Crypto

EDX Markets Debuts Cryptocurrency Trading Platform and Wraps Up Latest Investment Round

In a key milestone, EDX Markets has successfully kick-started its cryptocurrency trading operations and completed a fresh funding round. Based in Hoboken, New Jersey, EDX has been established as a trusted marketplace for digital assets, promoting safe and compliant trading through reliable intermediaries.

EDX has garnered the attention of major financial institutions, becoming the preferred cryptocurrency marketplace for industry leaders. The platform stands out with its non-custodial model designed to prevent conflicts of interest. It also offers benefits like enhanced liquidity, competitive quotes, and a retail-only quote, giving retail-originated orders a better pricing advantage. Currently, EDX supports the trading of well-known cryptocurrencies (mainly POW), including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

Another milestone is on the horizon for EDX. Later this year, it plans to launch a clearinghouse, EDX Clearing, which will settle trades matched on EDX Markets. The clearinghouse will function as a central counterparty for trades, reducing settlement risks, promoting price competition, and increasing operational efficiency.

The launch of EDX and the forthcoming EDX Clearing comes on the heels of a successful new funding round. The round saw participation from strategic investors such as Miami International Holdings, DV Crypto, GTS, GSR Markets LTD, and HRT Technology. These firms join the platform’s founding investors, including heavyweights like Charles Schwab, Citadel Securities, Fidelity Digital AssetsSM, Paradigm, Sequoia Capital, and Virtu Financial. The newly secured funding will bolster the ongoing development of EDX’s trading platform and strengthen its market leadership position.

Jamil Nazarali, CEO of EDX, expressed his confidence in the platform’s potential and its ability to attract investors. He stressed EDX’s commitment to incorporating the best practices from traditional finance into the cryptocurrency market and hinted at the significant edge EDX Clearing will provide by improving competition and operational efficiency.

Crypto

Trump to set the course for cryptocurrency market this year with his cabinet – Latest News

WASHINGTON

In a year that saw cryptocurrency markets reach unprecedented heights, 2025 is poised to be a watershed moment for digital assets, with the inauguration of President-elect Donald Trump on Jan. 20 having set the stage for potentially seismic shifts in the crypto world.

Throughout 2024, Bitcoin shattered records, surpassing $107,000 and pushing its market cap beyond $2 trillion. The entire cryptocurrency ecosystem’s value soared past $3.7 trillion, signaling growing mainstream acceptance.

Now, all eyes are on Trump’s administration and its pro-crypto stance. During his campaign, Trump vowed to make the U.S. the “crypto center of the world,” a promise that sent digital currencies surging after his election victory, with ambitious plans like a “national Bitcoin reserve,” though details remain scarce.

Trump’s cabinet choices reflect his crypto-friendly approach. David Sacks, a prominent entrepreneur and investor, is set to become the “White House Artificial Intelligence and Crypto Czar”—a” role in which the former PayPal senior executive would “guide policy… in two areas critical to the future of American competitiveness,” according to Trump.

Sacks will be tasked with developing a legal framework to provide the clarity the crypto industry has long sought.

The changing of the guard at key financial regulators is also stirring optimism. Gary Gensler, known for his skeptical view of cryptocurrencies, will step down as Securities and Exchange Commission (SEC) Chairman. His likely successor, Washington attorney Paul Atkins, is viewed as more amenable to digital assets.

Scott Bessent’s nomination to the Treasury Department further cements the perception of a crypto-positive economic team.

Last year’s approval of Bitcoin and Ethereum ETFs by the SEC opened the floodgates for institutional and retail investors alike. Speculation is rife that 2025 could see similar approvals for other cryptocurrencies like Solana, Ripple, and Hedera, potentially driving further market growth.

Ripple, a major altcoin project, and Coinbase, one of the largest U.S. cryptocurrency exchanges, have been embroiled in lawsuits with the SEC over allegations of unregistered securities transactions. These cases have cast a shadow over the market in recent years.

While Ripple secured a favorable ruling in 2024, the SEC’s subsequent appeal has left the case’s final resolution uncertain. The cryptocurrency community is eager to see how the new SEC leadership under the Trump administration will approach these high-profile cases.

Ripple CEO Brad Garlinghouse took to X to express his excitement about the state of cryptocurrency and Ripple’s trajectory in 2025, citing the surge in momentum as the “Trump bull market.”

“The ‘Trump effect’ is already making crypto great again,” Garlinghouse stated, reflecting optimism within the industry about a more supportive regulatory environment for blockchain and cryptocurrency under the new administration.

Crypto

Best Cryptocurrency To Invest Today: Many Eye 100x Potential In 2025

The cryptocurrency market is buzzing as we enter January 2025, marked by groundbreaking news that further solidifies the potential of blockchain technology.

Bitcoin’s network settled an astonishing $19 trillion in transactions during 2024, doubling the previous year’s volume.

This remarkable achievement, reported by CryptoNews, underscores the explosive growth of decentralized finance and blockchain systems.

Amid this surge, new opportunities are emerging, and one project, The Rise of Memes ($RISE), has caught the attention of investors worldwide.

It’s no surprise that many are wondering if it’s the best cryptocurrency to invest in today. Let’s explore why this presale is creating such a buzz and how you can capitalize on this limited-time opportunity.

Is $RISE the Best Cryptocurrency to Invest Today?

A Unique Blend of GameFi and Meme Coins

The Rise of Memes isn’t just another cryptocurrency. It’s a comprehensive ecosystem that merges blockchain technology with mobile gaming to create a dynamic Play-to-Earn (P2E) experience.

Players lead various distinct factions at the helm of which stands a popular meme hero, inspired by the largest meme coins(DOGE, PEPE, SHIB, etc).

Each faction offers unique in-game playstyle, benefits and opportunities to earn real-world value. This combination of decentralized finance and the growing gig economy makes $RISE one of the best cheap cryptos to buy now.

Presale Advantage: Buy Low, Maximize Potential Returns

The Rise of Memes coin is currently in the presale phase, its ICO has just recently started and the process of buying $RISE tokens is very simple.

The $RISE presale offers a rare chance to secure tokens at their lowest price. Early-stage investors stand to gain significantly as the project evolves and adoption grows.

With 650 million tokens sold, momentum is building fast. With only 20% of the total supply allocated for the presale, chances are that many will not be able to get in early.

Don’t miss your chance to get in early on this promising project!

Join the $RISE Presale Here to maximize your investment potential.

Riding the Meme Coin and Blockchain Wave

Meme coins continue to demonstrate immense growth potential. Recently, Robert Kiyosaki, author of Rich Dad Poor Dad, expressed strong bullish sentiments on Bitcoin, even amidst market volatility.

As reported by Investing.com, this renewed optimism highlights the resilience and opportunities within the crypto market.

Building on this momentum, The Rise of Memes leverages its community-driven model, state-of-the-art technology, and engaging gameplay to position itself as a leader in the P2E and meme coin sectors.

Key Features of $RISE

Mobile Gaming and Blockchain Integration

At the core of The Rise of Memes is its integration of mobile gaming and blockchain. AI enhances gameplay with personalized experiences, while blockchain ensures transparency and security. This technological synergy is key to driving investor confidence and user engagement.

Decentralized Finance and Sustainability

The project embraces a circular economy, enabling players to earn and reinvest within the ecosystem. This approach aligns with the principles of decentralized finance (DeFi), ensuring sustainable growth for both investors and players.

Community Governance

Token holders could gain more than just financial returns—they also influence the platform’s development, creating a strong sense of community and shared purpose.

Why Act Now? Urgency is Key

The Rise of Memes brings together the world’s most recognizable cryptocurrencies that have delivered life-changing returns for their earliest investors.

Cryptos like Doge, Shiba Inu, Pepe and many others have become a beacon for many investors who are hoping to find the next best cryptocurrency to invest in today and repeat the success of its predecessors.

$RISE has huge potential due to bringing together all popular meme coin heroes into one coherent platform where everyone can make a name for himself and have fun in the process.

The presale is your chance to secure $RISE tokens at their lowest price due the price increasing every few days. Early adopters always reap the highest rewards, and with a vibrant community and innovative roadmap, $RISE is poised for exponential growth.

Buy $RISE Now before the price increases!

Stay Updated with $RISE

For real-time updates, news, and community discussions, follow $RISE on Telegram and X. Don’t miss out on the latest developments and opportunities to engage with the community.

The Rise of Memes represents the future of decentralized gaming and investment. As we step into January 2025, this is your opportunity to invest in the best cheap crypto to buy now and secure your bag of $RISE tokens. With its presale live and excitement building, the time to act is now. Seize this chance and join the next big thing in crypto today.

Crypto

Cryptocurrency wallet drainers stole $494 million in 2024

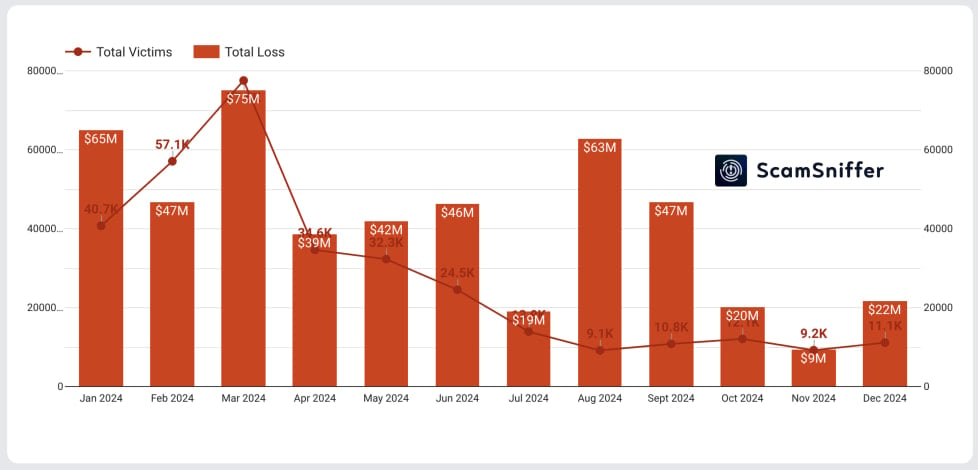

Scammers stole $494 million worth of cryptocurrency in wallet drainer attacks last year that targeted more than 300,000 wallet addresses.

This marks a 67% increase over 2023 figures although the number of victims only rose by 3.7%, indicating that victims held more significant amounts on average.

The data comes from web3 anti-scam platform ‘Scam Sniffer,’ which has been tracking wallet drainer activity for a while now, previously reporting attack waves that impacted up to 100,000 people at once.

Wallet drainers are phishing tools specifically designed to steal cryptocurrency or other digital assets from users’ wallets, often deployed on fake or compromised websites.

In 2024, Scam Sniffer observed 30 large-scale (above $1 million) thefts conducted via wallet drainers, with the largest single heist cashing in $55.4 million worth of cryptocurrency.

This occurred early in the year when Bitcoin’s price hikes fueled phishing activity. In the first quarter of the year, a total of $187 million was stolen via wallet drainer attacks.

Source: Scam Sniffer

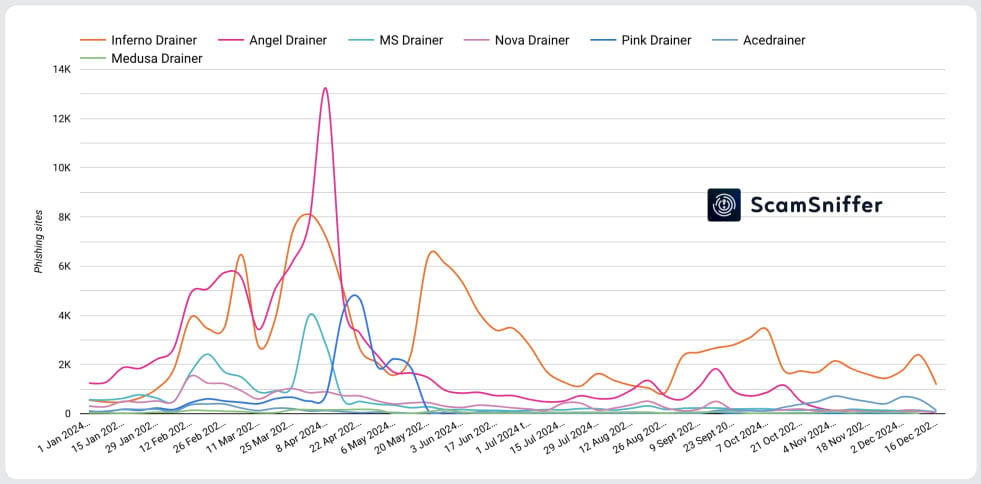

In the second quarter of the year, a notable drainer service named ‘Pink Drainer,’ previously seen impersonating journalists in phishing attacks to compromise Discord and Twitter accounts for cryptocurrency-stealing attacks, announced its exit.

Although this caused a drop in phishing activity, the scammers started to gradually pick up the pace in the third quarter with the Inferno service taking the the lead by causing $110 million in losses in August and September combined.

Finally, the activity subsided in the final quarter of the year, which only accounted for about 10.3% of the total losses recorded in 2024. At that time, Acedrainer also emerged as a major player, taking 20% of the drainer market, ScamSniffer says.

Source: Scam Sniffer

Most of the losses (85.3%) occurred on Ethereum, amounting to $152 million while staking (40.9%) and stablecoins (33.5%) were among the most targeted.

Regarding trends seen in 2024, Scam Sniffer highlights the use of fake CAPTCHA and Cloudflare pages, and IPFS to evade detection, as well as a shift in signature types facilitating money theft.

Specifically, most thefts relied on the ‘Permit’ signature (56.7%) or ‘setOwner’ (31.9%) to drain funds. The first gives approval for token spending as per the EIP-2612 standard, while the second updates smart contract ownership or administrative rights.

Another noteworthy trend is the increased use of Google Ads and Twitter ads as a source of traffic to the phishing websites, with the attackers using compromised accounts, bots, and fake token airdrops to achieve their goal.

Source: Scam Sniffer

To protect from Web3 attacks, the recommendation is to interact only with trusted and verified websites, cross-check URLs with official project websites, read transaction approval prompts and permission requests before signing, and simulate transactions before performing them.

Many wallets also offer built-in warnings for phishing or malicious transactions, so make sure to enable those. Finally, use token revoking tools to ensure no suspicious permissions are active.

-

Health1 week ago

Health1 week agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology1 week ago

Technology1 week agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

Business5 days ago

Business5 days agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture5 days ago

Culture5 days agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports5 days ago

Sports5 days agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics3 days ago

Politics3 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics3 days ago

Politics3 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics1 day ago

Politics1 day agoWho Are the Recipients of the Presidential Medal of Freedom?