed regulation and insight into how the government will treat stablecoins, a type of cryptocurrency typically backed by a fiat currency,” Gerhart explained. “At Telecoin, we are developing a stablecoin that will be backed by the U.S. dollar on a one-to-one basis.”

-

News1 week ago

News1 week agoVideo: Faizan Zaki Wins Spelling Bee

-

News1 week ago

News1 week agoVideo: Harvard Commencement Speaker Congratulates and Thanks Graduates

-

Politics1 week ago

Politics1 week agoMichelle Obama facing backlash over claim about women's reproductive health

-

Technology1 week ago

Technology1 week agoAI could consume more power than Bitcoin by the end of 2025

-

News1 week ago

News1 week agoPresident Trump pardons rapper NBA YoungBoy in flurry of clemency actions

-

Technology1 week ago

Technology1 week agoSEC drops Binance lawsuit in yet another gift to crypto

-

Technology1 week ago

Technology1 week agoOpenAI wants ChatGPT to be a ‘super assistant’ for every part of your life

-

World1 week ago

World1 week agoTwo killed in Russian attacks on Ukraine before possible talks in Turkiye