Business

Supreme Court upholds a tax on corporate wealth held overseas

The Supreme Court on Thursday refused to put new limits on Congress’ power to tax wealth that is not paid out in annual dividends.

In a setback for anti-tax conservatives, the justices upheld a provision of a 2017 tax law that imposed a one-time levy on the profits of foreign corporations whose shares were owned by Americans.

In a 7-2 decision, the justices said Congress has the power to tax corporate shareholders based on the company’s “undistributed income.”

“This court has long upheld taxes of that kind, and we do the same today,” said Justice Brett M. Kavanaugh for the court.

The case came to the court as a test of whether the conservative majority would put constitutional limits on “wealth taxes.”

Instead, the justices upheld an income tax that is not based on annual dividends.

While the decision upheld a Trump-era tax, progressives and tax experts cheered the ruling.

“Today’s decision will allow Congress to continue to exercise its power to tax income to fund the government and to make sure that all taxpayers — including multinational corporations and wealthy taxpayers — pay their fair share,” said Chye-Ching Huang, executive director of the Tax Law Center at NYU Law.

Alexandra Thornton of the Center for American Progress said the ruling “means that wealthy people attempting to avoid taxes by offshoring their money have to pay their fair share, just like every other American. The court’s decision avoids an outcome that would have thrown the American tax system into disarray and put at risk other forms of taxation that raise billions of dollars in revenue.”

Some noted that the ruling was limited to an unusual tax provision.

“The court makes clear it is not opening the door to a wealth tax, which would still face constitutional problems as a tax on property,” said Joe Bishop-Henchman of the National Taxpayers Union.

Thursday’s decision did not resolve a persistent dispute over whether the Constitution’s approval of income taxes includes taxing shares of corporate stock, or instead is limited to “realized” gains, such as wages, stock sales and stock dividends.

“So the precise and narrow question that the court addresses today is whether Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners, and then tax the shareholders or partners on their portions of that income,” Kavanaugh wrote for the majority. “This court’s longstanding precedents, reflected in and reinforced by Congress’s longstanding practice, establish that the answer is yes.”

Justices Clarence Thomas and Neil M. Gorsuch dissented.

Thomas wrote that the 16th Amendment says income is “only income realized by the taxpayer. The text and history of the amendment make clear that it requires a distinction between ‘income’ and the ‘source’ from which that income is ‘derived.’ And, the only way to draw such a distinction is with a realization requirement.”

Some conservatives fear that a future Congress led by progressive Democrats would impose taxes on accumulated wealth.

They urged the court to hear the case of Moore vs. United States and to rule that Congress may not impose a tax on “property or wealth.”

At issue in the case was the meaning of the 16th Amendment, ratified in 1913. It says Congress has the power to “lay and collect taxes on incomes, from whatever source derived.”

A few years later, the Supreme Court said corporate shares held by taxpayers could not be taxed as income unless they were “realized or received” as income. That decision was generally understood to mean that the government may impose taxes on wages or stock dividends, but not necessarily on property or corporate wealth that grows in value. These are referred to as “unrealized gains.”

But many constitutional scholars and tax experts had questioned that interpretation of the 16th Amendment. And in recent decades, Congress has imposed taxes on individuals who are earning income in partnerships and have ownership shares in some corporations, even if dividends are not paid out each year.

The case of Charles and Kathleen Moore began when they received a $14,729 tax bill for their ownership shares of a company based in India.

The Moores, who are retired and live in Washington state, said they received no income or dividends from their investment in the company, which supplies equipment to small farmers. They sued, alleging the tax was unconstitutional under the 16th Amendment.

But a federal judge and the 9th Circuit Court of Appeals disagreed with them and upheld part of the 2017 tax bill passed by the Republican-controlled Congress and signed by President Trump. It imposed a one-time tax on Americans who owned shares in foreign corporations that gained in value. The tax measure included large tax breaks for the wealthy, but to offset those losses in tax revenue, lawmakers sought to recoup some profits that Americans held abroad.

With the backing of the U.S. Chamber of Commerce and other business groups, the Moores petitioned the court with the help of Washington attorney David B. Rivkin and urged the justices to strike down the tax on overseas profits.

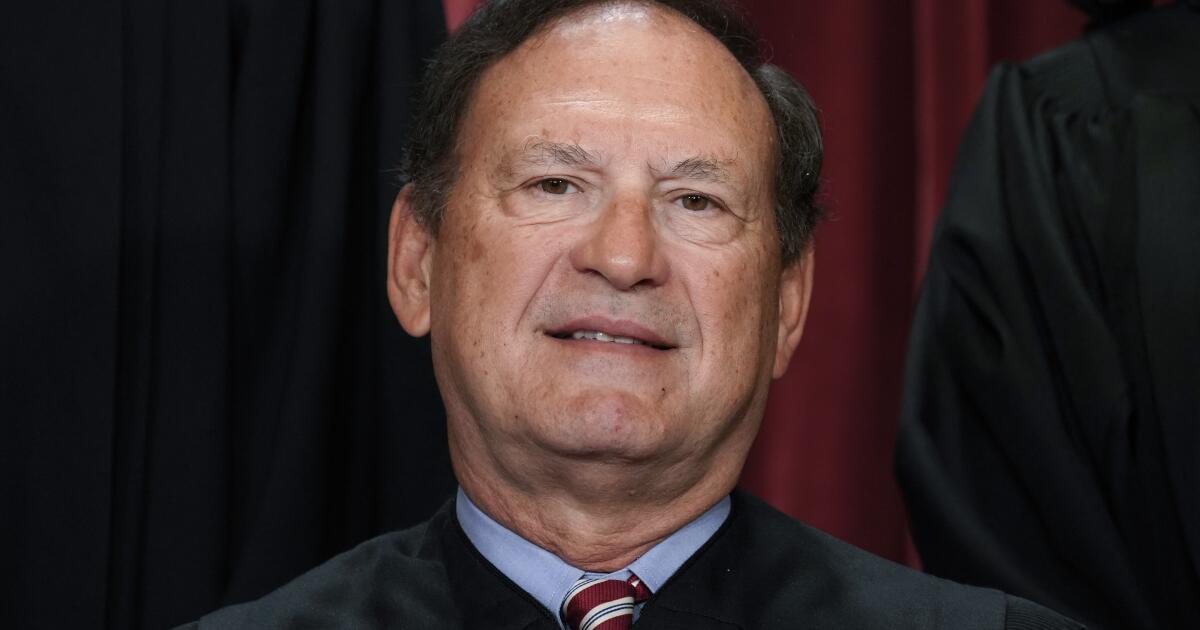

Some had called for Justice Samuel A. Alito Jr. to recuse himself from the matter.

Rivkin who helped write the appeal petition, interviewed Alito for two articles that appeared in the Wall Street Journal last year.

“There was no valid reason for my recusal in this case,” Alito wrote in response in September. “When Mr. Rivkin participated in the interviews and co-authored the articles, he did so as a journalist, not an advocate. The case in which he is involved was never mentioned; nor did we discuss any issue in that case either directly or indirectly.”

Alito concurred in the outcome Thursday.

Business

A new delivery bot is coming to L.A., built stronger to survive in these streets

The rolling robots that deliver groceries and hot meals across Los Angeles are getting an upgrade.

Coco Robotics, a UCLA-born startup that’s deployed more than 1,000 bots across the country, unveiled its next-generation machines on Thursday.

The new robots are bigger, tougher and better equipped for autonomy than their predecessors. The company will use them to expand into new markets and increase its presence in Los Angeles, where it makes deliveries through a partnership with DoorDash.

Dubbed Coco 2, the next-gen bots have upgraded cameras and front-facing lidar, a laser-based sensor used in self-driving cars. They will use hardware built by Nvidia, the Santa Clara-based artificial intelligence chip giant.

Coco co-founder and chief executive Zach Rash said Coco 2 will be able to make deliveries even in conditions unsafe for human drivers. The robot is fully submersible in case of flooding and is compatible with special snow tires.

Zach Rash, co-founder and CEO of Coco, opens the top of the new Coco 2 (Next-Gen) at the Coco Robotics headquarters in Venice.

(Kayla Bartkowski/Los Angeles Times)

Early this month, a cute Coco was recorded struggling through flooded roads in L.A.

“She’s doing her best!” said the person recording the video. “She is doing her best, you guys.”

Instagram followers cheered the bot on, with one posting, “Go coco, go,” and others calling for someone to help the robot.

“We want it to have a lot more reliability in the most extreme conditions where it’s either unsafe or uncomfortable for human drivers to be on the road,” Rash said. “Those are the exact times where everyone wants to order.”

The company will ramp up mass production of Coco 2 this summer, Rash said, aiming to produce 1,000 bots each month.

The design is sleek and simple, with a pink-and-white ombré paint job, the company’s name printed in lowercase, and a keypad for loading and unloading the cargo area. The robots have four wheels and a bigger internal compartment for carrying food and goods .

Many of the bots will be used for expansion into new markets across Europe and Asia, but they will also hit the streets in Los Angeles and operate alongside the older Coco bots.

Coco has about 300 bots in Los Angeles already, serving customers from Santa Monica and Venice to Westwood, Mid-City, West Hollywood, Hollywood, Echo Park, Silver Lake, downtown, Koreatown and the USC area.

The new Coco 2 (Next-Gen) drives along the sidewalk at the Coco Robotics headquarters in Venice.

(Kayla Bartkowski/Los Angeles Times)

The company is in discussion with officials in Culver City, Long Beach and Pasadena about bringing autonomous delivery to those communities.

There’s also been demand for the bots in Studio City, Burbank and the San Fernando Valley, according to Rash.

“A lot of the markets that we go into have been telling us they can’t hire enough people to do the deliveries and to continue to grow at the pace that customers want,” Rash said. “There’s quite a lot of area in Los Angeles that we can still cover.”

The bots already operate in Chicago, Miami and Helsinki, Finland. Last month, they arrived in Jersey City, N.J.

Late last year, Coco announced a partnership with DashMart, DoorDash’s delivery-only online store. The partnership allows Coco bots to deliver fresh groceries, electronics and household essentials as well as hot prepared meals.

With the release of Coco 2, the company is eyeing faster deliveries using bike lanes and road shoulders as opposed to just sidewalks, in cities where it’s safe to do so. Coco 2 can adapt more quickly to new environments and physical obstacles, the company said.

Zach Rash, co-founder and CEO of Coco.

(Kayla Bartkowski/Los Angeles Times)

Coco 2 is designed to operate autonomously, but there will still be human oversight in case the robot runs into trouble, Rash said. Damaged sidewalks or unexpected construction can stop a bot in its tracks.

The need for human supervision has created a new field of jobs for Angelenos.

Though there have been reports of pedestrians bullying the robots by knocking them over or blocking their path, Rash said the community response has been overall positive. The bots are meant to inspire affection.

“One of the design principles on the color and the name and a lot of the branding was to feel warm and friendly to people,” Rash said.

Coco plans to add thousands of bots to its fleet this year. The delivery service got its start as a dorm room project in 2020, when Rash was a student at UCLA. He co-founded the company with fellow student Brad Squicciarini.

The Santa Monica-based company has completed more than 500,000 zero-emission deliveries and its bots have collectively traveled around 1 million miles.

Coco chooses neighborhoods to deploy its bots based on density, prioritizing areas with restaurants clustered together and short delivery distances as well as places where parking is difficult.

The robots can relieve congestion by taking cars and motorbikes off the roads. Rash said there is so much demand for delivery services that the company’s bots are not taking jobs from human drivers.

Instead, Coco can fill gaps in the delivery market while saving merchants money and improving the safety of city streets.

“This vehicle is inherently a lot safer for communities than a car,” Rash said. “We believe our vehicles can operate the highest quality of service and we can do it at the lowest price point.”

Business

Trump orders federal agencies to stop using Anthropic’s AI after clash with Pentagon

President Trump on Friday directed federal agencies to stop using technology from San Francisco artificial intelligence company Anthropic, escalating a high-profile clash between the AI startup and the Pentagon over safety.

In a Friday post on the social media site Truth Social, Trump described the company as “radical left” and “woke.”

“We don’t need it, we don’t want it, and will not do business with them again!” Trump said.

The president’s harsh words mark a major escalation in the ongoing battle between some in the Trump administration and several technology companies over the use of artificial intelligence in defense tech.

Anthropic has been sparring with the Pentagon, which had threatened to end its $200-million contract with the company on Friday if it didn’t loosen restrictions on its AI model so it could be used for more military purposes. Anthropic had been asking for more guarantees that its tech wouldn’t be used for surveillance of Americans or autonomous weapons.

The tussle could hobble Anthropic’s business with the government. The Trump administration said the company was added to a sweeping national security blacklist, ordering federal agencies to immediately discontinue use of its products and barring any government contractors from maintaining ties with it.

Defense Secretary Pete Hegseth, who met with Anthropic’s Chief Executive Dario Amodei this week, criticized the tech company after Trump’s Truth Social post.

“Anthropic delivered a master class in arrogance and betrayal as well as a textbook case of how not to do business with the United States Government or the Pentagon,” he wrote Friday on social media site X.

Anthropic didn’t immediately respond to a request for comment.

Anthropic announced a two-year agreement with the Department of Defense in July to “prototype frontier AI capabilities that advance U.S. national security.”

The company has an AI chatbot called Claude, but it also built a custom AI system for U.S. national security customers.

On Thursday, Amodei signaled the company wouldn’t cave to the Department of Defense’s demands to loosen safety restrictions on its AI models.

The government has emphasized in negotiations that it wants to use Anthropic’s technology only for legal purposes, and the safeguards Anthropic wants are already covered by the law.

Still, Amodei was worried about Washington’s commitment.

“We have never raised objections to particular military operations nor attempted to limit use of our technology in an ad hoc manner,” he said in a blog post. “However, in a narrow set of cases, we believe AI can undermine, rather than defend, democratic values.”

Tech workers have backed Anthropic’s stance.

Unions and worker groups representing 700,000 employees at Amazon, Google and Microsoft said this week in a joint statement that they’re urging their employers to reject these demands as well if they have additional contracts with the Pentagon.

“Our employers are already complicit in providing their technologies to power mass atrocities and war crimes; capitulating to the Pentagon’s intimidation will only further implicate our labor in violence and repression,” the statement said.

Anthropic’s standoff with the U.S. government could benefit its competitors, such as Elon Musk’s xAI or OpenAI.

Sam Altman, chief executive of OpenAI, the company behind ChatGPT and one of Anthropic’s biggest competitors, told CNBC in an interview that he trusts Anthropic.

“I think they really do care about safety, and I’ve been happy that they’ve been supporting our war fighters,” he said. “I’m not sure where this is going to go.”

Anthropic has distinguished itself from its rivals by touting its concern about AI safety.

The company, valued at roughly $380 billion, is legally required to balance making money with advancing the company’s public benefit of “responsible development and maintenance of advanced AI for the long-term benefit of humanity.”

Developers, businesses, government agencies and other organizations use Anthropic’s tools. Its chatbot can generate code, write text and perform other tasks. Anthropic also offers an AI assistant for consumers and makes money from paid subscriptions as well as contracts. Unlike OpenAI, which is testing ads in ChatGPT, Anthropic has pledged not to show ads in its chatbot Claude.

The company has roughly 2,000 employees and has revenue equivalent to about $14 billion a year.

Business

Video: The Web of Companies Owned by Elon Musk

new video loaded: The Web of Companies Owned by Elon Musk

By Kirsten Grind, Melanie Bencosme, James Surdam and Sean Havey

February 27, 2026

-

World3 days ago

World3 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts3 days ago

Massachusetts3 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Louisiana5 days ago

Louisiana5 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Denver, CO3 days ago

Denver, CO3 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT