Business

The fast-food industry claims the California minimum wage law is costing jobs. Its numbers are fake

The fast-food industry has been wringing its hands over the devastating impact on its business from California’s new minimum wage law for its workers.

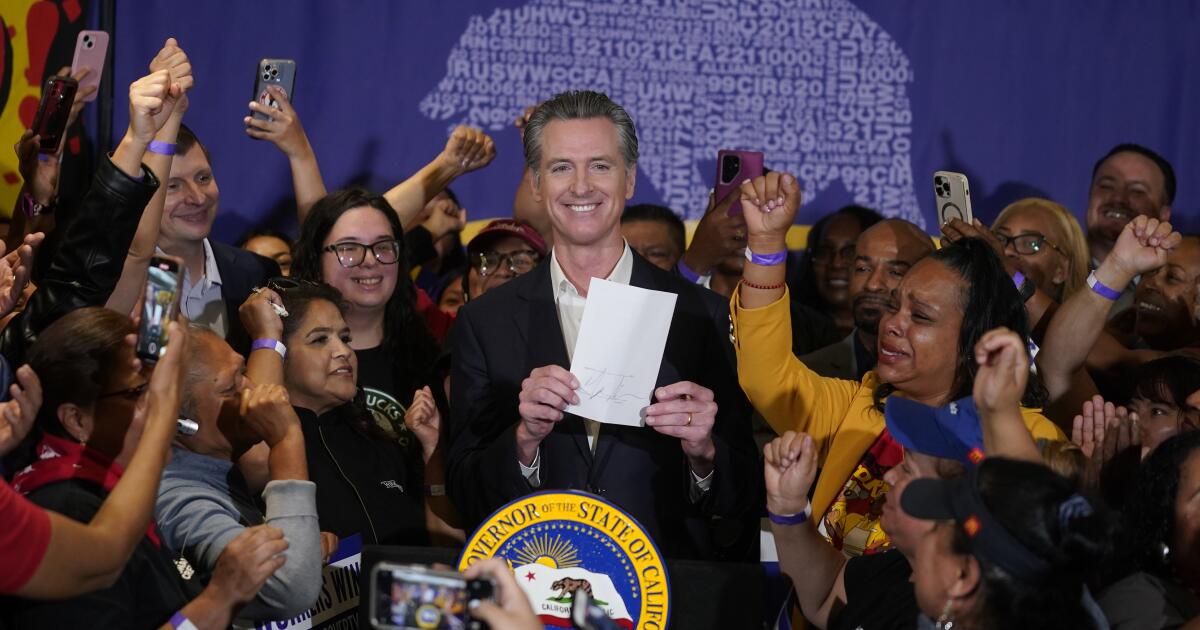

Their raw figures certainly seems to bear that out. A full-page ad recently placed in USA Today by the California Business and Industrial Alliance asserted that nearly 10,000 fast-food jobs had been lost in the state since Gov. Gavin Newsom signed the law in September.

The ad listed a dozen chains, from Pizza Hut to Cinnabon, whose local franchisees had cut employment or raised prices, or are considering taking those steps. According to the ad, the chains were “victims of Newsom’s minimum wage,” which increased the minimum wage in fast food to $20 from $16, starting April 1.

The rapid job cuts, rising prices, and business closures are a direct result of Governor Newsom and this short-sighted legislation

— Business lobbyist Tom Manzo, touting misleading statistics

Here’s something you might want to know about this claim. It’s baloney, sliced thick. In fact, from September through January, the period covered by the ad, fast-food employment in California has gone up, as tracked by the Bureau of Labor Statistics and the Federal Reserve. The claim that it has fallen represents a flagrant misrepresentation of government employment figures.

Something else the ad doesn’t tell you is that after January, fast-food employment continued to rise. As of April, employment in the limited-service restaurant sector that includes fast-food establishments was higher by nearly 7,000 jobs than it was in April 2023, months before Newsom signed the minimum wage bill.

Despite that, the job-loss figure and finger-pointing at the minimum wage law have rocketed around the business press and conservative media, from the Wall Street Journal to the New York Post to the website of the conservative Hoover Institution.

We’ll be taking a closer look at the corporate lobbyist sleight-of-hand that makes job gains look like job losses. But first, a quick trot around the fast-food economic landscape generally.

Few would argue that the restaurant business is easy, whether we’re talking about high-end sit-down dining, kiosks and food trucks, or franchised fast-food chains. The cost of labor is among the many expenses that owners have to deal with, but in recent years far from the worst. That would be inflation in the cost of food.

Newport Beach-based Chipotle Mexican Grill, for example, disclosed in its most recent annual report that food, beverage and packaging cost it $2.9 billion last year, up from $2.6 billion in 2022 — though those costs declined as a share of revenue to 29.5% from 30.1%. Labor costs in 2023 came to $2.4 billion, but fell to 24.7% of revenue from 25.5% in 2022.

At Costa Mesa-based El Pollo Loco, labor and related costs fell last year by $3.5 million, or 2.7%, despite an increase of $4.1 million that the company attributed to higher minimum wages enacted in the past as well as “competitive pressure” — in other words, the necessity of paying more to attract employees in a tight labor market.

Then there’s Rubio’s Coastal Grill. On June 3 the Carlsbad chain confirmed that it had closed 48 of its California restaurants, about one-third of its 134 locations. As my colleague Don Lee reported, Rubio’s attributed the closings to the rising cost of doing business in California.

There’s more to the story, however. The biggest expense Rubio’s has been facing is debt — a burden that has grown since the chain was acquired in 2010 by the private equity firm Mill Road Capital. By 2020, the chain owed $72.3 million, and it filed for bankruptcy. Indeed, in its full declaration with the bankruptcy court filed on June 5, the company acknowledged that along with increases in the minimum wage, it was facing an “unsustainable debt burden.”

The company emerged from bankruptcy at the end of 2020 with settlements that included a reduction in its debt load. Then came the pandemic, a significant headwind. Among its struggles was again its debt — $72.9 million owed to its largest creditor, TREW Capital Management, a firm that specializes in lending to distressed restaurant businesses. It filed for bankruptcy again on June 5, two days after announcing its store closings. The case is pending.

Fast-food and other restaurant jobs slump every year from the fall through January, due to seasonal factors (red line); seasonal adjustments (blue line) give a more accurate picture of employment trends. The sharp decline in 2020 was caused by the pandemic.

(Federal Reserve Bank of St. Louis)

It’s worth noting that high debt is often a feature of private-equity takeovers — in such cases saddling an acquired company with debt gives the acquirers a means to extract cash from their companies, even if it complicates the companies’ path to profitability. Whether that’s a factor in Rubio’s recent difficulties isn’t clear.

That brings us back to the claim that job losses among California’s fast-food restaurants are due to the new minimum wage law.

The assertion appears to have originated with the Wall Street Journal, which reported on March 25 that restaurants across California were cutting jobs in anticipation of the minimum wage increase taking effect on April 1.

The article stated that employment in California’s fast food and “other limited-service eateries was 726,600 in January, “down 1.3% from last September,” when Newsom signed the minimum wage law. That worked out to employment of 736,170 in September, for a purported loss of 9,570 jobs from September through January.

The Journal’s numbers were used as grist by UCLA economics professor Lee E. Ohanian for an article he published on April 24 on the website of the Hoover Institution, where he is a senior fellow.

Ohanian wrote that the pace of the job loss in fast-food was far greater than the overall decline in private employment in California from September through January, “which makes it tempting to conclude that many of those lost fast-food jobs resulted from the higher labor costs employers would need to pay” when the new law kicked in.

CABIA cited Ohanian’s article as the source for its claim in its USA Today ad that “nearly 10,000” fast-food jobs were lost due to the minimum wage law. “The rapid job cuts, rising prices, and business closures are a direct result of Governor Newsom and this short-sighted legislation,” CABIA founder and president Tom Manzo says on the organization’s website.

Here’s the problem with that figure: It’s derived from a government statistic that is not seasonally adjusted. That’s crucial when tracking jobs in seasonal industries, such as restaurants, because their business and consequently employment fluctuate in predictable patterns through the year. For this reason, economists vastly prefer seasonally adjusted figures when plotting out employment trendlines in those industries.

The Wall Street Journal’s figures correspond to non-seasonally adjusted figures for California fast-food employment published by the Bureau of Labor Statistics. (I’m indebted to nonpareil financial blogger Barry Ritholtz and his colleague, the pseudonymous Invictus, for spotlighting this issue.)

Figures for California fast-food restaurants from the Federal Reserve Bank of St. Louis show that on a seasonally adjusted basis employment actually rose in the September-to-January period by 6,335 jobs, from 736,160 to 742,495.

That’s not to say that there haven’t been employment cutbacks this year by some fast-food chains and other companies in hospitality industries. From the vantage point of laid-off workers, the manipulation of statistics by their employers doesn’t ease the pain of losing their jobs.

Still, as Ritholtz and Invictus point out, it’s hornbook economics that the proper way to deal with seasonally adjusted figures is to use year-to-year comparisons, which obviate seasonal trends.

Doing so with the California fast-food statistics give us a different picture from the one that CABIA paints. In that business sector, September employment rose from a seasonally adjusted 730,000 in 2022 to 741,079 in 2024. In January, employment rose from 732,738 in 2023 to 742,495 this year.

Restaurant lobbyists can’t pretend that they’re unfamiliar with the concept of seasonality. It’s been a known feature of the business since, like, forever.

The restaurant consultantship Toast even offers tips to restaurant owners on how to manage the phenomenon, noting that “April to September is the busiest season of the year,” largely because that period encompasses Mother’s Day and Father’s Day, “two of the busiest restaurant days of the year,” and because good weather encourages customers to eat out more often.

What’s the slowest period? November to January, “when many people travel for holidays like Thanksgiving or Christmas and spend time cooking and eating with family.”

In other words, the lobbyists, the Journal and their followers all based their expressions of concern on a known pattern in which restaurant employment peaks into September and then slumps through January — every year.

They chose to blame the pattern on the California minimum wage law, which plainly had nothing to do with it. One can’t look into their hearts and souls, but under the circumstances their arguments seem more than a teensy bit cynical.

The author of the Wall Street Journal article, Heather Haddon, didn’t reply to my inquiry about why she appeared to use non-seasonally adjusted figures when the adjusted figures were more appropriate. Tom Manzo, the founder and president of CABIA, didn’t respond to my request for comment.

Ohanian acknowledged by email that “if the data are not seasonally adjusted, then no conclusions can be drawn from those data regarding AB 1228,” the minimum wage law. He said he interpreted the Wall Street Journal’s figures as seasonally adjusted and said he would query the Journal about the issue in anticipation of writing about the issue later this summer.

He did observe, quite properly, that the labor cost increase from the law was large and that “if franchisees continue to face large food cost increases later this year, then the industry will really struggle.” Fast-food companies already have instituted sizable price increases to cover their higher expenses, he observed. “The question thus becomes how sensitive are fast-food consumers to higher prices,” a topic he says he will be researching as the year goes on.

Business

Labubu maker Pop Mart is opening U.S. headquarters in Culver City

Pop Mart, the Chinese toymaker known for its collectible Labubu dolls, reportedly plans to open a new office building in Culver City as it seeks to expand its North American presence.

The 22,000-square-foot office will serve as Pop Mart’s new U.S. headquarters, according to real estate data provider CoStar, which earlier reported the deal.

Pop Mart, founded in 2010 in Beijing, is credited with fueling the frenzy over “blind boxes” — small, collectible toys sold in packaging that keeps the exact figure inside a surprise until it is unsealed.

The toymaker, which is publicly traded on the Hong Kong Stock Exchange, has nearly 600 physical stores across 18 countries, according to its September 2025 half-year financial report.

Much of its recent growth has concentrated in the U.S. In the first half of last year, the company opened 40 new stores, including 19 in the Americas. In Southern California, it now has stores in Westfield Century City, Glendale Galleria, and Westfield UTC Mall in La Jolla.

The office building Pop Mart is moving into, named “Slash,” features leaning glass windows and a distinguishable jagged design. The 1999 building was designed by the Los Angeles architect Eric Owen Moss.

Pop Mart’s decision to root itself in L.A.’s Westside comes amid Culver City’s transformation from a sleepy suburb known for being the home to Sony Pictures Studios — to an urban hub, driven, in part, by the Expo Line station that opened in 2012.

Ikea recently announced plans to open a 40,000-square-foot store in Culver City’s historic Helms Bakery complex — its first in L.A.’s Westside — later this spring.

Big tech has played an important role in Culver City’s recent evolution. Recent additions include Apple, which has opened a studio and has been building a larger office campus; Amazon, which in 2022 unveiled a massive virtual production stage, and Tiktok, which in 2020 opened a five-floor office featuring a content creation studio. Pinterest has a new office in Culver City as of last month, according to the company’s LinkedIn account.

Business

After Warner Bros. merger, changes are coming to the historic Paramount lot. Here’s what to expect

With Paramount Skydance’s acquisition of Warner Bros. expected to saddle the combined company with $79 billion in debt, Paramount executives are looking to do away with redundant assets including real estate — and there is a lot of that.

Chief in the public’s imagination are their historic studios in Burbank and Hollywood, where legendary films and television show have been made for generations and continue to operate year-round.

“Both of these studios are in the core [30-mile zone,] the inner circle of where Hollywood talent wants to be,” entertainment property broker Nicole Mihalka of CBRE said. “It’s very prime real estate.”

When Sony and Apollo were bidding for Paramount in early 2024, their plan was to sell the Paramount property, but there is no indication that Paramount would part with its namesake lot.

For now, Paramount’s plan is to keep both studios operating with each studio releasing about 15 films a year, but the goal is to eventually consolidate most of the studio operations around the Warner Bros. lot in Burbank in order to to eliminate redundancies with the Paramount lot on Melrose Avenue, people close to Chief Executive David Ellison said.

A view of the Warner Bros. Studios water tower Feb. 23, 2026, in Burbank.

(Eric Thayer / Los Angeles Times)

Paramount would not look to raze its celebrated studio lot — the oldest operating film studio in Los Angeles — because of various restrictions on historic buildings there. Paramount also has a relatively new post-production facility on site and will likely need to the studio space.

Instead, the plan would be to lease out space for film productions, including those from combined Paramount-HBO streaming operations. Ellison also is considering plans to develop other parts of the 65-acre site for possible retail use, as well as renting space for commercial offices.

The studios’ combined property holdings are vast, and real estate data provider CoStar estimates they have about 12 million square feet of overlapping uses, including their studio campuses, offices and long-term leases in such film centers as Burbank, Hollywood and New York.

Century-old Paramount Pictures Studios is awash in Hollywood history — think Gloria Swanson as Norma Desmond desperately trying to enter its famous gate in “Sunset Boulevard,” and other classics such as “The Godfather,” “Titanic” and “Breakfast at Tiffany’s.”

The lot, however, is a congested warren of stages, offices, trailers and support facilities such as woodworking mills that date to the early 20th century. The layout is byzantine in part because Paramount bought the former rival RKO studio lot from Desilu Productions to create the lot known today.

Warner Bros. occupies 11 million square feet and owns 14 properties totaling 9.5 million square feet, largely in the United States and United Kingdom, CoStar said. About 3 million square feet of that commercial property is in the Los Angeles area.

The firm’s portfolio also includes the sprawling Warner Bros. Studios Leavesden complex in the U.K. and Turner Broadcasting System headquarters in Atlanta.

Paramount Skydance occupies 8 million square feet and owns 14 properties totaling 2.1 million square feet, according to CoStar. In addition to its Hollywood campus, Paramount’s holdings include prominent buildings in New York such as the Ed Sullivan Theater and CBS Broadcast Center.

Warner Bros. operates a 3-million-square-foot lot in Burbank with more than 30 soundstages — along with space for building sets and backlot areas — where famous movies including “Casablanca” and television shows such as “Friends” were filmed. Paramount’s 1.2-million-square-foot Melrose campus anchors a broader network of owned and leased production space, CoStar said.

Paramount’s lot is already cleared for more development. More than a decade ago, Paramount secured city approval to add 1.4 million square feet to its headquarters and some adjacent properties owned by the company.

The redevelopment plan, valued at $700 million in 2016, underwent years of environmental review and public outreach with neighbors and local business owners.

The plan would allow for construction of up to 1.9 million square feet of new stage, production office, support, office, and retail uses, and the removal of up to 537,600 square feet of existing stage, production office, support, office, and retail uses, for a net increase of nearly 1.4 million square feet.

The proposal preserves elements of the past by focusing future development on specific portions of the lot along Melrose and limited areas in the production core, architecture firm Rios said.

The Warner Bros. and Paramount lots “are two of the most prime pieces of real estate in the country,” Mihalka said. “These are legacy assets with a lot of potential to be [tourist] attractions in addition to working studios.”

Hollywood is still reeling from previous mergers, in addition to a sharp pullback in film and television production locally as filmmakers chase tax credits offered overseas and in other states, including New York and New Jersey.

Last year, lawmakers boosted the annual amount allocated to the state’s film and TV tax credit program and expanded the criteria for eligible projects in an attempt to lure production back to California. So far, more than 100 film and TV projects have been awarded tax credits under the revamped program.

The benefits have been slow to materialize, but Mihalka predicts that the tax credits and desirability of working close to home will lead to more studio use in the Los Angeles area, including at Warner Bros. and Paramount.

“These are such prime locations that we’ll see show runners and talent push back on having shows located out of state and insist on being here,” she said. “I think you’re going to see more positive movement here.”

Times staff writer Meg James contributed to this report.

Business

How our AI bots are ignoring their programming and giving hackers superpowers

Welcome to the age of AI hacking, in which the right prompts make amateurs into master hackers.

A group of cybercriminals recently used off-the-shelf artificial intelligence chatbots to steal data on nearly 200 million taxpayers. The bots provided the code and ready-to-execute plans to bypass firewalls.

Although they were explicitly programmed to refuse to help hackers, the bots were duped into abetting the cybercrime.

According to a recent report from Israeli cybersecurity firm Gambit Security, hackers last month used Claude, the chatbot from Anthropic, to steal 150 gigabytes of data from Mexican government agencies.

Claude initially refused to cooperate with the hacking attempts and even denied requests to cover the hackers’ digital tracks, the experts who discovered the breach said. The group pummelled the bot with more than 1,000 prompts to bypass the safeguards and convince Claude they were allowed to test the system for vulnerabilities.

AI companies have been trying to create unbreakable chains on their AI models to restrain them from helping do things such as generating child sexual content or aiding in sourcing and creating weapons. They hire entire teams to try to break their own chatbots before someone else does.

But in this case, hackers continuously prompted Claude in creative ways and were able to “jailbreak” the chatbot to assist them. When they encountered problems with Claude, the hackers used OpenAI’s ChatGPT for data analysis and to learn which credentials were required to move through the system undetected.

The group used AI to find and exploit vulnerabilities, bypass defences, create backdoors and analyze data along the way to gain control of the systems before they stole 195 million identities from nine Mexican government systems, including tax records, vehicle registration as well as birth and property details.

AI “doesn’t sleep,” Curtis Simpson, chief executive of Gambit Security, said in a blog post. “It collapses the cost of sophistication to near zero.”

“No amount of prevention investment would have made this attack impossible,” he said.

Anthropic did not respond to a request for comment. It told Bloomberg that it had banned the accounts involved and disrupted their activity after an investigation.

OpenAI said it is aware of the attack campaign carried out using Anthropic’s models against the Mexican government agencies.

“We also identified other attempts by the adversary to use our models for activities that violate our usage policies; our models refused to comply with these attempts,” an OpenAI spokesperson said in a statement. “We have banned the accounts used by this adversary and value the outreach from Gambit Security.”

Instances of generative AI-assisted hacking are on the rise, and the threat of cyberattacks from bots acting on their own is no longer science fiction. With AI doing their bidding, novices can cause damage in moments, while experienced hackers can launch many more sophisticated attacks with much less effort.

Earlier this year, Amazon discovered that a low-skilled hacker used commercially available AI to breach 600 firewalls. Another took control of thousands of DJI robot vacuums with help from Claude, and was able to access live video feed, audio and floor plans of strangers.

“The kinds of things we’re seeing today are only the early signs of the kinds of things that AIs will be able to do in a few years,” said Nikola Jurkovic, an expert working on reducing risks from advanced AI. “So we need to urgently prepare.”

Late last year, Anthropic warned that society has reached an “inflection point” in AI use in cybersecurity after disrupting what the company said was a Chinese state-sponsored espionage campaign that used Claude to infiltrate 30 global targets, including financial institutions and government agencies.

Generative AI also has been used to extort companies, create realistic online profiles by North Korean operatives to secure jobs in U.S. Fortune 500 companies, run romance scams and operate a network of Russian propaganda accounts.

Over the last few years, AI models have gone from being able to manage tasks lasting only a few seconds to today’s AI agents working autonomously for many hours. AI’s capability to complete long tasks is doubling every seven months.

“We just don’t actually know what is the upper limit of AI’s capability, because no one’s made benchmarks that are difficult enough so the AI can’t do them,” said Jurkovic, who works at METR, a nonprofit that measures AI system capabilities to cause catastrophic harm to society.

So far, the most common use of AI for hacking has been social engineering. Large language models are used to write convincing emails to dupe people out of their money, causing an eight-fold increase in complaints from older Americans as they lost $4.9 billion in online fraud in 2025.

“The messages used to elicit a click from the target can now be generated on a per-user basis more efficiently and with fewer tell-tale signs of phishing,” such as grammatical and spelling errors, said Cliff Neuman, an associate professor of computer science at USC.

AI companies have been responding using AI to detect attacks, audit code and patch vulnerabilities.

“Ultimately, the big imbalance stems from the need of the good-actors to be secure all the time, and of the bad-actors to be right only once,” Neuman said.

The stakes around AI are rising as it infiltrates every aspect of the economy. Many are concerned that there is insufficient understanding of how to ensure it cannot be misused by bad actors or nudged to go rogue.

Even those at the top of the industry have warned users about the potential misuse of AI.

Dario Amodei, the CEO of Anthropic, has long advocated that the AI systems being built are unpredictable and difficult to control. These AIs have shown behaviors as varied as deception and blackmail, to scheming and cheating by hacking software.

Still, major AI companies — OpenAI, Anthropic, xAI, and Google — signed contracts with the U.S. government to use their AIs in military operations.

This last week, the Pentagon directed federal agencies to phase out Claude after the company refused to back down on its demand that it wouldn’t allow its AI to be used for mass domestic surveillance and fully autonomous weapons.

“The AI systems of today are nowhere near reliable enough to make fully autonomous weapons,” Amodei told CBS News.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Wisconsin5 days ago

Wisconsin5 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts3 days ago

Massachusetts3 days agoMassachusetts man awaits word from family in Iran after attacks

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Maryland5 days ago

Maryland5 days agoAM showers Sunday in Maryland

-

Florida5 days ago

Florida5 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Oregon1 week ago

Oregon1 week ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling