Crypto

Crypto as currency: managing your financial life using digital coins

Many individuals have purchased and bought cryptocurrencies as an funding, but making an attempt to dwell on a wage paid in crypto is hard.

Alyssa Howell spent a lot of her profession within the gold-mining business earlier than becoming a member of a crypto-wallet firm final fall that pays all of its staff in bitcoin. The Denver-area resident mentioned studying the ins and outs of the crypto business — various kinds of digital wallets, non-fungible tokens (NFTs), and browser extensions — has been fairly an training.

“It has been a really steep studying curve for me,” mentioned Howell, 35, who works in investor relations for Exodus, a bitcoin and crypto pockets agency. “It’s only a new business, but additionally it is very fast-moving.

“So there’s at all times one thing new inside crypto that has developed.”

Howell by no means owned digital currencies earlier than taking this job. Now she is paid in bitcoin on the primary of each month — based mostly on her wage in U.S. {dollars}.

“If bitcoin is $50,000 (per token) and I make $25,000 per 30 days, I am going to obtain half of a bitcoin,” mentioned Howell. “Now on the primary [of the month], our firm units the value, so at a sure time on the primary of each month, they will say that is the alternate price for bitcoin.” Workers can then convert their crypto paychecks into {dollars}, with the corporate masking the conversion charges.

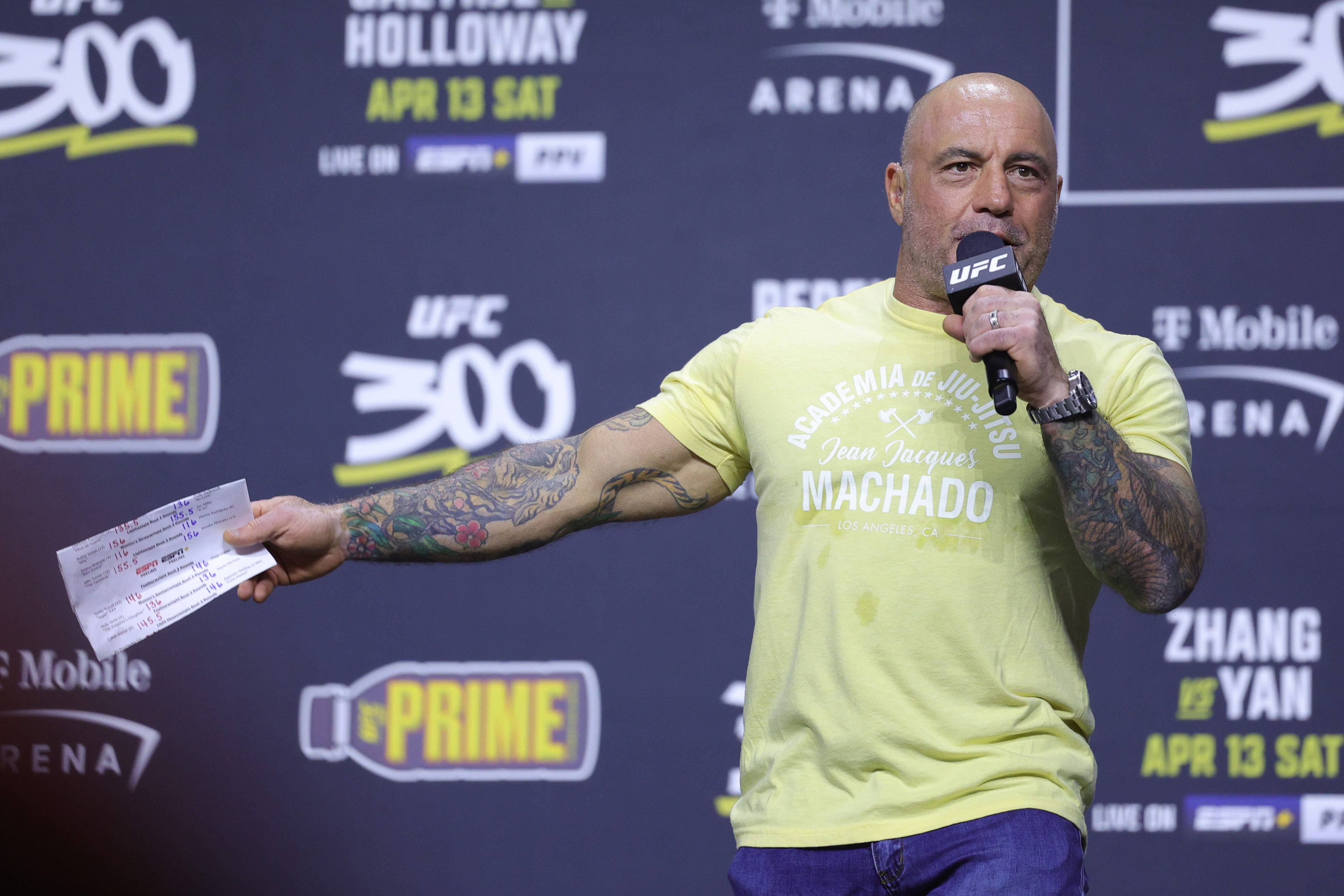

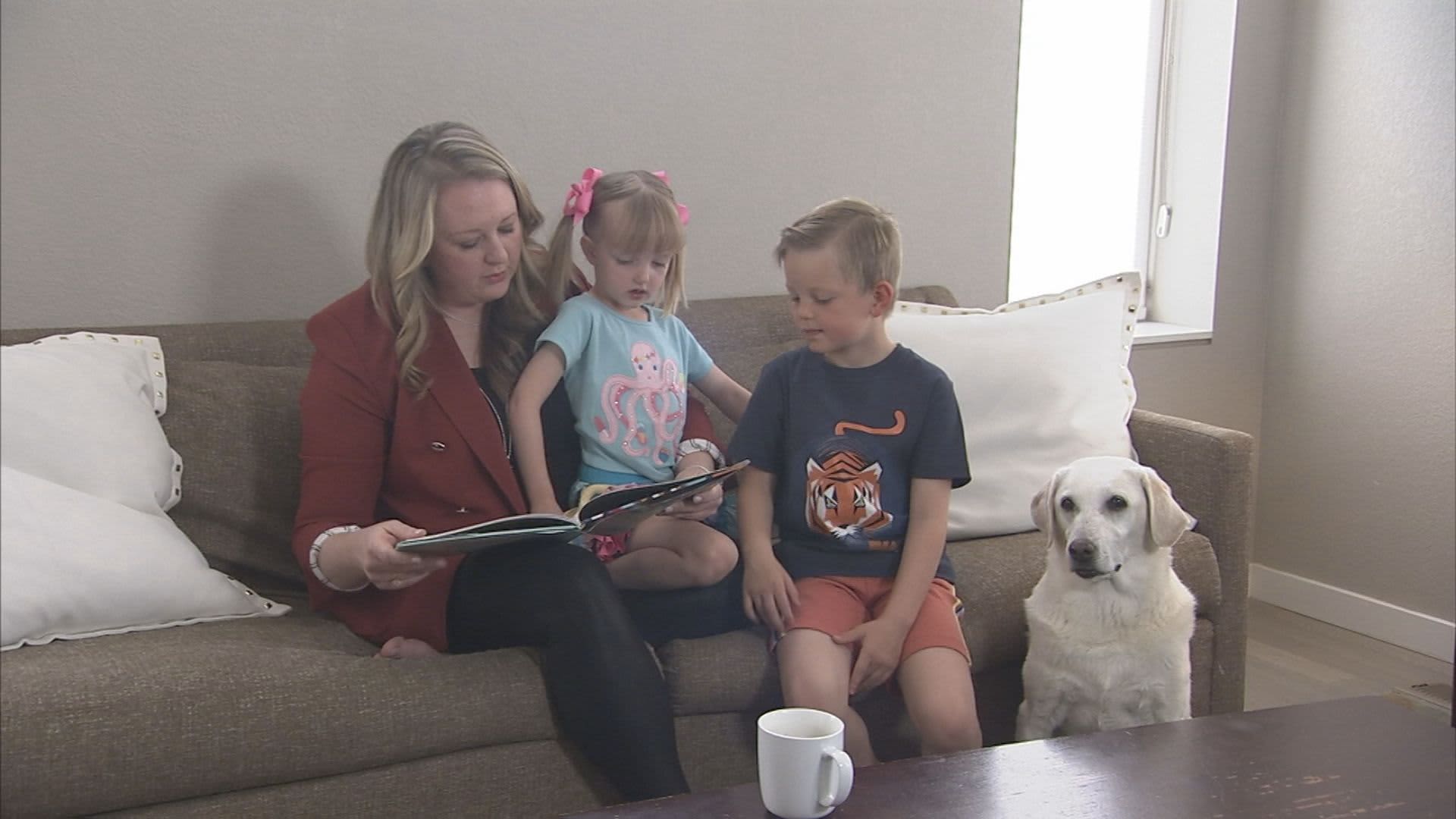

But, this single mom of two has gone all-in with crypto. She just lately bought a brand new dwelling, however struggled with the primary lender she tried not accepting her bitcoin revenue.

Allysa Howell, left, works for a crypto-wallet firm that pays all of its staff in bitcoin.

“I used to be disqualified from a mortgage, which made me actually nervous,” mentioned Howell as she mirrored on the expertise. “Fortunately, that is not the usual; the world is altering, the world is evolving.”

She discovered a lender to simply accept her bitcoin revenue and it was one which additionally let her make mortgage funds in cryptocurrency. Nonetheless, the mortgage was just lately bought and the brand new servicer is not going to take crypto funds.

“It was an enormous disappointment for me,” mentioned Howell, “I am going to have to purchase fiat [U.S. dollars] to pay my mortgage, and I actually attempt my greatest to dwell throughout the crypto area.”

Howell mentioned she retains 10% of her bitcoin pay for retirement financial savings and is not fearful concerning the forex’s ups and downs. “I am long-term cryptocurrency so I am not watching the volatility on the day at this time,” she mentioned. “I am right here for the subsequent 5 years, the subsequent decade, the subsequent 20 years.

“That is the place I actually see the chance,” she added.

Exodus’ CEO JP Richardson mentioned the corporate pays its staff in bitcoin to assist make digital currencies extra mainstream.

“By us backing the expertise and by us embracing that expertise and paying our staff with the expertise, we’re saying that we imagine on this long-term,” Richardson mentioned.

Richardson additionally lives a lot of his private monetary life utilizing crypto and he retains sufficient cash in U.S. {dollars} to handle bills, he mentioned, “in case, God forbid, one thing had been to occur to cryptocurrency.”

Bitcoin costs have been a on a curler coaster. The value hit a excessive above $68,000 and has traded under $30,000 for the final two weeks.

Monetary advisors warning traders to stability crypto investments with different monetary objectives. Earlier than investing in crypto, be sure you have adequate emergency financial savings and incapacity and life insurance coverage and are saving sufficient for retirement.

But advising purchasers may be tough.

Ersinkisacik | Istock | Getty Pictures

“We’re making an attempt to determine as an advisor, and as a fiduciary, what’s one of the best ways for us to assist our purchasers on this area,” mentioned Catherine Valega, an authorized monetary planner and chartered different funding analyst with Inexperienced Bee Advisory, based mostly within the Boston space.

Different concerns embrace charges incurred when exchanging bitcoin for {dollars} in addition to tax implications.

President Joe Biden issued an govt order in March for regulators to think about the dangers and advantages of cryptocurrencies.

Within the meantime, monetary advisors warn shoppers and traders that cryptocurrencies don’t present the identical protections that include a standard financial institution or brokerage account.

Nonetheless, Howell views cryptocurrency as the longer term and desires her youngsters to be taught its worth.

“What’s essential for me to show them is that cash has worth,” she mentioned. Though you may’t see it or really feel it, we ascribe worth to it.

“I’m actually centered on elevating them to be prudent and spend effectively.”

Crypto

Crypto And Bitcoin Go Mainstream In 2024: Here Are 5 Major Trends | Bitcoinist.com

There is no question that the cryptocurrency industry witnessed explosive growth in 2024, with the flagship cryptocurrency Bitcoin continuing to lead the market. Data shows that the total market capitalization of the crypto industry has more than doubled over the past year.

While it has been challenging to find a common theme for how the market has improved in 2024, it is easy to point out the different aspects of growth in the digital asset industry this year. A prominent blockchain firm has identified five trends that reflect the shift experienced in the crypto market in the past 12 months.

5 Trends In The Crypto Space In 2024

In its latest weekly report, market intelligence platform IntoTheBlock explained the five major on-chain trends that reflect the growth of the cryptocurrency industry in the past year. It’s been all (or mostly) fireworks for the digital asset market, specifically Bitcoin, in 2024.

Firstly, IntoTheBlock pointed to the growth and the rising dominance of Bitcoin in the crypto market, especially after the approval of spot exchange-traded funds in the United States. As a result, the premier cryptocurrency’s market share hit its highest level in over three and a half years.

The crypto analytics firm highlighted that Trump’s success in the presidential elections also played a role in driving higher the value of Bitcoin. All in all, Bitcoin’s dominance has now moved from under 50% to 59% year-to-date.

Like Bitcoin, the meme coin market also witnessed unprecedented growth in 2024, with its aggregate market capitalization surging by over 400%. IntoTheBlock specifically mentioned the introduction of Solana-based launchpad Pump.fun, which catalyzed a meme coin explosion in the Solana ecosystem.

Source: IntoTheBlock

However, this meme coin trend on the Solana network left a negative impact on the Ethereum ecosystem and ETH’s price performance in 2024. With meme coins shifting to Solana and non-fungible tokens (NFTs) not making a strong return this bull cycle, there was a decline in Ethereum network fees, leading to less ETH being burnt.

Furthermore, decentralized finance (DeFi) saw a resurgence in 2024, as fresh capital flowed into various protocols and projects. As less value was lost to hacks and exploits and regulatory pressure was reduced in 2024, the aggregate market cap of the DeFi sector hit its highest since early 2022.

Finally, IntoTheBlock noted that new projects that were pioneered during the last bear market saw remarkable growth in 2024. For instance, restaking projects and basis trading protocols were some of the highlights in the crypto space in the past year.

Total Crypto Market Cap

As of this writing, the total cryptocurrency market capitalization stands at around $3.49 trillion. According to data from TradingView, the crypto market cap has increased by more than 105% year-to-date.

The total cryptocurrency market capitalization at $3.3 trillion | Source: daily TOTAL chart on TradingView

Featured image from Pexels, chart from TradingView

Crypto

Governments and banks once mocked Bitcoin. Now they want in on it

Bitcoin has proven to be one of the best-performing assets in modern history.

The value of the cryptocurrency has increased some 1,000 times over the past decade, far outpacing US stocks and real estate.

Buoyed by United States President-elect Donald Trump’s crypto-friendly stance, Bitcoin’s record rally hit a new high of $107,000 on Monday after the Republican reiterated his intention to create a Bitcoin strategic reserve.

Bitcoin, the first decentralised digital currency, was invented by the pseudonymous figure Satoshi Nakamoto in the wake of the 2007-2008 global financial crisis.

Nakamoto introduced the blockchain system – a digital ledger that stores transactions in a network of computers – to enable anyone to make financial transactions without the involvement of banks, financial firms or governments.

Once widely derided as a speculative asset with no intrinsic value, Bitcoin is being taken increasingly seriously by governments, financial institutions and investors alike.

Boaz Sobrado, a London-based fintech analyst, said Bitcoin has transformed from being a niche asset favoured by political dissidents and criminals carrying out Illicit transactions “to something that central banks have to keep in mind and consider”.

“The IMF has put very firm anti-crypto political guidelines into place when negotiating with countries that might require its own assistance. It’s gone from being an academic question to a practical, real one and one that central banks are taking very seriously now,” Sobrado told Al Jazeera.

In January, the US Securities and Exchange Commission (SEC) approved Bitcoin ETFs (exchange-traded funds), allowing investors to have exposure to the asset on the stock exchange for the first time.

In an October report, the US Department of the Treasury referred to Bitcoin as “digital gold”, noting its use as a store of value.

A number of countries have made big bets on the cryptocurrency.

El Salvador has accumulated some $600m worth of Bitcoin reserves and is one of just a handful of countries, along with the Central African Republic, that accepts the asset as legal tender.

Other countries, including the US and the United Kingdom, have acquired large holdings of Bitcoin through the seizure of assets implicated in criminal activity.

The US has seized at least 215,000 Bitcoins, valued at almost $21bn at current prices, since 2020, according to an analysis by crypto firm 21.co.

With Trump returning to the White House, Bitcoin supporters are hopeful that cryptocurrencies will gain unprecedented legitimacy after years of government-led crackdowns on the sector.

Despite once labelling Bitcoin “a scam”, Trump has emerged as arguably the world’s most powerful advocate for the asset.

After pledging to make the US “crypto capital of the planet”, he has picked several high-profile crypto enthusiasts to join his incoming administration, including former PayPal Chief Operating Officer David Sacks as crypto tsar and Paul Atkins as SEC chair.

Trump’s pro-crypto stance has found allies in the US Congress, such as Senator Cynthia Lummis, a Republican from Wyoming, who earlier this year introduced the BITCOIN Act of 2024, which would include Bitcoin among reserve assets such as gold and oil as a long-term store of value.

Under Lummis’s plans, the government would buy roughly 200,000 Bitcoins every year for five years, and then hold the assets for 20 years as a hedge against inflation.

“If we did that with five percent of all the Bitcoin that will ever exist – which is roughly a million Bitcoin – we could cut our debt in half in 20 years,” Lummis said in a television interview with Fox Business.

On Wall Street, derision and mockery have also given way to more positive appraisals.

BlackRock CEO Larry Fink, who once described Bitcoin as an “index of money laundering”, in January said the commodity was “no different than what gold represented for thousands of years” and an “asset class that protects you”.

‘Currency of resistance’

The key attribute of Bitcoin that makes it revolutionary is that it separates money from the state, according to Max Keiser, senior Bitcoin adviser to El Salvador President Nayib Bukele.

“This is the first time in history that this has ever happened – money exists that has no central authority controlling it. This is what makes it unique, very powerful,” Keiser told Al Jazeera.

“There’s now this growing feeling that the 21st century will be the century of Bitcoin.”

Keiser spotted Bitcoin’s potential early on and advised people to buy it when its value was only $1 in 2011. That year, he and his wife, television presenter Stacy Herbert, called Bitcoin “the currency of resistance”, and predicted it would top $100,000.

One of the reasons Bitcoin has gained strength in value is the poor performance of economies such as Argentina, where inflation last year skyrocketed more than 200 percent, according to Gerald Celente, founder and director of the New York-based Trends Research Institute.

“People were seeing their currencies being devalued… People were saying: ‘I’m losing all my money, what am I going to do?’ They can’t afford to buy gold, so they started buying whatever they could in cryptocurrencies like Bitcoin, so that kept it strong,” Celente told Al Jazeera.

Since Trump’s election, Bitcoin’s price has risen by more than 50 percent and with an incoming pro-crypto administration, Celente predicts an even greater rally.

“[The value] could go through the roof, but we don’t see [Bitcoin] going down much at all,” he said.

Crypto supporters argue that Bitcoin’s winning advantage is that its global supply is capped at 21 million.

Unlike central banks that can print money indefinitely, Bitcoin’s supply stays constant no matter the demand, which has helped boost its value against the dollar.

Armando Pantoja, futurist and tech investor, believes that Bitcoin will appreciate in value “forever”, likening the purchase of the asset to buying real estate in Manhattan.

“Bitcoin has value not because of the currency, but because of the technology that governs it, blockchain technology,” Pantoja told Al Jazeera.

“In Bitcoin’s blockchain, there’s a certain supply of Bitcoin that comes out every 10 minutes, and every four years they cut it in half. Over time there is less and less Bitcoin being generated.

“Once it reaches the limit, no more can be created… That’s why it’s going to keep going up, every four years when they cut the supply, it has to respond positively. It has to keep going up to supply the demand.”

Keiser predicts Bitcoin will reach $1m in value in the coming years, with a market cap at least equal to gold’s market cap of $20 trillion.

“That would be $1m a coin. I think that would be a conservative estimate for the price for the next three to four years,” he said.

Bitcoin’s stellar rise, however, has not convinced everyone.

Despite its recent rally, the commodity continues to be extremely volatile.

After hitting $107,000 at the start of the week, the asset had by Friday plunged below $97,000.

Many financial analysts continue to view Bitcoin as a bubble with little to support its stunning rise.

“The more resources Americans misallocate to #Bitcoin and #crypto-related businesses, the fewer resources will be available to devote to making stuff we actually need,” Peter Schiff, chief economist at Euro Pacific Capital, said in a post on X last month.

“The end result will be larger trade deficits, a weaker dollar, higher inflation, and a lower standard of living.”

Even as Trump’s positive stance towards Bitcoin has thrilled crypto enthusiasts, some pro-crypto governments have reined in their support of the sector.

El Salvador announced this week that it would privatize or close its cryptocurrency wallet “Chivo” as part of the terms of a $1.4bn loan deal with the International Monetary Fund (IMF).

Bukele’s government also agreed to make acceptance of Bitcoin by businesses voluntary, within steps to assuage the IMF’s concerns about Bitcoin-related risks.

Central bank digital currencies

Some crypto supporters see governments and central banks taking a leading role in the global march towards digitised money with the development of their own currencies.

Celente of the Trends Research Institute said the US, for example, could create its own digital currency as a way to pay off its federal debt.

“There’s no way the US can pay off their $36 trillion worth of government debt. They may come up with a new cryptocurrency as part of CBDCs (Central Bank Digital Currency),” Celente said.

“You’re seeing more and more of the central banks talking about CBDCs, they’re definitely going to go into that direction,” Celente added.

“They’re going to use this as an excuse to come up with a coin because they cannot pay off the debt that they have now. They’re going to say, ‘This [digital currency] is worth a lot more than the dollar, yuan, the euro,’ and use that to pay off their debt.”

Some observers have warned that the introduction of CBDCs would open a Pandora’s box of problems related to government control and surveillance of people’s finances.

Trump’s pick for commerce secretary, Howard Lutnick, is the CEO of Cantor Fitzgerald, which manages the stockpile of US Treasuries that back Tether, the largest stablecoin by market cap.

Stablecoins are cryptocurrencies that are pegged to a traditional commodity or currency to maintain a stable price. They have reached record volumes of more than $200bn in total market cap.

Sobrado said there could be an opening for Tether to become the national de facto privatised CBDC for the US, and for smaller economies such as the UAE, Hong Kong, Singapore and Switzerland to issue their own CBDCs.

“The pro-crypto voices and Fed-critical voices have never been louder in the White House,” Sobrado said.

Celente said he had no doubt that the future of money is digital.

“There’s no question at all,” he affirmed.

Crypto

Hawk Tuah girl Haliey Welch finally breaks silence on crypto scandal: ‘I take this situation extremely seriously…’

‘Hawk Tuah’ girl Haliey Welch is determined to clear her name and rebuild her career following the fallout from a cryptocurrency scandal that has left her reputation under scrutiny.

The controversy stems from the huge crash of the $HAWK meme-coin, which Welch had promoted, and a subsequent lawsuit alleging improper registration of the cryptocurrency.

The lawsuit, filed by investors, targets overHere Ltd., its founder Clinton So, influencer Alex Larson Schultz, and the Tuah The Moon Foundation. It accuses them of unlawfully promoting and selling an unregistered cryptocurrency. Despite her public association with the memecoin, Welch herself is not named as a defendant

ALSO READ| Hawk Tuah girl Hailey Welch could be arrested for ‘crypto scam’. Here’s how

A source close to Welch told Daily Mail, “Haliey understands how her unexpected start in the industry comes across, but since achieving virality, she’s proven she has the star power to lead a successful career.”

“She plans to keep pushing forward after clearing up the narrative around her involvement in this project.”

Welch has enlisted the help of Burwick Law, a firm specializing in crypto litigation, to uncover the truth behind the project and hold the responsible parties accountable.

Haliey Welch denies leading $HAWK project

Daily Mail reported that Welch’s role in the project was limited. “She did not spearhead or create the crypto project,” the source explained. “She was nothing more than a paid spokesperson who received a sponsorship fee to lend her persona to the team that created and launched the $HAWK memecoin.”

“I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community. I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the truth, hold the responsible parties accountable, and resolve this matter,” Welch told Daily Mail.

ALSO READ| Hawk Tuah Girl’s meme coin crashes from $500m to $60m in minutes, fans in meltdown

The lawsuit alleges that the $HAWK token soared to a $490 million market cap before plummeting by over 90% within hours of its December 4 launch. Investors claim the presale raised approximately $2.8 million at a valuation of $16.69 million. Plaintiffs are seeking over $150,000 in damages, accusing the defendants of marketing the coin unlawfully and making minimal efforts to restrict its sale outside the US.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside the launch — and future — of ChatGPT

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Politics1 week ago

Politics1 week agoConservative group debuts major ad buy in key senators' states as 'soft appeal' for Hegseth, Gabbard, Patel

-

Business6 days ago

Business6 days agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology6 days ago

Technology6 days agoMeta’s Instagram boss: who posted something matters more in the AI age