Business

Millennials Want to Retire at 50. How to Afford It Is Another Matter.

Though Devangi Patel, 33, has been working as a cardiothoracic anesthesiologist at a big medical heart exterior Atlanta for under two years, her objective is to afford to stroll away from her job at 50.

“That, to me, is the American dream,” she mentioned.

Dr. Patel just isn’t alone in her quest to change into financially unbiased — and at a comparatively early age. Evidently a generational shift is properly underway: Many millennial staff don’t aspire to retire of their mid- or late 60s, like their mother and father. As an alternative, many with skilled careers are searching for to go away their jobs by 50 and work for themselves or take a lower-paying function that’s extra aligned with their pursuits, research are displaying and monetary advisers are discovering.

“I wish to get to some extent the place I don’t should work for cash anymore, and I can work for pleasure,” Dr. Patel mentioned.

However reaching that objective has been tougher than Dr. Patel anticipated. Though she contributes to a 401(okay) and a Roth particular person retirement account, invests in shares with a brokerage account and maxes out her well being financial savings account, she can also be paying off a $250,000 mortgage for medical faculty and paying for her wedding ceremony in December.

Whereas many millennial staff, like Dr. Patel, need monetary independence of their 50s, it’s not simply achieved, mentioned Christopher Lyman, an authorized monetary planner with Allied Monetary Advisors in Newtown, Pa. “I’ve lots of people coming in and saying, ‘I learn these articles. I see folks doing this. I wish to do that, too,’” Mr. Lyman mentioned. Whereas he by no means tries to dissuade purchasers, he does inject some realism — that reaching that independence by 50 will most certainly require saving between 50 and 60 p.c of their wage.

Millennials, who had been born between 1981 and 1996, got here into their skilled lives throughout the Nice Recession and are navigating a world wherein conventional pathways to wealth, like homeownership, are out of attain for a bigger share of them than of these a technology in the past.

Their attitudes are additionally being formed, partially, by uncertainty: They’re witnessing vital financial shifts simply as they’re striving to determine themselves. They usually wish to get pleasure from a post-career life-style before later.

“It requires saving as a lot as doable and spending as little as doable, and doing each of those as quickly as doable,” Mr. Lyman mentioned.

Whereas some millennials on this path determine with the motion often known as FIRE — monetary independence, retire early — others, like Brit Minichiello, have broader objectives.

“With conventional FIRE, we’d spend no cash and squirrel it away perpetually,” Ms. Minichiello, 36, mentioned. As an alternative, she is aligning her financial savings together with her need to get pleasure from life earlier than she turns 65, which is why she and her husband, Dave, 42, just lately targeted their financial savings technique on shopping for a second house.

For Dr. Patel, it’s difficult to avoid wasting 50 p.c of her wage though she just isn’t a giant spender.

“I must hand over holidays and the issues I like which can be splurgy, like consuming in finer eating places or flying to New Jersey to see my household on the drop of a hat,” she mentioned, including that she might save $3,000 a month if not for her mortgage obligations.

Aspiration vs. actuality

Mark Smrecek, a retirement marketing consultant and monetary wellbeing chief at Willis Towers Watson, the consulting agency, mentioned most millennials he works with should not really in a position to save sufficient for monetary independence by 50 — it’s simply not real looking given their residing prices and the approach to life they aspire to. This 12 months, the corporate’s World Advantages Attitudes Survey confirmed that 36 p.c of millennial staff in a broad vary of industries had been saving 5 p.c or much less of their revenue however needed to avoid wasting extra, 26 p.c had taken a mortgage from their 401(okay) and 25 p.c had withdrawn funds from their 401(okay). But, 52 p.c mentioned they anticipated to retire earlier than 65.

The 2022 Retirement Insights Survey from TIAA revealed related views, with 31 p.c of individuals ages 30 to 39 indicating that they’ve an above-average stage of confidence of their capacity to plan for retirement. Younger millennials, these 25 to 29, are probably the most assured: 40 p.c mentioned they’d an above-average stage of confidence of their capacity to plan.

Regardless of this confidence, millennials aren’t saving sufficient, and plenty of aren’t contributing sufficient to their 401(okay) to get the complete employer match, Mr. Smrecek mentioned.

Two of the challenges youthful staff face in making ready for retirement: Fewer employers provide pension plans, and it’s not assured that firms will match an worker’s 401(okay) contribution. Fifty-two p.c of private-sector staff had entry solely to outlined contribution plans, like 401(okay)s, in March 2020, in response to the Bureau of Labor Statistics. Solely 12 p.c had entry to each a pension plan and an outlined contribution plan, whereas 3 p.c had entry to solely a pension plan.

What’s extra, this lack of a pension or 401(okay) match places the burden on workers to avoid wasting for his or her future, mentioned Jake Northrup, an authorized monetary planner at Expertise Your Wealth in Bristol, R.I. “The accountability has shifted from employers serving to workers retire to workers serving to themselves retire,” he mentioned.

Not ready until 65

Ms. Minichiello and her husband began saving about 53 p.c of their after-tax revenue in 2010, in hopes of leaving their present jobs when she reaches her late 40s and he reaches his early 50s. Ms. Minichiello, a co-founder and accomplice of BEspoke Medical Affairs Options, a well being care consulting firm in Cambridge, Mass., needs to discover her curiosity in nonprofits and govt teaching — a discipline, she mentioned, that doesn’t pay as a lot as her present place.

“I don’t wish to get caught up in save, save, save, after which retire at 65,” Ms. Minichiello mentioned. She mentioned she had seen too many individuals put their lives on maintain till they retired solely to change into unwell or have their partner die.

Saving half their take-home pay hasn’t been that tough, Ms. Minichiello mentioned. “We by no means have the latest tech, we don’t purchase new vehicles and we use the whole lot till it doesn’t perform any longer,” she mentioned. Each she and her husband have six-figure incomes.

For a decade, the couple invested most of their financial savings in a brokerage account that earned compound curiosity and wouldn’t penalize them in the event that they made withdrawals earlier than they turned 59.5, as an I.R.A. would. The couple has paid off their pupil loans, they usually every max out their H.S.A.s and 401(okay)s yearly.

Having a mixture of conventional retirement accounts and extra versatile financial savings accounts is essential, Mr. Northrup mentioned.

“You don’t wish to have your entire financial savings in pretax retirement accounts that may be expensive to make use of earlier than age 59.5,” he mentioned. Mr. Northrup will typically advocate that his millennial purchasers scale back their retirement financial savings to have more money accessible for shorter-term objectives like shopping for a home, taking a visit or paying down debt.

Valerie A. Rivera, an authorized monetary planner and founding father of FirstGen Wealth in Chicago, provides her millennial purchasers related recommendation. When one in all her purchasers was maxing out her 401(okay) however struggling to avoid wasting for a house, Ms. Rivera suggested her to place that cash in a brokerage account for use for the actual property. “It feels totally different, extra tangible and fascinating, as a result of they’ll entry it,” she mentioned.

When Ms. Minichiello and her husband determined to save cash for a second house in mid-2020, the couple’s financial savings charge dropped to a variety of 40 to 50 p.c. As an alternative of investing their cash, they squirreled it away in a high-yield financial savings account they named Superior Life Fund.

In 2021, they purchased a house on Cape Cod, which they plan to lease out when not utilizing it with their two younger kids. “I consider your monetary strategy must be aligned along with your values,” Ms. Minichiello mentioned. “I worth freedom and suppleness greater than anything.”

A number of sources of revenue

Few millennials, Ms. Minichiello included, consider that they’ll have entry to Social Safety funds after they attain 62, and plenty of are skeptical that conventional plans alone, resembling a 401(okay) or Roth I.R.A., can be ample.

“I don’t know anybody who says, ‘Thank God I’ve my Roth I.R.A.,’” mentioned Joshua Frappier, 34, an actual property agent in Newburyport, Mass., promoting properties in southern New Hampshire and the north shore of Massachusetts.

Mr. Lyman agrees that even contributing the utmost quantity to a 401(okay) plan every year — this 12 months’s restrict is $20,500 — wouldn’t allow you to avoid wasting sufficient cash to be financially unbiased at 50. You would want different belongings, resembling actual property, an funding account or a enterprise that generates passive revenue to create sufficient wealth, he mentioned.

To cease working at 50, Mr. Frappier is targeted on creating a number of income streams past his full-time job as an actual property agent. With out passive revenue, he mentioned, “you don’t have a method of getting forward of your monetary limitations.”

Mr. Frappier owns two single-family properties in Hampton Seashore, N.H. He lives in a single and rents out the opposite, which he estimates generates at the least $60,000 a 12 months in revenue. He’s within the course of of shopping for a 10-unit property with a number of different actual property traders.

“I plan to accumulate as a lot actual property as I can as quick as I can whereas it’s cheaper than it will likely be subsequent 12 months or in 10 years,” Mr. Frappier mentioned. As a Marine veteran, he’s eligible to obtain low-interest loans, however as a result of he left the navy earlier than logging 20 years of service, he’s ineligible for a pension.

He believes that actual property will give him a greater return than the S.E.P.-I.R.A., designed for self-employed staff, to which he contributes yearly. He paid off his pupil loans years in the past and just lately opened a brokerage account.

Mr. Frappier is aware of that he’s lucky to have a monetary plan. “Virtually everybody I ever speak with doesn’t actually have a retirement plan,” he mentioned, “they usually’re caught up within the battle towards their happiness and their careers.”

Business

Inflation eases in May, but major relief on interest rates not coming soon

The rate of inflation eased slightly last month, the government said Wednesday, but the financial squeeze that Americans are feeling is not likely to let up anytime soon, especially in high-cost California.

That’s because a residue of sharply higher prices left behind by the COVID-19 pandemic still weighs on the pocketbooks and psychology of consumers.

Prices of new and used cars and trucks, for example, are 27% higher than before the pandemic, even though they went down 3.4% in May from a year earlier, according to the report from the Bureau of Labor Statistics. Much the same is true of other consumer goods and services, including dining out and personal care services such as hair salons as well as housing.

And there won’t be much relief on interest rates in the near term. The Federal Reserve has raised interest rates to the highest level in more than two decades to fight inflation, and on Wednesday policymakers said the fight wasn’t over.

Despite previous expectations of multiple rate cuts this year, fed officials projected just one quarter-point rate cut in 2024 in its benchmark interest rate, which currently is in the range of 5.25% to 5.5%.

The Fed, in its statement, said the economy was growing at a “solid pace,” with strong job gains and low unemployment. And Chairman Jerome H. Powell nodded to Wednesday’s better-than-expected inflation numbers.

“We do see today’s report as progress and as building confidence,” he said at a news conference. “But we don’t see ourselves as having the confidence that would warrant beginning to loosen [monetary] policy at this time.”

According to inflation data released Wednesday, overall consumer prices were up 3.3% in May from a year earlier. That’s down slightly from an annual inflation rate of 3.4% in April but still well above the Fed’s 2% target.

“We still need several more months of this, but the fundamentals are encouraging,” said Paul Ashworth, chief North America economist at Capital Economics, a research firm.

Other experts were less sanguine about the near-term inflation outlook: “It’s a maddening, sticky, stubborn situation,” said Dan North, senior economist at Allianz Trade, a credit insurance firm.

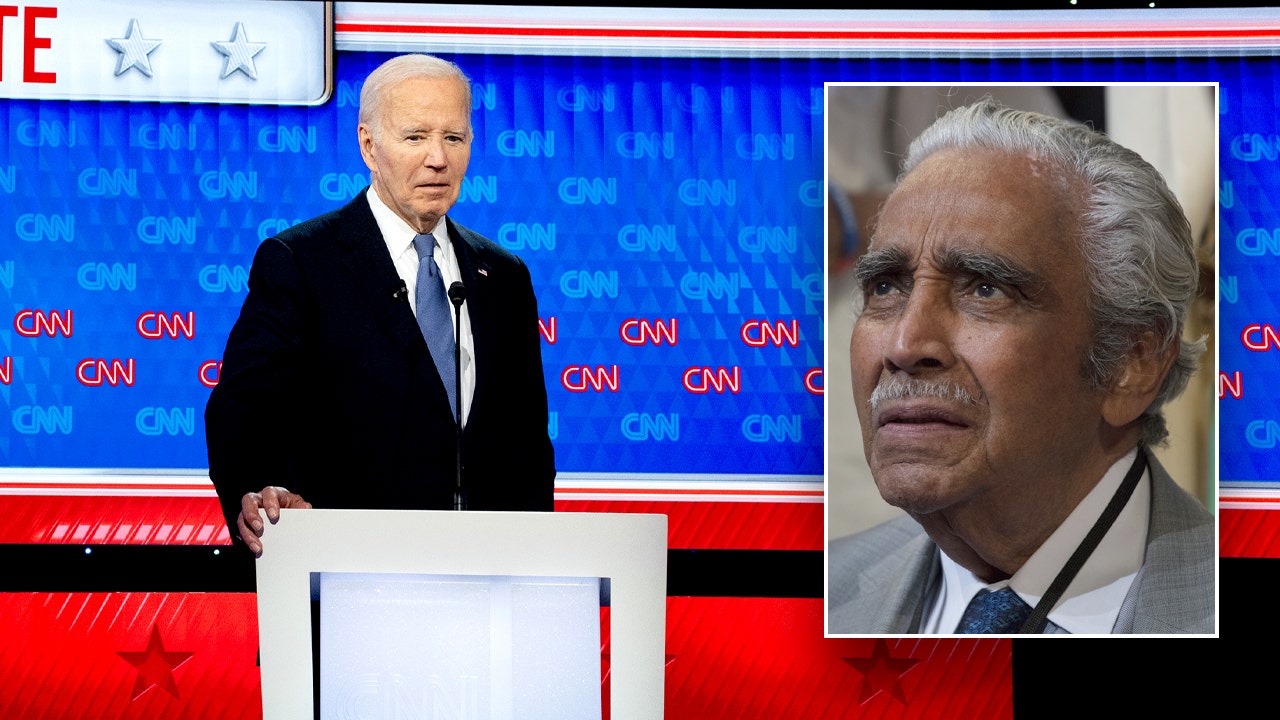

Both economists and political analysts have been puzzled that President Biden’s standing with the public on the economy has been languishing despite steady growth, strong job gains, and significant improvement in inflation. A big part of the answer is that people are still feeling the aftershocks of price increases in 2021 and 2022, when inflation peaked at 9.1%.

The costs of a broad range of everyday goods went up very sharply in those two years, and they’re not likely to return to pre-pandemic levels soon, if ever. The spillover effects are still playing out.

New vehicle prices, for example, went up by double-digit percent mostly in 2022, but auto insurance premiums, partly reflecting the higher car costs, started taking off last year and were up 20% in May from a year earlier.

Housing inflation, including rising rents and what are called homeowners’ equivalent rents, has been especially sticky, remaining in the range of 4.5% to 4.7% this year. That’s a particular concern in California, where the housing market has soared beyond the reach of most would-be buyers and high interest rates have only compounded the problem.

Despite broadly higher prices, analysts note that workers’ wages have been outpacing inflation, meaning that their purchasing power overall hasn’t weakened. In May, average weekly earnings were up 3.8% from a year earlier — a half point higher than inflation, according to a separate government report.

Still, most people living today have never experienced the kind of sharp, broad inflation that hit the U.S. during the pandemic.

“Even if you had a job, inflation is stressful because it forces you to think about day-to-day purchases,” said Aditya Bhave, senior U.S. economist at Bank of America Global Research.

People may not get over the inflation gloom and get used to the new price levels, he said, until they have “fully internalized the fact that their wages have also grown.”

But in large part because of the incremental gains in income and job gains, the higher costs have not stopped people from spending.

Consumer spending, which accounts for about two-thirds of U.S. economic activity, is expected to grow by a solid 2% this year.

Wednesday’s report showed that annual inflation also slowed in the Pacific coast region in May but is running above the nationwide average, at 3.7%, in part because of higher price increases for food, transportation and gas.

Housing inflation in May was 4.6% for the U.S. and 4.5% for the Pacific coast states, including Alaska and Hawaii.

Analysts are expecting inflation across the country to come down very slowly in the remaining months of the year, if at all. Prices for many goods, including appliances and new cars, dropped in the second half of last year, and inflation slowed sharply for other items and some services as well, all of which will make year-over-year comparisons more difficult to show favorable readings.

Business

Palmer Luckey: Millennial slayer of U.S. defense giants

A red phone sits on Palmer Luckey’s desk at the Costa Mesa headquarters of his military tech company, Anduril Industries.

The phone is a genuine article from the U.S. nuclear command, once connected to the network that led to the bunkers dug into the Rockies west of Colorado Springs that could order up the apocalypse. Luckey owned the red phone before he started Anduril, back when he was only famous for inventing the Oculus virtual reality headset in a trailer in the driveway of his childhood home in Long Beach, then selling that company to Facebook for $2 billion at age 21.

Discover the changemakers who are shaping every cultural corner of Los Angeles. This week we bring you The Disruptors. They include Mattel’s miracle maker, a modern Babe Ruth, a vendor avenger and more. All are agitators looking to rewrite the rules of influence and governance. Come back each Sunday for another installment.

Back then, the phone was just kitsch, a physical piece of history he could gaze at as he worked on VR for a social media company. But after he donated $10,000 to an anti-Hillary Clinton political group in the fall of 2016, then got fired from Facebook a few months later, the red phone changed from a prop to a proposition. Flush with cash, unemployed and annoyed at Silicon Valley, he decided to become a military mogul — possibly the first whose office uniform is a Hawaiian shirt, cargo shorts and flip-flops.

“That was the dream, to be the guy with the red phone who gets The Call,” Palmer, now 31, said in an interview at Anduril’s headquarters.

He founded his new enterprise with four others. One had worked with Luckey at Oculus, but the remaining three came from Palantir, the intelligence analytics software company founded by Peter Thiel, the billionaire tech investor and right-wing political donor. When Thiel founded Palantir in 2003, he named the firm after the magical seeing-stones from Tolkien’s “Lord of the Rings.” Luckey followed in Thiel’s footsteps. Anduril is the elvish name of the reforged sword of Aragorn, king of men and hero of the forces of good in Tolkien’s epic. Translated into English from Quenya, the name means “Flame of the West.” A replica of the sword from the “Lord of the Rings” films hangs on the wall in Anduril’s office.

“The first page of our first pitch deck said that Anduril is a company that will save Western civilization by saving taxpayers hundreds of billions of dollars a year as we make tens of billions of dollars a year,” Luckey said.

“We’re not making tens of billions of dollars a year yet,” he said, “but we’re getting there.”

Six years later, Anduril has signed well over $1 billion in public contracts with the U.S. and allied governments and raised more than $2 billion in venture funding. Last year, it brought in around $500 million in revenue, according to investor presentations reported by the Information.

Of those contracts, $250 million are with the U.S. Border Patrol, which is in the process of deploying a network of 189 Anduril sensor towers to form a “virtual border wall” of semiautomatic surveillance across the U.S.-Mexico border. Another $100 million is with the Australian navy, which hired Anduril to build submarine drones. Its biggest deal came in 2022, when the U.S. Special Operations Command awarded a 10-year, billion-dollar contract to Anduril for counter-drone defense systems that combine sensors, AI software and drones like Anduril’s Anvils, which can physically ram enemy drones to knock them out of the sky.

‘We are preemptively being invited to conversations to help solve problems — most companies will just never get that call.’

— Palmer Luckey

Luckey’s company has also developed a tube-launched drone with a “loitering munition” model (a.k.a. an exploding drone) and bought a rocket engine manufacturer in Mississippi that makes propulsion systems for hypersonic missiles. In late 2023, it unveiled a jet-powered drone that could be flown multiple times for surveillance missions, or equipped with a warhead for suicide missions. In April, Anduril beat out Boeing, Lockheed Martin and Northrop Grumman in an Air Force competition for a new autonomous fighter drone that can fly alongside manned warplanes like robot wingmen.

That red phone on Luckey’s desk isn’t connected to a live line — but he is undoubtedly getting The Call.

“We are preemptively being invited to conversations to help solve problems — most companies will just never get that call,” Luckey said. “It’s the dream come true for someone with my ideological bent.”

Luckey’s bent, at least when it comes to business, runs counter to the last few decades of America’s economic development. When he was working at Facebook and trying to scale up the production of the Oculus headset in Chinese factories, he started to believe that something had gone seriously wrong.

“I felt that we lived in a unique period of U.S. history where we had allowed our technological innovation apparatus to be completely hijacked by a foreign power: China,” Luckey said. “Almost none of the major tech companies in the United States were willing to work with the DoD in a major way, because doing so would get them locked out of China, Chinese capital, Chinese markets, Chinese manufacturing.”

“Apple could not pivot away from China even in the event of World War III,” Luckey said. “So you get to this weird situation, I realized, where these people who are supposed to be the most powerful people in the country are actually handcuffed and prohibited from saying anything that they might believe,” including criticizing the Chinese government’s mass detention of Muslim minorities. “If you’re the CEO of Apple, you can’t go out and say, ‘I think concentration camps are wrong, no matter where they are.’ I looked at that and said, ‘Oh my God, this is terrifying.’”

This line of thinking was considered fringe in the tech industry in 2016, when Luckey left Facebook, but after COVID-19 pandemic supply-chain disruption and wars in Europe and the Middle East, a growing slice of the tech industry has switched to Luckey’s point of view, emphasizing the need to bring manufacturing back to U.S. shores — or at least U.S. allies — and disentangle from the Chinese economy.

Luckey’s enthusiasm for working with the military was unpopular for much of the last decade, but his basic pitch for Anduril is classic Silicon Valley: Use software, venture capital money and a new business model to disrupt an industry full of lumbering incumbents. He and his co-founders thought that they could tap tech talent to bring machine vision and other AI technologies to military operations, and outflank the defense giants of Lockheed Martin, Raytheon, General Dynamics, Boeing and Northrop Grumman — known as the five “primes” in the industry — by pitching the military on a new way to pay. Instead of billing on a cost-plus basis, where the government covers all the costs of development and manufacturing, plus a little profit margin on top, Anduril talks to Department of Defense decision-makers up front, uses its own capital to develop new software and drones, and then sells the finished product to the military.

The company is not profitable, and has no intention of becoming profitable in the next few years. “We should not be profitable” in the near future, Luckey said. “We should be taking all of the money that we’re making and putting it back into growing the company, launching new product lines, trying to become the next major defense prime.”

It was an uphill fight to secure his first round of funding. Investors would tell him, “We love your people, we love your tech. You’re very patriotic, you’re very smart, but we don’t think you can actually get the government to buy your stuff.” “I pointed out to people that every defense company that had been founded by a billionaire was a success,” Luckey said, referring to Elon Musk’s SpaceX and Thiel’s Palantir. “I hate that we live in a country where that’s the case, but I realized that I had a unique responsibility as one of the very few people who was willing to work on national security and blessed with the resources to actually make a real go at it.”

Luckey has also used those resources to give millions to Republican political candidates and committees across the country, drawing criticism from a number of his peers in the tech industry, who tend to lean toward Democrats over the GOP.

‘I’m supporting the people who are generally very pro-innovation and national security.’

— Palmer Luckey

In the 2020 cycle, Luckey and his wife poured nearly $3 million into the coffers of Republican Party committees and congressional candidates in 45 states, and threw in $1.7 million for Donald Trump’s campaign on top. That October, Luckey also hosted a reported $100,000-a-person fundraiser for Trump, with the candidate in attendance, at his waterfront home on the tip of Newport Beach’s Lido Isle.

His political giving has kept up in the years since. In the 2021-22 cycle, federal election records show Luckey donated over $1.4 million to Republican committees and candidates. In 2023, he donated an additional $726,000. His sister, Ginger, is married to Rep. Matt Gaetz (R-Fla.).

“I’m supporting the people who are generally very pro-innovation and national security,” Luckey said. He doesn’t see a contradiction in building weapons for the Ukrainian army and supporting members of a political party that has been wobbly in its support for the war. “They are almost universally very supportive of using Ukraine as an opportunity to show Russia that they are not gonna get away with being an expansionist regime,” he said.

“At the end of the day, I would love it if I could only give money to the politicians who agree with me on everything, and only to the groups that agree with me on everything. Unfortunately, I have not found those groups.”

Earlier this month, Luckey again co-hosted a fundraiser for Trump in Newport Beach. Combined with other events in the region, it was expected to raise about $27.5 million for the presumptive Republican nominee’s campaign committee. Besides running a company, Luckey has a growing collection of toys to occupy his time. An 82-foot boat used by the Navy SEALS called the Mark V Special Operations Craft floats at the end of the dock outside his Lido Isle house, visible on Google Maps’ satellite view.

Through a series of LLCs with names such as Luckey Arms, Luckey Air Transport and Luckey Ground Technology, he owns a couple of submarines, a Black Hawk helicopter and a fleet of motorcycles and cars. On the day we met, he drove a Tesla stripped of all paint to the bare aluminum to work. He drove a 1990s Mazdaspeed Autozam converted to electric drive and skinned hot pink with graphics from the anime series “Gun Gale Online” to the annual Anime Expo at the L.A. Convention Center last summer. During his time at Facebook, the Wall Street Journal reported that he would drive a military Humvee to the Menlo Park, Calif., offices, complete with fake guns in its machine-gun mount.

Real guns are also a hobby. “I have a huge number of guns. Massive collection of guns.” His main interest is failed gun designs, stabs at innovation that led to technological dead ends. “I will say I’ve got the extreme machine gene,” Luckey said.

And then there are the nuclear missile silos. “I own a lot of ICBM sites all over the United States.” Corporate filings show that a decommissioned Atlas ICBM silo in rural Saranac, N.Y., is owed by Black Omen LLC, which is in turn managed by Fiendlord’s Keep LLC, whose chief executive is listed as Palmer Luckey.

Luckey would not confirm nor deny his ownership of that site, but he did say that he’s in the process of collecting the entire U.S. ground-based nuclear deterrent system. His goal, he says, is to turn it into a vast museum. “There are so many air museums, quite a few naval museums and ship museums, and there’s literally only one missile museum in the United States, the Titan II in Tucson, Arizona,” he said. “It’s just kind of weird that one of the three pillars of the nuclear triad has just been completely ignored by all the people that build museums. So I’m collecting those and restoring them.”

Like the red phone, only bigger.

Business

Ynon Kreiz: The CEO Mattel (and Hollywood) needed in the darkest hour

The day “Barbie” hit theaters in July, Mattel Chief Executive Ynon Kreiz was in New York City visiting his oldest daughter and the pair decided to walk to a nearby theater for some real-time market research. Kreiz, who had been the driving force behind the decision to bring Mattel’s iconic doll to life on the big screen, loved the film, but with its fate now in the hands of the ticket-buying public, his opinion didn’t much matter. He wanted to see how people were reacting.

His answer came quickly. As he and his daughter approached, they found themselves walking among droves of people dressed in Barbie’s signature pink. And when they poked their heads into each of the five packed theaters showing the movie, they were met with roars of laughter. Some viewers were crying.

Discover the changemakers who are shaping every cultural corner of Los Angeles. This week we bring you The Disruptors. They include Mattel’s miracle maker, a modern Babe Ruth, a vendor avenger and more. All are agitators looking to rewrite the rules of influence and governance. Come back each Sunday for another installment.

“Feeling that reaction — that audience reaction — was very telling,” he said, “and very exciting.”

What happened after opening night is now the stuff of Hollywood legend. The Greta Gerwig-directed film became an instant hit at the box office, raking in more than $1.4 billion, and kicked off a cultural phenomenon. Less well known, though, is the role the film has played in the story of Mattel’s revival. It’s a story that was written in large part by Kreiz, 59, who took the reins when the El Segundo-based company was struggling and who over his roughly six years at the helm has orchestrated a remarkable turnaround, making Mattel into one of the biggest corporate success stories of recent years.

At the heart of his plan was a move that seemed obvious to him, but which previous leaders failed to execute: Mattel needed to make a splash in the film business. To Kreiz, Mattel’s intellectual property was a gold mine. The company had a roster of instantly recognizable characters beloved by children and adults alike that he was confident could become enormously lucrative if they were exploited wisely.

For skeptics, that remains a big if. Mattel, in need of a big win in a dark hour, understandably chose to come out of the gate with its most reliable brand. The question now is whether Barbie’s success earned the toy maker’s film division enough industry respect, and breathing room, for the studio to re-create last summer’s magic with other, less potent brands, such as Hot Wheels, Polly Pocket and the card game Uno. Complicating the already uncertain road ahead, earlier this year an activist investor began agitating for the company to jettison some of its key brands to boost its middling stock price.

“This is not a novel concept where you take a strong brand in one vertical and import it to others,” Kreiz said at a conference last fall. “At Mattel, we haven’t done it. … You have ‘Fast and Furious,’ 10, and Hot Wheels, zero.” He believes with certainty that there’s an audience for such a film. After all, Mattel already sells nearly 800 million of the die-cast cars a year.

Mattel’s consumers, Ynon Kreiz said, are more than just consumers — they are fans.

Kreiz, who gets up around 4:30 or 5 a.m. to kiteboard or get some other workout in before work, brings a similar intensity to the office. He stays impressively on message when talking about Mattel, with seemingly effortless sound bites ready at hand, barely breaking eye contact. Watch clips of his public speaking appearances and it becomes clear he repeats talking points, often word for word, his calm, personable demeanor disguising the discipline with which he approaches the CEO role.

When asked about the key to Mattel’s transformation under his leadership, Kreiz, unhurried and with animated hands, launched into a theory that he has often recounted in interviews. Mattel’s consumers, he said, are more than just consumers — they are fans.

“And when you have a lot of fans, you have an audience,” he said.

Kreiz became Mattel’s fourth chief executive in four years when he took charge, inheriting a company that needed a lifeline. He brought with him extensive experience in the entertainment industry, having made career stops at Fox Kids Europe, Endemol Group — the production company known for its unscripted programs, including “Deal or No Deal” and “Big Brother” — and Maker Studios, a short-form video studio that Disney acquired in 2014.

The once dominant toy maker had lost its way: Some of Mattel’s biggest brands were struggling, and toy sales had been steadily declining since 2013. Its market cap had dipped more than $5 billion below that of rival Hasbro. Its second-largest customer, Toys R Us, filed for bankruptcy protection in 2017. That same year, Mattel reported a fourth-quarter loss of $281.3 million.

Kreiz needed to stop the bleeding. He restructured the company’s supply chain, reduced the number of items it produces by 35%, and cut five factories from its manufacturing lineup. The company slashed more than 2,200 jobs, 22% of its global nonmanufacturing workforce. Mattel was starting to move away from manufacturing and focus on developing its intellectual property, Kreiz told reporters. Between 2018 and 2021, Mattel said it achieved cost savings of more than a billion dollars.

The Mattel of today looks much different from the company five years ago. The toy maker is now outpacing Hasbro and dominating in fast-growing toy categories, such as fashion dolls, which are more popular than action figures at the moment, said Linda Bolton Weiser, a managing director and senior research analyst at D.A. Davidson who tracks consumer goods.

Kreiz’s work at Mattel hasn’t gone unnoticed. With Barbie’s wild success, he and the turnaround he’d orchestrated became the talk of corporate Hollywood. Matt Belloni, an industry prognosticator, recently anointed Kreiz “the Hollywood hero of the year” and said he was an obvious choice to replace Bob Iger at Disney.

When the first draft of the “Barbie” script landed in Kreiz’s inbox, he read it twice back to back. The text felt unconventional and special, and he loved it right away. Kreiz isn’t shy with his praise of Gerwig, often calling her a “creative genius.”

Robbie Brenner, the head of Mattel Films, felt the same.

Kreiz ‘is going to be able to go out there and get the best partners in Hollywood to do these future projects.’

— Linda Bolton Weiser, a managing director and senior research analyst at D.A. Davidson

Brenner, a producer who was nominated for an Academy Award for “Dallas Buyers Club,” was one of Kreiz’s first hires after starting as CEO. The two met at the Polo Lounge at the Beverly Hills Hotel after an agent suggested they connect.

“I mean, we hired Greta Gerwig for a reason, and you don’t hire Greta Gerwig and then try to cut her legs off,” Brenner added. “I think that we wanted her to fly and to tell an authentic, amazing personal story that was unique and different and bold, and surprise people.”

The film was a hit beyond expectations, both financially and in the cultural consciousness. The “Barbenheimer” opening weekend brought crowds of people back into movie theaters in numbers unheard of since the pandemic. More than a dozen fashion brands launched “Barbie” collaborations, including Zara and Vans. Burger King in Brazil sold a hamburger doused in pink sauce and French fries called “Ken’s potatoes.” “Barbiecore” was everywhere.

The movie became the highest-grossing film of 2023, surpassing $1 billion at the global box office just 17 days after its release. At a conference in September, Anthony DiSilvestro, Mattel’s chief financial officer, said that the company expected $125 million in revenue related to the “Barbie” movie — including toy sales — with a profit margin of about 60%.

Mattel declined to comment on how much its cut of the box office revenue is, but industry analysts have said the company’s take-home pay from ticket sales is in the tens of millions. In addition, insiders with knowledge of the financial arrangement said that Mattel also will receive payments for owning the rights to Barbie’s intellectual property in addition to profits as a producer of the movie, the New York Times reported.

The toy aisle also felt the effects of “Barbie” mania. Mattel’s third-quarter performance beat estimates, with sales of Barbie dolls jumping 16%. The doll category as a whole was up 27% from the previous year.

The longer-term dividends the film will pay are harder to quantify but crucial to Mattel’s future.

“Barbie” has laid the groundwork for the future of Mattel’s entertainment sector, Bolton Weiser said. “[Kreiz] is going to be able to go out there and get the best partners in Hollywood to do these future projects. And it’s all good, you know? Very low risk for Mattel. They don’t take any big capital risks doing these entertainment events. So it all makes sense.”

Mattel Films now has 16 projects in development: A J.J. Abrams-produced Hot Wheels movie, Lily Collins and Lena Dunham signed on for Polly Pocket, and Vin Diesel as a partner for Rock ’Em Sock ’Em Robots, among others.

As the scale of “Barbie’s” success became clear, a question began to circulate: Can Mattel repeat this success story? Hollywood is a fickle beast, and the company’s use of its most resonant brand for its first act was a gamble.

“It’s difficult to imagine any other movie based on a toy ever reaching ‘Barbie’s’ heights,” Eliana Dockterman, who reviews TV and films for Time magazine, wrote in August. “Barbie is an icon. She has name recognition across the world equal to Mickey Mouse and Coca-Cola. And, sure, Hot Wheels may be popular, but won’t a Hot Wheels movie just be a racing movie, even if J.J. Abrams is at the helm as executive producer?”

Still, Dockterman admitted that she’s curious about Mattel’s next entertainment ventures, namely “Daniel Kaluuya’s involvement with what sounds like a very meta Barney movie (as in, yes, the big purple dinosaur); whether Lena Dunham can find a quirky take on Polly Pocket; and if a Magic 8 Ball horror movie can actually prove to be scary.”

Kreiz quickly brushed off concerns of “Barbie” as a one-hit wonder. “We’re not saying that every movie will be as successful as ‘Barbie,’” he said, “but we absolutely look to have the same approach in terms of attracting and collaborating with the talent, supporting and backing the talent,” and enticing Mattel’s built-in fan base to the theater.

“The idea is to create something unique in every movie,” he added. “Every project has a unique purpose, and will have a unique voice.”

While “Barbie” captured fans’ collective imagination last year, Mattel’s future is not tied exclusively to films. Company execs like to joke that the nearly 800 million Hot Wheels sold annually make Mattel the biggest auto manufacturer in the world.

In September, the company unveiled a two-story L.A. flagship store for American Girl at the Westfield Century City Mall. On opening day, a line of toddlers to tweens, with dolls clutched to their chests and their parents in tow, lined up in front of the store’s doors. Inside, the cafe serves doll-sized pancakes on tiered serving trays alongside plates of human-sized ones. A hair and nail salon styles dolls and their humans.

But Kreiz’s big bet on entertainment is never far off. Mattel announced in December plans to give the American Girl brand its own Hollywood treatment with a live-action movie directed by Lindsey Anderson Beer. Some of the American Girls have already starred in movies, mostly direct-to-DVD and made-for-TV films, but the company is aiming to go bigger.

Nostalgia, tapped effectively, can be a powerful force at the box office. There is a reason why studios keep reaching for reboots and reimaginings of beloved franchises — fans want to reconnect with characters with whom they have a history. But it can be a tricky business trying to nail the sweet spot of familiarity and freshness.

Kreiz thinks the company is up to the task.

“Play is our language,” he said. “This is how we start the journey. This is how we speak to our fans.”

-

News1 week ago

News1 week agoTracking a Single Day at the National Domestic Violence Hotline

-

World7 days ago

World7 days agoIsrael accepts bilateral meeting with EU, but with conditions

-

World1 week ago

World1 week agoIs Israel’s Smotrich fulfilling his dream of annexing the West Bank?

-

News1 week ago

News1 week agoSupreme Court upholds law barring domestic abusers from owning guns in major Second Amendment ruling | CNN Politics

-

News1 week ago

News1 week agoA Florida family is suing NASA after a piece of space debris crashed through their home

-

Politics1 week ago

Politics1 week agoSupreme Court upholds federal gun ban for those under domestic violence restraining orders

-

Politics1 week ago

Politics1 week agoTrump classified docs judge to weigh alleged 'unlawful' appointment of Special Counsel Jack Smith

-

World1 week ago

World1 week agoNew Caledonia independence activists sent to France for detention

/cdn.vox-cdn.com/uploads/chorus_asset/file/25255195/246965_vision_pro_VPavic_0034.jpg)